PanGeo Subsea, a subsidiary of Kraken Robotics, has been awarded a US$5mn contract by Couvillion Group for assistance with a decommissioning project in the Gulf of Mexico.

In 2004, a storm induced mudslide caused an offshore jacket to topple which has since been lying on the seafloor 150 metres down, with subsea conductors buried in around 60 metres of mud. PanGeo will use Acoustic Corer, its high-resolution sub-seabed imaging technology, to identify where the conductors are located in the debris field to provide valuable information for the plugging and abandonment of the well.

The campaign will start in Q2 2022 and will last for 90 days – representing the largest Acoustic Corer project undertaken by the company to date.

Moya Cahill, PanGeo’s CEO, said, “The Acoustic Corer delivers a unique solution to the industry that has been tried and proven by the Couvillion Group in a demonstration project in 2019. We are truly excited to return to this site and work with the Couvillion team to complete a full site investigation of the debris field.

Couvillion Group’s CEO, Timmy Couvillion, added, “We believe that PanGeo has the key to unlock the unknowns below the seafloor that will ultimately enable a successful plug and abandonment of the well.”

In addition to the debris survey, PanGeo has been issued a letter of intent for a multi-million Acoustic Corer campaign of 50 days for an offshore wind farm in the Baltic where it will be imaging boulders in the sub-seabed.

Modern American Recycling Services, Inc. (MARS) has recently finalised the acquisition of the DP3 Diving Support Construction vessel Caballo Marango representing a substantial investment in the offshore market and further increasing the company’s footprint worldwide.

Modern American Recycling Services, Inc. (MARS) has recently finalised the acquisition of the DP3 Diving Support Construction vessel Caballo Marango representing a substantial investment in the offshore market and further increasing the company’s footprint worldwide.

The move is also said to support the continued growth of the offshore decommissioning and subsea installation industry. The vessel will be owned by MARS and operated by Shore Offshore Services, LLC.

The vessel, previously named Caballo Marango, was built at the Marco Polo Shipyard in Batam, Indonesia in 2013. MARS said that the vessel will be renamed Captain America and will maintain its Panamanian flag while following ABS guidelines. The DSCV Captain America will also be relocated to its new homeport located in Pascagoula, Mississippi, where it is scheduled to undergo the necessary service and maintenance required to get back into class by end of the year 2022.

According to MARS, Captain America will be outfitted to perform floating platform and FPSO decommissioning subsea work, small flexible flowline, cable and umbilical lay/retrieval, drilling rig equipment change, and wind farm construction. The 399-man accommodation will support decommissioning preparatory work, platform support for maintenance, field upgrades and will also be able to provide offshore support as a flotel.

The 141.7 m long vessel is equipped with a large 1500 sq m clear deck, a 480 sq m covered deck and a 100 sq m poop deck. A 1000 MT– 35000 Liebherr crane is also carried by the vessel, making it ideal for the construction of floating wind farms.

President, Dwight (Butch) Caton, Sr of MARS, USA said, “MARS is always preparing to meet the future demands of our clients and to support them in their construction and decommissioning needs. Acquiring a dive and construction vessel ensures that we are ready to serve our clients’ needs now and in the future. This investment prepares us for the increase in the market and allows us to maintain our leadership position. We are sure that Captain America will have an impressive career in the MARS fleet and it underlines our efforts to meet and exceed our customers’ requirements”.

D&A GOM 2022

At D&A GOM 2022, the offshore community is set to reunite face-to-face to discuss the challenges and opportunities marking decommissioning and abandonment in the region, listen to sessions delving into current complex situations and network to help each other optimise their strategies. To find out more, download the brochure: www.offsnet.com/da-gom/conference-brochure

Or contact:

Joseph Watson

Project Manager

Offshore Network Ltd.

t: +44 (0) 20 3409 5720

e:

Fugro has signed a four-year agreement with Heerema Marine Contractors for survey and positioning support services onboard Heerema’s heavy lift crane vessels.

Fugro’s worldwide reach and technology offers Heerema a solid support base for their global project portfolio, ensuring optimised offshore operations that minimise environmental impact. Fugro will use their innovative vision technologies, such as QuickVision, 3Direct and InclinoCam, combined with remote services and expert teams to optimise Heerema’s offshore installation and decommissioning campaigns across Europe, the Americas, Middle East, and APAC regions.

Fugro’s survey Geo-data and positioning support will assist Heerema in identifying seabed structures and debris while providing centimetre level precision for installation projects. Real-time touchless inspection and monitoring technology offers a much safer, more efficient and sustainable solution to offshore operations.

Remote support will also enable Heerema to monitor their operations in real-time leading to faster and more informed decision-making as their projects progress.

Thijs Prins, Fugro’s Service Line Director Marine Asset Integrity, commented, “Our vision-based technologies and remote services improve staff safety, significantly reduce project complexity, accelerate turnaround times, and allow operations to be conducted in a wider weather window – critical benefits for Heerema as they complete campaigns over the next four years. We’re proud to be delivering innovative solutions that support the responsible installation, maintenance and decommissioning of offshore energy assets.”

D&A GOM 2022

At D&A GOM 2022, the offshore community is set to reunite face-to-face to discuss the challenges and opportunities marking decommissioning and abandonment in the region, listen to sessions delving into current complex situations and network to help each other optimise their strategies. To find out more, download the brochure: www.offsnet.com/da-gom/conference-brochure

Or contact:

Joseph Watson

Project Manager

Offshore Network Ltd.

t: +44 (0) 20 3409 5720

e:

With many oil rigs being decommissioned in the Gulf of Mexico each year, plans of converting rigs for alternatives like offshore multi-trophic aquaculture (finfish, oyster and algae) production and renewable energy, has been on the cards for oilmen and fisheries alike.

US regulations already allow US Gulf of Mexico platforms to be used for other purposes, apart from oil and gas production. Right of Use and Easement (RUE) permits for alternative uses of offshore platforms have been granted in the past and these regulations would also allow for aquaculture and other marine-related activities. Leasing of Gulf of Mexico areas for wind power is expected to begin in late 2022.

Aquaculture is an increasingly important source of nutritious and sustainable seafood for people worldwide. Globally, aquaculture production must double by 2030 to keep pace with demand. This increase in demand for aquaculture products, food security considerations, and job creation has generated the need for skilled workers.

Ivan Puckett, one of the founders of Blue Silo Aquaculture LLC, while speaking to The Fish Site, said, “Our objective is to find as many uses as possible because we will need an income stream to maintain and operate the platforms. There’s enough space on these installations for several projects and the more operations we can have, the better it is.”

Aquaculture is one of the sectors they see as having the most promise for extending the useful shelf life of the platforms.

Puckett believes aquaculture is promising. “The water quality and oxygen levels are good and disease transmission is low. However, travel expenses to and from the platforms are high, the weather can be challenging, with hurricanes not infrequent and living arrangements are more challenging,” he added.

Kent Satterlee, co-founder Blue Silo Aquaculture LLC, informed that the company is planning to initially install a grid of 12 of Innovasea’s SeaStation pens and add another 12 at another platform site.

The SeaStation design includes the ability to be raised above the waterline in calm weather, exposing the netting to naturally defoul in the sunshine and then be submerged to a depth where they will avoid the full impact of any hurricanes or storm events that happen to pass.

“Innovasea also has expertise, materials, equipment and relationships to provide nearly all of the support aspects of the operation. Video monitoring, feeding systems, various marine and atmospheric monitoring devices, design and technical support, IT integration capabilities and much more,” Satterlee noted, while speaking to The Fish Site.

Puckett added that the company is looking into multi-trophic production; with a mixture of finfish, seaweed and oysters, and the University of Miami will be researching species selection.

In this scenario, the mooring grid for the SeaStation pens could also host the downlines for oysters and algae. The platform structure could also serve as host for the downlines.

D&A GOM 2022

At D&A GOM 2022, the offshore community is set to reunite face-to-face to discuss the challenges and opportunities marking decommissioning and abandonment in the region, listen to sessions delving into current complex situations and network to help each other optimise their strategies. To find out more, download the brochure: https://offsnet.com/da-gom/conference-brochure

Or contact:

Joseph Watson

Project Manager

Offshore Network Ltd.

t: +44 (0) 20 3409 5720

e:

The US Department of the Interior has announced that US$1.15bn in funding is available to states from the Bipartisan Infrastructure Law to create jobs cleaning up orphaned oil and gas wells across the country.

This is a key initiative of President Biden’s Bipartisan Infrastructure Law, which allocated a total of US$4.7bn to create a new federal programme to address orphan wells. Millions of Americans across the country live within a mile of an orphaned oil and gas well.

The historic investments to clean up hazardous sites will create good-paying, union jobs, catalyse economic growth and revitalisation, and reduce dangerous methane leaks.

“President Biden’s Bipartisan Infrastructure Law is enabling us to confront the legacy pollution and long-standing environmental injustices that for too long have plagued underrepresented communities,” said Secretary Deb Haaland. “We must act with urgency to address the more than one hundred thousand documented orphaned wells across the country and leave no community behind. This is good for our climate, for the health of our communities, and for American workers.”

Plugging orphaned wells will also help advance the goals of the US Methane Emissions Reduction Action Plan, as well as the Interagency Working Group on Coal and Power Plant Communities and Economic Revitalization, which focuses on spurring economic revitalisation in the hard-hit energy communities.

Nearly every state with documented orphaned wells submitted a Notice of Intent (NOI) showing interest in applying for a formula grant to fund the proper closure and cleanup of orphaned wells and well sites.

The Department released the amount of funding that states are eligible to apply for in Phase One, which includes up to US$25mn in Initial Grant funding and a quarter of the total Formula Grant money available for the 26 states that submitted NOIs. These allocations were determined using the data provided by states from the NOIs and equally considers the following factors required by the Bipartisan Infrastructure Law.

In the coming weeks, the Department will release detailed guidance for states to apply for the Initial Grants. These resources will allow state officials to begin building out their plugging programs, remediating high-priority wells, and collecting additional data regarding the number of orphaned wells in their states.

D&A GOM 2022

At D&A GOM 2022, the offshore community is set to reunite face-to-face to discuss the challenges and opportunities marking decommissioning and abandonment in the region, listen to sessions delving into current complex situations and network to help each other optimise their strategies. To find out more, download the brochure: https://offsnet.com/da-gom/conference-brochure

Or contact:

Joseph Watson

Project Manager

Offshore Network Ltd.

t: +44 (0) 20 3409 5720

e:

Kongsberg Digital has confirmed that Heerema Marine Contractors (HMC) has renewed its Long-Term System Support Program (LTSSP) contract with the company for another five years.

The LTSSP is in support of a K-Sim Offshore Crane simulation system, which features digital twins of HMC’s semi-submersible construction vessels, ships and barges.

Renewal of the LTSSP ensures Kongsberg Digital’s continued commitment to maintaining Heerema’s simulators at the leading edge of available technology. Installed in 2015 as one of the world’s most advanced offshore heavy lift crane simulators, its usage ranges from confirming feasibility of new methods and equipment to optimising efficiency and safety performance for current execution methods.

“By renewing this LTSSP we are ensuring that our clients, offshore crew and project teams continue to benefit from the most advanced simulation-based training and project preparation on the market, simulating real-world scenarios,” commented Jan Pieter de Vries, Manager Simulations and Visual Products, HMC Academy. “Kongsberg Digital have proved a competent partner, working in close collaboration with the team here at HMC to ensure that training and simulation needs are met. We are pleased to confirm our ongoing relationship.”

Heerema’s simulator platform was developed specifically by Kongsberg Digital to meet Heerema’s requirements as a leading marine contractor in offshore renewables and oil and gas, specialising in transporting, commissioning, and decommissioning offshore facilities.

The Simulation Centre is a real-time offshore environment where offshore crew and project teams examine all project aspects and associated risks. It includes two offshore crane operator domes and a bridge with K-Sim DP simulator, based on the same Kongsberg Maritime K-Pos DP systems used on HMC’s vessels. Detailed models of Heerema’s SSCVs, Heavy Lift Vessel, tugs and barges ensure realistic scenarios and enable detailed pre-mission training for heavy-lift projects.

“HMC’s renewal of this LTSSP is a clear endorsement of the capability and longevity of our maritime simulation solutions,” remarked Andreas Jagtøyen, Executive Vice President Digital Ocean, Kongsberg Digital. “Our commitment to supporting the maritime industry is not limited to providing the best technology, but also extends to ensuring that our customers gain value from their investment for years to come, through long product lifecycles and extensive service, provided by our 24/7 support network. Our LTSSP programme elevates our relationship with our customers beyond just being a vendor to rather act a trusted partner.”

At the Deepwater Decommissioning Gulf of Mexico 2021 Virtual Workshop, Thore Andre Stokkeland, Head of Global Sales Archer Oiltools, Archer, chaired a panel to explore the latest innovations permeating the plug and abandonment (P&A) and decommissioning markets, and what the best practices are for getting new technology recognised by the industry.

Stokkeland began by noting that new technology is inherently designed to reduce risk and improve efficiency and asked the panel to outline some of the benefits which can be achieved for P&A and decommissioning operations through the implementation of these innovations.

Bart Joppe, Well Abandonment Leader at Baker Hughes, focused on the significant cost and time saving that can be unlocked through the utilisation of new technology. Providing an example of this, Joppe described an innovation Baker Hughes brought to the North Sea after they identified an opportunity in the market to remove subsea wellheads more cost-effectively. Traditionally, these have been removed by using a drill pipe-deployed cutting and pulling system from a rig, semisubmersible or a drillship which can be costly while other methods often have similar limitations.

Baker Hughes designed a solution to use a chemical cutter on a wellhead clamp and then power all of it with a ROV. The ROV and the crane wire are the only two things on the water and on deck the only equipment is the bottom-hole assembly. Once this is overboard there is no equipment on the surface. Using this technology, the subsea wellhead can be cut and pulled by two people from any vessel as long as it can deploy the tool overboard. This is a much more cost-effective solution especially for remote wells where getting a rig on location would cost a lot of time, effort and money as well as generate a lot of emissions.

Reducing emissions

Picking up on emissions reduction, the panellists noted that this had fast-become a serious concern of the industry and, therefore, technology that could help operators limit their climate impact was becoming of paramount importance.

Gabriel Barragan, Well Abandonment Advisor, Chevron, said, “We all know that operators are on a strong push to look at carbon emission reduction, with significant pressure from governments, shareholders and customers to do so. It is something pretty fresh and it is still developing now. At Chevron we are brainstorming ideas on how to achieve this such as reducing the risk of fugitive emissions and reducing idle time for rigs. While diesel engines are idly running, emissions are being produced, so reducing this time is a great opportunity. At some point we will come to service providers and see where there technology can help us in this aspect.”

Kevin Squyres, Sales and Service Deliver Manager, Archer, added to this by noting how there are a lot of indirect emissions which are only just being seriously identified as a low hanging fruit to reduce carbon footprint. Saving just a day or two of rig time, for example, is great for the environment. In regards to P&A, when dealing with wells drilled in the 1960s to 1980s the cement technology and care was not there. It is difficult to deal with these nowadays, but new technology can help clients fix these wells.

Stokkeland said, “The industry was very much focused on time saving and cost saving in environments when the rig cost was high. Now we look to reduce rig times not just for the cost saving but also for the emissions savings. Solutions are getting smarter and we can now perform more operations in one run than we could just a few years ago. That will be the way forward, to reduce footprint, reduce rig time and reduce the amount of people on the drilling rig.

Delivering new technology to the market

While at all times there is plethora of new technology being developed, often many fail at the first hurdles or are unable to make an impression on operators and so do not live up to their potential. The panellists therefore explored how providers can ensure that these innovations can make an impact on the market and help operators achieve the value they are designed for.

“Technology development starts by identifying the challenge you want to resolve and how you can address it most effectively. It is really important to understand how the perspective of the operator, customer and regulator as well as ensuring that you are selecting the technology for the right application. There have been lots of innovations where the trial did not work because the right application was not selected,” Joppe commented.

“Also, don’t develop technology and then try and solve the most complex scenario you can think of. Instead build a staircase, select multiple wells of different levels of complexity in a step-by-step testing process and learn as you go.”

Barragan noted, “Take advantage of industry events such as these. Present a technology, do some networking and get contact information from the appropriate people. It is important to understand their well management portfolio which will build your case and value proposition to that operator. Explain at what stage you are in the development phase, is it an early concept? Has a prototype been tested? Or perhaps it has been trialled multiple times. It is important to be transparent about the technology, and this includes being up front about its limitations.”

Squyres echoed these thoughts by noting that in regards to Archer’s Stronghold systems his company tried to be as open and transparent as possible. He said, “If a client comes and says we have this dual casing which is larger than we have done before we won’t just sit there and say we can do anything. Of course we want to say that but it is important to take time, and ensure you have your calculations, case histories and risk assessment as well as ensuring regulators and stakeholders are on board.”

Stokkeland added, “It is about patience and learning. As they say, Rome was not built in a day and it is the same with new technology. You have to learn, you have to go through hurdles sometimes before you end up with a field proven product.”

At the Deepwater Decommissioning Gulf of Mexico 2021 Virtual Workshop, a panel of industry experts discussed the essential considerations when conducting plug and abandonment (P&A) operations in order to mitigate risk and enhance efficiency.

At the Deepwater Decommissioning Gulf of Mexico 2021 Virtual Workshop, a panel of industry experts discussed the essential considerations when conducting plug and abandonment (P&A) operations in order to mitigate risk and enhance efficiency.

Opening the session, Kenneth Bhalla, Chief Technology Officer at Stress Engineering Services Inc., explained that even in the last couple of decades the design of subsea wells have dramatically changed, which can raise multiple complications to operators looking to conduct P&A operations if this is not properly taken into consideration. He commented, “If you look at wells which came into operation 20-30 years ago, typically they were drilled with a fourth generation blowout preventer (BOP). Relative to fifth and sixth wells, the stack has gotten taller and heavier going from 600 Kips to more than a 1000 Kips. The wellhead and casing system are going to be see much larger loads, whether that is static loads or dynamic loads and the loads of the BOP stack need to be accounted for during P&A operations.”

“Also to note is the conductor casing, which typically today are 36” x 2” X80. Going back 20-30 years ago these wells were designed with X56, 36” x 1” for example. Your conductor casing is lower yield as well as lower stiffness. In addition, if you look at conductor casing design today we push the first connector as low as possible to reduce the fatigue loads. When dealing with the P&A of wells drilled 20-30 years ago we have a different type of well design where the connectors are not as deep as they are today and are thus susceptible to potential fatigue damage and overload as well. You need to understand the fatigue damage caused by prior operations as well.”

Following this, Alex Lawler, Drilling/ Completions Engineer at LLOG Exploration, added that there truly are generational differences between the designs of wells and what was fit for purpose even a decade ago is completely different environment to today. For example, he outlined the production packer generations which can affect everything. If the packer needs to be removed, the operator needs to understand if it is a shift to release or cut to release as well as other considerations such as what the cut zone is, for example.

Therefore, in order to carry out a P&A operation safely and effectively, it is paramount when planning to understand these differences, understand them early, and understand them thoroughly. It is also important to remember that you may require some specific tools designed for the well, and often these have been discontinued since drilling. Sometimes these could be in another part of the world, and if this is not planned for it could cause real problems down the line.

Getting the right information

With older wells that have often changed owners several times, the information and documentation is frequently unavailable. It can therefore be incredibly difficult to find out everything you need to know before planning a P&A operation.

One way to mitigate this is to speak to engineers who have worked on the well previously (preferably those who were involved in drilling and production) and have them on board for the operation. Bhalla said, “I have been involved in a couple of different instances where two particular operators had a number of fields that they stopped development on but they knew they would come back in a year or two for P&A. They knew the people and the rig would change, so what they did was create a file around the wells based on the experience of their engineers there and people involved in earlier campaigns in order to identify future risks.”

Sometimes, especially with much older wells, it is not possible to contact past engineers. If this is the case, the panellists commented that you just have to go back to basics by going to the public records or seeing if you can get information from past operators. By identifying which rig performed the initial drilling, if there were any recompletions, and as much about its life as possible you can patch together some information on the well. The more that can be gathered, the safer and more efficient the P&A will be.

Planning contingencies

The participants continued by emphasising that it was absolutely fundamental contingency plans were put in place, as you are planning to fail without them.

Lawler said, “You are gutting an old house – there are going to be a few surprises. Do as much planning ahead of time and plan those contingencies, because they are going to happen. They are essential if the operation is going to be a success. What we have discovered to be very beneficial is approaching BSEE (or whichever local regulatory body you are dealing with) early. They want to make you attempt to isolate the zone, but if you say you have concerns and point out your contingencies to them you may not get immediate approval but it will not surprise them when the contingency comes up. When the contingency is needed, you will usually need approval very quickly, it could even be a matter of hours, and you will be more likely to get quick approval as they are aware of it.”

Dave Mantei, Subsea Manager at Murphy Oil, echoed these sentiments by adding, “I cannot emphasise how useful early engagement with regulatory bodies is for getting early direction so that when, at 2am the calls comes in and the contingency is needed, that are already on the same page. That is absolutely key in conducting a P&A operation.”

George Coltrin, D&C/ Wells Advisor at Endeavor Management, commented, “A couple of things which can help with these operations is foresight when drilling. When you plan new wells, especially development projects, it is worthwhile putting in the effort to think about the impact on the P&A. Obviously this is not a big driver in the choices you are making at that moment as you are thinking more about well integrity and production, but it is still a driver which should be considered and will help later on.”

“Also, often it seems when we are dealing with P&A is that it is planned more piecemeal. When an operator is drilling a series of exploration wells and need a gap filler P&A is often used to fill this. But we can get into a lot more when considering all the P&A obligations as a portfolio. In an ideal world, operators would get a rig and conduct a whole P&A programme. As an industry we are more efficient with things we do on a regular basis; operations not done for a while tend to be not as efficient as workers have not used the tools for a while or perhaps not ever. So doing a whole P&A campaign would avoid problems and make operations much more efficient,” Coltrin added.

All about the people

Finally, the participants emphasised the importance of people, noting that having competent and experienced employees will ensure P&A operations are conducted much more effectively and safely as, at the end of the day, they are the ones on the front line who will be conducting the operations.

Coltrin said, “With new rigs and equipment what we can do today is incredible. But I would prefer to have mediocre tools with great people rather than mediocre people and great tools. Therefore focusing on people is really one of the best things you can do. If you are trying to reduce the risk of operations, good communication between the office team and rig team is essential, and the best way to do this is get people in the office who have experience on the rig, who know it and have relationships with the engineers out there. You need to put time into the people who are on your team, otherwise you might get teams with mismatches, and risks can be the result.”

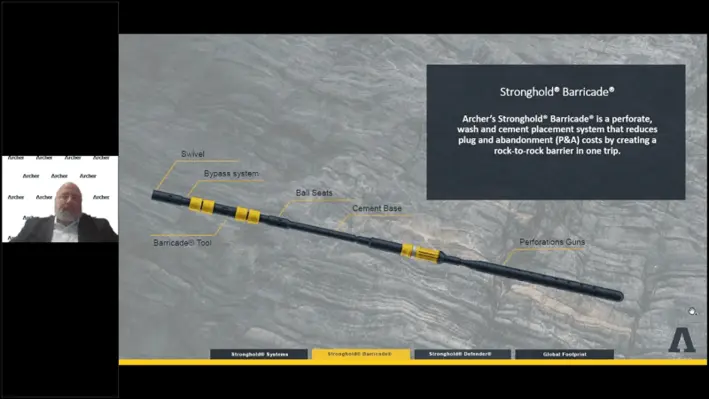

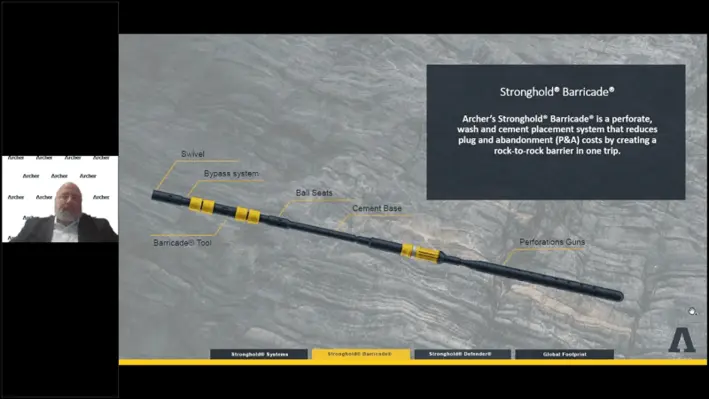

At the Deepwater Decommissioning Gulf of Mexico 2021 Virtual Workshop, Kevin Squyres, Sales and Service Delivery Manager, Archer, presented the Stronghold systems: the latest set of innovations from Archer Oiltools which offer an economical effective alternative to traditional methods of plug and abandonment (P&A).

At the Deepwater Decommissioning Gulf of Mexico 2021 Virtual Workshop, Kevin Squyres, Sales and Service Delivery Manager, Archer, presented the Stronghold systems: the latest set of innovations from Archer Oiltools which offer an economical effective alternative to traditional methods of plug and abandonment (P&A).

Squyres explained how, by eliminating the need for milling, Archer’s Stronghold systems have the capacity to deliver more efficient P&A operations. When used in conjunction with Tubing Conveyed Perforating (TCP) products and new charge developments, the systems give economical and safe execution of operations providing time and cost savings for customers. The systems have been tried and tested in multiple environments across the globe including, the Gulf of Mexico, Alaska, the North Sea, the Middle East, Asia, and Australia.

Going into more detail, Squyres outlined the three tools for barrier verification and setting which make up Stronghold systems.

Barrier Verification

Archer Oiltools’s verification solutions consist of the Stronghold Defender and Stronghold Fortify systems:

-The Stronghold Defender test system enables operators to efficiently perforate and test an annular barrier. It functions in three steps by first perforating the casing or liner, then verifying the integrity of the annulus, before finally placing barrier material inside the casing.

-The Stronghold Fortify system provides a reliable verification of annular integrity in just one trip which consists of perforation of the casing, testing the integrity of the annulus, verifying the annulus integrity with a unique pressure verification system and cementing across the perforated areas.

Barrier Setting

The Stronghold Barricade system, the main focus of Squyres presentation, perforates, washes, and cements the annulus in order to create a rock-to-rock barrier to achieve permanent caprock integrity.

Usually, this can be achieved in just one trip, which consists of perforating the section, at which point the guns drop automatically; thoroughly washing the perforated annular section, moving down and up if required; placing spacer fluid in the annulus using the calculated pump and pull method; and placing the barrier material using the same technique, once the blank casing is reached the ball will automatically shear out. At this point the pumps are stopped and the operator will pull above expected top of cement to circulate/reverse out any residual cement in the drill pipe.

Squyres explained that in the Gulf of Mexico frequently rat holes are not available and so two trips may be required, but even if this is the case a lot of time and cost can still be saved against a lengthy cut and pull or section milling operation for example.

To demonstrate the benefits of using the Stronghold Barricade system, Squyres outlined a case study from the Gulf of Mexico where an operator needed to set a 330 ft cross sectional cement barrier in 13 3/8” x 20” casing which had no cement in place. The well was located in more than 6,000 ft of water depth and required a barrier placed just above the 20” casing shoe. The operator wanted a barrier to be deployed in order to prevent a cut and pull.

To meet this challenge, Archer deployed the Stronghold Barricade system after working with a local provider to ensure they had the right TCP charge performance. The tool successfully washed and cemented the 330 ft long interval with even rates at 1200 lpm. A successful test thereafter showed the operation was a success and the operator was able to move on with the completion of the P&A.

By using this method, the operator was able to capture value and time by avoiding a cut and pull. Off of the successful completion of this operation, Archer has now been commissioned for several more projects in the region with this client and indeed several others.

Globally, more than 200 P&A plugs have now been installed using Stronghold systems which have delivered 99% operation efficiency, achieved US$250mn in customer savings, and saved 190 tons of CO2 emissions per barrier.

Heerema has announced that last month its deepwater construction vessel, Balder, completed the offshore removal of the Morpeth Tension-leg Platform (TLP) on behalf of client Eni US Operating Company.

The Balder vessel, constructed in Japan in 1978, is 154 metres long and 86 metres wide with a draft of 36 feet (which can be increased to 82 feet when ballast water is taken in). It is capable of a tandem lift of 4,000t and working within water depths from 70 feet and beyond.

Balder mobilised to the Morpeth Field in mid-April to begin executing the removal of the TLP. The campaign involved the engineering, preparation, removal, and disposal of the offshore infrastructure. The removal consisted of the 2,650 short-ton topside, 2,500 short-ton hull, and 1,300 short-tons of tendons and piles.

Following the successful removal of the components, the topside was transported by barge, the tendons and piles on supply vessels, and the hull wet towed for recycling at MARS (Modern American Recycling Services) facilities at various US locations.

This project was the first TLP removal campaign for Heerema and adds another successful decommissioning project to Heerema’s portfolio, following a record-breaking 2020 that saw the company remove 85,277 metric tons of decommissioned structures in one year.

Ardyne, an Aberdeen and Norway-based fishing, milling and casing recovery provider, has announced a strategic alliance with Dynasty Energy Services (Dynasty), a leader in specialised fishing services and plug and abandonment (P&A), to deliver enhanced P&A services around the world.

The exclusive partnership will enable easier access to leading world-class downhole technologies from both companies to deliver major cost and time efficiencies for P&A operations. As part of the agreement, Ardyne’s US team of five people will transfer to Dynasty, ensuring continuity from employees experienced in running Ardyne equipment over the last three years in US onshore and offshore applications.

Worldwide service

The alliance broadens Dynasty’s market offering in the western Hemisphere, while also enhancing Ardyne’s technology offering in the North Sea and wider eastern Hemisphere. It also allows for increased efficiencies for clients in both western and eastern Hemisphere markets.

Alan Fairweather, CEO of Ardyne, commented, “The future of many oil and gas supply chain companies will depend on their ability to adapt to market conditions and to continue identifying opportunities to improve their offering by creating greater operational efficiencies.

“Our strategic alliance with Dynasty is not only exciting for Ardyne, it also presents a model for other companies of a similar size to strengthen their existing technology portfolio and deliver a more robust global offering to clients.”

The alliance’s offerings

Ardyne will bring to the table its systems for casing recovery which save rig time and can provide solutions to challenging operations. The company’s Casing Recovery Toolbox offers flexibility and functionality to optimise operations and quickly adapt to unexpected circumstances.

Ardyne’s TRIDENT system, an integrated, single-trip casing cutting and pulling system has been developed to save rig time while offering precision and additional functionality is also on offer. Additionally, the TITAN system provides power downhole, enabling repeatable, on demand casing cutting and jacking capability in a single trip – it has been run successfully more than 1,200 times around the world.

From Dynasty, the unique Predator thru-casing section milling technology mitigates sustained pressure, providing a secure environment for barrier placement, saving costs through less rig time and multiple trips in the well. The Predator enables stabilised multiple string section milling without damaging outer casing strings. It allows real time decision-making, greater flexibility and contingency planning – especially valuable for P&A campaigns where the original well records are questionable or absent.

Combining Predator with the TRIDENT and TITAN systems enables multiple time saving solutions for P&A operations, with the benefit of being available from one service provider.

Alan Fairweather continued, “Forecasts for the decommissioning market are healthy but to maximise these opportunities will require greater innovation in technology and service provision. The exclusive partnership between Ardyne and Dynasty answers the need for a truly world-class full service fishing, milling and casing recovery offering for the global P&A sector.

“It reaffirms our ongoing commitment to the North Sea well-decom efficiency tool kit and opens our business up to greater opportunities in the locations where Dynasty is already established, including the Gulf of Mexico and US land.”

Keith Alexander, executive VP and chief operations officer of Dynasty Energy Services, added, “Under the partnership agreement, we will supply Ardyne’s technologies to support our services in the Western Hemisphere while Ardyne will supply our products along with their own in the Eastern Hemisphere.

“Combining our technologies to establish a stronger, holistic offering represents a win-win for both companies. However the ultimate winners are the clients who will benefit from easier access to our products to help them achieve greater P&A efficiencies.”

Page 3 of 3