Energy market research and consultancy firm, Westwood Global Energy Group, has found that decommissioning in the North Sea involves considerable financial and logistical challenges.

Energy market research and consultancy firm, Westwood Global Energy Group, has found that decommissioning in the North Sea involves considerable financial and logistical challenges.

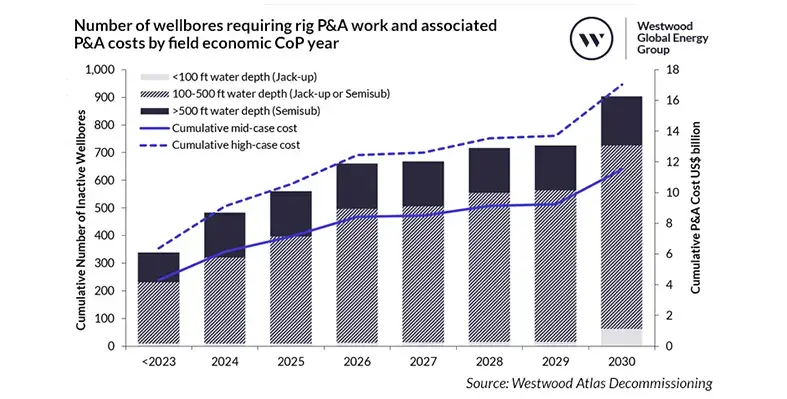

Domestic production is declining owing to shaken investor confidence in the UK as a result of political and fiscal uncertainty. This suggests around US$26bn might be spent on decommissioning in the next decade, with well plug and abandonment (P&A) alone accounting for ~50% of the cost.

While decommissioning tasks keep piling up, contract awards, especially for rigs, have remained low due to the uncertainties driving financial and operational risks for operators. Execution of delayed decommissioning work will pose pressure on the already-strained supply chain. This can P&A costs could climb by up to US$5.5 billion, due to higher offshore rig dayrates, increasing financial liabilities for both operators and the UK Government, which provides tax relief on decommissioning costs.

“As the UK North Sea enters a new phase where decommissioning becomes the dominant industry driver, the supply chain faces significant demand and major financial risk,” said Yvonne Telford, Research Director at Westwood. “Based on current investment plans, up to 40% of UK fields could cease production before 2030. With the impact of decommissioning tax liabilities on abandonment expenditure, cost-effective P&A must be paramount."

Dominic Ferry, CEO at Westwood, said, “Westwood’s new Atlas Decommissioning module provides the clarity the market needs by linking infrastructure data with economic forecasts, offering stakeholders a clear view of the timing, cost, and risks associated. By delivering granular insights into decommissioning activity, the module helps operators, service providers, and investors make informed decisions, mitigate financial exposure, and seize emerging opportunities in this evolving landscape.”

Westwood has launched the new Atlas Decommissioning module which gives detailed insights into decommissioning timelines, infrastructure removal and market dynamics in real-time. It leverages key economic drivers, such as commodity prices and operating costs to dynamically model decommissioning schedules, allowing them to predict shifts in activity and optimise planning.