Reflecting a rise in confidence in Thailand’s offshore drilling and interventions expertise, as well as its keenness to embrace new technologies, PTT Exploration and Production Public Company Limited (PTTEP) has confirmed that it plans to go ahead with the nation’s first Carbon Capture and Storage Project (CCS) project.

Reflecting a rise in confidence in Thailand’s offshore drilling and interventions expertise, as well as its keenness to embrace new technologies, PTT Exploration and Production Public Company Limited (PTTEP) has confirmed that it plans to go ahead with the nation’s first Carbon Capture and Storage Project (CCS) project.

It has reached a final investment decision (FID) on a US$320mn CCS project at the Arthit gas field, paving the way for the technology to play a role in advancing the country’s net zero goal.

The Arthit oil and gas field is an established producing field located in the Gulf of Thailand.

The CCS project will be designed to capture and store up to one million tonnes of carbon dioxide per year, said Montri Rawanchaikul, PTTEP’s CEO, and turns a “vision” into reality.

“PTTEP strives not only to safeguard the country’s energy security but also to reduce greenhouse gas (GHG) emissions,” said Rawanchaikul.

“CCS is an essential technology, both nationally and globally, complementing other clean energy solutions in addressing climate change.”

It marks a strategic step toward applying the technology to reduce GHG emissions, in line with government policy, which recognises the project under the Nationally Determined Contribution (NDC) Action Plan on Mitigation 2021–2030.

“The Arthit CCS Project will serve as a pilot for cultivating expertise and driving CCS adoption in Thailand, including the Eastern CCS Hub in the Northern Gulf of Thailand, which has potential to make material contribution to the country’s net zero target and enhance the nation’s long-term economic competitiveness” added Rawanchaikul.

CCS is regarded as a reverse process of petroleum exploration and production.As natural gas is extracted from underground to provide energy for national development and everyday life, the excess carbon dioxide is captured and safely injected back into its original subsurface reservoirs.

A huge amount of preliminary work has already gone into the Arthit CCS project, from storage site selection with reservoirs at depths of 1,000–2,000 metres, to engineering design, and comprehensive Measurement, Monitoring and Verification (MMV) programmes.

PTTEP intends to leverage existing infrastructure at the field while constructing and installing additional facilities as required.

It hopes that carbon storage operations will commence in 2028, with capacity gradually ramping up to around 1 million tonnes of carbon dioxide per year.

HELLENiQ Energy has confirmed its participation, in partnership with Chevron, in the Call for Tenders issued by the Ministry of Environment & Energy (FEK 2104/30.04.2025) for hydrocarbon exploration and production rights in four offshore blocks located south of the Peloponnese and south of Crete.

The joint offer was formally submitted on 10 September, in line with tender regulations.

This step marks a significant milestone for HELLENiQ Energy as it builds on its existing exploration and production portfolio in Greece, reinforcing the company’s commitment to supporting the country’s energy ambitions and strengthening its upstream activities.

For Chevron, the participation represents a strategic new entry into the Greek energy market, underscoring the international appeal of Greece’s offshore potential.

The partnership between HELLENiQ Energy and Chevron combines deep technical expertise, operational experience, and financial strength, positioning the consortium as a competitive player in unlocking the hydrocarbon resources of the region.

If awarded, the project is expected to contribute to enhancing domestic energy security, diversifying supply sources, and supporting the wider energy transition goals of Greece and the European Union.

Stavros Papastavrou , Greek Minister of Environment and Energy, said on Wednesday, "Today, the Chevron and HELLENiQ Energy consortium announced its participation in the international competition for the 4 offshore blocks south of Crete and the Peloponnese. Thus, a new chapter opens for the exploitation of the underwater energy wealth of our homeland."

"This is a development of Hope and Perspective for our country. Greece, with national self-confidence, is laying solid foundations for its energy self-sufficiency and capitalising on its geopolitical position in the Eastern Mediterranean. The Government of Kyriakos Mitsotakis is fulfilling its duty to our children and future generations, implementing its commitments for a Greece that is energy secure, investment attractive and geopolitically strong. Starting tomorrow, we are moving forward even more decisively, faster, unlocking our country's potential for progress and prosperity for all Greek women and men."

Well integrity specialist Unity has strengthened its capabilities in the Asia Pacific (APAC) region after securing a new partnership with Clear Cut Interventions (CCI) Australia, a leading provider of well intervention services.

Well integrity specialist Unity has strengthened its capabilities in the Asia Pacific (APAC) region after securing a new partnership with Clear Cut Interventions (CCI) Australia, a leading provider of well intervention services.

The collaboration marks a significant step forward in delivering advanced intervention and well integrity solutions to operators across Australia and also shoring up service and support across the wider APAC region.

“The partnership…reinforces Unity’s long-term commitment to the Asia Pacific region, establishing Perth as its regional hub, and providing a platform for further international growth,” Unity announced in a statement.

“At the same time, it enhances CCI’s already comprehensive suite of end-to-end solutions across the well lifecycle."

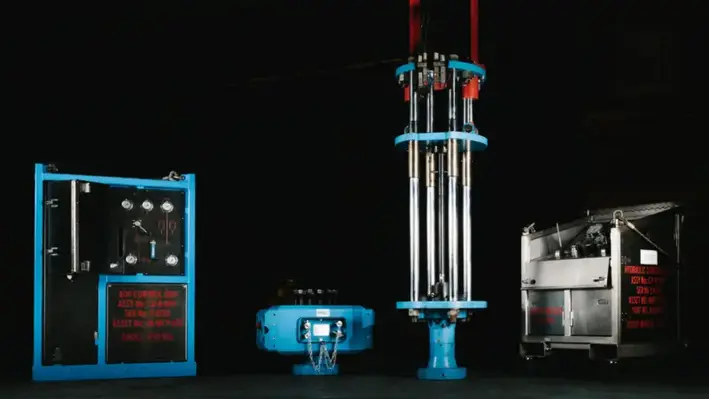

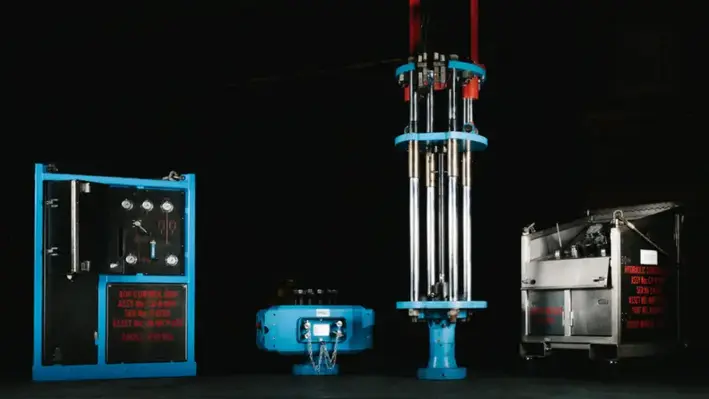

Through this partnership, operators will now benefit from the local deployment of Unity’s proprietary Compact Intervention Suite of Tooling, QV range of Wellhead & Christmas Tree products and Thru Tubing solutions, supported by CCI’s established infrastructure, the company noted.

The collaboration also ensures rapid mobilisation and operational assurance without the need to import support from overseas, it added.

CCI is an Australia-based oilfield services provider specialising in Hydraulic Workover (HWO), slickline/wireline, coiled tubing, and onshore drilling services.

“Together we are creating something unique for local operators: the assurance of world-class technology delivered with the speed, agility, and regulatory confidence of an established Australian partner,” said Stuart Slater, Unity’s Technical Sales Director.

By addressing the offshore realities of limited POB, restricted deck space and crane capacity, the partnership will also ensure operators can execute critical well integrity work with greater efficiency, safety and certainty, the statement added.

Limited POB well intervention refers to performing maintenance or restoration on an oil or gas well, but with a restricted number of personnel on-site, often due to platform limitations, safety concerns, or cost-saving measures.

“POB limits, tight decks and de-rated cranes can turn simple interventions into major logistics exercises,” said Dean McTiffen, Managing Director, CCI.

“With Unity’s compact tooling in-country and CCI’s Western Australian team and infrastructure behind it, we’re giving operators a genuinely end-to-end route to safer, faster interventions that fit the real-world constraints offshore.”

PTTEP Sabah Oil Limited's Block H gas field expansion project will be undergoing engineering, procurement, construction and installation (EPCI) services by McDermott, in line with a significant offshore subsea contract signed between the operator and the engineering firm.

PTTEP Sabah Oil Limited's Block H gas field expansion project will be undergoing engineering, procurement, construction and installation (EPCI) services by McDermott, in line with a significant offshore subsea contract signed between the operator and the engineering firm.

Part of a larger gas support system for the Petronas Floating Liquefied Natural Gas Dua (PFLNG DUA) facility, the EPCI services will be conducted for a carbon steel pipeline, along with transportation and installation of key subsea umbilicals, risers and flowlines (SURF) components.

"This award reflects PTTEP's continued trust in McDermott's expertise to deliver complex subsea infrastructure," said Mahesh Swaminathan, McDermott's Senior Vice President, Subsea and Floating Facilities. "Leveraging our proven subsea engineering and marine construction capabilities, we are well-positioned to build on our strong track record of successful project execution for PTTEP. The expansion of Block H represents a pivotal development in Malaysia's energy landscape, and our work on this project further reinforces McDermott's strategic presence, anchored by our Kuala Lumpur office – our hub for global deepwater project delivery."

Engineering and project management will be led from McDermott's Subsea and Floating Facilities team in Kuala Lumpur, while offshore installation will leverage the company's versatile marine construction fleet.

A cornerstone of Malaysia's deepwater gas strategy, the Block H is located offshore Sabah, covering the Alum, Bemban and Permai deepwater fields. The Block H has expansion plans to increase domestic gas supply, supporting long-term energy security and economic growth.

Tekmar Group, based in the UK, has secured another significant contract in the Middle East, continuing its strong momentum in the region

Tekmar Group, based in the UK, has secured another significant contract in the Middle East, continuing its strong momentum in the region

This new deal, valued at over $10 million, involves the provision of Tekmar's advanced cable protection system, TekDuct, and engineered ballast modules for an offshore energy project in the United Arab Emirates.

The contract is with a leading international engineering, procurement, and construction (EPC) contractor. Under the agreement, Tekmar will design and manufacture its polyurethane cable protection system, with work beginning immediately and final delivery scheduled for the first quarter of 2026.

Richard Turner, CEO of Tekmar Group, said, “We are delighted to partner again with this major customer on a significant energy project. This award reflects our strong presence and track record in the Middle East and underpins our position as a market leader in supporting customers with high-quality engineered asset protection technology."

He added, “This contract is also an important marker as we translate our healthy pipeline to good quality orders and build the platform for sustained growth for 2026 and beyond.”

Earlier this year, Tekmar also announced a contract for the supply of bespoke subsea infrastructure technology for a pipeline project in the Middle East, though the exact location has not been disclosed. In August, the company secured two offshore grouting contracts in Qatar, valued at approximately $1.6 million, to support subsea infrastructure inspection, maintenance, and repair (IMR) campaigns.

To advance the Maromba field development offshore Brazil, BW Energy will refurbish and redeploy the Maromba floating production storage offloading vessel (FPSO).

To advance the Maromba field development offshore Brazil, BW Energy will refurbish and redeploy the Maromba floating production storage offloading vessel (FPSO).

The oil and gas operator, alongside China Export & Credit Insurance Corporation (Sinosure), has successfully completed a US$365mn project finance facility, to fund the vessel utilisation.

The company will also be acquiring the Super Gorilla class jack-up rig BW MAROMBA B rig via a short-term lease with Minsheng Financial Leasing Co.

The project finance facility was significantly oversubscribed and will cover approximately 80% of the total FPSO project cost and is provided by a syndicate comprising The Export-Import Bank of China (CEXIM), Abu Dhabi Commercial Bank PJSC (ADCB), Arab Banking Corporation B.S.C. (Bank ABC), National Bank of Fujairah (NBF), and Commercial Bank of Dubai (CBD). CEXIM, ADCB and Bank ABC acted as Mandated Lead Arrangers, and ADCB and Bank ABC acted as Structuring and Advisory and Documentation Banks. Bank ABC is also acting as Technical Advisory Bank.

The facility has an interest rate of SOFR plus a margin of 2.8%, and is structured as a project finance loan with progressive drawdowns during the construction period followed by a 6.5-year amortisation period after project completion. A commitment fee of 40% of the margin applies to undrawn amounts until completion.

“The closing of this financing marks an important milestone in the Maromba development, demonstrating our ability to secure competitive long-term funding and build strong relationships with a diversified group of new lenders from Middle East and Asia. Furthermore, it reflects our strategy of reusing existing production infrastructure, which not only reduces overall development costs and environmental footprint but also enables access to cost-effective ECA-based financing,” said Brice Morlot, CFO of BW Energy.

Unity has announced a strategic partnership with Clear Cut Interventions Australia, marking a significant step forward in delivering advanced well intervention and integrity solutions across the region.

Unity has announced a strategic partnership with Clear Cut Interventions Australia, marking a significant step forward in delivering advanced well intervention and integrity solutions across the region.

Stuart Slater, Unity’s Technical Sales Director, said, “Australia is a strategic market for Unity, and we are delighted to have the opportunity to partner with CCI. Together, we are creating something unique for local operators: the assurance of world-class technology delivered with the speed, agility and regulatory confidence of an established Australian partner.”

Combining Unity’s advanced technology with CCI’s knowledge of Australia and regulatory expertise, the partnership will offer accelerated access to engineered well integrity and P&A solutions, joint technology transfer programmes, and comprehensive end-to-end project delivering capability from diagnostics through to remediation.

Managing Director of CCI, Dean McTiffen, commented, “POB limits, tight decks and de-rated cranes can turn simple interventions into major logistics exercises. With Unity’s compact tooling in-country and CCI’s Western Australian team and infrastructure behind it, we’re giving operators a genuinely end-to-end route to safer, faster interventions that fit the real-world constraints offshore.”

Through this partnership, operators will benefit from the local deployment of Unity’s Compact Intervention Suite of Tooling, QV range of Wellhead and Christmas Tree products and Thru Tubing solutions.

Expro, a global provider of energy services, has set a new world record by deploying the heaviest casing string ever installed.

Expro, a global provider of energy services, has set a new world record by deploying the heaviest casing string ever installed.

The achievement was made possible through the use of its advanced Blackhawk Gen III Wireless Top Drive Cement Head combined with SKYHOOK technology, during a major project in the Gulf of Mexico for a supermajor operator.

The milestone was reached aboard the Transocean Deepwater Titan, an eighth-generation ultra-deepwater drillship. With a maximum hook load capacity of 2.849 million pounds, the casing string installation surpassed all previous offshore benchmarks in deepwater well construction.

This accomplishment highlights Expro’s commitment to advancing innovation and performance in offshore well construction. The Gen III cement head with SKYHOOK is currently the industry’s only cementing system rated to three million pounds combined, designed to ensure enhanced safety, operational efficiency, and reliability in some of the harshest offshore environments.

The Blackhawk Gen III Top Drive Cement Head is specifically designed for rotating while cementing drill pipe-deployed casing strings or liners. When used with the SKYHOOK Cement Line Make-Up Device, the wireless cement heads improve safety by eliminating the requirement for personnel above the rig floor, while simultaneously boosting operational efficiency.

Engineered to withstand both full pressure and tensile capacity — rated at 15,000 psi and three million pounds respectively — the Gen III cement head was pivotal to the record-setting operation. Unlike other cementing systems that require derating under high-pressure conditions, Expro’s Gen III maintained consistent performance and integrity throughout.

The operator’s campaign is regarded as one of the most technically challenging well construction projects globally. With exceptionally high tensile loads on casing due to deep set points, the operation required a cementing solution engineered for extreme conditions. Expro applied its technical expertise to deliver a custom high-capacity cement head specifically tailored to the demands of the project.

“This deployment marks a step-change in offshore cementing, setting a new standard for ultra deep high pressure targets,” said Jeremy Angelle, Vice President of Well Construction at Expro.

“We are extremely proud to have supported this operator in achieving this critical milestone with a robust, high-performance cement head that delivered safely and reliably under record-setting loads,” Angelle added.

Following a comprehensive wireline programme, acquiring core, fluid and log data for evaluation, Talos Energy has confirmed successful drilling results from the Daenerys exploration prospect located in the US Gulf of America Walker Ridge blocks 106, 107, 150, and 151.

Following a comprehensive wireline programme, acquiring core, fluid and log data for evaluation, Talos Energy has confirmed successful drilling results from the Daenerys exploration prospect located in the US Gulf of America Walker Ridge blocks 106, 107, 150, and 151.

Drilled approximately 12 days ahead of schedule and delivered around US$16mn under budget, the West Vela deepwater drillship reached a total vertical depth of 33,228, encountering oil presence in multiple high-quality, sub-salt Miocene sands.

With the discovery well currently suspended for future use, the company is now planning to take up an appraisal well to further define the discovered resource.

"We are encouraged by the results of our Daenerys discovery well, which confirms the presence of hydrocarbons and validates our geologic and geophysical models. We believe these results support Talos's pre-drill resource assumptions. We are now working closely with our partners to design an appraisal program that will further delineate this exciting discovery. We anticipate spudding the appraisal well in the second quarter of 2026," said Talos President and Chief Executive Officer, Paul Goodfellow.

Talos, as operator, will hold a 27% working interest, Shell Offshore Inc. will hold 22.5%, Red Willow will hold 22.5%, Houston Energy, L.P. will hold 10%, Cathexis will hold 9%, and HEQ II Daenerys, LLC will hold 9%.

HIMA Group, the global safety automation expert, is setting new benchmarks for functional safety in the offshore industry. The company is showcasing its expanded portfolio, which combines decades of expertise with next-generation digitalisation to enhance safety, security, and efficiency across oil and gas, offshore wind, hydrogen, and carbon storage operations.

With Sella Controls and Origo Solutions now part of the HIMA Group, operators and contractors benefit from powerful synergies and a broadened offering that covers the entire safety automation value chain. Together, the group is delivering unmatched consulting, engineering, and project execution expertise across conventional and renewable offshore projects.

At the heart of HIMA’s portfolio is its independent open safety platform, which integrates hardware and software on a single technology base. Certified by TÜV, Lloyd’s Register, Bureau Veritas and DNV, the platform enables functional safety, OT security, and compliance with international standards, while also driving process efficiency and improving plant availability.

Under its #safetygoesdigital strategy, HIMA is accelerating the transition toward digitalised safety lifecycle management. This includes innovative tools like Safety Lifecycle Digitalisation (SLD) Cockpits, which use dashboards and data-driven monitoring to optimise productivity, streamline compliance, and improve safety outcomes.

HIMA Group's solutions are employed all over the world, but especially in the Middle East through the HIMA Middle East division located in Dubai.

The group’s proven solutions extend from high-integrity pressure protection systems (HIPPS) with Planar 4 technology for critical offshore applications, to turbomachinery control solutions with SIL3 compliance and advanced load-sharing capabilities. Origo Solutions’ SCADA+ platform brings flexible control and visualisation across wind, hydrogen, and oil and gas plants, now further enriched by HIMA integration. Meanwhile, FLOWorX® delivers comprehensive pipeline management and leak detection with high sensitivity and real-time monitoring, also suitable for hydrogen applications.

Other highlights include SafeHMI, a new approach to safe plant operations with inherent safety features and digitalised management of change. These developments reflect HIMA’s vision of building a future where digitalisation strengthens safety and resilience across the offshore sector.

By uniting the expertise of HIMA, Sella Controls, and Origo Solutions, the group is shaping the future of functional safety in offshore operations and reinforcing its position as a trusted partner for energy companies navigating both traditional and renewable transitions.

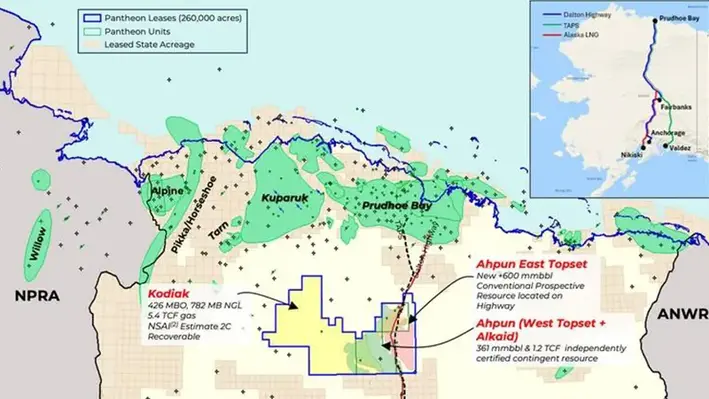

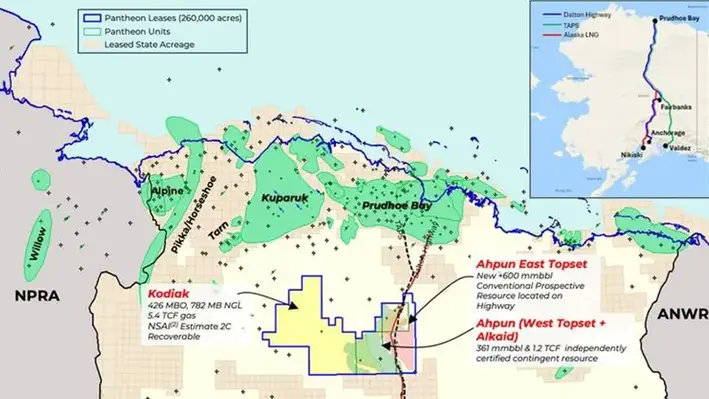

Following the first phase of the Dubhe-1 well programme, Pantheon Resources has successfully drilled, logged and cored the Dubhe-1 pilot hole to a total measured depth of 12,833 ft, equivalent to 8,699 ft true vertical depth.

Following the first phase of the Dubhe-1 well programme, Pantheon Resources has successfully drilled, logged and cored the Dubhe-1 pilot hole to a total measured depth of 12,833 ft, equivalent to 8,699 ft true vertical depth.

A deviated pilot hole had to be tackled to gather cores and logs to select the optimum landing zone for a subsequent lateral sidetrack in the primary SMD-B zone. The well successfully reached the planned true vertical depth and achieved all planned target reservoir penetrations -- both primary and exploration objectives.

The primary target of Dubhe-1 was the topset horizon (SMD-B), appraising the already discovered resource. Additionally, the well was designed to encounter three further exploration horizons (Prince Creek, SMD-C and the Slope Fan System), none of which have previously had any resource estimate attributed to them. Logs confirm additional prospective resource upside in these horizons.

Post analysis of the thickness and quality of the primary target topset, the company has confirmed that the SMD-B has exceeded the upside pre-drill expectations. The gross thickness of the hydrocarbon column in this interval was measured at 565 ft true vertical thickness; exceeding pre-drill expectations by 26%.

Following this, the company plans to drill, and subsequently flow test the planned sidetrack lateral in the SMD-B horizon to refine the production well type curve.

Dubhe-1 has confirmed a gross 565 ft TVT hydrocarbon bearing column in the SMD-B primary target horizon. The hydrocarbon mix between oil, NGLs and gas will be determined after flow testing.

Erich Krumanocker, chief development officer, said, "We are delighted to announce the Dubhe-1 pilot hole results as a success. The well confirms the presence and quality of the oil and gas reservoirs in the Ahpun field, exceeding our pre-drill expectations. We are now transitioning toward field development planning in support of capital efficient commercial production. The upside presented by the SMD-C and Slope Fan zones highlights the enormous potential in our portfolio."

A new collaboration is set to advance Western Australia’s decarbonisation and economic diversification ambitions.

A new collaboration is set to advance Western Australia’s decarbonisation and economic diversification ambitions.

The Centre of Decommissioning Australia (CODA), the University of Western Australia (UWA), and Teesside University’s Net Zero Industry Innovation Centre (NZIIC) are coming together to establish a WA Industry Transformation Hub.

The collaboration brings together expertise from Australia and the UK to support Western Australia’s industrial transition to net zero, aligning with government priorities including decarbonisation and the LNG Jobs Taskforce. It builds on the shared industrial heritage of Teesside and Western Australia and will combine CODA’s extensive Australian and international decommissioning networks, UWA’s track record of supporting Australian industry with applied research, and NZIIC’s strong research base and industrial partnerships in the UK.

Key focus areas include industrial emissions reduction (including CCUS technologies), circular economy and advanced manufacturing; and knowledge exchange and work-integrated learning.

“This hub’s focus advances the WA CCUS Action Plan vision of establishing a world-leading CCUS industry to decarbonise heavy industries while supporting economic diversification. It also supports the Made in WA agenda by building local advanced manufacturing capability and skilled jobs, keeping WA at the forefront of global market shifts through strong industry support and innovation infrastructure,” said Francis Norman, CODA's CEO.

Page 19 of 118