Earlier this month Subsea7 was awarded a sizeable contract by Ithaca Energy for work in the UKCS.

Earlier this month Subsea7 was awarded a sizeable contract by Ithaca Energy for work in the UKCS.

The contract outlines the provision of off-station decommissioning services for the Alba Floating Storage Unit and Greater Stella field FPF-1 production facility, located 230km east of Aberdeen.

The scope includes the flushing of the subsea pipelines, provision of diver support vessel services, and seabed clearance.

Project management and engineering will commence immediately, with offshore activities penned to begin from Q2 2026.

Hani El Kurd, Senior Vice President of UK and Global Inspection, Repair and Maintenance for Subsea7, said, “This award provides an excellent opportunity to further demonstrate the extent of our three decades of full-field proven decommissioning expertise and our capability in delivering complex, safe and effective solutions.

“Subsea7 is proud of its longstanding relationship with Ithaca Energy, which began in 2008, and looks forward to collaborating closely throughout this project to combine our expertise and ensure its successful delivery.”

Vår Energi (OSE: VAR, the Company) has confirmed an oil discovery at the Goliat North exploration well, situated close to the Vår Energi-operated Goliat field in the Barents Sea.

Vår Energi (OSE: VAR, the Company) has confirmed an oil discovery at the Goliat North exploration well, situated close to the Vår Energi-operated Goliat field in the Barents Sea.

The exploration well, located five kilometres north of the Goliat field, encountered hydrocarbons in the Realgrunnen and Kobbe formations. Estimated gross recoverable resources encountered are up to 5 million barrels of oil equivalent (mmboe).

The Goliat North well is an integral part of the Goliat Ridge appraisal drilling programme. Vår Energi and partner Equinor will drill a total of four wells in the Goliat Ridge, with the Zagato side track currently ongoing. Following completion of the appraisal programme, the Company will assess the entire potential of Goliat Ridge utilizing the extensive data acquisition combined with the newly acquired 3D seismic data.

Including the latest discovery, the Goliat Ridge is estimated to contain gross discovered resources of 39 to 108 mmboe, with additional prospective resources taking the total gross potential to up to 200 mmboe. A tie-back of the Goliat Ridge discoveries to the nearby Goliat FPSO is being planned.

The partners in the licence are Vår Energi (operator, 65%) and Equinor (35%).

Frequent delays across offshore energy and infrastructure projects are putting the UK’s underwater supply chain at risk, according to new findings from Global Underwater Hub (GUH), the national trade and industry development body for the sector.

In its Business Survey 2025, almost all respondents (96%) reported that activity in oil and gas, offshore wind and defence is progressing too slowly, while 81% believe developments are failing to move at the pace the country requires.

The report, titled ‘Minding the Gap’, warns that continued slow project delivery may push companies to relocate overseas, with 82% of the sector saying current UK supply-chain capacity does not match demand. Alongside capturing industry sentiment, the annual survey provides insight into market size, growth opportunities and business confidence.

Neil Gordon, GUH CEO, said, “For much of the last year I have warned of the risk of ‘minding the gap’, where oil and gas projects slow and renewables projects are delayed, creating a vacuum of inactivity that threatens the UK’s world-leading underwater supply chain. Our latest business survey shows this is already playing out and, increasingly, there is a real possibility this gap will be filled by fast-moving international projects, drawing away our assets, facilities and skilled personnel. If this is to happen, then a return to the UK will be incredibly unlikely, even when our own projects eventually begin.”

Despite these concerns, the study highlights a modest increase in the size of the UK underwater market, rising from approximately US$11.5bn in 2024 to US$11.75bn in 2025. This growth is driven largely by new project construction across various global markets, reflected in rising export activity. Exports now account for 43% of all revenue generated by UK underwater supply-chain companies, underscoring the sector’s strong international reputation while also presenting a risk of long-term talent and investment drift.

Gordon noted, “Our research shows that companies increasingly view greater prospects internationally than domestically, with shorter timelines, supportive government policy and greater volume. A sea-based supply chain is, by nature, highly mobile and, unless things improve in the UK, then it seems inevitable that companies will consider not just exporting to other regions but relocating there.”

Ahead of the Autumn Budget, the report urges swift action to safeguard the UK’s underwater supply chain and identifies four priorities: accelerating domestic project delivery, improving policy certainty and support, strengthening the skills pipeline and promoting strategic diversification. Together, these recommendations aim to close the energy transition gap, improve supply-chain utilisation and build long-term resilience.

Gordon added, “The UK has a supply chain with the capability and capacity to lead, but confidence in project timelines and policy support is eroding. Major industrial projects take years to mobilise, and we risk repeating past declines that cannot be reversed overnight. This is a pivotal moment. We need a coordinated industrial strategy, targeted investment and a sustainable skills pipeline to keep the UK at the forefront of underwater innovation. Stakeholders must act now to align policy, project flow and investment with the supply chain’s readiness and ambition. The opportunity is clear, but so is the risk.”

With an aim to expand its engineering and procurement services to support operations and decommissioning in the North East, Tattva Group has announced a UK£2mn investment in Project Development International (PDi).

With an aim to expand its engineering and procurement services to support operations and decommissioning in the North East, Tattva Group has announced a UK£2mn investment in Project Development International (PDi).

This will support not only the advancement of PDi’s offerings in subsea engineering and decommissioning but also enhance its wider engineering services in topsides. This allows the company to serve the nation at an apt time, as it navigates policy uncertainty and supply chain volatilities.

Welcoming the move as 'a vote of confidence' for PDi, the company's new CEO, Girish Kabra, said, “Tattva Group’s commitment to PDi — especially amid current policy uncertainty from the UK Government and pressures facing the supply chain – is welcomed, to boost workforce confidence and support the collective regional effort to retain skills in the North Sea.”

“This strategic capital injection of UK£2mn empowers us to expand and elevate our engineering and procurement services, with a sharpened focus on supporting late-life asset management and decommissioning activities. We’re committed to delivering even more flexible and value-added solutions, addressing the evolving needs of the UK energy sector and solidifying PDi’s position as a key partner in the North Sea’s future. This investment means greater capacity, deeper expertise, and a more robust offering to help all our clients and customers navigate their operational and decommissioning challenges efficiently and effectively.”

Explaining the copmpany's strategy behind the move, TR Narayanaswamy, Group Chairman of Tattva, said, “We see a gap in the market where operators are seeking more flexibility and value-added service offerings...With its refreshed management team and focus, PDi is uniquely positioned to meet that need and deliver long term value to clients.”

Norwegian operator Aker BP has received approval from the country’s offshore safety regulator to deploy two of Island Offshore’s mobile offshore units across its operated fields on the Norwegian Continental Shelf.

Norwegian operator Aker BP has received approval from the country’s offshore safety regulator to deploy two of Island Offshore’s mobile offshore units across its operated fields on the Norwegian Continental Shelf.

According to the Norwegian Ocean Industry Authority (Havtil), the consent covers the use of the Island Constructor and Island Wellserver vessels for riserless light well intervention (RLWI) activities on all of Aker BP’s production licences, as mention in Offshore Energy.

The Island Constructor, delivered in 2008 and built to the Ulstein SX 121 design, is a multi-purpose offshore vessel with accommodation for 90 personnel. The unit has been cleared for Norwegian operations since obtaining its Acknowledgement of Compliance (AoC) from the Petroleum Safety Authority in April 2010.

Its sister vessel, the Island Wellserver, also delivered in 2008, is equipped to carry out a wide range of subsea and intervention tasks. These include light well intervention, construction and installation work, well securing, trenching, tower and module handling, plug and abandonment (P&A), crane operations, inspection, maintenance and repair (IMR), supply duties and X-tree installation. The 116-metre vessel remains a core asset for Island Offshore’s well intervention campaigns.

Island Offshore previously secured a two-year extension for Island Wellserver in May 2023 for continued light well intervention work on the NCS, with additional options for further activity. The Island Constructor received a separate consent in 2023 allowing RLWI operations without risers on production licences 359, 338 C and 028 B.

The company is also enhancing its fleet to support future demand. VARD recently marked the keel-laying of Island Offshore’s second hybrid-powered ocean energy construction vessel, underscoring the firm’s ongoing investment in next-generation offshore capabilities.

The offshore drilling industry is entering a period of vigorous growth as operators worldwide accelerate exploration and production to meet rising energy demand, according to The Business Research Company.

Valued at US$33.53bn in 2024, the sector is projected to climb to US$36.28bn in 2025. This reflects a compound annual growth rate of 8.2%.

The expansion follows a decade shaped by strategic discoveries of deepwater reserves, improvements in offshore infrastructure, and increasing global energy consumption. The depletion of easily accessible onshore resources and the availability of specialised offshore expertise have further reinforced activity across major basins.

Looking ahead, the offshore drilling market is forecast to reach US$49.67bn by 2029, maintaining the same growth trajectory of 8.2%.

This forward momentum is driven by renewed investment aimed at strengthening energy security, securing supply chains, and expanding access to capital. Governments and operators alike are also responding to evolving climate regulations and rising expectations around safety, prompting upgrades to equipment and operational standards.

Technological transformation is set to become a defining feature of the forecast period. Operators are expected to increase the use of digital tools, integrate drilling operations into hybrid renewable energy systems, and push further into ultra deepwater territories. Advances in seismic imaging and the adoption of digital twin technology will play a central role in improving accuracy, reducing risk, and optimising asset performance.

A primary force behind the market’s expansion is the steady rise in global consumption of oil and natural gas. These fuels remain vital to heating, power generation, and transport, making them central to energy systems around the world. Economic growth, increasing populations, and the continued shift toward cleaner burning fuels in power and transport sectors are amplifying demand.

Offshore drilling offers the ability to tap large reserves beneath the seabed, thereby ensuring continued supply. Data from the United States Energy Information Administration illustrates this trend. By the end of 2022, proven US crude oil and lease condensate reserves rose by 9% to reach 48.3 billion barrels. Natural gas reserves increased by 10%, climbing to 691 trillion cubic feet. Such figures highlight the sustained appetite for exploration and the vital role offshore assets will continue to play.

Across Europe, leading operators are pursuing competitive advantage through robotics and artificial intelligence. A notable example emerged in 2024 when Schlumberger and Equinor achieved a milestone in autonomous drilling on the Peregrino C platform. Using cloud based applications and AI driven planning tools, the partners succeeded in autonomously drilling 99 per cent of a 2.6 km section. The project demonstrated not only improved efficiency and lower operational costs but also meaningful reductions in carbon emissions.

Asia Pacific remained the world’s largest offshore drilling region in 2024, followed by Western and Eastern Europe, North America, South America, the Middle East, and Africa.

Ocean services provider DeepOcean has been awarded a contract by Equinor to provide various subsea construction and installation activities as part of the Snorre Export and Import Gas Project (SNEIG) for offshore execution in 2026

Ocean services provider DeepOcean has been awarded a contract by Equinor to provide various subsea construction and installation activities as part of the Snorre Export and Import Gas Project (SNEIG) for offshore execution in 2026

The SNEIG project is part of the broader Snorre Expansion Project, which aims to extend the production life of the Snorre oil and gas field – originally discovered in 1979 and operational since 1992 – beyond 2040. The Snorre field is located in the Tampen area of the northern North Sea, in water depths of 300–350 meters.

DeepOcean’s scope of work includes installation of a subsea safety isolation valve (SSIV), a subsea umbilical, and tie-in to the existing pipeline using connectors and associated tooling from the Pipeline Repair and Subsea Intervention (PRSI) pool.

DeepOcean will also provide preparatory subsea construction activities include isolation pig tracking, pipeline coating removal and cutting operations. Suitable crossings for the new umbilical will also be prepared and installed at the field before various mechanical completion and commissioning activities are performed.

“This is a complex subsea project that underlines Equinor’s dedication to responsible resource utilisation through life-of-field extensions. Through our in-depth knowledge of the specialised tooling from the PRSI pool, matched with our highly capable construction vessel fleet, I am confident that our skilled project team will ensure a safe and successful project execution in close cooperation with Equinor,” says Olaf A. Hansen, managing director of DeepOcean’s European operation

The award also includes the provision of onshore engineering, procurement and project management services. DeepOcean will manage the project out of its office in Haugesund, Norway.

Offshore operations will be executed during the summer season of 2026 using a subsea construction vessel from DeepOcean’s chartered fleet.

Last week the industry’s finest gathered in Aberdeen to see who will be crowned this year’s well intervention champions!

Last week the industry’s finest gathered in Aberdeen to see who will be crowned this year’s well intervention champions!

The annual celebration saw a panel of expert judges acknowledge the very best in global well intervention excellence.

This year’s winners included:

A huge congratulations to all the winners and nominees, and a big thank you to everybody who attended! We look forward to another year of seeing this industry push boundaries and drive the wider offshore community into the future.

Archer Limited will be delivering a P&A unit, which is much lighter than usual, for the Fulmar platform in North Sea.

Archer Limited will be delivering a P&A unit, which is much lighter than usual, for the Fulmar platform in North Sea.

The unit will be deployed as part of an additional contract linked to a five-year agreement with Neo Next Energy.

While the P&A unit will be replacing one of Archer’s modular drilling rigs, the expanded scope of the new contract will cover platform drilling, facilities engineering, coil tubing, wireline services, and downhole well service technologies across Neo Next’s offshore portfolio. This portfolio includes integrated drilling and well services for late-life operations and P&A activities for approximately 130 wells, requiring safe and cost-effective project delivery.

Alexander Olsson, EVP Platform Operations Archer, said, “We are very pleased with this contract award as this anchors our strategic focus on late life and P&A operations. This amendment reflects our ability to grow long-term client relationships by delivering value through operational excellence and innovative solutions. Archer’s capabilities to offer lighter, leaner and more cost-efficient P&A units, is a competitive advantage as the demand for cost efficient P&A programmes grow. We are proud to extend our collaboration with NEO NEXT in this area.”

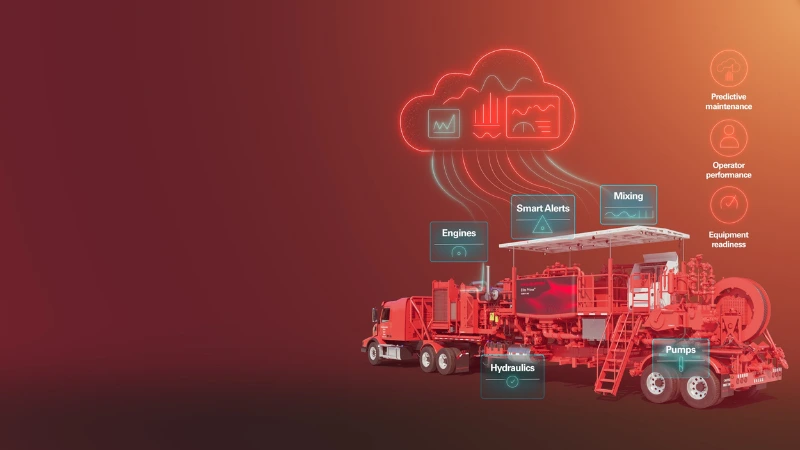

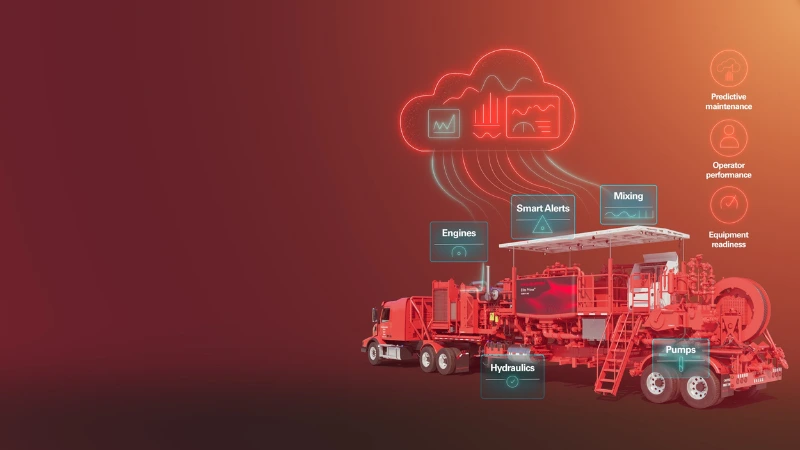

Halliburton has introduced LOGIX unit vitality, expanding its LOGIX automation and remote operations suite. The system provides real-time monitoring of cementing equipment, streamlines preparation for upcoming jobs, and offers direct insight into equipment performance and operation.

Daniel Casale, vice president of Cementing at Halliburton, said, "LOGIX unit vitality delivers unprecedented visibility into equipment health and operator performance. Artificial intelligence (AI) and real-time data transform equipment maintenance from reactive to predictive to help customers gain greater insight into their operations and reduce non-productive time."

The system links key cement unit components to intelligent controllers, tracking more than 400 real-time parameters to maintain optimal performance. Data is securely transmitted to the cloud, where machine learning models process it immediately, providing continuous insights into equipment health, operational readiness, operator performance, and predictive maintenance recommendations.

By combining AI with human expertise, LOGIX unit vitality enables smarter operations, faster responses, and more confident execution. The system supports Halliburton's land-based Elite and Elite Prime cement units, with offshore deployment planned for 2026.

Digital technology is central to Halliburton’s operations, shaping problem-solving and enhancing value for customers. The LOGIX automation and remote operations family delivers analytics and visualisation services that improve reliability, efficiency, and operational consistency, enabling safer operations, smarter decision-making, and lower total cost of ownership.

The energy giant has awarded DOF Group a three-year contract, with optional extensions, for the provision of subsea services in the North Sea.

The energy giant has awarded DOF Group a three-year contract, with optional extensions, for the provision of subsea services in the North Sea.

Under the agreement, DOF will support bp with subsea construction, inspection, repair and maintenance operations. Work is expected to commence in Q1 2026.

Mons S. Aase, DOF Group CEO, said, “We are proud to be awarded a contract with bp for subsea services in the North Sea. This agreement represents a significant step forward for DOF and our UK subsea organisation. We are committed to delivering best-in-class services, with an uncompromising focus on safety and operational performance in the years ahead.”

Preparations are already underway, with DOF providing a comprehensive scope including project management, engineering, logistics, and offshore execution as part of the service.

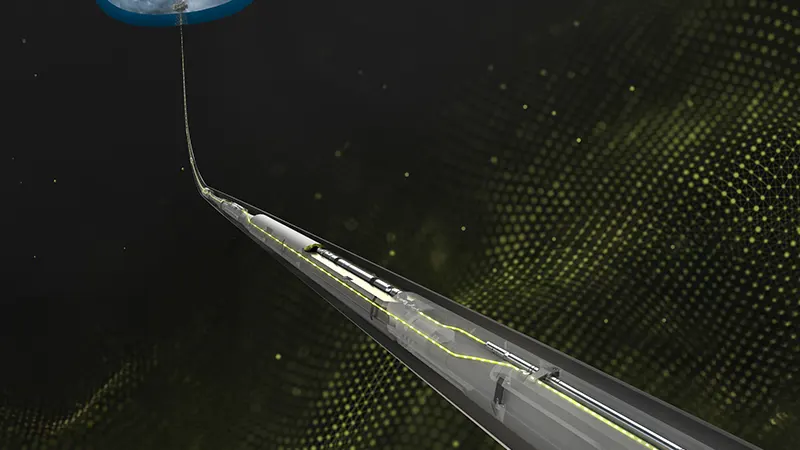

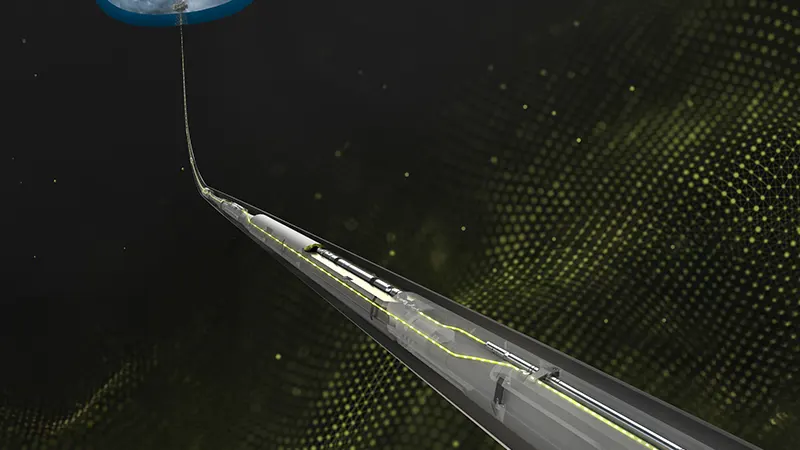

Emerson, in collaboration with Interwell, a global leader in well intervention and integrity solutions, has announced the launch of the Adaptive Gas Lift System (AGLS), the world’s first retrievable electric gas lift system designed to comply with internationally recognised safety and performance standards

Emerson, in collaboration with Interwell, a global leader in well intervention and integrity solutions, has announced the launch of the Adaptive Gas Lift System (AGLS), the world’s first retrievable electric gas lift system designed to comply with internationally recognised safety and performance standards

The AGLS enables continuous optimisation of oil production without requiring costly and intrusive well interventions. Its retrievable design reduces downtime while improving both safety and sustainability in gas lift operations.

Conventional gas lift systems are typically most effective in the early stages of a well’s life, when tubing pressure is high. As reservoir conditions change, drawdown efficiency drops and oil output declines, often resulting in over or under-injection of lift gas. Traditional injection pressure operated (IPO) valves must reduce casing pressure to close, which restricts injection depth and production capacity.

Controlling casing pressure and temperature-related uncertainties in valve behaviour can also cause multi-pointing, where gas is injected at unintended depths, creating inefficiencies and production losses. To address these challenges, operators often resort to costly interventions to alter valve port sizes or injection depths.

The Adaptive Gas Lift System revolutionises gas lift operations by offering real-time remote control of valve port sizes, gas injection rates, injection depths and drawdown, all without halting production. Since valve closure does not depend on reducing casing pressure, operators can achieve deeper injection, resulting in improved lifting efficiency throughout the well’s lifecycle.

With continuous data-based online adjustments, the AGLS removes the need for traditional intervention-based modifications, maximising uptime, production and safety while shortening project payback periods. Its unique retrievable design allows complete valve assembly replacements using standard wireline techniques, avoiding the need for costly workovers.

The system is powered and managed through Emerson’s Roxar Integrated Downhole Network, a permanent monitoring and control platform that delivers real-time data on pressure, temperature and flow for enhanced reservoir management. It also incorporates Interwell’s proven Side Pocket Mandrels and barrier-rated Gas Lift Valve.

AGLS has been designed and qualified to meet the American Petroleum Institute’s API 19G1 (V1), 19G2 (V0), and the Advanced Well Equipment Standards Group’s AWES 3362-36 standards.

By reducing the frequency of well interventions, which typically require heavy equipment mobilisation, energy use and associated emissions, the system lowers the carbon footprint of gas lift operations. Its enhanced production efficiency further decreases CO2 emissions per barrel of oil, supporting more sustainable energy production.

“We designed the AGLS to meet the most rigorous industry standards,” said Jan Inge Ellingsen, vice president and general manager for Roxar products at Emerson’s measurement solutions business. “This innovative technology will help unlock the full potential of assets in the field while eliminating the need for extensive interventions, improving safety, and supporting the transition toward net-zero energy production.”

“The oil and gas industry has long required a more dynamic and resilient approach to electric gas lift,” said Thormod Langballe, chief executive officer of Interwell. “Combining Emerson’s industry-leading digital automation expertise with Interwell’s specialised gas lift technology and know-how, we have developed a robust, real-time controllable gas lift solution that tackles these challenges head-on.”

Page 1 of 36

Copyright © 2026 Offshore Network