ConocoPhillips Skandinavia AS (ConocoPhillips) has awarded Halliburton a significant five-year contract to provide a full range of well stimulation services aimed at boosting well performance and enhancing reservoir productivity. The agreement also includes three optional extension periods, potentially extending the collaboration well beyond the initial term.

As part of the contract, Tidewater’s vessel, North Pomor, will undergo a major transformation into a state-of-the-art stimulation vessel, purpose-built to deliver efficient and effective offshore well stimulation operations in the challenging conditions of the North Sea. The vessel upgrades will feature advanced technology, including Halliburton’s proprietary Octiv digital fracturing services, which are designed to optimise stimulation equipment performance, streamline operations, and improve overall efficiency.

The project represents a key step in Halliburton’s strategy to offer integrated, technology-driven solutions for complex offshore developments. By combining vessel capabilities with cutting-edge digital tools, Halliburton aims to deliver consistent, high-quality stimulation treatments that help operators unlock additional value from existing reservoirs while supporting safe and efficient offshore operations.

According to the company, this latest contract award underscores Halliburton’s market leadership in stimulation services and its ability to tailor solutions to the specific needs of offshore environments. For ConocoPhillips, the partnership is expected to play an important role in maintaining and enhancing production levels in the North Sea, a region where operational efficiency and innovation are essential to long-term energy output.

Mark Dawson, senior vice president, Halliburton Completion and Production division, said, "We are pleased to strengthen our longstanding relationship with ConocoPhillips through this important award. This contract win complements our extensive experience in well stimulation and highlights how we execute globally. The combination of our latest technology and our focus on automation and safety is how we maximise value for our customers."

Well-Safe Solutions has secured a significant multi-year contract with EnQuest.

The scope, expected to generate over US$45 million in revenue, will be carried out using the Well-Safe Defender and involves a minimum of 100 days of operations in 2026 and at least 130 days in 2027. The contract also includes options for additional work between 2028 and 2034, establishing a long-term strategic partnership and securing key supply chain resources in the North Sea well into the next decade.

This contract marks a major milestone for Well-Safe Solutions, reinforcing its position as a leading player in the UK decommissioning sector. It also reflects the company’s strategic shift in the first half of 2025 to offer full well lifecycle services in response to rising demand for integrated, multi-phase campaigns.

Phil Milton, Chief Executive Officer at Well-Safe Solutions, said, “This contract is a testament to the trust our clients place in us and the consistent performance of our teams. It marks a pivotal moment in our journey and sets the tone for the next phase of our growth.”

Despite the challenges facing the sector in 2025, this award represents a significant turning point. The industry is preparing for an anticipated rise in demand from 2026 onwards, at a time when the availability of mobile offshore drilling units (MODUs) has sharply decreased. With only seven semi-submersibles currently in or near the region—many either committed long-term or stacked—market capacity remains tight.

Chris Hay, Chief Commercial Officer at Well-Safe Solutions, added, “This contract award reflects not only Well-Safe’s technical capabilities but also its ability to respond to market needs with agility. We’re proud to support EnQuest in this critical campaign and look forward to delivering a safe and efficient operation.”

The contract award follows successful decommissioning campaigns completed with several other UKCS clients using the Well-Safe Defender and Well-Safe Protector, highlighting Well-Safe’s reputation for operational excellence. Since its mobilisation in April 2023, the Well-Safe Defender has consistently delivered top-quartile performance, with rig uptime exceeding 98%, thanks to the dedication and collaboration of both offshore and onshore teams.

Steve Bowyer, EnQuest’s North Sea Managing Director, commented on the contract, “EnQuest is delighted to have chosen Well-Safe Solutions to support the next phase of our Group decommissioning plans. Having completed the plugging and abandonment of more than 35% of all wells decommissioned across the northern and central North Sea over the past three years, EnQuest is proud to be one of the most prolific decommissioning operators in the North Sea, employing innovative technologies and operating techniques to deliver top-quartile decommissioning performance. Accordingly, we look forward to executing the upcoming activity in a safe and efficient manner, alongside the Well-Safe team.”

Expro has reported robust financial results for Q2 2025, supported by strong operational execution and new technology deployments across key offshore markets, including the North Sea.

Expro has reported robust financial results for Q2 2025, supported by strong operational execution and new technology deployments across key offshore markets, including the North Sea.

The company posted US$423mn in revenue—exceeding its guidance—and delivered an adjusted EBITDA margin of 22%, marking its third consecutive record quarter. Free cash flow reached US$27mn, with adjusted free cash flow at $36 million.

CEO Michael Jardon credited the company’s consistent growth to strategic investment, cost discipline, and global execution, “Our new business wins are a testament to the trust our customers place in Expro and highlight our commitment to safety, service quality, and the delivery of cost-effective, technology-driven solutions throughout the well lifecycle.”

In the UK North Sea, Expro extended a three-year contract worth approximately US$30 million for well intervention, well services, and well testing—continuing a long-standing collaboration with a major operator. The company also achieved an industry first by deploying its Remote Clamp Installation System (RCIS) in the region—successfully running a fully hands-free upper completion, reducing installation time by 50% per clamp. The RCIS, developed with a super major, is already securing follow-on deployments.

These developments are part of a broader international push. In Q2 alone, Expro secured major contracts in Guyana, Mexico, Brazil, Angola, MENA, and Asia Pacific, reinforcing its diverse global footprint and offshore capabilities.

Read the complete story on Expro's official website here

Global energy technology company SLB has been awarded a technologies and services contract for carbon storage site development in the North Sea by the Northern Endurance Partnership (NEP), an incorporated joint venture between bp, Equinor and TotalEnergies

Global energy technology company SLB has been awarded a technologies and services contract for carbon storage site development in the North Sea by the Northern Endurance Partnership (NEP), an incorporated joint venture between bp, Equinor and TotalEnergies

NEP is developing onshore and offshore infrastructure needed to transport CO2 from carbon capture projects across Teesside and the Humber — collectively known as the East Coast Cluster — to secure storage under the North Sea.

SLB will deploy its Sequestri carbon storage solutions portfolio — which includes technologies specifically engineered and qualified for the development of carbon storage sites — to construct six carbon storage wells. The project scope includes drilling, measurement, cementing, fluids, completions, wireline and pumping services.

“Technologies and services tailored for carbon storage will play a critical role in shifting the economics and safeguarding the integrity of carbon storage projects before and after the FID,” said Katherine Rojas, senior vice-president of industrial decarbonisation, SLB. “We are excited to be a part of this groundbreaking CCS project in the UK, leveraging the proven carbon storage technologies in our Sequestri portfolio and our extensive expertise delivering complex CCS projects around the world.”

The NEP infrastructure is crucial to achieving net zero in the UK’s most carbon intensive industrial regions. NEP, via the Endurance saline aquifer and adjacent stores, has access to up to 1 billion metric tons of CO2 storage capacity. The infrastructure will transport and permanently store up to an initial 4 million metric tons of CO2 per year with start-up expected in 2028.

Saipem and Subsea7 have entered into a binding merger agreement to create a global leader in energy services, reaffirming the terms outlined in their February 2025 Memorandum of Understanding.

Both companies provide well upgrades and other services.

The new combined entity, to be called Saipem7, will be headquartered in Milan and listed on both the Milan and Oslo stock exchanges.

With an estimated annual revenue of €21bn, EBITDA exceeding €2bn, and a combined project backlog of €43bn, Saipem7 aims to position itself as a dominant force in offshore energy projects.

The merger brings together two highly complementary businesses, combining their geographic footprints, technologies, fleets and client portfolios.

No single entity will represent more than 15% of the overall backlog, underscoring the diversified nature of the business.

On completion, expected in the second half of 2026, shareholders of Saipem and Subsea7 will each own 50% of the new entity.

Subsea7 shareholders will receive 6.688 new Saipem shares per share held and a €450mn extraordinary dividend prior to closing.

Leadership will reflect a balanced governance structure: Mr Kristian Siem is expected to chair the board, while Mr Alessandro Puliti is set to become CEO. The Offshore Engineering & Construction business will be managed under a separate company, Subsea7 – a Saipem7 company – with Puliti and Subsea7’s John Evans leading as Chairman and CEO respectively.

The deal is backed by major stakeholders Eni, CDP Equity and Siem Industries, who have signed a shareholders’ agreement and committed to vote in favour.

The merger is expected to deliver €300mn in annual synergies, with added benefits to clients through enhanced project scheduling, expanded fleet capabilities, and integrated life-of-field services across oil, gas, and carbon capture.

Serica Energy plc, a UK-based independent upstream oil and gas company with a focus on the North Sea and a production portfolio comprising over 85% gas, has released an operational update reflecting its continued development.

Serica Energy plc, a UK-based independent upstream oil and gas company with a focus on the North Sea and a production portfolio comprising over 85% gas, has released an operational update reflecting its continued development.

Mitch Flegg, Chief Executive Officer of Serica Energy, commented, "I am delighted with the significant progress that Serica has continued to make during 2022. The impact of the substantial investment programmes undertaken in the last three years has seen increased production levels providing responsibly sourced gas to the UK domestic market, protecting security of supply, and reducing the UK’s reliance on imports as part of the transition to a lower carbon future.

Commodity prices have been exceptionally strong during the period with a resulting positive impact on income.

Serica has no debt, limited decommissioning liabilities and with growing cash reserves is well positioned to continue to invest in further projects and other opportunities to add shareholder value. We have just completed a well intervention campaign on Bruce that has boosted net production by over 3,000 boe/d and provides further evidence of the value in Serica’s assets that can be realised through measured and expert operatorship.

Operations have also commenced on the North Eigg exploration well with potential for transformational results, while we are now accelerating further well intervention work on Bruce and Keith following the success of the recently completed campaign.”

Bruce Field light well intervention results

Serica recently completed its inaugural Light Well Intervention Vessel (LWIV) campaign, which concluded safely and without any environmental issues. This campaign aligns with Serica’s strategy to enhance value and extend the operational lifespan of the Bruce facilities.

The first well (Bruce M1) was accessed for the first time since 1998. Following successful scale removal and water shutoff, extensive reperforation and new perforation activities were carried out, leading to a production increase from approximately 400 boe/d to over 1,800 boe/d as of July 2022.

A similar approach was implemented on Bruce M4, where production rose from around 450 boe/d to over 2,400 boe/d. The strong results from both wells surpassed expectations and are expected to positively impact independently assessed reserves. The successful execution of this programme has boosted confidence in the potential of future well interventions.

As capital investment in the Bruce and Keith fields qualifies for investment relief under the UK’s recently introduced Energy Profits Levy, Serica is now fast-tracking additional interventions on other Bruce and Keith wells, both subsea and platform-based.

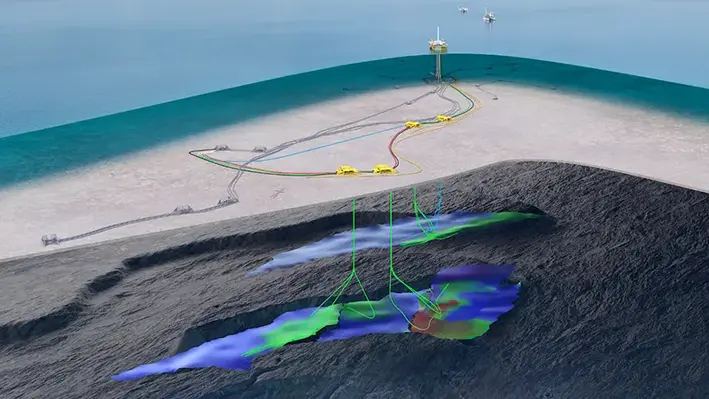

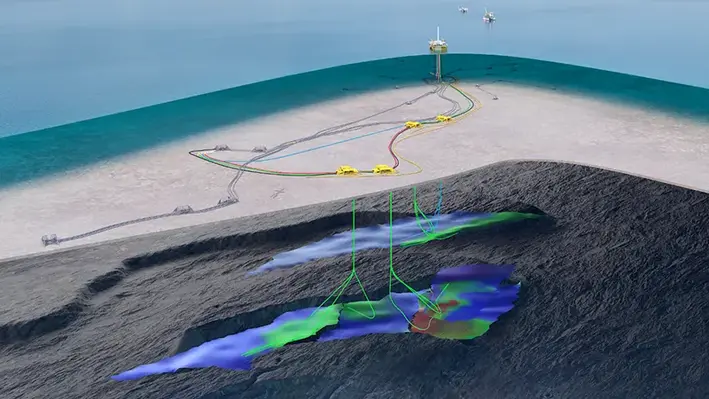

The Fram Sor development project offshore Norway will undergo engineering, procurement, construction and installation (EPCI) work in line with a significant contract signed between the project operator, Equinor, and offshore projects enabler, Subsea7.

The Fram Sor development project offshore Norway will undergo engineering, procurement, construction and installation (EPCI) work in line with a significant contract signed between the project operator, Equinor, and offshore projects enabler, Subsea7.

The EPCI development will comprise the inlaying of 53 kms of production, gas lift and water injection lines that will make up the vast body of subsea structures and flowlines. Alongside, the technical development will also include the installation of an umbilical system to support the front-end engineering and design in terms of an earlier contract reached in January.

The assembling activities to advance engineering and project management will be initiated from the company's Norway and United Kingdom bases before offshore installation work begins from 2026-2028.

The Fram Sor region sits 10-30 kms north of the Equinor-operated Troll C platform, which lies 70 kms north-west of Bergen. There are plans to connect the project to the existing Fram and Troll C infrastructure.

Erik Femsteinevik, Vice President for Subsea 7 Norway, said, “This award continues our long-standing collaboration with Equinor. The FEED study enabled Subsea7 to engage early in the field development process, optimising design solutions and contributing to the final investment decision. We look forward to working closely with Equinor to deliver the Fram Sør development safely and efficiently."

Contract is subject to authority approval of Plan for development and operations (PDO).

A new natural gas discovery has been made at the “Pegasus-1” well, located in Block 10 of the Exclusive Economic Zone (EEZ) of the Republic of Cyprus.

The discovery follows the successful completion of drilling operations carried out by the consortium of ExxonMobil Exploration and Production Cyprus (Offshore) Limited, the operator, and QatarEnergy International E&P LLC.

Valaris, a global offshore drilling company that provides services to the energy industry, confirmed the discovery. The “Pegasus-1” well is situated approximately 190 km offshore, southwest of Cyprus. Drilling was conducted by the “Valaris DS-9” drillship, which safely reached a depth of 1,921 metres of water. The well revealed an estimated 350 metres of gas-bearing reservoir.

According to the government of Cyprus, further evaluation will be required in the coming months to assess the results of the discovery and determine the potential of the find.

This marks the second confirmed gas discovery in Block 10 by ExxonMobil and QatarEnergy. The first was the “Glaucus-1” well, announced in February 2019. That was followed by the “Glaucus-2” appraisal well, completed in March 2022, which confirmed the existence of high-quality gas-bearing reservoirs in the area.

Earlier this month, the President of the Republic of Cyprus, Mr Nikos Christodoulides, was briefed on the discovery. Present at the briefing were the Vice President of ExxonMobil, Mr John Ardill; the Minister of Energy, Commerce and Industry of Cyprus, Mr George Papanastasiou; and ExxonMobil Cyprus Country Manager, Mr Varnavas Theodossiou.

Serica Energy plc has confirmed the completion of scheduled maintenance at the Triton Floating Production Storage and Offloading (FPSO) vessel, with the restart of production operations now underway.

Serica Energy plc has confirmed the completion of scheduled maintenance at the Triton Floating Production Storage and Offloading (FPSO) vessel, with the restart of production operations now underway.

The Triton FPSO is operated by South Korea's Dana Petroleum.

Repairs were finalised earlier, and production will begin shortly, ramping up as each field tied back to the FPSO resumes output according to the standard post-maintenance procedure.

A stable production rate is expected to be achieved in July, the company said.

Prior to the shutdown, the Triton FPSO was delivering 25,000 barrels of oil equivalent per day (boepd) net to Serica.

This figure could increase with the addition of two new wells brought online during the downtime.

These include the W7z well on the Guillemot North West field, in which Serica holds a 10% interest, and the EV02 well on the Evelyn field, which is fully owned by Serica.

Both wells were completed on schedule and under budget.

During the shutdown, extensive upgrades and repairs were carried out, including a major overhaul of the inert gas marine system, with more than 100 components replaced or refurbished.

Preparations were also made to accommodate future production from the Belinda field, expected in early 2026.

Additional work included safety-critical maintenance on the firewater system and the replacement of valves and piping throughout the FPSO.

These efforts are expected to significantly enhance the FPSO’s operational performance, with no further planned outages for the remainder of 2025.

Serica Energy is a British independent oil and gas company with a strong presence in the UK Continental Shelf (UKCS).

The company is responsible for around 5% of the UK’s natural gas production, contributing to the country’s energy transition.

Its production portfolio centres around two key hubs: the Bruce, Keith and Rhum fields in the UK Northern North Sea, and a group of operated and non-operated fields tied back to the Triton FPSO.

Serica also operates the Columbus and Orlando fields and holds a non-operated stake in the Erskine field.

A complex wellhead severance project was completed in the Southern North Sea by Mermaid Subsea Services following critical challenges relating to target well removal.

A complex wellhead severance project was completed in the Southern North Sea by Mermaid Subsea Services following critical challenges relating to target well removal.

This was tackled with a dedicated precision subsea tooling and expert project execution to sever and recover the well conductor, with all environmental and regulatory standards considered.

Delivered on schedule and within budget, the Island Valiant-driven campaign turned out successful with close coordination across multiple vendors to ensure seamless and safe operation.

Scott Cormack, Regional Director for Mermaid Subsea Services (UK), said, “This successful wellhead severance marks a major achievement for Mermaid. By overcoming previous challenges, we’ve demonstrated our capability to deliver complex decommissioning scopes safely, efficiently, and in line with regulations.”

This success ads to Mermaid's other effective completion of a scale inhibitor treatment on the Teal P2 well, part of the Anasuria Cluster in the Central North Sea.

Also conducted from the Island Valiant vessel, this time on behalf of Anasuria Operating Company (AOC), the intervention aims to safeguard production flow and well integrity for at least three years.

Recent projects underscore Mermaid’s growing capability in complex subsea work and its strong collaboration with multiple partners.

In addition to plans to introduce Mermaid’s own dive vessel later in 2025, limited availability remains for the Island Valiant, which the company has chartered for a second year.

Decom Engineering has developed an ultra-light Chopsaw which has the ability to transform how contractors approach challenging subsea cutting operations.

Decom Engineering has developed an ultra-light Chopsaw which has the ability to transform how contractors approach challenging subsea cutting operations.

The C1-16UL represents the most significant advancement in Decom’s Chopsaw range, specifically engineered to handle the demanding task of cutting flexible risers and mooring chains under tension.

A standout feature is the chopsaw’s weight characteristics – weighing approximately 270kg in air but only 30kg in sea water. The dramatic weight reduction offers unprecedented manoeuvrability with ROVs while maintaining robust cutting capabilities.

Commercial Director Nick McNally said, “We've fundamentally rewritten the chopsaw rulebook. Where traditional subsea cutting relied on heavier, rigid steel frames, we've created a tool that delivers superior performance while being light enough for smaller ROVs to deploy effectively. This eliminates the need for cranes and enables access to challenging locations previously considered inaccessible."

Following extensive testing and trails, the C1-16UL has been successfully deployed offshore on international projects, leading to Decom investing in three additional units which are currently engaged in cutting and flexible riser cutting operations.

McNally added, “Close collaboration with our clients has enabled us to deliver a tool that cuts large mooring chain in a matter of minutes, where previously these operations could take hours per cut using other methods. The efficiency gains and cost savings are transformational for our clients' subsea operations."

“The versatility of the C1-16UL allows for cuts to be made in any orientation, providing unprecedented flexibility in various operational scenarios. This adaptability, combined with its lightweight design, opens up entirely new possibilities for subsea intervention work.

“We identified significant knowledge gaps that couldn't be bridged by existing adaptations of conventional technology. The redesign of the cutting frame using subsea aluminium to reduce weight, the reconfiguration of hydraulic drive systems to enhance efficiency, and the integration of buoyancy control systems are hallmarks of Decom’s innovative approach to offering clients optimal cutting solutions.”

Well intervention services are gaining momentum across Europe’s offshore energy sector, with the UK North Sea seeing a series of strategic operations aimed at optimising production, maintaining well integrity, and progressing decommissioning plans.

Well intervention services are gaining momentum across Europe’s offshore energy sector, with the UK North Sea seeing a series of strategic operations aimed at optimising production, maintaining well integrity, and progressing decommissioning plans.

As mature fields approach the end of their productive life, operators are increasingly turning to integrated technologies and service partnerships to extend asset value and support energy transition goals.

Halliburton has secured a five-year contract with Repsol Resources UK to support the full well lifecycle across its platform assets in the North Sea. The scope of work includes the delivery of subsurface technology, drilling and completion services, as well as digital solutions to enable efficient development and production. A key element of the agreement is the introduction of a rigless intervention framework, designed to enhance well construction, boost performance, and streamline plug and abandonment operations.

Timothy Horsfall, Vice President at Halliburton Europe, said the collaboration marks a strategic milestone, highlighting the shared commitment to safely and effectively maximising the potential of North Sea assets. This initiative reflects a broader trend of operators focusing on lifecycle efficiency while preparing for long-term decommissioning in compliance with UK regulatory targets.

Meanwhile, Odfjell Drilling Ltd has completed its scheduled Special Periodic Survey (SPS) for the Deepsea Aberdeen rig, concluding a multi-year SPS programme across its entire owned fleet. The sixth-generation semi-submersible has now returned to operations after three weeks of downtime, with work delivered on time and within budget. In addition to essential maintenance, Odfjell implemented major upgrades across the fleet, including the installation of a new blowout preventer on the Deepsea Atlantic and an increase in variable deck-load capacity on both Deepsea Atlantic and Deepsea Stavanger. These enhancements position the rigs for more efficient drilling, intervention, and decommissioning campaigns in challenging offshore environments.

CEO Kjetil Gjersdal acknowledged the extensive planning and coordination required, noting that with capital expenditure now significantly reduced and no major debt maturities until 2028, the company is well placed for future performance and returns. The Deepsea Aberdeen is currently drilling for Equinor at the Breidablikk field, under an extended contract that runs through 2026 with options into 2029.

Further demonstrating the importance of well intervention, Mermaid Subsea Services (UK) has completed a successful scale inhibitor treatment on the Teal P2 well in the Central North Sea. The project, undertaken for Anasuria Operating Company (AOC), was executed using the Island Valiant vessel and was aimed at preserving flow efficiency and well integrity for up to three years. The well is part of the Anasuria Cluster, a group of tied-back fields connected to a floating production storage and offloading unit. The intervention highlights Mermaid’s growing capabilities in subsea services and its ability to manage complex offshore operations in collaboration with multiple stakeholders. Scott Cormack, Regional Director for Mermaid, praised the outcome, calling it a reflection of the company’s commitment to operational excellence. AOC’s Wells Manager Tom Reeve added that the intervention not only protects long-term production but also strengthens the foundation for future work between the partners.

These developments collectively underscore how well intervention strategies, whether through lifecycle support, asset readiness, or targeted treatments, are shaping the future of offshore energy operations across the region.

Page 5 of 36

Copyright © 2026 Offshore Network