As part of its measures to advance responsible offshore energy development, the Bureau of Ocean Energy Management has published the Final Programmatic Environmental Impact Statement for Gulf of America Regional OCS Oil and Gas Lease Sales and Post-Lease Activities.

As part of its measures to advance responsible offshore energy development, the Bureau of Ocean Energy Management has published the Final Programmatic Environmental Impact Statement for Gulf of America Regional OCS Oil and Gas Lease Sales and Post-Lease Activities.

It comes with a solid environmental review framework with a robust and transparent environmental evaluations for future exploration, development, and decommissioning activities in the Gulf. This development has also been supported by bodies such as the United States Government Accountability Office, which had expressed the need for clearly defined timelines, when it comes to decommissioning.

It had pushed for better enforcement of decommissioning deadlines in a safe manner on BOEM's part, ensuring thorough execution of the actions planned. GAO's proposals came on the basis of extensive reviewing of laws, regulations, implementing guidance, policies, procedures, budget justifications, and other documentation related to the bureau's decommissioning deadlines.

It had pointed out the urgency of addressing long-standing issues such as effectiveness of enforcement tools, deadlines delivery, supplemental bonding levels and operational standards.

On the status of bonding coverage for decommissioning liabilities, GAO proposed on adopting a reporting mechanism or additional direction laying out how BOEM can balance the priorities set by the Outer Continental Shelf Lands Act, including safety, environmental protection, development of resources, conservation of resources. This will help to promptly address the risks pertaining to decommissioning liabilities, enabling timely decisions on future mitigation measures.

Buccaneer Energy that operates exploration and production activities in Texas, United States, has completed an organic oil recovery pilot project in its Pine Mills field in East Texas.

Buccaneer Energy that operates exploration and production activities in Texas, United States, has completed an organic oil recovery pilot project in its Pine Mills field in East Texas.

One injector and two of four producing wells in the Northern section of Pine Mills (Battery 3 area) were subjected to treatment, resulting to a 100% production boost. To facilitate the process of organic oil recovery, a nutrient mixture was injected into the reservoir to stimulate the growth of naturally occurring microorganisms. The rapid growth of these microbes converts the surface properties from hydrophilic (attracted to water) to hydrophobic (repelled by water). This leads to better mobility of residual oil within mature waterflood systems, as the microbial action reduce the interfacial tension between the rock face and the reservoir oil. One treated producer experienced a significant reduction in water cut immediately following treatment.

The post-treatment period has not only recorded an increase from 15 bopd to approximately 30 bopd but maintained consistency. Water cut was nil from 80% in one of the treated wells.

With costs akin to any routine field workover, the company is currently planning follow-up treatment of the remaining two producing wells.

The company will continue to evaluate production performance at the treated wells while also designing the next phase of field implementation.

Paul Welch, Buccaneer Energy's Chief Executive Officer, said, "We are very encouraged by the success of the Pilot Project where average production from the area treated increased 100% to 30 bopd. The initial results significantly exceeded our expectations. The process is well-suited to mature waterfloods, like Pine Mills, where the "easier oil" has been produced and a large amount of residual oil remains in place. Efficiently dislodging this residual oil has a significant impact on production rates. One of the treated producers in the Pilot went from an 80% water cut to a 0% water cut after treatment, a remarkable result.

"Most importantly, the cost of this treatment is modest and comparable to a routine workover, meaning it can be applied without a material capital investment.

"As highlighted in our recent reserve update, Pine Mills carries an NPV10 of approximately $9.6 million at $60 oil pricing. Our current market capitalisation is approximately £1.3 million. Our focus is on closing that gap through incremental production growth, improved recovery and disciplined execution. We see this programme as a practical step toward converting underlying reserve value into cash flow and look forward to updating shareholders as we expand the initiative across the field."

A new report from Fortune Business Insights on the global offshore decommissioning market forecasts that the North America decommissioning market will grow at a CAGR of 7.06% from 2026 to 2034, the highest rate regionally after Europe.

A new report from Fortune Business Insights on the global offshore decommissioning market forecasts that the North America decommissioning market will grow at a CAGR of 7.06% from 2026 to 2034, the highest rate regionally after Europe.

The North America offshore decommissioning market size stood at around US$2.26bn in 2025, accounting for roughly 26.49% of the global market size, valued at US$8.52bn in 2025, according to the report. The region contains over 14,000 inactive offshore wells and more than 2,000 decommissioned platforms, creating a continuous pipeline of abandonment work. Many shallow-water platforms installed in the 1970s–1990s are at the end of their life, while deepwater fields sanctioned in the early 2000s are now entering late-life phases.

Offshore decommissioning is driven mainly by ageing assets, regulatory enforcement, and the economic reprioritisation of offshore portfolios, the report notes. Large energy companies are exiting marginal offshore fields to reallocate capital toward higher-return assets, including LNG, deepwater hubs, and low-carbon investments.

The report highlights the shift from multi-vendor execution toward integrated single-contract (EPC-style) decommissioning models, enableing operators to lock in costs early, transfer execution risk, and simplify regulatory compliance through a single accountable entity. Contractors with combined capabilities, including heavy-lift removal, subsea services, well P&A coordination, and access to certified recycling yards, are gaining a competitive advantage.

Challenges for offshore decommissioning include the high capital intensity combined with cost uncertainty, which continues to delay project sanctioning despite regulatory pressure. Decommissioning expenditures require substantial upfront capital for well plugging and abandonment, heavy-lift vessel mobilisation, subsea clearance, and onshore dismantling. For operators managing multiple late-life assets, these costs compete directly with sustaining capital expenditures (capex) and balance-sheet priorities, often leading to phased or deferred execution rather than complete removal.

One of the most critical challenges is execution complexity arising from legacy infrastructure and incomplete historical data, with many offshore fields scheduled for decommissioning developed before standardised digital asset management and modern integrity documentation came into use. This lack of reliable data increases the risk of encountering unknown well conditions, undocumented tie-ins, or degraded materials during execution.

Offshore decommissioning presents significant opportunities driven by project aggregation, specialisation, and industrialisation of removal activities rather than one-off asset retirement, the report notes. As decommissioning volumes rise sharply in mature basins, operators are increasingly bundling multiple platforms, wells, and subsea assets into multi-field or basin-wide decommissioning programmes. This creates opportunities for contractors to secure long-term framework agreements, enabling fleet optimisation, repeatable execution, and margin stability through scale efficiencies.

Another key opportunity lies in late-life asset transfer and decommissioning-only operators. The report notes that financial investors and specialist firms are acquiring end-of-life offshore assets specifically to execute decommissioning at lower cost through lean operating models and optimised contracting strategies, opening the market for advisory, engineering, and execution partners with specialised decommissioning expertise rather than traditional exploration and production (E&P) capabilities.

DOF Group ASA has secured a significant new contract from Shell Offshore Inc., strengthening its position in the North American offshore energy market.

DOF Group ASA has secured a significant new contract from Shell Offshore Inc., strengthening its position in the North American offshore energy market.

The agreement covers the delivery of hydraulic subsea well intervention services and falls within DOF’s substantial contract category, valued between US$mn and US$50mn.

The work will be handled by DOF’s subsea team based in North America, which will oversee the project from planning through to offshore execution. This includes full responsibility for project management, engineering, the intervention vessel, and all surface and subsea services required to inject chemical fluids into selected subsea wells. The contract highlights DOF’s capability to provide fully integrated solutions for complex offshore operations.

Offshore activities are expected to begin in the second quarter of 2026. Vessel operations in the United States Gulf are planned to span between 75 and 120 days, reflecting a strong level of utilisation and a well defined operational schedule.

Mons S. Aase, CEO DOF Group ASA, said, “I am delighted to see how DOF is continuously expanding our portfolio of services and adding value to our clients and other stakeholders.”

This contract represents another step forward for DOF as it continues to broaden its service offering and deepen relationships with major international energy companies. It also underlines the company’s focus on delivering reliable, high quality subsea services while supporting efficient and safe offshore operations in one of the world’s most active energy regions.

Energy technology company, Baker Hughes, has secured a multi-year contract from North America’s natural gas producer, Expand Energy, to deploy its Leucipa automated field production solution that will cover multiple gas-producing wells in the region.

Energy technology company, Baker Hughes, has secured a multi-year contract from North America’s natural gas producer, Expand Energy, to deploy its Leucipa automated field production solution that will cover multiple gas-producing wells in the region.

The deployment of Leucipa will empower North America’s natural gas supply chain while advancing production optimisation for Expand Energy. Equipped with artificial intelligence-powered Production Management and Field Optimizer services, Leucipa will make a big difference in Expand Energy's operational efficiencies by generating advanced workflows. It will establish seamless connection across a diverse portfolio of gas-producing wells, driving more informed, data-driven decisions.

Expand Energy will also launch a pilot of Lucy, the Leucipa AI Production Assistant, which provides real-time analysis of production data through a generative AI-powered conversational interface to simplify decision-making in the field.

“This collaboration illustrates how digital technologies are reshaping the economics of natural gas production,” said Amerino Gatti, executive vice president of Oilfield Services & Equipment at Baker Hughes. “By providing comprehensive, real-time insights for wells, fields, and basins across the United States, Expand Energy can achieve greater efficiency, reliability, and sustainability across the natural gas value chain.”

Leucipa will be deployed as SaaS on Amazon Web Services (AWS), providing Expand Energy a secure, scalable environment for broad deployment and simplified management across their nationwide portfolio.

This agreement will co-develop new workflows that integrate seamlessly with Expand Energy’s existing digital tools. Workflows for gas nominations and field forecasting will provide more certainty for contract commitments and scenario modeling. Leucipa’s flexible architecture will also help integrate Expand Energy’s edge, on-prem and cloud-based systems into a unified framework.

“This collaboration marks a significant step forward in the digital transformation of our upstream operations,” said Josh Viets, executive vice president & chief operating officer at Expand Energy. “By deploying AI-powered systems across our nationwide network of wells, Expand Energy will enhance the value of our assets through more efficient and reliable delivery of energy to our customers.”

By signing a decommissioning definition engineering contract from QatarEnergy, a Houston-based company from the United States called McDermott will be facilitating the State of Qatar's inaugural offshore decommissioning initiative.

By signing a decommissioning definition engineering contract from QatarEnergy, a Houston-based company from the United States called McDermott will be facilitating the State of Qatar's inaugural offshore decommissioning initiative.

Services will include the development of a comprehensive technical and commercial framework followed by detailed techno-economic studies before the safe initiation of systematic retirement and removal of 27 aging offshore platforms. This will be covering a vast network of subsea infrastructure—including subsea cables and pipelines—located in the Al-Karkara, Idd El-Shargi and Maydan Mahzam fields.

With definition engineering set to start from its Doha base, McDermott's Senior Vice President representing Offshore Middle East, Mike Sutherland, said, "As the first decommissioning project of its kind in the country, and given the scale of assets to be retired, this award represents a significant milestone and an exciting new chapter for McDermott, QatarEnergy and the State of Qatar...We are uniquely positioned to deliver a landmark framework that will set new industry benchmarks and establish best-in-class standards for future decommissioning efforts in the region and beyond."

"McDermott has installed the majority of Qatar's offshore assets," added Neil Gunnion, Qatar Country Head and Vice President, Operations. "We are proud to apply decades of experience to continue delivering innovative, lifecycle-focused energy solutions through our long-standing, trusted partnership with QatarEnergy."

While originally from the United States, McDermott's global client base has not only earned it deep knowledge and expertise on offshore assets and their strategic decommissioning but also efficient project delivery with minimal operational risk and maximum environmental responsibility. The company leverages its years of understanding of the engineering, procurement, construction and installation (EPCI) phases for a smooth transition from decommissioning definition engineering to execution.

Transportation and installation work is set to begin for Shell's Kaikias Waterflood project off the Louisiana coast in the United States as Subsea7 signed a contract with Shell.

Transportation and installation work is set to begin for Shell's Kaikias Waterflood project off the Louisiana coast in the United States as Subsea7 signed a contract with Shell.

Subsea7 will be structuring subsea umbilicals, riser and a rigid flowline, all running 1,650 metres deep to support the offshore development project in the Mars-Ursa Basin. This will advance sustainable production from the Kaikas project, which is being developed by the waterflood method. The field will be subjected to oil recovery two times by water injection so that displaced oil becomes apparent to the nearby wells.

Subsea7 will be running contract operations from its base in Houston, Texas, initiating project management and engineering activities. This will be followed by offshore delivery in 2027.

Craig Broussard, Senior Vice President for Subsea7 Gulf of Mexico, said, “This award strengthens our long-standing and successful collaboration with Shell. We are bringing our deepwater experience to the Kaikias development and delivering cost-effective solutions that will support safe and efficient project execution, helping Shell maximise long-term value from the field.”

Shell's investment in the Kaikias Waterflood project will generate high-margin production for the oil major.

Halliburton reported a strong close to 2025, with fourth-quarter results highlighting changing activity levels across North America, including offshore-related services in the Gulf of Mexico, alongside continued strength in international markets.

Halliburton reported a strong close to 2025, with fourth-quarter results highlighting changing activity levels across North America, including offshore-related services in the Gulf of Mexico, alongside continued strength in international markets.

For the fourth quarter of 2025, Halliburton posted net income of US$589 million, or US$0.70 per diluted share. Adjusted net income, excluding impairments and other charges and tax adjustments, reached US$576 million, or US$0.69 per diluted share. This marked a significant improvement from the third quarter of 2025, when net income was US$18 million, or US$0.02 per diluted share, and adjusted net income stood at US$496 million, or US$0.58 per diluted share.

Total company revenue for the quarter reached US$5.7 billion, up slightly from US$5.6 billion in the previous quarter. Operating income increased to US$746 million, compared to US$356 million in the third quarter. On an adjusted basis, operating income rose to US$829 million from US$748 million.

North America revenue for the fourth quarter of 2025 was US$2.2 billion, reflecting a sequential decline of 7%. The decrease was primarily attributed to lower stimulation activity across US Land and Canada, reduced fluid services activity in the Gulf of America, and lower well intervention services in US Land. These declines were partially offset by improved cementing activity and higher completion tool sales in both US Land and the Gulf of America.

In contrast, Halliburton’s international business delivered growth, with total international revenue increasing 7% sequentially to US$3.5 billion. The company highlighted strong performance across multiple regions, including Europe, Africa and the Middle East, where well intervention services and stimulation activity increased during the quarter.

From an operating segment perspective, the Completions and Production division generated revenue of US$3.3 billion in the fourth quarter, flat sequentially.

Operating income rose by 11% to US$570 million, driven by higher year-end completion tool sales globally, improved cementing activity in the Western Hemisphere and Africa, and increased well intervention services internationally. These gains were partially offset by lower stimulation activity in the Western Hemisphere.

The Drilling and Evaluation segment also reported flat sequential revenue of US$2.4 billion. Operating income increased by 5 percent to US$367 million, supported by higher wireline activity in the Eastern Hemisphere and increased year-end software sales, offset by lower fluid services in North America.

For the full year 2025, Halliburton reported total revenue of US$22.2 billion, compared to US$22.9 billion in 2024. Operating income for the year was US$2.3 billion, while adjusted operating income reached US$3.1 billion.

Commenting on the results, Chairman, President and CEO Jeff Miller said the company outperformed expectations in the fourth quarter and highlighted the strength of Halliburton’s international business, while noting that North America is expected to respond first when macro fundamentals improve.

New legislation is on the cards which could serve to advance and streamline the USA’s Rigs to Reefs initiative.

New legislation is on the cards which could serve to advance and streamline the USA’s Rigs to Reefs initiative.

The USA’s Subcommittee on Energy and Mineral Resources has held a legislative hearing on a bill to codify the existing Rigs to Reef initiative which allows oil and gas operators to decommission offshore energy infrastructure which has reached the end of its life, and convert it to artificial reefs.

H.R. 5745, the Marine Fisheries Habitat Protection Act, introduced by U.S. Rep. Mike Ezell (R-Mississippi), formalises and builds upon the Rigs to Reef initiative, which proponents of the bill have argued has been hampered by red tape. The bill establishes clear procedures and timelines to ensure a reliable permitting process and authorizes the Bureau of Safety and Environmental Enforcement (BSEE), in coordination with relevant state agencies, to designate Reef Planning Areas. Finally, the bill directs BSEE to provide a map of each idle structure that supports an established reef ecosystem and an annual report detailing reefing applications and outcomes to Congress, the Secretary of the Interior, and the Administrator of NOAA. BSEE Gulf of America Regional Director Bryan Domangue testified in support of the bill, saying the BSEE is keen to work with lawmakers to improve its provisions.

Subcommittee chairman Pete Stauber, R-Minnesota said, “The Rigs to Reefs program has been a great success story, thanks in no small part to partnerships between domestic energy producers and federal and state regulators and conservation agencies. I commend Representative Ezell for his leadership on the Marine Fisheries Habitat Protection Act, which will strengthen this program, benefiting marine habitat and coastal communities for years to come. I look forward to working with Representative Ezell to advance this important legislation through the Natural Resources Committee.”

However, opponents of the bill expressed the fear it could reduce government oversight, removing key environmental safeguards and allowing oil companies to more easily swerve their clean-up obligations.

The Gulf of America is one of the leading regions for Rigs to Reefs projects, with 634 platforms in the Gulf of Mexico having been transformed into reefs as of June 2023, according to a Government Accountability Office (GAO) report. Many studies have been conducted by the US Government to examine the impact the reefs have both on the structures themselves and the surrounding marine ecosystem. One benefit is that of marine restoration and biodiversity enhancement – the deployment of artificial reefs in areas that have been affected by situations such as coral bleaching and destructive fishing practices allows new habitats to house a variety of marine life and play a significant contribution to ecosystem restoration.

Other benefits can include the enhancement of fisheries around the localised area; a rise in ecotourism, in particular destination diving; added coastal protection from erosion as the rigs act as submerged breakwaters; advancement in marine research; increased maintenance of nutrient cycling and water quality; contribution to environmentally responsible practices; and coral restoration and conservation.

On the other side of the coin, however, there has been some pushback due to a number of posed risks associated with the process. Concerns include habitat displacement as some reefs can alter local marine habitats; the risk of pollution from improperly prepared materials; physical damage to the seafloor if the design or placement of the rig is not appropriate; damage to the surrounding ecosystem if the construction has not been actioned properly; the negative impacts associated with long-term maintenance of the rigs; the economic costs of reef management; and design flaws which may create conflict with local environmental conditions.

According to the United States Department of the Interior's Bureau of Safety and Environmental Enforcement, well decommissioning is a critical process for environmental protection.

According to the United States Department of the Interior's Bureau of Safety and Environmental Enforcement, well decommissioning is a critical process for environmental protection.

After a well has been drilled and utilised for production, it must be safely plugged and sealed in the Outer Continental Shelf, with the production-supporting equipment removed for disposal. This is established right from the start when a company signs a lease for offshore exploration, Right-of-Way or Right-of-Use-and-Easement.

Decommissioning activity in a platform generally relates to two parts -- the topside that can be seen above the waterline, and the mudline substructure that remains between the surface and the seabed. The operational components that make up the topsides are removed to be taken to shore for repurposing. The substructure, on the other hand, is dismantled 15 ft below the mudline before they are transported to shore for commercial purposes or recycling/reinstallation.

In case a structure is kept as it is for conversion to an artificial reef in line with the National Oceanic and Atmospheric Administration's National Artificial Reef Plan, it requires approval from the Regional Supervisor.

A central part of BSEE's decommissioning rules is the 'Idle Iron' policy that is applicable for decommissioned and no longer 'economically viable' operations. This distinction bars inactive facilities from littering the Gulf of America by alarming operators on the urgency of dismantling and disposal responsibilities once non-productive wells have been plugged.

The Idle Iron policy helps safeguard environmental hazards that can result from unremoved topsides and the associated equipment, electronics, wiring, piping and tanks, among others. Also, severe weather conditions like hurricanes can cause idle facilities to leak, giving rise to unwanted risks.

Archer, in collaboration with SLB, has been awarded an integrated plug and abandonment (P&A) contract with Equinor for the Titan platform in the Gulf of America (GoA).

Archer, in collaboration with SLB, has been awarded an integrated plug and abandonment (P&A) contract with Equinor for the Titan platform in the Gulf of America (GoA).

The service offerings under the contract includes project management, well engineering, provision of a compact workover rig, coiled tubing, wireline services, and a suite of downhole P&A technologies and the scope covers P&A of three wells. The award combines SLB’s established deepwater leadership in the region with Archer’s specialist expertise as a P&A service provider.

Dag Skindlo, CEO of Archer, commented, “This integrated deepwater P&A project builds on our momentum following several large P&A contract awards in the North Sea in 2025. The recent acquisitions of the US based fishing specialists WFR and Premium were key steps in our strategy to position Archer as a leading service provider in the growing deepwater P&A market in the GoA.”

The contract follows hot on the heels of the award of an integrated P&A contract with Equinor for 30 subsea wells. The fully integrated P&A programme incorporates the planning scope including project management, well and subsurface engineering (provided through the Archer Elemental joint venture) with the execution scope including wireline, fishing and remedial services, downhole mechanical isolation, P&A services, cementing, fluids, and mudlogging.

The awards further reinforce Archer’s leading position within the P&A market and reflect its ability to deliver integrated well abandonment solutions from concept selection through to the permanent abandonment of wells. The company has successfully completed hundreds of permanent P&A wells in the North Sea.

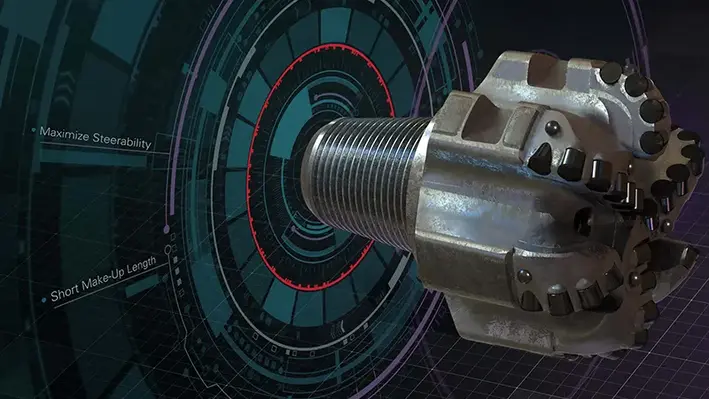

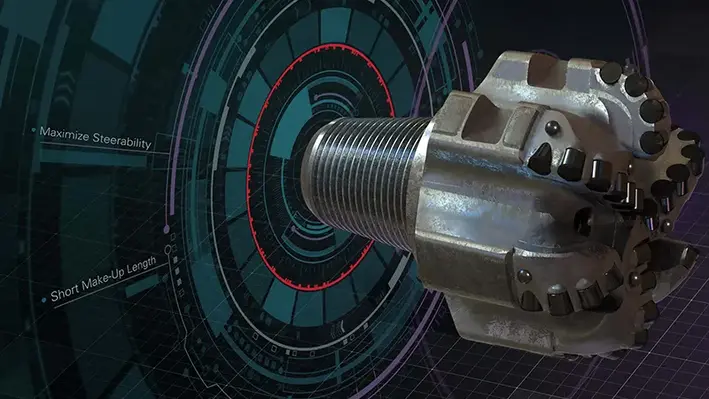

Halliburton has launched its first shankless matrix-body bit called the HyperSteer MX directional drill bit.

Halliburton has launched its first shankless matrix-body bit called the HyperSteer MX directional drill bit.

Improving durability and maximising directional control, the bit promises longer runs and fewer trips, resisting erosion and abrasion, and performing reliably in high-flow, abrasive environments.

"HyperSteer MX directional drill bits mark a major step forward in drilling. The technology combines the precise steerability of HyperSteer directional drill bits with a durable matrix body. It allows operators to drill longer in harsh environments and supports efforts to minimize well time and maximize directional performance for customers," said Amr Hassan, Vice President, Drill Bits and Services, Halliburton.

The tool utilises advanced matrix materials to resist erosion and abrasion, extend bit life in abrasive, high-flow environments, and improve efficiency and reliability during operations. It deliver precise steerability that boosts performance in vertical, curve, and lateral sections, and reduces well time as well as well construction costs. The bit reduces trips, lowers exposure to unplanned events, and maintains directional precision in the most abrasive environments.

HyperSteer MX directional drill bits adds to the HyperSteer portfolio, reflecting the oilfield services provider's engagement in innovative engineered solutions for asset value maximisation.

Page 1 of 24

Copyright © 2026 Offshore Network