DOF Group ASA has been awarded two subsea contracts for offshore execution in 2025, adding to its already full workload in the APAC region.

DOF Group ASA has been awarded two subsea contracts for offshore execution in 2025, adding to its already full workload in the APAC region.

DOF’s dive support vessel (DSV) Skandi Singapore will execute the first contract utilising its saturation diving services offshore Malaysia where it is expected to be engaged for 30 days commencing in Q2 2025.

The second contract was awarded for construction support services in Indonesia wherein DOF will utilise one of the region’s multipurpose vessels for offshore execution in Q3 2025 with an expected duration of seven days.

Mons Aase, CEO of DOF Group ASA, said, “These contract awards secure backlog for the APAC region with an estimated combined value of over US$30m.”

Both contracts will include DOF’s in-house project management and engineering, related subsea and logistics support.

Previously in August 2024, DOF won an extension for Skandi Singapore to remain in the Asia Pacific region, followed by securing a decommissioning contract for the CSV Skandi Hercules. In November, DOF reported it was to spend 150 days in the APAC region as part of an IMR and associated subsea services contract.

Offshore Network’s premier well intervention event is returning to Kuala Lumpur this May where attendees will gain exclusive insights into decisive strategies, cutting-edge technologies and regulatory updates set to shape the region’s oil and gas future.

Offshore Network’s premier well intervention event is returning to Kuala Lumpur this May where attendees will gain exclusive insights into decisive strategies, cutting-edge technologies and regulatory updates set to shape the region’s oil and gas future.

Back for its ninth edition, this year’s installation of the OWI APAC 2025 conference will take place in the JW Marriott Hotel Kuala Lumpur on 20-21 May, where 30 expert speakers will take centre stage to discuss new innovations changing the oil and gas landscape; the impact the energy transition has on intervention best practices; and the importance of cross-industry collaboration to drive production gains and asset integrity.

Featuring 10 technology demos , the conference promises to be an insightful and lucrative experience for all. More than 200 decision makers are expected to descend into the showcase halls, partaking in nine devoted networking events and engaging with a series of key sessions discussing topics such as strategic pathways and partnerships for integrated intervention, the impact of the energy transition, advanced innovations, and structured collaboration policies.

Not only will attendees have ample time to engage with other delegates in an informal manner over drinks, but Premium Pass holders will also experience an elevated offering in the form of an exclusive VIP Dinner and Drinks. Delegates will have the unique opportunity to connect in an intimate over high-end cuisine and cocktails.

For more information regarding OWI APAC 2025, the full brochure can be found here.

The Asia Pacific Offshore Decommissioning Services Market shows significant growth potential, driven by technological advancements, increased consumer demand, and evolving regulatory frameworks.

The APAC market is projected to reach US$3bn by 2030, growing at a CAGR of 9.5% from 2024 to 2030. As the market matures, innovation in product offerings and digital transformation is expected to shape its expansion. Rising interest in sustainable and eco-friendly solutions, especially in sectors like manufacturing and healthcare, is likely to drive demand. Additionally, France’s aging population and shrinking workforce may push for automation and AI-driven technologies across industries.

Sales ratios are projected to shift toward higher-value, premium products, fueled by increasing disposable incomes and consumer preferences for quality over quantity. Government initiatives promoting industry modernisation and international trade partnerships will further enhance growth opportunities. However, competitive pressures and stringent regulations may influence market dynamics.

The Offshore Decommissioning Services Market in North America showcases significant regional diversity, driven by varying consumer preferences, technological advancements, and regulatory landscapes across the US, Canada, and Mexico. The US remains the dominant player, offering a robust infrastructure and high demand across sectors such as healthcare, technology, and consumer goods. Canada complements with a focus on innovation and sustainability, while Mexico's manufacturing base plays a crucial role in cost-efficient production.

This market's economic significance lies in its contribution to GDP growth, job creation, and international trade, making it a key driver in both domestic and global economies. Regional strengths combined with market size position North America as a critical hub for the expansion and investment opportunities in the Offshore Decommissioning Services industry.

The key factors driving the growth of the offshore decommissioning services market include an increasing number of aging offshore oil and gas platforms, stringent regulations regarding decommissioning activities, and advancements in decommissioning technologies. The key players in the offshore decommissioning services market include Schlumberger, Baker Hughes, Halliburton, Weatherford International, and Tetra Technologies.

Technological advancements such as robotics, drones, and advanced sensing technologies are enabling more efficient and cost-effective decommissioning activities in the offshore sector. Market trends in the offshore decommissioning services industry, such as regulatory changes, technological advancements, and industry consolidation, can impact business investment decisions by influencing the demand for decommissioning services, the competitive landscape, and the potential for growth and profitability.

The offshore decommissioning services market aligns with environmental and sustainability goals by addressing the safe and efficient retirement of offshore infrastructure, minimising environmental impacts, and promoting the responsible management of decommissioning waste and materials.

Moreover, stakeholders' engagement plays a major role in the offshore decommissioning services market. Stakeholder engagement is essential in the offshore decommissioning services market to address the concerns and interests of various stakeholders, including regulatory bodies, industry players, environmental groups, local communities, and investors, throughout the decommissioning process.

Well services and engineering solutions provider Odfjell Technology has entered into a cooperation agreement with Australian-based R&D Solutions to expand its presence in the Asia Pacific region.

Well services and engineering solutions provider Odfjell Technology has entered into a cooperation agreement with Australian-based R&D Solutions to expand its presence in the Asia Pacific region.

The agreement allows Odfjell Technology to utilise its well intervention services, wellbore clean up and whipstock tools to service the Australian well services and deepwater markets. The company also has future plans for growth in the regional plug and abandonment (P&A) sector.

Paul Toner, Vice President – Middle East & Asia Pacific at Odfjell Technology, said, “Expanding our reputation and relationships into Australia is a critical part of our global growth strategy. With strong localised operations already in place across Southeast Asia, we are confident our new cooperation agreement with R&D Solutions will enable the same excellent level of customer service and delivery for the Australian energy market.”

Doug Gillespie, Director and Managing Partner at R&D Solutions, commented, “R&D Solutions prides itself on the technology and service capabilities it has delivered to market over the years […] we feel Odfjell Technology compliments the spirit of our motto ‘Tomorrow’s Technology Today’, bringing the next level of excellence in quality service and technology to Australia.”

As part of its promise to boost the competitiveness of its upstream sector while pursuing a sustainable future, PETRONAS will continue to prioritise its decommissioning responsibilities, directing its focus to accessing unused assets for potential repurposing.

As part of its promise to boost the competitiveness of its upstream sector while pursuing a sustainable future, PETRONAS will continue to prioritise its decommissioning responsibilities, directing its focus to accessing unused assets for potential repurposing.

The Malaysia-based operator has released its 2025-2027 Activity Outlook report, where it highlights the call to decommission the Sabah-Sarawak Gas Pipeline alongside 37 offshore facilities. PETRONAS’ three-year plan also includes the plugging and abandonment of 153 wells within the region.

The report states, “PETRONAS continues to explore innovative decommissioning solutions focusing on technologies, reuse/repurpose options, integrated multi-year execution approach for economies of scale, as well as identifying potential alternatives that can introduce cost compression. Thus, participation and collaboration are encouraging from all parties.”

PETRONAS’ report noted the importance of decommissioning matured assets in Malaysia’s upstream oil and gas industry as it is “essential to restore the area to a safe and environmentally stable condition.”

With that initiative at the forefront, in December 2024 the operator collaborated with the Department of Fisheries to launch the 10-year Malaysia Master Reefing Plan which outlines the potential for reefing in the region by spotlighting suitable candidates and locations to undergo the ‘rigs-to-reef’ operation: an initiative which stands as a popular decommissioning alternative in the Gulf of Mexico.

Alongside decommissioning, PETRONAS shares its outlook regarding upstream operations. In the short-term, the operator will focus on intensifying exploration activities and expediting appraisal programmes to sustain production and contribute towards Malaysia’s energy security. In the medium- to long-term, PETRONAS will continue to meet production targets and maximise shareholder value while decarbonising the value chain through innovation, technical deployment, and close collaboration with industry partners.

To read the full 2025-2027 Activity Outlook, click here.

Malaysia is set to receive Shelf Drilling’s 1983-built Baltic jack-up rig to kickstart a multi-year plug and abandonment programme

Malaysia is set to receive Shelf Drilling’s 1983-built Baltic jack-up rig to kickstart a multi-year plug and abandonment programme

Last upgraded in 2015, the rig can support up to 120 crewmen, and comes with the Marathon LeTourneau Super 300 design.

It is anticipated that T7 Global has acquired the rig from the Dubai-based provider to facilitate Petronas Carigali’s P&A initiative.

As Petronas continue to invest in innovative well solutions to boost production, the operator also has plans to permanently plug more than 500 wells over the next five years.

There has been a number of efforts to expand production in Malaysia’s offshore oil and gas fields, with a number of key industry players increasing their stake in the region.

TotalEnergies, for instance, has finalised the acquisition of interests of OMV and Sapura Upstream Assets in SapuraMOV Upstream, an independent gas producer in Malaysia. SapuraOMV’s main assets are its 40% operated interest in block SK408 and 30% operated interest in block SK310, located offshore Sarawak. In 2024, SapuraOMV’s operated production (100%), supported by the start-up of the Jerun gas field, is expected to reach approximately 590 Mcf/d of natural gas, feeding the Bintulu LNG plant operated by Petronas, as well as 10 kb/d of condensates.

Elsewhere, EnQuest Petroleum Production Malaysia announced in December an agreement to develop approximately 155 Bscf (c.27mn barrels of oil equivalent) of additional Seligi field gas resources along with a 50% equity share.

In partnership with PETRONAS Carilgali Sdn Bhd and E&P Malaysia Venture Sdn Bhd, the agreement enables the parties to develop and commercialise the non-associated gas resources in the PM8E PSC contract area and, in line with expected demand, supply around 70mmscf per day of sales of gas. EnQuest will produce additional Seligi Field non-associated gas by modifying its existing infrastructure, providing a cost-efficient way to deliver new volumes into the Peninsula Malaysia gas system.

“Malaysia is a key area for EnQuest’s growth strategy, and this agreement complements the signing of the DEWA Complex Cluster SFA PSC in October this year,” remarked EnQuest CEO, Amjad Bseisu.

December was also marked by PETRONAS awarding production sharing contracts for three discovered resource opportunities clusters and one exploration block offered under the Malaysia Bid Round (MBR) 2024 which was launched earlier this year. The resources are located next to existing infrastructure, enabling synergistic development and swift monetisation that, PETRONAS said, will allow for efficient and cost-effective resource extraction.

“We are pleased to see our petroleum arrangement contractors growing their portfolios in Malaysia,” said Senior Vice President of MPM, Datuk Ir. Bacho Pilong. “With their strong track records and proven capabilities, they continue to contribute significantly to the growth of Malaysia's petroleum sector… The year 2024 marks another successful year with the award of 18 PSCs across exploration, DRO and Late Life Asset. This is a testament of investors' confidence in PETRONAS' innovative asset offerings with high monetisation potential, solidifying Malaysia’s position as a preferred destination for upstream investments.”

While Malaysia is already a strong point in the APAC region for well intervention services beyond drilling, the expansion of production in the country suggests that even more opportunities will be forthcoming for such service providers.

Seequent, the Bentley subsurface company, has announced it has entered it a strategic partnership with the International Geothermal Association (IGA) to boost the role of geothermal power as a reliable renewable energy source.

Seequent, the Bentley subsurface company, has announced it has entered it a strategic partnership with the International Geothermal Association (IGA) to boost the role of geothermal power as a reliable renewable energy source.

Currently, Seequent software supports more than half of the world’s geothermal electricity production. The company has been one of the forefront leaders in bringing technical advancements to the industry, for example it has helped bring geothermal energy directly into homes in both Paris and Munich for heating.

The company’s latest innovations include adding new capabilities to its software to trace fluids more accurately, leading to more efficient resource management and more sustainable geothermal operations.

Graham Grant, Chief Executive Officer at Seequent, said, “Seequent is honoured to partner with the International Geothermal Association for the next two years. We will work with global partners to build clear and consistent messaging for the industry, positioning geothermal as a vital contributor to the energy transition.

“An emerging use case for geothermal is the rise of hyperscale AI-enabled data centres which represent a rapidly emerging new form of power demand requiring reliable baseload, or consistent, power supply. Geothermal is the cleanest form of renewable energy able to provide this baseload power and should play a key role in future data centre strategy globally.”

Seequent customer Fervo Energy is applying its technology to find new ways to produce geothermal energy for Google’s data centres in Nevada.

Marit Brommer, Chief Executive Officer of the IGA, commented, “We are excited to partner with Seequent, whose technological innovations in subsurface modelling bring clarity to geothermal development, empowering countries to leverage this clean energy resource and drive meaningful progress toward global net zero goals.

“We encourage other industry leaders and companies to join and amplify promotion of geothermal, as collaborative efforts are key to unlocking geothermal's full potential for a sustainable future."

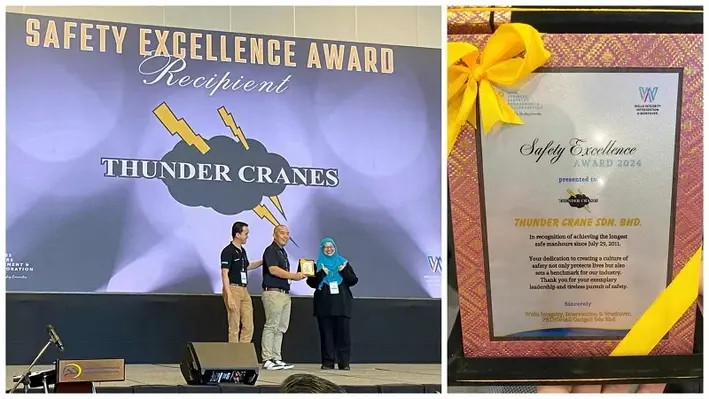

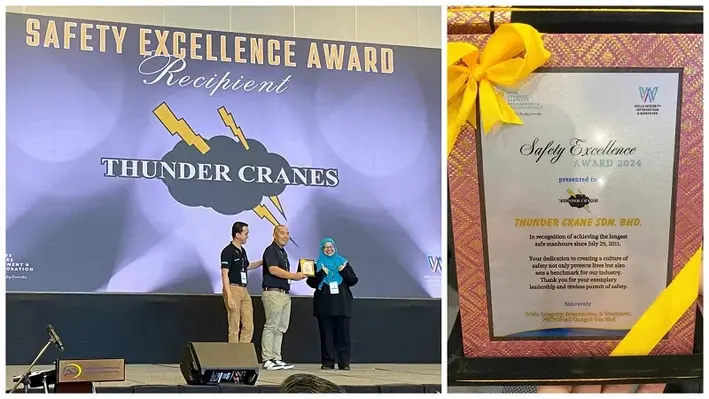

Thunder Cranes, a provider of portable-modular cranes and specialised lifting solutions for the offshore oil and gas industry, has been awarded the Safety Excellence Award by Petronas Carigali Sdn Bhd (PCSB).

The accolade pays tribute to the work Thunder Cranes has undertaken with PCSB since 2011, recognising its outstanding commitment to safety. This is proven by the fact it has achieved the longest safe manhours in operating with PCSB’s well integrity, intervention and workover department over the past 13 years.

In receiving the award, PCSB management thanks Thunder Cranes for its dedication to creating a culture of safety that “not only protects lives but also sets a benchmark for our industry.”

Across all of its offshore operations in Malaysia with PCSB, Thunder Cranes has accumulated 1.69mn LTI-free manhours over 4,759 days of operations since 2011.

Thunder Cranes has certainly been making waves in recent months, having just proven its worth in a Gulf of Thailand decommissioning project. Discover the full story by clicking here.

New Zealand-based Contact Energy has reached a major commissioning milestone with its new Te Huka 3 geothermal power station as it has synchronised and provided power to the national grid for the first time.

New Zealand-based Contact Energy has reached a major commissioning milestone with its new Te Huka 3 geothermal power station as it has synchronised and provided power to the national grid for the first time.

At full capacity the power station will run at 51.4MW which equates to enough renewable energy to power the equivalent of 60,000 homes. During a three week testing period with Transpower, approximately 15MW will initially be fed into the grid before gradually increasing.

This period will be followed by formal generator compliance testing to Transpower’s system operator code requirements to confirm Te Huka 3 can provide electricity to the grid efficiently and safely.

Contact’s CEO Mike Fuge said “This marks a huge moment for the team at Te Huka 3, who have, for the past two years, worked tirelessly from the initial ground-breaking on site to building a fully operational renewable power station.

“[Te Huka 3] is a significant demonstration of our ability to invest, build and deliver world class assets for the benefit of all New Zealand.”

Once Transpower’s tests are completed, Contact will carry out further performance and reliability testing before the site is expected to become fully operational by the end of the year. One of the tests will include a 30-day reliability run to confirm that Te Huka 3 can run continuously and reliably at 51.4MW over a month-long period.

Fuge continued, “It is a really exciting time for geothermal energy. It has often been the unsung hero of power, but now it is really coming into its own as it plays a crucial role in New Zealand’s transition away from fossil fuels while helping to keep the lights on.”

PT Pertamina Power Indonesia (Pertamina NRE), PT Pertamina Geothermal Energy Tbk (PGE) and France-based clean hydrogen technology venture Genvia have signed a MoU to collaboratively develop green hydrogen production through the integration of advanced solid oxide electrolyser (SOEL) technology with geothermal heat resources.

The agreement includes the technical and economic study of the use of Genvia’s advanced high-temperature SOEL technology to reduce energy consumption in green hydrogen, and will be conducted at one of PGE’s geothermal sites.

The collaboration will leverage PGE’s geothermal expertise and Pertamina NRE’s broader clean energy portfolio, including renewables, green hydrogen, battery storage, electric vehicles and carbon businesses.

John Anis, CEO of Pertamina NRE, said, “We at Pertamina NRE are very enthusiastic about the collaboration with Genvia, which we believe will significantly accelerate the development of green hydrogen in Indonesia. This collaboration underlines our commitment to explore innovative solutions to achieve more cost-effective hydrogen production and maximise Indonesia’s green energy potential, such as geothermal.”

Florence Lambert, CEO of Genvia, commented, “Through our collaboration with Pertamina NRE and PGE, we see great potential in combining Genvia’s advanced technology with Indonesia’s abundant geothermal resources to drive a sustainable energy future. By exploring the potential of high-temperature SOEL technology, we aim to unlock new efficiencies in green hydrogen production.”

Baseload Power Taiwan has announced a partnership with Taiwan Power Company (Taipower), Taiwan Cogeneration Corporation (TCC), and other international partners to develop geothermal energy in the Tatun Mountain area of northern Taiwan.

The collaborative partnership will unlock the country’s largest geothermal energy reserve in order to rapidly advance geothermal development at scale. By harnessing this energy, it is believed that geothermal power will become a key pillar in Taiwan’s journey towards hitting its Net Zero goal by 2050.

On 1 October, 2024, Taipower held a signing ceremony for the ‘MOU for Cooperation – Geothermal Development at Tatun Mountain’ with joint signatures from Taipower Chairman Wen-sheng Tseng, TTC Chairman Shun-I Huang, Baseload Capital Chairman Magnus Brandberg, and representatives from GreenFire Energy and other international geothermal companies.

Magnus Brandberg, Co-Founder and Chairman of Baseload Capital, said, “As Taiwan’s first international geothermal developer, we are committed to delivering 24/7 clean energy and advancing the geothermal industry. By leveraging public-private collaboration, we aim to unlock Taiwan’s geothermal potential, contribute to its energy independence, and support the 2050 Net-Zero goal.”

Following the signing, a series of initiatives will take place including the analysis of existing geological data; geology, geochemistry and geophysics exploration; establishment of conceptual modules; determining drilling targets; and the execution of an exploration drilling programme.

Once the exploration phase is complete, assessments will begin for the potential of geothermal power plants and the possible implementation of Advanced Geothermal Systems.

Page 7 of 15

Copyright © 2026 Offshore Network