FourPhase, a specialist in solids and production performance within the oil and gas sector, has introduced The Observer, an advanced tool for real-time data capture and optimisation.

FourPhase, a specialist in solids and production performance within the oil and gas sector, has introduced The Observer, an advanced tool for real-time data capture and optimisation.

Already deployed in five operations across the Gulf of Mexico and the Norwegian Continental Shelf, the solution will soon be integrated across all FourPhase operations, enabling full-scale remote monitoring. As operators increasingly shift towards data-driven smart operations, the real-time insights provided by The Observer are proving invaluable.

Addressing key industry challenges

The Observer is designed to tackle three critical industry challenges: minimising downtime through data-driven decision-making, enhancing equipment maintenance efficiency, and accelerating the shift to remote operations. The system continuously captures real-time data to generate a live operational feed within FourPhase’s control centre while simultaneously populating online dashboards accessible to customers globally.

A key strength of The Observer is its robust security architecture. Adhering to a zero-trust security model, it complies with ISO 27001, 27017, and 27701 standards. The system establishes a secure connection to onshore operations via Starlink or similar technologies, providing a protected data transmission channel between offshore sites and onshore centres.

"Coupled with onsite remote operations, these capabilities are enabling a step-change improvement in offshore sand management. This opens up new opportunities for production optimisation and autonomy that were previously not possible," remarked FourPhase CEO Øyvind Heradstveit.

Leveraging a decade of data

Since 2013, FourPhase has been gathering solids management data, using it to simulate operational scenarios. By applying insights from real-world experiences rather than relying purely on theoretical calculations, the company has achieved an uptime exceeding 99.5% over the past decade. This extensive database allows for more accurate operational planning and improved performance predictions.

"As the energy industry operates with multiple, often competing, data-sharing standards, we’ve developed The Observer as a universal solution, integrating over 300 languages and protocols rather than locking into a single standard. This allows for real-time monitoring across diverse equipment—including Multiphase Flow Meter, the DualFlow Desander, Acoustic Sand Detectors, and client plant data—all simultaneously. The goal is to capture and process data instantly, empowering operators with real-time insights to make informed decisions," explained Jørgen Bruntveit, COO/CTO.

"Many competitors claim real-time monitoring, yet their systems often suffer from minute-long delays and cumbersome designs—some as large as a server rack. The Observer delivers true real-time monitoring in a form factor small enough to hold in one hand," added Bruntveit.

Although real-time condition monitoring and data-driven optimisation are now standard in many production-related workflows, sand management has largely remained dependent on labour-intensive legacy methods. This reliance has slowed the adoption of autonomous and low-manning platforms. By investing significantly in remote monitoring technology, FourPhase has closed this gap, ensuring The Observer enables full oversight across its entire fleet, including desanders.

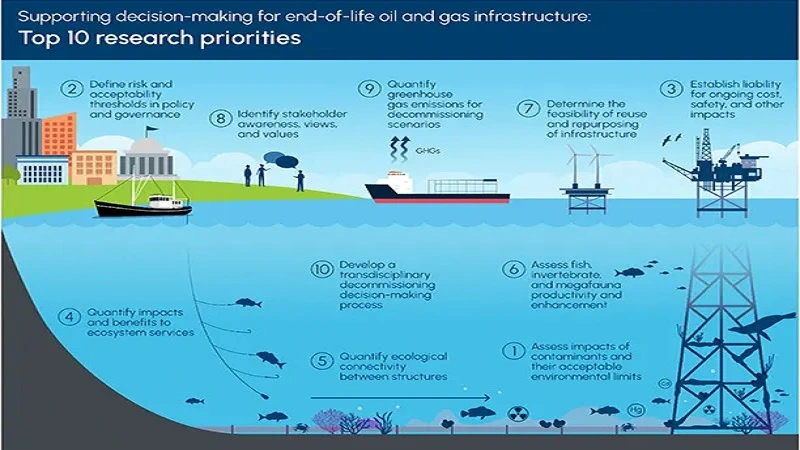

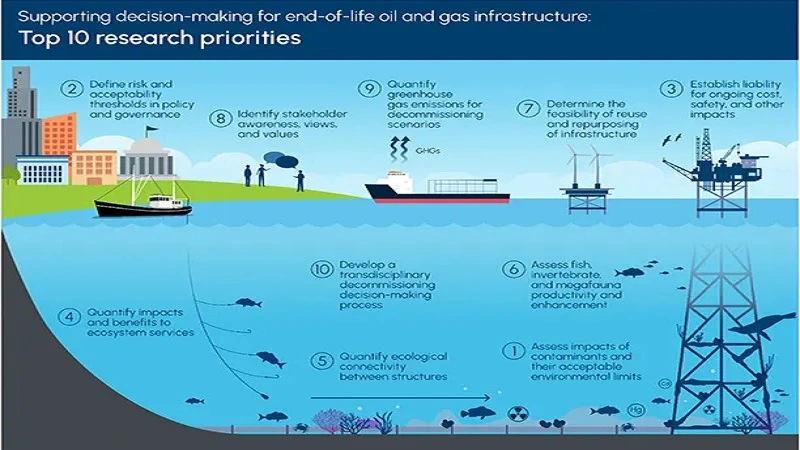

Depending on the scenario, decommissioning oil and gas infrastructure can have potential negative impacts both on the economy and environment.

Depending on the scenario, decommissioning oil and gas infrastructure can have potential negative impacts both on the economy and environment.

The top 10 research priorities were highlighted in a 2023 resarch paper which aid in making informed decommissioning decisions and enhance our understanding of its detrimental impacts.

Several contaminants are released into the environment during the decommissioning process. These include residual chemicals and reservoir constituents that can have significant negative impacts on marine life. As part of the risk assessment framework, all contaminants need to be carefully identified and assessed. Understanding the long-term, site-specific consequences of these contaminants is key to adequately assess risks from various decommissioning options including full removal, partial removal and leave in-situ decommissioning options.

A majority of risks associated with offshore decommissioning activities lack well defined baselines to measure potential impacts. In order to identify parameters that can be measured and monitored, a baseline needs to be predetermined, without which, the acceptability of decommissioning options cannot be assessed.

Due to a lack of knowledge and inconsistent or deficient regulatory guidance, the ongoing costs within current decommissioning decision-making processes are often overlooked. Liability frameworks should therefore be defined to determine the cost of full removal of structures, making remaining items safe, and returning the seabed to its pre-activity state. Costs involving alternative approaches such as the relocation of structures to a reefing location are also calculated by the industry.

To adequately assess and compare the social, technical and economic impact of decommissioning, the ecosystem services that are gained or lost from different decommissioning options need to be determined. While few marine-based environmental impact assessments (EIAs) are currently being integrated with ecosystem services, there has been limited success attributed to data gaps and the values have been ineffectively captured by ecosystem services. Hence, alternate schemes such as the Intergovernmental Platform for Biodiversity and Ecosystem Services (IPBES) and Nature's Contributions to People have been developed.

The long-term presence of offshore structures can have a positive and negative influence on ecological diversity, productivity and connectivity. For example, the presence of oil and gas structures in marine ecosystems can have negative consequences on the natural migration pathways of species that might be altered by the emission of sound, vibrations and light from structures. On the other hand, presence of these offshore infrastructures can also extend foraging opportunities of certain mobile species such as Australian fur seals. Long-term monitoring data should therefore be collected throughout the lifecycle of these installations to appropriately understand their impact on populations and connectivity.

Production and attraction mainly refer to whether fish are attracted to an artificial structure or whether it enhances fish production. When a new structure is installed, fish are rapidly attracted to the structure which can redistribute existing production. In some cases, fish production can significantly increase when infrastructures are installed in predominantly sandy, oligotrophic habitats since they provide additional hard substrata that can potentially increase the carrying capacity of organisms that utilise such habitats. Assessments should consider the duration of these structures in place and the extent of connectivity between fish populations on the structures and the broader ecosystem.

A range of research questions need to be addressed to assess the feasibility of re-using or re-purposing offshore structures. Firstly, it is important to understand the process of degradation of different materials beyond their initial design life. Secondly, the evolution of different seabed sediments and their impact on the stability and integrity of decomissioned offshore infrastructure need to be considered. Thirdly, the technology required to contain hazardous substances, monitor their impact on the ocean environment, pursue re-cycle, re-purpose and re-use opportunities for recovered infrastructure needs to be understood. Lastly, performing testing and validation is crucial to achieving confidence of the sector and inclusion in industry standards.

A review of stakeholder values regarding the benefits of offshore instrastructure identified both risks and opportunities. These involve a combination of social and economic values that are shaped by their knowledge frames. Since there is no one-size-fits-all, further research is required to understand the factors that influence the perceptions and attitudes of stakeholders towards decommissioning.

Although the decommissioning process contributes minimally to greenhouse gas (GHG) emissions in comparison to its full cycle, it still needs to be evaluated in regard to its total contribution to the global goal of reaching net zero emissions by 2050. It is also important to highlight the positive contributions of these structures such as the carbon sequestration potential of marine ecosystems formed around these structures in situ. Qualitative analysis of all sources of GHG emissions sequestered should also be considered. A combination of all these analyses would result in a net-carbon footprint being identified for each decommissioning option.

While classifying research priorities into disciplines is necessary to assess their impact, they are also in most cases, found to be transdisciplinary in nature.

The offshore well intervention market in the Asia-Pacific region is experiencing steady growth, driven by increasing investments in oilfield optimisation and advanced intervention technologies.

The offshore well intervention market in the Asia-Pacific region is experiencing steady growth, driven by increasing investments in oilfield optimisation and advanced intervention technologies.

According to a report by Future Market Insights (FMI), the global downhole tractor market is expected to expand from US$4,033.6mn in 2025 to US 7,088.4mn by 2035, at a 5.8% CAGR.

Rising demand for downhole tractors

The growing complexity of offshore drilling operations in the region has heightened demand for downhole tractors, particularly in deepwater and horizontal well applications. Countries like China, Australia, and Malaysia are leading investments in offshore exploration, requiring efficient well-intervention solutions.

Technological advancements driving growth

Technological advancements, such as real-time monitoring and AI-driven automation, are enhancing the efficiency of downhole tractors. "The growing need for efficient well intervention and technological advancements will continue to drive the downhole tractor market’s expansion. The increasing application of these tools in complex drilling operations and emerging oilfields, especially in key regions, positions the market for sustained growth over the next decade," said Nikhil Kaitwade, Associate Vice President at Future Market Insights (FMI).

With increased investment in offshore well optimization, the Asia-Pacific region is poised to play a critical role in shaping the future of downhole intervention technologies.

For more insights please visit here

Brunei Shell Petroleum (BSP) has awarded Serikandi Hilong Sdn Bhd, a joint venture between Serikandi Oilfield Services (Serikandi) and Hilong Marine Engineering (Hilong), a significant contract for decommissioning services offshore Brunei.

Brunei Shell Petroleum (BSP) has awarded Serikandi Hilong Sdn Bhd, a joint venture between Serikandi Oilfield Services (Serikandi) and Hilong Marine Engineering (Hilong), a significant contract for decommissioning services offshore Brunei.

In a LinkedIn article published by the consortium, the contract is for the Engineering, Preparation, Removal and Disposal (ERRD) of redundant structures. Serikandi says the project “prioritises resource reclamation, ecosystem revitalisation, and economic growth aligning with global sustainability goals.”

Serikandi states the that by leveraging its local expertise with Hilong’s technology proficiency, the collaboration will deliver safe, efficient and environmentally responsible decommissioning services.

Revi Bhaskaran, CEO of Serikandi Group, said, “This milestone reflects our commitment to environmental preservation and operational excellence. Collaborating with Hilong enables us to expand our capabilities while supporting regional decommissioning expertise.”

Jeffery Gu, Executive Deputy President of Hilong Group, commented, “We are honoured to contribute to Brunei’s first major decommissioning project. Together with Serikandi, we will ensure successful delivery while upholding the highest safety and environmental standards.”

The offshore oil and gas industry is experiencing a transformative wave, driven not only by innovations in downhole technologies but also by its increasing adoption of digitalisation.

The offshore oil and gas industry is experiencing a transformative wave, driven not only by innovations in downhole technologies but also by its increasing adoption of digitalisation.

Across the globe, digital technologies and digitised data are reshaping industries, and oil and gas is no exception. Solutions leveraging IoT technologies, data analytics, and digital twins are enabling operators to harness information more effectively. These advancements are improving productivity and unlocking significant cost savings.

According to SLB, many companies are leveraging digitalisation to enhance their portfolios. SLB, for instance, uses its Intervention Advisor Software to manage risks, cut value chain costs, and improve production. The software offers diagnostic, remediation, and prevention methods tailored to optimise operations and reduce costs per barrel. Additionally, SLB’s recently announced partnership with Geminus AI introduces a physics-informed AI model builder, allowing for real-time optimisation across various outcomes, including operational expenditure reduction, increased productivity, and carbon emissions minimisation. “Geminus’ capability to fuse AI methods with physics-based simulation data will empower customers to quickly and easily create hybrid models of their operating assets that can be optimised in real time against numerous outcomes, such as opex reduction, increased productivity, and carbon emissions minimisation,” remarked Rakesh Jaggi, President, Digital and Integration, SLB.

In the second half of 2023, Silverwell Technology announced it had secured a major contract in Southeast Asia to deploy its digitally intelligent artificial lift (DIAL) system across multiple wells. According to the company, DIAL integrates in-well monitoring with surface analytics and automation to optimise gas-lifted fields remotely, even in challenging environments. Silverwell added that, across a three-year contract, the technology would be deployed in difficult conditions and expressed hopes that its successful completion would encourage broader adoption in the region.

The development of digital tools, especially around data interpretation, is being closely watched in the industry. According to Utama, “Improving the interpretation of logging data with new technology will enable oil companies to make better decisions for their well, especially around abandonment.”

The continued evolution and adoption of digitalisation remain a focal point for the offshore oil and gas sector, driving innovation and efficiency across operations.

In Asia, regulatory change driven largely by environmental concerns has continued apace, notably with the ASEAN Council on Petroleum (ASCOPE) issuing decommissioning guidelines for oil & gas facilities.

In Asia, regulatory change driven largely by environmental concerns has continued apace, notably with the ASEAN Council on Petroleum (ASCOPE) issuing decommissioning guidelines for oil & gas facilities.

Industry sources estimate that around 800 offshore platforms in the Asia Pacific region will enter decommissioning by 2027, at a predicted cost of some US$100 bn. While English law remains a popular choice to govern Asia Pacific decommissioning contracts, it faces stiff competition from other systems.

The dispute resolution clause of BIMCO’s DISMANTLECON form of contract envisages a choice between English, Singapore and US maritime (or New York) law. Historically, English and Singapore law have followed each other closely. However, the common law of penalties is the latest area in which divergence has emerged, with the Singapore Court of Appeal declining to follow the UK Supreme Court’s Cavendish Square decision when examining liquidated damages and forfeiture clauses in oil and gas contracts. Choice of law therefore, has real consequences for businesses engaged in decommissioning.

Net zero also has a profound impact on decommissioning. Despite the Strategy’s change of name, the MER objective remains in place. This is no “keep it in the ground” strategy. What has altered is the way assets are managed in the context of recovery of oil and gas. The updated OGA Strategy is unlikely in itself to accelerate the pace at which assets come forward for decommissioning, beyond the consequences of falling demand (and perhaps prices) flowing from the government’s overall policy of reducing fossil fuel dependence in the downstream economy. Rather, elements of the OGA Strategy may slow the pace of decommissioning.

The Central Obligation is supplemented by a number of detailed provisions on re-use of assets not only for CCS projects but also, 'where appropriate', for 'projects relating to hydrogen supply'. 15 to 17 of the OGA Strategy, headed 'Decommissioning', require relevant persons to demonstrate, before planning decommissioning of infrastructure, that 'all viable options' for its continued use, 'including for reuse or re-purposing for CCS' have been 'suitably explored'. Note the word 'including': potential re-use is not confined to CCS but could also include hydrogen and other clean energy uses such as offshore wind. So, even where an asset cannot continue in economic petroleum use, OPRED may reject a decommissioning programme where the whole or part of the structure may viably support clean energy development.

The OGA may also use its licensing powers to ensure cooperation between asset owners and others, including parties seeking to invest in alternative uses. Postponement of decommissioning will sometimes, but not always, be welcome news to asset owners. UKCS M&A transactions and other contracts will typically be priced on assumptions about the useful life of an asset and the timeframe within which the costly process of decommissioning is expected to take place. Insistence by OGA or OPRED on prolonging the life of an asset with a view to reuse may result in parties discovering they have overpaid into a security arrangement, or finding themselves compelled to negotiate elaborate cost apportionments with incoming investors. Unravelling or altering already complex contractual arrangements to accommodate these changes may prove legally and financially problematic.

DOF Group ASA has been awarded two subsea contracts for offshore execution in 2025, adding to its already full workload in the APAC region.

DOF Group ASA has been awarded two subsea contracts for offshore execution in 2025, adding to its already full workload in the APAC region.

DOF’s dive support vessel (DSV) Skandi Singapore will execute the first contract utilising its saturation diving services offshore Malaysia where it is expected to be engaged for 30 days commencing in Q2 2025.

The second contract was awarded for construction support services in Indonesia wherein DOF will utilise one of the region’s multipurpose vessels for offshore execution in Q3 2025 with an expected duration of seven days.

Mons Aase, CEO of DOF Group ASA, said, “These contract awards secure backlog for the APAC region with an estimated combined value of over US$30m.”

Both contracts will include DOF’s in-house project management and engineering, related subsea and logistics support.

Previously in August 2024, DOF won an extension for Skandi Singapore to remain in the Asia Pacific region, followed by securing a decommissioning contract for the CSV Skandi Hercules. In November, DOF reported it was to spend 150 days in the APAC region as part of an IMR and associated subsea services contract.

Offshore Network’s premier well intervention event is returning to Kuala Lumpur this May where attendees will gain exclusive insights into decisive strategies, cutting-edge technologies and regulatory updates set to shape the region’s oil and gas future.

Offshore Network’s premier well intervention event is returning to Kuala Lumpur this May where attendees will gain exclusive insights into decisive strategies, cutting-edge technologies and regulatory updates set to shape the region’s oil and gas future.

Back for its ninth edition, this year’s installation of the OWI APAC 2025 conference will take place in the JW Marriott Hotel Kuala Lumpur on 20-21 May, where 30 expert speakers will take centre stage to discuss new innovations changing the oil and gas landscape; the impact the energy transition has on intervention best practices; and the importance of cross-industry collaboration to drive production gains and asset integrity.

Featuring 10 technology demos , the conference promises to be an insightful and lucrative experience for all. More than 200 decision makers are expected to descend into the showcase halls, partaking in nine devoted networking events and engaging with a series of key sessions discussing topics such as strategic pathways and partnerships for integrated intervention, the impact of the energy transition, advanced innovations, and structured collaboration policies.

Not only will attendees have ample time to engage with other delegates in an informal manner over drinks, but Premium Pass holders will also experience an elevated offering in the form of an exclusive VIP Dinner and Drinks. Delegates will have the unique opportunity to connect in an intimate over high-end cuisine and cocktails.

For more information regarding OWI APAC 2025, the full brochure can be found here.

The Asia Pacific Offshore Decommissioning Services Market shows significant growth potential, driven by technological advancements, increased consumer demand, and evolving regulatory frameworks.

The APAC market is projected to reach US$3bn by 2030, growing at a CAGR of 9.5% from 2024 to 2030. As the market matures, innovation in product offerings and digital transformation is expected to shape its expansion. Rising interest in sustainable and eco-friendly solutions, especially in sectors like manufacturing and healthcare, is likely to drive demand. Additionally, France’s aging population and shrinking workforce may push for automation and AI-driven technologies across industries.

Sales ratios are projected to shift toward higher-value, premium products, fueled by increasing disposable incomes and consumer preferences for quality over quantity. Government initiatives promoting industry modernisation and international trade partnerships will further enhance growth opportunities. However, competitive pressures and stringent regulations may influence market dynamics.

The Offshore Decommissioning Services Market in North America showcases significant regional diversity, driven by varying consumer preferences, technological advancements, and regulatory landscapes across the US, Canada, and Mexico. The US remains the dominant player, offering a robust infrastructure and high demand across sectors such as healthcare, technology, and consumer goods. Canada complements with a focus on innovation and sustainability, while Mexico's manufacturing base plays a crucial role in cost-efficient production.

This market's economic significance lies in its contribution to GDP growth, job creation, and international trade, making it a key driver in both domestic and global economies. Regional strengths combined with market size position North America as a critical hub for the expansion and investment opportunities in the Offshore Decommissioning Services industry.

The key factors driving the growth of the offshore decommissioning services market include an increasing number of aging offshore oil and gas platforms, stringent regulations regarding decommissioning activities, and advancements in decommissioning technologies. The key players in the offshore decommissioning services market include Schlumberger, Baker Hughes, Halliburton, Weatherford International, and Tetra Technologies.

Technological advancements such as robotics, drones, and advanced sensing technologies are enabling more efficient and cost-effective decommissioning activities in the offshore sector. Market trends in the offshore decommissioning services industry, such as regulatory changes, technological advancements, and industry consolidation, can impact business investment decisions by influencing the demand for decommissioning services, the competitive landscape, and the potential for growth and profitability.

The offshore decommissioning services market aligns with environmental and sustainability goals by addressing the safe and efficient retirement of offshore infrastructure, minimising environmental impacts, and promoting the responsible management of decommissioning waste and materials.

Moreover, stakeholders' engagement plays a major role in the offshore decommissioning services market. Stakeholder engagement is essential in the offshore decommissioning services market to address the concerns and interests of various stakeholders, including regulatory bodies, industry players, environmental groups, local communities, and investors, throughout the decommissioning process.

Well services and engineering solutions provider Odfjell Technology has entered into a cooperation agreement with Australian-based R&D Solutions to expand its presence in the Asia Pacific region.

Well services and engineering solutions provider Odfjell Technology has entered into a cooperation agreement with Australian-based R&D Solutions to expand its presence in the Asia Pacific region.

The agreement allows Odfjell Technology to utilise its well intervention services, wellbore clean up and whipstock tools to service the Australian well services and deepwater markets. The company also has future plans for growth in the regional plug and abandonment (P&A) sector.

Paul Toner, Vice President – Middle East & Asia Pacific at Odfjell Technology, said, “Expanding our reputation and relationships into Australia is a critical part of our global growth strategy. With strong localised operations already in place across Southeast Asia, we are confident our new cooperation agreement with R&D Solutions will enable the same excellent level of customer service and delivery for the Australian energy market.”

Doug Gillespie, Director and Managing Partner at R&D Solutions, commented, “R&D Solutions prides itself on the technology and service capabilities it has delivered to market over the years […] we feel Odfjell Technology compliments the spirit of our motto ‘Tomorrow’s Technology Today’, bringing the next level of excellence in quality service and technology to Australia.”

As part of its promise to boost the competitiveness of its upstream sector while pursuing a sustainable future, PETRONAS will continue to prioritise its decommissioning responsibilities, directing its focus to accessing unused assets for potential repurposing.

As part of its promise to boost the competitiveness of its upstream sector while pursuing a sustainable future, PETRONAS will continue to prioritise its decommissioning responsibilities, directing its focus to accessing unused assets for potential repurposing.

The Malaysia-based operator has released its 2025-2027 Activity Outlook report, where it highlights the call to decommission the Sabah-Sarawak Gas Pipeline alongside 37 offshore facilities. PETRONAS’ three-year plan also includes the plugging and abandonment of 153 wells within the region.

The report states, “PETRONAS continues to explore innovative decommissioning solutions focusing on technologies, reuse/repurpose options, integrated multi-year execution approach for economies of scale, as well as identifying potential alternatives that can introduce cost compression. Thus, participation and collaboration are encouraging from all parties.”

PETRONAS’ report noted the importance of decommissioning matured assets in Malaysia’s upstream oil and gas industry as it is “essential to restore the area to a safe and environmentally stable condition.”

With that initiative at the forefront, in December 2024 the operator collaborated with the Department of Fisheries to launch the 10-year Malaysia Master Reefing Plan which outlines the potential for reefing in the region by spotlighting suitable candidates and locations to undergo the ‘rigs-to-reef’ operation: an initiative which stands as a popular decommissioning alternative in the Gulf of Mexico.

Alongside decommissioning, PETRONAS shares its outlook regarding upstream operations. In the short-term, the operator will focus on intensifying exploration activities and expediting appraisal programmes to sustain production and contribute towards Malaysia’s energy security. In the medium- to long-term, PETRONAS will continue to meet production targets and maximise shareholder value while decarbonising the value chain through innovation, technical deployment, and close collaboration with industry partners.

To read the full 2025-2027 Activity Outlook, click here.

Malaysia is set to receive Shelf Drilling’s 1983-built Baltic jack-up rig to kickstart a multi-year plug and abandonment programme

Malaysia is set to receive Shelf Drilling’s 1983-built Baltic jack-up rig to kickstart a multi-year plug and abandonment programme

Last upgraded in 2015, the rig can support up to 120 crewmen, and comes with the Marathon LeTourneau Super 300 design.

It is anticipated that T7 Global has acquired the rig from the Dubai-based provider to facilitate Petronas Carigali’s P&A initiative.

As Petronas continue to invest in innovative well solutions to boost production, the operator also has plans to permanently plug more than 500 wells over the next five years.

Page 1 of 10

Copyright © 2025 Offshore Network