Global well integrity and production optimisation firm, Coretrax, has created a casing integrity solution for a major North Sea operator which is said to eliminate the need for a casing string to be replaced.

Global well integrity and production optimisation firm, Coretrax, has created a casing integrity solution for a major North Sea operator which is said to eliminate the need for a casing string to be replaced.

The project saw a team of three engineers identify and mobilise the trouble zone, and install a short patch on a casing section of the well affected by corrosion.

To pinpoint the trouble zone, the engineers deployed its CX-RTP (retrievable test packer), a heavy-duty service packer used to set and pressure test a range of depths to identify the area in need of patching.

Following the identification of the trouble zone, the company deployed its ReLine HYD expandable casing patch to isolate the area and regain well integrity without the costs associated with replacing the casting.

Western Hemisphere President at Coretrax, Keith Bradford, said, “Our team of engineers worked collaboratively to identify how we could combine technologies from across our portfolio to effectively meet our client’s objectives. We mobilise products from CORE, our expandable tubular product line, and packers from our AEON line which we use for plug and abandonment solutions.

“The outcome was a great success and allowed our client to not only continue operations with minimal disruption or downtime, but also potentially saved costs on replacing the entire casing string.”

The project was completed in five days.

Argeo Robotics AS, a fully owned subsidiary of Argeo AS which develops robotic and digital solutions for the ocean space, has been granted a patent from the Norwegian Industrial Patent Office for a subsea electromagnetic remote-sensing system.

The company has developed a portfolio of electromagnetic source and receiver systems for Autonomous Underwater Vehicles (AUV), Underwater Intervention Drones (UID) and ROVs. This patent protects Argeo’s exclusive services with the products Argeo Whisper and Argeo Discover.

Argeo Whisper is an AUV and ROV system developed for localising and tracking buried pipelines as well as detecting buried objects in a decommissioning survey. It can also be used for detecting unexploded ordnances.

Argeo Discover is an application or detecting, delineating, and characterising deep sea mineral deposits or other conductive objects below the seafloor utilising an electromagnetic source integrated in an AUV or ROV.

The company has developed an electromagnetic source that is designed to operate down to 6,000 m water depth. This technology enables ultra-high resolution characterisation of minerals that has previously not been possible. With Argeo Discover added to Argeo’s AUV and ROV sensor portfolio, Argeo is in a position to provide effective ultra-high resolution data acquisition for both larger regional and detailed local exploration over large areas with deposits utilising its fleet its AUVs rated to 6,000 m water depth.

Thorbjørn Rekdal, CTO in Argeo, commented, “We are very pleased with the electromagnetic source and sensor technologies that are developed by Argeo Robotics, and protecting our inventions is something we consider of utmost importance.”

The project for Argeo Searcher and both of the SeaRaptors is scheduled to commence directly after completing the vessel conversion project in January 2023 with a duration of 3-4 weeks and an estimated completion in February. The project has good possibility for extension further into Q1 2023.

The company will provide high resolution environmental and potential marine mineral resource assessment in addition to an advanced dual-AUV operation. Argeo will retain show and marketing rights for the data and present the results using its digital visualisation platform, Argeo SCOPE.

The recycling operation of Curlew, an FPSO vessel, has started in Vats, Rogaland, this week, with the 235 m-long ship loaded-in by a float-over and subsequent site move operation.

The vessel will now be cleaned, dismantled and at least 97% of it will be recycled.

This is the first time this type of vessel has been recycled in Norway. The production vessel, Curlew, was operated by Shell UK, and produced oil and gas from the Curlew field in the UK sector in the North Sea. The chosen decommissioning solution known as a float-over-float-in operation has never been used on such a large scale anywhere in the world. The contract was awarded to AF Offshore Decom through competitive tendering, and includes engineering, preparatory work, dismantling and recycling.

Dismantling and recycling of offshore installations and ships is an important part of the green transition. Here, Norwegian industry and engineering expertise have developed solutions that are at the forefront of the industry. This provides tangible evidence of the circular economy given nearly 97% of the ship can be used as raw materials in new production, with steel being used as rebar in new buildings, and all hazardous waste is taken out of the system and disposed of in a responsible manner.

“This is a very complex logistics project with significant marine operations. We are proud that we can carry out such complicated operations in a safe and environmentally sound manner," said Lars Myhre Hjelmeset, Executive Vice President for Offshore in AF Gruppen.

The production vessel Curlew has been in operation in the UK sector of the North Sea and was transported to the facility at AF Environmental Base Vats in Rogaland in 2020. The preparations on the FPSO have been ongoing at AF Environmental Base for some time, and the float-over-float-in-operation was completed this week. Now the ship has been transported ashore in the largest single offloading of a production vessel that has been carried out in this way. The hull is now safely located on the quayside at AF Environmental Base Vats, ready for cleaning, dismantling and final recycling. These activities will start immediately and continue throughout 2023.

“We have considerable experience in recovering offshore installations and floating production vessels is another area where our expertise and approach is both relevant and internationally recognised. Complex operations like this show that Norwegian offshore and engineering expertise helps set the standard for safe and environmentally sound solutions," commented Hjelmeset.

Treating and removing scale build-up within a tubing retrievable subsurface safety valve (TRSSSV) can be problematic, costly, and timely. For scale dissolvers to work effectively, they require extended soak periods to penetrate the scale.

Treating and removing scale build-up within a tubing retrievable subsurface safety valve (TRSSSV) can be problematic, costly, and timely. For scale dissolvers to work effectively, they require extended soak periods to penetrate the scale.

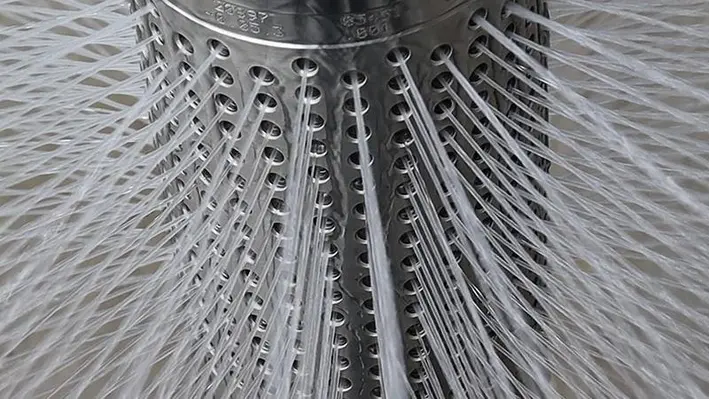

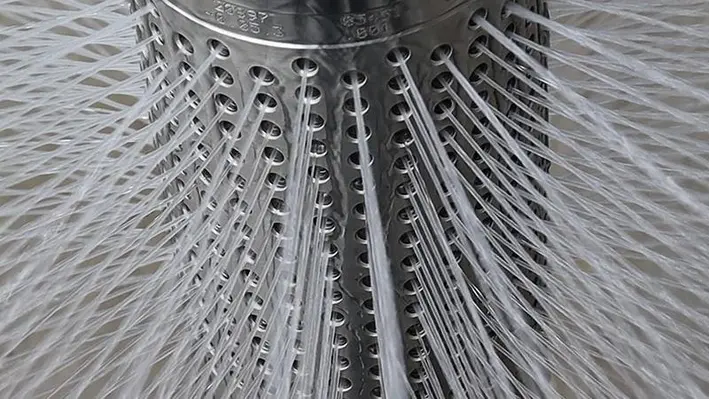

To meet this problem, Oilenco has introduced the Oilenco Bullheading Jetting Sleeve which combines traditional soaking methods with a ‘jetting’ action, targeting scale dissolvers directly at critical components of the downhole safety valve, agitating the scale as well as soaking it?

Combining two tried and tested technologies, the new tool delivers optimum scale treatment results by using a repeated method of scale soak and targeted jetting.

Requiring minimal well intervention, this innovative product is designed to precisely target critical areas within the TRSSSV using a ‘jetting’ action to optimise distribution and efficacy of scale treatment. Designed with a minimum of two jet subs, the system is preconfigured to target key mechanical components within the TRSSSV before being deployed into the well on slickline.

Unique to the Bullheading Jetting Sleeve is the multi jet sub system. Each jet sub consists of an array of micro nozzles that create a 360⁰ jetting pattern. By positioning two or more jet subs at key locations within the safety valve (i.e. flow tube, exercise profile, flapper, etc.), scale dissolver can be precisely targeted at these critical areas.

Between each jet sub there is a flowrate sensing valve that directs fluid to either the upper or lower jet sub depending on the velocity of the fluid passing through it. When pumping stops, the jetting stops. When not jetting, the Bullheading Jetting Sleeve reverts to a conventional soak arrangement allowing the scale dissolver to soak into the scale. As soon as surface pumping is reintroduced, the jet subs become active and intense fluid agitation can recommence.

With constant replenishment of fluid, the system maximises performance of the scale dissolver in the most efficient time frame. Every drop of dissolver can be targeted at any critical area of the TRSSSV where scale build up could be affecting the functionality of the valve.

An ideal dual technology solution when scale build-up is identified as the likely cause of a TRSSSV not functioning, the Bullheading Jetting Sleeve (patent pending) is an innovative addition to the Oilenco safety valve management portfolio, re-establishing the integrity of a well and allowing operations to continue.

With an ever-increasing demand and healthy oil price appearing to reach relative stability, much of the oil and gas industry has thrived across 2022, despite the tumultuous geopolitical environment threatening to upset Covid-19 recovery efforts.

As supply from Russia continues to reduce, European countries are preparing to fill the gap by boosting production while balancing their environmental commitments. To help walk this tightrope, there are calls for operators in the North Sea to invest more into offshore well intervention an opportunity which could see it emerge as a cornerstone of the North Sea industry.

With more capital available for spending on such activities and a plethora of shut-ins, experts have highlighted how the industry is also presented with a blank canvas in the North Sea for testing new technologies. The eventual implementation of these could really help tip the balance in the risk versus reward scale and take down a potential barrier preventing future interventions.

While stimulating production is the most pressing concern at this time, increasingly influential regulators are ensuring that the decommissioning wave on the horizon is not removed from gaze. As climate concerns continue to mount and the ageing region advances in its maturity, there is growing pressure for the industry to expand their attention on end of life activity. This is work that will not simply disappear and, with soaring profits rolling in from high demand and healthy oil price, there are calls for operators to take advantage of this boom and get ahead of their liabilities – a trend which could open up the market for companies offering project management, engineering analysis, data collection, downhole tools, etc within this workscope.

Download the full, free-to-read report on these trends and more here.

20 winners have been selected over seven categories for the Net Zero Technology Centre (NZTC) UK£10mn funding competition.

20 winners have been selected over seven categories for the Net Zero Technology Centre (NZTC) UK£10mn funding competition.

The NZTC launched its Open Innovation Programme in March, 2022, aimed at developing tech in the hope of starting initiatives which will reduce offshore emissions, accelerate clean energy production and deliver on the UK’s net zero ambition.

Of the 154 applicants for the first UK£8mn trache, 20 have been selected, the majority of which reside in Scotland, for the second round which will be announced later in the year for the remaining funding.

The competition winners were selected over seven categories: carbon capture, utilisation and storage (CCUS), hydrogen and clean fuels, renewables and energy storage, zero emissions power, venting and flaring, integrity management and last life and decommissioning.

Highlighting some of the winners, Copsys has designed an ‘intelligent digital skin’ paint-based technology which can detect corrosion. Innovatium has designed a Liquid Air Battery which can store excess renewable power and high-density pressurised liquid air, which can further be converted into electrical power. Sulmara Subsea won with an uncrewed drone system which will significantly reduce the size of vessel needed for offshore survey. Enertechnos has created a specialised cable designed to electrify North Sea oil and gas installations, and Heriot-Watt Univeristy has designed a new tool to measure the probability of CO2 leaks from wells.

“There have been some really exciting technologies come through in the programme – each and every one of them has real potential. They went through a robust screening in the indutsy to see how viable they were – and if we could have we would have supported more,” said Head of Emissions at the NTZC, Rebecca Allison.

Each project has at least one industry sponsor and an NTZC project manager.

The North Sea Transition Authority (NSTA), in its latest Wells Insight Report, has recommended a series of measures to bolster oil and gas production in the North Sea.

The North Sea Transition Authority (NSTA), in its latest Wells Insight Report, has recommended a series of measures to bolster oil and gas production in the North Sea.

The report found that drilling activity had remained low in 2021 due to the impact of Covid-19 with drilling operations falling from 141 wells in 2019 to 66 in 2020. It added that, as a result of this production totalled 480 million barrels in 2021 which was down from 600 million in 2019.

The NSTA report suggested that drilling will most likely pick up in the medium term, spurred by the 33rd offshore oil and gas licensing round (the first since 2019).

However, a pivotal component of bringing production rates back up is the implementation of more well interventions – a policy which the NSTA wishes to see more of. It noted that due to a reduction in well maintenance in 2021, the performance of the existing wellstock has further declined, with 34% of total active wells on the UKCS now shut-in or plugged.

Many types of intervention cost just UK£5-10 per barrel, which should make it an attractive option for industry, particularly when oil and gas prices are high.

Disappointingly, the NSTA added, intervention work was carried out on just 15% of wells in 2021, down from 17% in 2020, resulting in the addition of only 36.2 million barrels of production, well below the average of 50 million added in previous years.

Some operators are facing logistical constraints on their platforms and/or with supply chain availability. In addition, subsea well intervention remains stubbornly low, as fewer than 10% of subsea wells are being surveyed and/or receiving maintenance work each year.

To sustain domestic production and bolster the UK’s energy security, the NSTA is actively working with operators on ways to accelerate exploration and development plans and perform more maintenance and intervention work on the existing well stock.

Dana Petroleum has selected leading service provider, Petrofac, to provide well management services for all of its UK North Sea operated assets.

Dana Petroleum has selected leading service provider, Petrofac, to provide well management services for all of its UK North Sea operated assets.

The two-year contract, which will include providing services to both the Triton FPSO (Floating Production Storage and Offloading) and the Western Isles FPSO vessels, continues on the back of an existing five-year relationship between the two companies. Petrofac previously provided outsourced well engineering services to Dana’s 11 operated and 18 non-operated Licenses in the UK North Sea.

The contract includes full life cycle well engineering, from initial concept through detailed design and planning, supporting well construction, intervention, and decommissioning activities. The contract is valued at approximately US$60mn.

“I’m proud of the value we have been delivering to Dana for the last five years, but there is no better validation of our delivery than our customers decision to retain our services. We look forward to supporting their delivery of value for their shareholders through continued safe, reliable and efficient operations,” said Nick Shorten, Chief Operating Officer, Petrofac’s Asset Solutions.

Chief Operating Officer at Dana Petroleum, Andy Duncanson, said, “We are really pleased to award this new contract to Petrofac. Dana is committed to doing all we can to support the supply chain and nurture the specialist skills that are so important for both our business and the wider sector.”

When conventional recovery methods failed to retrieve a flow target left downhole, a North Sea oil and gas operator approached Oilenco to create a bespoke solution to clear the restriction and allow abandonment operations to continue.

The initial project investigation identified several potential challenges:

• Unknown orientation of the flow target

• The flow target had the ability to rotate

• The hanger type needed to be identified

• Recovery was ruled out due to tight tolerances between the seal bores and OD of the flow target.

The concept

Oilenco began a collaboration project with Welltec to create a solution that reduced the restriction caused by the flow target, maximising access to the wellbore, allowing the operator to use industry standard plugging and cutter options.

The proposal was to use a unique ‘offset or eccentric’ milling solution to drill a large hole through the flow target using Welltec milling technology.

A conventional concentric milling approach would have caused the flow target to rotate, however by creating an offset within the milling guide sleeve, the flow target would be prevented from rotating.

The result

Following successful onshore trials and approval by the client, the operation was completed. Using the Oilenco depth indicator tool, a bespoke design for the asset, the client was able to correlate the depth, determine the position of the flow target, and verify the hanger type from one run of the tool.

An offset milling sleeve was then run to stabilise the flow target and protect the seal bores throughout the operation using the results from the depth indicator tool.

Once milling was complete, a flow target conduit protection sleeve was run, allowing the operator safe access through the milled flow target for well entry and exit.

Client support

Following numerous unsuccessful fishing attempts, the client was looking for an optimised solution to solve their novel issue in the most efficient and effective way.

In collaboration with Welltec and the client P&A team, Oilenco supported the project from design, through to manufacture, providing workshop and offshore support to asset personnel helping to ensure a successful operation.

The client provided feedback stating, “The flow target was not wedged in place within the tubing hanger and could move around, so it was a great achievement in milling it and gaining access allowing a successful P&A of the well.

“Our confidence in this solution allowed us to call off the preparation of a costly coil tubing contingency. This operation is seen as a huge success.”

This article was authored by Oilenco. For more information, visit the Oilenco and Welltec websites.

Leading energy services provider, Expro, has successfully completed the plug and abandonment of Ireland’s first indigenous gas wells.

Leading energy services provider, Expro, has successfully completed the plug and abandonment of Ireland’s first indigenous gas wells.

Expro provided the delivery of integrated subsea and well test services over an eight-month period to intervene, plug and abandon subsea wells from a mobile offshore drilling unit located in the Celtic Sea.

The intervention scope utilised Expro’s ELSA (Expro Landing String Assemblies) system, supported by a complete backup system and direct hydraulic topside and subsea controls package.

Achieving more than 3,000 successful operations globally, ELSA is Expro’s industry-leading subsea well access technology, providing clients with a safe and environmentally secure operating system for commissioning and decommissioning subsea wells.

Expro’s Vice President of Subsea Well Access, Graham Cheyne, said, “With ten wells successfully intervened and abandoned one after another in a short timeframe, the reliability of the system was proven with 100% operational uptime and zero NPT, improving the efficiency of Expro and our client’s subsea operations over the extended operational period.

“This project not only enhances our already established subsea well access experience and track record, but it also demonstrates our strong position to deliver value and extraordinary performance in the integrated decommissioning and plug and abandonment market.”

AF Gruppen, a leading contracting and industrial group, has been awarded a contract from TotalEnergies EP Nederland B.V. for the removal and recycling platforms in the Dutch sector of the North Sea.

The contract includes engineering, preparatory works, removal, transportation, recycling and disposal (EPRD) of 10 platforms with a combined weight of 17,000 tons.

AF Gruppen has developed the technology to be able to treat and recycle up to 80% of materials that otherwise would have been sent to a disposal site, pioneering itself as an industry leader in environmental solutions.

The project will start immediately after contract signing and is planned to be completed by the end of 2025. The platforms will be transported to the AF Environment Base Vats for recycling.

Boaty McBoatface, a robot submarine lovingly named through an Internet poll gone awry, is being utilised by the National Oceanography Centre (NOC) to conduct research on end-of-life oil fields off the coast of the Shetland Islands, North Sea.

The robot will be exploring several oil and gas structures in a bid to revolutionise the way marine surveys are conducted and ultimately protect the marine environment while helping the industry transition towards net-zero.

The Autonomous Techniques for infraStructure Ecological Assessment (AT-SEA) project, led by the NOC will trial the concept of using submarines like Boaty for high-tech, low-impact monitoring to pick up any potential environmental impacts at these industrial sites. This may eventually replace the current approach for environmental monitoring for decommissioning that requires dedicated ships and teams of people offshore.

The robots used will gather data on the water, pollutants and currents, as well as taking images of the sea floor. The team will test whether these robotic systems can gather equivalent information to the surveys currently done using ships. In doing so, emissions, risks and the cost of these operations will be significantly reduced in the future, thanks to the automated technology being developed at the NOC.

Project Lead for AT-SEA, Daniel Jones from the National Oceanography Centre, explained, “The overall goal of the project is to improve the environmental protection of the North Sea at a reduced cost and impact to the environment. We aim to demonstrate how this leading robotic technology from the NOC could be used worldwide to support this crucial ocean monitoring.”

There are currently thousands of oil and gas structures in the sea that are approaching the end of their lives – in UK waters alone there are nearly 500. As part of decommissioning, they typically need to be removed and the environment returned to a safe state. To ensure that no harmful effects will occur to the marine environment, decommissioning operations need to be supported by an environmental assessment and subsequent monitoring.

Dr Jones continued, “This technology has the potential to change the way marine surveys are carried out in the future. Autonomous submarines could offer many advantages over current approaches; improving the quality and quantity of environmental information while cutting the cost and environmental impact for a survey ship and its crew. The AT-SEA project will test this concept in UK waters and carry out the first fully autonomous environmental assessment of multiple decommissioning sites.”

As well as the decommissioned sites, the robot will visit a special marine protected area that is known to have natural leaks of gas, to check the robot can reliably detect a leak should one occur in the future.

Page 22 of 36

Copyright © 2026 Offshore Network