With a vision to be the go-to well abandonment and decommissioning partner for their clients, Graeme Brand, Business Development Director, explained how JFO has continued to innovate, grow and enhance their business and team globally, despite the challenges posed by the pandemic.

In an article for Energy Voice, Brand explained how, in order to achieve their goal, the company has acquired subsea project and engineering consultancy Subsea Engenuity, identified for its drive to create better technologies and solutions for subsea well abandonment. This has allowed JFO to enhance their portfolio of solutions and embrace new experienced members into their team.

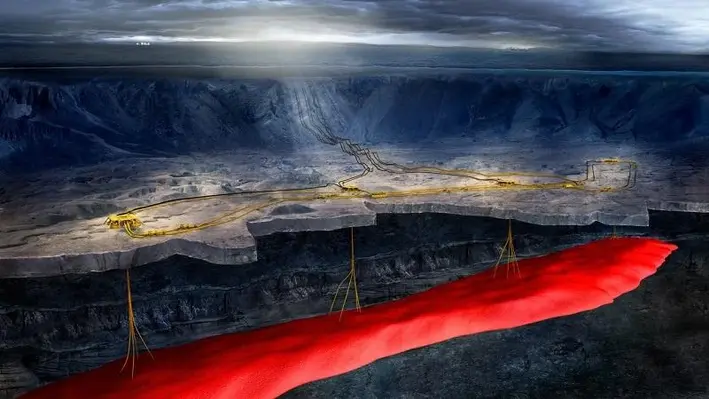

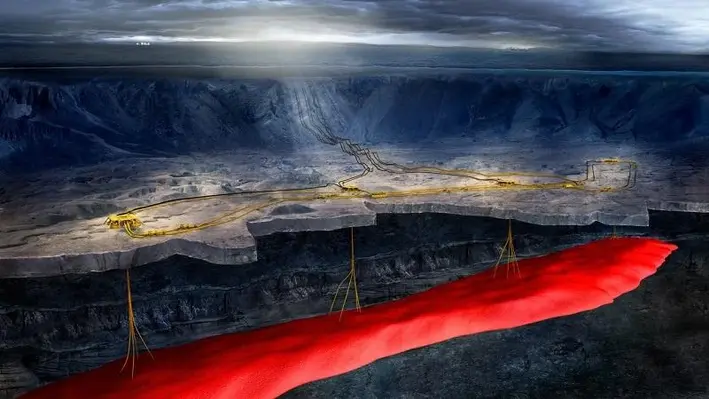

This acquisition has allowed the new members to release the SEABASS vessel based subsea abandonment tool. This is a single trip mechanically locking system for the abandonment of category 2 wells and is designed to deliver cost and time efficiencies compared to existing alternatives. The SEABASS tool is designed to remove containments and provide barriers to allow the well site to return to its original environment state.

Incorporating SEABASS into JFO’s full back deck capabilities, whether combining with our abrasive water jet cutting, or our internal cut and lift tool, for example, a single vessel and multi-skilled team delivers cost and time efficiencies, reduces deck and POB space, improves assurance and safety while significantly reducing a projects carbon footprint. This will allow JFO to deliver a single-source solution, reducing contractual complexity and enabling multi-well and multi-operator campaigns, encouraging collaboration along with more efficient and effective use of vessels.

Decommissioning potential

Brand also noted that, with the outcome of the forthcoming COP26 kept in mind, there will be many opportunities for decommissioning across the globe. A report by MarketsAndMarkets suggested that 7500 offshore platforms across 53 countries are ready to be eased into retirement and a separate study by Rystad predicted that the potential global value of US$42bn by 2024.

Moreover, as Brand continued, the North Sea is the most active basin for offshore decommissioning, setting the benchmark for best practice innovation. With the introduction of the new team members, the SEABASS tool and the existing capabilities of the company, JFO should be well positioned to take advantage of the forthcoming wave of decommissioning and hopes to continue to evolve in order to meet the demands and expectations of their clients and the offshore society.

During a challenging time for the industry, Wellvene, a design, engineering and manufacturing company, has continued to progress from strength to strength and has capped its impressive performance with the introduction of its latest well intervention solution: the WellHOP™ - Shallow Application Slickline Solution.

Writing in its latest update bulletin, Bronson Larkins, managing director of Wellvene, outlined how the company, which is entering its fifth year of operations, has continued in its evolution despite the industry downturn. When the pandemic hit, many companies including Wellvene were forced change their business plans and way of operations. Despite this, Wellvene has pushed on and successfully re-adapted its 2020/21 plan in order to protect its growth objectives and support the changing requirements of the well industry.

For instance, the company recognised that with the increasing pressure on operators and providers to deliver more climate friendly services and products, there has been a shift away from new well delivery to lower cost, lower rate adding well intervention opportunities while companies are also more intent on achieving their P&A obligations. By steering into this, and working to reduce its carbon footprint itself, Wellvene has expanded upon its working relationships with major operating and service companies in the UK, Norway, the Middle East and Australasia.

While signalling that further growth is still on the horizon, Bronson commented, “We’ll continue to re-invest in our business and our people, and reaffirm our commitment to industry improvement, whilst staying true to our core values of safety, integrity, trust, transparency and respect.”

The WellHOP™ solution

As if to demonstrate the strong position the company is currently holding, Wellvene has released the WellHOP™ Shallow Application Slickline Solution, designed as a more efficient solution to addressing shallow plug installations for xmas tree, well head repairs and DHSV remedial work. For their WellHop technology, Wellvene has been selected as a finalist in the Emerging Technology category for The Offshore Achievement Awards 2021.

Wellvene recognised that operating companies have a HSE obligation to carry out annual Wellhead maintenance on all xmas tree valves, wellhead valves and DHSV’s and, with a significant number of tests on any given platform, failure of numerous valves may occur. This can result in the requirement for wireline to be mobilised in order to plug the well for surface valve repairs or to complete remedial work on the DHSV. This can become a time consuming and costly problem for operating companies as securing space on any platform post maintenance campaign, is often tricky.

This is where the WellHOP™ comes in. With a wire drum c/w 3,000ft of 0.125” slickline, measuring head and toolstring winch installed directly onto a frame around the lubricator, it challenges traditional slickline rig ups and operating methods by eliminating the need for a mast and separate wireline winch whilst also simplifying the overall PCE rig up.

The WellHOP™ is specifically designed for DHSV remedial work and to set shallow plugs for xmas trees and wellhead repairs or emergent plugging operations. With the ability to be transported in only two baskets for reduced lifts and full PCE rigged up directly onto well with only two lifts, the system offers significant time saving during rig up and rig down. For multi well campaigns the system can also be lifted directly from one well to the next in a single lift and allows a customer to achieve more xmas tree and DHSV repairs within a single campaign compared with conventional slickline. The WellHOP™ ensures a reduction in operational risk, time, cost and POB whilst improving overall operational efficiency.

Due to its numerous benefits, the WellHOP™ solution has been submitted for the OWI Global Awards 2021. To find out more information on this event, follow this link: https://offsnet.com/owi-awards

Spirit Energy has announced that they have begun planning for the decommissioning of the Chestnut oilfield in the Central North Sea.

Thanks to continued investment from operator Spirit Energy and partner Dana Petroleum, additional wells and class leading production efficiency on the Hummingbird Spirit Floating Production Storage and Offloading (FPSO) vessel which sits on Chestnut, the field has produced almost quadruple the initial reserve estimates and has survived for more than a decade after it was first expected to be shut in.

Chestnut – which first came on stream in 2008 with an expected two-year production life – is still producing oil via three wells, the last of which was drilled in 2020. The field, nearly 200 km east of Aberdeen, has now produced more than 27 million barrels of oil, having initially been expected to yield only around 7 million barrels.

All good things…

After an impressive and perhaps unexpected lifespan, Spirit Energy and the FPSO owner Teekay have now started the first stages of preparing to decommission the field.

Under the proposed decommissioning plans, the FPSO will be removed and Teekay will assess potential reuse options or ultimately recycle the vessel in an environmentally safe and responsible manner in accordance with applicable UK/EU regulations. The risers will also be flushed, cleaned and taken back to shore.

The start date for the offshore campaign is dependent on final cessation of production from the field.

Mark Fotheringham, Capital Projects Director at Spirit Energy, commented, “Chestnut has been a key field in Spirit Energy’s portfolio for many years and thanks to the excellent work of teams both on and offshore, it has continued to perform above expectation.

“While it continues to produce today, we need to look to our responsibilities in the future and have the right plans in place for when the time does come to start decommissioning the field. As its production life nears an end, we are now looking forward to a safe removal campaign.

“The collaborative spirit which characterised the production phase of Chestnut’s life will continue as we support Teekay in any repurposing opportunities for the vessel, as well as working with our supply chain on an efficient campaign to plug and abandon the wells.”

Aberdeen-based downhole sensing technology specialist, Well-SENSE, has entered into a five-year agreement that provides Halliburton Company exclusive rights to distribute and deploy Well-SENSE’s FiberLine Intervention (FLI) technology in North America’s unconventional wells market.

Aberdeen-based downhole sensing technology specialist, Well-SENSE, has entered into a five-year agreement that provides Halliburton Company exclusive rights to distribute and deploy Well-SENSE’s FiberLine Intervention (FLI) technology in North America’s unconventional wells market.

Understanding and optimising well and fracture interactions is a challenge that operators face today. Branded by Halliburton as ExpressFiber, the disposable fibre-optic surveying solution offers operators in North America’s unconventional market an accurate and direct subsurface measurement during fracture operations, at a price point to suit every well pad. Unlike other cross-well monitoring techniques that provide indirect measurements, ExpressFiber uses distributed acoustic sensing (DAS) to acquire a direct measurement of microseismic, strain and temperature.

Annabel Green, CEO of Well-SENSE, said, “Entering into our first, multi-year, commercial contract with a leading oil and gas service company is an exciting step for Well-SENSE and it will demonstrate the scalability of FLI. Our unique bare fibre deployment technology delivers cost and time savings alongside superior data and has a wide range of downhole applications. We are firmly focused on delivering that value to operators around the world and our agreement with Halliburton represents a key milestone in this strategy.”

Well-SENSE’s wider range of acoustic and thermal fibre solutions have been successfully deployed, both onshore and offshore, around the world for a variety of applications. Currently the technology is in high demand to assist with cement assurance, leak detection, P&A planning, cross-well strain and vertical seismic surveys.

Well-SENSE is part of Aberdeen’s FrontRow Energy Technology Group, which is focused on nurturing new technology to provide practical solutions to current oil and gas challenges.

KDS JV AS, the joint venture between DOF Subsea and Aker Solutions, has been awarded a subsea decommissioning contract for DNO at the Norwegian Continental Shelf.

The contract includes engineering, preparation, removal & disposal work (EPRD) of associated subsea hardware.

The project shall be delivered by an integrated expert team from the JV partners. DOF Subsea shall deploy Skandi Acergy from its fleet, and Aker Solutions will use its disposal site at Stord for recycling.

Engineering will start immediately, with offshore execution planned for the first quarter of 2022, although there is a possibility for an earlier start in the last quarter of 2021.

Included in the project scope is the removal and disposal of subsea infrastructure such as template, manifold, production spools, umbilical, covers and associated hardware.

Netherlands-based Wintershall Noordzee B.V., a joint venture of Wintershall Dea GmbH and Gazprom EP International B.V., has started a largescale decommissioning programme in the Southern North Sea.

Netherlands-based Wintershall Noordzee B.V., a joint venture of Wintershall Dea GmbH and Gazprom EP International B.V., has started a largescale decommissioning programme in the Southern North Sea.

The first phase of this programme will last for approximately one and a half years and entails the plugging-and-abandonment (P&A) of 24 wells in both Dutch and German waters, and the removal of two platforms and two subsea installations.

The tender for the first part of this extensive programme was granted to Swift Drilling BV. In the past months, the SWIFT 10 jack-up rig has been modified and prepared to start work after a period of stacking due to a worldwide economic slump in offshore activities. The rig will first set sail to the P9 location to close off and safely abandon two subsea wells. It will then continue to the next wells until all 24 wells have been securely plugged and abandoned.

Decommissioning and complete removal of its assets is part of the full activity cycle of Wintershall Noordzee. A largescale campaign such as this is an efficient and effective way for the company to fulfill its decommissioning liabilities, Windershall Noordzee says.

“It is merely the final act of what we do, and one we have mastered doing over the years”, said Jone Hess, Managing Director of Wintershall Noordzee B.V. “We are proud of our accomplishments in the Southern North Sea and will continue to fulfill our obligations when it comes to our assets.”

Removal of four non-producing assets

Part of the largescale decommissioning programme is the full removal of the Q4-A and B production platforms, in addition to the two P9 subsea installations. These activities are due to start in the spring of 2022, with completion by Q4 2022.

Wintershall Noordzee B.V. is one of the largest producers of natural gas on the Dutch continental shelf. It is operator of 23 production platforms and six subsea installations in the Dutch, English, German, and Danish sectors of the North Sea. Active in the Southern North Sea since 1965, the company has substantial experience in decommissioning and re-use of its installations. Since the late 1980s, 58 wells have successfully been plugged and abandoned, starting with the first five wells in 1988 belonging to production platform K13-D. That same year, the topside of K13-D was moved to its new location in sector L8 becoming production platform L8-H. This marked the company’s first of a total of seven reused topsides to date.

Wintershall Noordzee has fully decommissioned and removed 16 production platforms during the past 30+ years, of which seven topsides were reused at new locations in the Southern North Sea. The topside of production platform P14-A has already been recycled twice by becoming the topside of E18-A in 2008, which became the topside of production platform D12-B in 2019.

Aberdeen-based Well-Safe Solutions, which specialises in the decommissioning of onshore and offshore wells, is gearing up to take advantage of the expected increase in activity in 2021/2022.

Aberdeen-based Well-Safe Solutions, which specialises in the decommissioning of onshore and offshore wells, is gearing up to take advantage of the expected increase in activity in 2021/2022.

In the company’s Group Strategic Report and Directors’ Report for the year ended 31 March 2020, issued in July 2021, CEO Phil Milton commented that the improving COVID-19 situation, improving oil prices and steps taken by the company to reduce capex and opex mean that it will be well positioned to commence decommissioning operations in 2021/2022 as contracts are awarded.

Milton commented that the size of the market has not been affected by the downturn in activity, with the commencement of work being deferred rather than cancelled, although he noted that there remains some uncertainty about the speed and timing of contract awards.

“The business remains focused on fulfilling current agreed work, and is in active discussion with other third parties regarding new and future contracts,” he said.

“The focus for the year ahead is in managing costs while working through the downturn in activity as a result of the COVID-19 pandemic and oil price crash.

“We continue to plan for the restart of the well decommissioning programme suspended due to the COVID-19 outbreak, where four wells were mechanically suspended and still required to be fully decommissioned.” He added that the offshore decommissioning programme restarted in May 2021.

According to the Directors’ Report, the group had in excess of £12mn (US$16.7mn) in cash reserves at the end of June 2021 to support the final pieces of refurbishment works required on its fleet, converting the rigs to bespoke plugging and abandonment (P&A) units in readiness for an increase in activity.

Well-Safe Solutions was established in 2017 to provide a ground-breaking approach to safe and cost-efficient decommissioning. It continues to develop its innovative P&A Club whereby members provide a pool of wells that enable Well-Safe Solutions to leverage economies of scale to reduce decommissioning costs for all members. The company is engaged in research and development activities with the aim of enhancing industry knowledge and understanding of key technologies and processes which can deliver costs and efficiency improvements to clients’ decommissioning projects.

With the industry’s drilling units (both semi-submersible and jack-ups) in the UKCS in decline through retirement and cold stacking, Well-Safe is bucking the trend by investing heavily in its fleet. The company added a second rig to its fleet of bespoke decommissioning assets in September 2020, the Well-Safe Protector. Following this acquisition, it secured a £26mn (US$36.1mn) investment to fund the next stage in its growth plan and deliver its vision to become a globally recognised Tier 1 well decommissioning company, with the ability to cover both subsea wells and multiple platform projects. Well-Safe Solutions is looking to add further assets to its growing fleet.

EnerMech, a global services company specialising in critical asset support across the asset lifecycle from pre-commissioning to decommissioning, has appointed Daniel McCarthy as its strategic proposals director to help accelerate its planned growth across the business.

EnerMech, a global services company specialising in critical asset support across the asset lifecycle from pre-commissioning to decommissioning, has appointed Daniel McCarthy as its strategic proposals director to help accelerate its planned growth across the business.

In McCarthy’s 18-year career in oil and gas, he has won high-value projects in North and South America, the Caribbean, Europe and the Middle East, and managed and developed multi-discipline tender teams to ensure proposals meet all health, safety and quality requirements.

Based in the United Kingdom, McCarthy will be instrumental in building on recent successes with a key focus on devising and implementing best-in-class procedures for cross-regional, complex proposals. His focus on large-scale tenders will also see Mr McCarthy align the company’s technical expertise across its global locations to deliver proposals across the energy and infrastructure sectors.

McCarthy commented, “EnerMech is a forward-thinking company with vision, energy and purpose, and I am very excited to be joining the business and supporting its next stage of international growth. When bidding for new business across multiple countries and sectors, there is a myriad of different requirements, nuances and complexities involved in the tendering process. The team at EnerMech are incredibly experienced in addressing these challenges and have won a significant number of important and large-scale contracts as a result, despite the recent downturn and coronavirus pandemic.”

Behzad Kazerani, Chief Business Development Officer at EnerMech, added, “Daniel’s appointment underlines the company’s commitment to building a world-class senior team to support our overarching global ambitions.

“We have added a number of key contract wins to our books since the start of the year including a five-year contract with Chevron in Australia. And, as awareness has increased of our extensive capabilities and in-house resources to support this scale of opportunity, we are submitting a growing number of new, exciting large scope tenders from new clients in new territories. Daniel’s insight will help to advance our teams and their ability to deliver proposals that strike the right chord.”

The business has experienced a strong performance in 2021 and secured contracts totalling UK£170mn in the first quarter of the year including substantial downstream projects in Africa and the US as well as a second award for its unique patented catalyst handling technology.

Following an initial agreement between the two companies in 2018, Equinor and Ardyne, a specialist downhole technology and services company for reducing rig time on well abandonment, slot recovery, workover, exploration and P&A operations have agreed a second joint industry project (JIP) to develop a unique well decommissioning technology to reduce the economic and environmental impacts of slot recovery and well decommissioning operations.

The UK£1mn project has been jointly funded by Equinor and Ardyne. Ardyne will manage all engineering, project management and onsite rig qualification testing before deployment for field trials.

TITAN RS

TITAN RS, which will be ready for commercialisation in 12 months, combines Ardyne’s field proven bottom hole assembly (BHA) systems with the new resonance tool to aid casing recovery by using resonance to reduce the pulling force required to free stuck casing. Successful trial wells have been completed recovering casing encased in settled solids.

The system uses the novel and highly effective application of resonance or vibration technology to allow longer sections to be pulled more quickly from settled material in the well. Ardyne has proved resonance to be highly effective in loosening settled material surrounding the casing, with an approximate 30% reduction in pull force required. The vibrations remain isolated downhole and are not transferred to the rig floor.

Compared to conventional rig systems, TITAN RS can provide up to 40% time efficiency savings for well abandonment, decommissioning and brownfield slot recovery projects through fewer runs and time downhole, with a resultant reduction in carbon emissions due to less rig time. The additional functionality means well clean up can be achieved as part of the recovery process without the need for additional trips in the well.

Ardyne has calculated that, when considering a single well scenario, an average rig time saving of more than 78 hours can be achieved. This would equal 136 tonnes of CO2 avoided, 156.8 MW hours of electricity and 13,807 gallons of diesel.

Alan Fairweather, CEO of Ardyne, commented, “The process is proven. The ability to cut days off existing processes through the innovative use of resonance is compelling at a time when the industry is seeking to maximise efficiencies at every opportunity. The environmental benefits of reduced carbon emissions through less time required on site are clear.”

“Equinor has already identified wells offshore Norway for the commercial deployment of TITAN RS next year. We look forward to providing them with a unique and industry-leading method to reduce operational costs and carbon emissions.”

Pål V. Hemmingsen, Task Leader Low-cost P&A Equinor, added, “The benefits of TITAN RS match our ambitions to shape the future of energy. We have been impressed with Ardyne’s unique application of resonance as a force for good in reducing project time and carbon output associated with P&A and slot recovery operations. We look forward to full commercialisation of the system from this latest JIP with the company.”

The UK Oil and Gas Authority (OGA) has published a new cost estimate for offshore oil and gas decommissioning in the UK Continental Shelf (UKCS), suggesting that the total cost of decommissioning has reduced, spelling good news for both the industry and the Exchequer.

The report showed that the total cost of decommissioning UKCS offshore oil and gas infrastructure has reduced to UK£46bn, which is a projected saving of nearly UK£14bn. This marks steady progress towards the US£39bn by end-2022 target called for in the 2017 report.

Behind the decline

The UK£2bn reduction in the 2021 estimate is the result of continuous improvement and reductions in well decommissioning costs, driven by reductions in subsea P&A costs, cost estimating uncertainty and associated cost risk.

Expenditure in 2020 was impacted by Covid-19 and the low commodity price, contributing to a continuation of a plateau in the rate of cost reduction reported last year. While short-term forecasts show a recovery from this slowdown, commercial transformation remains key to meeting the cost reduction target.

There are positive signs that operators are embracing lessons learned from across the industry as well as embedding a culture of continuous improvement and setting ambitious best in class performance targets. This is helping drive the downward cost trajectory and, more will be needed to meet the target. At the same time however there remain some real inconsistencies in cost performance, reducing the overall improvement of the basin.

The majority of decommissioning cost is forecast to be incurred over the coming two decades, and the window of opportunity to identify and embed the necessary changes to drive the next step change in cost efficient decommissioning is immediate.

Achieving the cost reduction target

The OGA’s updated Decommissioning Strategy sets out the commercial transformation and strategic objectives required to deliver cost efficiency and achieve the UKCS cost reduction target of greater than 35%.

The 2021 Estimate notes that there are a number of opportunities to bring about further cost reductions, but it also highlights risks to continuing to bring down costs.

An average annual cost reduction of 6% has been delivered over the past four years. If this average is maintained, the 35% target remains achievable by end-2022.

Equinor Energy has opted to add additional well intervention work to the previously agreed work scope for the low-emission jack-up rig Maersk Intrepid at the Martin Linge field offshore Norway.

Maersk Intrepid is an ultra-harsh environment CJ70 jack-up rig, designed for year-round operations in the North Sea and featuring hybrid, low-emission upgrades. It was delivered in 2014 and is currently operating at Martin Linge for Equinor. The rig was initially contracted by Equinor for both drilling and accommodation activities and its scope in the region has been continually extended as the field has been developed.

Of the latest contract extension, the firm value is approximately US$10.5mn, including integrated services but excluding potential performance bonuses. The added well intervention scope has a firm duration of 31 days, which means that the rig is now contracted until February 2022.

The contract extension is entered under the Master Framework Agreement between Equinor and Maersk Drilling, in which the parties have committed to collaborate on technology advancements and further initiatives to limit greenhouse gas emissions. The contract with Equinor Energy AS contains a performance bonus scheme based on rewarding reduced CO2 and NOx emissions.

A/S Norske Shell has utilised Kongsberg Digital’s digital twin solution Kognitwin Energy to create a virtual representation of their Ormen Lange deepwater gas field which was released to users last month.

Feeding into the onshore digital twin developed at Nyhamna gas processing facility, the two will be combined to become the first ever fully integrated reservoir to market digital twin.

In October 2019, Norske Shell collaborated with Kongsberg Digital to operationalise an ‘asset of the future’ through a partnership development of the Nyhamna Dynamic Digital Twin, using Kongsberg Digital’s Kognitwin Energy solution. By the end of the year the solution was operational and since January 2020 the Nyhamna Dynamic Digital Twin has been evolving continuously through monthly product releases, focusing on safe, effective and integrated work processes and the optimisation of production and energy use. With Nyhamna having paved the way, the decision was made to expand the collaboration with another digital twin of the related Ormen Lange deepwater gas field, which feeds gas to Nyhamna.

Ormen Lange

Hege Skryseth, President of Kongsberg Digital and EVP Kongsberg, said, “With Ormen Lange, we are very proud to have been awarded the contract for the development of a second digital twin for Norske Shell. This is a direct result of our successful collaboration around the Nyhamna dynamic digital twin. We would particularly like to highlight a strong core product, Kognitwin Energy, rapid deployments, and fast time to value as unique differentiators in this ongoing project. Now, we are eager to help Norske Shell realise the full potential of their assets through integration of these two digital twins.”

The first version of the Ormen Lange digital twin comprises primarily data integrations and visualisation of subsea 3D models including production and MEG pipelines, well surface locations and well-bore paths, seabed bathymetry data detailed around the production templates, built documentation and drawings, real time data from DCS and PI and much more. For disciplines and teams across the initial Ormen Lange user base the twin provides unified data for everyone to access across the same work surface.

Rolf Einar Sæter, Digitalisation Manager in Norske Shell, commented, “Digital twins are technology for people. The partnership model, combining Kongsberg Digital’s digital capabilities with our own employee’s expertise in the operations and maintenance domain, has been very effective in delivering use cases that let our teams to collaborate better and become more effective. This in turn enable us to save costs and optimise production whilst improving safety and environmental impact.”

Page 30 of 36

Copyright © 2026 Offshore Network