The AGSM AIM Group has invested in a specialised geothermal energy project in Verona, Italy, which will see the construction of geothermal wells capable of providing clean thermal energy to those connected to the district heating network.

The AGSM AIM Group has invested in a specialised geothermal energy project in Verona, Italy, which will see the construction of geothermal wells capable of providing clean thermal energy to those connected to the district heating network.

The project process, which began in December 2023 with the approval by the Board of Directors of AGSM AIM as part of the industrial and economic plan of the ‘Geothermal Project’, will continue over the coming weeks with the establishment of a company to lead the project.

The project will provide geothermal energy to five cogeneration plants in Verona located in Borgo Trento, Forte Procolo, Golosine, City Center and Banks, as well as the Vicenza district heating plants in the future. Utilising geothermal energy is a key part of the objectives and actions envisaged by AGSM AIM’s industrial and strategic plan which places sustainability among the main pillars of growth for the group.

Federico Testa, President of AGSM AIM, said, “Thanks to this important technology our Group confirms that it faces the challenges of the energy sector with a new vocation of values, always directed towards sustainable development and cost containment for citizens and businesses.”

The project aims to bring economic benefits to district heating customers due to the strong reduction of methane gas that will be compensated by geothermal resources. The thermal source is expected to save more than 40% of the gas consumed by the region, thus reducing CO2 emissions by approximately 30,000 tons.

A UK£1mn investment in developing its largest subsea Chopsaw to date has paid off for Decom Engineering (Decom) following impressive results on its first deployment.

A UK£1mn investment in developing its largest subsea Chopsaw to date has paid off for Decom Engineering (Decom) following impressive results on its first deployment.

The C1-46 Chopsaw played a pivotal role in a subsea infrastructure decommissioning project on behalf of DeepOcean in the northern region of the North Sea.

This ambitious project involved the removal of pipelines, control umbilicals, and various subsea structures from the seabed in water depths of up to 180 metres, each requiring precise and efficient cutting.

The Decom team was tasked with cutting a wide range of pipe sizes, from 1,042 mm OD concrete-coated carbon steel pipes to 220 mm OD super duplex pipes. These subsea pipelines needed to be segmented into 9.5 metre sections for efficient recovery to the vessel deck.

Powered from topside and ROV using a Hydraulic Power Unit (HPU), reeler, hot stabs and control panel, the C1-46 exceeded all expectations, proving its worth in the harshest of subsea environments. The smaller C1-24 chopsaw was utilised for certain tasks and also operated with a mix of topside and ROV controls.

The C1-46 averaged 15 cuts before requiring a blade change, significantly reducing the need for recovery to the surface and impressively completed 79 cuts on its first deployment, showcasing a remarkable 100% success rate.

Substantial time savings of almost 300% were achieved compared to using traditional diamond wire saws which typically have longer cut times, carry a risk of wires breaking, and require multiple trips to the surface vessel for blade replacement. Using customised insertable and replaceable tips voided the need for blade changes, reducing costs and increasing efficiency by minimising vessel time.

In contrast, the C1-46 completed some cuts in as little as 20 minutes, while the C1-24 saw excelled in cutting super duplex and flexible risers - materials that traditional shears can’t handle.

Furthermore, Decom’s innovative approach to reducing seabed dredging time by modifying the saw’s clamps reduced dredge time from 3.5 hours to just 30 minutes.

Established in the United Kingdom in 2011, Decom is an R&D specialist focusing on the design and fabrication of cutting solutions and innovative decommissioning equipment, with a growing reputation for providing complex deep water project solutions.

Decom Engineering Managing Director, Sean Conway, said, “The C1-46 Chopsaw is a remarkable piece of subsea engineering which was designed, developed, and deployed in under six months, specifically for this North Sea decommissioning campaign.

“This project underlined our commitment to engineering innovation and underlined our credentials for pushing the limits of what’s achievable in subsea decommissioning. To efficiently cut through a submerged 1,042mm reinforced concrete coated pipe is not without its challenges, but the C1-46 was more than up to this difficult task.

“It’s been a valuable learning experience and the performance of the C1-46 Chopsaw sets the benchmark for going on to roll out our technologies which offer multiple benefits to contractors and operators engaged in complex subsea decommissioning projects.”

The C1-46 Chopsaw has been designed to cut tubulars and other materials up to 46” diameter and is able to cut a wide range of materials, including inconel alloys, duplex and concrete.

It can be operated in water depths of up to 2,000 metres, has the ability to cut in any orientation, and is capable of multiple cuts per blade (20-100), resulting in large cost savings and increased efficiency. Blade changes are efficient and safe and the chopsaw can be supplied set up in a number of configurations and settings to suit project requirements.

Aker Solutions has secured a significant contract for the dismantling and recycling of a platform topside and jacket in the North Sea.

While expressing its excitement and earning the contract with Saipem, Aker noted that the decommissioning market is a growing market and one that is rapidly growing its backlog of orders.

“This award adds to an order backlog that already stretches to 2030, and provides further predictability so that we can continue to develop our facility and execution model, with a strong focus on safe operations and capability to deliver a high degree of recycling,” remarked SVP Decom Thomas Nygård.

Indeed, according to the company, it is knowing how to conduct such operations which won this contract. As per the order, Aker will support the receiving, dismantling, sorting and recycling 19,000 tonnes of topside and a steel jacket weighing 10,000 tonnes. These structures will be delivered mainly as modules by Saipem’s semi-submersible heavy-lift vessel, Saipem 7000 between 2025 and 2027.

Of this, 98% is expected to be recycled, representing a key component of the circular economy.

Serica Energy has provided an organisation and operations update, charting the successful operations it has carried out in the North Sea since September.

The latter half of 2023 has seen Serica successfully carry out the summer shutdowns at both the Bruce and Triton fields. In the former, the shutdown workscope was completed later than planned due to the decision to carry out permanent rather than temporary repairs on the flare tower.

Strong levels of production have been established from both the Bruce and Rhum fields with Serica’s average production entitlement being over 24,000 boe per day during the last four weeks.

Commencing in September, Serica has been conducting its second Light Well Intervention Vessel (LWIV) campaign on the Bruce field. This has involved successfully re-entering three wells to identify areas of scale build-up, perform water shut offs and perforate target intervals. With work on one well still to finish, there has been an uplift in overall production from the re-entered wells of about 2,500 boe per day so far.

Serica has now intervened on five of the subsea wells that form the Western Area Development (WAD) part of the Bruce complex. Since taking over operatorship, Serica has also re-entered fourteen Bruce platform wells. The results have demonstrated the benefits of low cost well interventions and a third LWIV campaign is planned during 2024 which will involve work on both Bruce and Keith wells. The inventory of platform wells on the Bruce field is also being high graded for potential future interventions.

The company is also currently carrying out vessel-based final abandonments of four exploration and appraisal wells on the Keith field and the North Eigg exploration well. This campaign is consistent with the NSTA’s initiative to reduce the number of suspended inactive wells in the UK North Sea. The abandonments are scheduled to be completed in late December 2023.

At Triton, the summer shutdown was completed in September 2023 with the activities carried out including essential fabric maintenance and inspections, a further phase of the control systems upgrade and preparation for the reinstatement of water injection on the Bittern field, which is planned to restart in early 2024. Good production rates are being achieved from all of Serica’s fields in the Triton Area.

During the middle of this year, a rig-based well intervention campaign was carried out on the Guillemot West and North West fields. These were the first such interventions on the fields in over ten years and have resulted in incremental gross daily production of about 1,500 barrels of oil from one well and 12 million cubic feet of gas from another, both of which had been shut-in for lengthy periods.

Mitch Flegg, Chief Executive of Serica, explained, “I am pleased to report the successful conclusion of the planned summer shutdowns on Serica’s Bruce and Triton hubs and the re-establishment of strong levels of production at both. During the last month Serica has been consistently achieving production rates in excess of 50,000 boe per day. Overall production guidance for the year is unchanged reflecting delayed production restarts and slower than expected production ramp-ups after the summer shutdowns.

“I am also pleased to report successful well campaigns on the Bruce and Guillemot fields during 2023. These are further proof of the benefits to be had from low cost, short cycle investments in our existing asset portfolio. The full impact on production of the well work carried out this year is expected to be felt in 2024, aided by the work on the Bruce facilities deferring the need for another major shutdown until 2025.

“The LWIV vessel used on Bruce is already booked for a third campaign in 2024, which will target wells on both the Bruce and Keith fields. We are also looking forward to the start of a four well drilling campaign in the Triton area, with the first well on the Bittern field scheduled to begin around the middle of the first quarter. 2024 is anticipated to be a very busy and impactful year of investments in Serica's North Sea portfolio.”

An enormous congratulations to the OWI Global Awards 2023 winners who were crowned in Aberdeen last week during a night filled with fun, food and festivities, where the offshore well intervention community gathered to cap the year of with a bang!

At the annual celebration, a panel of expert judges acknowledged the very best in global well intervention excellence and were tasked with picking out the best from a competitive field of submissions. However, for going above and beyond, there were some who stood out slightly higher from the crowd and were recognised for their achievements.

The winners for 2023 included:

Intervention Champion of the Year: Expro, for taking the crown after celebrating 40 years of its Subsea Test Tree Assemblies operations, delivering more than 3,000 deployments in subsea Exploration and Appraisal completion and intervention applications, and expanding its capabilities to offer a complete subsea well access portfolio!

Energy Transition Pioneer of the Year: Expro, for pioneering to the top with its 50-year legacy supporting the UK oil and gas industry and, last year, investing more than 50% of its development budget into lowering clients’ carbon emissions!

Best Example of Diversity and Inclusion: TechnipFMC, after being names one of the World’s Top 400 Female-Friendly Companies by Forbes and participating in a full roster of events aimed at supporting inclusion in every form!

Best Example of Subsea Intervention: Welltec, after demonstrating huge success with its ultra-slim e-line intervention tools last year!

Best Example of Platform Intervention: 3M, for its impressive achievement in helping to deliver successful sand control remediation through coil tubing deployment to allow the asset to achieve production goals!

Best Example of Downhole Innovation: DarkVision, claiming the top spot for its HADES downhole inspection platform that provides a comprehensive evaluation of the entire well in 3D in a single pass!

Market Intelligence Platform of the Year: Energy Industries Council, as one of the world’s largest energy trade associations for companies to supply goods and services to energy industries worldwide since 1943!

Best Project Outcome: TechnipFMC, securing the accolade with its successful RWLI campaign in ultra-deepwater Angola which included water shut-off and acid stimulation operations for three wells in just 27 days!

Best Example of Collaboration: WellBarrier – a SLB technology & Equinor. The WellBarrier solution was successfully deployed at scale across Equinor’s organisation in support of replacing manual tasks with digital solutions. This solution is estimated to have engineering effort savings of around 10,000 hours during the first year.

Best Example of Digital Innovation: Evoilve, for the excellent work that has come from Evoilve’s COLLABWELLS Well Integrity Management software which has ushered in a new era of efficiency, collaboration and automation within the oil and gas industry.

Best Example of Well Integrity Innovation: EV, prevailing as champion through its award-winning innovation that is the world’s only integrated array video and phased array ultrasound scanning tool.

Best Example of Decom Innovation: Oceaneering, which took home the crown for designing, building and operating an ROV-based annular access methodology based on multi-string hot tapping to mitigate against annular gas and avoid HSE risk in a wellhead severance campaign for a major operator in Southeast Asia.

OWI Global Awards: Significant Contribution to the Industry: Jørgen Hallundbæk, accepted by Cristian Kruger. After our community bid a sad farewell to an individual who has contributed so much towards its progression, the final iteration of this award was presented to Jørgen Hallundbæk, a worthy winner whose legacy will continue to shine through his formidable work and family and friends. To honour his impact, this year saw the first presentation of the ‘Jørgen Hallundbæk Lifetime Achievement’ award which will continue to honour visionaries within the industry.

Jørgen Hallundbæk Lifetime Achievement: Tom Brighton, claiming the prestigious accolade for his 37 years of service and dedication. With an unrivalled portfolio, Tom Brighton has imparted the best practice methods and increased operation standards to the well discipline across the globe and was a worthy winner of the new award!

Thank you to everyone for attending and we look forward to another year of seeing our network push the boundaries of engineering excellence and driving the wider offshore community forward!

Harbour Energy, the operator of the Viking CCS CO2 transportation and storage network, has announced that the Planning Inspectorate has accepted for examination its application to build the Viking CCS onshore CO2 transportation pipeline in the UK.

The 55 km pipeline will transport captured CO2 from the Immingham industrial area to the former Theddlethorpe Gas Terminal site. From there, it will be sent to the depleted Viking gas fields, located 2.7 km under the seabed for permanent storage.

The pipeline is considered a key component to decarbonise and rejuvenate the industries of the Humber, potentially unlocking UK£7bn of investment across the full CO2 capture, transport and storage value chain over the next decade. The acceptance by the Planning Inspectorate is the next stage in the process to acquiring a Development Consent Order (DCO) for the pipeline and follows a comprehensive programme of consultation and engagement with local communities and stakeholders.

“This is another critical step forward towards delivering our Viking CCS project, which will create thousands of jobs in the Humber region and is targeting 10 million tonnes per annum of CO2 emissions reduction by 2030, vital for the UK to deliver its climate ambitions,” remarked Viking CCS Project Director Graeme Davies.

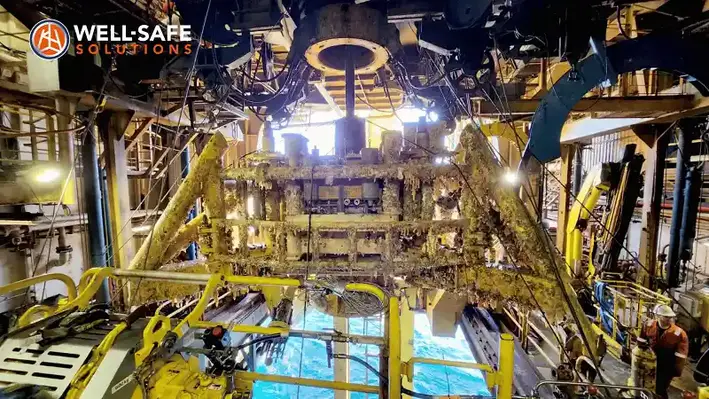

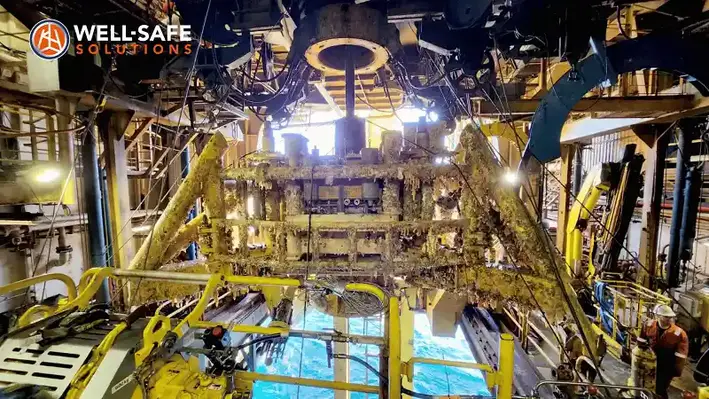

Well-Safe Solutions, a global P&A company, has agreed a global master agreement with bp wherein the decommissioning specialist will provide the operator with project management, well engineering, engineering design and well decommissioning services.

Well-Safe Solutions, a global P&A company, has agreed a global master agreement with bp wherein the decommissioning specialist will provide the operator with project management, well engineering, engineering design and well decommissioning services.

The agreement will last until at least September 2026, with two one-year contract extension options available.

Matt Jenkins, Chief Operating Office at Well-Safe Solutions, said, “Following on from our work with bp decommissioning wells in the North Sea’s Kate field earlier in the year, we are delighted to have been awarded this agreement. This multi-year contract will see us deploy our Well Decommissioning Delivery Process (WDDP), which guides operators through the well plug and abandonment process efficiently and safely.

“Our commitment to safe, smart and efficient decommissioning well enable us to deliver bespoke solutions tailored to bp’s well stock, including the possibility of utilising the Well-Safe Guardian, Well-Safe Protector or Well-Safe Defender plug and abandonment rigs.”

Plexus Holdings PLC, an AIM quoted oil and gas engineering service business, has announced a rental contract award for Exact Adjustable Wellhead and Centric Mudline Suspension Equipment with Neptune Energy UK.

The contract is for Adjustable Surface Wellhead equipment and Mudline Tooling to allow for the permanent abandonment of a UK North Sea well, with operations planned to commence during Q2 2024.

Plexus’ CEO, Ben Van Bilderbeek, commented, “The number of wells that must be permanently plugged and abandoned is fast growing, particularly in mature offshore locations such as the North Sea. We are therefore delighted that Plexus’ reputation is strengthening within this sector, and that our range of customers is broadening.

“Furthermore this contract continues our progress back into Adjustable Wellhead and Mudline equipment market as an expert in this field and ‘go-to’ company for this type of equipment.”

The contract is valued in excess of £175,000 and is an example of the growing rental wellhead market for jackup rigs engaged in plug and abandonment operations.

Aberdeen-based industrial data and engineering consultancy, Imrandd, has reported its most significant six-month growth period.

Aberdeen-based industrial data and engineering consultancy, Imrandd, has reported its most significant six-month growth period.

The firm has secured a record UK£2mn in topsides asset integrity awards with new and existing clients, amplifying its agile data-driven intelligence services further across the UK.

The firm has won 11 contracts indicating a 27% increase in revenue in Q3 of 2023 compared to the same period last year. As a result, 13 data scientists and multi-discipline engineers have been recruited, ramping up its headcount to 63.

Established in 2015, the company specialises in industrial data solutions helping clients in energy and other sectors to make fast and efficient business decisions in line with commercial and ESG strategies.

The new North Sea campaigns include extracting data from six of Ithaca Energy’s offshore installations, a one-year integrity management contract extension with long-term client Dana Petroleum; a 12-month pipework/ vessel risk-based assessment, and technical integrity scope for Harbour Energy; plus assessing the integrity of the Excalibur Floating Production Storage and Offloading facility for first-time client Ping UK, using Imrandd’s unique data gathering and analysis capability in collaboration with digital asset management specialist, GDi Ltd.

Imrandd founder and CEO Innes Auchterlonie, said, “This record period of growth demonstrates the competitive edge our data solutions and expert engineering guidance is delivering. Particularly where there are facilities operating beyond their original life span, companies are seeking fast, optimal answers to harness their assets’ performance safely and sustainably.

“R&D remains core to our strategy, and we continually reinvest 20% of our efforts into evolving the next generation of our propriety AI and digital software services to help our clients stay ahead of the curve. This has ensured we are well positioned to leverage our expertise to safeguard the effectiveness of our clients offshore and onshore assets as they navigate the energy transition.”

A range of Imrandd’s suite of digital solutions will be utilised across the new campaigns. These include EXTRACT, which digitises legacy asset information and EXACT, which maps and predicts engineering, inspection and maintenance activities to deliver actionable insights which have proven to reduce Opex costs.

Amplus Energy, a provider of economically-viable global field development solutions, has marked its entry into carbon capture with a significant investment into Carbon Circle AS of Norway and support the establishment of Carbon Circle UK in Aberdeen, UK.

Amplus Energy General Manager, Steve Gardyne, will lead Carbon Circle UK, supported by a team of carbon capture specialists from Norway. Further senior Carbon Circle UK personnel are currently being recruited.

The company has made the multi-million-pound investment in light of the emerging carbon capture market in the UK and how this is impacting the UK Government’s net-zero ambitions. Carbon Circle UK is currently working on front end engineering and design (FEED) studies for the decarbonisation of two major industrial sites in the UK. These projects will have a positive impact on the UK Government’s net zero ambitions.

Amplus Managing Director, Ian Herd, remarked, “We are excited by this opportunity to participate within the Energy Transition in the UK through bringing our client focused, innovative approach to project delivery coupled with the ‘best-in-class’ domain knowledge and significant EPC experience already assembled within Carbon Circle. The creation of Carbon Circle UK brings a new, innovative Carbon Capture EPC partner into a UK market with huge potential.”

Aslak Hjelde, CEO of Carbon Circle, added, “We are excited by our partnership with Amplus Energy, a collaboration set to enhance the growth and innovation of the carbon capture sector in the UK. The UK Government’s significant commitment of UK£20bn to Carbon Capture and Storage is a testament to the strategic importance of CCS technologies in achieving national net-zero ambitions. With the support and expertise of Amplus Energy, Carbon Circle is ready to be a major contributor in the UK’s carbon capture sector."

Well decommissioning specialist, Well-Safe Solutions, has signed an agreement with Spirit Energy to add a well from the Appleton field to the existing scope of the Well-Safe Defender rig.

Well decommissioning specialist, Well-Safe Solutions, has signed an agreement with Spirit Energy to add a well from the Appleton field to the existing scope of the Well-Safe Defender rig.

This project will add approximately one month of work to the Well-Safe Defender, which mobilised in March 2023 to plug and abandon 14 wells on the UK continental shelf for Spirit Energy.

Chris Hay, Director of Strategy and Commercial at Well-Safe Solutions, said, “From the earliest days of Well-Safe Solutions over six years ago, we have fostered collaborative working throughout the industry to realise safe, smart and efficient well decommissioning operations.

“Spirit Energy’s decision to grant Well-Safe Solutions this contract extension is an endorsement of the excellent performance of the Well-Safe Defender and its crew. We are proud to continue our relationship with Spirit Energy and look forward to continuing our world-class decommissioning operations later this year.”

Head of Wells for Spirit Energy, Nicky Riley, commented, “Well-Safe’s continued strong performance has allowed us to collaborate further with the team - accelerating the decommissioning of the Appleton well, aligning us further with our strategic pillar of meeting and de-risking our decommissioning operations.”

Unity, Europe’s largest provider of well integrity solutions, has launched a new Wellhead Integrity Verification Programme for operators and integrated service providers who are beginning to plan their well abandonment operations.

Unity, Europe’s largest provider of well integrity solutions, has launched a new Wellhead Integrity Verification Programme for operators and integrated service providers who are beginning to plan their well abandonment operations.

The programme contains a package of technical support, products and innovative technologies to deliver an inspection, maintenance, repair and assurance service to verify that the wellhead and Xmas Tree equipment is in good condition and fully prepared for operations.

The integrity verification provides a complete check of the Xmas Tree, wellhead and near-surface well equipment and delivers value by reducing risk, cost, downtime and man hours while improving safety and efficiency. It aligns with the industry’s preparatory ‘Phase 0’ stage of plug and abandonment and is a critical stage intended to prevent the significant costs associated with unplanned downtime due to equipment failure after rig-based operations have commenced.

Unity’s Technical Sales Director, Stuart Slater, commented, “Working closely with operators over the life of their wells and through the decommissioning process, we have seen an escalating need for good integrity planning before embarking on P&A operations. Already attracting a high cost burden, operators are looking to mitigate additional risk, expense and downtime caused by unexpected surface equipment failures.

“Awareness among our clients of the need to include a full wellhead integrity review in their pre-abandonment planning is increasing and we are ideally placed to work in partnership with the wider industry to deliver this specialist service.”

Page 15 of 36

Copyright © 2026 Offshore Network