The offshore drilling industry is entering a period of vigorous growth as operators worldwide accelerate exploration and production to meet rising energy demand, according to The Business Research Company.

Valued at US$33.53bn in 2024, the sector is projected to climb to US$36.28bn in 2025. This reflects a compound annual growth rate of 8.2%.

The expansion follows a decade shaped by strategic discoveries of deepwater reserves, improvements in offshore infrastructure, and increasing global energy consumption. The depletion of easily accessible onshore resources and the availability of specialised offshore expertise have further reinforced activity across major basins.

Looking ahead, the offshore drilling market is forecast to reach US$49.67bn by 2029, maintaining the same growth trajectory of 8.2%.

This forward momentum is driven by renewed investment aimed at strengthening energy security, securing supply chains, and expanding access to capital. Governments and operators alike are also responding to evolving climate regulations and rising expectations around safety, prompting upgrades to equipment and operational standards.

Technological transformation is set to become a defining feature of the forecast period. Operators are expected to increase the use of digital tools, integrate drilling operations into hybrid renewable energy systems, and push further into ultra deepwater territories. Advances in seismic imaging and the adoption of digital twin technology will play a central role in improving accuracy, reducing risk, and optimising asset performance.

A primary force behind the market’s expansion is the steady rise in global consumption of oil and natural gas. These fuels remain vital to heating, power generation, and transport, making them central to energy systems around the world. Economic growth, increasing populations, and the continued shift toward cleaner burning fuels in power and transport sectors are amplifying demand.

Offshore drilling offers the ability to tap large reserves beneath the seabed, thereby ensuring continued supply. Data from the United States Energy Information Administration illustrates this trend. By the end of 2022, proven US crude oil and lease condensate reserves rose by 9% to reach 48.3 billion barrels. Natural gas reserves increased by 10%, climbing to 691 trillion cubic feet. Such figures highlight the sustained appetite for exploration and the vital role offshore assets will continue to play.

Across Europe, leading operators are pursuing competitive advantage through robotics and artificial intelligence. A notable example emerged in 2024 when Schlumberger and Equinor achieved a milestone in autonomous drilling on the Peregrino C platform. Using cloud based applications and AI driven planning tools, the partners succeeded in autonomously drilling 99 per cent of a 2.6 km section. The project demonstrated not only improved efficiency and lower operational costs but also meaningful reductions in carbon emissions.

Asia Pacific remained the world’s largest offshore drilling region in 2024, followed by Western and Eastern Europe, North America, South America, the Middle East, and Africa.

Ocean services provider DeepOcean has been awarded a contract by Equinor to provide various subsea construction and installation activities as part of the Snorre Export and Import Gas Project (SNEIG) for offshore execution in 2026

Ocean services provider DeepOcean has been awarded a contract by Equinor to provide various subsea construction and installation activities as part of the Snorre Export and Import Gas Project (SNEIG) for offshore execution in 2026

The SNEIG project is part of the broader Snorre Expansion Project, which aims to extend the production life of the Snorre oil and gas field – originally discovered in 1979 and operational since 1992 – beyond 2040. The Snorre field is located in the Tampen area of the northern North Sea, in water depths of 300–350 meters.

DeepOcean’s scope of work includes installation of a subsea safety isolation valve (SSIV), a subsea umbilical, and tie-in to the existing pipeline using connectors and associated tooling from the Pipeline Repair and Subsea Intervention (PRSI) pool.

DeepOcean will also provide preparatory subsea construction activities include isolation pig tracking, pipeline coating removal and cutting operations. Suitable crossings for the new umbilical will also be prepared and installed at the field before various mechanical completion and commissioning activities are performed.

“This is a complex subsea project that underlines Equinor’s dedication to responsible resource utilisation through life-of-field extensions. Through our in-depth knowledge of the specialised tooling from the PRSI pool, matched with our highly capable construction vessel fleet, I am confident that our skilled project team will ensure a safe and successful project execution in close cooperation with Equinor,” says Olaf A. Hansen, managing director of DeepOcean’s European operation

The award also includes the provision of onshore engineering, procurement and project management services. DeepOcean will manage the project out of its office in Haugesund, Norway.

Offshore operations will be executed during the summer season of 2026 using a subsea construction vessel from DeepOcean’s chartered fleet.

Promethean has announced its Q4 Gulf of Mexico mobilisation, marking the beginning of a new operational phase dedicated to safe and complaint decommissioning.

Promethean has announced its Q4 Gulf of Mexico mobilisation, marking the beginning of a new operational phase dedicated to safe and complaint decommissioning.

Committed to operational excellence and continuous improvement, Promethean has embedded integrated data management and innovative technologies into its work processes after recognising that a significant number of safety incidents go unnoticed until they result in workplace incidents.

To address this critical gap, Promethean has partnered with Detect Technologies to implement an innovative visual AI monitoring system, T-Pulse, on decommissioning projects. The technology enhances HSER practices by integrating visual data sources, including fixed cameras and robotic systems to analyse imagery and extract actionable insights on safety compliance and risk mitigation.

Danny Turner, SVP Projects, said, “The meticulous planning over the last three months reflects Promethean Energy’s steadfast commitment to doing decommissioning the right way, with safety, environmental stewardship, a technical excellence, and cost efficiency at the forefront. Our structured approach ensures that every stage, from platform preparation to post-plugging verification, delivers long-term integrity and measurable value to our stakeholders.”

The scope of work is organised under five key operational phases:

This milestone underscores the operator’s continued leadership in delivering efficient and technically robust decommissioning programmes across the Gulf.

Two substantial platforms in the Gulf of America were subjected to comprehensive full-cycle offshore decommissioning campaigns by MC Offshore Petroleum, which also advanced environmental stewardship.

Two substantial platforms in the Gulf of America were subjected to comprehensive full-cycle offshore decommissioning campaigns by MC Offshore Petroleum, which also advanced environmental stewardship.

A multi-asset operation, the campaign involved the retirement of the Jolliet Tension Leg Well Platform (TLWP) in Green Canyon Block 184 and the fixed production infrastructure at Marquette comprising a production platform, GC52A, and a processing platform, GC52CPP, in Green Canyon Block 52. These will be further converted into an artificial reef in Green Canyon Block 52.

When installed as the first TLWP in the Gulf of America, Jolliet came to be known as the world's deepest floating production unit at the time of installation. The current campaign honours the platform's legacy while establishing a model for the next generation of offshore decommissioning excellence.

Right from the planning stage in 2022, MCOP has followed a strategy to execute the removals ahead of the peak months of hurricane season. The final decision to begin decommissioning operation was made in the first quarter of 2024. Decommissioning operations, along with the plug and abandonment of all wells on GC 52-A (Marquette) and GC 184 (Jolliet), were set to begin with an execution team in place by the second quarter of 2024.

With the well P&A work underway, pipeline abandonment operations begun as three pipelines were flushed and abandoned. The project team also abandoned another 24-mile pipeline belonging to a midstream operator that originated at GC52.

The decommissioning of the Jolliet TLWP and removal of GC52A and GCS2CPP was made possible with high-level engineering work. Disconnecting the TLWP tendons from the template, ballasting the JOLLIET TLWP during tendon removals and towing the platform to Port Aransas were backed by extensive planning.

The Institute for Energy Economics and Financial Analysis (IEEFA) has published its responses to the Victorian Legislative Council Environment and Planning Committee and its inquiry into the decommissioning of oil and gas infrastructure.

The Institute for Energy Economics and Financial Analysis (IEEFA) has published its responses to the Victorian Legislative Council Environment and Planning Committee and its inquiry into the decommissioning of oil and gas infrastructure.

IEEFA is an independent energy finance think tank that examines issues related to energy markets, trends and policies.

The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.

In a statement published on its website, IEEFA noted that Victoria is in a “unique position” to establish a decommissioning industry, given the state has some of the oldest oil and gas extraction infrastructure in Australia “and therefore has a greater proportion of its property and equipment ready for decommissioning.”

It also called on the Victorian government to ensure decommissioning work is undertaken in an orderly and transparent manner.

“This will help to keep cost downs and provide opportunities for the state’s oil and gas workforce and contractors to move into the next phase of oil and gas lifecycle, decommissioning.

Victoria’s decommissioning asset profile includes 22 platforms, over 2,000 km of pipelines and umbilicals, as well as around 460 wells to be plugged and abandoned, according to the National Offshore Petroleum Safety and Environmental Management Authority (Nopsema).

The infrastructure earmarked for decommissioning offshore Victoria is owned and operated by a handful of companies.

Historically, the largest oil and gas producing complex is the Gippsland Basin Joint Venture (GBJV), also known as the Bass Strait project. This year, Woodside took over as operator of the venture from ExxonMobil, which had operated the project since 1969.

Other companies with decommissioning liabilities offshore Victoria include Beach Energy and Amplitude Energy.

Last week the industry’s finest gathered in Aberdeen to see who will be crowned this year’s well intervention champions!

Last week the industry’s finest gathered in Aberdeen to see who will be crowned this year’s well intervention champions!

The annual celebration saw a panel of expert judges acknowledge the very best in global well intervention excellence.

This year’s winners included:

A huge congratulations to all the winners and nominees, and a big thank you to everybody who attended! We look forward to another year of seeing this industry push boundaries and drive the wider offshore community into the future.

Archer Limited will be delivering a P&A unit, which is much lighter than usual, for the Fulmar platform in North Sea.

Archer Limited will be delivering a P&A unit, which is much lighter than usual, for the Fulmar platform in North Sea.

The unit will be deployed as part of an additional contract linked to a five-year agreement with Neo Next Energy.

While the P&A unit will be replacing one of Archer’s modular drilling rigs, the expanded scope of the new contract will cover platform drilling, facilities engineering, coil tubing, wireline services, and downhole well service technologies across Neo Next’s offshore portfolio. This portfolio includes integrated drilling and well services for late-life operations and P&A activities for approximately 130 wells, requiring safe and cost-effective project delivery.

Alexander Olsson, EVP Platform Operations Archer, said, “We are very pleased with this contract award as this anchors our strategic focus on late life and P&A operations. This amendment reflects our ability to grow long-term client relationships by delivering value through operational excellence and innovative solutions. Archer’s capabilities to offer lighter, leaner and more cost-efficient P&A units, is a competitive advantage as the demand for cost efficient P&A programmes grow. We are proud to extend our collaboration with NEO NEXT in this area.”

In an article on the ASCO website, John Davidson, Operations Manager – Environmental Services, ASCO discusses how the UK’s experience of building a system to deal with Naturally Occurring Radioactive Material (NORM) can benefit Australia.

In an article on the ASCO website, John Davidson, Operations Manager – Environmental Services, ASCO discusses how the UK’s experience of building a system to deal with Naturally Occurring Radioactive Material (NORM) can benefit Australia.

Davidson points out that as Australia faces a massive decommissioning wave, dealing with NORM will be one of the challenges it will need to address. This residue, which builds up in pipework, tanks and separators over years of oil and gas production, carries radiological risks and requires expert handling, treatment and disposal.

In the UK, the oil and gas sector has been dealing with NORM for decades, although the early years were challenging, he notes. “But through trial and error, the UK built a system that now works,” he says.

“NORM processing was centralised. Long-distance, highly regulated transport systems were developed. Experienced specialists were embedded into local teams. Most importantly, collaboration gradually replaced competition. Today, the UK has one of the most mature decommissioning supply chains in the world.”

Australia has a chance to avoiding years of inefficiency and unnecessary cost by learning lessons from the UK experience, he suggests. ASCO, which has built and operated one of the world’s most advanced NORM facilities in the North Sea, can now transfer that knowledge directly into Australia.

He goes on to suggest that a logistics strategy to deal with the long distances of offshore assets from disposal sites needs to be put in place; the expertise of experienced specialists should be leveraged at an early stage; and collaboration between companies should be encouraged, with shared infrastructure, expertise and logistics creating efficiencies and helping to address gaps in local capabilities.

On the questions of regulation, he notes that UK authorities engaged closely with industry to co-develop standards and best practice. “The UK’s lesson is clear: proactive engagement builds trust, accelerates approvals and avoids gridlock.”

“If Australia can absorb the lessons above now, rather than repeat the UK’s early missteps, it has the opportunity to build one of the world’s most resilient and effective decommissioning supply chains,” he concludes.

In a strategic move to strengthen the energy export network of the US Gulf of Mexico, Shell and Chevron have joined forces once again through their Amberjack Pipeline Company joint venture.

In a strategic move to strengthen the energy export network of the US Gulf of Mexico, Shell and Chevron have joined forces once again through their Amberjack Pipeline Company joint venture.

The partnership has awarded offshore contractor Allseas a major contract to install the Rome Pipeline, a 150-km, 24-inch trunk line designed to boost oil transport capacity from Shell’s Green Canyon 19 platform to the Louisiana coast.

This vital new link will expand Shell’s extensive Gulf of America pipeline system, enhancing export efficiency and operational flexibility across the region’s offshore network. The project underscores Shell and Chevron’s ongoing commitment to modernising and optimising oil transport infrastructure in one of the world’s most productive offshore basins.

Installation will be executed in two main phases. The nearshore section, scheduled for 2027, will be handled by Allseas’ automatically positioned anchor barge Sandpiper. Following that, the dynamically positioned pipelay vessel Solitaire—one of the most advanced ships of its kind will take on the deepwater installation in 2028. Together, these operations will form a critical artery within the Gulf’s subsea network, ensuring smooth and secure flow of hydrocarbons to shore.

The Rome Pipeline builds on the long-standing collaboration between Shell, Chevron, and Allseas, following the successful completion of previous ventures such as the Amberjack Debottleneck Project in 2016.

With an impressive record of more than 8,000 km of subsea pipelines safely installed in the US Gulf, Allseas continues to play a key role in shaping the region’s energy infrastructure. This new project not only reinforces its technical excellence but also represents a significant milestone in sustaining the Gulf’s vital oil and gas exports for years to come.

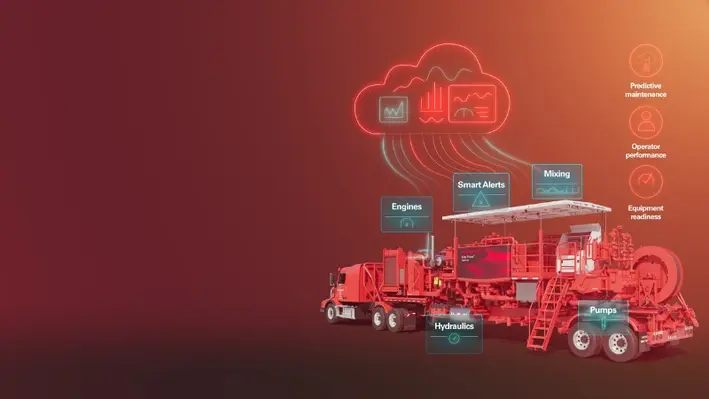

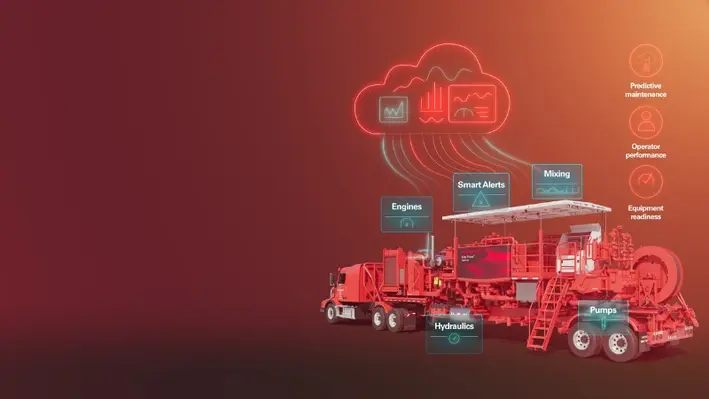

Halliburton has introduced LOGIX unit vitality, expanding its LOGIX automation and remote operations suite. The system provides real-time monitoring of cementing equipment, streamlines preparation for upcoming jobs, and offers direct insight into equipment performance and operation.

Daniel Casale, vice president of Cementing at Halliburton, said, "LOGIX unit vitality delivers unprecedented visibility into equipment health and operator performance. Artificial intelligence (AI) and real-time data transform equipment maintenance from reactive to predictive to help customers gain greater insight into their operations and reduce non-productive time."

The system links key cement unit components to intelligent controllers, tracking more than 400 real-time parameters to maintain optimal performance. Data is securely transmitted to the cloud, where machine learning models process it immediately, providing continuous insights into equipment health, operational readiness, operator performance, and predictive maintenance recommendations.

By combining AI with human expertise, LOGIX unit vitality enables smarter operations, faster responses, and more confident execution. The system supports Halliburton's land-based Elite and Elite Prime cement units, with offshore deployment planned for 2026.

Digital technology is central to Halliburton’s operations, shaping problem-solving and enhancing value for customers. The LOGIX automation and remote operations family delivers analytics and visualisation services that improve reliability, efficiency, and operational consistency, enabling safer operations, smarter decision-making, and lower total cost of ownership.

The forward look for well services and interventions across the Asia Pacific market, and for other industry providers, bodes well as spending levels accelerate across the region.

The forward look for well services and interventions across the Asia Pacific market, and for other industry providers, bodes well as spending levels accelerate across the region.

In the latest insight paper by Westwood, offshore investment is expected to remain resilient despite a turbulent year for global oil markets.

Between 2025 and 2029, offshore engineering, procurement, construction and installation investment is projected to reach US$310bn globally, with APAC accounting for 27% of this spend, it notes.

Southeast Asia alone is set to award US$37bn in new offshore contracts, led by deepwater gas projects in Indonesia, and emerging carbon capture and storage (CCS) initiatives in Malaysia.

Thailand is also embarking on its maiden CCS scheme.

“Oil and gas companies – including regional NOCs – continue to prioritise decarbonisation, though the approach is evolving toward more disciplined oil and gas investment and cost efficiency,” Westwood notes in the paper.

“This shift is expected to drive down industry costs, even as supply chain margins remain under pressure.”

These macro trends are influencing not just oil and gas, but also the region’s growing offshore wind sector, it adds.

This could mean a weakening in rates for the offshore marine fleet that services the region’s oil and gas industry.

There are currently 84 active platform supply vessels and 449 anchor handling tug/supply vessels in the Asia Pacific region, operated by key incumbents such as Wintermar, HADUCO and Nam Cheong.

Dayrates for offshore support vessels have softened from recent record highs yet continue to exceed historical averages, according to Westwood, sustained by firm utilisation levels amid tightening supply as units are redeployed out of the region.

In its concluding remarks, Westwood notes that the Asia Pacific offshore market is navigating both challenges and opportunities as 2025 draws to a close.

From ageing fleets and cost pressures to the promise of offshore wind and deepwater gas, the region is poised to play a key role in the global energy transition, it adds.

As Asia Pacific continues to evolve, Westwood notes that staying informed and engaged will be key for all stakeholders across the energy value chain.

“As frameworks evolve and investment flows shift, collaboration between operators, service providers and governments will be essential to unlocking sustainable growth,” it states.

“Innovation in technology, financing and project execution will define the next chapter of offshore energy.”

With an aim to advance optimal and sustainable energy supply, PETRONAS, through Malaysia Petroleum Management (MPM), has signed several Memoranda of Understanding (MoUs) at ADIPEC 2025.

With an aim to advance optimal and sustainable energy supply, PETRONAS, through Malaysia Petroleum Management (MPM), has signed several Memoranda of Understanding (MoUs) at ADIPEC 2025.

In the spirit of global collaboration and technology driven innovation, the MoUs include partners such as SLB, Beicip-Franlab, ConocoPhillips, Eliis, PTTEP, Microsoft, Shell, and TotalEnergies. The partnerships will drive seismic imaging and artificial intelligence (AI) and machine learning (ML) development enabled by high-performance computing (HPC).

Senior Vice President of MPM, Datuk Ir. Bacho Pilong, said, “Partnerships like these are essential in advancing Malaysia’s upstream landscape. By combining the strengths of energy operators and technology innovators we are not only strengthening our exploration and development capabilities but also setting the foundation for a more efficient and resilient Malaysia upstream sector."

The partners will work together to leverage dynamic modelling and agentic artificial intelligence (AI) for real-time data integration, uninterrupted predictive analysis, and proactive decision-making. With the deployment of Normally Unattended Facilities and Remote Autonomous Operations (NUF-RAO), partners can reap benefits right from subsurface evaluation to offshore facility optimisation.

These advancements will also support more efficient technical evaluations and investment decisions. These collaborations fit perfectly with MPM's managerial role in ensuring the best petroleum arrangements and drawing high-value upstream investments.

Page 11 of 118