Petrofac, a leading provider of services to the global energy industry, has added a third Gulf of Mexico field, and extended the scope of its existing contract to decommission two fields, in the Gulf of Mexico.

Following this contract expansion, the legacy offshore fields and assets now include 12 platforms, 211 wells and 32 pipeline segments, as well as operations and logistics services. The scope includes the safe, efficient, and assured decommissioning of the fields and operation of the fields during the execution of the decommissioning work.

Petrofac will use its proven decommissioning programme management systems, tools, and processes to deliver the project. Its integrated local team, wider global decommissioning organisation and supply chain partners, have collectively plugged and abandoned more than 2,300 wells and decommissioned over 250 facilities.

Nick Shorten, Chief Operating Officer for Petrofac’s Asset Solutions business, remarked, “This sizable contract expansion recognises our industry-leading decommissioning programme management experience and our differentiated in-house capability to manage all well and asset decommissioning phases.

“Through this and other decommissioning projects, Petrofac is actively and sustainably contributing to the energy transition globally.”

Helix Alliance, the Louisiana-based subsidiary of Helix Energy Solutions Group, has been awarded a 39-well decommissioning contract for the Gulf of Mexico shelf.

Helix Alliance, the Louisiana-based subsidiary of Helix Energy Solutions Group, has been awarded a 39-well decommissioning contract for the Gulf of Mexico shelf.

Owen Kratz, Helix’s President and Chief Executive Office, said, “This award demonstrates Helix’s position as the preeminent company for full-field decommissioning in the Gulf of Mexico shelf, along with our other services supporting the full life cycle of offshore fields, following the expansion of our industry-leading decommissioning services with our acquisition of Alliance last year.”

The scope of work includes the plug and abandonment of 39 wells, 15 pipelines and seven structures. Helix Alliance plans to utilise the EPIC Hedron heavy lift derrick barge for structure removals, lifeboats for P&A activities, the Triton Explorer dive support vessel for pipeline abandonments and multiple Helix Alliance OSVs throughout the campaign.

As the focus on environmental sustainability has never been more prevalent across all industries than it is right now, the race is on to find long-term renewable solutions to the climate crisis. Operators across the globe are trying to make their innovations in the oil and gas industry as green as possible, but that is not an easy stepping-stone to overcome.

As the focus on environmental sustainability has never been more prevalent across all industries than it is right now, the race is on to find long-term renewable solutions to the climate crisis. Operators across the globe are trying to make their innovations in the oil and gas industry as green as possible, but that is not an easy stepping-stone to overcome.

Geothermal energy could be the answer so many are looking for. It is a method of clean energy which bridges the gap between the oil and gas industry and renewable energy sources in order to reach net zero. The US has already increased federal funding by millions of dollars in 2022 alone to widen the scope of geothermal projects up and down the country, tapping into the underutilized potential beneath our feet.

A key area of interest within the geothermal industry is that of repurposing end-of-life oil and gas wells. Geothermal companies can turn these assets back into active wells, only producing a slightly different end-product, negating the need for decommissioning services and the associated costs. Operators can turn their liabilities into profitable assets at a quarter of the cost while producing green energy.

In spite of the benefits associated with geothermal, there are a number of issues holding the industry back from becoming a mainstream alternative. For one, the extortionate upfront costs associated with starting geothermal projects from scratch prove a wall too vast to climb in most instances, as well as the technological challenges that present themselves when working with temperatures of this calibre.

Nevertheless, advanced methods and technologies are working at mitigating against the challenges posed by geothermal extraction, using expertise from the oil and gas industry to finesse already existing drilling equipment in order to marry the industries together to be able to harness a green energy source born from an oil well.

The omens for the offshore decommissioning market are looking positive as the industry prepares for 2023 and all that it has in store.

While a turbulent geopolitical environment has caused market fluctuations over the last few years (with Covid restrictions giving way to war in eastern Europe), a healthy oil price has been enjoyed through most of 2022, which is expected to settle in short- to medium-term. In addition, the pandemic revealed more than ever the pressing concerns around the fragile nature of our environment and has spurred the energy industry to promote sustainable practices wherever possible. In the case of the latter in the offshore world, there has been a renewed focus on decommissioning responsibilities, to ensure operators leave their stomping grounds as tidy and climate-friendly as possible.

Such concerns have been expounded by developments in Australia where the ongoing decommissioning of the Northern Endeavour FPSO (and the controversy around the trailing liabilities attached to it) has pushed this issue even more to the fore. The understanding of the forthcoming decommissioning wave has never been so developed, and the perception that we must get ahead of this, lest we get swept away by it, is sharp. By example, a recent report by Offshore Energies UK indicated that around the UK more than 2,000 North Sea wells are to be decommissioned at a cost of around UK£20bn. OEUK Decommissioning Manager, Ricky Thomson, said, “The UK’s decommissioning sector is snowballing and will continue growing for years to come.”

Fortunately, a healthy oil price and an ever-growing demand for oil and gas is filling the coffers of operators across the globe, making the burden of end-of-life activities easier to bare. Owing to these developments, industry reports are indicating that the global offshore decommissioning market will experience a strong growth in the immediate and long-term future. One report published by Visiongain, for instance, has forecasted that the market (which it valued at US$10.275bn) will grow at a CAGR of 6.5% between 2023 and 2033.

The opportunity to capitalise here is a tantalising one, with Thomson adding that with right government support the decommissioning challenge can be turned into gain, with the potential to create thousands of jobs. Indeed, many in the industry are not ignorant of this opportunity but are making moves to capitalise on this potentially lucrative market. At the end of 2022, for example, Harbour Energy, ConocoPhillips, Spirit Energy and Repsol Sinopec formed a well decommissioning collaborative initiative in conjunction with the Net Zero Technology Centre (NTZC). The initiative will enable new technologies to be trialled and tested in collaborative field trials enabling faster, lower-cost trials and wider industry adoption.

So, while no one knows for certain what 2023 will hold for the decommissioning sector, the strong position it has started the year in is a positive sign for its future growth and development in years to come.

As the oil market fluctuated more than it has in over a decade due to the fragile global developments that have occurred over the last few years, decommissioning and abandonment services in the Gulf of Mexico are facing a turbulent future as demand skyrockets.

As the oil market fluctuated more than it has in over a decade due to the fragile global developments that have occurred over the last few years, decommissioning and abandonment services in the Gulf of Mexico are facing a turbulent future as demand skyrockets.

As the restrictions eased after the Covid-19 pandemic, the world opened up again, bringing with it a tidal wave of demand, and due to the tightened restrictions put in place all over the Gulf to meet the needs of a sustainable future, the industry became gridlocked in a chain of bureaucratic laws and the increasing costs of labour and equipment.

Limited crews and equipment are only the tip of the proverbial iceberg as the ‘boomerang’ asset problem has started to cause havoc around the Gulf. With the law stating all operators, past and present, are liable for the decommissioning costs regardless of how long they owned the asset, mixed with the skyrocketing rates of inflation and equipment, the costs presented to operators may be insurmountable. The Fieldwood bankruptcy, which was finalised in 2020, is still sending waves around the Gulf, increasing the scope of work of up to 1,000 additional wells.

It's not all doom-and-gloom however, as opportunities for third party operators to shoulder the costs are becoming more prevalent. Operators who can’t afford the increased costs and scope of work in the given time frame can sell their assets to outsourced organisations who take full responsibility in carrying out decommissioning services. For the next few years, the Gulf is expected to continue riding the decommissioning wave until the spike in demand has dropped significantly.

The scope for decommissioning services in the GOM region is exponential, and is predicted to keep on rising, creating a haven for oil and gas operators. As long as the scope of work doesn’t outweigh the resources available, the Gulf is set to be in a very desirable position in the years to come.

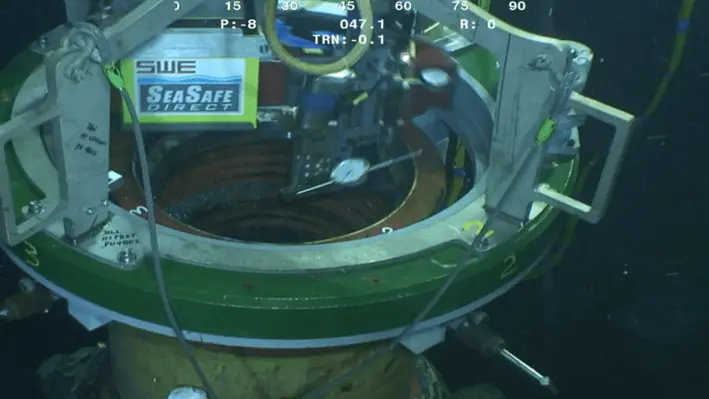

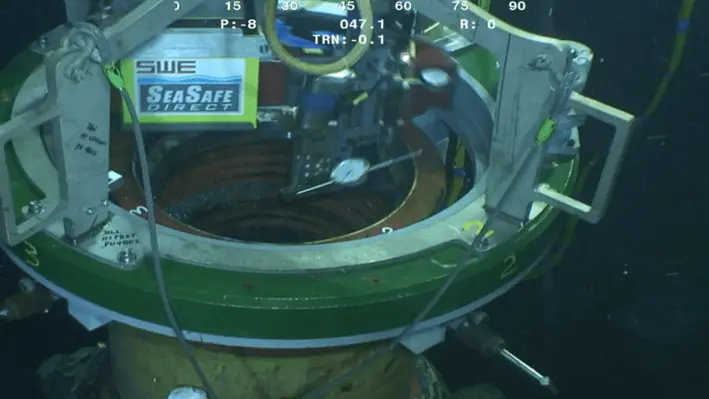

At the recently concluded Offshore Well Intervention Gulf of Mexico conference, representatives from Caltex Oil Tools provided a detailed presentation of a recently concluded damaged wellhead repair project where the company utilised new technology and methodologies to successfully bring a well back online.

Since bursting onto the subsea scene in 2018, Caltex has become an established solutions-focused business which provides rentals, services and bespoke engineering capabilities for subsea operations. In the case of the latter, the company and its affiliates offer a range of services including equipment rental to support vessel and rig-based pre-commissioning, controls, completions, intervention and decommissioning activities; consultancy services with experts specialising in business development, sales, remote technologies, subsea controls, diver and diverless interventions, vessel based IMR operations, and emergency response repairs; as well as engineered solutions where it specialises in unplanned emergency response requests to developing transformative technical solutions.

The project that was presented at OWI GOM began when a major operator contacted Caltex over an offline well which had visible damage to the VX profile, FX profile and isolation sealing surface. Knowing Caltex’s extensive capabilities, the operator sought the company’s immediate help to intervene and bring the well back online. In turn, Caltex responded by developing a custom solution for machining the inner wellhead profile to remove the damaged surfaces.

It was in November 2021 when Caltex first began work on the project, with an initial concept to remove protruding materials and polish damages. According to Carter Kacal, Project Manager at Caltex, it was shortly after this, in January, when the project began to grow and the scope developed from what was originally perceived. After analysis of damage, their plans involved to machine the new ID .25’’ beyond the last damage, increase the ID of the wellhead by 0.125’’ and machine a 30° lead-in bevel at top/bottom of the increased ID.

This involved the development of a tool with the goal to machine a new ID of the damaged wellhead to tight specifications which also incorporated an automated system featuring closed loop controls and independent electronic actuator controls. From January onwards, Caltex swiftly developed Software (in just 15 days) and tested the tool to perform the required work before travelling to the manufacturer of the wellhead to perform an SIT at the beginning of March.

The technology utilised in the solution delivered by Caltex, according to Kacal, included a real mix of field-proven to new technology, resulting in a bespoke solution. It included three electronic actuators, an RPM sensor, subsea control units, a localised subsea power bank and an optical communication link connected through the ROV and controlled from the surface.

Kacal commented, “The results of the SIT were extremely positive, better than we could have expected, and well within the specifications we needed to be which is shown in the table.”

“We needed to be within 0.005'' concentricity and we achieved 0.002'' which was great. And then the surface finish that was well below what it needed to be as well. The goal (measured in Ra) was to be 111 Ra or lower. And so you can see there the average of the three numbers [on the table] is around 46. The only thing missing there is the results on the bevel cut. So we needed to cut a bevel as well as machine new diameter. We needed to be 30°, we were at 26°. This was a little steeper than we needed to be, but still successful nonetheless. From that everyone was happy to go offshore and we felt comfortable as well.”

Indeed, little time was wasted in doing so as, by the middle of March, the tool was offshore and ready to perform. Kacal continued, “We had a timely mobilisation with no downtime for the tool. We performed the operation in five days (from mobilisation to demobilisation) which included less than 24 hours operation of the tool itself. Then, once we pulled it off and actually tested the wellhead, everything was successful and eventually the well was able to be brought back online.”

For a job that began in November and had to contend with workscope changes along the way, it was a remarkably quick turnaround for the company which was ultimately successful. Kacal remarked that, alongside the timeliness of the operation, what worked very well was the automated system with closed loop controls alongside the performance of the tungsten carbide tool tip. He added that given slightly more time they could have spent more time developing and optimising the tool, however this did not overtly affect the performance and it has given the company confidence that they could deliver another project of similar scope and time effectively again.

“If there's ever an opportunity, we'd love to be able to try our hand at it again because we've proved it, we've developed it. At the moment I would say many people just don’t really know that is out there and no one really discusses if they have a damaged wellhead or not. So we want to show, with this example, that this technology is available and we have the ability to remediate the wellhead with a less invasive strategy than what is currently out there. At OWI GOM we had some interested discussions around this and people seemed definitely interested so we shall see what the future holds.”

C-Innovation (C-I) and Grand Isle Shipyard, LLC (GIS), two strategic oil and gas industry partners, have been awarded a plug and abandonment contract by Helix Alliance Decom, LLC, to provide pre-feed services for the decommissioning of three offshore platforms for a major deepwater client.

In Phase I of the project, C-I provided ROV services to deliver marine water inspection and integrated the data within MODS software to provide live operations for the client operating fixed leg platforms in 165-200 ft of water. The GIS Aerobotics Drone Division provided aerial inspection services. The joint technical innovations aim to determine the current condition of the wells and the facility, enabling the timely and cost-effective decommissioning of the wells, platform and jacket for each of the three platforms.

The partnership harnessed its technology to offer increased safety margins. All of the inspections were able to be completed via line wireless transmission from the back of the boat within a connex box without requiring the deployment of personnel on ropes.

Michael MacMillan, Operations Manager, C-I, stated, “The equipment used took very little time to mobilise and provided subsea operations in a safe and efficient manner while using a limited number of personnel. The ability to launch this type of ROV from almost any asset not only allows operations to be efficient but also mitigates safety risks while practically eliminating the traditional risks associated with the launch and recovery of an ROV.”

DaCoda Bartels, GIS Aerobotics Division Manager and Pilot, said, “The GIS drone can safely operate from up to 100 ft away from the asset as we have the camera stabilisation technology to zoom in on an area of interest. Most of these areas are not accessible by human personnel. We are able to live stream the drone's camera view in real time to make informed decisions on the spot. It’s a super fast and super safe alternative, where the only potential risk is to the equipment rather than the personnel.”

MacMillan added, “Our partnership with GIS enables C-I to continue to demonstrate our flexibility to provide resources and equipment in a non-traditional scenario. The availability of equipment and personnel for these types of scopes is more important now than ever, due to the demands of today’s market.”

Helix Energy Solutions Group has completed the acquisition of all the equity interests of the Alliance group of companies which will expand its decommissioning presence in the Gulf of Mexico.

The acquisition will also advance the company’s Helix’s environmental, social and governance (ESG) initiatives by responsibly supporting the end-of-life requirements of oil and gas projects.

Owen Kratz, President and Chief Executive Officer of Helix, commented, “We are pleased to have completed our acquisition and added Alliance to the Helix family, which complements Helix’s existing deepwater abandonment offerings by adding shelf and facility abandonment capabilities and significantly enhances our position as a full-field abandonment services provider.

“The acquisition marks a meaningful step in our participation in the Energy Transition, and we are excited to welcome our new colleagues to the Helix family.”

Helix also announced that it has amended its existing asset-based revolving credit facility (ABL Facility). The amendment aligns with Helix’s Alliance acquisition, expanding the eligible credit line and establishing a link in its pricing to sustainability targets. The key features of the amendment include increasing the size of the ABL Facility to US$100mn and including ESG/sustainability-linked performance targets that may result in adjustments to commitment and borrowing rates.

Kratz continued, “We have increased the size of our ABL Facility to accommodate the increase in our expected borrowing base with the Alliance acquisition. We are also pleased to have included a sustainability-linked performance target that may reduce our fees under the facility and we are appreciative of the support from our bank group in this amendment.”

Energy services provider Danos has been awarded the opportunity to support the Promethean Decommissioning Company (PDC) and Petrofac alliance, to decommission multiple facilities in shallow water fields in the Gulf of Mexico.

CEO Paul Danos said, “Danos is honoured to join the efforts with PDC and Petrofac to provide safe and efficient operational and construction support for the alliance. We look forward to planning and executing this project with our partners and applying our 75 years of experience, safety and operational excellence in the Gulf of Mexico.”

The project, which began at the end of May, includes ten platforms, 196 wells and 32 pipeline segments in the South Pass and East Break fields of the Gulf.

This multi-year programme will allow Danos to support the PDC and Petrofac alliance and its decommissioning program with several of its service lines, including production workforce, construction, fabrication, and instrumentation and electrical.

Danos has many years of experience supporting decommissioning work through various service lines in the Gulf of Mexico as well as internationally.

“Having been appointed decommissioning operator for this project, we are delighted to have Danos join us and support the alliance we have formed with Petrofac. Together, our mission is to deliver safe, lean, integrated, best practices and technology-driven decommissioning operations which will reflect the highest ESG standards and include the minimising of GHG emissions/intensity and the environmental footprint of operations. Danos’ experience and knowledge will prove invaluable to the successful delivery of this program,” said Aditya Singh, President of Promethean Energy.

“Danos’ longstanding relationships in the Gulf of Mexico and comprehensive range of services positions them to provide the expertise needed for the programme,” a Petrofac representative said.

Helix Energy Solutions Group, Inc. has announced that it has entered into a definitive agreement to acquire 100% of the equity interests of the Alliance group of companies for US$120mn million cash at closing, plus the potential for post-closing earnout consideration.

Helix Energy Solutions Group, Inc. has announced that it has entered into a definitive agreement to acquire 100% of the equity interests of the Alliance group of companies for US$120mn million cash at closing, plus the potential for post-closing earnout consideration.

Alliance is a Louisiana-based privately held company that provides services in support of the upstream and midstream industries in the Gulf of Mexico shelf, including offshore oil field decommissioning and reclamation, project management, engineered solutions, intervention, maintenance, repair, heavy lift and commercial diving services.

Helix said that the transaction aligns with its ‘Energy Transition’ business model, by expanding its decommissioning presence in the Gulf of Mexico shelf and advancing Helix’s ESG initiatives by responsibly supporting end-of-life requirements of oil and gas projects.

The transaction also augments Helix’s decommissioning and life-of-field maintenance service capabilities through the addition of Alliance’s comprehensive shallow water assets, including a fleet of Jones Act-compliant lift boats, offshore supply vessels, a heavy lift derrick barge and diving vessels, as well as plug and abandonment systems, coiled tubing systems and snubbing units.

The deal further positions Helix to further penetrate the North American decommissioning market, with published reports forecasting nearly US$3bn of decommissioning expenditures between 2022 and 2025, and the potential to expand into the global market. Based on the assets being acquired, the parties’ assumptions and market conditions, and anticipating Alliance's potential annual EBITDA in excess of US$30-40mn, the transaction is expected to add accretive free cash flow and diversify Helix’s asset base and revenue stream, at an attractive valuation.

According to Helix, the deal will help in preserving a strong financial position and liquidity, as Helix’s pro forma cash, liquidity and net debt would approximate US$145mn, US$186mn and US$119mn, respectively. The transaction is also expected to enhance the financial performance outlook, with expected continued improvements in free cash flow resulting in expected strong liquidity and leverage position.

Owen Kratz, Helix’s President and Chief Executive Officer said, “Based on a number of markets and regulatory drivers and our current expectations, we fully believe that the offshore oil and gas decommissioning market will grow significantly in the near term. This acquisition complements Helix’s present deepwater abandonment offerings by adding shelf and facility abandonment capabilities and significantly enhances our position as a full-field abandonment services provider, both in the Gulf of Mexico and globally. We also see possibilities to expand our opportunities within our existing late-life production business.”

Steve Williams, owner of Alliance said, “Our recent successes in acquiring and developing businesses and assets to establish Alliance as an offshore shallow water energy services company has led us to Helix, who we see as the industry standard in deepwater energy services.”

The acquisition is expected to close in mid-2022 and is subject to regulatory approvals and other customary conditions.

Petrofac, a leading provider of services to the global energy industry, and Promethean Decommissioning Company (PDC), a pure-play decommissioning operator, will come together to decommission the South Pass 60, South Pass 6 and East Breaks 165 fields, offshore Gulf of Mexico.

The substantial scope of work includes work on nine platforms, 200 wells and 32 pipeline segments, all of which will need to be safely and assuredly decommissioned.

PDC takes on the role of decommissioning operator and is responsible for fulfilling the field decommissioning orders received from the U.S. Department of the Interior’s Bureau of Safety and Environmental Enforcement in February 2022.

Petrofac has been appointed by PDC as the decommissioning services provider in a contract valued at around US$200mn. The company will use its proven decommissioning programme management systems, tools, and processes to deliver the programme.

The PDC-Petrofac alliance has selected Danos, a leading Gulf of Mexico offshore services provider, for more than 75 years to support field operations and the decommissioning programme. With nearly 2,500 employees, Danos has a proven history of operational excellence and safe operations.

The project will be led from Houston, with the integrated alliance team using the latest digital software, including Petrofac’s proprietary project management tool Turus, to deliver the decommissioning project with comprehensive dashboards, transparency and assurance.

Nick Shorten, Chief Operating Officer for Petrofac’s Asset Solutions business, commented, “This significant contract recognises our industry-leading decommissioning programme management experience and our unique in-house capability to manage all well and asset decommissioning phases. It’s been more than four decades since Petrofac first began in Texas and in that time we have expanded our offshore capabilities across the globe. This expertise will be applied to the project, complemented by our already strong onshore presence in Texas.”

Aditya Singh, Founder and CEO, Promethean Energy Corporation added, “We are pleased to offer our new outsourced ‘decommissioning operator’ service to the industry and to commence activity on this major decommissioning project. We are fully aligned with all our stakeholders to improve environmental performance through the safe and efficient decommissioning of end-of-life assets. We accomplish this with a dedicated, fit-for-purpose entity, PDC, via an integrated operating service model and focused programme management. I am particularly pleased that the PDC and Petrofac alliance has been selected, leveraging the complementary strengths of both companies.”

Helix Energy Solutions Group, a leading provider of offshore energy services, has entered into a new multi-year contract with Shell Offshore to provide well intervention services in the Gulf of Mexico.

The three-year contract, commencing in March 2022, includes an anticipated 75 days utilisation per year with the option to add additional utilisation days.

Helix will provide either the Q4000 or Q5000 riser-based semi-submersible well intervention vessel, a 10k or a 15k Intervention Riser System (IRS), remotely operated vehicles, project management and engineering services to cover operations from fully integrated well intervention to fully integrated plug and abandonment well services.

The Q4000 and Q5000 well intervention vessels provide an optimal platform for a wide variety of tasks, including subsea well intervention, field and well decommissioning, installation and recovery of subsea equipment, well testing and emergency well containment.

Scotty Sparks, Helix’s Executive Vice President and Chief Operating Officer, commented, “Shell continues to be a valued customer of Helix. We appreciate their continued confidence in our fully integrated well intervention services, our commitment to safety and cost-effective and efficient solutions. We are confident in the efficiencies and value we bring to our customers, and this contract further signals the increasing demand for our services.”

Page 2 of 3