As December 2025 draws to a close, West Africa's offshore oil and gas industry demonstrates steady momentum, driven by conferences, acquisitions, seismic advancements, and ongoing projects amid a challenging market for crude sales.

The MSGBC Oil, Gas & Power Conference, held 8-10 December in Dakar, spotlighted deepwater prospects in the Mauritania-Senegal-Gambia-Guinea-Bissau-Guinea-Conakry basin.

New seismic data highlighted frontier geology, while discussions emphasised LNG progress, green hydrogen, and investment opportunities in onshore/offshore blocks, particularly in The Gambia and Guinea-Conakry.

In Angola, Viridien launched a 4,300 sq km seismic reimaging programme over offshore Block 22 in the Kwanza Basin on 10 December, applying advanced technologies to support upcoming licensing rounds and enhance pre- and post-salt imaging.

BW Energy, in consortium with Maurel & Prom, announced on 12 December the acquisition of a combined 20% non-operated interest (BW's share: 10%) in Blocks 14 and 14K from Azule Energy (BP-Eni JV).

This marks BW's entry into Angola's mature deepwater sector, operated by Chevron, adding immediate production and upside potential.Investor interest persists in deepwater areas across Nigeria, Angola, and Ghana, bolstered by regulatory reforms and gas-focused policies.

ExxonMobil continues its planned US$1.5bn investment to revive Nigeria's Usan field, while Valaris secured a drillship contract for West Africa operations.

However, West African crude faces sales difficulties, with unsold cargoes for December-January loading due to global surplus and competition from cheaper supplies.

Ongoing milestones include the Greater Tortue Ahmeyim LNG project, which achieved first gas earlier in 2025 and is ramping up production.

The sector anticipates 2026 startups and final investment decisions, positioning West Africa for sustained growth despite market headwinds.(Word count: 348)

The Asia-Pacific offshore oil and gas sector advanced significantly in well decommissioning and abandonment during Q4 2025, with key developments in regulatory frameworks, cost assessments, and workforce development amid a projected regional spend of US$30-100bn by 2030 for over 7,000 wells and 1,500 platforms.

Australia took centre stage with the release of its Offshore Resources Decommissioning Roadmap on 9 December.

This government initiative outlines strategies to foster a domestic decommissioning industry, emphasising timely and environmentally responsible removal of infrastructure, workforce training, and international partnerships.

It projects approximately A$60bn in spending over the next 30-50 years, supporting economic opportunities while aligning with net-zero transitions.

Complementing this, a November report by Xodus Group revised Australia's offshore decommissioning liability downward to A$43.6bn (A$66.8bn inflation-adjusted) through 2070, covering over 700 wells, 7,600 km of pipelines, and 520 subsea structures.

The reduction stems from refined forecasting, advancements in well plugging and abandonment (P&A) techniques, and potential efficiencies from coordinated campaigns and emerging technologies.

In Malaysia, Petronas launched the Hydraulic Workover Unit (HWU) Academy on 23 October to address skills shortages in well abandonment.

The academy, a collaboration with industry partners, universities, and government ministries, offers hands-on training using retired assets to build national expertise for safe, cost-effective P&A operations.

This supports Petronas' ongoing plans to plug and abandon around 153 wells and decommission 37 offshore facilities through 2027-2028.

These initiatives underscore the region's focus on cost management, regulatory compliance, and local capacity as Southeast Asia prepares for its decommissioning peak.

Innovations like rigless P&A and rigs-to-reefs are gaining traction to balance economics and environmental stewardship.

As 2025 closes, stakeholders anticipate accelerated activities in 2026, driven by maturing fields and energy transition pressures.

ADNOC has secured US$11bn in structured financing from a consortium of 20 banks to monetise midstream assets linked to its Hail and Ghasha offshore gas project, according to The National.

The Abu Dhabi energy company said it, together with its concession partners Italy’s Eni and Thailand’s PTT Exploration and Production Public Company, opted for a non-recourse financing structure. Under this arrangement, lenders are repaid directly from the project’s future cash flows rather than from the balance sheets of the concession holders.

To enable the transaction, gas processing facilities associated with the Hail and Ghasha concessions were carved out from the upstream project. The financing was reported to be around 1.5 times oversubscribed, reflecting strong interest from regional and international lenders, particularly from Asia.

Hail and Ghasha are among the UAE’s largest offshore gas developments and are expected to produce up to 1.8bn standard cubic feet per day of gas. First gas is anticipated by the end of the decade. A source close to the transaction told The National that the deal was structured as pre-export finance and arranged several years ahead of production.

Chinese lenders, including Industrial and Commercial Bank of China, Agricultural Bank of China and Bank of China, participated in the financing, alongside seven UAE-based banks. The funds will be made available in staggered phases to support construction of gas processing infrastructure, including sulphur separation facilities required for the ultra-sour gas produced from the fields.

Russia’s Lukoil exited its 10% stake in the Hail and Ghasha concession last month, with ADNOC subsequently absorbing the holding. The company said the financing enabled it to secure upfront value at competitive rates while accelerating development plans.

Dr Sultan Al Jaber, Minister of Industry and Advanced Technology and managing director and group chief executive of ADNOC, said Hail and Ghasha would play a central role in the company’s long-term gas strategy and was on track to deliver new gas supplies for customers.

ADNOC added that the financing model could be replicated across other large-scale greenfield projects. Across the region, national oil companies have increasingly turned to monetising midstream assets to unlock capital while retaining ownership. Similar transactions have been completed by Saudi Aramco in recent years, including multibillion-dollar pipeline and gas processing deals with global infrastructure investors.

Offshore oil development plans at Benin’s Sèmè field have suffered a setback after technical complications disrupted drilling operations, forcing a delay to the long-anticipated production start-up.

Offshore oil development plans at Benin’s Sèmè field have suffered a setback after technical complications disrupted drilling operations, forcing a delay to the long-anticipated production start-up.

Akrake Petroleum, a wholly owned subsidiary of Lime Petroleum Holding, which itself is 89.74% owned by Singapore-based Rex International Holding, confirmed that the challenges have pushed first oil beyond the previously targeted timeline.

The issues emerged during drilling at the first of three planned wells at the Sèmè field, located offshore Benin in Block 1. Akrake Petroleum, the field operator, commenced drilling in August 2025 using Borr Drilling’s Gerd jack-up rig, a modern offshore drilling unit supplied by Crystal Offshore Middle East. The campaign was designed to restart production at the mature shallow-water field.

Block 1 spans approximately 551 square kilometres, with water depths ranging between 20 and 30 metres, making it suitable for jack-up rig operations. However, in its latest operational update, Rex International Holding acknowledged that the drilling programme has encountered “further significant technical issues.” While drilling activities are ongoing as teams work to resolve the problems, the company has confirmed that oil production will no longer begin in 2025.

Akrake Petroleum Benin holds a 76% working interest in the Sèmè field and serves as operator, playing a central role in the redevelopment of one of West Africa’s historic offshore oil assets. Prior to the drilling setbacks, key infrastructure milestones had been progressing as planned. The mobile offshore production unit (MOPU) was scheduled for timely delivery, while the floating storage and offloading (FSO) vessel underwent dry docking following a contract awarded in April, both aligned with a Q4 2025 start-up.

The Sèmè field has a long and notable history. Originally discovered by Union Oil in 1969, it was later developed by Norway’s Saga Petroleum. Between 1982 and 1998, the field produced around 22 million barrels of oil before operations were halted amid weak oil prices in the late 1990s.

Despite the current offshore drilling challenges, the Sèmè redevelopment remains a strategically important project for Benin’s energy sector and for Rex International’s African portfolio, as stakeholders look ahead to a revised production timeline.

INEOS Energy has reported a new oil discovery in the Norphlet formation in the Gulf of America, where the company holds a 21% working interest

INEOS Energy has reported a new oil discovery in the Norphlet formation in the Gulf of America, where the company holds a 21% working interest

The Nashville exploration well, operated by Shell with a 79% interest, represents INEOS Energy’s first successful exploration outcome in the region.

Drilled to a depth of more than five miles below the seabed, the Nashville well encountered high-quality oil within one of the Gulf’s most prospective deepwater reservoirs. The discovery is located close to Shell’s Appomattox production platform, opening up the possibility of a tie-back development to existing infrastructure jointly owned by Shell and INEOS.

David Bucknall, CEO of INEOS Energy, commented, "This is a good result for INEOS Energy and an important step in building our presence in the US Gulf where world-class resources are to be found and developed responsibly. We believe Nashville will help strengthen energy security and provide reliable supplies for many years to come."

According to the company, the well was drilled using the Deepwater Proteus, regarded as one of the most advanced offshore drilling rigs currently in operation. INEOS added that further technical evaluation is under way to assess the full scale and commercial potential of the discovery.

Heather Osecki, CEO of INEOS Energy’s US Gulf business, said, "The drilling results at Nashville are very encouraging and fully in line with what we hoped to find. This discovery is an important first step in our plans to grow our existing assets while we look to further strengthen our position in the Gulf. We look forward to continuing our work to bring further value to the Appomattox host platform."

Petronas' natural gas development project offshore Brunei Darussalam will see engineering, procurement, construction, installation and commissioning (EPCIC) work by McDermott.

Petronas' natural gas development project offshore Brunei Darussalam will see engineering, procurement, construction, installation and commissioning (EPCIC) work by McDermott.

A subsea contract between Petronas and McDermott, this follows front-end engineering design, engineering optimisation and readiness planning delivery for the project, also by McDermott.

A significant conventional gas project from Brunei, the latest contract will require McDermott to support the development of a subsea production system and associated infrastructure. The company will be delivering umbilicals, risers and flowlines, which will connect six wells to a floating production unit for natural gas recovery. It will also cover EPCIC services for a gas export pipeline that will supply feedstock to Brunei's liquefied natural gas (LNG) sector.

"Transitioning from FEED to a full EPCIC award underscores McDermott's engineering excellence and proven ability to deliver complex subsea projects across the region," said Mahesh Swaminathan, McDermott's Senior Vice President, Subsea and Floating Facilities. "It also reinforces McDermott's collaborative approach in working with customers to drive engineering value. We look forward to continuing our collaboration with PETRONAS Carigali Brunei and its partners to advance this project safely and efficiently."

Project management will be led from McDermott's engineering center of excellence in Kuala Lumpur, Malaysia, supported by teams across other McDermott offices and project sites.

The Brunei gas development project aims to deliver a long-term solution for natural gas supply, covering the region's domestic energy needs and LNG export commitments.

In line with its ambitions, Gulf Keystone, a leading independent operator and producer in the Kurdistan Region of Iraq, has managed to record a gross average production of around 41,400 bopd in 2025

In line with its ambitions, Gulf Keystone, a leading independent operator and producer in the Kurdistan Region of Iraq, has managed to record a gross average production of around 41,400 bopd in 2025

The company's approach involved transitioning from trucking sales to pipeline exports via the Iraq-Türkiye Pipeline so that volumes can be quickly ramped up to attain full well capacity.

Well workover is currently underway to bring back two wells online, which in turn, will result in increased production rates by early 2026. A three-week shutdown is also in plans next year to ensure safety upgrades at PF-2, with equipment tie-ins to be conducted as well. Engineering design work is on track for the installation of PF-2 water handling in 2027.

Jon Harris, Gulf Keystone’s chief executive officer, said, "2025 has been a milestone year for the Company after pipeline exports from the Shaikan Field were successfully restarted in September following a hiatus of over two and a half years. Liftings allocated to Gulf Keystone and other IOCs commenced in November and we are pleased to have recently received our first payment. The process as outlined in the interim exports agreements is working and we look forward to a return to full PSC entitlement at international prices following the international independent consultant’s review.

"We are on track to meet our production, capital and cost guidance for 2025. Strong operational and financial performance in the year has enabled us to safely advance key projects while distributing US$50mn of dividends to shareholders. Cumulative production from the Shaikan Field recently surpassed 150 million barrels, underlining the scale and quality of the asset. Looking ahead to 2026, we are expecting a base work programme focused on the progression of current projects. We are also embedding optionality to restart drilling and review disciplined field development, contingent on consistent exports payments at international prices. We are excited about a potentially transformational year for the company and remain focused on executing for our shareholders."

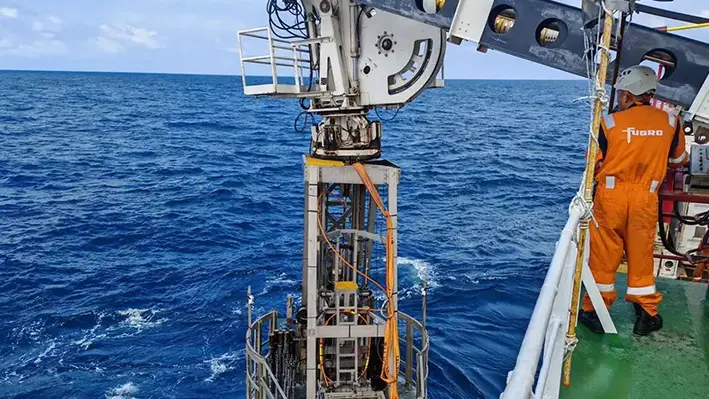

Fugro has secured a significant contract with Mubadala Energy (South Andaman) RSC Limited to deliver cutting-edge soil investigation services for the South Andaman Deepwater Development offshore Indonesia.

Fugro has secured a significant contract with Mubadala Energy (South Andaman) RSC Limited to deliver cutting-edge soil investigation services for the South Andaman Deepwater Development offshore Indonesia.

Italian oilfield services provider Saipem has confirmed that Aker BP has exercised a further option to extend the contract for the semi-submersible drilling rig Scarabeo 8, keeping the unit on the Norwegian Continental Shelf (NCS) for an additional year, now through to 2028.

This marks the third consecutive extension of the agreement since the original charter was signed in March 2022, reflecting sustained drilling activity and operational collaboration between the two companies.

The extension is valued at US$157mn, covering the rig hire dayrate but excluding fuel and supplementary services, and is subject to approval by Aker BP’s board, expected in January 2026. Saipem and Aker BP have also included a contractual clause enabling future options for further extensions, signalling their intention to maintain the partnership beyond 2028 if market conditions and operational requirements align.

Scarabeo 8 is a sixth-generation semi-submersible drilling unit engineered for demanding offshore environments such as the North Sea and Barents Sea, capable of year-round operations under stringent regulatory standards. The rig is equipped with advanced dynamic positioning (DP3) and mooring systems and holds a DNV winterised basic classification, allowing it to operate in harsh weather conditions while aiming for “zero pollution” and “zero discharge” performance. It can support drilling to significant depths and accommodate large crews, making it suitable for complex exploration and well construction projects in deep and shallow waters.

The original contract, awarded in March 2022, had a three-year firm period worth approximately US$325mn and included options for two further one-year extensions. Since then, Aker BP has exercised those options annually, with the latest move extending the contract into 2028 after previous extensions for 2026 and 2027.

Operationally, Scarabeo 8 has been involved in key activities on the ncs under Aker BP’s drilling programme. Last year, it set a new record for the longest exploration well drilled by Aker BP in Norway, reaching a total depth of 8,513 m, underscoring the rig’s performance and capability in frontier exploration drilling.

The latest extension not only highlights Saipem’s ongoing role in supporting hydrocarbon exploration and production in one of the world’s most challenging offshore environments but also indicates broader confidence in continued offshore oil and gas activity in norway amid evolving energy markets.

Seadrill Limited has announced new contract awards for its rigs West Neptune, Sevan Louisiana, and Sonangol Quenguela.

Seadrill Limited has announced new contract awards for its rigs West Neptune, Sevan Louisiana, and Sonangol Quenguela.

In the U.S. Gulf of Mexico, the West Neptune has secured a contract with LLOG Exploration. The four-month program is scheduled to begin immediately following the current contract, contributing approximately $48 million to Seadrill’s backlog.

Meanwhile, the Sevan Louisiana also received a contract award in the U.S. Gulf from an undisclosed operator for a two-month program. This engagement is set to start directly after its current contract with Walter Oil and Gas. The campaign will mark the first use of the Trendsetter well-intervention equipment in the region.

In Angola, an option for five wells has been exercised, extending the Sonangol Quenguela’s operations by around ten months, keeping the rig contracted through February 2027.

“These awards reflect Seadrill’s ability to contract preferentially in direct continuation to current contracts and avoid costly white space in a challenging market phase,” said Simon Johnson, President and Chief Executive Officer. “We continue to build backlog into 2026 and beyond, deepening longstanding partnerships with existing and repeat customers.”

As Reconnaissance Energy Africa reports a productive 2025 in its year-end corporate operational performance, the company is preparing to conduct a well test in Damara Fold Belt offshore Namibia.

As Reconnaissance Energy Africa reports a productive 2025 in its year-end corporate operational performance, the company is preparing to conduct a well test in Damara Fold Belt offshore Namibia.

“We are preparing to conduct a production test on Kavango West 1X, which will allow us to conduct a longer flow period and pressure buildup analysis to better calculate potential production rates and reserve estimates. Early planning suggests that we may test up to eight separate reservoir intervals of interest,” said Nick Steinsberger, Senior Vice President Drilling & Completions.

Unlike the usual process, the partners are prioritising production testing over a drill stem test to allow for more controlled testing of isolated intervals of interest. This way better addressed the operational challenges posed by a 2,000-m open hole section in adequately testing the entire gross Otavi reservoir at one time.

Production casing and testing equipment are being sourced before testing operations can be commenced in the first quarter of 2026. In a span of roughly two months, up to eight zones of interest will be evaluated.

Wireline logging from the Huttenberg and Elandshoek formations within the Upper Otavi Group have also indicated promising results. Well analysis from the Elandshoek sections shows 81 m of hydrocarbon fluorescence found in cuttings, a clear indicator of hydrocarbons. Indications of fracturing were pervasive based on well logs.

Also, rapid increases in gas readings after drilling connections indicated hydrocarbons flowing actively towards the wellbore.

“We have had an active and productive 2025 in which we advanced the Company on multiple strategic fronts. We completed drilling our second well in the Damara Fold Belt resulting in encountering of significant hydrocarbons, extended our acreage position into Angola at a low cost of entry and expanded our asset portfolio into offshore Gabon to help balance our investment risk profile. These actions set the Company up for several important milestones in 2026.

We are preparing for the production test at Kavango West 1X next year after only our second exploration well drilled in the Damara Fold Belt, a unique position to be in when exploring a new basin. Our teams are working on procuring the equipment needed for this test which is expected to commence operations by the end of the first quarter of 2026.

While recently visiting Namibia after our Kavango West 1X well results, the partnership group operated by ReconAfrica and including NAMCOR and BW Energy, had the privilege of meeting Her Excellency President Nandi-Ndaitwah. We are grateful for the President’s recognition of the significance of hydrocarbons encountered in the Kavango West well and how the partnership can help support onshore hydrocarbon development and the long-term energy supply for Namibia,” said Brian Reinsborough, President and CEO.

As NuGulf is looking towards major decommissioning operations, a Bureau of Safety and Environmental Enforcement-aligned Cased Hole Well Control Manual for Decommissioning Activity that is dedicated to the nearshore Gulf of America has been released.

As NuGulf is looking towards major decommissioning operations, a Bureau of Safety and Environmental Enforcement-aligned Cased Hole Well Control Manual for Decommissioning Activity that is dedicated to the nearshore Gulf of America has been released.

The document focuses on decommissioning where the well is made safer, especially during the operation. The initial process involves establishing plug and cement barriers to isolate all hydrocarbon hazards. Once this step is achieved, well changes are determined by 'class' from pressure for flow potential to no pressure and no potential to flow. Equipment rig up can change from pressure tested PCE to 'open hole' operations to cut and pull tubing and casing.

This document comes after a tried and tested onshore Cased Hole Well Control Manual that ensured consistency in operations and both well site supervisors and contractors understand what is required for any cased hole operation.

A United States-based operator, NuGulf works to eliminate the global Asset Retirement Obligation (ARO) through the careful decommissioning, plugging and abandoning, and environmental cleanup of wells and field infrastructure. Their approach involves innovative solutions to efficiently deliver some of the most challenging decommissioning, well intervention and hurricane recovery projects.

Page 7 of 118