C-Innovation has completed the decommissioning of the Joliet tension leg platform (TLP) in the Gulf of America.

C-Innovation has completed the decommissioning of the Joliet tension leg platform (TLP) in the Gulf of America.

Joliet was the oldest TLP installed in the Gulf (since 1989) in 1,725ft of water. The decommissioning contract involved the MSV Island Venture, along with its ROVs, cranes and back deck support services.

Island Venture was responsible for cutting the two 8 inch and 10 inch flexible risers which were then abandoned in a pre-determined area of the sea floor.

Additionally, the scope included the detaching of 12 mooring tendons from the Joliet TLP. The tendons, each measuring over 1,700ft long, were cut into 305 separate sections aboard the Island Venture and transferred to an OSV to transport to shore.

George Wilson, Project Manager at C-Innovation, said, “The C-Innovation team executed the project safely and efficiently, competing it ahead of schedule without any accidents or incidents. Our success was driven by strong offshore leadership, careful planning, a focus on safety and the lift capacity of the Island Venture crane.

“The original agreement was for 26 days with extension options, which were exercised, bringing the total to 36 days. The contract was signed on 15 January, 2025, work began on 2 May, and the project was successfully completed on 3 June, 2025.”

Autonomous subsea software company, Nauticus Robotics, has announced the Aquanaut Mark 2 has set a new record for ultra-deepwater depth off the coast of Louisiana.

Autonomous subsea software company, Nauticus Robotics, has announced the Aquanaut Mark 2 has set a new record for ultra-deepwater depth off the coast of Louisiana.

The flagship fully electric-operated underwater vehicle reached depths of 2,300 metres underwater, opening new opportunities for underwater monitoring.

Daniel Dehart, Nauticus’ VP of Field Operations, said, “I am pleased to report our vehicle has reached unprecedented ultra-deepwater depths without the need of a tether. Reaching this new depth is an exciting milestone, and we have obtained significant data on both Aquanaut and ToolKITT from these tests – particularly regarding acoustic communication challenges in ultra-deepwater.

“Our Autonomous Solutions team will spend the necessary time to analyse the new data and apply this information to optimise performance for our ultra-deep applications and across our portfolio.”

CEO John Gibson commented, “The more time we spend untethered in the water, the greater our operational and technical lead expands in the market. I want to thank our employees for their dedication to innovating for our customers and their offshore projects. I’m proud that our team is constantly finding solutions to strengthen our capabilities underwater and enhance revenue opportunities for projects at these depths.”

Helix Energy Solutions has been awarded a multi-year contract for production enhancement and well abandonment services in the Gulf of America with an undisclosed major operator.

Helix Energy Solutions has been awarded a multi-year contract for production enhancement and well abandonment services in the Gulf of America with an undisclosed major operator.

The contract will commence next year and calls for the provision of either the Q5000 or Q4000 riser-based well intervention vessel, a 10k or 15k Intervention Riser System (IRS) and remotely operated vehicles.

Helix’s services will cover operations from fully integrated production enhancement to full integrated plug and abandonment well services.

Scotty Sparks, Executive Vice President and Chief Operating Officer, said, “We are pleased to expand our backlog by successfully executing another multi-year contract for well intervention services. This contract underscores our commitment to delivering safe, cost-effective and efficient production enhancement and abandonment services in the Gulf of America, supported by Helix’s advanced vessels, decades of industry-leading experiences, and the collaborative capabilities of our Subsea Services Alliance.”

The contract includes equipment and services as part of the Subsea Services Alliance: a strategic partnership between Helix and SLB.

Kent, the global integrated energy services partner is acquiring Exceed (XCD) Holdings Limited, to create a global leader in decommissioning, well management and sub surface engineering services.

Kent, the global integrated energy services partner is acquiring Exceed (XCD) Holdings Limited, to create a global leader in decommissioning, well management and sub surface engineering services.

This acquisition will strengthen Kent’s position in the fast-growing global decommissioning market, set to rise from US$8bn to US$16bn a year by 2035, as the company aims to become a full-service partner across the energy lifecycle, including late-life operations through to the safe and successful decommissioning of customer assets.

Exceed, headquartered in Aberdeen and active in over 40 countries, has two decades of experience in delivering complex offshore well projects, with over 70 wells drilled and more than 150 decommissioned to date. Its proven delivery model and track record will combine with Kent’s global platform and project execution strength to meet growing demand for safe, compliant and cost-effective end-of-life solutions for oil and gas infrastructure.

The deal could also open up significant energy transition opportunities given Exceed is already repurposing reservoirs for carbon capture and hydrogen storage projects, and Kent also has expertise in this area.

“Our agreement to acquire Exceed is a bold step into the future of responsible energy operations,” said John Gilley, CEO of Kent. “Exceed’s specialist capabilities in well and reservoir management, coupled with their strong reputation in decommissioning, complement our vision of offering full lifecycle services to our clients. Together, we will be uniquely positioned to help the industry navigate energy security, net-zero mandates, and the safe retirement of offshore assets.”

Ian Mills, Managing Director of Exceed, commented, “We’ve built Exceed over 20 years with a commitment to technical excellence, innovation and client trust. Joining forces with Kent is the natural next step. It gives us the financial backing and global reach to scale our expertise to new markets and opportunities, while preserving the same culture, entrepreneurial spirit and values that define us.”

The transaction is expected to be completed later this year.

French energy giant TotalEnergies has secured a 25% stake in a portfolio of 40 offshore exploration leases in the U.S. Gulf of Mexico, operated by Chevron. The agreement strengthens TotalEnergies' presence in U.S. offshore energy projects and supports its goal of boosting oil and gas production by 3% annually through 2030, focusing on low-cost, low-emissions output.

French energy giant TotalEnergies has secured a 25% stake in a portfolio of 40 offshore exploration leases in the U.S. Gulf of Mexico, operated by Chevron. The agreement strengthens TotalEnergies' presence in U.S. offshore energy projects and supports its goal of boosting oil and gas production by 3% annually through 2030, focusing on low-cost, low-emissions output.

The newly acquired federal leases are located across three major areas: 13 blocks in Walker Ridge, 9 in Mississippi Canyon, and 18 in East Breaks. These zones are known for their resource-rich deepwater potential, with Chevron continuing as the operator of the assets.

TotalEnergies already holds minority interests in four Chevron-operated offshore fields in the Gulf of Mexico, further reinforcing its long-term collaboration with the Texas-based energy company.

In the liquefied natural gas (LNG) sector, TotalEnergies is the leading U.S. LNG exporter, managing over 10 million metric tons per year under long-term contracts. Historically, the company has sourced LNG from local producers, but recently it has shifted toward more upstream investments.

In 2024, TotalEnergies also acquired stakes in two Texas shale gas fields from Lewis Energy Group. This move gives the company direct access to natural gas at the U.S. Henry Hub price benchmark—an important step to ensure cost-efficiency in LNG exports amid changing market conditions.

This latest offshore deal marks a significant step in TotalEnergies' strategy to expand in low-carbon oil and gas production while ensuring energy security and cost stability through integrated supply chain management.

Following horizontal well completion activities in the Lower Selma Chalk area of the Gwinville Field, Mississippi-focussed producer, Southern Energy Corp, has reported average natural gas rates at 3.6 MMcfe/d (99% gas), a marked rise from the original LSC horizontal wells. Ever since, the company has been tapping into its commercial value, driven by the exceptional well flow to facilities.

Following horizontal well completion activities in the Lower Selma Chalk area of the Gwinville Field, Mississippi-focussed producer, Southern Energy Corp, has reported average natural gas rates at 3.6 MMcfe/d (99% gas), a marked rise from the original LSC horizontal wells. Ever since, the company has been tapping into its commercial value, driven by the exceptional well flow to facilities.

This comes from the first of the company's three remaining drilled but uncompleted (DUC) horizontal wells from the Q1 2023 drilling programme, the GH LSC 13-13 #2 wellbore.

The well was stimulated with 25 fracture stages, placing over 5.3 mn lbs of proppant into the wellbore. While this increased proppant intensity by a striking 70%, targeted stimulation design changes boosted the predictability and speed of the fracture operations. To top that, it reduced the overall completion cost down to US$2.2mn by more than 10% below pre-job estimates. This and other cost savings have allowed the company to cut down such operational budgets by 20%.

Southern will continue to monitor both regional natural gas pricing and well performance from the GH LSC 13-13#2 over the upcoming months before making a decision on the completion timing of the remaining two DUC wells and will update the market at that time. The remaining two DUC wellbores have been drilled in the LSC and City Bank formations.

Ian Atkinson, President and Chief Executive Officer of Southern, said, “We are very pleased with the early flowback results of the GH LSC 13-13 #2 well that will help us establish a longawaited type curve for the remaining potential 60+ LSC horizontal locations in our vast Gwinville inventory. We expect the lower decline from the LSC reservoir to support the ~ 3.5 Bcfe recovery per well predicted by both management and our third-party reserve evaluator. The Southern operations team has safely executed this operation at 10% below our original completion estimate, which not only drives a much quicker payout on this capital but will also allow Southern to start redeveloping the Gwinville Field much sooner as natural gas prices are still expected to improve materially into the back half of 2025 and continue into 2026.

"From a revenue generation perspective, since bringing these significant new production volumes on-line in late June with minimal incremental operating costs, Southern has also greatly benefited from a daily natural gas basis premium of approximately 17% above Henry Hub pricing due to the start of warmer seasonal temperatures and associated natural gas fired power demand in the southeast U.S. which we expect to continue or improve throughout the summer. We look forward to providing these improved cash flow results from additional Q3 volumes in November 2025.”

As part of sustainability-driven initiatives to expand domestic energy production in the US Gulf of America, bp has started up the Argos Southwest Extension project.

As part of sustainability-driven initiatives to expand domestic energy production in the US Gulf of America, bp has started up the Argos Southwest Extension project.

This development is the first of a decade-long initiative by the oil major.

The project will generate an additional 20,000 barrels of oil equivalent per day of gross peak annualised average production at the existing Argos platform. Argos, which began production in 2023, is bp’s fifth operated production platform in the Gulf of America with a gross production capacity of up to 140,000 barrels of oil per day.

“The Argos expansion underpins our commitment to investing in America, growing our US offshore energy production safely and efficiently,” said Andy Krieger, bp’s senior vice president for the Gulf of America and Canada. “This project also kicks off a period of significant growth for bp in the Gulf of America, which will continue to play a critical role in delivering secure and reliable energy the world needs today and tomorrow.”

The Argos Southwest Extension project will add three wells and include a new drill center roughly 5 miles southwest of Argos. The subsea tieback, which connects new wells to existing offshore production facilities through pipelines, will extend the footprint of the Mad Dog field discovered in 1998.

The Argos Southwest Extension project was delivered seven months ahead of schedule by implementing concurrent workstreams, optimising project management and engaging in early procurement.

“Argos’ expansion project demonstrates how bp can swiftly bring new barrels to market safely and efficiently,” said Gordon Birrell, bp’s executive vice president of production and operations. “Our ability to move from resource discovery to first oil at record pace underscores our relentless pursuit to grow shareholder value.”

Following Argos Southwest Extension, bp plans to deliver two additional expansion projects in the Gulf of America by 2027.

Oceaneering International has announced its Subsea Robotics segment has upgraded the Ocean Intervention II (OI2), an oceanographic research vessel, in order to perform simultaneous autonomous survey operations.

Oceaneering International has announced its Subsea Robotics segment has upgraded the Ocean Intervention II (OI2), an oceanographic research vessel, in order to perform simultaneous autonomous survey operations.

The purpose-built OI2 was first launched in 2000 to carry out geophysical and geotechnical surveys. Earlier this year the vessel underwent significant upgrades to expand its capabilities and improve performance for modern survey demands.

Peter Buchanan, Senior Director of Survey, Products and Services, Subsea Robotics, Oceaneering, said, “The Ocean Intervention II provides a step change in survey data acquisition productivity with the ability to simultaneously collect AUV, towed geophysical and geotechnical data. We’re excited to offer this enhanced capability to our clients.”

Some of the enhancements included:

With its enhanced configuration, the OI2 transitions between AUV and towed geophysical surveys, and geotechnical sampling, supporting efficient multi-discipline campaigns.

When paired with Oceaneering’s remotely operated USV capabilities and global Onshore Remote Operations Centers, the OI2 becomes a key enabler of fully integrated, low-risk offshore surveys. The next-gen survey approach supports faster data acquisitions, improved decision-making and increased efficiency thro8ugh simultaneous operations.

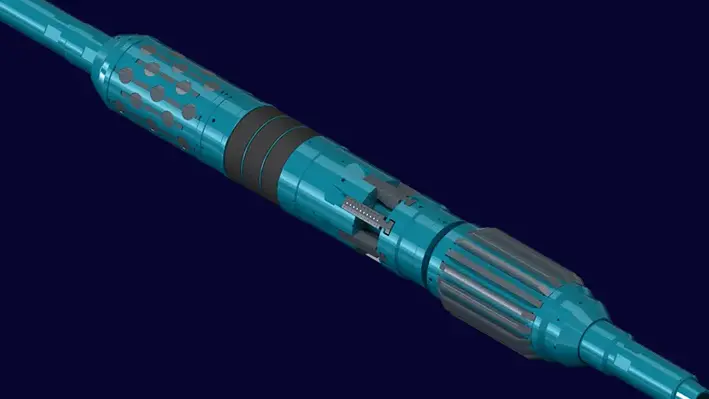

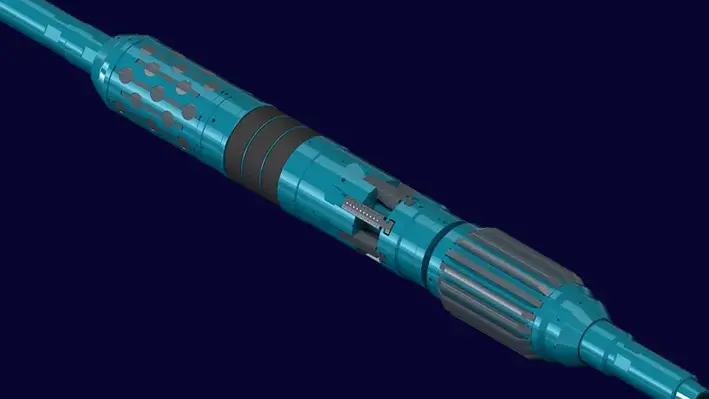

Expro has launched its most advanced BRUTE High-Pressure, High Tensile Packer System to date.

Expro has launched its most advanced BRUTE High-Pressure, High Tensile Packer System to date.

This new system is built to perform in extreme deepwater well conditions, handling the highest differential pressures in the industry. It allows operators to set higher in the wellbore, helping save rig time, reduce operational risks, and meet regulatory requirements more easily.

A key part of this launch is the BRUTE Armor Packer, a major step forward in Expro’s BRUTE range. This system offers unmatched strength and flexibility, with the ability to fully support 20k deepwater projects. When paired with the BRUTE 2 Storm Valve, it forms the most highly rated Storm/Service Packer and Valve combo available in the market, according to the company.

This latest technology was first used in a high-spec 20k deepwater project in the Gulf of America for a major energy company. In April 2025, Expro successfully deployed the 12.25” BRUTE Armor Packer System rated to 12,850 psid. The test confirmed the system's ability to handle extreme downhole pressures, proving its reliability in demanding offshore settings.

Following this success, Expro also introduced a new 20”/22” BRUTE Packer System. This tool was designed to overcome previous challenges faced by retrievable mechanical packers in large casing sizes. Traditional systems often struggle with tight internal diameters in subsea wellhead housings and casing adapters. Expro’s new packer offers double the expansion of standard systems, improving casing isolation for testing, suspension, and squeeze operations—without limiting performance.

In June 2025, the new 20”/22” packer was successfully used in a major offshore campaign in the Gulf of America. It passed through tight wellhead areas and expanded fully in a larger ID section below. The system achieved pressure integrity on the first try, confirming its ability to reduce rig time and risk while improving efficiency.

Jeremy Angelle, Vice President of Well Construction at Expro, said,“This launch sets a new standard for deepwater packers. The BRUTE system offers top-level pressure and tensile performance with unmatched adaptability. It proves Expro is leading the way in supporting the future of 20k offshore developments. We're not just meeting the industry's toughest standards – we're defining them.”

The Department of the Interior has updated its guidelines for states applying to federal programmes specialising in the cleanup of orphaned oil and gas wells.

The Department of the Interior has updated its guidelines for states applying to federal programmes specialising in the cleanup of orphaned oil and gas wells.

The revised guidelines mean two federal grant programmes have been updated: the US£780mn Orphaned Wells State Matching Grant Program and the US$1.93 billion Orphaned Wells State Formula Grant Program.

The revisions eliminate non-statutory requirements and reduces the burdens placed on state grant recipients, including removing the requirement that states conduct pre- and post-plugging methane measurements; recognizing the discretion states have in identifying and plugging orphaned wells; and eliminating the Department’s post-award environmental review and approval process.

Acting Assistant Secretary of Policy, Management and Budget, Tyler Hassen, said, “States know their land and their needs best. By cutting unnecessary barriers, we’re helping them clean up old wells faster, protect communities and support energy development.”

Eva Vrana, Deputy Assistant Secretary for Policy and Environmental Management, commented, “These changes make it easier for states to get to work. States can move more quickly to plug wells and reduce environmental risks.”

The updated guidance supports the Trump’s administration initiatives to prioritise the USA’s energy independence and cut regulations. By giving the states more flexibility and speeding up plugging efforts, DOI is helping to achieve this goal.

The coiled tubing market is experiencing significant momentum, particularly in North America, due to increased offshore well intervention activities.

A recent report by Allied Market Research titled "Coiled Tubing Market" reveals that the global market was valued at US$3.0 billion in 2020 and is expected to grow to US$4.7 billion by 2030, registering a CAGR of 4.5% during the forecast period from 2021 to 2030.

Coiled tubing—long, continuous steel or composite tubing used in oil and gas operations—has become a key tool for offshore interventions. It offers flexibility, rapid deployment, and minimal surface footprint, making it ideal for offshore applications such as cleanouts, acidizing, fracturing, and stimulation. As operators seek to optimize well performance and prolong the life of maturing offshore assets, coiled tubing has emerged as a cost-effective solution for maintaining and enhancing productivity.

In North America, the presence of substantial offshore resources and a mature oil and gas industry has positioned the region as a dominant player in the coiled tubing market. The U.S. leads in offshore well intervention, supported by continued investment in deepwater and ultra-deepwater drilling. The integration of advanced coiled tubing technologies—such as real-time data monitoring, improved corrosion resistance, and enhanced injectors—has further strengthened its application in complex offshore environments.

Well intervention remains the largest service segment in the market, accounting for a significant share due to its widespread use in maintaining offshore production. Despite the advantages, offshore coiled tubing operations are challenged by high operational costs and equipment wear, especially in high-pressure, high-temperature wells.

However, these challenges are being addressed through technological innovation and automation. Leading oilfield service providers such as Halliburton, Schlumberger, Baker Hughes, and Weatherford are investing in research and development to improve equipment durability and operational efficiency.

With the increase in unconventional and offshore drilling projects, the North American coiled tubing market is poised for continued growth. The demand for safe, reliable, and sustainable well intervention services is expected to rise, reinforcing coiled tubing’s role in the future of offshore oil and gas operations.

The coiled tubing market is experiencing significant momentum, particularly in North America, due to increased offshore well intervention activities.

A recent report by Allied Market Research titled "Coiled Tubing Market" reveals that the global market was valued at $3.0 billion in 2020 and is expected to grow to $4.7 billion by 2030, registering a CAGR of 4.5% during the forecast period from 2021 to 2030.

Coiled tubing—long, continuous steel or composite tubing used in oil and gas operations—has become a key tool for offshore interventions. It offers flexibility, rapid deployment, and minimal surface footprint, making it ideal for offshore applications such as cleanouts, acidizing, fracturing, and stimulation. As operators seek to optimize well performance and prolong the life of maturing offshore assets, coiled tubing has emerged as a cost-effective solution for maintaining and enhancing productivity.

In North America, the presence of substantial offshore resources and a mature oil and gas industry has positioned the region as a dominant player in the coiled tubing market. The U.S. leads in offshore well intervention, supported by continued investment in deepwater and ultra-deepwater drilling. The integration of advanced coiled tubing technologies—such as real-time data monitoring, improved corrosion resistance, and enhanced injectors—has further strengthened its application in complex offshore environments.

Well intervention remains the largest service segment in the market, accounting for a significant share due to its widespread use in maintaining offshore production. Despite the advantages, offshore coiled tubing operations are challenged by high operational costs and equipment wear, especially in high-pressure, high-temperature wells.

However, these challenges are being addressed through technological innovation and automation. Leading oilfield service providers such as Halliburton, Schlumberger, Baker Hughes, and Weatherford are investing in research and development to improve equipment durability and operational efficiency.

With the increase in unconventional and offshore drilling projects, the North American coiled tubing market is poised for continued growth. The demand for safe, reliable, and sustainable well intervention services is expected to rise, reinforcing coiled tubing’s role in the future of offshore oil and gas operations.

To read more about the report or explore insights from other regions, visit: www.world.einnews.com

Helix Energy Solutions has announced a new plug and abandonment agreement with ExxonMobil in the Gulf of America.

Helix Energy Solutions has announced a new plug and abandonment agreement with ExxonMobil in the Gulf of America.

The operator’s Louisiana-based shallow water abandonment group, Helix Alliance, has secured a three-year framework agreement for P&A services within the region.

Owen Kratz, President and Chief Executive Officer of Helix, said, “This agreement underscores our commitment to delivering high-value, fit-for-purpose decommissioning services. This agreement also demonstrates Helix Alliance’s position as a trusted partner for comprehensive offshore solutions, providing well intervention, diving, heavy lift, and marine support services on the US Gulf of America shelf.”

Page 5 of 24

Copyright © 2026 Offshore Network