The Bacalhau field in Brazil has seen start-up of production as its operator, Equinor, along with partners ExxonMobil Brasil, Petrogal Brasil (JV Galp|Sinopec) and Pré-sal Petróleo SA (PPSA), achieved exceptional engineering feat.

The Bacalhau field in Brazil has seen start-up of production as its operator, Equinor, along with partners ExxonMobil Brasil, Petrogal Brasil (JV Galp|Sinopec) and Pré-sal Petróleo SA (PPSA), achieved exceptional engineering feat.

“Around 70 million hours of work have been recorded in the project with solid safety results. I would like to sincerely thank our partners, suppliers, and employees for making this achievement a reality. With its size, water depth and lower carbon intensity, Bacalhau is a testament to our engineering capabilities and ability to operate internationally,” said Geir Tungesvik, Executive Vice President, Projects, Drilling and Procurement.

With recoverable reserves surpassing 1 billion barrels of oil equivalent (boe), Bacalhau is the largest international offshore field ever developed by Equinor.

"The safe start-up of Bacalhau marks a major milestone for Equinor. Bacalhau represents a new generation of projects that bring together scale, cost-efficiency and lower carbon intensity. With this development, we are strengthening the longevity of our oil and gas production and securing value creation for decades to come,” says Anders Opedal, President and CEO of Equinor.

Bacalhau is located in the pre-salt region of Brazil's Santos Basin in ultra-deep water exceeding 2,000 metres. The field features one of the most modern floating production storage and offloading vessels (FPSO) in the world, measuring 370 metres in length and 64 metres in width, with a production capacity of 220,000 barrels of oil per day (bpd).

About 19 wells, producers and injectors are set to be brought online in sequence as part of the Phase 1 development of the project ahead of ramp up and production sustenance work.

The Bacalhau FPSO is equipped with advanced carbon-reduction technology in the form of combined-cycle gas turbines (CCGT). With an expected CO₂ intensity of around 9 kg per boe, and advanced abatement across flaring, processing, power generation, and storage, the field sets a new benchmark for cost efficient and lower emission deepwater production.

“Brazil is a core area for us and Bacalhau will be a major contributorto Equinor’s goal of generating more than 5 billion dollars of free cashflow by 2030 from our international portfolio. Bacalhau will also deliver positive ripple effects and long-term benefits to Brazil´s economy, creating approximately 50,000 jobs over its 30-year lifetime,” said Philippe Mathieu, Executive Vice President for Exploration and Production International.

MODEC, the FPSO contractor, will operate the unit for the initial phase. Thereafter, Equinor plans to operate the Bacalhau facilities until end of the license period.

Dubai-based offshore vessel operator Astro Offshore, part of the Adani Group, has reached a major milestone by adding its 50th vessel to the fleet.

Dubai-based offshore vessel operator Astro Offshore, part of the Adani Group, has reached a major milestone by adding its 50th vessel to the fleet.

The company has welcomed the Astro Achernar, an advanced 88-metre DP2 diesel-electric multipurpose support vessel (MPSV), designed to enhance its offshore support and subsea operations.

The newly acquired Astro Achernar comes equipped with accommodation for 222 personnel and a 100-tonne active heave-compensated (AHC) crane, boosting the firm’s capabilities across complex offshore projects.

“This milestone represents more than just a number, it’s a reflection of the trust our clients place in us and the dedication of our team across every level of the organisation,” said Mark Humphreys, CEO of Astro Offshore. “With the addition of Astro Achernar, we continue to strengthen our fleet, expand our capabilities, and position Astro as a trusted partner in delivering safe, efficient, and versatile offshore support.”

The expansion reflects a period of exceptional growth for Astro Offshore, which has doubled its fleet from 25 to 50 vessels in just 12 months. Over the past six weeks alone, the company has added seven new vessels, with the Astro Achernar marking the eighth in this rapid phase of development.

This strategic growth highlights Astro Offshore’s commitment to delivering high-performance solutions and maintaining its reputation as one of the region’s most reliable offshore support providers. With a focus on safety, innovation, and operational excellence, the company continues to strengthen its position in the global offshore market.

As part of Trion project's subsea infrastructure development, Woodside Energy has employed Tenaris for casing and tubing services, alongside line pipe and coatings for bends, flowlines and risers.

As part of Trion project's subsea infrastructure development, Woodside Energy has employed Tenaris for casing and tubing services, alongside line pipe and coatings for bends, flowlines and risers.

Located in the Perdido Fold Belt, approximately 180 kilometers off the Mexican coastline, Trion is a highly anticipated deepwater project from Mexico that is set to generate first oil in 2028, with a nameplate production capacity of 100,000 barrels per day. A greenfield project at a water depth of 2,500 meters, Trion is being developed by Woodside-affiliate, Woodside Petroleo Operaciones de México, S. de R.L. de C.V. (Operator, 60%) and Pemex (40%).

Following its Rig Direct service model, Tenaris will supply 12,000 tons of casing and tubing, including 1,600 tons in the Super 13 Chrome steel grade. For the line pipe portion, the company will deliver approximately 16,000 tons of pipe for flowlines and risers, including the application of TenarisShawcor Marine 5-Layer Syntactic and Solid Polypropylene for flow assurance, and TenarisShawcor Fusion Bonded Epoxy, Three-Layer Polypropylene, and Liquid Epoxy coatings for corrosion protection. Line pipe and coatings will be supplied along with One Line project solutions.

“Trion represents a historic milestone for Mexico’s energy future, and we are proud to be part of it,” said Pablo Gómez, Tenaris Commercial Vice-President in Mexico. “This project underscores the strength of our customer partnerships and our ability to deliver advanced technological solutions for the most demanding offshore environments.”

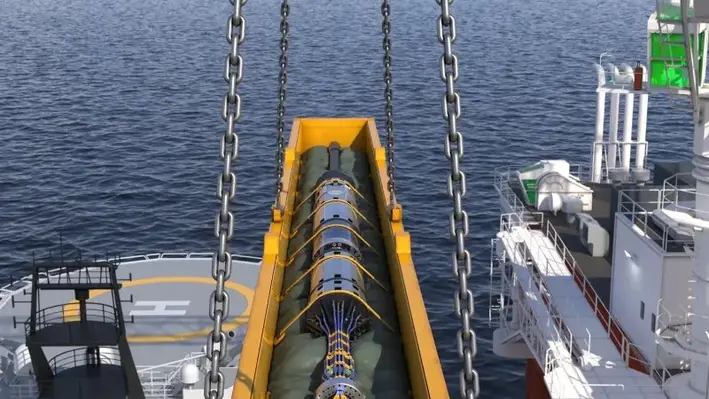

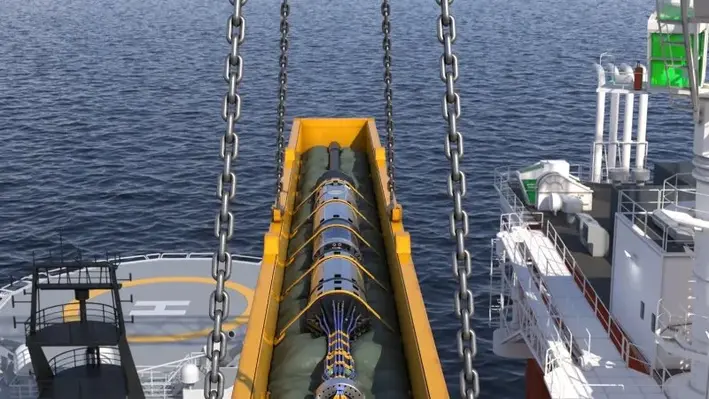

Halliburton has entered into a framework agreement with Shell to deliver umbilical-less tubing hanger installation and retrieval services using its Remote Operated Controls Systems (ROCS) technology

The agreement follows a successful three-well technology phase in the Gulf of Mexico, which demonstrated ROCS's effectiveness in deepwater conditions.

The collaboration marks a significant advancement in deepwater operations. With its speed, precision, and safety benefits, ROCS offers operators a reliable and cost-effective alternative to traditional methods, paving the way for its broader adoption across global rig fleets.

Josh Sears, senior vice president of Halliburton’s Drilling and Evaluation division, explained that ROCS is a compact, umbilical-less control system that replaces conventional hydraulic setups, helping to reduce surface pressure risks and limit personnel exposure. Already deployed in the Norwegian Continental Shelf, West Africa, and the Gulf of Mexico, ROCS recently achieved a milestone with the installation of a tubing hanger at 8,458 ft, setting the record for the deepest umbilical-less operation to date.

Developed by Optime, a Halliburton service, ROCS technology enhances operational efficiency by enabling faster running-in and pulling-out-of-hole procedures compared to conventional systems. It improves downhole line tests and reduces deck operations by up to 75%, ensuring higher safety and productivity during installation.

With its proven performance and measurable results, ROCS is redefining well-completion standards in deepwater environments. As operators increasingly seek smarter and safer ways to complete wells in challenging conditions, ROCS stands out as a proven solution that meets the demands of modern deepwater operations.

Malaysian offshore services provider Vantris Energy, formerly known as Sapura Energy, has signed a significant long-term agreement with Saudi Aramco to support its offshore operations.

Malaysian offshore services provider Vantris Energy, formerly known as Sapura Energy, has signed a significant long-term agreement with Saudi Aramco to support its offshore operations.

According to a recent Bursa Malaysia filing, the agreement covers the provision of diving support vessels, remotely operated vehicles (ROVs), and the deployment of highly skilled diving and technical personnel. These resources will assist Aramco in a range of offshore activities, ensuring safe and efficient operations.

The contract is set to commence on 1 May 2027 and will continue until 30 April 2034. It includes services such as inspection, survey, photography, non-destructive testing, structural maintenance, and repair work. While financial terms were not disclosed, the deal is expected to make a positive contribution to Vantris Energy’s earnings and further strengthen its order book.

“This achievement validates our strategic direction to strengthen our operations and maintenance portfolio while expanding beyond Malaysian waters,” said Muhammad Zamri Jusoh CEO of Vantris Energy.

This agreement marks another step in Vantris Energy’s strategy to grow its presence in the global offshore services market.

Helix Energy Solutions Group has reported a strong turnaround in its financial performance for the third quarter of 2025, posting a net income of US$22.1mn.

Helix Energy Solutions Group has reported a strong turnaround in its financial performance for the third quarter of 2025, posting a net income of US$22.1mn.

This marks a significant improvement from the US$2.6mn loss in the previous quarter, though slightly below the US$29.5mn recorded in the same period of 2024.

The company’s Adjusted EBITDA climbed to US$103.7mn, more than double the US$42.4mn achieved in Q2 2025, and higher than the US$87.6mn posted in Q3 2024. Third-quarter revenues also strengthened, reaching US$376.9mn, compared with US$302.3mn in the preceding quarter and US$342.4mn a year earlier.

For the first nine months of 2025, Helix reported net income of US$22.6mn on US$957.3mn in revenue, slightly lower than the US$35.5mn profit on US$1.003bn earned in the same period last year.

Owen Kratz, President and CEO of Helix, said the company’s latest results represent its highest quarterly EBITDA since 2014, demonstrating the business’s growth potential. “The strong Q3 results provide insight into the business’s earnings potential,” he said, noting the achievement came despite downtime on the Q4000 and the Seawell rigs being stacked.

Following the improved performance, Helix has revised its full-year 2025 Adjusted EBITDA guidance upwards to between US$240mn and US$270mn, and now expects free cash flow generation of US$100mn to US$140mn.

Operationally, the company saw robust results across several divisions. The robotics segment benefited from increased trenching and renewable energy operations, while the shallow water division recorded higher levels of activity.

Helix also secured key commercial contracts, including a four-year robotics trenching agreement in the North Sea and a Well Intervention contract in the Gulf of America.

Revenues in the Well Intervention segment grew 23 per cent sequentially, driven by higher utilisation of the Q5000 and Q7000 rigs, while robotics revenues increased 16 per cent thanks to stronger trenching demand. The shallow water abandonment division saw the sharpest rise up 47 per cent due to higher utilisation of the Epic Hedron vessel and improved asset activity.

As part of Phase 1 development, four wells in the Shenandoah field have been ramped up by Beacon Offshore Energy to attain the target rate of 100,000 bopd / 117,000 boepd.

As part of Phase 1 development, four wells in the Shenandoah field have been ramped up by Beacon Offshore Energy to attain the target rate of 100,000 bopd / 117,000 boepd.

The Shenandoah floating production system (FPS) has proved its top tier operability as it delivered exceptional well productivity, reliability and uptime metrics, while accomplishing the ramp up target within 75 days following first production.

The Shenandoah reserves, located at reservoir depths of approximately 30,000 ft true vertical depth, are being developed utilising industry leading high pressure 20,000 psi technology which Beacon expects to facilitate development of other similarly situated fields in the Inboard Wilcox trend.

The Shenandoah FPS located on Walker Ridge 52 approximately 150 miles off the coast of Louisiana in a water depth of approximately 5,800 feet has a nameplate capacity of 120,000 bopd and 140 mmcfd. The Shenandoah FPS has been designed as a regional host facility that will enable development of additional resources including the Beacon-operated Monument and Shenandoah South discoveries which together with Shenandoah are expected to hold recoverable resources of nearly 600 MMBOE. Beacon is working alongside HEQ Deepwater and Navitas Petroleum to develop the Shenandoah project.

Fugro announced that it would showcase its latest digital innovations in offshore asset management at ADIPEC 2025, taking place in Abu Dhabi from 3–6 November.

Visitors to Fugro’s booth would see how the company was transforming conventional inspection workflows through advanced digital solutions, uncrewed surface vessels (USVs) and AI-powered analytics — all aimed at helping clients make faster decisions, lower costs and enhance sustainability.

Presented under the theme “Digital Geo-data”, Fugro’s exhibit would demonstrate how cutting-edge technology was redefining the monitoring and maintenance of offshore infrastructure. Among the key technologies were high-resolution 3D point clouds that replaced static drawings with interactive, navigable visuals; digital twins offering continuously updated virtual replicas of offshore assets for improved planning and maintenance; and AI-driven systems that automatically detected corrosion, flooded members and structural anomalies to enable predictive maintenance.

Fugro’s integrated approach focused on continuous, intelligent inspection using USVs to perform regular remote surveys. The data collected from these missions fed into AI platforms that identified potential issues before they developed into critical problems. This proactive system helped clients avoid costly downtime, strengthen asset reliability and make informed operational decisions.

The benefits of this digital transformation were clear: improved efficiency, reduced operational expenses and comprehensive datasets to support long-term asset management strategies. Fugro’s remote and autonomous technologies also contributed to sustainability objectives by reducing offshore vessel time and lowering CO₂ emissions, reinforcing the company’s commitment to a safer, more efficient and environmentally responsible offshore industry.

Aquaterra Energy, a leading provider of offshore engineering solutions, has announced the appointment of Matt Marcantonio as its new Head of Engineering, marking an important milestone in the company’s ongoing growth and dedication to advancing offshore technologies.

Aquaterra Energy, a leading provider of offshore engineering solutions, has announced the appointment of Matt Marcantonio as its new Head of Engineering, marking an important milestone in the company’s ongoing growth and dedication to advancing offshore technologies.

With more than 18 years of experience in the offshore energy sector, Marcantonio is a well-known figure in the industry. In his new role, he will oversee Aquaterra Energy’s global engineering function, driving innovation, enhancing product development, and strengthening the company’s technical leadership across Well Access and Offshore Developments, including well intervention, late-life abandonment operations, and carbon capture and storage (CCS).

Marcantonio joins Aquaterra Energy after nearly 17 years with Claxton Engineering and 18 years within the Acteon Group, bringing with him substantial expertise in riser systems, bespoke tooling, and complex well abandonment projects. He also brings experience in platform design gained during his time with UWG and 2H. With a strong history of leading multidisciplinary engineering teams to deliver innovative offshore solutions, Marcantonio’s appointment will help advance Aquaterra’s strategic focus on expanding its engineering capabilities and accelerating the development of proprietary technologies such as the Recoverable Abandonment Frame (RAF), the AQC systems suite, and the Sea Swift platform.

George Morrison, CEO at Aquaterra Energy, commented, “Hiring a talent like Matt underscores our ambition to remain at the forefront of offshore energy innovation while addressing our clients’ offshore challenges. His combination of deep technical knowledge, product development experience and leadership capability will be instrumental as we expand globally and continue developing technologies that support the energy transition and deliver value across the full well lifecycle.”

Alongside enhancing Aquaterra’s intellectual property portfolio and promoting operational excellence across global projects, Marcantonio will also focus on mentoring the company’s emerging engineering talent, helping to strengthen skills within Aquaterra and the wider offshore industry.

Matt Marcantonio, Head of Engineering, added, “I’ve always admired Aquaterra Energy’s reputation for innovation and engineering excellence, so I’m delighted to be joining such a talented and ambitious team. This is a company that delivers practical, field-ready solutions to solve some of the offshore industry’s biggest challenges – from cost-effective abandonment to enabling the future of CCS. What excites me most is the chance to support the next generation of engineers, sharing experience and building confidence in a sector that urgently needs new talent. Together, we have the chance to strengthen Aquaterra’s position as a leader in offshore innovation and make a lasting impact across the energy industry.”

As ExxonMobil Australia steps up decommissioning of ageing offshore oil and gas assets in the Gippsland Basin, the company is also repurposing onshore infrastructure as part of its ongoing energy transition and forward investment plans.

As ExxonMobil Australia steps up decommissioning of ageing offshore oil and gas assets in the Gippsland Basin, the company is also repurposing onshore infrastructure as part of its ongoing energy transition and forward investment plans.

That includes the demolition of the former Altona refinery facilities, which Mobil commenced in September.

Rhys Kelly, Terminal Manager, Melbourne Terminal, said in an update that this decommissioning work would continue for two more years.

“Demolition of former refinery infrastructure is a complex task,” he noted. “Work commenced in September 2025 and is expected to continue through to the end of 2027.”

It follows a review of future opportunities for parts of the Altona Terminal site which are not required for fuel terminal operations.

Following the review, the company is planning to demolish a number of tanks, former refinery process units and associated infrastructure that are not required to support its vision for a reliable supply of fuel to Victoria.

Since works to transition the Altona site to a world-class terminal began in 2021, it has refurbished a number of tanks, increasing fuel storage capacity by almost 250 million litres to ensure it can meet the federal government’s minimum fuel storage requirements, as well as maintain a vital role in supplying around 40% of Victoria’s fuel needs.

“This year, we continue to focus on delivering additional fuel storage across the Mobil Melbourne terminal, including at Gellibrand Wharf and the Altona site, so that we can maintain our supply of around 40% of Victoria’s fuel from Melbourne’s largest fuel storage and distribution terminal,” added Kelly.

“It has been a productive year, and we have completed many projects that will provide the additional storage required to support our ongoing, reliable supply of fuel to Victoria into the future.”

In a community bulletin, Mobil added that it had carefully planned the demolition work to ensure it is managed safely.

Given the nature of the work, it said there may be “noticeable changes” in the site profile, with the flare being one of the first assets to be removed.

Mobil added that it will also implement strict environmental controls to minimise impact on the neighbourhood, including completing most work during the day, industrial hygiene monitoring and using dust suppression.

“We have worked closely with regulators to obtain the necessary approvals and carefully planned the demolition works to minimise impacts on our neighbours,” said Kelly.

“We will also closely monitor the works so that we can quickly respond to any unexpected impacts if they occur.”

The United Kingdom has witnessed the successful drilling of the country's first carbon storage appraisal well as part of its ambitious carbon capture and storage objectives.

The United Kingdom has witnessed the successful drilling of the country's first carbon storage appraisal well as part of its ambitious carbon capture and storage objectives.

According to Offshore Energies UK, this new well in the decommissioned Hewett gas field off Bacton on the coast of North Norfolk, will play a significant role in accelerating the path to net zero greenhouse gas emissions as it serves as a major carbon store in the region. The project reflects the UK industry's sustainable approach as it repurposes existing oil and gas infrastructure, delivering carbon capture and storage with the help of efficient supply chains and skilled workforce.

The site operated by the global energy company Eni, is part of the North Sea Transition Authority’s first carbon storage licencing round.

Powering the UK with gas for decades, the Hewett field will now boast a storage capacity of up to 10 million tonnes of CO2 annually as a large-scale carbon storage facility. This equals the yearly greenhouse gas emissions of around a fifth of all UK industry.

The location of Hewett is particularly well placed to support the decarbonisation of industry in Southern England and also industrial greenhouse gas producers in continental Europe.

With an aim to accelerate this process, Offshore Energies UK has initiated a round table with the European Commission, looking to navigate regulatory barriers that currently prevent cross border transport of carbon emissions.

The North Sea Transition Authority which oversees Britain’s carbon capture plans, has already awarded permits for the UK’s first two carbon storage projects. These are the Northern Endurance Partnership off Teesside in December 2024, and Liverpool Bay carbon capture and storage project in April 2025, which is also operated by Eni.

These two projects together could store more than 200 million tonnes of CO2, equivalent to taking 110 million cars off the road for a year. The permits have also unlocked £6bn worth of supply chain contracts and 4,000 construction jobs.

Enrique Cornejo, OEUK Head of Energy Policy, said, “This Hewett appraisal well is a powerful signal of industry’s commitment to invest in the UK’s net zero future. It shows how our existing energy infrastructure and expertise are being repurposed to deliver climate solutions. But for commercial carbon capture and storage to succeed at scale, government must accelerate a clear route to market for projects like Bacton CCS which are outside the government’s planned cluster sequencing process. The Hewett appraisal well is a tangible example of industry stepping up, and now it’s time for policy to keep pace.”

The Qatar BH EPIC EPC (Engineering, Procurement and Construction) project is set to take off as Offshore Oil Engineering Co., Ltd. (COOEC) has kick-started meetings for the project development in Tianjin and Singapore.

The Qatar BH EPIC EPC (Engineering, Procurement and Construction) project is set to take off as Offshore Oil Engineering Co., Ltd. (COOEC) has kick-started meetings for the project development in Tianjin and Singapore.

This marks the full-scale launch of the largest international offshore oil and gas EPC project contracted by a Chinese company to date. Playing an important role in developing high-quality international oil and gas collaboration under the Belt and Road Initiative, the project will take China-Qatar energy cooperation to new heights.

Situated in the Bul Hanine (BH) oilfield in the Qatari waters of the Persian Gulf, about 100 kms east of the country's coastline, the project will be developed by QatarEnergy with substantial investments. It has a maximum water depth of approximately 40 meters.

Beyond its record-breaking contract value, the project also stands out for its unprecedented scope and technical complexity. It includes more than 60 offshore oil-and-gas facilities, as well as 40 subsea pipelines and cables, and covers the modification of existing platforms and the decommissioning of obsolete facilities.

The full-scale launch of the BH EPIC project will deepen energy cooperation between China and Qatar, and play an important role in advancing energy partnerships among The Belt and Road countries.

Page 14 of 118