As part of Phase 1 development, four wells in the Shenandoah field have been ramped up by Beacon Offshore Energy to attain the target rate of 100,000 bopd / 117,000 boepd.

As part of Phase 1 development, four wells in the Shenandoah field have been ramped up by Beacon Offshore Energy to attain the target rate of 100,000 bopd / 117,000 boepd.

The Shenandoah floating production system (FPS) has proved its top tier operability as it delivered exceptional well productivity, reliability and uptime metrics, while accomplishing the ramp up target within 75 days following first production.

The Shenandoah reserves, located at reservoir depths of approximately 30,000 ft true vertical depth, are being developed utilising industry leading high pressure 20,000 psi technology which Beacon expects to facilitate development of other similarly situated fields in the Inboard Wilcox trend.

The Shenandoah FPS located on Walker Ridge 52 approximately 150 miles off the coast of Louisiana in a water depth of approximately 5,800 feet has a nameplate capacity of 120,000 bopd and 140 mmcfd. The Shenandoah FPS has been designed as a regional host facility that will enable development of additional resources including the Beacon-operated Monument and Shenandoah South discoveries which together with Shenandoah are expected to hold recoverable resources of nearly 600 MMBOE. Beacon is working alongside HEQ Deepwater and Navitas Petroleum to develop the Shenandoah project.

Navigating the pressures of burgeoning decommissioning liabilities of North America and the Government-flagged urgency for immediate action, Petrofac recently initiated the 'Boomerang' project, mobilising a team to take over custody of the field in only a month.

Navigating the pressures of burgeoning decommissioning liabilities of North America and the Government-flagged urgency for immediate action, Petrofac recently initiated the 'Boomerang' project, mobilising a team to take over custody of the field in only a month.

The company's extensive experience and industry connections allow it to equally leverage the local and global supply chain, thus offering a resonable and customised service with the best suited equipment and crews, in a very tight and competitive market. Such measures helped Petrofac deliver the significant Danos decommissioning project in the Gulf of Mexico by collaborating with more than 250 vendors. It saw Petrofac tackling end-to-end decommissioning services, from project management, planning and engineering to procurement, field execution oversight and fast-tracking mobilisation of industry-leading experts.

To achieve cost efficiency that forms the core of Petrofac's approach to decommissioning, the company resorts to new approaches and innovations to match the project scale.

For instance, deploying compact, low-cost crews for pre-decommissioning activities, involving diagnostic and wellhead maintenance work can ensure better planning, permitting and cost estimating.

Other economic ways employed by the company includes well work delegation to groups of 3-6 people, alongside equipment upgradation, crew utilisation and ensuring minimal non-productive time.

“This significant contract recognises our industry-leading decommissioning programme management experience and our unique in-house capability to manage all well and asset decommissioning phases.

“Four decades of global expertise will be applied to the project, complemented by our already strong onshore presence in Texas,” said Iain Murray, President, Americas, Asset Solutions.

As the recent well test on the State 36-2 LNW-CC-R well from Zephyr Energy's Paradox project reflected considerable well productivity, the company announced an updated Competent Person's Report (CPR) that was compiled by independent energy consulting and advisory firm, Sproule-ERCE International Limited

As the recent well test on the State 36-2 LNW-CC-R well from Zephyr Energy's Paradox project reflected considerable well productivity, the company announced an updated Competent Person's Report (CPR) that was compiled by independent energy consulting and advisory firm, Sproule-ERCE International Limited

This acknowledgement has allowed Zephyr Energy to transition the Paradox project from appraisal to development, as the well test revealed high reservoir pressure, reservoir quality and liquid yields, leading to a significant boost in recoverable reserves across all reserve categories.

Based on the performance of the Cane Creek reservoir on 20,000 acres held within Zephyr's White Sands Unit, the CPR confirmed a 93-fold increase in Proved Recoverable Reserves (1P Reserves), demonstrating the site's scale and immediate production potential. It will be able to deliver 14.8 million net barrels of oil equivalent proved recoverable reserves, an increase from 0.16 million net boe in the 2022 CPR.

Speaking of the Paradox project, Colin Harrington, Chief Executive of Zephyr, said, "To date, we have drilled two successful, one-mile horizontal wells utilising different completion technologies and both demonstrated strong deliverability and expanded our completion design options for the greater field development. We have also gathered a substantial amount of data that will help inform future development plans. Furthermore, we have acquired significant infrastructure that will enable us to bring the project into full production, including gas gathering lines, plant infrastructure, permits and future water disposal wells, and we are close to securing gas export capacity. All this has been achieved at low development costs, especially when compared with many other new field startups of a similar size, and this infrastructure should enable accelerated project development once a suitable partner is secured. It should be noted that while acceleration of drilling activity and increased gas processing capacity won't change undiscounted free cash flow totals, they would enhance the current NPV-10 value of the project by bringing forward future cashflows."

Funk Futures, a leading growth consultancy for energy companies, has announced a strategic partnership with KCI, a specialist in well integrity, intervention, and leak sealing for both brownfield and greenfield assets, to expand their presence in the North American energy market.

Funk Futures, a leading growth consultancy for energy companies, has announced a strategic partnership with KCI, a specialist in well integrity, intervention, and leak sealing for both brownfield and greenfield assets, to expand their presence in the North American energy market.

Since its founding in 2002, KCI has built a strong reputation by tackling some of the industry’s toughest engineering challenges across subsea, topside, pipeline, downhole, and process environments. From chemical leak sealing to isolation gels, KCI’s solutions are trusted to minimize downtime, cut costs, and extend the operating life of production assets. Their expertise lies in a holistic approach: rigorous asset assessment, customized procedures, and precise execution that enable operators to protect production and ensure long-term well integrity.

KCI’s plug and abandonment (P&A) solutions are also becoming increasingly important as operators and regulators work to address the growing challenge of orphan and idle wells responsibly. By combining proven intervention expertise with advanced abandonment technologies, KCI supports clients through both the production and end-of-life stages of well operations.

“KCI’s track record in delivering reliable, effective solutions for production well integrity and intervention is exactly what today’s operators need — maximizing uptime while reducing risk,” said Jeremy Funk, Founder & CEO of Funk Futures. “We’re also excited to showcase their P&A capabilities, which will be critical as North America faces the orphan wells challenge head-on.”

“We have always prided ourselves on solving complex problems where traditional methods fall short,” said Kevin Watt, Managing Director of KCI. “Partnering with Funk Futures allows us to highlight our integrity and intervention expertise for production wells, while also expanding awareness of our P&A solutions that address the industry’s environmental and regulatory responsibilities.”

With this partnership, the primary focus will be on supporting well integrity and well intervention teams responsible for keeping production wells online and performing. This remains KCI’s legacy strength and a critical area for operators seeking safe, efficient, and cost-effective production.

DOF Group ASA will be delivering several projects in the North America region in lines with a contract worth more than US$60mn with scope for extension.

DOF Group ASA will be delivering several projects in the North America region in lines with a contract worth more than US$60mn with scope for extension.

DOF's vessels that are already available in the region have been booked for more than 300 days of firm vessel utilisation. While Skandi Skansen will cover a six-week mooring project in Guyana starting October, Skandi Implementer has been held in Mexico for a two-month service before the year-end, involving subsea cable repair and subsea installation.

Furthermore, the third-party vessel Cade Candies will be used to provide Walk to Work services off the East Coast of the USA with expected commencement in Q2 2026 and duration of approximately eight months with further options.

Mons Aase, DOF Group ASA CEO, said, “I am very happy to see the strong momentum in the North America region continue with these project awards, securing utilisation for project vessels in the region. I am especially pleased that Skandi Implementer has been working non-stop in the region after we terminated her original long-term contract in Mexico in early 2025.”

Archer Limited, based in Bermuda, has announced plans to acquire Premium Oilfield Services, LLC, a US-based well services provider specialising in fishing and plug & abandonment (P&A) operations. Premium is known for its experienced workforce and strong service reputation with major oil and gas operators.

Archer Limited, based in Bermuda, has announced plans to acquire Premium Oilfield Services, LLC, a US-based well services provider specialising in fishing and plug & abandonment (P&A) operations. Premium is known for its experienced workforce and strong service reputation with major oil and gas operators.

This move is part of Archer’s strategy to expand its presence in the Gulf of Mexico, where its combined client base with Premium covers over 80% of the projected $15 billion deepwater P&A and decommissioning market through 2040.

The US$20 million acquisition will be financed through a planned private placement. It is expected to close shortly after the placement is completed, subject to standard closing conditions, including financing.

One key benefit of the deal is Archer’s acquisition of a well-maintained fleet of fishing equipment valued at $35–40 million, which will cut rental costs and boost efficiency. The acquisition will create cost and capital synergies and is expected to deliver a full return on investment within two years.

Financially, the deal is seen as highly accretive. Archer anticipates a 5% boost to annual EBITDA and an 8–10% rise in annual cash flow, based on pro-forma results and synergies. This supports the company’s strategy to increase shareholder returns and reduce debt.

This acquisition builds on Archer’s strong M&A track record. Since 2023, the company has invested around $90 million in bolt-on acquisitions, generating approximately $30 million in EBITDA, reflecting a multiple of around 3x EV/EBITDA. Archer aims to continue targeting accretive, synergy-driven deals in the well services space.

Under a new agreement, Haliburton will have the right to deploy WellSense’s FiberLine Intervention (Fli) technology for use in well stimulation monitoring.

Under a new agreement, Haliburton will have the right to deploy WellSense’s FiberLine Intervention (Fli) technology for use in well stimulation monitoring.

WellSense, a subsidiary of FrontRow Energy Technology Group, will continue to deploy the technology globally for all other oil and gas applications, including well P&A, well integrity and leak detection, as well as CCUS.

CEO of WellSense, Annabel Green, said, “The successful completion of this deal is a defining moment for WellSense and for our parent company, FrontRow Energy Technology Group. Not only is it a strong industry endorsement of our technology and the value it delivers, but also our business model of bringing new and innovative solutions to market.

“Our unique bare fibre dynamic despooling technology delivers superior data quality for a detailed subsurface understanding. Unlike other well monitoring techniques, it provides a lightweight offline intervention solution with disposable probes for significant efficiency savings and reduced risk.”

Fli, which was developed 10 years ago, commenced commercial operation in 2018.

The riserless light well intervention (RLWI) market, valued at US$270.52mn in 2024, is projected to reach US$405.81mn by 2032, growing at a CAGR of 5.2%, according to Credence Research.

Key players shaping the market include Expro, ExxonMobil, Halliburton, Aramco, NOV, Emdad, Baker Hughes, Oceaneering, Hunting Energy, and Nortech. These companies focus on technological innovation, vessel upgrades, and digital integration to improve efficiency and safety in offshore interventions.

Within the service segment, logging and bottom hole surveys account for over 25% of total demand. These services are critical for evaluating reservoir conditions, identifying production zones, and ensuring accurate well diagnostics without costly drilling. Operators increasingly rely on advanced downhole logging tools for real-time data, which reduces non-productive time and optimises subsea operations.

By intervention type, light interventions dominate with over 40% market share, using wireline, slickline, or coiled tubing techniques for routine tasks such as inspection, cleaning, and data collection. These methods reduce operational costs and environmental risks, making them ideal for mature offshore fields. For example, Halliburton’s ClearTrac wireline tractor can traverse highly deviated wells while carrying payloads up to 1,000 lbs efficiently.

Offshore applications account for 65% of the market, driven by rising deepwater and ultra-deepwater exploration. RLWI provides cost-effective well maintenance without heavy rigs, maintaining production efficiency and safety. The growing number of aging subsea wells in North America further reinforces offshore interventions’ importance.

North America: Market leadership and offshore dominance

North America dominates the riserless light well intervention (RLWI) market with a 35% share, supported by extensive offshore activity in the Gulf of Mexico. The region benefits from advanced offshore infrastructure, mature subsea wells, and a strong presence of leading service providers. Operators focus on extending the production life of aging wells while maintaining cost efficiency, driving consistent demand for RLWI services. Regulatory support for safe intervention practices and investments in deepwater exploration further reinforce the region’s leadership. The combination of technological expertise and high offshore activity ensures North America remains a primary market driver.

To learn more about the RLWI market in other regions, visit Credence Research’s full report here

The Gulf of Mexico’s decommissioning specialisit Promethean Energy has successfully completed a multi-client campaign in the South Timbalier lease area for the plugging and abandonment of an orphaned well on a storm-damaged platform.

The Gulf of Mexico’s decommissioning specialisit Promethean Energy has successfully completed a multi-client campaign in the South Timbalier lease area for the plugging and abandonment of an orphaned well on a storm-damaged platform.

The high-risk project (thanks to extensive hurricane-related structural damage) was completed sans incidents and under budget, reinforcing Promethean’s com8ittment to retiring ageing offshore infrastructure while supporting the broader goals of the BSSE’s orphaned well programme.

The project entailed reinstating well control barrier on an orphan well and completing abandonment activities. Structural instabilities, deteriorated well barrier, hydrocarbon leaks and subsurface complexities posed significant risks to the operation, yet through phased execution, proactive risk mitigation and an experienced team, the project was completed incident-free.

The initial inspection of the well was conducted in May 2025, revealing extensive damage including a missing boat landing, the heliport having been torn away, the wellhead access deck was no longer intact, and the main deck support column was detached from the stabbing guide.

The well was also venting gas from the production casing downstream of the gate valve. Drone surveys and high-res imagery uncovered severe structural compromise at a jacket leg weldment, and the desk leg had been forcibly displaced into the jacket leg, exceeding material deformation limits. The pile-to-jacket connection on the leg has also completely failed. The data and stability assessments indicated a high-risk of structural collapse.

Despite the high risks, the operator successfully executed the decommissioning project using a combination of advanced inspection tools, methodical engineering reviews and meticulous planning. The site has been secured without environmental harm.

Expro, a global provider of energy services, has set a new world record by deploying the heaviest casing string ever installed.

Expro, a global provider of energy services, has set a new world record by deploying the heaviest casing string ever installed.

The achievement was made possible through the use of its advanced Blackhawk Gen III Wireless Top Drive Cement Head combined with SKYHOOK technology, during a major project in the Gulf of Mexico for a supermajor operator.

The milestone was reached aboard the Transocean Deepwater Titan, an eighth-generation ultra-deepwater drillship. With a maximum hook load capacity of 2.849 million pounds, the casing string installation surpassed all previous offshore benchmarks in deepwater well construction.

This accomplishment highlights Expro’s commitment to advancing innovation and performance in offshore well construction. The Gen III cement head with SKYHOOK is currently the industry’s only cementing system rated to three million pounds combined, designed to ensure enhanced safety, operational efficiency, and reliability in some of the harshest offshore environments.

The Blackhawk Gen III Top Drive Cement Head is specifically designed for rotating while cementing drill pipe-deployed casing strings or liners. When used with the SKYHOOK Cement Line Make-Up Device, the wireless cement heads improve safety by eliminating the requirement for personnel above the rig floor, while simultaneously boosting operational efficiency.

Engineered to withstand both full pressure and tensile capacity — rated at 15,000 psi and three million pounds respectively — the Gen III cement head was pivotal to the record-setting operation. Unlike other cementing systems that require derating under high-pressure conditions, Expro’s Gen III maintained consistent performance and integrity throughout.

The operator’s campaign is regarded as one of the most technically challenging well construction projects globally. With exceptionally high tensile loads on casing due to deep set points, the operation required a cementing solution engineered for extreme conditions. Expro applied its technical expertise to deliver a custom high-capacity cement head specifically tailored to the demands of the project.

“This deployment marks a step-change in offshore cementing, setting a new standard for ultra deep high pressure targets,” said Jeremy Angelle, Vice President of Well Construction at Expro.

“We are extremely proud to have supported this operator in achieving this critical milestone with a robust, high-performance cement head that delivered safely and reliably under record-setting loads,” Angelle added.

Following a comprehensive wireline programme, acquiring core, fluid and log data for evaluation, Talos Energy has confirmed successful drilling results from the Daenerys exploration prospect located in the US Gulf of America Walker Ridge blocks 106, 107, 150, and 151.

Following a comprehensive wireline programme, acquiring core, fluid and log data for evaluation, Talos Energy has confirmed successful drilling results from the Daenerys exploration prospect located in the US Gulf of America Walker Ridge blocks 106, 107, 150, and 151.

Drilled approximately 12 days ahead of schedule and delivered around US$16mn under budget, the West Vela deepwater drillship reached a total vertical depth of 33,228, encountering oil presence in multiple high-quality, sub-salt Miocene sands.

With the discovery well currently suspended for future use, the company is now planning to take up an appraisal well to further define the discovered resource.

"We are encouraged by the results of our Daenerys discovery well, which confirms the presence of hydrocarbons and validates our geologic and geophysical models. We believe these results support Talos's pre-drill resource assumptions. We are now working closely with our partners to design an appraisal program that will further delineate this exciting discovery. We anticipate spudding the appraisal well in the second quarter of 2026," said Talos President and Chief Executive Officer, Paul Goodfellow.

Talos, as operator, will hold a 27% working interest, Shell Offshore Inc. will hold 22.5%, Red Willow will hold 22.5%, Houston Energy, L.P. will hold 10%, Cathexis will hold 9%, and HEQ II Daenerys, LLC will hold 9%.

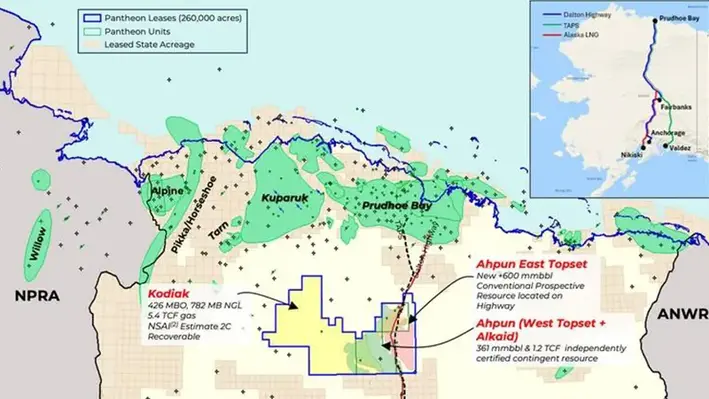

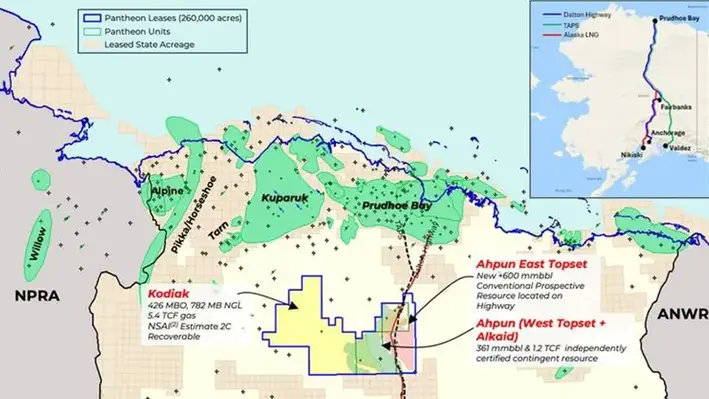

Following the first phase of the Dubhe-1 well programme, Pantheon Resources has successfully drilled, logged and cored the Dubhe-1 pilot hole to a total measured depth of 12,833 ft, equivalent to 8,699 ft true vertical depth.

Following the first phase of the Dubhe-1 well programme, Pantheon Resources has successfully drilled, logged and cored the Dubhe-1 pilot hole to a total measured depth of 12,833 ft, equivalent to 8,699 ft true vertical depth.

A deviated pilot hole had to be tackled to gather cores and logs to select the optimum landing zone for a subsequent lateral sidetrack in the primary SMD-B zone. The well successfully reached the planned true vertical depth and achieved all planned target reservoir penetrations -- both primary and exploration objectives.

The primary target of Dubhe-1 was the topset horizon (SMD-B), appraising the already discovered resource. Additionally, the well was designed to encounter three further exploration horizons (Prince Creek, SMD-C and the Slope Fan System), none of which have previously had any resource estimate attributed to them. Logs confirm additional prospective resource upside in these horizons.

Post analysis of the thickness and quality of the primary target topset, the company has confirmed that the SMD-B has exceeded the upside pre-drill expectations. The gross thickness of the hydrocarbon column in this interval was measured at 565 ft true vertical thickness; exceeding pre-drill expectations by 26%.

Following this, the company plans to drill, and subsequently flow test the planned sidetrack lateral in the SMD-B horizon to refine the production well type curve.

Dubhe-1 has confirmed a gross 565 ft TVT hydrocarbon bearing column in the SMD-B primary target horizon. The hydrocarbon mix between oil, NGLs and gas will be determined after flow testing.

Erich Krumanocker, chief development officer, said, "We are delighted to announce the Dubhe-1 pilot hole results as a success. The well confirms the presence and quality of the oil and gas reservoirs in the Ahpun field, exceeding our pre-drill expectations. We are now transitioning toward field development planning in support of capital efficient commercial production. The upside presented by the SMD-C and Slope Fan zones highlights the enormous potential in our portfolio."

Page 4 of 24

Copyright © 2026 Offshore Network