Australia’s Woodside spent almost US$1bn on decommissioning activities around the globe last year, the company reported in an update recently.

Australia’s Woodside spent almost US$1bn on decommissioning activities around the globe last year, the company reported in an update recently.

“In 2025, Woodside continued execution of planned decommissioning activities spending approximately US$823mn across our portfolio.”

In Australia, it cited “significant progress” across the Enfield, Griffin and Stybarrow fields, offshore north west Western Australia, as well as the Minerva field, offshore Victoria.

Outside Australia, decommissioning is ongoing with work in Canada, at both the upstream Liard and Horn River basins and downstream Kitimat locations in British Columbia, and in the USA where one deepwater well has been plugged and abandoned and legacy site decommissioning is ongoing.

“Our priority as we conduct decommissioning work is the safety of our people and the environment,” the statement posted on its website added.

“We conduct this work using recovery methods developed by Woodside and our specialist contractors, who bring experience, technical know-how and specialist equipment required for the variety of activities in our decommissioning portfolio.”

Within Australia, work included the conclusion of the 10-well Stybarrow plugging campaign that commenced in 2024), the retrieval of the Echo Yodel umbilical and the completion of plugging and abandonment activities at the Minerva field.

“In 2025, final infrastructure was recovered from the Enfield field, concluding a multi-year decommissioning programme that included permanently plugging and abandoning all 18 Enfield wells, recovering and deconstructing the Nganhurra riser turret mooring, and removing flexible flowlines, umbilicals and other subsea structures,” the company stated.

“Deconstruction of the Nganhurra riser turret mooring reused, repurposed or recycled 99.6% of materials. Enfield is the first project that Woodside has taken from exploration through development and operations, to decommissioning. The remaining activity at Enfield is to complete final surveys, which are planned for 2026.”

The Gippsland Basin Joint Venture (GBJV), comprising Esso Australia and Woodside also continues planned decommissioning activities in the Bass Strait.

In 2025, 69 wells were plugged and abandoned, contributing to a cumulative total of more than 220 wells permanently plugged since the campaign commenced.

This includes the completion of plugging the Bream B and Kingfish A platform wells in the first half of 2025.

Woodside added that detailed engineering and execution planning, including submission of environmental approvals to regulators for assessment, is “well advanced” for the Bass Strait offshore platform removal campaign planned to commence in 2027.

Recfishwest, a non-profit organisation representing the interests of Western Australian recreational fishers, and global energy company Woodside have collaborated to install the Dampier Artificial Reef.

Recfishwest, a non-profit organisation representing the interests of Western Australian recreational fishers, and global energy company Woodside have collaborated to install the Dampier Artificial Reef.

The Dampier Artificial Reef is a new, pupose-built artificial reef designed to boost recreational fishing opportunities and enhance marine biodiversity off the Western Australian coast. Backed by scientific research and community input, it has the support of the WA Government, City of Karratha, Traditional Owners and fishing clubs. It aims to create a new marine habitat and boost recreational fishing opportunities in the Pilbara region. The reef consists of 48 purpose-built concrete modules installed in approximately 35 metres of water, near Rosemary Island in the Dampier Archipelago, Western Australia. Each module is designed with complex internal spaces and hard surfaces to encourage coral growth, shelter juvenile fish and attract larger species higher up the food chain, creating a thriving and sustainable marine ecosystem. The 48 concrete reef modules were installed on the seabed from Fugro’s multipurpose vessel, the Fugro Etive.

Over time, the site is expected to become a high-quality fishing location for species such as Spanish mackerel, cobia, emperor, cod and even sailfish – a welcome addition for local fishers and visiting anglers alike, while supporting local tourism. Similar projects, such as Exmouth’s King Reef, have transformed bare sand into vibrant habitats supporting more than 150 fish species within five years.

Recfishwest CEO Dr Andrew Rowland said, “The deployment of the Dampier Artificial Reef will provide new fishing opportunities while enhancing fish habitats. Our collaboration with Woodside demonstrates what can be achieved when industry and the recreational fishing community work together for positive outcomes.

“These scientifically designed structures build healthier oceans — supporting biodiversity, boosting fish stocks and strengthening ecosystem resilience. Most importantly, they create fantastic new fishing opportunities particularly in this instance for pelagic species like mackerel and sailfish, and all the flow-on benefits that brings to coastal communities,” he said.

Woodside acting executive vice president & chief operating officer Australia Breyden Lonnie said, "Woodside is excited to collaborate with Recfishwest and the local fishing community to bring this new reef to life. The reef is expected to provide a productive marine habitat for diverse species of algae and corals, supporting an abundance of fish life to feed and shelter. Not only is the reef expected to contribute to marine biodiversity; it will also be an added drawcard to boost fishing tourism to the Pilbara, supporting the local economy and communities."

The installation of the reef was funded by Woodside and its Scarborough Joint Venture partners JERA Australia and LNG Japan. Woodside’s joint venture partner in the Enfield Joint Venture, Mitsui E&P Australia, contributed to the acquisition of the concrete modules for the reef.

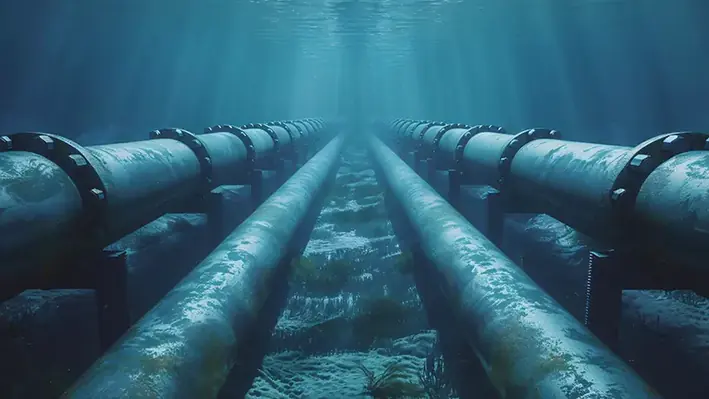

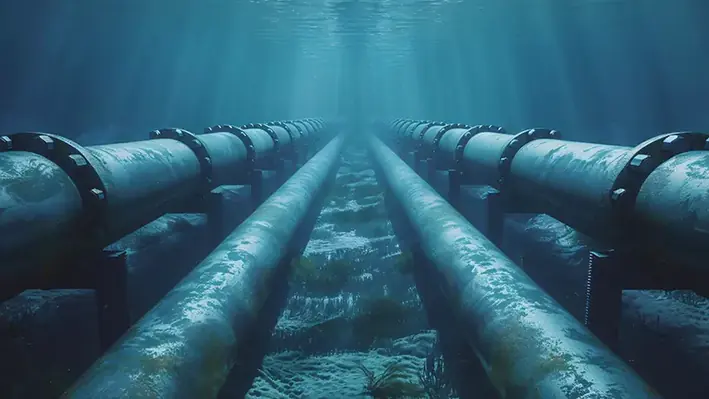

Subsea pipelines used by the oil and gas industry may contain naturally occurring radioactive materials, mercury, hydrocarbons, and heavy metals that pose a risk to human health and the environment, a parliamentary inquiry into decommissioning offshore oil and gas infrastructure has heard.

Subsea pipelines used by the oil and gas industry may contain naturally occurring radioactive materials, mercury, hydrocarbons, and heavy metals that pose a risk to human health and the environment, a parliamentary inquiry into decommissioning offshore oil and gas infrastructure has heard.

Appearing before the Legislative Council Environment and Planning Committee’s inquiry into decommissioning oil and gas infrastructure, Fern Cadman, Fossil Fuel Industry Campaigner at the Wilderness Society warned that Gippsland’s offshore region has around 800 km of subsea pipelines.

“Even if buried, eventually they will degrade, and all that is going to end up in the environment,” she told the Committee.

Stan Woodhouse from environmental organisation Friends of the Earth told the hearing that some contaminants can bioaccumulate and move through the food chain.

“If we leave it on the seabed, it will end up on our dinner plates,” he said.

The Committee is investigating the scale and legal ownership structure of the infrastructure, including offshore wells, pipelines, high-pressure transmission and low-pressure distribution systems and relevant projects in Commonwealth waters.

The environmental groups advocated for removing the pipelines before they have a chance to corrode.

“Industry says it’s too hard to remove them, but engineers say almost anything can be done, you just have to be prepared to pay for it and use the right tools,” Cadman added.

Instead, Victoria should treat the pipelines and other infrastructure as a potential resource and an opportunity to boost domestic steel recycling and cut emissions.

Jerusha Beresford, Sustainability Adviser at the Australian Steel Institute (ASI), urged the Committee to recognise the value of infrastructure such as oil platforms that have reached the end of their life.

“We are strongly recommending that the scrap steel recovered from the decommissioning of the Bass Strait oil and gas infrastructure is recognised as a valuable national resource and prioritised for local recycling into domestic steel manufacturing and not exported,” Beresford told the Committee.

According to ASI, the first tranche of decommissioning will yield 60,000 tonnes of high-grade steel from 12 retired platforms, with significantly more expected over the next decade.

“Demand for steel for renewable infrastructure alone is forecasted to be about 400,000 tonnes per year through to 2030…retaining scrap locally is essential to meet that demand,” he added.

The benefits extend beyond supply security. Using scrap steel in manufacturing dramatically reduces carbon intensity compared to primary production and can support Australia’s transition to low-emission steelmaking.

Beresford told the hearing that both electric arc furnaces and blast furnaces rely heavily on scrap, with the former using up to 90% recycled content.

Economic modelling also points to strong local gains.

ASI cited analysis showing that every 10,000 tonnes of scrap steel that’s processed domestically creates 37 jobs and $4.8mn in value-add, compared to just $1.3mn if exported.

“Scrap use lowers the carbon intensity of steelmaking by reducing reliance on primary resources like iron and coal…It is crucial in meeting Australia’s capability to manufacture low-emission steel products,” Beresford said.

However, he warned that without regulatory intervention, contractors may opt to export scrap for short-term financial gain.

“Unfortunately, the past has showed that sometimes scrap is exported because it is perceived to be an easier way to get rid of the waste and the contractor gets paid for it,” he added.

With Australia’s steel industry employing 100,000 people and generating $30bn annually, Beresford said the decommissioning pipeline represented a ‘once-in-a-generation' chance to strengthen domestic manufacturing, create jobs and advance the circular economy.

ExxonMobil Australia has issued a decommissioning update charting the activities of the Valaris 107 jack-up rig in the Bass Strait.

ExxonMobil Australia has issued a decommissioning update charting the activities of the Valaris 107 jack-up rig in the Bass Strait.

In a 30 January update on its LinkedIn social media page, Richard Perry, Project Manager, called the rig “one of the hardest working mobile offshore assets currently active in Bass Strait.”

Esso Australia’s Bass Strait decommissioning team reached several major milestones in 2025, the post noted, including investing nearly $3bn in early decommissioning works, safely sealing more than 200 wells in the Bass Strait, and removing and recycling over 10,000 tonnes of steel.

“A key enabler of this progress is the heavy duty Valaris 107 jack-up rig, which has been supporting activities across our operations since the end of 2024,” said Perry.

A jack-up rig is a mobile offshore platform with a floating hull and long, extendable legs that can be lowered to the seabed, lifting the entire platform above the waves to create a stable base for drilling or decommissioning wells or other underwater works.

To date, the Valaris 107 has safely sealed 26 wells across eight former oil and gas production facilities, Perry added.

He described the delivery of a campaign of such size and complexity on a single rig as a “remarkable achievement” and a “clear demonstration of the scale, ambition, and progress of Esso’s multi-year decommissioning programme in [the] Bass Strait, the largest of its kind in Australia.”

In addition to carrying out decommissioning work, the Valaris 107 is also supporting Esso Australia’s investment to deliver more gas to Australia.

Last year the rig drilled and installed the new Kipper 1b well, which started producing gas for Australian households and businesses near the end of 2025.

Its next task will be to start drilling wells for the Turrum Phase 3 project.

This $350mn project involves drilling five new wells in the Turrum and North Turrum gas fields to access currently undeveloped gas resources.

Turrum Phase 3 will be one of the largest gas developments on the east coast this decade and continues Esso Australia’s long history of reliably supplying gas to the domestic market for over 50 years, Perry noted.

Turrum is expected to come online before winter in 2027.

“As we continue our decommissioning journey, we remain focused on safety, environmental responsibility, and supporting local employment,” he added.

“We’re proud of what we’ve achieved so far—and even more excited about what’s to come.”

Australia's offshore oil and gas sector is entering a critical phase of decommissioning, as ageing infrastructure in regions like the Bass Strait and Western Australia reaches the end of its productive life.

With maturing fields driving activity, the industry faces substantial challenges in safely removing platforms, pipelines, and wells while minimising environmental impact and ensuring financial accountability.

Recent analysis by global energy consultancy Xodus, commissioned by the Australian Government, estimates the total decommissioning liability in Commonwealth waters at AUD43.6bn through 2070, or AUD66.8bn when adjusted for inflation.

This figure represents a significant reduction from the 2020 estimate of AUD61.8bn, attributed to improved efficiencies and better understanding of decommissioning processes.

The scope encompasses over 700 wells, 7,600 km of pipelines, and 520 subsea structures, with approximately 55% of the work anticipated before 2040.

Separately, the Centre of Decommissioning Australia (CODA) projects US$40bn in offshore activity over the next 50 years, emphasising well plugging and pipeline removal as primary costs.

Key projects illustrate progress. ExxonMobil Australia's Bass Strait programme, the nation's largest decommissioning effort, advanced significantly in 2025.

The team permanently sealed more than 200 wells and processed over 10,000 tonnes of steel and concrete for recycling or disposal.

Retired platforms have entered "stasis mode," secured and prepared for removal, with the Allseas Pioneering Spirit vessel scheduled to commence lifting operations in 2027.

Woodside Energy has also made strides in Western Australia.

Offshore decommissioning at the Enfield field, which began in 2022, is nearing completion.

While physical removal works are complete, post-decommissioning environmental obligations are still ongoing. According to Woodside, an annual report is scheduled for December 2026.

The Nganhurra Riser Turret Mooring was recovered in November 2023, and deconstruction achieved over 95% reuse or recycling by March 2024.

Ongoing work at the Griffin and Stybarrow fields includes the Griffin Riser Turret Mooring recovery in December 2024.

Government reforms are also bolstering the framework.

In November 2025, the Department of Industry, Science and Resources (DISR) released a consultation paper on enhancing decommissioning planning, financial assurance, and compliance tools.

Additionally, the Offshore Petroleum and Greenhouse Gas Storage (Resource Management and Administration) Regulations 2025 have been remade, effective from 31 March 2026, to improve resource management.

As Australia transitions towards net-zero goals, these efforts underscore a commitment to responsible decommissioning, balancing economic realities with environmental stewardship. Industry collaboration, as highlighted in reflections on 2025's landscape, will be pivotal in navigating the ramp-up to 2027 and beyond.

Wood has secured a two-year contract extension with Woodside Energy for the continued deliverance of brownfield engineering, procurement and construction management services across its offshore assets at the North West Shelf Project.

Wood has secured a two-year contract extension with Woodside Energy for the continued deliverance of brownfield engineering, procurement and construction management services across its offshore assets at the North West Shelf Project.

Under the contract, which is worth up to US$65mn, Wood will deliver asset modifications to boost production, reliability and longevity across Woodside’s NWS offshore assets, including the North Rankin Complex and the Okha FPSO.

John Mtanios, President of Asia Pacific Operations at Wood, iterated, “This extension reflects the strength of our 35-year relationship with Woodside and the trust built through consistent performance and a shared drive for excellence. Since first securing this contract in 2013, our teams have developed deep knowledge of each assets and Woodside’s operational priorities. That insight enables us to go beyond safe, reliable operations – finding smarter ways to improve productivity, reduce costs and optimise performance.”

The NWS Project, located in Western Australia, is one of the largest LNG developments in the world and has supplied the region with affordable and reliable energy for decades.

One of Australia’s newest ships that could play a crucial role in the nation’s decommissioning effort has been christened.

One of Australia’s newest ships that could play a crucial role in the nation’s decommissioning effort has been christened.

Bhagwan Marine announced on 7 January, 2026 that it had named its newest vessel the 'Bhagwan Micah' at its Brisbane operational base — it is named in honour of the late Micah Kirk, a former member of the group's Melbourne team.

The company said the vessel is purpose-built for the energy transition and critical infrastructure sectors.

Formerly named ‘the Phoenix’, the Bhagwan Micah is a 38m state-of-the-art Stern Landing Vessel (SLV), designed for the exacting requirements of modern offshore energy and subsea operations, particularly oil and gas decommissioning, with the ability to work in shallow water environments, subsea inspection, maintenance and repair and defence logistics projects.

“This latest addition to our fleet marks another milestone in the company’s strategic growth as Australia’s leading provider of integrated marine solutions across offshore energy, subsea, ports and inshore logistics and defence sectors,” a Bhagwan Marine statement read.

“With a fleet now of over 100 vessels, Bhagwan Marine continues to position itself as the partner of choice for operators who demand proven reliability, technical excellence and low-risk project execution in complex marine environments.”

The vessel is secured under a five-year bareboat charter from BM Fleet, providing Bhagwan Marine with long-term control of a scarce, high-spec asset while maintaining capital flexibility for further fleet renewal.

“The Bhagwan Micah is not just another vessel – it is a strategic asset that reinforces Bhagwan Marine’s leadership in complex, high-consequence marine operations where safety, technical performance and environmental responsibility cannot be compromised,” the statement added.

Last August, in its 2025 results presentation, the company highlighted how it had grown its presence in the decommissioning sector.

It also highlighted future growth opportunities, citing “a substantial long-term pipeline of offshore oil and gas decommissioning projects” as well as potential work arising from ageing offshore assets requiring inspection, repair and maintenance.

Subsea decommissioning specialist Decom Engineering has provided an update on its work offshore Australia.

Subsea decommissioning specialist Decom Engineering has provided an update on its work offshore Australia.

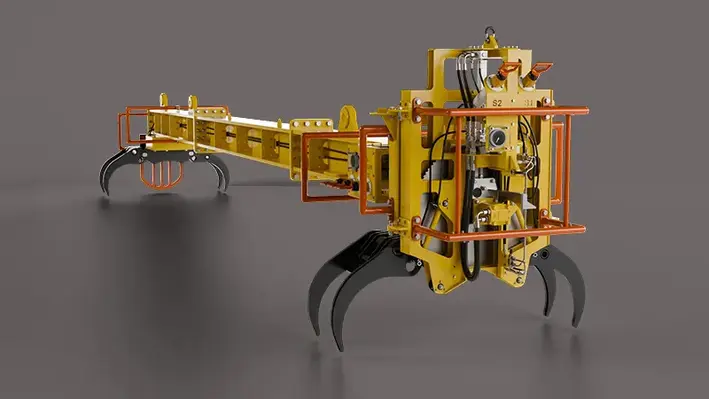

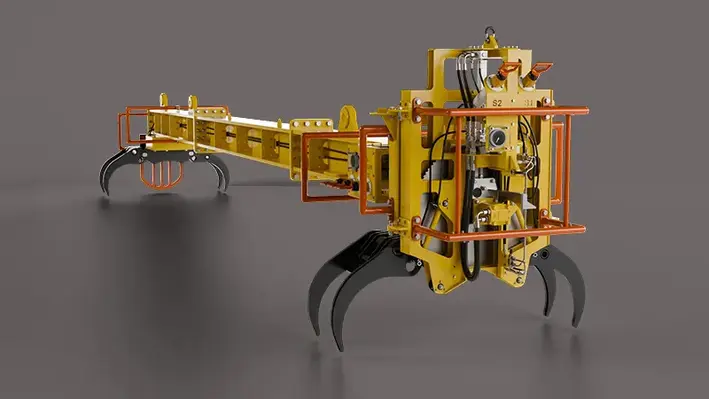

In a social media post titled “Live from the Seabed: TRACS-16 Performance in Australia” the company reveals action footage of its TRACS-16 tool performing live cutting operations on the seabed.

TRACS-16 (Twin Recovery & Cutting System) is the firm’s innovative modular tool that combines cutting, lifting and recovery, designed to cut and recover pipelines up to 20m long with diameters up to 16”, although custom sizes can also be engineered.

It is ideal for decommissioning operations, with the crane-deployable tool capable of recovering sections and returning them to the deck or relocating to a subsea basket.

In a video posted on LinkedIn, the company shows TRACS-16 at work, cutting away at an unspecified subsea decommissioning site offshore Australia.

“We are getting January off to a super start with some live offshore footage from our project in Australia,” the company stated in the post.

“Here is the TRACS-16 tool performing live cuts on the seabed. We are seriously happy with the performance of this new tool in our toolbox, delivering impressive results across the campaign.”

These results include its speed, with cycle times of as little as nine minutes, with individual cuts averaging as fast as four minutes and 30 seconds “with some ever faster,” it added.

It also cited the machinery’s durability, achieving 38 cuts per blade, “demonstrating the reliability of our proprietary cutting technology.”

The post added: “This level of efficiency is exactly how we help operators minimise vessel time and keep complex decommissioning projects on track.”

The TRAC 16’s quick connect system allows for seamless attachment and detachment of the C1-16 Chopsaw, which comes with a 1,040mm blade capable of making precise cuts through pipes up to 16″ in diameter.

It also includes ROV (remotely-operated vehicle) grab bars at both ends and near the hotstab panel, ensuring easy positioning and stabilisation by the ROV.

The system is operable via ROV or topside control package.

One of the key players working on Australia’s flagship Northern Endeavour decommissioning programme has been taken over by a former American rival.

One of the key players working on Australia’s flagship Northern Endeavour decommissioning programme has been taken over by a former American rival.

US-based CB&I has entered into an agreement to acquire Petrofac’s Asset Solutions business after the parent company filed for administration in late 2025 due to financial distress from cost overruns and contract issues.

Petrofac was awarded its Northern Endeavour contract by the Australian government in April 2022, heralding the start of an era of decommissioning in the nation’s offshore oil and gas sector.

Petrofac’s Australia team, based in Perth, were contracted to complete Phase 1 of the decommissioning of the FPSO (Floating Production, Storage and Offtake) facility.

It is unclear at this point how the project will be affected, if at all, after the CB&I acquisition goes through, with approximately 3,000 Petrofac employees expected to join the Texas company at the close of the transaction, anticipated to occur in the first quarter of 2026.

According to Mark Butts, CB&I’s President and CEO, the acquisition will strengthen the group’s overall portfolio and enhance service capabilities.

He said it also supports CB&I’s diversification into integrated services, expands customer relationships and opens pathways for growth in international markets.

“Asset Solutions’ leadership demonstrates pride in operational excellence, commitment to customers, and resilience through challenging circumstances,” said Butts.

“Our organisations share similar management philosophies and industry-leading safety performance. With this combination we see strong cultural alignment, diversification benefits, and clear opportunities to enhance performance and deliver stable cash flow generation. These factors collectively support CB&I’s long-term growth objectives.”

Following the close of the transaction, CB&I will operate as one company with two global business units, CB&I Asset Solutions based in Aberdeen, Scotland, and CB&I’s existing operations, CB&I Storage Solutions, based in The Woodlands, Texas.

With thousands of jobs saved, it is hoped there will be minimal disruption to the Northern Endeavour work.

“We are excited about this opportunity to focus on our core strengths, reaffirm critical customer relationships, stabilise our supply base and deliver operational excellence for our current and future projects,” said John Pearson, Petrofac Asset Solutions Chief Operating Officer.

“We have the operational and engineering talent required to deliver high-value growth opportunities and expand differentiated services. Our cultural compatibility with CB&I enhances our integration and supports a smooth transition.”

Subsea7 has been awarded a contract with Chevron Australia for subsea installation on the Gorgon Stage 3 Project.

Subsea7 has been awarded a contract with Chevron Australia for subsea installation on the Gorgon Stage 3 Project.

Subsea7’s scope of work includes project management, engineering, procurement, fabrication, transportation, installation and pre-commissioning of subsea equipment and associated infrastructure at the project site, located at 1,350m water depth.

Project management and engineering work will commence immediately, with offshore operations expected to begin in 2028.

David Bertin, Senior Vice President for Subsea7 Global Projects Centre East, said, “This project marks an important milestone and reinforces our long-term strategic engagement with Chevron. Building on our local and international capability and experience, we look forward to working collaboratively with Chevron Australia – focusing on safety and quality to optimise reliability, technical integrity and offshore operations – to successfully deliver the Gorgon Stage 3 subsea installation.”

ExxonMobil Australia Chair, Simon Younger, outlined the state of play in the company’s decommissioning efforts in the Gippsland Basin during a recent industry event.

ExxonMobil Australia Chair, Simon Younger, outlined the state of play in the company’s decommissioning efforts in the Gippsland Basin during a recent industry event.

He said the company is committed to “responsibly decommissioning” a number of offshore facilities that are no longer producing oil and gas, highlighting the global significance of the project off the coast of Victoria.

“You may be surprised to learn that Victoria is home to Australia’s largest decommissioning project, and ExxonMobil’s largest decommissioning project globally, a multi-year, multi-billion dollar programme of works,” he noted.

Younger was speaking at an event to mark ExxonMobil Australia’s 130 years in the country.

From humble beginnings as the Vacuum Oil Company (later known as Mobil Oil Australia) selling a barrel of cylinder oil to a Bendigo Goldmine from its Melbourne office back in 1895, 130 years later it has grown to become one of Australia’s most critical energy suppliers.

The event also celebrated 60 years of its membership to the Committee for Economic Development of Australia (CEDA), an independent, member-based public policy think tank.

“So far we’ve safely completed over $2.5 billion of early works across our offshore operations, including the permanent sealing of more than 200 wells,” said Younger.

All this work, he added, is in preparation for the arrival of the world’s largest construction vessel, the Allseas Pioneering Spirit, in 2027.

“This mammoth vessel, which is as long as almost 3 MCG fields laid end to end, will travel from Norway to start removal of the 12 retired offshore facilities in Bass Strait and deliver them to our Barry Beach Marine Terminal in Southeast Gippsland, where they will be safely dismantled and recycled.”

After that, the mega project entails a huge and coordinated recycling effort, he noted.

“We plan to maximise recycling of these facilities for a second life and minimise the number of materials processed as waste,” said Younger.

“In fact, our aim is to recycle more than 95% of the mostly steel material from our oil and gas structures. Most of the steel will either be sent offsite in trucks, or via ships for onward transportation to recycling facilities.”

At the same time, Younger noted that ExxonMobil Australia remains committed to supporting the reliable supply of gas from the Bass Strait into the 2030s.

Over the last decade, it has invested almost a billion dollars in the Gippsland Basin.

These investments include the Kipper 1B project, which started up last month, the Kipper Compression Project, and the West Barracouta project, which came online in 2021.

“And right now, in conjunction with our joint venture partner Woodside Energy, we are investing $350 million to develop the Turrum Phase 3 project, which will further bolster supplies of Gippsland gas to the east coast domestic market by 2027,” he said.

“Turrum Phase 3 will be one of the largest gas developments on the east coast and means our Gippsland operations are set to continue powering Australian homes and businesses well into the next decade.”

Australia faces a major offshore oil and gas decommissioning challenge, with costs estimated at US$40.5bn over the next 50 years, covering more than 1,000 wells as well as related infrastructure.

Australia faces a major offshore oil and gas decommissioning challenge, with costs estimated at US$40.5bn over the next 50 years, covering more than 1,000 wells as well as related infrastructure.

This is estimated by the Centre of Decommissioning Australia (CODA) to involve the dismantling and disposal of topsides and substructures equivalent to 75 Eiffel towers.

Recent guidance issued by the UK’s Net Zero Technology Centre, in partnership with engineering consultancy Astrima, could help energy companies globally speed up the rollout of improved technologies for decommissioning oil and gas wells, thereby helping to cut costs as well as reducing the environmental impact of ageing energy assets.

The Aberdeen-based centre said the current pace of deployment “remains incredibly slow” as the scale of the challenge grows.

The first guidance is focused specifically on well plug and abandonment (P&A), given that well abandonment is one of the most costly aspects of decommissioning.

It sets out a clear, evidence-based process to assess whether materials can safely and permanently seal wells that are no longer in use. The six-step framework supports safe and confident use through a structured qualification process, helping users identify risks, build a strong evidence base, and streamline approvals to accelerate the safe deployment of new solutions.

Long-term safety and environmental protection are critical as the industry moves away from traditional cement-based barriers. New technologies using low melting point alloys, resins, polymers and epoxies are emerging, but face challenges demonstrating their effectiveness and reliability.

The framework incorporates input from operators, regulators and technology developers, and draws on international guidelines and standards such as DNV RP A203 and API RP 17Q, which are widely used across the energy sector.

Lewis Harper, Programme Manager at NZTC, said,“Well decommissioning is an increasingly urgent global issue as maturing basins seek ways to cut costs, reduce emissions and improve efficiency. The only way to achieve that is through new technology, but the pace of developing and deploying new solutions remains incredibly slow.

“This guidance will help speed up the safe adoption of innovative technologies, giving operators and regulators the confidence to move faster. By managing performance to stringent standards, the adoption of new materials should become easier and more reliable. This framework gives the industry the tools to tackle well decommissioning challenges with greater confidence.”

Page 1 of 14

Copyright © 2026 Offshore Network