Gulf of Suez Petroleum Company (GUPCO) has commenced production from the Al-Wasl-4 development well at the North Safa Field, marking a further boost t crude oil output from one of the Gulf of Suez region’s most important recent offshore discoveries.

The well, drilled from the field’s offshore production platform, has an initial production rate of around 2,250 barrels of crude oil per day, alongside approximately 1.3mn cubic feet of gas per day. As a result, GUPCO’s total crude oil production has risen to roughly 65,000 barrels per day, strengthening Egypt’s upstream output from mature offshore assets.

In a statement issued on Tuesday, Egypt’s Ministry of Petroleum and Mineral Resources said the start-up reflects GUPCO’s ongoing strategy to maximise value from its asset base through an integrated development approach. This includes drilling new exploratory and development wells, re-evaluating geological structures and leveraging remaining potential within mature producing fields.

The Al-Wasl-4 well is among the flagship projects within GUPCO’s 2026 development plan, having been prioritised following encouraging technical and geological studies. According to the ministry, these assessments confirmed the commercial viability of the well and its role in sustaining and expanding production from the North Safa Field.

North Safa is regarded as one of the most significant offshore discoveries in the Gulf of Suez in recent years. Commercial production from the field began in 2024 after GUPCO completed a major development programme that included the installation of a new offshore production platform and the laying and connection of subsea production pipelines. The project was executed in line with stringent occupational safety, health and environmental protection standards, the ministry added.

Alongside bringing new wells on stream, GUPCO is also advancing an integrated reservoir pressure maintenance programme designed to support long-term production sustainability. The programme involves water injection across three wells, aimed at maintaining reservoir pressure, optimising recovery rates and enhancing overall production efficiency.

Preparations are already under way for the second phase of development at North Safa, with reservoir performance data from current operations expected to inform future drilling and production plans. The ministry noted that the company’s focus remains on balancing short-term production gains with long-term field management, particularly in offshore environments where maximising recovery from existing infrastructure is critical.

The latest production milestone underscores the continued importance of the Gulf of Suez as a core oil-producing region, even as operators increasingly rely on advanced studies and targeted development to unlock additional value from established fields.

Technology solutions company, Rosenxt Group, has acquired K.U.M Umwelt- und Meerestechnik Kiel GmbH (K.U.M), strengthening its position in the growing subsea technology market and expands its portfolio with specialised solutions for deep-sea monitoring and data acquisition.

Technology solutions company, Rosenxt Group, has acquired K.U.M Umwelt- und Meerestechnik Kiel GmbH (K.U.M), strengthening its position in the growing subsea technology market and expands its portfolio with specialised solutions for deep-sea monitoring and data acquisition.

K.U.M boasts a vast portfolio of customised subsea monitoring systems, ocean-bottom seismometers, seabed instrument carriers, and other advanced deep-sea solutions. The company has more than 400 offshore expeditions and a broad customer base across 40 countries. Now, as part of Rosenxt Group, K.U.M will gain access to a broader international market and be able to scale its subsea solutions more rapidly.

Through the acquisition, Rosenxt will significantly expand its presence in the specialised subsea domain: K.U.M brings more than 20 years of experience in developing complete subsea systems. The acquisition supports Rosenxt’s strategy on integrating sensing, robotics, digitalisation, materials technology and deep environmental expertise to develop robust solutions that create value across subsea, offshore and upstream applications.

Hermann Rosen, Chairman of the Board at Rosenxt, said, “The integration of K.U.M is a consistent contribution to our responsibility to shape the future of critical infrastructure in a resilient and technologically excellent way. K.U.M brings decades of subsea engineering expertise and precise data acquisition to the table – a strong addition to our group. We think in the long term – beyond market cycles – and are laying the foundations today for the solutions of tomorrow. Rosenxt is staying true to its course and sending a clear signal about its ambitious development in the subsea market.”

CEO of K.U.M, Onno Bliss, commented, “Joining the Rosenxt Group enables K.U.M to further scale our subsea data acquisition and instrumentation solutions and benefit from the group’s broader technology ecosystem. Our shared values – innovation, precision, integrity – make this partnership an excellent fit.”

Archer, in collaboration with SLB, has been awarded an integrated plug and abandonment (P&A) contract with Equinor for the Titan platform in the Gulf of America (GoA).

Archer, in collaboration with SLB, has been awarded an integrated plug and abandonment (P&A) contract with Equinor for the Titan platform in the Gulf of America (GoA).

The service offerings under the contract includes project management, well engineering, provision of a compact workover rig, coiled tubing, wireline services, and a suite of downhole P&A technologies and the scope covers P&A of three wells. The award combines SLB’s established deepwater leadership in the region with Archer’s specialist expertise as a P&A service provider.

Dag Skindlo, CEO of Archer, commented, “This integrated deepwater P&A project builds on our momentum following several large P&A contract awards in the North Sea in 2025. The recent acquisitions of the US based fishing specialists WFR and Premium were key steps in our strategy to position Archer as a leading service provider in the growing deepwater P&A market in the GoA.”

The contract follows hot on the heels of the award of an integrated P&A contract with Equinor for 30 subsea wells. The fully integrated P&A programme incorporates the planning scope including project management, well and subsurface engineering (provided through the Archer Elemental joint venture) with the execution scope including wireline, fishing and remedial services, downhole mechanical isolation, P&A services, cementing, fluids, and mudlogging.

The awards further reinforce Archer’s leading position within the P&A market and reflect its ability to deliver integrated well abandonment solutions from concept selection through to the permanent abandonment of wells. The company has successfully completed hundreds of permanent P&A wells in the North Sea.

Equinor has been granted approval by the Norwegian Offshore Directorate to drill a new exploration well in the Norwegian part of the North Sea, strengthening ongoing activity in one of the country’s mature offshore areas.

The permit relates to the 34/8-A-37 H wildcat well within production licence 120, a licence originally awarded on 23 August 1985 and currently valid through to 2034. Equinor operates the licence with a 53.2% interest. The remaining stakes are held by Petoro, which owns 30%, ConocoPhillips Skandinavia with 9.1%, and Repsol Norge with 7.7%.

Drilling of the well is planned to take place from the Visund field, with operations expected to commence in January 2026. The Visund field is situated in the northern North Sea, northeast of the Gullfaks field, in waters measuring around 335 m in depth.

Discovered in 1986, Visund moved into the development phase following approval of its plan for development and operation in 1996. First oil was achieved three years later, in 1999, and the field has remained an active production hub since then.

The development comprises the Visund A platform, a semi-submersible installation that combines accommodation, drilling and processing functions. This surface infrastructure is supported by a subsea production facility located in the northern part of the field, enabling continued operations in the area.

With some of Vietnam’s older fields entering the decommissioning stage, reflecting the maturity of south-east Asia’s offshore oil and gas sector, the industry is still capable of throwing up a surprise or two.

With some of Vietnam’s older fields entering the decommissioning stage, reflecting the maturity of south-east Asia’s offshore oil and gas sector, the industry is still capable of throwing up a surprise or two.

In a move that should stir longer-term demand for oil well services of all kinds, Vietnam has just unearthed its largest discovery in a generation.

For US independent Murphy Oil Corporation, 2026 truly began with a bang with the drilling of the Hai Su Vang-2X (HSV-2X) appraisal well in Block 15-2/17 in the Cuu Long Basin, yielding what is thought to be the biggest find across the region in 20 years.

Located approximately 40 miles off the coast of Vietnam, the well spud in early October 2025 and marks a major milestone in Murphy’s strategic appraisal campaign for the Hai Su Vang (Golden Sea Lion) field.

The HSV-2X well was drilled to appraise the 2025 Hai Su Vang discovery, where an initial discovery well encountered approximately 370 feet of net oil pay across two reservoirs.

The HSV-2X well encountered 429 feet of net oil pay across the same two reservoirs, including 332 feet of net oil pay in the deeper primary reservoir and 97 feet of net oil pay in the shallow reservoir.

While further testing is ongoing, the primary reservoir achieved a production rate of 6,000 barrels of oil per day (bopd) of high-quality, 37-degree API oil.

These results confirm Hai Su Vang as a “significant discovery,” a Murphy Oil statement noted, pushing up resource estimates at the site beyond the initial 430 MMBOE high-end range.

“This is a pivotal moment for our Vietnam business,” said Eric Hambly, Murphy Oil’s President and CEO.

“The success of HSV-2X not only reinforces the commerciality of the Hai Su Vang field but also sets the stage for a robust development programme.”

Additional appraisal wells are needed to further refine the range of recoverable resources for both reservoirs — the HSV-3X appraisal in Block 15-1/05, and the HSV-4X well in Block 15-2/17 are both included in the group’s 2026 capital programme.

It also bodes well for the Cuu Long Basin going forward and the scope for oil well services in the region.

Now considered a mature basin, work on decommissioning, dismantling and relocation of Vietnam’s Song Doc Platform is already underway.

It means news from the Murphy Oil camp at the start of 2026 will be welcomed by the whole services industry.

Canada’s ReconAfrica has increased a private finance placement ahead of a major 2026 programme covering planning, pre-drill work, appraisal and testing across its West African assets.

Canada’s ReconAfrica has increased a private finance placement ahead of a major 2026 programme covering planning, pre-drill work, appraisal and testing across its West African assets.

The company reported that it increased the size of the finance offering from C$20mn to C$32mn due to strong investor demand.

In a statement, Brian Reinsborough, President and CEO, called the 2026 capital spend “the most comprehensive and diverse programme in ReconAfrica's history.”

It will fund multiple activities in parallel, including advancing the Kavango discovery in Namibia toward commerciality, advancing the exploration inventory of the newly discovered Damara Fold Belt play from Namibia into Angola, and progressing the Loba discovery on the Ngulu exploration block offshore Gabon to a drill-ready state.

Work at Namibia’s Kavango West 1X will include a production test after a decision was taken not to perform a drill stem test (DST) to allow for more controlled testing of isolated intervals of interest.

A production casing string will be installed from the surface down to a total depth of 4,260 metres to allow for more controlled testing of all hydrocarbon-bearing intervals and for the well to be completed as a potential producing well.

The activities in Namibia aim to position the company towards final investment decision and commercialisation of the Kavango discovery and the acceleration of first production, according to Reinsborough.

In Gabon, the company signed a production-sharing contract last year for the Ngulu block, located in shallow waters offshore.

After wading through seismic data, ReconAfrica plans to obtain a third-party resource report outlining the block’s potential with the goal of progressing the Loba field appraisal well to a drill-ready status.

In Angola, ReconAfrica plans to accelerate geochemical sampling of surface oil seeps in its MOU area and commence permitting for a potential 2D seismic programme as part of a broader evaluation of the Damara Fold Belt, with crews expected on site in April 2026.

One of Australia’s newest ships that could play a crucial role in the nation’s decommissioning effort has been christened.

One of Australia’s newest ships that could play a crucial role in the nation’s decommissioning effort has been christened.

Bhagwan Marine announced on 7 January, 2026 that it had named its newest vessel the 'Bhagwan Micah' at its Brisbane operational base — it is named in honour of the late Micah Kirk, a former member of the group's Melbourne team.

The company said the vessel is purpose-built for the energy transition and critical infrastructure sectors.

Formerly named ‘the Phoenix’, the Bhagwan Micah is a 38m state-of-the-art Stern Landing Vessel (SLV), designed for the exacting requirements of modern offshore energy and subsea operations, particularly oil and gas decommissioning, with the ability to work in shallow water environments, subsea inspection, maintenance and repair and defence logistics projects.

“This latest addition to our fleet marks another milestone in the company’s strategic growth as Australia’s leading provider of integrated marine solutions across offshore energy, subsea, ports and inshore logistics and defence sectors,” a Bhagwan Marine statement read.

“With a fleet now of over 100 vessels, Bhagwan Marine continues to position itself as the partner of choice for operators who demand proven reliability, technical excellence and low-risk project execution in complex marine environments.”

The vessel is secured under a five-year bareboat charter from BM Fleet, providing Bhagwan Marine with long-term control of a scarce, high-spec asset while maintaining capital flexibility for further fleet renewal.

“The Bhagwan Micah is not just another vessel – it is a strategic asset that reinforces Bhagwan Marine’s leadership in complex, high-consequence marine operations where safety, technical performance and environmental responsibility cannot be compromised,” the statement added.

Last August, in its 2025 results presentation, the company highlighted how it had grown its presence in the decommissioning sector.

It also highlighted future growth opportunities, citing “a substantial long-term pipeline of offshore oil and gas decommissioning projects” as well as potential work arising from ageing offshore assets requiring inspection, repair and maintenance.

Equinor has awarded a new set of long-term framework agreements to seven supplier companies, with a combined value of about NOK 100 billion, reinforcing the foundation for safe, efficient and competitive operations across its offshore installations and onshore plants.

Equinor has awarded a new set of long-term framework agreements to seven supplier companies, with a combined value of about NOK 100 billion, reinforcing the foundation for safe, efficient and competitive operations across its offshore installations and onshore plants.

In total, twelve framework agreements have been signed covering maintenance and modification services. These contracts will take effect in the first half of 2026 and run for five years, with options to extend by a further three and two years. Together, they represent an estimated annual value of around NOK 10 billion and are expected to generate long-term stability and significant knock-on benefits for the Norwegian supplier industry nationwide.

“The Norwegian continental shelf will remain the backbone for Equinor for a long time. Our ambition is to maintain a high production level and predictable energy deliveries to Europe towards 2035. At the same time, the shelf is entering a mature phase that will require new solutions. To succeed, we must, together with the supplier industry, find new ways of working that strengthen our competitiveness. These agreements facilitate long-term collaboration and continuous improvement on core tasks at Equinor’s offshore installations and onshore facilities in Norway,” said Kjetil Hove, executive vice president for the Norwegian continental shelf at Equinor.

“These are strategically important agreements, and collectively among the largest Equinor has awarded. The agreements will ensure long-term activity and value creation across Norway, with job creation estimated at around 4,000 man-years at the suppliers. The goal is close, long-term, and predictable cooperation that strengthens the culture for safety and security and our shared competitiveness. Together, we will work safer and smarter, and scale up the use of new technology,” added Jannicke Nilsson, chief procurement officer at Equinor.

The framework agreements support Equinor’s objective of sustaining production of around 1.2 million barrels of oil equivalent per day on the Norwegian continental shelf, broadly in line with 2020 levels, through to 2035. To achieve this, the company plans annual investments of approximately NOK 60–70 billion in increased recovery and new field developments. This includes drilling about 250 exploration wells and around 600 wells aimed at improving recovery, carrying out roughly 300 well interventions each year, and executing close to 2,500 modification projects.

Equinor also intends to mature and develop more than 75 subsea projects that can be tied back to existing infrastructure, while continuing efforts to cut its own greenhouse gas emissions by nearly 50% by 2030 compared with 2015 levels. Alongside maintaining stable and reliable energy supplies to Europe, the company will invest heavily in maintenance and upgrades to enhance safety, ensure high operational regularity, and reduce climate and environmental impacts.

The agreements span seven suppliers in total, including three companies that are new entrants to Equinor’s maintenance and modification portfolio.

Petrobras has begun oil production from the P-78 floating production, storage and offloading (FPSO) vessel in the Búzios field, in the pre-salt layer of the Santos Basin.

Petrobras has begun oil production from the P-78 floating production, storage and offloading (FPSO) vessel in the Búzios field, in the pre-salt layer of the Santos Basin.

Búzios 6 (P-78) has the capacity to produce 180,000 barrels of oil and 7.2 million cubic metres of gas per day. The FPSO will increase the field's installed production capacity to approximately 1.15 million barrels of oil per day. The project will also allow for the export of gas to the mainland via interconnection with the ROTA 3 gas pipeline , expanding Brazil's gas supply by up to 3mn cubic metres per day .

"With the first oil from the P-78 platform, we are starting the year already advancing towards our main goal for 2026: increasing Petrobras' oil and gas production. We project producing 2.5 million barrels of oil per day throughout this year, and a large part of that will come from Búzios, the country's largest field in terms of reserves and production. In addition, we are also expanding the supply of natural gas to the Brazilian market, another goal expressed in our Business Plan," said Magda Chambriard, president of Petrobras.

The P-78 is an FPSO (Floating Production, Storage and Offloading) unit and inaugurates a new family of proprietary unit projects, bringing even greater safety and reliability to operations. The platform is equipped with technologies for reducing emissions and increasing operational efficiency, notably the exhaust gas recovery system, the adoption of variable speed drives in pumps and compressors, and energy integrations between hot and cold streams in oil and gas processing.

The project comprises 13 wells, 6 producers and 7 injectors, equipped with intelligent completion systems that enhance production management. The unit will be interconnected with rigid pipelines for production, injection and gas export, and flexible pipelines for service lines, using innovative technologies for attaching the pipelines to the FPSO. These pipelines will allow for the high-capacity production planned for the field's wells.

The platform is the seventh in operation in the Búzios field, the largest in the country in terms of reserves. Located 180 km off the coast of the state of Rio de Janeiro, in ultra-deep waters of the Santos Basin, at a depth of more than 2,000 meters, it surpassed 1mn bpd production in October 2025.

Subsea decommissioning specialist Decom Engineering has provided an update on its work offshore Australia.

Subsea decommissioning specialist Decom Engineering has provided an update on its work offshore Australia.

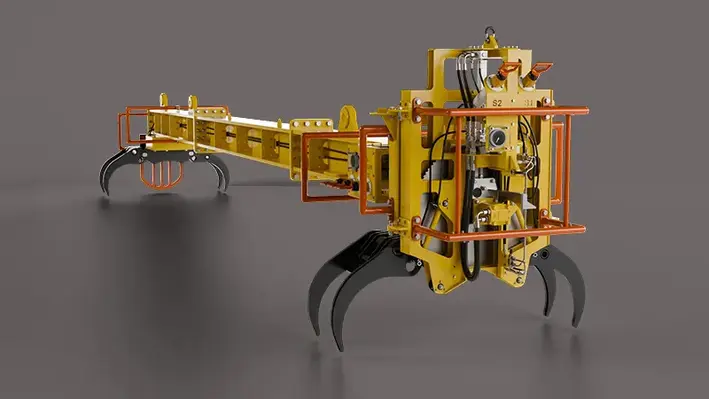

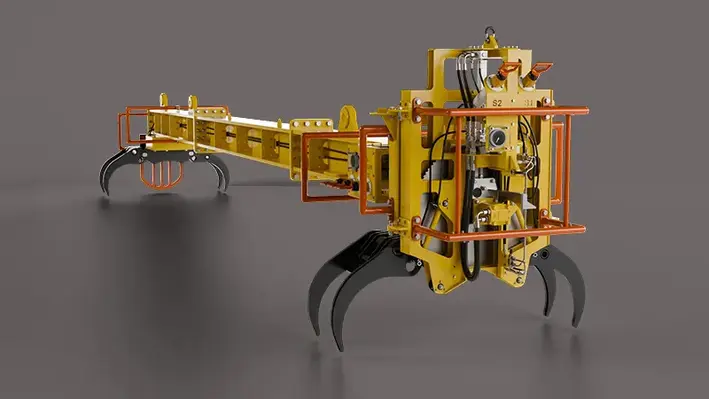

In a social media post titled “Live from the Seabed: TRACS-16 Performance in Australia” the company reveals action footage of its TRACS-16 tool performing live cutting operations on the seabed.

TRACS-16 (Twin Recovery & Cutting System) is the firm’s innovative modular tool that combines cutting, lifting and recovery, designed to cut and recover pipelines up to 20m long with diameters up to 16”, although custom sizes can also be engineered.

It is ideal for decommissioning operations, with the crane-deployable tool capable of recovering sections and returning them to the deck or relocating to a subsea basket.

In a video posted on LinkedIn, the company shows TRACS-16 at work, cutting away at an unspecified subsea decommissioning site offshore Australia.

“We are getting January off to a super start with some live offshore footage from our project in Australia,” the company stated in the post.

“Here is the TRACS-16 tool performing live cuts on the seabed. We are seriously happy with the performance of this new tool in our toolbox, delivering impressive results across the campaign.”

These results include its speed, with cycle times of as little as nine minutes, with individual cuts averaging as fast as four minutes and 30 seconds “with some ever faster,” it added.

It also cited the machinery’s durability, achieving 38 cuts per blade, “demonstrating the reliability of our proprietary cutting technology.”

The post added: “This level of efficiency is exactly how we help operators minimise vessel time and keep complex decommissioning projects on track.”

The TRAC 16’s quick connect system allows for seamless attachment and detachment of the C1-16 Chopsaw, which comes with a 1,040mm blade capable of making precise cuts through pipes up to 16″ in diameter.

It also includes ROV (remotely-operated vehicle) grab bars at both ends and near the hotstab panel, ensuring easy positioning and stabilisation by the ROV.

The system is operable via ROV or topside control package.

Italian engineering and energy services giant Saipem has confirmed plans to restart operations on its Perro Negro 7 jackup rig in Saudi Arabia, marking a positive signal for the recovery of offshore drilling activity in the Middle East.

Italian engineering and energy services giant Saipem has confirmed plans to restart operations on its Perro Negro 7 jackup rig in Saudi Arabia, marking a positive signal for the recovery of offshore drilling activity in the Middle East.

The rig is scheduled to resume work in January 2026 after a temporary suspension.

Originally built in 2008, the Perro Negro 7 operates under a long-term contract awarded by Saudi Aramco in 2011. This agreement was extended in June 2023 for an additional 10 years, underlining Aramco’s continued confidence in Saipem’s offshore capabilities. Operations were paused for a 12-month period in 2024, but Saipem confirmed that the suspension will be fully recovered at the end of the contract, extending its duration until 2034.

Designed for challenging offshore environments, the jackup rig is capable of operating in water depths of up to 115 metres and drilling wells reaching 9,100 metres. It is equipped with advanced technologies that enhance operational efficiency, workplace safety and environmental compliance, aligning with increasingly stringent industry standards.

Saipem views the restart of Perro Negro 7 as a clear indication of renewed momentum in Middle East offshore drilling, a region the company continues to prioritise as a strategic growth market. The move reflects broader industry trends pointing to rising upstream investment and sustained demand for high-specification offshore rigs across the Gulf.

With Saudi Arabia pushing ahead with energy development plans, Saipem’s resumed operations further reinforce its position as a key player in the region’s offshore oil and gas sector.

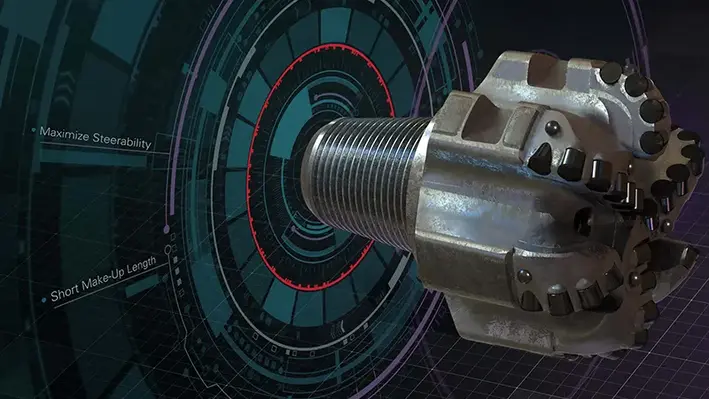

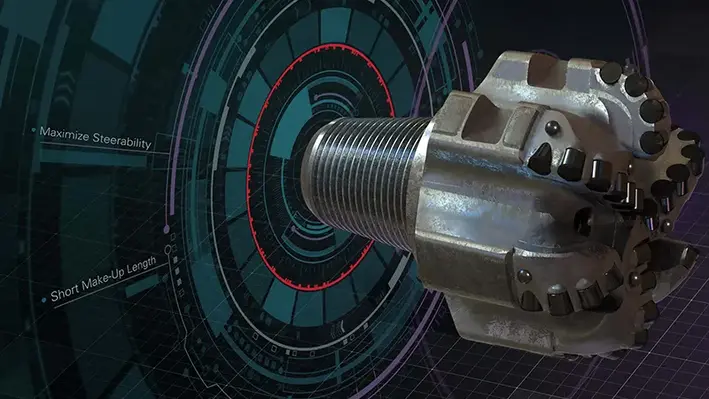

Halliburton has launched its first shankless matrix-body bit called the HyperSteer MX directional drill bit.

Halliburton has launched its first shankless matrix-body bit called the HyperSteer MX directional drill bit.

Improving durability and maximising directional control, the bit promises longer runs and fewer trips, resisting erosion and abrasion, and performing reliably in high-flow, abrasive environments.

"HyperSteer MX directional drill bits mark a major step forward in drilling. The technology combines the precise steerability of HyperSteer directional drill bits with a durable matrix body. It allows operators to drill longer in harsh environments and supports efforts to minimize well time and maximize directional performance for customers," said Amr Hassan, Vice President, Drill Bits and Services, Halliburton.

The tool utilises advanced matrix materials to resist erosion and abrasion, extend bit life in abrasive, high-flow environments, and improve efficiency and reliability during operations. It deliver precise steerability that boosts performance in vertical, curve, and lateral sections, and reduces well time as well as well construction costs. The bit reduces trips, lowers exposure to unplanned events, and maintains directional precision in the most abrasive environments.

HyperSteer MX directional drill bits adds to the HyperSteer portfolio, reflecting the oilfield services provider's engagement in innovative engineered solutions for asset value maximisation.

Page 5 of 118