In an operations update, EnQuest has indicated that it is making good progress in its decommissioning project in the UK, North Sea.

EnQuest stated that the Heather and Thistle plug and abandonment (P&A) campaigns are progressing well with six wells completed at Heather and nine wells completed at Thistle. As a result, the group remains on track to complete the P&A of 16 wells at each installing in 2022.

In addition, the company noted that the tender processes for heavy lift vessels for Heather and Thistle topsides and jacket removals has concluded. Contracts to complete the scopes (scheduled for 2024 and 2025) are expected to be awarded in Q” 2022.

EnQuest also reported that, at the Dons, subsea infrastructure within the 500 metre zone is progressing as expected. Two phases were completed during the first half of the year and the final phase is scheduled for completion in August.

Thompsons of Prudhoe have successfully secured two decommissioning projects, working closely along with Heerema Marine Contractors and DeepOcean.

These two challenging contracts allow Thompsons of Prudhoe to provide a full turnkey dismantling and waste management contract solution to asset owner, Spirit Energy.

The six southern North Sea structures will be delivered into the Battleship Wharf Terminal by Heerema on two large North Sea barges during Q3 2023. The assets will be offloaded and transported using SPMTs to the purpose-built decommissioning facility in collaboration with our decommissioning partner the Port of Blyth and strategic subcontract partner Mammoet. In addition to this, DeepOcean will be recovering the subsea structures, rigid pipelines, flexibles, umbilicals and concrete mattresses and delivering them into the port using a variety of vessels from their versatile fleet.

After being involved in this important project since 2019, Thompsons of Prudhoe are proud to have now been chosen by two of the industry’s most recognised contractors to undertake these works. Mark Hill, Bid/Business Development Manager for Thompsons of Prudhoe, said, “We have worked hard over the last two-and-a-half years to establish a compelling and competitive decommissioning service offering. Having secured both, the topside and jacket dismantlement & disposal works for Heerema Marine Contractors, as well as the subsea waste management and disposal works for DeepOcean, is really beyond expectations."

Neil McCulloch, CEO of Spirit Energy and Industry Co-Chair of the Decommissioning and Repurposing Taskforce (DaRT), said, “Spirit Energy continues to create value with our industry-leading decommissioning capability and performance, and we are delighted that Thompsons have been selected, by our contractors, for the safe waste disposal of materials recovered from our assets. This builds on the excellent work that Thompsons have already carried out, at our South Morecambe Terminal, and demonstrates Spirit Energy’s ongoing commitment to support the local supply chain.”

Thompsons have begun working with all stakeholders including the Environmental Agency (EA) and the Health & Safety Executive (HSE) to successfully deliver these works over the forthcoming months. These recent project successes demonstrate and showcase Thompsons objective to become a trusted decommissioning partner to the oil & gas industry.

Serica Energy plc, a British independent upstream oil and gas company with operations centred on the UK North, has provided an operations update outlining its successful well intervention campaign on the Bruce Field.

Serica’s first ever light well intervention vessel (LWIV) campaign, part of the company’s ongoing plan to add value and extend the life of its Bruce facilities, has now concluded without any safety incidents or environmental issues.

The initial well (Bruce M1) was re-entered for the first time since 1998 and, after a successful scale removal and water shutoff, a significant reperforation and new perforation campaign was executed with the well returned to production.

Rates from the well have since increased from around 400 boe/d before intervention to more than 1,800 boe/d.

A similar programme was followed on the second well (Bruce M4) and production rates for the well increased from around 450 boe/d to more than 2,400 boe/d. The results from these two wells are at the upper end of the range of expectations and it is expected that there will be an uplift to independently assessed reserves.

This programme has increased confidence that further uplift can be achieved from future well interventions. Subsequently, plans to perform similar interventions on other Bruce and Keith wells, both subsea and from the platform, are now being accelerated.

Serica’s production performance in 2022 is benefitting from the significant investment in the Rhum R3 well reintervention, the Columbus development project and now the LWIV campaign. Serica’s average net production in July has averaged over 29,150 boe/d and YTD average net production is 26,832 boe/d.

Mitch Flegg, Chief Executive of Serica Energy, commented, "I am delighted with the significant progress that Serica has continued to make during 2022. The impact of the substantial investment programmes undertaken in the last three years has seen increased production levels providing responsibly sourced gas to the UK domestic market, protecting security of supply, and reducing the UK’s reliance on imports as part of the transition to a lower carbon future.

“Serica has no debt, limited decommissioning liabilities and with growing cash reserves is well positioned to continue to invest in further projects and other opportunities to add shareholder value. We have just completed a well intervention campaign on Bruce that has boosted net production by over 3,000 boe/d and provides further evidence of the value in Serica’s assets that can be realised through measured and expert operatorship.

“Operations have also commenced on the North Eigg exploration well with potential for transformational results, while we are now accelerating further well intervention work on Bruce and Keith following the success of the recently completed campaign.”

Well decommissioning specialists Well-Safe Solutions have signed an agreement to plug and abandon (P&A) 14 wells on the United Kingdom Continental Shelf (UKCS).

The deal is the first scope agreed for the Well-Safe Defender semi-submersible rig, which the company purchased in June 2022. The project, for an undisclosed value, will see the rig mobilising in March 2023 for approximately 250 days of work.

Neil Ferguson, Operations Director at Well-Safe Solutions, said, “This is a very exciting time for our teams, with a little over a month between Well-Safe taking ownership of the Well-Safe Defender and the signing of this contract with our latest client.”

According to the company, the Well-Safe Defender is currently undergoing a host of efficiency enhancements as part of its integration into the business as well as the completion of its recertification ahead of mobilisation in March 2023.

Gavin Robinson, Commercial Manager at Well-Safe Solutions, said, “We are delighted to assist our client, a leading European operator, with meeting their decommissioning obligations on these historic fields. Like the Well-Safe Guardian and Well-Safe Protector, the Well-Safe Defender is a dedicated decommissioning asset converted from a drilling rig. Clients benefit from a greatly reduced carbon footprint and quicker mobilisation times as a result, as no virgin steel is required for a new-build rig.”

“In addition to the clear economic benefits of this approach, we expect this work to generate approximately 60 new positions offshore, with several supporting roles also required onshore. This will take the total estimated headcount in Well-Safe to 330 people in early 2023,” Gavin added.

The contract announcement is the latest in a summer of growth for Well-Safe Solutions, which previously announced a well decommissioning contract with Ithaca Energy as well as a capital funding boost of more than US$59mn (£50 million) by new and existing investors.

Allseas has celebrated yet another major offshore milestone after completing the removal of Repsol Norge’s 30,000 tonne Gyda platform in a matter of days.

Pioneering Spirit delivered the platform’s jacket to Asker Solutions’ disposal yard in Stord, Norway, less than 48 hours after removing it from the southern Norwegian Sea. The latest job for vessel’s jacket lift technology is one of the heaviest ever, but well within the 20,000 tonne lift capacity.

The jacket was set down directly onto the quayside and reunited with it decommissioned drilling and production topsides. Aker Solutions expects to recycle around 98% of the facilities.

Split across two campaigns, Pioneering Spirit completed the removal, transport and load-in to the disposal yard of the entire Gyda platform, its 32 conductors and template in 12 days.

To facilitate removal of the jacket, the structure’s 24 foundation piles were cut below seabed level. Main hoist blocks suspended from the Jacket lift system (JLS) beams were connected to pre-installed rigging and the entire structure lifted and aligned with the lifting beams. As the jacket was vertically fabricated and installed, the structure could not sustain loading in the horizontal position during transport.

The solution of transporting the jacket in a near-vertical (60%) position, with interface supports and grillage made delivery of the complete jacket to the yard possible. Pioneering Spirit only requires days in the field to remove entire platforms and subsea facilities, eliminating the need for multiple trips and a support fleet. Saving time and reducing vessel operations to a minimum significantly reduces the vessel’s emissions footprint.

“Our mission at Allseas is to remain a frontrunner in the offshore energy market by pioneering ground-breaking technology to meet the industry’s ever-changing needs,” said Allseas President Edward Heerema. “The Gyda platform removal strengthens our reputation as a game changer in the industry. Again we have shown that Pioneering Spirit provides a significantly faster, safer, more efficient and sustainable option for the removal and installation of offshore facilities.”

The world’s largest construction vessel will now mobilise for further heavy lift commitments. These include further jacket removals, as well as installation of a major offshore wind transmission station and jacket in the German North Sea that will supply clean electricity to tens of thousands of homes.

In what has been a busy year for Pioneering Spirit, the vessel has already lifted and transported more than 90,000 tonnes of decommissioned and new offshore facilities for the offshore energy industry in 2022, deploying both its Jacket lift and Topsides lift systems.

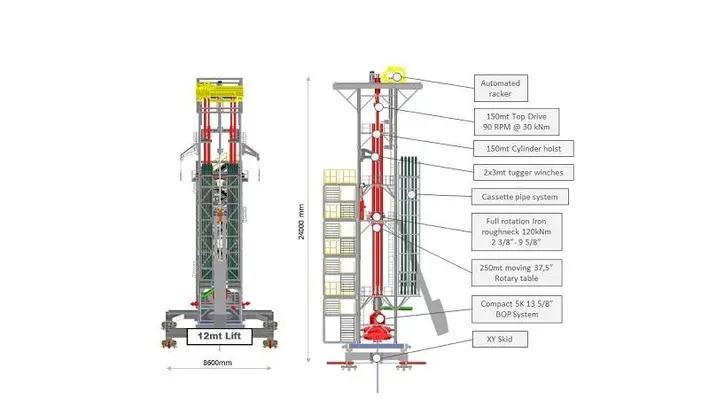

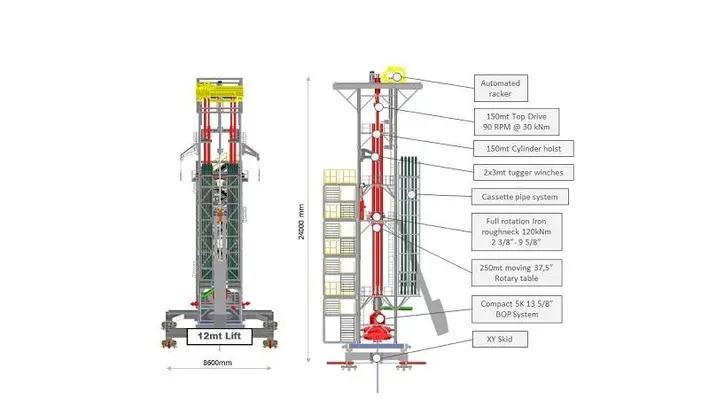

To fill a glaring gap in the decommissioning market, Voll Marintek Limited is pioneering the HWU-150 Lean Machine, a dual jack lifting system with key advantages over rigless operations and MDR to deliver significant cost, risk and climate benefits for the industry.

Dennis Vollmar, CEO of Voll Marintek Limited, spoke to Offshore Network to discuss his innovative solution in detail and explained how he identified this opening in the market.

“So we realised there was a gap by knocking on doors really. We had deep interactions with different operators, service providers and contractors and realised there was space for something new.

“It comes down to knowing well conditions. Wells which are coming to the end of their life are usually decades old and in this time the way data is collected has changed. In many cases you don’t even know which revision is the most updated one. In these cases, you have two options: either a customised approach with the deployment of specialised workover units for each subtask or use a rig.”

There are drawbacks to both. In the former, rigless workover units require intensive planning, a detailed knowledge of well integrity and, due to their simplicity and dependency on crane support, they are highly vulnerable to unforeseen events and weather conditions. Rigs on the other hand have more capacity and can simplify the planning and execution phase, but generally have a very high spread cost and carbon footprint.

Voll Marintek, therefore, has developed the Lean Machine, a multipurpose unit to fill the void between these two options.

“The Lean Machine is basically a hybrid solution between a hydraulic workover unit (HWU) and a modular drilling rig (MDR). It combines the main features of a HWU such as fast assembly, lightness, compactness and only requires a small footprint in addition to the benefits of MDR such as drilling, milling, making pipe connections respectively handling different pipe types conventionally and in a safe manner.”

The dual jack lifting system is a modular adaptable multipurpose unit which has the capacity to be upgraded with additional features so that it can be customised for each project and adapted to various interfaces. It consists of different modules designed to cover a specific P&A task which can be stacked on top of each other, extending the previous operational envelope of the complete system (this is called ‘The Happy Meal’). This means it can be upgraded with existing modules at the offshore location to perform sequential tasks instead of mobilising specialised equipment for each subtask or oversized workover rigs.

The operator can choose the options required based on additional costs for each contingency as desired always keeping integrated costs in mind. Importantly, the compactness of the 10 ft container footprint and the lightness of each module (around 12 mt) allow its assembly on a skid beam substructure, heave compensation platform or in a derrick structure of an existing rig.

Explaining the benefits of the system, Vollmar commented, “Cost and risk are the main drivers here. When looking at costs for an operation you want to see exactly the expenditure that will be incurred. Often this is not possible without an extensive preparation phase and even then unforeseen circumstances can occur – which is why rigs are often used.

“What we are doing is to see how we can make the whole process lean. So when you know the potential work scopes you need to perform you can configure the machine to it but, if you have the eventuality of making adaptations (maybe to enhance the operational envelope or even downsize it), you can do that in the field and this is where costs can be significantly reduced.”

Vollmar claimed that the deployment of the modular adaptable unit to tackle challenges within the P&A and decommissioning space will enable the highest potential cost savings available. The faster pipe recovery system alone allows cost savings of US$1mn per well based on a five day execution phase reduction. A global operator has already performed a preliminary total cost analysis in comparison to conventional solutions and identified a cost reduction above 30% for his 100 well campaign.

The high cost of a rig is also mirrored in its high carbon footprint, a somewhat neglected but increasingly pressing concern for the oil and gas industry. HWU’s of course have an advantage here, but poor weather, unforeseen events and the mobilisation of additional equipment to cover all P&A phases can bring down operational efficiency and extends the time duration for a P&A campaign– which is not a problem for the Lean Machine.

Mounting market interest

While still at the start of its journey, the Lean Machine is already attracting attention and suitors which is driving it steadily towards commercialisation.

“The interest in regard to decommissioning is operators who see themselves as delay asset management companies and want to change or look at game changers to reduce the cost of decommissioning,” Vollmar remarked.

“There is also interest beyond decommissioning in production enhancement, for example. As the oil and gas prices increases, we need to look at solutions which reduce costs and simplify the process. Usually, you can collect wells with the same well challenges which only require wireline (for example) for a campaign. Then you need to get a certain threshold to justify the costs to mobilise other equipment. Our approach gives you the advantage as it is multipurpose and has all this included. You can combine now all the different well interventions and justify the cost much easier, which obviously increases the recovery factor of mature fields.” The wide application range simplifies wireline, side track drilling, coiled tubing, ESP runs, conductor pulling, life well interventions or slot recovery operations. On top, the dual jacking system reduces operational time by almost 40% and its offering a hoisting capacity up to 250mt.

For the next steps on its promising journey, Voll Marintek will be conducting a FEED study in September 2022 for which they have been granted a significant grant by Innovate UK. The company will look at different potential well designs which would require P&A and test the technical, commercial and operational feasibility of the Lean Machine against them. Over the course of the study, further engineering and optimisation of the solution will be undertaken.

“We are already receiving interest from operators to manufacture the system and offer it at a rental rate. The idea here would be we manufacture the system, rent it out and then provide maintenance and support when needed,” surmised Vollmar.

While Europe is the launch pad, it is clear that Vollmar has no intention of shackling his ambitions to this region, but instead envisioned the Lean Machine being rolled out across the globe.

“This solution has been developed through niche market research and I looked at a lot which are not currently provided for with a sufficient solution. For example, Australia and Brunei have a lot of wells in four to five metres water depth which you cannot enter with normal jackups. So you need to engineer something which is light, compact and could be added to any vessel of opportunity. But, at the same time, you don’t want to make any large vessel modification. So companies have been looking at lift barges to put a cantilever on but this is not economical or would only be so with a contract for 5-10 years as, again, you need to make modifications. It would be much easier to have something light and compact which could be put on top of the wellheads and even deployed by a jacking barge (or between two).”

“In Asia and Africa, people did not really think about workovers and so you often find wells with a production facility incredibly close. Workover equipment is only feasible if you look really deeply into interfaces and have the time and resources to do it. The Lean Machine could really help here and can be easily adapted depending on how much space is available at location.”

While it was clear that Vollmar is very much ready to take on the world with the Lean Machine, for now it is time to build the foundations. After the start of the FEED study, the next steps for Voll Marintek will be building alliances, manufacturing and testing and field trials before commercialisation – currently targeted in 2024/25. Without doubt, however, there will be many in the industry following this progression with great interest.

THREE60 Energy, a leading independent energy service company offering complete asset life cycle solutions, has acquired Fraser Well Management, a well and pipeline operator and well management specialist, in order to strengthen its wells credentials.

THREE60 Energy will become one of only two companies that can undertake the role as outsourced duty holder (installation operator), pipeline operator and well operator across the asset life cycle, further positioning the company as a strategic services partner.

Fraser Well Management’s services span the complete well lifecycle, both onshore and offshore, with comprehensive end-to-end well and pipeline operator solutions provided to customers across the world. The company also provides well management, decommissioning, specialist engineering, and commercial services, with sustainability as a key operational consideration.

All of Fraser Well Management’s personnel will transfer to the THREE60 Energy team.

Walter Thain, Group CEO at THREE60 Energy, commented, “The capabilities and expertise that Fraser Well Management has accumulated will greatly benefit the integrated solutions we offer our customers throughout the asset life cycle. We are immensely proud to have our new team members join THREE60 Energy, as we can continue to provide better energy together.

“As we continue to transition into sustainable and renewable energies alongside traditional means of energy production and storage, there has never been a more pertinent time to invest in the future of our business and our place in the energy supply chain.”

Lasse Hermansson, Managing Director at THREE60 Energy Norway, added, “The breadth of transferrable knowledge across THREE60 Energy is crucial for capitalising on the synergies across disciplines, and the addition of Fraser Well Management’s skills and people will greatly add to our expertise.

“This not only enhances our UK capabilities, but provides additional competencies and services to our Norwegian and global business. We are extremely excited about the acquisition and see a great cultural and collaborative fit with the excellent team at Fraser Well Management.”

Nick Ford, Managing Director at Fraser Well Management, remarked, “We have watched the rapid and sustained growth of THREE60 Energy alongside our own development and can see the synergies that the integration of Fraser Well Management’s service offerings combined with that currently provided by THREE60 Energy will provide our clients better solutions to their energy needs. This deal is a natural progression for our services and people, as both can continue to grow and expand under THREE60 Energy.

“As late life, CCUS and decommissioning play an ever more significant role, we are proud to be part of THREE60 Energy Group as the company delivers in these key areas.”

Abu Dhabi National Energy Company PJSC (TAQA), an integrated utility company in the Europe, the Middle East and Africa region, has announced the completion of safe and successful removal of the Brae Alpha West drilling rig and the Brae Bravo upper main jacket in the northern North Sea.

The operation, which was the latest in TAQA’s extensive UKCS decommissioning programme, involved the removal and transport of more than 12,000 tonnes of material from the Brae field in the UK North Sea.

The HAF Consortium, Heerema Marine Contractors and AF Offshore Decom, were contracted to execute the operation on behalf of TAQA.

The Heerema-operated Sleipnir semi-submersible crane vessel first removed the 1,000 tonne Brae Alpha Rig 1, in a single lift on 20 June.

Sleipnir then moved to Brae Bravo to remove the 11,000-tonne upper main jacket. This forms part of TAQA’s decommissioning obligations and follows the removal of the Brae Bravo topsides modules and flare bridge, jacket and tower last summer – one of the largest topsides removals in the UK North Sea.

Both Rig 1 and the Brae Bravo jacket have been safely offloaded at the AFOD Environmental Base in Vats, Norway, and are being processed with the aim of reusing or recycling 95% or more of the material, which is expected to be completed in 2023. The entire operation was successfully completed with zero health and safety incidents.

Donald Taylor, TAQA Managing Director for Europe, commented, “TAQA’s extensive late-life portfolio positions us at the forefront of decommissioning in the UK. By adopting valuable lessons learned during last year’s successful Brae Bravo topside removal campaign, we are continuing to develop our skills and capabilities supporting the transition from operations to removals and disposal.

“The coming years offers some of the most interesting challenges and opportunities for our workforce and wider industry. TAQA is proud to pioneer this change while maximising the value of our assets and playing a valuable role in the energy transition.”

Specialist well-decommissioning services provider Well-Safe Solutions has announced the completion of its third investment round, raising £50 million for the company.

Specialist well-decommissioning services provider Well-Safe Solutions has announced the completion of its third investment round, raising £50 million for the company.

Well-Safe Solutions said it will use the funds for the purchase of its third rig and to broaden the capabilities it offers to clients around the world. The funding round was led by MW&L Capital Partners, a London-based principal investment and financial advisory firm, with participation from a consortium of new and existing investors.

The latest investment brings the total capital raised by the company to over UK£150mn.

Phil Milton, Chief Executive Officer of Well-Safe Solutions, said, “This further investment demonstrates our strong investor support, enabling ongoing growth here in the UK as well as delivering the next stage of Well-Safe’s international growth.”

“The capital raised in previous investment rounds has been instrumental in enabling the company to put in place a world-class portfolio of bespoke well plug and abandonment (P&A) assets, backed by expert onshore and offshore teams. These investments are now bearing fruit thanks to recent contract wins and workscopes throughout the North Sea for our rigs and well engineering teams.”

“As we continue to build upon Well-Safe’s operational record, we are looking forward to exporting this model to new markets, which have expressed an interest in our collaborative, multi-well, multi-operator approach to well decommissioning,” Phil added.

Well-Safe was recently awarded its first contract with Ithaca Energy for the Well-Safe Protector jack up rig, which will be used to decommission several wells located in the Southern North Sea. The business also announced the acquisition of the ex-Awilco Drilling WilPhoenix semi-submersible rig, which is to be renamed the Well-Safe Defender.

The Aberdeen-based company said that it is building on this positive momentum, with over 100 new employees joining the company in the past 12 months.

Alasdair Locke, Chairman and majority Shareholder of Well-Safe Solutions, said, “This financing allows a step-change in the capabilities of Well-Safe Solutions, enabling us to be competitive on a global basis. I’m grateful for the support from existing and new investors.”

Julian Metherell, a founding partner of MW&L Capital Partners, added: “We are delighted to continue to partner with Well-Safe to build a world-class decommissioning business.”

EXCEED has announced the award of a milestone, vessel-based well plugging and abandonment campaign to be carried out in partnership with Mermaid Subsea Services UK (Mermaid) on behalf of four operators.

EXCEED has announced the award of a milestone, vessel-based well plugging and abandonment campaign to be carried out in partnership with Mermaid Subsea Services UK (Mermaid) on behalf of four operators.

The result of a tranche of initial bids from the strategic partnership builds upon EXCEED’s 130+ well abandonment track record and is the company’s largest vessel-based well P&A campaign to date, whilst representing Mermaid’s entry into the North Sea marketplace.

Due to commence Q3, the multi-operator vessel-based campaign is thought to be one of the largest campaigns of its type to be undertaken on the UKCS for at least a decade, and currently comprises the decommissioning of ten E&A wells across Northern, Central and Southern areas.

Based on the campaign approach, which has been highlighted as an important lever in the cost reduction of well P&A, the potential for this to become a multi-operator programme was the objective upon which the partnership was founded.

Mermaid Operations Director, Scott Cormack, explained, “New contracting models are critical to achieving the decommissioning cost reduction target set by the North Sea Transition Authority (NSTA). However, the NSTA reported in 2021 that these models were yet to become the norm and that a lack of collaboration was, in part, responsible.

“Our aim is to help address that situation, not only through our own collaboration with well management leaders EXCEED, but also by encouraging operators to consider the benefits of a lump sum, campaign approach to decommissioning. That this has been the precise outcome of our first campaign is testament to the clear appetite for this approach amongst the operator community,” Scott added.

John Anderson, Commercial Director for EXCEED commented, “Our well decommissioning experts have worked on some of the sector’s highest-profile abandonment campaigns, and it’s clear to us that this partnership brings something unique to the sector; a turnkey well P&A service, which provides not only the technical downhole capabilities but also complete control over vessel schedules.

“In this way, we can optimise timings to allow for multi-operator campaigns. With mobilisation/demobilisation accounting for a third of the total well P&A cost, this approach makes good economic sense, as well as minimising the environmental impact of multiple, separate campaigns.”

NSTA Head of Decommissioning Pauline Innes said, “The NSTA is actively promoting multi-operator, well-decommissioning campaigns – which can deliver substantial cost efficiencies, reduce emissions and give suppliers confidence to invest – and is encouraged this approach has gained traction in the North Sea market.”

Fairfield Energy recently announced the removal of the topsides from Dunlin Alpha platform which is the latest milestone in the decommissioning of the four fields which make up the Greater Dunlin Area.

Following the hook down and removal activities undertaken by the HAF Consortium (Heerema Marine Contractors and AF Offshore Decom) last month, Heerema’s SSCV Sleipnir transferred the remaining modules to its deck before removing the main 11,750-tonne Module Support Frame (MSF) in a single lift. The Sleipnir then returned to AF Offshore Decom’s Environmental Base at Vats where more than 95% of the Dunlin topsides will be recycled.

The Dunlin Alpha installation, located approximately 137 km northeast of Shetland and in a water depth of 151 m, produced its first oil in 1978. In the 37 years that followed, more than 522 million barrels of oil were recovered from the Greater Dunlin Area, comprising the Dunlin, Dunlin S/W, Osprey and Merlin fields. Fairfield Energy acquired the assets in 2008 and took over full operatorship in 2014, maximising production during its late-life stage and then progressing its subsequent decommissioning programmes.

Alan Scott, General Manager for the Greater Dunlin Area Decommissioning Project said, “This is a poignant milestone for an installation which has been a central part of UK North Sea production since the industry’s earlier days. Notably, in 1978 it was the first field to produce into the Sullom Voe Terminal on Shetland, paving the way for the many which came after.

“The Greater Dunlin Area itself has made its mark but it’s important not to forget the thousands of people who have visited or called the platform their working home. Dunlin has always been blessed with a strong team spirit and this is another core part of its legacy, having influenced the careers of many across the industry. I’d like to thank everyone who has been involved with Dunlin over the years, helping the asset overcome any challenges and achieve its many successes,” Alan Scott added.

An agreement was reached with the UK authorities in 2015 that the fields had reached Maximum Economic Recovery (MER), enabling Fairfield to begin the multi-asset, multi-year decommissioning of the Greater Dunlin Area. Since then, Fairfield has developed, consulted upon and gained the approval for its decommissioning proposals and executed a series of scopes which, at their peak, employed 600 personnel from over 26 drilling, subsea and topside operations companies.

Gary Farquhar, Platform and Infrastructure Decommissioning Manager said, “Project execution has involved the P&A of 12 Osprey and four Merlin subsea wells; the decommissioning of the extensive subsea infrastructure associated with those satellite fields; the decommissioning of subsea power import, gas import and oil export infrastructure; the P&A of 45 platform wells; and the engineering down of the Dunlin Alpha topsides. We are pleased to have added Topsides Removal to the list of activities that have been safely and efficiently executed.”

Ithaca Energy, an oil and gas operator has contracted Well-Safe Solutions to plug and abandon (P&A) six wells on the Anglia Platform in the Southern North Sea.

The contract – for an undisclosed sum – will see the Aberdeen-based well decommissioning specialists provide project management, well engineering and all managed delivery services for the project.

The Well-Safe Protector, a heavy-duty harsh environment jack-up rig, is nearing the end of extensive technical preparations and will mobilise to the field in late summer 2022.

Matt Jenkins, Chief Operating Officer at Well-Safe Solutions, said, “This full-service contract is further vindication of our operating model and allows Ithaca to realise the benefits of Well-Safe’s extensive experience in the Southern North Sea. Well-Safe delivers environmentally-friendly and cost-effective well decommissioning operations, unlocking key learnings over multi-well, multi-operator campaigns."

An option to P&A an additional three subsea wells is also available during 2023.

Jane Eddie, Bid Manager, added, “We have worked closely with Ithaca Energy to design a contract which meets their needs and – crucially – those of Offshore Energies UK, the North Sea Transition Authority and other industry stakeholders.”

“Our team is uniquely positioned to support Ithaca Energy with their decommissioning obligations, as we are the first UK-based company with owner-operated rigs to exclusively perform well P&A operations.”

Ricky Thomson, OEUK Decommissioning Manager, said, “Decommissioning has a crucial role to play in helping the UK deliver its net zero ambitions, as outlined in the North Sea Transition Deal. The UK’s decommissioning industry has an incredibly exciting future ahead, and projects like this will be vitally important to realising those ambitions.

This contract announcement follows recent news of Well-Safe Solutions’ purchase of the WilPhoenix semi-submersible rig from Awilco Drilling. The rig will now undergo conversion for well P&A activity and has been renamed the Well-Safe Defender.

Page 7 of 11