At the recently concluded Offshore Well Intervention Australia 2023 conference held in Perth, a panel of industry experts convened to explore the outlook for the CCS market in Australia.

Together, they considered the ambitious goal of significant emissions reduction by 2030 and how the industry can overcome the time constraints by implementing CCS projects, what opportunities exist or could be put in place to facilitate industry stakeholder collaboration, and how can the industry share knowledge to accelerate CCS adoption and address common challenges effectively.

In the session, Diego Vazquez Anzola, CCS Specialist at APES Energy Evolution, explained, “Acceleration can indeed benefit from industrial and governmental collaboration. Collaboration is important and necessary, but it is not indispensable.

“There are those who point at regulations, or sometimes the lack of them, as the reason for the slow progress of CCS projects in Australia. Australia has the opportunity to not reinvent the wheel and analyse closely the history of other successful projects in other jurisdictions. The few successful commercial scale CCS projects around the world, in or nearing execution, were matured in various timeframes. However, those projects with the most compressed maturation timelines have common denominators, which, contrary to the general belief, are not particularly technical.

“The acceleration of CCS projects around the world has been attained by prioritising simplicity in storage development planning, with phased and calculated strategies for growth and scalability. Furthermore, acceleration has been truly attained by having first a clear understanding of the value generating models, with clear strategies on revenue generation and maximisation. This is indispensable.

“It is when commercial models are clear that industrial collaborations thrive – with a solid strategy towards job creation and workforce re-skilling and with regulators incentivising an environment of knowledge sharing and communication that naturally results in simpler and more streamlined approval processes.

“In summary, industrial and governmental collaboration and knowledge sharing would indeed be beneficial for acceleration. However, commercial clarity is what enables true collaboration towards acceleration.”

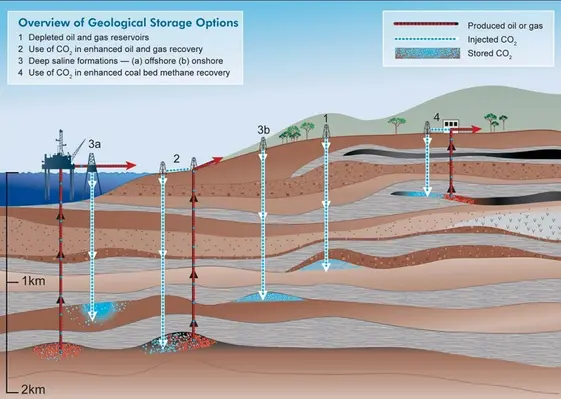

Adding his voice here, Jason McKenna, CCS Strategic Advisor at CO2Tech/CO2CRC, commented, “If I had to choose one word to describe the goal of achieving significant GHG emissions reductions by 2030, it would be ‘challenging’. In Australia, the LNG and gas industries are likely to be the first movers as the capture component is already built in to the CCS value chain. The rate limiting step for significant emissions reductions is likely to be the development of cost-effective large-scale capture technologies for the hard-to-abate sectors. In terms of storage, depleted fields may offer reduced project development timelines in comparison to green-field saline aquifers by avoiding the need for lengthy appraisal programmes and the possible re-use of existing infrastructure.

“Currently, there seems to be more of a competitive rather than a collaborative environment amongst the oil and gas companies in terms of access to geological storage. There is the possibility for the Australian CO2 storage capacity to be ‘over-subscribed’ at the moment due to the number of gazetted GHG permits. It would be disappointing to see a number of individual small-scale CCS developments fail the commerciality test (i.e $/tonne) to the detriment of more commercially efficient hub-scale collaborative CCS developments.

“Another area of collaboration to facilitate timely project development timelines is early and regular engagement with stakeholders, particularly NOPTA and NOPSEMA. CCS is an emerging industry globally and regulators will likely have more confidence to provide timely project approvals if they feel informed and engaged at key project milestones.”

Ageing Wells for CO2 Storage

On exploring the advantages and disadvantages of repurposing ageing wells for CO2 storage, Vazquez Anzola continued, “It is well known that engineers prefer to build from scratch rather than modify existing tools, machines or gadgets. Well engineers around the world concur that newly built wells result in the most effective and safest designs.

“On the other hand, general perception dictates that reutilising infrastructure, including aged oil and gas wells, is the simplest and the most cost efficient solution for CO2 storage development plans that can be matured in the shortest time frame. This is not always the case, and it is rarely the case for scalable CO2 storage hubs.

“Although injecting CO2 in depleted fields is a valid option for commercial scale CCS projects, especially in early phases for CO2 storage hubs, this does not come without technical challenges and can result in extremely complex and/or expensive solutions.

“Traditional oil and gas professionals need to soon understand the concept of ‘permanent storage’ when commerciality of CCS projects is directly dependent on demonstrating to authorities, regulators, shareholders, and the market in general, that every molecule that has been injected is expected to remain sequestered for centuries. A small percentage of leakage after 100 or 200 years or more is considered acceptable in various jurisdictions. The general expectation is that by then, CO2 sequestration would not be as necessary to tackle global warming as it is today.

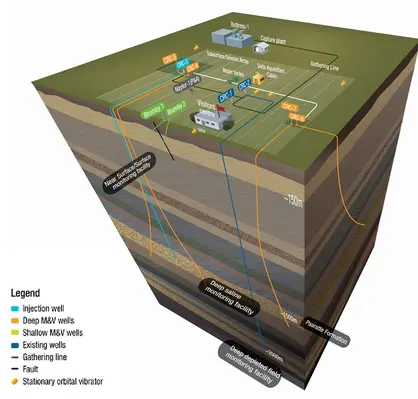

“As a consequence of these radically different timeframes, risks of loss of containment and mitigation plans embedded in the much needed Measure, Monitoring and Verification (MMV) plans of any CO2 storage project directly affect the design and material selection of future P&A campaigns, as well as all steps required for transforming other infrastructure for CO2 manipulation, conditioning and transportation.

“In a nutshell, initial scale and future scalability of the future CO2 storage hub determines whether or not depleted fields are suitable options. Long term containment risks need to be managed in a cost-efficient but also pragmatic fashion founded on a thorough understanding of these containment risks, their likelihood and their consequence severity.

“However, even when legacy wells are not re-used as CO2 injectors or monitors, they may need to be abandoned more adequately as they will eventually be exposed to the CO2 pressure and/or saturation plumes. The challenge reaches its peak when some of the riskiest legacy wells abandoned years ago following traditional O&G standards, might not even be accessible for adequate re-abandonment. Costs but most importantly containment risks determine whether or not a specific storage site is adequate to the required CO2 injection scale. This is of particular importance in depleted fields.

Picking up this thread, McKenna added, “The perceived advantages of using legacy petroleum wells (and legacy petroleum facilities for that matter) are reduced project timelines and reduced cost (CAPEX). However, this perception may be a false economy as retrofitting a brownfield development may not deliver on these perceived benefits and may pose increased safety risk. Furthermore, the operational efficiency (up-time) and OPEX costs (well interventions and facility maintenance) for brownfield developments may offset and negate any commercial benefit over a greenfield CCS development. There is the added risk of extended monitoring periods post-injection to achieve site closure and relinquish liability for the storage site. A key technical risk I foresee for legacy wells is related to the thermal shock the wells may experience from Joules-Thomsen cooling effects when high pressure CO2 is injected into pressure depleted reservoirs or when a CO2 injection well is shut-in and there is a pressure drop in wellbore.

“There also seems to be somewhat of a double standard developing between greenfield versus brownfield CCS developments. Well designs for greenfield developments are generally being built with several layers of redundancy to ensure well integrity over geological time. In contrast, well integrity issues related to legacy wells which were designed for a completely different purpose may be seen through ‘rose coloured’ glasses by some operators.”

Regulatory and environmental pressures

Across all the issues discussed at OWI AUS, a common thread throughout was the impact of regulatory and environmental pressures and this held true when it came to CCS. On reaching this topic, the panellists sought to understand how these were reshaping and influencing the CCS landscape and what strategies operators can adopt to proactively address the concerns in their future campaigns.

Providing his perspective here, Vazquez Anzola noted, “Communication is key. The operator should provide the regulator with a holistic perspective of how their CCS projects would not only help their own decarbonisation plans, but also how they fit into a deeper and wider plan that not only results in net-zero or even negative emissions, but is directly linked to value generating models that would positively impact the community.

“A key role of the regulator is to ensure that no industrial activity causes irreversible harm to natural resources, flora and fauna as well as human life.

“When the operator genuinely seeks guidance from the regulator to enable a project that visibly generates value (and revenue) for everybody, all pieces start falling into place and true collaboration enables quality projects adhering to the highest safety and environmental standards.”

Continuing the discussion, McKenna added, “With respect to NOPTA approvals, there is an additional approval required for CCS projects in comparison to petroleum developments. This relates to approval from the Responsible Commonwealth Minister (RCM) for any Key GHG Operations (ie seismic surveys, geotechnical surveys and drilling wells). The guidance provided for these approvals is three months for NOPTA review and one month for RCM approval. If the GHG activity overlaps an existing petroleum title, the GHG Operator is required to demonstrate there will not be a ‘A Significant Risk Of A Significant Adverse Impact’ (SROASAI) on a discovered or undiscovered petroleum resource or an associated increase in costs to develop the resource.

“To facilitate timely approval of a Key GHG Operation, it is preferable for the overlapping petroleum titleholder to agree in writing that there is no significant risk posed by the GHG activity. However, if such agreement cannot be achieved, the RCM can form an independent view of the SROASAI assessment. This additional approval and the requirement to engage with overlapping titleholders has the potential to increase project development timelines. There is also the possibility that CCS proponents may have to declare force majeure if they cannot obtain RCM approval to undertake the activities related to their permit commitments. The unfamiliarity of the regulator to approve a Declaration Of Identified Storage Formation (DISF) and subsequent Injection License may increase uncertainty in project timelines for early adopters of CCS technology.

“Brownfield developments may suffer from project delays related to achieving approval of safety cases to from NOPSEMA to re-use legacy petroleum infrastructure. In terms of environmental approvals, the recent litigation against NOPSEMA approvals for petroleum activities poses similar risk for CCS activities. Furthermore, the CCS industry may be seen by activists as extending the life of the fossil fuel industry.

“I agree with Diego that communication is pivotal. A strategy of early and regular engagement with stakeholders who have high interest and high influence is Stakeholder Management 101. Education will also be a key enabler for the public acceptance of CCS technology.”