Saipem and Subsea7 have entered into a binding merger agreement to create a global leader in energy services, reaffirming the terms outlined in their February 2025 Memorandum of Understanding.

Both companies provide well upgrades and other services.

The new combined entity, to be called Saipem7, will be headquartered in Milan and listed on both the Milan and Oslo stock exchanges.

With an estimated annual revenue of €21bn, EBITDA exceeding €2bn, and a combined project backlog of €43bn, Saipem7 aims to position itself as a dominant force in offshore energy projects.

The merger brings together two highly complementary businesses, combining their geographic footprints, technologies, fleets and client portfolios.

No single entity will represent more than 15% of the overall backlog, underscoring the diversified nature of the business.

On completion, expected in the second half of 2026, shareholders of Saipem and Subsea7 will each own 50% of the new entity.

Subsea7 shareholders will receive 6.688 new Saipem shares per share held and a €450mn extraordinary dividend prior to closing.

Leadership will reflect a balanced governance structure: Mr Kristian Siem is expected to chair the board, while Mr Alessandro Puliti is set to become CEO. The Offshore Engineering & Construction business will be managed under a separate company, Subsea7 – a Saipem7 company – with Puliti and Subsea7’s John Evans leading as Chairman and CEO respectively.

The deal is backed by major stakeholders Eni, CDP Equity and Siem Industries, who have signed a shareholders’ agreement and committed to vote in favour.

The merger is expected to deliver €300mn in annual synergies, with added benefits to clients through enhanced project scheduling, expanded fleet capabilities, and integrated life-of-field services across oil, gas, and carbon capture.

Esso Australia has spent more than US$2.5bn in early decommissioning works in the Bass Strait so far as it dismantles infrastructure in the area — with the Barry Beach Marine terminal as integral to future work as it was in the establishment of the region’s offshore industry decades earlier.

Esso Australia has spent more than US$2.5bn in early decommissioning works in the Bass Strait so far as it dismantles infrastructure in the area — with the Barry Beach Marine terminal as integral to future work as it was in the establishment of the region’s offshore industry decades earlier.

The spend so far includes the permanent plug and abandonment of more than 200 wells, according to Richard Perry, a project manager for the company.

“This work will continue through to 2027, when we will then be ready to decommission by removing the platforms and transporting them to shore for dismantling and recycling,” he wrote in a recent update.

The group’s work in the Bass Strait represents perhaps Australia’s biggest decommissioning project.

The Strait is home to 19 offshore platforms that have produced oil and gas that has played a vital role in powering Australian homes and businesses and supported the nation’s energy security since the late 1960s.

Today, it supplies much-needed gas to south-east Australia from only six of these facilities.

“While ongoing investments will see us maintain our reliable supply of gas from Bass Strait into the 2030s, we are also decommissioning the 13 offshore facilities that are no longer producing oil and gas,” noted Perry.

However, decommissioning an offshore platform is a complex, multi-stage process, he added in a community outreach note.

“It begins with well plug and abandonment, which permanently seals the wells underneath the platform that have provided access to the oil and gas resources below the seafloor. Some of our platforms have up to 37 wells, while others have only a few. We then carry out essential maintenance including cleaning and disconnecting all pipelines from the platform.”

The Pioneering Spirit, the world’s largest construction vessel, will cut, lift and transfer the topsides and jackets from offshore platforms, onto barges for transport to the Barry Beach Marine Terminal, where they will be offloaded for dismantling and recycling.

For nearly 60 years, the terminal has played a central role in supporting Esso Australia’s Bass Strait operations, and will continue to do so as the emphasis shifts to decommissioning.

“The terminal has played a critical role in our safe completion of over US$2.5bn in early decommissioning works, including the permanent plug and abandonment of more than 200 offshore wells,” said Perry.

That incudes the safe recycling and disposal over 10,000 tonnes of steel and concrete at the terminal — around as much as the Eiffel tower weighs.

“As we move into the next phase of decommissioning, the terminal will continue to serve as our primary marine base, supporting both ongoing gas production and the safe, environmentally responsible and efficient removal of offshore infrastructure.”

The Middle East and Africa well intervention market, valued at US$2.4bn in 2024, is projected to reach US$4.6bn by 2034, driven by a 6.4% CAGR, fueled by the region's focus on ageing oilfields and rising energy demands.

These figures, published by Global Market Insights (GMI), also reveal that this growth is evident in recent activities across Saudi Arabia, the UAE, and Egypt, where advanced well intervention techniques are enhancing oil and gas production. According to GMI, the offshore segment in this industry is expected to grow by 7% between 2025 and 2034.

In Saudi Arabia, the well intervention market is expected to reach US$510mn by 2034, propelled by extensive proven oil reserves and a focus on mature fields. In July 2024, Saudi Aramco announced discoveries in the Eastern Province, including two unconventional oil deposits, a light oil reservoir, and multiple gas fields, with the Al-Ladam field’s Ladam-2 well producing 5,100 barrels of very light Arabian oil and 4.9 million standard cubic feet of gas daily. These discoveries necessitate well intervention techniques like hydraulic fracturing and acid stimulation to optimise output from low-pressure wells and shale reserves, addressing the increasing presence of such assets.

In the UAE, ADNOC’s US$1.7bn contract awarded to ADNOC Drilling Company in May 2024 for 144 unconventional oil and gas wells is actively progressing this year. Well intervention services, including coiled tubing and wireline logging, are critical for maintaining well integrity and boosting production efficiency in these unconventional resources, reflecting the region’s shift toward complex geological challenges.

In Egypt, BP Egypt’s discovery of a substantial gas reservoir near its Temsah offshore operations in September 2024 spurred increased well intervention activities by July 2025. Companies deployed advanced logging services to assess reservoir changes and optimise production, driven by rising energy consumption and urbanisation. These efforts align with the region’s growing focus on deep and ultra-deep-sea explorations, where well intervention is essential for sustaining output.

Technological advancements are pivotal. In February 2024, Odfjell Technology opened a 10,000 sq m facility in Saudi Arabia’s Eastern Province, enhancing wellbore maintenance and intervention operations. By June 2025, this facility supported expanded drilling and intervention with new machinery and workforce growth. Strategic partnerships and mergers are also strengthening market positions, with companies investing in R&D for innovative intervention tools tailored to mature fields.

Government initiatives are fostering growth. Policies in Saudi Arabia and the UAE prioritise developing mature fields, with the zonal isolation segment expected to generate significant revenues by 2034. These efforts reflect a regional strategy to meet energy demands while extending the life of existing oil and gas assets through advanced well intervention techniques.

The newly rebranded MENA WELLS 2025 is set to bring together the Middle East and North Africa’s leading well operations professionals on 9–10 September 2025 at the Bab Al Qasr Hotel, Abu Dhabi.

The newly rebranded MENA WELLS 2025 is set to bring together the Middle East and North Africa’s leading well operations professionals on 9–10 September 2025 at the Bab Al Qasr Hotel, Abu Dhabi.

Previously known as OWI MENA, the event has been refreshed to cover the entire well lifecycle — from integrity and intervention to decommissioning and productivity — reflecting the evolving needs of the industry across both onshore and offshore assets.

This year’s agenda is packed with more than 25 expert presentations, 10 live technology demos, and five dedicated networking sessions, offering valuable insight and opportunities to connect. Delegates will also benefit from exclusive access to PDO’s Workover Journey Workshop and the IMCA Regional Meeting, making it one of the most comprehensive well-focused gatherings in the region.

Senior engineers, technical leads, and decision-makers from organisations including ADNOC, Petrobel, PDO, and EGPC will take the stage to share real-world case studies and practical lessons. Topics include advanced well diagnostics, expanding the use of glass plug and steel patch technologies, managing legacy assets, and improving diver safety during subsea decommissioning.

New sessions will also highlight how AI, data analytics, and next-gen materials are reshaping maintenance planning and enhancing long-term well integrity. Whether you’re involved in drilling, completions, production, or abandonment, MENA WELLS 2025 delivers timely, relevant content to help teams boost performance while meeting rising safety and sustainability expectations.

The event is designed to support collaboration and knowledge exchange — from the technology showcase hall to the VIP meeting area, where sponsors, operators, and solution providers can discuss projects and build strategic partnerships in a focused setting.

"It was an amazing conference where we learned about new technologies and some very good presentations on production optimization and plug and abandonment." said Muhammad Farooqn Zubair, Senior Completion and Workover Engineer, ADNOC.

Early bird rates are available until 8 August 2025, so now is the time to secure your place. For full information, download the brochure at https://events.offsnet.com/MENAWells2025#/Brochure

Petrobras operations offshore Brazil at water depths of around 1,500 m saw the deployment of thermoplastic composite pipes by Strohm as part of its first field trials.

Petrobras operations offshore Brazil at water depths of around 1,500 m saw the deployment of thermoplastic composite pipes by Strohm as part of its first field trials.

Conducted last month in the Campos Basin, the testing and engineering assessments have reflected exceptional durability under harsh offshore environment following a smooth installation process in lines with the standard flexible pipe installation vessels which Petrobras' fleet are originally equipped with.

During the trial run, Strohm's TCP followed the exact methodologies that drive conventional flexible pipes, while keeping the Brazilian market in mind.

The pipe has undergone crushing and deep immersion performance (DIP) tests, as well as subsea first and second-end vertical connection tests. As part of the process, the pipe was installed in a catenary configuration in which it was kept for 24 hours to assess its behaviour under normal operational conditions.

The tested TCP is suitable for post-salt wells and the tests results provided valuable learnings that will support the qualification of TCPs for pre-salt applications as well. Since the technology is resistant to stress corrosion cracking caused by CO₂ - one of the major challenges in the area, it shows strong potential as a definitive solution for the pre-salt cluster offshore Brazil

Furthermore, TCP has a significantly smaller carbon footprint compared to conventional flexible pipes due to the materials used and its light weight, leading to lower transportation and installation costs. It can be installed using vessels currently available in the market, and further, due to its light weight, also enables simpler and more cost-effective installation methods to be deployed, such as the subsea pallet.

Renato Bastos, VP Brazil at Strohm, said, “This successful phase marks the culmination of a remarkable collaboration between Petrobras and Strohm throughout the last few months and the field trial results are proof of the innovation and quality that TCP brings to the industry. The technology has the potential to transform the global deepwater market and unlocks a huge potential for us in Brazil.

“This is the first offshore trial for Petrobras to include thermoplastic composite pipes, and it’s a testament to our companies’ longstanding relationship. The success of the field trial paves the way for wider adoption of our technology in the country, keeping us on track to fulfil our commitment to becoming the leading composite pipe supplier to Petrobras, as well as preparing for local production.”

Gustavo Calazans, Subsea Engineering General Manager, added, "This is an important milestone of our Subsea Industrialization Program in which Strohm is a key partner. This result strongly contributes to accelerate the installation of a new plant in Brazil bringing not only technological advances, but also competitiveness, an increase in local content, and cost reduction for Petrobras' projects. As the largest flexible pipe consumer in the world and with a strong demand forecast in the coming years, we welcome Strohm's entry into the Brazilian market with great expectations."

Decommissioning activities can be complex and challenging, and unexpected costs can often arise.

Decommissioning activities can be complex and challenging, and unexpected costs can often arise.

This is illustrated by some of the challenges faced by Woodside, which is currently executing multiple complex decommissioning activities offshore Australia. In its Q2 2025 report it outlines progress in the quarter.

“We successfully completed the plugging of the Minerva and Stybarrow wells. Removal of other equipment at the legacy Minerva, Stybarrow and Griffin assets has been impacted by unexpected challenges, with further engineering and alternative solutions required. Whilst this has had some cost impacts, we are applying learnings to improve planning and execution,” said Woodside CEO Meg O’Neill.

The company successfully completed the plug and abandonment of the three remaining wells at the Minerva field, offshore Victoria, as well as concluding the 10-well Stybarrow plugging campaign. It recovered around 45% of the Minerva pipeline across State and Commonwealth waters. However, activities had to be suspended due to challenges to pipeline recovery and adverse weather conditions, with recommencement depending on vessel availability.

Woodside continued decommissioning activities in the Bass Strait, including the submission of environmental approvals and plugging of 22 wells.

The company is currently evaluating decommissioning work plans for Minerva, Stybarrow and Griffin.

“The as-left condition on some closed sites has continued to present challenges for safe and efficient execution of decommissioning,” the company said, adding that these challenges have pushed up spend and cost estimates.

O’Neill said the company continued to demonstrate operational excellence and world-class project execution over the second quarter, with a focus on driving future growth and value.

On its website, Woodside underlines its commitment to executing decommissioning activities with a focus on safety and the environment, coupled with efficiency. “Decommissioning is integrated into project planning and operations, from the early stages of development through to the end of field life. This includes conducting assessments to inform our planning and decision making, which is underpinned by science and marine research. In the developing regulatory environment, we continue to listen, learn and respond to our stakeholders, while expanding our global decommissioning experience,” the company says.

Woodside’s decommissioning approach recognises the importance of reusing and recycling material from its decommissioning activities where possible. Its waste mitigation hierarchy prioritises reduction, reuse, recycling, and treatment over disposal.

The floating production storage and offloading (FPSO) vessels deployed for a significant deepwater gas development in the Turkish area of the Black Sea will be equipped with titanium stress joints (TSJ) over the next two years

The floating production storage and offloading (FPSO) vessels deployed for a significant deepwater gas development in the Turkish area of the Black Sea will be equipped with titanium stress joints (TSJ) over the next two years

The US$31mn deal has been bagged by precision engineering group, Hunting plc, who will be delivering six TSJs as part of phase three of the major project. These TSJs, which will be arriving from the company's Subsea Spring business unit in Houston, Texas, are backed by patented 'Direct Pull-thru Tube' technology. The TSJs will be used on the second and third vessels serving the project.

Hunting is also serving the phase two development contract that was reached last year, with completion awaited in 2026. The back to back awards have generated US$51.6mn in revenue for the company.

Speaking of the latest contract, Jim Johnson, Chief Executive, said, "Our continued success in the Turkish area of the Black Sea demonstrates the international demand and strength of Hunting's titanium stress joint product offering. This order continues the Group's run of success deploying this product line into key offshore regions including the Black Sea, Guyana, and the Gulf of Mexico.

"Our revenue opportunities have also been expanded with the acquisition of FES in June, which forms part of our 2030 Strategy to target revenue from the longer cycle segment of the industry, which is less impacted by short-term commodity price volatility."

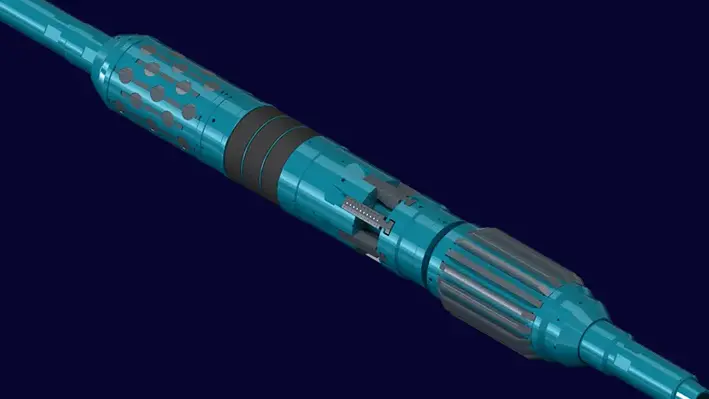

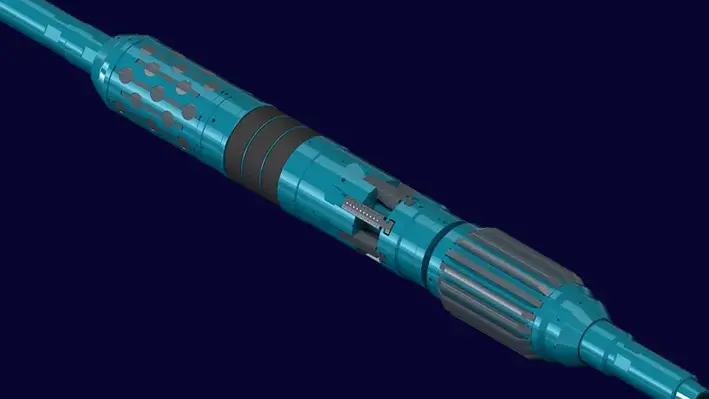

Expro has launched its most advanced BRUTE High-Pressure, High Tensile Packer System to date.

Expro has launched its most advanced BRUTE High-Pressure, High Tensile Packer System to date.

This new system is built to perform in extreme deepwater well conditions, handling the highest differential pressures in the industry. It allows operators to set higher in the wellbore, helping save rig time, reduce operational risks, and meet regulatory requirements more easily.

A key part of this launch is the BRUTE Armor Packer, a major step forward in Expro’s BRUTE range. This system offers unmatched strength and flexibility, with the ability to fully support 20k deepwater projects. When paired with the BRUTE 2 Storm Valve, it forms the most highly rated Storm/Service Packer and Valve combo available in the market, according to the company.

This latest technology was first used in a high-spec 20k deepwater project in the Gulf of America for a major energy company. In April 2025, Expro successfully deployed the 12.25” BRUTE Armor Packer System rated to 12,850 psid. The test confirmed the system's ability to handle extreme downhole pressures, proving its reliability in demanding offshore settings.

Following this success, Expro also introduced a new 20”/22” BRUTE Packer System. This tool was designed to overcome previous challenges faced by retrievable mechanical packers in large casing sizes. Traditional systems often struggle with tight internal diameters in subsea wellhead housings and casing adapters. Expro’s new packer offers double the expansion of standard systems, improving casing isolation for testing, suspension, and squeeze operations—without limiting performance.

In June 2025, the new 20”/22” packer was successfully used in a major offshore campaign in the Gulf of America. It passed through tight wellhead areas and expanded fully in a larger ID section below. The system achieved pressure integrity on the first try, confirming its ability to reduce rig time and risk while improving efficiency.

Jeremy Angelle, Vice President of Well Construction at Expro, said,“This launch sets a new standard for deepwater packers. The BRUTE system offers top-level pressure and tensile performance with unmatched adaptability. It proves Expro is leading the way in supporting the future of 20k offshore developments. We're not just meeting the industry's toughest standards – we're defining them.”

Serica Energy plc, a UK-based independent upstream oil and gas company with a focus on the North Sea and a production portfolio comprising over 85% gas, has released an operational update reflecting its continued development.

Serica Energy plc, a UK-based independent upstream oil and gas company with a focus on the North Sea and a production portfolio comprising over 85% gas, has released an operational update reflecting its continued development.

Mitch Flegg, Chief Executive Officer of Serica Energy, commented, "I am delighted with the significant progress that Serica has continued to make during 2022. The impact of the substantial investment programmes undertaken in the last three years has seen increased production levels providing responsibly sourced gas to the UK domestic market, protecting security of supply, and reducing the UK’s reliance on imports as part of the transition to a lower carbon future.

Commodity prices have been exceptionally strong during the period with a resulting positive impact on income.

Serica has no debt, limited decommissioning liabilities and with growing cash reserves is well positioned to continue to invest in further projects and other opportunities to add shareholder value. We have just completed a well intervention campaign on Bruce that has boosted net production by over 3,000 boe/d and provides further evidence of the value in Serica’s assets that can be realised through measured and expert operatorship.

Operations have also commenced on the North Eigg exploration well with potential for transformational results, while we are now accelerating further well intervention work on Bruce and Keith following the success of the recently completed campaign.”

Bruce Field light well intervention results

Serica recently completed its inaugural Light Well Intervention Vessel (LWIV) campaign, which concluded safely and without any environmental issues. This campaign aligns with Serica’s strategy to enhance value and extend the operational lifespan of the Bruce facilities.

The first well (Bruce M1) was accessed for the first time since 1998. Following successful scale removal and water shutoff, extensive reperforation and new perforation activities were carried out, leading to a production increase from approximately 400 boe/d to over 1,800 boe/d as of July 2022.

A similar approach was implemented on Bruce M4, where production rose from around 450 boe/d to over 2,400 boe/d. The strong results from both wells surpassed expectations and are expected to positively impact independently assessed reserves. The successful execution of this programme has boosted confidence in the potential of future well interventions.

As capital investment in the Bruce and Keith fields qualifies for investment relief under the UK’s recently introduced Energy Profits Levy, Serica is now fast-tracking additional interventions on other Bruce and Keith wells, both subsea and platform-based.

The first of a series of turnkey floating production storage and offloading vessels (FPSO) has been delivered by Seatrium for deployment in Brazil's prolific Buzios field, operated by the country's national oil company, Petrobras

The first of a series of turnkey floating production storage and offloading vessels (FPSO) has been delivered by Seatrium for deployment in Brazil's prolific Buzios field, operated by the country's national oil company, Petrobras

Following an extensive period of integration and commissioning works, the delivery was marked by a sailaway ceremony at the company's Singapore yard as Seatrium celebrated the occasion as a significant and timely milestone. Once it arrives at the Buzios field, the company will conduct the final phase of offshore commissioning works. When it becomes operational, the technically equipped P-78 FPSO will boost national oil production while advancing job creation locally. Driven by an eagerness to promote local content development for Brazil with work-force training and lpong-term skills enhancement, the company has primarily executed its activities in the Brazilian shipyards.

Seatrium has previously delivered FPSOs, floating production units, floating storage regasification units, drilling rigs and accomodation vessels that have contributed to Brazil's vast energy infrastructure while serving Petrobras' projects.

"We take great pride in delivering the first of the series of engineering, procurement and construction (EPC) FPSO to Petrobras. As a leader in providing sustainable offshore energy and infrastructure assets, Seatrium is committed to supporting Petrobras in their efforts to reduce carbon emissions from their floating production units. Our long-standing partnership with Petrobras in their decarbonisation journey spans five other FPSO projects, each showcasing innovative sustainability features. We look forward to building on our strong track record of performance, leveraging our seamless One Seatrium Global Delivery model to continue delivering safe and high-quality vessels that meet the evolving demands of the industry," said Chris Ong, Chief Executive Officer, Seatrium.

Identified as Petrobras 78 (P-78), the vessel will support the development of the world's largest deepwater project that promises a production capacity of 180,000 barrells of oil per day (bopd), 7.2 million cubic metres (mcbm) of gas per day, and a storage capacity of 2 million barrels of oil.

“The FPSO P-78 is more than just the largest and most complex unit ever built for Petrobras — it is a testament to how far we’ve come. This vessel embodies the highest standards of construction and commissioning quality, integrating a wealth of new specifications and hardearned lessons from the Replicantes and Cessão Onerosa FPSO series. In many ways, the P-78 is the culmination of over 15 years of Petrobras’ legacy in building and operating FPSOs in the Pre-Salt region — a legacy now sailing into the future,” said Renata Baruzzi, Executive Officer for Engineering, Technology and Innovation, Petrobras.

While covering projects for Petrobras in Brazil, Seatrium follows their One Seatrium Global Delivery Model, which advances fostering partnerships with industry stakeholders for project delivery across the globe. This has earned the company experiences of fabricating topside modules to the weight of 54,000 mt across its shipyards in Singapore, China and Brazil.

The Department of the Interior has updated its guidelines for states applying to federal programmes specialising in the cleanup of orphaned oil and gas wells.

The Department of the Interior has updated its guidelines for states applying to federal programmes specialising in the cleanup of orphaned oil and gas wells.

The revised guidelines mean two federal grant programmes have been updated: the US£780mn Orphaned Wells State Matching Grant Program and the US$1.93 billion Orphaned Wells State Formula Grant Program.

The revisions eliminate non-statutory requirements and reduces the burdens placed on state grant recipients, including removing the requirement that states conduct pre- and post-plugging methane measurements; recognizing the discretion states have in identifying and plugging orphaned wells; and eliminating the Department’s post-award environmental review and approval process.

Acting Assistant Secretary of Policy, Management and Budget, Tyler Hassen, said, “States know their land and their needs best. By cutting unnecessary barriers, we’re helping them clean up old wells faster, protect communities and support energy development.”

Eva Vrana, Deputy Assistant Secretary for Policy and Environmental Management, commented, “These changes make it easier for states to get to work. States can move more quickly to plug wells and reduce environmental risks.”

The updated guidance supports the Trump’s administration initiatives to prioritise the USA’s energy independence and cut regulations. By giving the states more flexibility and speeding up plugging efforts, DOI is helping to achieve this goal.

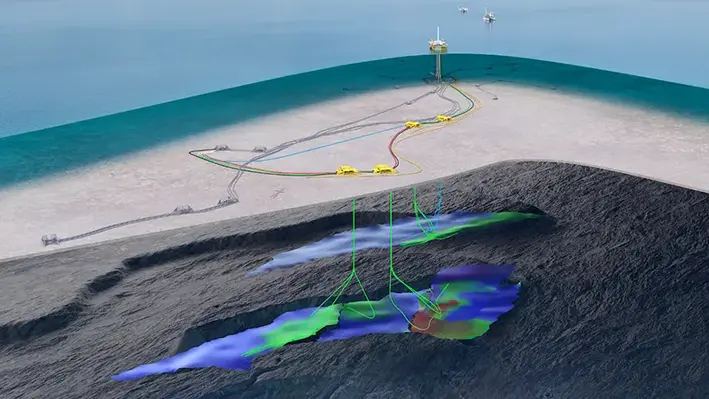

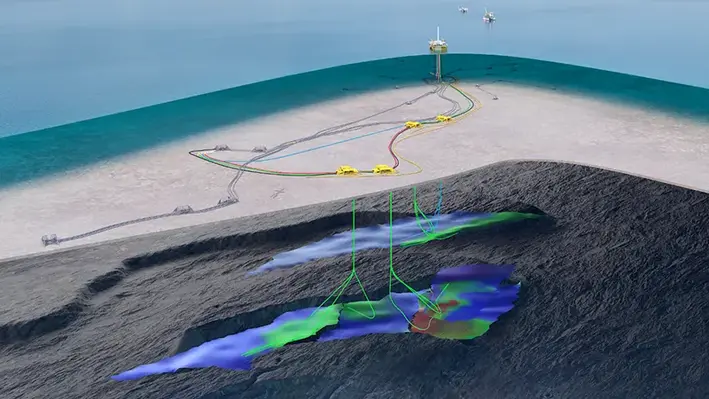

The Fram Sor development project offshore Norway will undergo engineering, procurement, construction and installation (EPCI) work in line with a significant contract signed between the project operator, Equinor, and offshore projects enabler, Subsea7.

The Fram Sor development project offshore Norway will undergo engineering, procurement, construction and installation (EPCI) work in line with a significant contract signed between the project operator, Equinor, and offshore projects enabler, Subsea7.

The EPCI development will comprise the inlaying of 53 kms of production, gas lift and water injection lines that will make up the vast body of subsea structures and flowlines. Alongside, the technical development will also include the installation of an umbilical system to support the front-end engineering and design in terms of an earlier contract reached in January.

The assembling activities to advance engineering and project management will be initiated from the company's Norway and United Kingdom bases before offshore installation work begins from 2026-2028.

The Fram Sor region sits 10-30 kms north of the Equinor-operated Troll C platform, which lies 70 kms north-west of Bergen. There are plans to connect the project to the existing Fram and Troll C infrastructure.

Erik Femsteinevik, Vice President for Subsea 7 Norway, said, “This award continues our long-standing collaboration with Equinor. The FEED study enabled Subsea7 to engage early in the field development process, optimising design solutions and contributing to the final investment decision. We look forward to working closely with Equinor to deliver the Fram Sør development safely and efficiently."

Contract is subject to authority approval of Plan for development and operations (PDO).

Page 24 of 118