Full-cycle energy services expert Expro Group is collecting orders from the growth and evolution of southeast Asia’s oil and gas industry.

Full-cycle energy services expert Expro Group is collecting orders from the growth and evolution of southeast Asia’s oil and gas industry.

In a recent presentation, it confirmed that it had secured a three-year contract in Indonesia worth around US$15mn for combined electric line cased hole and slickline services on a single unit across 315 wells.

Separately, it has secured a two-year contract valued over US$8mn in Brunei to deliver well metering services for a client’s production assets.

This agreement, which commenced in February 2025, underscores Expro’s role in enhancing its client’s reservoir and facility management through advanced well flow measurement solutions, such as QPulseTM, Sonar Meter and Multiphase Flow Meters, the company noted.

In the group’s first quarter 2025 results, Expro CEO Michael Jardon said his company is “well-positioned” for the remainder of the year and said he remains “optimistic” about the outlook for more business over the next several years.

The first quarter delivered a solid performance in a “dynamic operating environment”, the company reported, with total global revenues hitting US$391mn.

The company is due to host a conference call on July 29, 2025 to discuss results for the second quarter ended June 30, 2025.

China’s coiled tubing market is expanding rapidly, highlighting growing demand for specialist well services in a country with huge oil and gas production and sustained energy demand.

China’s coiled tubing market is expanding rapidly, highlighting growing demand for specialist well services in a country with huge oil and gas production and sustained energy demand.

In 2024 alone, over 15,000 coiled tubing interventions were performed across the country, according to the Intervention & Coiled Tubing Association (ICoTA), “placing China at the forefront globally and highlighting the enormous potential of this dynamic market.”

The association recently participated at the inaugural International Symposium on Coiled Tubing Technology in Wuhan after re-establishing its China chapter, a recognition of the country’s growing importance to global energy markets and in the evolution of advanced well technologies.

The recent symposium centred on the theme of ‘Innovative Application Scenarios, Unleashing Infinite Potential, and Sharing the Development in the Coiled Tubing Industry’.

“This conference embodies the spirit of ‘technology-driven innovation and win-win cooperation’— setting the stage for the new ICoTA chapter to foster international collaboration and advancements in the coiled tubing sector,” the association noted in a statement.

The symposium was co-hosted by China Petroleum Engineering & Technology Co., Ltd (CPET), National Engineering Research Centre for Oil & Gas Drilling and Completion Technologies, National R&D Centre for Intelligent Oil & Gas Well Engineering, the Coiled Tubing Engineering Committee of the Chinese Petroleum Society, and the CNPC Coiled Tubing Operations Technology R&D Centre.

Co-organisers included oil and gas heavyweights such as CNPC, Sinopec, CNOOC, Halliburton, Schlumberger, Baker Hughes, as well as various renowned universities.

Areas covered during the forum included cutting-edge topics such as ultra-deep and long horizontal well coiled tubing operations, coiled tubing digitalisation, coiled tubing drilling, coiled tubing logging and offshore applications.

Among these, a session on coiled tubing digitalisation drew widespread attention, reflecting the industry’s strong momentum toward intelligent intervention technologies.

During the symposium, Steve Moir, Global Chair of ICoTA, delivered a keynote presentation and officially announced the establishment of ICoTA China, which will be led by CPET.

He also pointed out that the future development of coiled tubing technology will primarily focus on intelligent operations, enhanced adaptability to extreme conditions and deep integration with the energy transition.

Brunei hopes to complete the first stage of a new decommissioning hub during 2025, after initial foundation works commenced earlier this year.

Brunei hopes to complete the first stage of a new decommissioning hub during 2025, after initial foundation works commenced earlier this year.

The nation’s first integrated marine maintenance and decommissioning yard is being put together by Anson International Sdn Bhd, which groups Qaswa Holdings of the Adinin Group, CessCon Decom of the UK and Korea’s Dongil Shipyard Co. Ltd.

The project also has the backing of the Ministry of Finance & Economy, Brunei Economic Development Board (BEDB) and Brunei Shell Petroleum Co. Sdn. Bhd.

Located at Pulau Muara Besar, Brunei’s first commercial integrated decommissioning and marine maintenance yard will first service domestic demand, then wider regional demand.

It will see the creation of a 16-acre integrated yard and initially support Brunei’s own ambitious decommissioning efforts.

Brunei is home to some of the oldest oil and gas infrastructure anywhere in the Asia Pacific region, with 214 offshore platforms and over 1,400 wells.

By offering decommissioning services along with marine maintenance, repair and overhaul, the aim of the new yard is to retain and generate in-country value for Brunei as it phases out some of its ageing hydrocarbon infrastructure.

The yard’s operation is expected to create more than a hundred direct jobs, with Anson International offering apprenticeships and overseas training with CessCon Decom and Dongil for local staff.

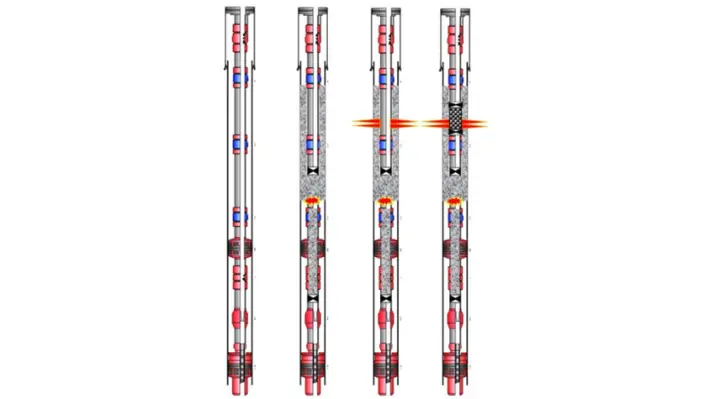

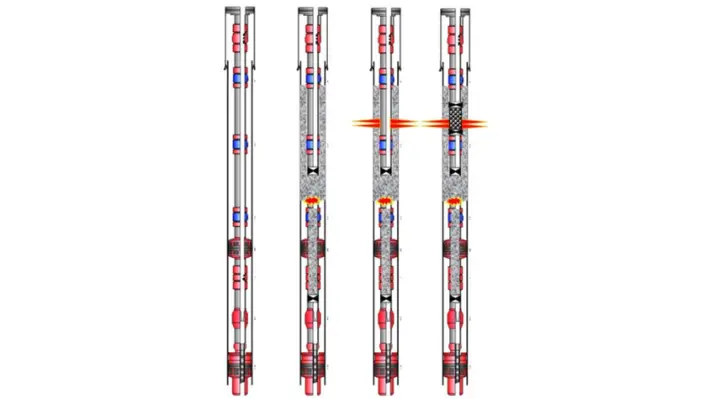

Southeast Asia's mature sandstone reservoirs face economic challenges in hydrocarbon extraction. Sand control impacts asset deliverability, while regional initiatives aim to create a sustainable, locally empowered oil and gas industry for energy security and growth.

3M and PT Pipa Mas Putih are collaborating to address sand control challenges by manufacturing 3M™ Ceramic Sand Screens in Indonesia, aiming to enhance hydrocarbon extraction and regional capabilities.

Brunei Shell Petroleum Sdn Bhd has signed a five-year contract with John Wood Group PLC and its joint venture partner, Tendrill International Sdn Bhd, for the provision of brownfield engineering, procurement, and construction (EPC) services

Brunei Shell Petroleum Sdn Bhd has signed a five-year contract with John Wood Group PLC and its joint venture partner, Tendrill International Sdn Bhd, for the provision of brownfield engineering, procurement, and construction (EPC) services

The contract will span across conceptual design through commissioning and start-up for BSP offshore as well as onshore assets.

A front-runner of Brunei Darussalam's oil and gas industry, BSP contributes significantly to the region's daily oil and gas production.

TendrillWood employs approximately 1,000 people, 70% of which are Bruneian. Under this contract, the JV will continue to invest in the development of local expertise and the supply chain.

Ken Gilmartin, CEO at Wood said, “This award strengthens our position as a trusted EPC partner in Brunei. For over a decade Wood has consistently delivered safe, reliable and efficient engineering and operations solutions to BSP, contributing to domestic energy security.

“Our experience of BSP’s assets enables us to advance asset performance while enhancing local skills development and creating opportunities for the regional supply chain.”

Haryati Ramlee, Managing Director at Tendrill said, “This award marks a significant milestone for Tendrill and our joint venture with Wood. Our local expertise will complement Wood’s experience to deliver safe, efficient and result-driven outcomes for BSP while aligning to the national agenda to maximise local content, capacity development and long-term value creation for the country. Our joint venture brings world-class standard to local operations while ensuring our people, our communities and our industries continue to benefit.”

The contract has scope for a two-year extension.

As oil and gas wells reach the end of their productive life, there is a risk of leaving shallow reservoirs untapped left behind casing. These shallow reservoirs, including gas caps and thin bed formations, may hold valuable resources that are uneconomical to produce using conventional rig based well recompletions.

As oil and gas wells reach the end of their productive life, there is a risk of leaving shallow reservoirs untapped left behind casing. These shallow reservoirs, including gas caps and thin bed formations, may hold valuable resources that are uneconomical to produce using conventional rig based well recompletions.

In Indonesia's Belida field, operators tackled this challenge by implementing rigless up-hole recompletions and utilising 3M Ceramic Sand Screens for downhole sand control. By employing this, operator was able to achieve high production rates from short reservoir perforated zone, maximising hydrocarbons recovery and extending the productive life of the wells and asset.

What role did 3M Ceramic Sand Screens play in facilitating rigless up-hole recompletions for shallow reservoir extraction?

How 3M technology contributes the extension of asset life by accessing previously uneconomical reservoirs?

How does 3M's solution manage erosion and hotspotting risks contributing faster return on investment?

The Intervention and Coiled Tubing Association (ICoTA) has re-established its China Chapter, a recognition of the country’s growing importance to global energy markets and in the evolution of advanced well technologies.

The Intervention and Coiled Tubing Association (ICoTA) has re-established its China Chapter, a recognition of the country’s growing importance to global energy markets and in the evolution of advanced well technologies.

ICoTA called it a “significant milestone” in the association’s global expansion and a commitment to technological innovation in well intervention.

In a statement, it said the revitalised China Chapter would serve as a critical hub for networking, knowledge exchange and technological advancement in the well intervention and coiled tubing sector across the whole of the Asia-Pacific region.

“This strategic relaunch reflects ICoTA's dedication to supporting emerging markets and fostering global industry collaboration,” the association noted.

Steve Moir, Global Chair of ICoTA, called it a landmark moment with implications for the whole region.

“Re-establishing the China chapter of ICoTA marks a pivotal moment as we unite to harness the immense potential of well intervention services in one of the world’s largest markets,” he said.

“Together, we will drive innovation and collaboration, ensuring a prosperous future for coiled tubing technology in China and beyond."

Frank Kong, from CNPC USA, described the market for well intervention services in China alone as huge.

“In 2024, the number of coiled tubing operations is about 12,000 jobs,” he said.

“The CNPC Engineering Technology R&D Company and Jianghan Machinery Institute have taken the lead in establishing the Coiled Tubing Technical Committee of the China Petroleum Society, which plays a leading role in China. The combination of China and ICoTA will for sure greatly promote the development of the industry and expand ICoTA's influence.”

Key objectives of ICoTA’s renewed China Chapter include:

Providing a robust platform for Chinese and international professionals in well intervention technologies.

Facilitating knowledge sharing and technical expertise across regional and international boundaries.

Supporting local industry professionals through networking, training and professional development opportunities.

Promoting cutting-edge technological innovations in well intervention and coiled tubing operations.

The Asia Pacific region is set to continue to provide a steady stream of work for the interventions market for some years to come, as high levels of upstream activity drive demand for drilling contractors and specialist expertise across a broad range of areas.

The well interventions segment is likely to prosper injecting new life into some of the region’s ageing oil and gas fields, all set against a backdrop of a general rise in energy demand globally.

This is likewise driving current upstream activity in the area.

According to industry consultancy, Westwood Energy, there are more than a dozen high-impact wells expected across the Asia Pacific region during the course of this year.

This includes the Hai Su Vang-1X well, which was completed as a discovery in early 2025.

As the region’s oil and gas sector expands and matures, the demand for well intervention services from local and international contractors is expected to follow suit.

Energy services provider, Expro Group, for example, reported significant contracts from the Asia-Pacific region in its Q1 results, including work to provide combined e-line cased hole and slickline services across 315 wells.

UK-listed EnQuest is among the upstream operators with an eye on the region’s hydrocarbon potential, with operations now spread across Malaysia, Vietnam and Indonesia.

Organic and transactional growth in the region already provides a pathway for the company to grow its South East Asian production to more than 35,000 Boepd by the end of the decade, EnQuest Chief Executive, Amjad Bseisu, said at the end of May.

He also noted that the group is in “advanced discussions” around a further new country entry in the region, highlighting keen investor appetite.

It underscores the potential for contracting teams, including across the well services and internentions market, to secure more business as the industry flourishes.

Westwood Energy identified various other key frontier wells for 2025 across the region, offshore South Korea at Daewanggorae, as well as at Mailu offshore Papua New Guinea.

Drilling will also continue in the Kutei Basin, offshore Indonesia, it noted, whilst a 2025 exploration programme offshore Malaysia is still to be firmed up, with only the Megah high-impact well currently drilling confirmed.

In addition, India should see at least five or six high impact wells from Oil India and ONGC across the east coast and Andaman Islands basins, the consultancy group noted earlier this year.

China’s DS Global Offshore has reported that its Huan Qiu 1200 vessel has now completed decommissioning contract work in Thailand, on behalf of operator, Chevron.

China’s DS Global Offshore has reported that its Huan Qiu 1200 vessel has now completed decommissioning contract work in Thailand, on behalf of operator, Chevron.

The vessel has now returned to Chinese waters for domestic-based work.

“From early spring 2024 to late spring 2025, after more than a year of hard work, the Thailand Chevron oil and gas field subsea pipeline recovery project led by the ship, Huan Qiu 1200, of DS Global Offshore Engineering (Tianjin) Co.,Ltd. has successfully concluded,” it noted in a statement.

“After more than 400 days, with the excellent performance of the DP2 power positioning system, the team successfully recovered more than 60 21-inch cement-coated sea pipes in the deep sea, breaking the industry record and setting a new benchmark for global deep-sea energy development.”

It described the submarine pipeline labyrinth as an “underwater steel forest” spanning multiple kilometres in length.

DS Global Offshore said in its statement that precision technology and solutions had won praise from Chevron for overcoming challenges such as the increased weight of cement coatings and disturbance from underwater currents in the deep-sea environment.

It said the project team adopted the “segmented disassembly and precise lifting scheme, optimising the cutting path through dynamic simulation and using high-precision sensors to adjust the lifting angle in real time, successfully avoiding the risk of pipeline entanglement.”

At the core of the project, it noted, was the vessel’s DP2 power positioning system.

“The system analyses wind speed, ocean currents and ship displacement data in real-time through onboard computers, automatically adjusts the propulsion power, and controls the positioning error of the engineering ship within three metres, even in deep sea and level four sea conditions,” the DS Global Offshore statement noted.

The company added: “The Chevron owner stated: This cooperation fully demonstrates the excellent technical strength and professional competence of the engineering ship team, setting a benchmark for future offshore energy projects.”

Chevron is looking to decommission dozens of offshore platforms and subsea pipelines in Thailand over the coming years.

South East Asia’s decommissioning challenge is at a pivotal point. With an estimated 1,500 platforms and 7,000 wells nearing decommissioning by 2030, it is a challenge that is coming into sharp focus. But which country faces the greatest test?

South East Asia’s decommissioning challenge is at a pivotal point. With an estimated 1,500 platforms and 7,000 wells nearing decommissioning by 2030, it is a challenge that is coming into sharp focus. But which country faces the greatest test?

While Southeast Asia is a region with profound market differences, each of the main oil and gas-producing states faces a stern test ahead. According to recent insight article by Bureau Veritas South East Asia, the decommissioning journey ahead will not be simple, but with billions of dollars at stake, sustainable, economic and effective solutions must be found.

With over 630 offshore platforms, many of which are over 40 years old, Indonesia faces a great challenge ahead. Despite its comparatively limited decommissioning experience, Indonesia’s regulatory body, SKK Migas, is focused on enhanced oil recovery initiatives and maximising output from existing assets before decommissioning, notes Bureau Veritas, a world leader in testing, inspection and certification services. However, initial projects such as the Anoa field’s decommissioning and the removal of the Belanak floating storage and offloading unit have provided important learnings for future activity, it adds.

Brunei is home to some of the oldest oil and gas infrastructure anywhere in the wider Asia Pacific region. It is prioritising the phased abandonment of its shallow-water fields, including the Champion and Ampa fields, according to the Bureau Veritas article. With 214 offshore platforms and over 1,400 wells, the nation’s petroleum infrastructure is extensive, though, it notes. Decommissioning activities are supported by updated guidelines developed in collaboration with Brunei Shell Petroleum.

It is estimated that around 40% of Malaysia’s 300-plus offshore platforms are now over 30 years old — moreover, a significant number are operating beyond their design life. To address this problem, state oil company, Petronas, plans to invest around US$2bn in decommissioning activities over the coming decade. Future plans include plugging and abandoning approximately 153 wells and the abandonment of about 37 offshore facilities, as well as one onshore facility connecting the Sabah-Sarawak Gas Pipeline.

With 450 offshore platforms, Thailand is channelling its decommissioning efforts through initiatives such as Decomm 2.0, the Bureau Veritas article notes, which streamlines regulatory approvals under the Thailand Department of Mineral Fuels. According to Bureau Veritas, the nation’s legal framework, rooted in its Petroleum Act, provides “a strong foundation” for efficient and sustainable decommissioning activities.

In a significant stride for India’s energy infrastructure, the Panna-Mukta and Tapti (PMT) joint venture – comprising Shell (via BGEPIL), Reliance Industries Limited (RIL), and ONGC – has wrapped up country’s first offshore decommissioning project successfully.

In a significant stride for India’s energy infrastructure, the Panna-Mukta and Tapti (PMT) joint venture – comprising Shell (via BGEPIL), Reliance Industries Limited (RIL), and ONGC – has wrapped up country’s first offshore decommissioning project successfully.

The milestone marks the safe removal of offshore facilities in the mid and south Tapti fields, located off India’s west coast.

The PMT JV, which operated the Tapti fields under a production sharing contract with the Government of India, includes ONGC with a 40% stake, and BGEPIL (Shell) and Reliance holding 30% each.

Production from the fields ceased in March 2016, marking a major shift in India’s oil and gas sector – from extracting resources to safely shutting down operations.

The multi-phase project involved the removal of five wellhead platforms, the safe plugging and abandonment of 38 wells, and the removal of infield pipelines. The entire process closely adhered to safety and environmental standards, at every stage – from offshore execution to onshore dismantling, planned with utmost precision.

The project, aligned with India’s ‘Make in India’ mission, awarded major contracts to Indian firms – Larsen & Toubro, who led the offshore removal, while Chowgule Shipyard in Ratnagiri handled the onshore dismantling. This not only strengthened domestic capability in energy infrastructure but also created a blueprint for future decommissioning operations in Indian waters.

What sets this project apart is not just its scale but its role in shaping a strong regulatory and operational framework for offshore decommissioning in India. Built in close collaboration with stakeholders – the Ministry of Petroleum and Natural Gas, the Directorate General of Hydrocarbons, and the Oil Industry Safety Directorate, the Tapti decommissioning project sets a benchmark of how legacy fields can be responsibly retired.

“The safe and successful completion of the Tapti offshore project is a landmark moment for India’s offshore energy sector,” said Nipun Pradhan, managing director of BGEPIL and GM, Shell Upstream India, adding, that this project sets a new benchmark for responsible decommissioning, which has been made possible by global expertise, strong collaboration, and an unwavering commitment to safety and sustainability.

Sanjay Barman Roy, president of E&P, Reliance Industries, shared, “The safe and responsible offshore decommissioning by the PMT JV marks a significant step forward for India’s energy sector. From the outset, the JV partners worked tirelessly to strengthen local supply chains and enhance the technical and safety capabilities of Indian contractors, especially for offshore dismantling activities,” stating that this has been successful in fulfilling the government’s ‘Make and Break in India’ vision.

For ONGC, the project’s complexity, given its proximity to active assets, underscored the importance of meticulous planning. “This first-of-its-kind large-scale offshore decommissioning underscores ONGC’s commitment to responsible energy practices, said Pankaj Kumar, director of production, ONGC, expressing that the project’s complexity, especially its proximity to ONGC’s live assets demanded strategic planning, precise execution, and utmost focus on safety and that it sets the foundation for India’s next chapter in offshore transformation.

As India strives to balance energy growth with environmental responsibility, the Tapti project sets a timely benchmark for offshore decommissioning in the country’s evolving energy transition.

Well intervention in the Asia Pacific (APAC) region is expected to witness significant growth in the coming years.

According to a report by Allied Market Research, an increase in energy demand and revitalisation of aging brown field wells are factors propelling the growth of the market. However, environmental risks coupled with strict government regulations are key factors that slow down market growth.

The well intervention services market is categorised based on service type, applications, and countries. China, Australia, India, Indonesia, and Malaysia are among the handful of APAC countries that are set to experience remarkable market growth. Companies such as FMC Technologies, Nabors Industries Limited, Archer Limited, and Expro International Group Holdings Ltd., have adopted various innovative strategies, that have enabled them to gain a strong foothold in the market.

Driven by increasing energy demand, exploration activities and technological advancements in well intervention, the market is projected to expand to around US$2.7bn by 2032.

Page 4 of 14

Copyright © 2026 Offshore Network