Lachlan Harris will replace Sherry Duhe as Santos’ Acting Chief Financial Officer on an interim basis.

Lachlan Harris will replace Sherry Duhe as Santos’ Acting Chief Financial Officer on an interim basis.

Harris has served as Santos’ Treasurer and Deputy Chief Financial Officer for more than two years and has previously acted in the Chief Financial Officer role. Harris joined the company 15 years ago from KPMG and has had extensive experience in a range of risk and finance roles across Santos since.

Managing Director and Chief Executive Officer, Kevin Gallagher, thanked Duhe for her service to the role, “Sherry has made a significant contribution in her time at Santos, leading the structural cost reduction initiative over the past year and implementing a number of other business improvements, particularly in the long-term planning and budget processes.

“Sherry has been a valued member of the Santos executive leadership team and is leaving the company to pursue other interests. I wish her all the very best for the future.”

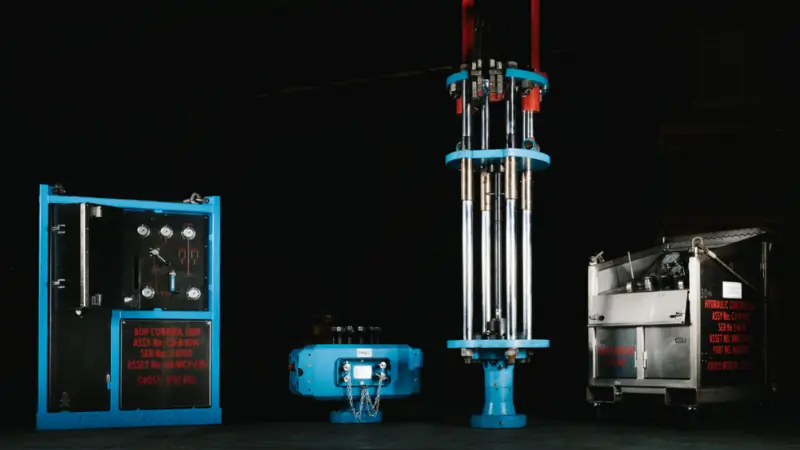

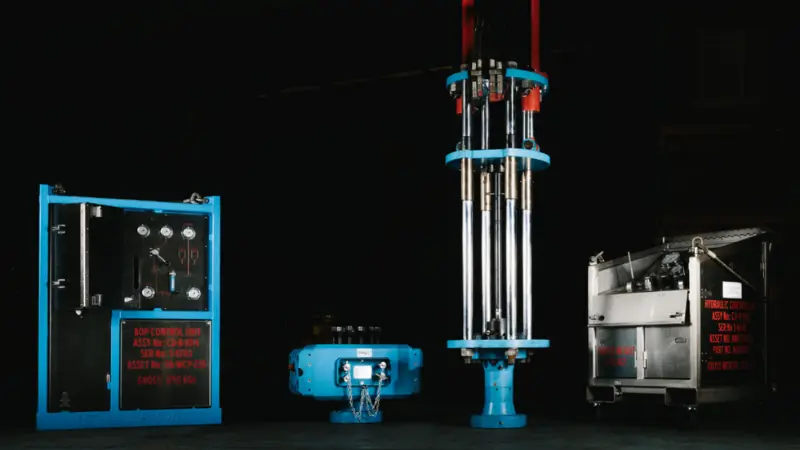

Aceteon’s Moorings and Anchor’s business line, Intermoor, has secured a contract from Petrofac to cover the engineering, mooring equipment, marine spread, installation and removal of a temporary mooring system for the FPSO Northern Endeavour.

Aceteon’s Moorings and Anchor’s business line, Intermoor, has secured a contract from Petrofac to cover the engineering, mooring equipment, marine spread, installation and removal of a temporary mooring system for the FPSO Northern Endeavour.

The Northern Endeavour permanently shut down in 2019 in the Timor Sea, approximately 550km northwest of Darwin, Australia. Petrofac is managing the decommissioning and disconnection of the vessel.

Under the contract, Aceteon will be responsible for the project management and engineering (PME), design, provision, installation, and recovery of the temporary mooring system, including full mobilisation and demobilisation.

Chee-Hoe Tay, General Manager at Intermoor APAC, said, “We’re proud to leverage our global expertise to support Petrofac on this high-profile decommissioning campaign involving the Australian Government. Our team is fully committed to delivering a safe, seamless execution, and to exceeding expectations through close collaboration, innovation and operational excellence.”

The Northern Endeavour will be positioned offshore Singapore during its decommissioning phase.

With around US$60bn worth of decommissioning activity due to take place in Australia over the next five decades, the challenges of disposing of or recycling a growing volume of waste materials have come to the fore.

A study undertaken by Centre of Decommissioning Australia (CODA) with support from the Government of Western Australia, explores the capacity, capability, and regulatory landscape for waste disposal in Australia while identifying barriers, opportunities, and actions to improve the safe and sustainable handling of materials over the coming decades. It makes recommendations which will help waste management and recycling supply chains address the challenges and opportunities, promoting best-practice approaches and encouraging re-use and recycling rather than just disposal.

Recommendations include:

1. Develop clear communications which help to demystify and normalise oil and gas decommissioning as a process. Public information packs and fact sheets which concentrate on the industry’s effective risk management strategy and opportunity creation.

2. Maintain a materials focus: communications relating to oil and gas decommissioning programmes should talk about ‘materials’ and not just ‘waste’ to build expectation around recovery, re-use and recycling rather than just disposal.

3. Connect waste producers with the supply chain: enhance connections between the oil and gas and waste management industry sectors to improve waste producers’ understanding of the full range of options available to them and to publicise opportunities to the supply chain.

4. Develop a ‘waste-led decommissioning’ approach, prioritising critical-path waste management needs such as decontamination and hazardous materials management as the essential precursor to the safe and sustainable dissemination of materials and waste into disposal and recycling supply chains.

5. Clarify the circular economy perspective: position oil and gas decommissioning in the context of the circular economy and the role it can play in contributing to increasingly circular material flows.

6. Integrate oil & gas decommissioning and mining closure: identify common needs and optimise the range of solutions available to both industries.

7. Map and model industrial systems and supply chains in detail to fully understand the dependencies and opportunities within supply chains relevant to decommissioning materials and waste management.

The report, titled ‘Decommissioning Waste Disposal Pathways’ also stresses the importance of collaboration and partnership between government agencies, industry operators, and the waste supply chain to ensure alignment; education and awareness for regulators and planning policy bodies; uniformity and clarity of regulations, and the streamlining of regulation processes; an integrated national approach involving stakeholders from across the sector to support the creation of an enabling regulatory framework and national guidelines; and risk-based assessment and approval processes.

Woodside Energy is gearing up for the next phase of the Echo Yodel decommissioning, with the retrieval of the Echo Yodel umbilical expected to commence during the second half of 2025.

Woodside Energy is gearing up for the next phase of the Echo Yodel decommissioning, with the retrieval of the Echo Yodel umbilical expected to commence during the second half of 2025.

The company outlines its various decommissioning plans recently in its half-year 2025 results, stating that it had continued execution of planned activities in the first half of the year, spending approximately $565mn across its portfolio.

Woodside has progressed planned decommissioning activities across the Enfield, Griffin and Stybarrow fields, offshore north west Western Australia, as well as the Minerva field, offshore Victoria, it noted.

Next up, is the removal of the Echo Yodel umbilical, part of a phased decommissioning process that has been ongoing already for several years.

The Echo Yodel subsea decommissioning plan details the proposed removal of subsea infrastructure which includes a 23-km pipeline, an electrohydraulic umbilical, two umbilical termination assemblies, an infield umbilical termination basket and infield electrical and hydraulic jumpers.

It marks the latest step in what has been a busy year already for Woodside.

During the first half of 2025, it concluded the 10 well Stybarrow plugging campaign and successfully completed the plug and abandonment of three remaining wells at the Minerva field.

In February, final infrastructure was recovered from Enfield, concluding a multi-year decommissioning that included permanently plugging and abandoning all 18 Enfield wells, recovering and deconstructing the Nganhurra riser turret mooring and removing flexible flowlines, umbilicals and other subsea structures.

Enfield marked the first project that Woodside has taken from exploration to development and operations, right through to decommissioning.

The company also said that it experienced a Tier 1 process safety event when unexpected fluids were released during flushing activities of a Griffin subsea flowline, but added that water quality monitoring identified no impact on the environment.

The company is now currently evaluating decommissioning work plans for Minerva, Stybarrow and Griffin.

The as-left condition on some closed sites, it noted, “has continued to present challenges for safe and efficient execution of decommissioning and learnings are being applied to improve planning and execution.”

In the financial statement, it reported that these challenges were the primary driver of a $445mn pre-tax ($218mn post-tax) restoration expense being recognised in the profit and loss in the half-year results.

At Bass Strait, the Gippsland Basin Joint Venture has safely completed approximately A$2,500mn (100% share) of early decommissioning works, including the plug and abandonment of over 200 wells, the company added.

This includes the completion of plugging the Bream B and Kingfish A platform wells in the first half of 2025.

Looking forward, detailed engineering and execution planning, including submission of primary and secondary environmental approvals to regulators for assessment, is well advanced for the Bass Strait offshore platform removal campaign planned for 2027, Woodside noted.

The Australian government is seeking feedback on the Offshore Decommissioning Directorate’s progress in implementing Australia’s Offshore Resources Decommissioning Roadmap.

The Australian government is seeking feedback on the Offshore Decommissioning Directorate’s progress in implementing Australia’s Offshore Resources Decommissioning Roadmap.

The Decommissioning Roadmap was released in December 2024 with the aim of maximising the opportunities arising from the estimated US$60bn worth of offshore oil and decommissioning activity due to take place in Australia over the next five decades. It gives a pathway to scaling up Australia’s local decommissioning industry with the aim of boosting local capabilities and creating jobs, as well as ensuring oil and gas infrastructure is decommissioned in a timely, safe and environmentally friendly way.

The roadmap focuses on five key areas of opportunity:

1. Ensuring a regulatory framework that protects the environment and attracts investment

2. Partnering with First Nations people and local communities

3. Optimising infrastructure opportunities and availability

4. Supporting new jobs and investment in recycling and waste management

5. Building a skilled, safe and diverse offshore decommissioning workforce.

The Directorate works with industry, unions, state and territory governments, international partners and other interest groups and organisations to maximise the benefit of decommissioning oil and gas infrastructure to the Australian economy and the environment. Feedback is sought from the businesses, communities and organisations it works with on its activities so far and how it can best continue supporting offshore oil and gas decommissioning activities in Australia. This will help it to ensure it is meeting industry and community needs, as well as directorate objectives, improve its decommissioning guidance and research and refine what it is working on to better meet needs and objectives over time.

For more information and to take part in the survey, go to https://app.converlens.com/industry/offshore-decommissioning-directorate-evaluation-survey

The survey closes on 24 October 2025.

The Centre of Decommissioning Australia (CODA), the University of Western Australia (UWA) and the UK’s Teesside University’s Net Zero Industry Innovation Centre (NZIIC) have signed a memorandum of understanding (MoU) to collaborate on the establishment of a Western Australia Industry Transformation Hub.

The Centre of Decommissioning Australia (CODA), the University of Western Australia (UWA) and the UK’s Teesside University’s Net Zero Industry Innovation Centre (NZIIC) have signed a memorandum of understanding (MoU) to collaborate on the establishment of a Western Australia Industry Transformation Hub.

The proposed WA Industry Transformation Hub will unite academic expertise, industry leadership and government support to drive innovation in decarbonisation and local manufacturing.

It also marks the latest collaboration between Australia and the UK in the drive towards decarbonisation, which includes the decommissioning of ageing oil and gas infrastructure, among other areas.

The latest MoU brings together expertise from both sides to support Western Australia’s industrial transition to net zero, aligning with a number of Australian government priorities including decarbonisation and the LNG Jobs Taskforce.

“This hub’s focus advances the WA CCUS [carbon capture, utilisation and storage] Action Plan vision of establishing a world-leading CCUS industry to decarbonise heavy industries while supporting economic diversification,” said CODA’s chief executive, Francis Norman.

“It also supports the Made in WA agenda by building local advanced manufacturing capability and skilled jobs, keeping WA at the forefront of global market shifts through strong industry support and innovation infrastructure,” said Norman.

The new ‘hub’ will focus on three core research themes:

Industrial emissions reduction: targeting heavy industries such as oil and gas, mining and cement, developing and deploying CCUS technologies in collaboration with industrial centres like Kwinana and the Pilbara.

Circular economy: supporting the Made in WA agenda, the hub will promote advanced manufacturing, industrial waste recycling and life-cycle design to grow WA’s circular economy.

Knowledge exchange: a joint governance model will embed international collaboration, with NZIIC and WA industry representatives guiding strategic direction to ensure alignment with the state’s Diversify WA priorities.

Each of the MoU partners brings unique strengths to the collaboration: CODA’s extensive Australian and international decommissioning networks, UWA’s track record of supporting Australian industry with applied research, and NZIIC’s strong research base and industrial partnerships in the UK.

Professor Hélène de Burgh-Woodman, Pro Vice Chancellor (Research Training) at UWA said: “The international network established by this MoU will provide a springboard to deliver innovation not just in net zero technologies themselves, but in their process of discovery.”

Earlier in the year, another UK-Australia MoU saw Global Underwater Hub (GUH) and Subsea Innovation Cluster Australia (SICA) team up to pursue subsea opportunities, including decommissioning, across both hemispheres.

Woodside has welcomed the Australian Government’s final decision to grant environmental approval for the North West Shelf Project extension.

The operator’s Executive Vice President and Chief Operating Officer Australia, Liz Westcott, said, “This final approval provides certainty for the ongoing operation of the North West Shelf Project, so it can continue to provide reliable energy supplies as it has for more than 40 years.

The Australian Government approval includes conditions that require additional monitoring and management of air emissions to protect the Dampier Archipelago National Heritage Place.

Thus far, the North West Shelf Project has supplied more than 6,000 petajoules of domestic gas, powering homes and industry in western Australia. If used just for household electricity, this is enough to power homes in a city the size of Perth for 175 years.

Australia’s Department of Industry Science and Resources has released a request for tender (RFT) on the AusTender platform for a lead contractor to deliver Phase 2 of the Northern Endeavour decommissioning programme.

Australia’s Department of Industry Science and Resources has released a request for tender (RFT) on the AusTender platform for a lead contractor to deliver Phase 2 of the Northern Endeavour decommissioning programme.

Phase 2 of the Northern Endeavour programme includes permanently plugging and abandoning nine wells in the Laminaria and Corallina oil fields in a planned two-stage process.

Stage 1 will involve project management, engineering, logistics, regulatory approval, subcontracting and procurement activities to: design and plan to permanently plug and abandon the wells; develop a Stage Gate Review Pack outlining a pricing model with detailed budget, risk profile and Performance Management Framework; and achieve Registered Operator status and monitor and maintain the Laminaria Corallina oil fields.

Stage 2 will include: permanently plugging and abandoning the wells; project management, engineering, procurement and field monitoring; meeting all regulatory requirements, including a National Offshore Petroleum Safety and Environmental Management Authority (NOPSEMA) approved Safety Case.

The Department intends to hold four industry briefing sessions for interested parties, each covering a different topic of the programme including commercial, technical, regulatory and financial aspects of the RFT.

The briefings are set to begin during the week of 22–26 September 2025.

Closing date for the submission of bids is 1 December 2025.

The flagship Northern Endeavour decommissioning project is already underway amid initial Phase 1 work at the site, which is located in the Timor Sea, approximately 550 km northwest of Darwin, Australia.

Unity has announced a strategic partnership with Clear Cut Interventions Australia, marking a significant step forward in delivering advanced well intervention and integrity solutions across the region.

Unity has announced a strategic partnership with Clear Cut Interventions Australia, marking a significant step forward in delivering advanced well intervention and integrity solutions across the region.

Stuart Slater, Unity’s Technical Sales Director, said, “Australia is a strategic market for Unity, and we are delighted to have the opportunity to partner with CCI. Together, we are creating something unique for local operators: the assurance of world-class technology delivered with the speed, agility and regulatory confidence of an established Australian partner.”

Combining Unity’s advanced technology with CCI’s knowledge of Australia and regulatory expertise, the partnership will offer accelerated access to engineered well integrity and P&A solutions, joint technology transfer programmes, and comprehensive end-to-end project delivering capability from diagnostics through to remediation.

Managing Director of CCI, Dean McTiffen, commented, “POB limits, tight decks and de-rated cranes can turn simple interventions into major logistics exercises. With Unity’s compact tooling in-country and CCI’s Western Australian team and infrastructure behind it, we’re giving operators a genuinely end-to-end route to safer, faster interventions that fit the real-world constraints offshore.”

Through this partnership, operators will benefit from the local deployment of Unity’s Compact Intervention Suite of Tooling, QV range of Wellhead and Christmas Tree products and Thru Tubing solutions.

A new collaboration is set to advance Western Australia’s decarbonisation and economic diversification ambitions.

A new collaboration is set to advance Western Australia’s decarbonisation and economic diversification ambitions.

The Centre of Decommissioning Australia (CODA), the University of Western Australia (UWA), and Teesside University’s Net Zero Industry Innovation Centre (NZIIC) are coming together to establish a WA Industry Transformation Hub.

The collaboration brings together expertise from Australia and the UK to support Western Australia’s industrial transition to net zero, aligning with government priorities including decarbonisation and the LNG Jobs Taskforce. It builds on the shared industrial heritage of Teesside and Western Australia and will combine CODA’s extensive Australian and international decommissioning networks, UWA’s track record of supporting Australian industry with applied research, and NZIIC’s strong research base and industrial partnerships in the UK.

Key focus areas include industrial emissions reduction (including CCUS technologies), circular economy and advanced manufacturing; and knowledge exchange and work-integrated learning.

“This hub’s focus advances the WA CCUS Action Plan vision of establishing a world-leading CCUS industry to decarbonise heavy industries while supporting economic diversification. It also supports the Made in WA agenda by building local advanced manufacturing capability and skilled jobs, keeping WA at the forefront of global market shifts through strong industry support and innovation infrastructure,” said Francis Norman, CODA's CEO.

Not long after Decom Engineering secured work in Australia’s nascent decommissioning sector, the UK-based company has appointed Nick McNally as its new Managing Director to steer its global growth ambitions.

Not long after Decom Engineering secured work in Australia’s nascent decommissioning sector, the UK-based company has appointed Nick McNally as its new Managing Director to steer its global growth ambitions.

The appointment was announced on the website of the Centre of Decommissioning Australia, or CODA, reflecting its significance to the nation’s decommissioning efforts.

“This is an exciting new stage for Decom as the business evolves from a highly respected niche engineering firm into a globally recognised technology partner,” said McNally in a statement.

“With new markets opening up, and recent contract wins in Australia, Brazil and the Gulf of Mexico, the opportunities ahead are considerable and my focus will be on building the infrastructure, capability and culture to meet that growth head-on.”

McNally, who has served as Decom’s Commercial Director since 2019, takes up his new role at a key time for the company as it steps up international expansion and technological innovation in the decommissioning sector.

His appointment reflects the Aberdeen-based company’s strategic focus on scaling operations, expanding into new markets, and strengthening its position as a leading provider of patented cutting technologies to the global energy industry.

Under his leadership, Decom succeeded in rolling out a new ultra-light chopsaw with improved cutting performance, which has seen the C1-16UL deployed across complex subsea projects in various challenging offshore environments.

The company has been buoyed by recent project wins in Australia.

Last year, it executed three market-entry Australian contracts to strengthen its position within the Asia Pacific region, including the deployment of its chopsaw cutting technologies on behalf of a major operator in the Bass Strait alongside two other clients in Australian waters.

Together, the contracts amounted to more than UK£500,000.

Decom is now actively progressing ISO certification alongside additional IP coverage and is looking to expand its workforce from 16 to over 25 staff within the next 18 months, with new roles across engineering, operations and business development.

“With international demand growing and increasing interest in our cutting technology, we’re focused on scaling responsibly, strengthening our systems, investing in our people and remaining agile, which enables us to move into new markets such as offshore wind and onshore decommissioning,” said McNally.

As well as the Australian market, the company is also chasing emerging business opportunities in North America, with demonstration events planned for the United States later this year as it evaluates potential partnerships and future growth.

A well operations management plan and multidisciplinary collaboration have been critical success factors in ensuring Exxon Mobil's Bass Strait decommissioning project is carried out safely , efficiently and in compliance with regulatory requirements,

A well operations management plan and multidisciplinary collaboration have been critical success factors in ensuring Exxon Mobil's Bass Strait decommissioning project is carried out safely , efficiently and in compliance with regulatory requirements,

In an article on the Exxon Mobil website, Project Manager Richard Perry talks about how Exxon Mobil is executing the largest offshore decommissioning project in its global history in Bass Strait.

ExxonMobil’s wells team is permanently and safely plugging and abandoning hundreds of wells in Bass Strait, as it retires infrastructure that has reached the end of its productive life. To date, the company has safely plugged and abandoned over 200 offshore wells, using specialised equipment to install cement plugs at depths equivalent to a 20-storey building. These plugs undergo rigorous pressure testing to ensure long-term integrity and environmental protection.

“To guide this work, our team developed a first-of-its-kind Well Operations Management Plan, ensuring all plug and abandonment activities meet strict regulatory requirements and adhere to the highest safety standards,” Parry explains. “This plan draws on ExxonMobil’s global experience managing successful decommissioning campaigns in Canada, the United States, and the North Sea, while also incorporating innovative practices that improve both efficiency and environmental outcomes.

“Our Bass Strait well plug and abandonment program is among the largest of its kind globally,” he adds, noting that it relies on close collaboration across a multidisciplinary team—including geoscientists, well integrity engineers, reservoir specialists, regulatory experts, and safety, health and environment professionals—to ensure each well is retired safely, responsibly, and in full compliance with environmental expectations.

Once all wells have been safely plugged and abandoned, each platform is placed in a safe state until it is ready to be removed and safely transported to Barry Beach Marine Terminal for dismantling.

“We remain committed to transparent engagement with our community—keeping stakeholders informed and ensuring our work aligns with local expectations,” Perry concludes.

Page 2 of 13

Copyright © 2025 Offshore Network