Enersol has announced the launch of Video While Fishing (VWF), an innovative service developed through the first-ever collaboration between its portfolio companies, Deep Well Services (DWS) and EV.

Enersol has announced the launch of Video While Fishing (VWF), an innovative service developed through the first-ever collaboration between its portfolio companies, Deep Well Services (DWS) and EV.

The milestone was unveiled at ADIPEC, one of the world’s leading energy events, held in Abu Dhabi.

The partnership signifies the start of Enersol’s mission to introduce cutting-edge technology and AI-powered innovations to the Middle East’s energy industry.

VWF integrates EV’s downhole video technology with DWS’s patented Hydraulic Completion and Intervention Units (HCUs), allowing operators to visually guide fishing operations with exceptional accuracy. The result is faster, smarter, and more efficient well interventions.

Dean Watson, CEO of Enersol, said, “This is more than a product launch, it’s a proof point of what Enersol was built to do. By bringing together the strengths of DWS and EV, we’re solving real-world challenges with real-time intelligence. This is the first of many collaborations that will unlock the full potential of our portfolio, delivering measurable impact, faster recovery, and smarter operations across the region.”

Instead of relying on guesswork, operators can now see exactly what’s happening downhole, identifying stuck objects, assessing conditions and orientation, and carrying out retrievals with confidence. This visual capability transforms fishing from a reactive process into a proactive, data-driven operation.

The launch of VWF highlights Enersol’s commitment to integrating AI, machine learning, and advanced diagnostics into traditional oilfield operations. This approach enhances performance, reduces non-productive time, and accelerates well returns.

As the UAE continues to lead the global energy transformation, Enersol is proud to support this vision by providing next-generation solutions that blend American innovation with Emirati ambition.

As the world’s largest energy event, ADIPEC is the ideal platform to experience the innovation Enersol is bringing to the Middle East and beyond.

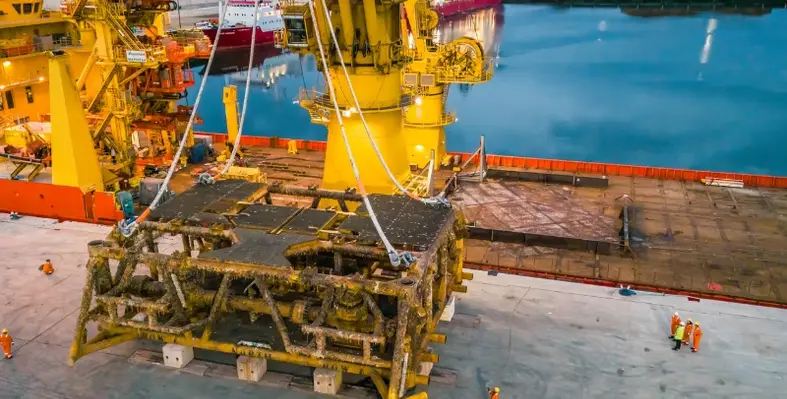

Australia’s Strake Engineering has expanded its offshore equipment offering with the addition of four DNV-certified subsea baskets, purpose-built to support installation and recovery tasks across decommissioning and broader offshore operations.

Australia’s Strake Engineering has expanded its offshore equipment offering with the addition of four DNV-certified subsea baskets, purpose-built to support installation and recovery tasks across decommissioning and broader offshore operations.

Each basket offers a 53-tonne payload and 47-tonne tare weight, complete with rigging, load test certification, and manufacturer data records.

The units have already demonstrated “proven offshore performance” on a recent decommissioning project, it was reported by the Centre of Decommissioning Australia (CODA), which announced the new equipment launch on its website.

The Perth-based company is a CODA partner as Australia gets to grips with its immense offshore decommissioning challenges.

The new subsea baskets are designed to enhance safety, boost operational efficiency and reduce project costs through a flexible rental model.

“Strake is proud to introduce its fleet of subsea baskets for rent, delivering a safer, smarter, and highly efficient solution for offshore installation and recovery tasks,” the company noted in its marketing of the new equipment, also available on the CODA website.

According to Strake, the purpose-built equipment enhances safety by mitigating the risk of unknown structural integrity in offshore recovery; boosts efficiency by streamlining workflows and reducing project timelines with optimised handling and transport; and reduces costs, via a rental model that offers access to top-tier equipment without the capital expenditure of ownership.

In its latest comprehensive report and digital platform titled 'Gulf of America Forward', National Ocean Industries Association (NOIA) has acknowledged the Gulf of America as a prominent offshore energy region, setting standards for industry dynamism, innovation, economic strength, and national security.

In its latest comprehensive report and digital platform titled 'Gulf of America Forward', National Ocean Industries Association (NOIA) has acknowledged the Gulf of America as a prominent offshore energy region, setting standards for industry dynamism, innovation, economic strength, and national security.

The report has particularly highlighted the region's environmental stewardship through programmes such as Rigs to Reefs, which saw the transformation of hundreds of decommissioning platforms into thriving marine habitats. This significantly contributes to the region's reputation in producing some of the lowest-carbon barrels in the world, backed by path-breaking technology and consistent environmental progress.

"The Gulf of America is not a legacy asset, it’s a strategic platform for America’s energy leadership," said NOIA President Erik Milito. "It gives our nation a crucial edge in a rapidly evolving global energy landscape. As global demand rises, driven by population growth, AI-powered data centers, electrification, and industrial expansion, the Gulf of America is uniquely positioned to meet that challenge. With world-class reserves, advanced technology, a highly skilled workforce, and strong environmental stewardship, it delivers secure, affordable, and lower-emission energy to Americans and our allies."

Odfjell Technology (UK) Ltd has announced a two-year extension of its Master Service Agreement with Serica Energy (UK) Limited.

Odfjell Technology (UK) Ltd has announced a two-year extension of its Master Service Agreement with Serica Energy (UK) Limited.

The renewed agreement underscores the companies’ strong partnership and Odfjell Technology’s ongoing commitment to delivering reliable, high-quality campaign support and maintenance services within the energy industry.

Originally awarded in November 2018, the Serica contract covers the provision of storage, preservation, maintenance, and drilling services. It has since been sustained through several rolling extensions. Under this agreement, Odfjell Technology supplies skilled personnel to support intervention and maintenance operations on the Bruce platform, along with engineering expertise through targeted surveys that contribute to Life of Field activities. The latest extension secures an additional two years of backlog for Odfjell Technology, reinforcing its continued support for Serica’s operational objectives.

John Moffat, Senior Vice President of Operations & P&A UK, commented, “This extension reflects the trust Serica places in Odfjell Technology and the value our teams deliver across intervention, maintenance, and drilling support. We are proud to continue this long-standing partnership and strengthen our position for future campaign readiness, reinforcing our commitment to reliable, flexible service delivery.”

With more than 50 years of experience, Odfjell Technology is an integrated provider of offshore operations, well services technology, and engineering solutions. The company is dedicated to improving safety, efficiency, and sustainability across all operations while reducing time, cost, and emissions for clients. Operating in over 30 countries, Odfjell Technology employs more than 2,400 skilled professionals worldwide.

The Norwegian-based offshore and subsea services provider DOF Group ASA has announced contract extensions for three high-specification pipelay support vessels (PLSVs) owned via its joint venture with TechnipFMC (50:50).

The Norwegian-based offshore and subsea services provider DOF Group ASA has announced contract extensions for three high-specification pipelay support vessels (PLSVs) owned via its joint venture with TechnipFMC (50:50).

The vessels are engaged by Petrobras in Brazil and are now set to bolster the company’s offshore presence well into the next decade.

The PLSVs Skandi Vitória and Skandi Niterói have had their existing contracts, originally due to end in Q4 2025, extended through to Q1 2027. Their subsequent three-year contracts, announced in June 2024, will commence once the extended period concludes. Meanwhile, Skandi Açu has seen its current charter, set to finish in Q3 2026, likewise extended to Q1 2027, ahead of a separate three-year deal announced in August 2024.

DOF says these amendments add approximately US$100mn to the company’s firm backlog, while all other terms of the previously disclosed three-year agreements remain unchanged. “We are happy to extend the firm backlog of these three high-end vessels into 2030,” said Mons Aase, CEO of DOF Group ASA. “Together with other contracts previously announced, DOF now has 17 vessels in Brazil with firm backlog extending towards and into the next decade.”

The announcement underscores the firm’s commitment to its offshore services footprint in Brazil, securing long-term engagements for its pipelay assets in a key global market.

Energy technology company, Baker Hughes, has entered a deal with Aramco to expand its integrated underbalanced coiled tubing drilling (UBCTD) operations across Saudi Arabia’s natural gas fields.

Energy technology company, Baker Hughes, has entered a deal with Aramco to expand its integrated underbalanced coiled tubing drilling (UBCTD) operations across Saudi Arabia’s natural gas fields.

The multi-year agreement secures scope for current UBCTD fleet expansion from four to 10 units for re-entry and greenfield drilling projects across fields in the Kingdom. The integrated solutions will cover every aspect of the UBCTD operations, including coiled tubing drilling units, underbalanced drilling services, operational management, well construction, and geosciences to scale and accelerate their access to gas from new and established fields.

“This project is the result of nearly two decades of successful collaboration between Baker Hughes and Aramco, which have set the standard for UBCTD,” said Amerino Gatti, executive vice president of Oilfield Services & Equipment at Baker Hughes. “By combining advanced technologies with a holistic, integrated approach, we can support Aramco to more efficiently access bypassed and hard-to-reach hydrocarbons and produce the resources that help the Kingdom thrive. This expansion sets the stage for further innovation in UBCTD, which has the potential to shape how oil and gas are produced around the world.”

The integrated approach to UBCTD includes CoilTrak bottomhole assembly (BHA) system and enhanced reservoir analysis driven by GaffneyCline energy advisory. The combined effect of these technologies and insights result in smooth navigation of the subsurface environment during horizontal drilling and re-entry operations. These, backed by holistic project management services, will lead to enhanced production efficiency, speed and safety while mitigating reservoir damage when compared to traditional development methods.

Work under the expanded agreement is scheduled to commence in 2026.

Service provider DeepOcean will support the decommissioning of subsea infrastructure at Western Australian oil and gas fields.

Service provider DeepOcean will support the decommissioning of subsea infrastructure at Western Australian oil and gas fields.

The scope of work includes suspension of subsea trees, removal of flowlines, riser and dynamic umbilical, and removal of a disconnectable turret mooring buoy (DTM). The work is scheduled to begin next year and will be performed form one of the company’s regional vessels.

The fields are located off the coast of Western Australia in depths of 300-400 metres.

Colin McGinnis, Managing Director of DeepOcean’s Asia Pacific operations, said, “We are honoured that DeepOcean has been entrusted with the delivery of this significant project. It builds on our extensive regional and international experience in decommissioning and reinforces our long-term commitment to supporting the energy sector in Australia.

“DeepOcean is already one of the market leaders within subsea decommissioning in the mature North Sea region. This project demonstrates that we are already managing to combine local Shelf Subsea expertise with our North Sea decommissioning competence. The end-beneficiary is our clients in the region.”

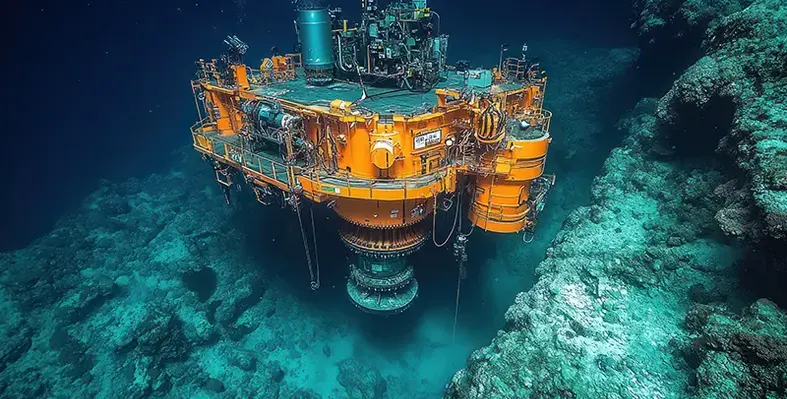

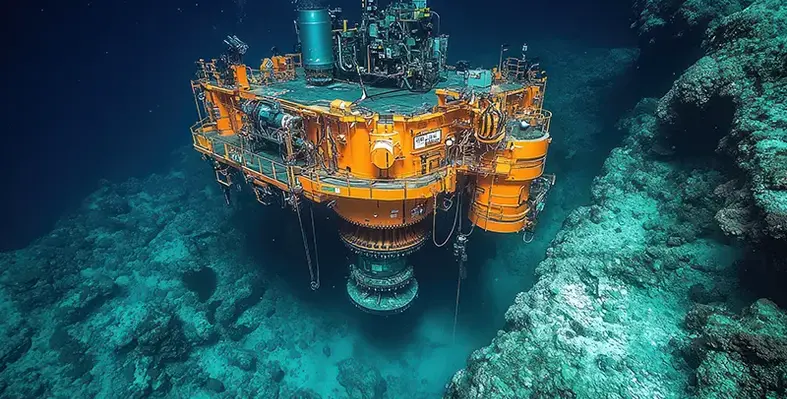

Two engineering, procurement and construction (EPC) contracts have been awarded by PTT Exploration and Production Public Company Ltd. (PTTEP) to SLB’s OneSubsea joint venture for work in Malaysian offshore fields.

Two engineering, procurement and construction (EPC) contracts have been awarded by PTT Exploration and Production Public Company Ltd. (PTTEP) to SLB’s OneSubsea joint venture for work in Malaysian offshore fields.

The contracts build on a 20-year collaboration between the two companies. As part of the EPC contracts, OneSubsea will deliver comprehensive subsea production systems for the Alum, Bemban and Permai deepwater gas fields located in Block H and the Kikeh field – Malaysia’s first deepwater oil project.

The scope of work includes horizontal subsea trees, umbilicals, control systems, and associated services.

Mads Hjelmeland, Chief Executive Officer at SLB OneSubsea, said, “We are proud to continue our long-standing relationship with PTTEP, which has seen the delivery of more than 50 systems over the past 20 years. By leveraging our experience in complex deepwater environments and adopting a highly collaborative, early engagement process with our clients, we will help PTTEP unlock maximum value from these projects.”

The Block H gas development began producing natural gas from the Rotan and Buluh fields in 2021, while the Kikeh oil and gas field has been in production since 2007. SLB OneSubsea’s experience of deploying technology in complex deepwater environments will further extend the life of these two fields.

Oceaneering International, Inc. has announced that its Offshore Projects Group (OPG) has received a contract from bp Exploration (Caspian Sea) Ltd. to provide riserless light well intervention (RLWI) services at the Azeri-Chirag-Deepwater Gunashli (ACG) oilfield in the Caspian Sea

Oceaneering International, Inc. has announced that its Offshore Projects Group (OPG) has received a contract from bp Exploration (Caspian Sea) Ltd. to provide riserless light well intervention (RLWI) services at the Azeri-Chirag-Deepwater Gunashli (ACG) oilfield in the Caspian Sea

As part of the agreement, Oceaneering will deliver RLWI services for a multi-well mechanical wireline intervention campaign using one of its deepwater systems, which will be integrated onto a subsea construction vessel provided by the client. The project scope also includes management, engineering, and systems integration services to be carried out by both local and international Oceaneering teams.

Engineering and pre-mobilisation activities are already underway, with field operations expected to begin in the fourth quarter of 2025.

Chris Dyer, Senior Vice President of OPG, said, “Oceaneering has successfully provided RLWI solutions to help restore and improve production from existing wells in other deepwater regions of the world. We appreciate bp’s continued trust in our ability to safely provide reliable and cost-effective deepwater intervention solutions, particularly in support of the critical production in the Deepwater Gunashli area of the ACG field.”

Halliburton has introduced the StreamStar wired drill pipe interface system, a pioneering solution that provides real-time, high-speed data and continuous downhole power.

Designed to improve orchestrated closed-loop automation, the system enables faster and more accurate decision-making.

By reducing reliance on downhole generators and lithium batteries, StreamStar allows a compact bottomhole assembly that positions sensors closer to the bit for enhanced measurement reliability.

It also enables instant, two-way communication between the logging-while-drilling system and rotary steerable system, cutting well construction time.

The StreamStar system is part of Halliburton’s iStar intelligent drilling and logging platform, integrating seamlessly with the LOGIX automation and remote operations suite.

This combination allows instant execution of commands, closed-loop control, and real-time optimisation of drilling operations.

As the industry moves toward smarter, automated drilling, StreamStar delivers enhanced precision, operational efficiency, and confidence at every stage of well construction.

Maritime Developments Ltd (MDL) has secured a significant subsea installation contract in the Asia-Pacific region, involving the laying of two subsea cables and two umbilicals.

Maritime Developments Ltd (MDL) has secured a significant subsea installation contract in the Asia-Pacific region, involving the laying of two subsea cables and two umbilicals.

The project, which will take place at water depths of between 800 and 1,200 metres, reinforces MDL’s growing footprint across the region.

The 60-day offshore campaign is scheduled to mobilise from Singapore in 2026, with MDL providing a complete flex-lay spread for the operation. This will include one of the company’s renowned Horizontal Lay Systems (HLS) - a compact, integrated package that has delivered proven results on both installation and decommissioning projects worldwide. The spread will also feature MDL’s high-capacity four-track tensioner and its flagship Reel Drive System (RDS), ensuring precision and reliability throughout the installation.

As part of its long-term strategy to support clients in the Asia-Pacific market, MDL recently opened a new regional office in Singapore. The hub will serve as a base for operations, project delivery, and client engagement across the Eastern Hemisphere.

The Singapore office is led by Bernice Tan, MDL’s Regional Manager for APAC, who brings more than 15 years of experience in the Asian energy sector, covering business development, commercial management, and supply chain operations.

“With years of experience promoting flex-lay equipment and services in the region, I’m thrilled to join MDL - a company that truly shares my values,” said Tan. “This expansion marks an important step in strengthening MDL’s ability to support clients globally. With our equipment now based in Singapore, we can deliver faster, more efficient, and localised service across Asia-Pacific.”

Tan added that her priority will be to work closely with long-standing and new clients as MDL continues to deliver world-class subsea engineering solutions to one of the world’s most dynamic offshore markets.

This contract highlights MDL’s commitment to providing innovative, cost-effective subsea solutions and underlines its ambition to be a leading provider of offshore installation services throughout the Asia-Pacific region.

Petronas, through Malaysia Petroleum Management (MPM), has launched the Hydraulic Workover Unit (HWU) Academy to develop Malaysian talent and strengthen national capabilities in well abandonment and decommissioning.

Petronas, through Malaysia Petroleum Management (MPM), has launched the Hydraulic Workover Unit (HWU) Academy to develop Malaysian talent and strengthen national capabilities in well abandonment and decommissioning.

“The HWU Academy’s programmes are designed to equip Malaysians with the technical expertise needed to lead in emerging opportunities, complementing the national Technical and Vocational Education and Training (TVET) agenda for hands-on, industry-relevant training,” said Datuk Ir. Bacho Pilong, Senior Vice President of MPM.

Petronas noted in a statement that thenew academy underscores its commitment to ensure “the continuous development of skilled talent to support safe, cost-efficient and sustainable Plug and Abandonment (P&A) operations, a vital component of Malaysia’s upstream lifecycle.”

Building on a 2024 Memorandum of Understanding (MoU) between MPM and industry partners, the HWU Academy has progressed from concept to implementation, including two successful pilot training sessions to validate the programme framework.

Serving as a centre of excellence, it will provide hands-on training using retired assets such as the Velesto HWU Gait-01 training unit.

Learners will also benefit from technology-driven modules developed with Halliburton, featuring virtual reality simulators and digital learning tools to enhance technical proficiency and operational readiness.

In addition, the academy will strengthen academic–industry collaboration through strategic partnerships with leading universities such as Universiti Malaysia Sabah (UMS), Kolej Kemahiran Tinggi MARA (KKTM), Universiti Teknologi Malaysia (UTM), Universiti Teknologi PETRONAS (UTP) and Universiti Teknologi MARA (UiTM).

This will also include collaboration with key ministries such as the Ministry of Human Resources (KESUMA) and the Ministry of Higher Education (KPT), and the Malaysian Oil and Gas Services Council (MOGSC).

These collaborations aim to facilitate student enrolment, programme accreditation and grant accessibility, whilst attracting both local and international talent.

“This initiative aligns with Petronas’ aspiration to strengthen the local oil and gas ecosystem, empowering Malaysians to play a leading role in shaping the future of our industry,” said Pilong.

“Velesto Energy Academy and ZNUSS will be the first to embark on this exciting training journey. This partnership reinforces our collective commitment to continuity, consistency and standardisation in developing Malaysia’s HWU capability through the HWU Academy framework.”

Page 13 of 118