The Woodside Energy-operated Trion deepwater oil and gas development offshore Mexico will receive tubular running services (TRS) and cementing services from Expro to build the greenfield project

The Woodside Energy-operated Trion deepwater oil and gas development offshore Mexico will receive tubular running services (TRS) and cementing services from Expro to build the greenfield project

Before the project is ready for its first targeted oil in 2026, the three-year contract involves the deployment of Expro's well construction technologies, which are designed to deliver effective problem-solving from top drive to target depth. The comprehensive suite of services will involve TRS casing, drilling and completions, casing accessories, cement heads, and Expro's Skyhook system.

Set to be Mexico's first deepwater oil production facility, the Trion greenfield project will be supported by Expro to achieve maximum well performance optimisation alongside technical execution. Its approach will be backed by practices driving cost-effectiveness and operational reliability throughout the project lifestyle.

Woodside and Expro go back a long way, with the latest partnership seeing the establishment of a new Expro hub in the region as Woodside manage operations from its Tampico shore base and office. This will also generate local employment and economic upliftment.

Jeremy Angelle, Vice President of Well Construction said, “With our extensive track record and a reputation as a trusted provider of TRS solutions, we are proud to play a key role in this world-class development. This contract win reflects not only the strength of our technical capabilities and commercial offering but also our legacy of supporting Trion exploration wells through Frank’s TRS and VERSAFLO TM systems.

"This project represents an exciting opportunity to showcase our innovative technologies on a historic deepwater development, and we look forward to building a strong, long-term partnership with Woodside in Mexico.”

The Trion field is situated in the Perdido Fold Belt, approximately 180 km off Mexico’s coastline in the Gulf of Mexico, in water depths of around 2,500 meters.

Click here to register for Offshore Network's international well intervention and decommissioning conferences.

![]() Beacon Offshore Energy's Shenandoah floating production system in the Gulf of America is being served by Danos Operations Services via a contract signed by the partners.

Beacon Offshore Energy's Shenandoah floating production system in the Gulf of America is being served by Danos Operations Services via a contract signed by the partners.

The production services contract will be delivered by a team of production operators, instrumentation and electrical technicians, mechanics, and offshore installation managers. Several employees began work on the platform in 2024.

“We are honoured to support Beacon Offshore Energy with production services,” said CEO Paul Danos. “Danos is a people-focused company, and we’re proud to introduce our new partner to the high-performing employees and strong customer service that define our team.”

In the final stages of hook-up with production expected later this summer, the Shenandoah facility boasts of a nameplate capacity of 120,000 barrels of oil per day. Located approximately 230 miles from New Orleans, the project represents a major investment in the future of US offshore production.

Founded in 1947, Danos started out as a small tugboat company, gradually expanding its services with the evolving offshore industry, now employing about 1,300 production services personnel in the Gulf of America. Its comprehensive suite of services include production, supply chain and energy systems. It delivers fabrication, construction, coatings and other project services as well.

Click here, to register for Offshore Network's international well intervention and decommissioning conferences.

CAM Integrated Solutions has announced its official entry into the offshore decommissioning market, marking a significant milestone for the company as it continues to broaden its service offerings.

CAM Integrated Solutions has announced its official entry into the offshore decommissioning market, marking a significant milestone for the company as it continues to broaden its service offerings.

CAM’s new Decommissioning Division will provide clients with turnkey solutions that ensure the efficient and environmentally responsible retirement of end-of-life assets. By integrating decommissioning with its existing services, CAM is positioned to deliver great value to operators navigating end-of-life asset strategies offshore in the Gulf of Mexico.

To spearhead the new initiative, CAM has appointed Brady Barras as the Vice President of Decommissioning. With more than 31 years of experience in the offshore oil and gas industry, Barras will bring his wealth of expertise to decommissioning project through the Gulf and beyond.

Craig Pierrotti, CEO of CAM Integrated Solutions, said, “We are thrilled to be entering the decommissioning market, a natural next step in the evolution of CAM’s integrated service offering. Brady’s depth of knowledge, hands-n experience, and commitment to operational excellent make him the ideal person to lead this new endeavour. I am confident that with Brady at the helm, CAM will quickly establish itself as a trusted and forward-thinking partner in the decommissioning space.”

An upgrade to autonomous hydraulic fracturing technology, Chevron USA and Halliburton have jointly developed a new process that allows closed-loop, feedback-driven completions in Colorado

An upgrade to autonomous hydraulic fracturing technology, Chevron USA and Halliburton have jointly developed a new process that allows closed-loop, feedback-driven completions in Colorado

This intelligent fracturing process combines automated stage execution with subsurface feedback to optimise delivery of energy into the wellbore without relying on human intervention.

The new process ensures efficiency and consistency during fracture execution. To top that, these new technologies come with added control functionality. Backed by digital automation and real-time feedback from the subsurface, autonomous workflows adjust completion behaviour with the goal of improving asset performance.

A combination of technologies from the wellsite to the cloud is required to enable this new approach to intelligent completions. Halliburton’s ZEUS IQ intelligent fracturing platform, comprised of OCTIV auto frac and Sensori monitoring, provides the necessary closed feedback loop and control capability. Chevron’s hydraulic fracturing and subsurface knowledge is built into an algorithm to enable the advanced decision making.

“We drive innovation in the digital space,” said Shawn Stasiuk, Halliburton’s Vice President of Production Enhancement. “We built the digital environment down to the field level and enable our customers to test their best ideas.”

Chevron’s work in closed-loop automation changes the approach to hydraulic fracturing in shale and tight rock formations. Operations can now react to a localized environment through real-time adaptation rather than performance forecasting.

“At Chevron, we focus on continuously advancing asset performance safely through the innovation of our subject matter experts, new technology, and strategic collaborations. This real-time adaptive feedback loop is expected to further drive efficiencies and improve overall asset performance,” said Chevron’s Kim McHugh, Vice President of the Rockies Business Unit.

Click here, to register for Offshore Network's international well intervention and decommissioning conferences.

ExxonMobil has awarded EnerMech a contract to deliver a complete flowline decommissioning package for the Hoover Diana development in the Gulf of Mexico.

ExxonMobil has awarded EnerMech a contract to deliver a complete flowline decommissioning package for the Hoover Diana development in the Gulf of Mexico.

The scope includes decommissioning subsea flowlines, marking EnerMech’s first major decommissioning campaign in the region. An expert team integrating multiple service lines will be deployed from EnerMech’s Energy Solutions division to complete the full scope of work, including coiled tubing, pressure pumping, chemical services, filtration, separation and pipeline gauging.

In more detail, the scope includes flushing, pigging and filling subsea pipelines to safely remove hydrocarbons and prepare for decommissioning. This involves flushing the umbilical, pipeline flushing and seawater fill operations for the subsea flowline loop, as well as nitrogen flushing via subsea vessel, coiled tubing services and sweater filling for the Northern Diana flowline.

EnerMech CEO, Charles Davison Jr., said, “The Hoover-Diana project marks our first large-scale decommissioning engagement in the Gulf of Mexico, building on the strong relationship we’ve developed with ExxonMobil in Guyana since 2018.

“Securing this new contract following a competitive tender is a testament to our deep expertise, integrated capabilities, and the trust ExxonMobil continues to place in our team. Our early engagement has allowed us to develop a tailored methodology that maximizes efficiencies, minimizes risks, and ensures a safe, cost-effective execution.”

The Hoover and Diana fields have been a landmark offshore development for 25 years. This project will utilise the once pioneering floating production deep draft caisson vessel which gained prestige for being the deepest draft drilling and production system in the world.

Integrated decommissioning solutions, late-life asset management, and engineering services tailored for deepwater wells are among the key investment opportunities in the Gulf of America decommissioning market.

Integrated decommissioning solutions, late-life asset management, and engineering services tailored for deepwater wells are among the key investment opportunities in the Gulf of America decommissioning market.

That’s according to a new report from Verified Market Research, which highlights that joint ventures and strategic partnerships are on the increase, in response to high CapEx requirements given the average cost per well decommissioning of around US$1-5mn. The rise in offshore renewable energy projects also presents opportunities to repurpose infrastructure or convert platforms to artificial reefs.

However, risks include fluctuating oil prices affecting operator cash flows, particularly now with the Iran/Israel conflict sending oil prices spiralling, and an ever-changing US tariff regime impacting the oil market. Complex regulatory requirements and regulatory uncertainty, with the rolling back of some Biden-era legislation, can also pose a challenge, along with environmental liabilities. Legal challenges from improper decommissioning and long project timelines (often 12-36 months) pose further capital exposure. Due diligence on operator history, liability transfers, and local regulatory adherence is critical for financial stability and ROI predictability, the report advises.

Key trends include a shift toward sustainable decommissioning, cost optimisation strategies, and integration of robotics and ROVs (remotely operated vehicles) to enhance efficiency and safety. There is a growing focus on sustainability, spurred by both consumer pressure and regulatory requirements, with increased use of eco-friendly materials, implementation of energy-efficient processes, and introduction of waste reduction initiatives. Reflecting developments in the industry generally, the decommissioning market is embracing digital transformation, incorporating cutting-edge technologies such as AI, IoT, and blockchain, which is significantly enhancing operational efficiency and boosting innovation.

Stringent U.S. federal mandates on well abandonment and subsea asset removal are pushing operators to adopt ESG-aligned practices, the report finds. ESG frameworks now play a decisive role in decommissioning project bids and funding eligibility, with green decommissioning, carbon footprint reporting, and stakeholder transparency becoming market entry norms. Companies integrating ESG metrics into decommissioning lifecycle planning are positioned to attract sustainable capital flows and maintain a competitive edge in this evolving offshore energy transition market, the report suggests.

An oil producer from the United States employed Emerson and the company's local partner, Puffer-Sweiven, to replace existing traditional actuator systems on shutdown valves at production wellheads with two Bettis RTS electric valve actuators

An oil producer from the United States employed Emerson and the company's local partner, Puffer-Sweiven, to replace existing traditional actuator systems on shutdown valves at production wellheads with two Bettis RTS electric valve actuators

Successfully pilot-tested, the solutions reduced power consumption and surge events, improved time to market (TTM) with quick implementation, and ensured data-based maintenance decisions. The FQ Series fail-safe quarter-turn actuator mounted on a ball valve, and the FL Series fail-safe linear actuator mounted on a reverse-acting gate valve. As electric actuators, these did not require air compressors, filtration and tubing.

The existing model cost the producer high maintenance charges and operational disruptions as it required addressing failures in cases of power outages or air leaks. Diaphragm wear and corrosion in the air lines raised safety issues as they needed manual intervention. Emerson's systems eliminated this step with its onboard diagnostic features to enable remote monitoring and troubleshooting, including partial valve stroke test (PVST). Equipped to achieve Safety Integrity Level 3 (SIL3), they are mechanical fail-safe to support emergency shutdown applications with the necessary response time. To deal with outage issues, the systems come with a fail-safe 24 V DC circuit, independent of the main power grid.

Capable of operating within a temperature range from -40 °F to +140 °F (-40 °C to +60 °C), it solved the problem of frozen instrument air supply lines of the traditional actuators during colder seasons.

The new systems eliminated methane emissions which were common with each stroke from the tradional actuators.

Click here to register for Offshore Network's global well intervention and decommissioning conferences.

The Department of the Interior has announced that the lead federal agency responsible for overseeing decommissioning activities within the Chumash Heritage National Marine Sanctuary will be the Bureau of Safety and Environmental Enforcement (BSEE).

The Department of the Interior has announced that the lead federal agency responsible for overseeing decommissioning activities within the Chumash Heritage National Marine Sanctuary will be the Bureau of Safety and Environmental Enforcement (BSEE).

The responsibility was transferred from the Department of Commerce to the Interior, underscoring the critical role BSEE plays in managing safe and environmentally sound offshore transitions.

The transfer followed extensive coordination between the National Oceanic and Atmospheric Administration, BSEE and the Bureau of Ocean Energy Management, ensuring a unified approach to decommissioning in the Sanctuary.

Acting Assistant Secretary for Land and Minerals Management, Adam Suess, said, “This is a strong example of interagency collaboration to streamline permitting and promote responsible energy development while honouring our commitment to environmental protection. By leveraging BSEE’s regulatory expertise, we can ensure that offshore decommissioning activities within the Sanctuary are conducted safely and efficiently.”

BSEE Principal Deputy Director, Kenneth Stevens, commented, “The announcement exemplifies our commitment to streamlining processes, reducing unnecessary regulatory burdens, and promoting energy production in alignment with strong environmental protections. Early coordination between NOAA and BSEE will ensure clarity and efficiency, establishing agreed-upon mitigation measures and providing a streamlined regulatory pathway for permittees.”

In 2025, the offshore oil and gas sector in the Gulf of America is undergoing a rapid transformation, as new well intervention technologies reshape how operators approach subsea production, integrity, and high-pressure challenges.

With legacy fields maturing and operational efficiency becoming a strategic priority, companies are turning to advanced systems and partnerships to optimise well performance, extend asset life, and reduce rig time.

Chevron’s Ballymore development stands out as a symbol of this shift. By leveraging a subsea tieback to the existing Blind Faith platform, the project avoids the need for new topside infrastructure while still enabling high-yield production from three wells. This infrastructure-light approach exemplifies a broader industry trend, as operators seek scalable, sustainable solutions that reduce capital expenditure while accelerating timelines. Ballymore is expected to contribute significantly toward Chevron’s target of producing 300,000 barrels of oil equivalent per day from the region by 2026.

On the other hand, Shell is deploying innovative materials in its Whale project, located around 200 miles offshore. The company has partnered with CRP Subsea to introduce crushable foam wrap (CFW) technology – engineered to collapse under specific temperature and pressure thresholds. This provides thermal expansion management and pressure relief in the annulus, addressing critical integrity challenges in deepwater completions. Set for phased delivery starting in the third quarter of 2025, the technology reflects growing emphasis on preemptive integrity control in complex environments.

Meanwhile, intervention hardware is also evolving to meet the region’s high-pressure demands. Trendsetter Engineering has successfully deployed its Trident 20K system at Beacon Offshore’s Shenandoah project. Designed for operations in ultra-high-pressure wells, the intervention system was installed from the Deepwater Atlas drillship and enabled a two-well flowback campaign without requiring the system to be recovered between wells. Its modular design and wet-mate capabilities allowed operators to save valuable rig time while maintaining safety in technically challenging conditions.

The Gulf of America is shifting toward a model where reliability, modularity, and pressure management dominate offshore engineering priorities. As Chevron retools infrastructure usage, Shell integrates intelligent thermal solutions, and Trendsetter pushes the limits of high-pressure intervention, the region is positioning itself as a proving ground for next-gen well intervention technologies. These advancements are expected to support longer well life cycles and safer operations as operators balance performance with cost control.

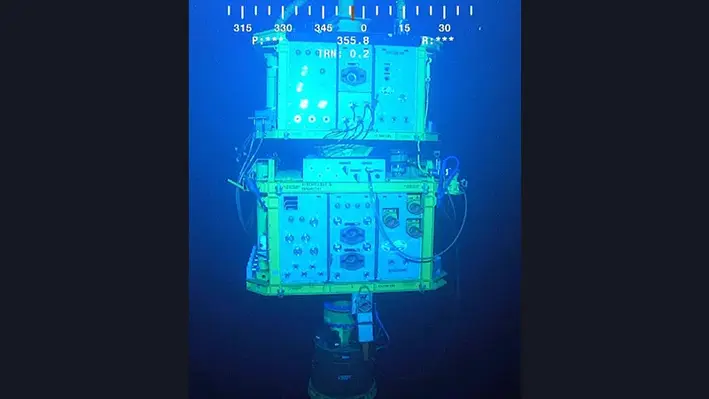

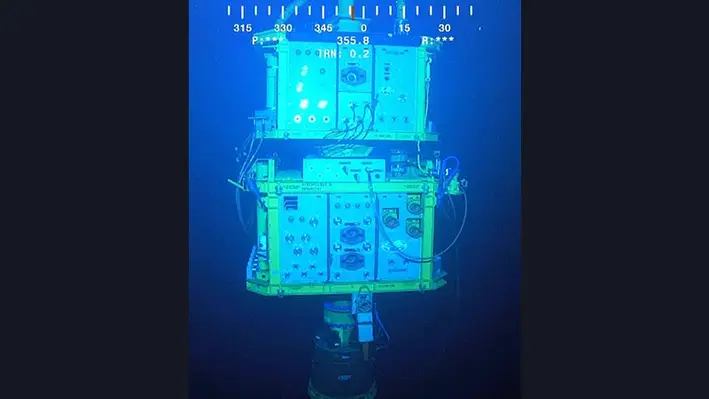

Houston-based subsea hardware and offshore service solutions, Trendsetter Engineering, has deployed for the first time its flagship Trident 20K Intervention System for Beacon Offshore Energy’s Shenandoah project in the Gulf of America

Houston-based subsea hardware and offshore service solutions, Trendsetter Engineering, has deployed for the first time its flagship Trident 20K Intervention System for Beacon Offshore Energy’s Shenandoah project in the Gulf of America

The deployment was initiated from the Deepwater Atlas for a two-well flowback operation at the Shenandoah site. The system was wet-hopped between wells, which not only helped to cut down operational costs but also several days of critical path rig time. The system is currently undergoing post-campaign maintenance by Trendsetter so that it is ready for further deployments.

The launch of the 20K Open Water Intervention Riser System (OWIRS) with its first deployment marks a milestone for Trendsetter.

The 20K intervention system enhances the company's fleet of rental intervention kits. It is the realisation of a groundbreaking innovation as it has been on the cards since the company's 2020 launch -- Trident 15K Intervention System. It was the result of dedicated research, development, engineering, design, assembly, and testing.

From exploration drilling through abandonment, Trendsetter Engineering offers solutions globally.

Register here for Offshore Network's global well intervention and decommissioning conferences.

In yet another move to roll back Biden-era legislation, The U.S. Department of the Interior (DOI) has announced it intends to revise the Bureau of Ocean Energy Management’s 2024 Risk Management and Financial Assurance for OCS Lease and Grant Obligations Rule.

In yet another move to roll back Biden-era legislation, The U.S. Department of the Interior (DOI) has announced it intends to revise the Bureau of Ocean Energy Management’s 2024 Risk Management and Financial Assurance for OCS Lease and Grant Obligations Rule.

The rule increased the financial assurance requirements for offshore operators to ensure they meet their decommissioning obligations and was designed to “better protect the taxpayer from potentially bearing the cost of facility decommissioning and other financial risks associated with OCS development, such as environmental remediation.”

This rule was challenged by the Republican-led states of Louisiana, Mississippi and Texas and oil and gas industry groups, who argued that it would result in "potentially existential consequences" for small and medium-sized companies, although a federal judge earlier this year rejected their bid to block the rule. According to the DOI this rule was estimated to increase financial assurance requirements for offshore oil and gas operators by US$6.9bn in additional bonding, costing businesses an additional US$665mn in premiums each year.

The Trump administration intends to develop a new rule that will supposedly cut costs and red tape and free up billions of dollars for American producers to use to explore and produce oil and gas in the Gulf of America while protecting American taxpayers against high-risk decommissioning liabilities, according to the DOI statement.

“This revision will enable our nation’s energy producers to redirect their capital toward future leasing, exploration, and production all while financially protecting the American taxpayer,” said DOI Secretary Doug Burgum. “Cutting red tape will level the playing field and allow American companies to make investments that strengthen domestic energy security and benefit the Gulf of America states and their communities.”

The Department expects to finalise the rule this year, and will welcome public comments on the proposal.

The Bureau of Ocean Energy Management will continue to require all operators on the Outer Continental Shelf to provide financial assurance for their decommissioning obligations.

In a contract with Shell Offshore, innovative solutions provider, CRP Subsea, will be supplying crushable foam wrap (CFW) for the Whale deepwater development situated 200 miles south of Houston in the Gulf of America

In a contract with Shell Offshore, innovative solutions provider, CRP Subsea, will be supplying crushable foam wrap (CFW) for the Whale deepwater development situated 200 miles south of Houston in the Gulf of America

The contract covers one well-set to be delivered by Q3 2025, followed further by the generation of four additional well-sets over the year. Each well-set are made of 1,798 CFW quadrants, each one metre in length. Other components include installation equipment, such as adhesive (one tube per two quadrants), adhesive dispensing guns, tie wraps, and Spanset straps.

An engineered syntactic foam, CFW comprises of a thermoset resin and hollow glass microspheres (HGMS). Once installed around the inner drill casing, it is immersed in the annulus fluid. As pressure within the annulus increases, the CFW will collapse at a pre-determined pressure and temperature combination, as dictated by well conditions. This controlled collapse allows for the expansion of annulus fluid, dispersing potentially destructive pressure build-up.

Andy Smith, Head of Sales, said, "It’s fantastic that Shell has chosen us to support this exciting deepwater project. We’ve been manufacturing and deploying crushable foam wrap for decades, helping to protect wells around the world. This contract is a great validation of our team’s expertise and dedication to delivering high-quality solutions for the industry."

The CFW will be produced at the company's Skelmersdale facility, once project engineering begins shortly.

Click here to know more about Offshore Network's well intervention conferences.

Page 6 of 24

Copyright © 2026 Offshore Network