Viaro Group has appointed well management company, Exceed Energy, as the well operator for the 192 wells from One Gas West assets.

Viaro Group has appointed well management company, Exceed Energy, as the well operator for the 192 wells from One Gas West assets.

This follows Viaro’s acquisition of the North Sea assets from Shell and ExxonMobil.

The contract will enable Exceed to manage all aspects of late life well operations, starting with the decommissioning of the 26 wells associated with the SNS Leman Foxtrot and Golf platforms, which commences later this year.

This will be followed by well intervention and further decommissioning operations, as well as the development of new gas production wells as per the five-year, multi-million contract.

Marking the win as the most significant in its 20-year history, John Anderson, Exceed's Commercial Director – Wells, said, "Our well and reservoir management capabilities have gained an outstanding reputation for the ability to balance decarbonisation with energy security and affordability, as we continue to champion a sustainable UK energy transition.

"Understandably, this contract has been keenly contested across the North Sea industry, and we are delighted that our capacity and competency have been recognised by Viaro as providing optimum levels of expertise and support for its major acquisition."

Click here to register for Offshore Network's international well intervention and decommissioning conferences.

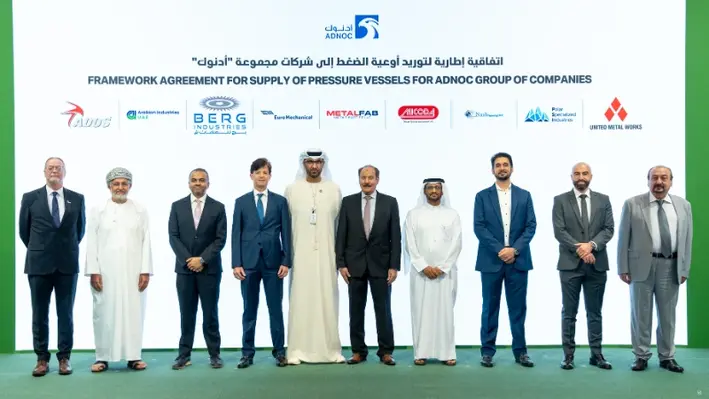

The Abu Dhabi National Oil Company (ADNOC), the UAE’s largest offshore oil and gas producer, is revolutionising its offshore operations by prioritising locally-manufactured products, aligning with the “Make it in the Emirates” initiative.

ADNOC produces 4.85 barrels of oil per day, accounting for half of Abu Dhabi’s oil production capacity. This includes its nine offshore fields.

The company's push for local sourcing enhances efficiency, reduces supply chain risks, and supports the UAE’s economic diversification, as highlighted at the 2025 Make it in the Emirates forum (MIITE), which took place from 19-22 May this year.

ADNOC Logistics & Services (ADNOC L&S) is leading this transformation, deploying UAE-built offshore support vessels (OSVs) equipped with smart digital systems for real-time monitoring.

At MIITE, Capt. Mohamed Al Ali, SVP Offshore Logistics, emphasised these vessels’ role in optimising logistics for offshore fields, showcasing Emirati expertise and the role ADNOC is playing in enhancing Emiratisation.

In 2024, ADNOC L&S also acquired six flat-top cargo barges from Dubai’s Premier Marine Engineering, supporting its engineering, procurement, and construction (EPC) projects.

On the other hand, ADNOC’s partnership with Tubacex, announced on 19 May, introduces locally-developed well completion technologies at a new UAE R&D centre.

These AI-driven systems enhance subsea interventions like wireline logging and stimulation in fields such as Lower Zakum, boosting recovery rates.

Additionally, ADNOC has awarded AED543 million (US$147.8mn) in contracts to nine local suppliers for products like valves and corrosion inhibitors, which are critical for offshore well integrity.

These agreements, facilitated by ADNOC’s In-Country Value (ICV) programme, aim to localise AED90 billion (US$24.5bn) in procurement by 2030, creating 3,500 skilled jobs.

The RoboWell AI system, deployed across 10 wells at the NASR field in 2024, marks a global first for autonomous offshore well control.

Developed with AIQ, RoboWell uses cloud-based algorithms to optimise operations, reducing emissions and human supervision. Plans to expand to 300 wells underscore ADNOC’s digital leadership.

Critically, while local manufacturing strengthens resilience, reliance on foreign partners like Tubacex for advanced tech highlights a need for deeper UAE innovation.

ADNOC’s strategy, blending local production with global expertise, positions it as a pioneer in sustainable offshore operations, driving UAE’s industrial growth.

In 2025, the offshore oil and gas sector in the Gulf of America is undergoing a rapid transformation, as new well intervention technologies reshape how operators approach subsea production, integrity, and high-pressure challenges.

With legacy fields maturing and operational efficiency becoming a strategic priority, companies are turning to advanced systems and partnerships to optimise well performance, extend asset life, and reduce rig time.

Chevron’s Ballymore development stands out as a symbol of this shift. By leveraging a subsea tieback to the existing Blind Faith platform, the project avoids the need for new topside infrastructure while still enabling high-yield production from three wells. This infrastructure-light approach exemplifies a broader industry trend, as operators seek scalable, sustainable solutions that reduce capital expenditure while accelerating timelines. Ballymore is expected to contribute significantly toward Chevron’s target of producing 300,000 barrels of oil equivalent per day from the region by 2026.

On the other hand, Shell is deploying innovative materials in its Whale project, located around 200 miles offshore. The company has partnered with CRP Subsea to introduce crushable foam wrap (CFW) technology – engineered to collapse under specific temperature and pressure thresholds. This provides thermal expansion management and pressure relief in the annulus, addressing critical integrity challenges in deepwater completions. Set for phased delivery starting in the third quarter of 2025, the technology reflects growing emphasis on preemptive integrity control in complex environments.

Meanwhile, intervention hardware is also evolving to meet the region’s high-pressure demands. Trendsetter Engineering has successfully deployed its Trident 20K system at Beacon Offshore’s Shenandoah project. Designed for operations in ultra-high-pressure wells, the intervention system was installed from the Deepwater Atlas drillship and enabled a two-well flowback campaign without requiring the system to be recovered between wells. Its modular design and wet-mate capabilities allowed operators to save valuable rig time while maintaining safety in technically challenging conditions.

The Gulf of America is shifting toward a model where reliability, modularity, and pressure management dominate offshore engineering priorities. As Chevron retools infrastructure usage, Shell integrates intelligent thermal solutions, and Trendsetter pushes the limits of high-pressure intervention, the region is positioning itself as a proving ground for next-gen well intervention technologies. These advancements are expected to support longer well life cycles and safer operations as operators balance performance with cost control.

The European well intervention market, valued at US$4.73bn in 2024, is forecasted to grow to US$ 7.17bn by 2030, at a CAGR of 7.02%. Well intervention encompasses a range of operations aimed at maintaining, repairing, or boosting oil and gas wells to ensure optimal production and efficiency.

Demand in Europe is rising due to energy security concerns amid geopolitical tensions and supply disruptions. To reduce reliance on imports, European countries are investing heavily in well intervention services to maximise output from existing assets. Techniques such as enhanced oil recovery (EOR) and gas lift optimisation play vital roles in sustaining production levels and managing decline rates. Operators are also balancing fossil fuel production with sustainability objectives, using well intervention to lower environmental impact.

Despite its growth, the market faces challenges including high operational costs, especially offshore in regions like the North Sea, where harsh conditions and complex logistics increase expenses. Price volatility in the oil and gas sector, along with rising material costs and supply chain issues, add further pressure.

To address these hurdles, the industry is adopting cost-effective methods like rigless interventions, leveraging advancements in coiled tubing and electric wireline technologies. Maintaining stringent safety standards remains a priority.

Digital transformation is reshaping the sector through AI, machine learning, and real-time data analytics, which help optimise operations, cut costs, and improve safety. Technologies such as fiber-optic sensors and downhole cameras support remote monitoring and predictive maintenance, reducing downtime and preventing failures.

Robotic intervention systems and remotely operated vehicles (ROVs) are increasingly used to improve safety and efficiency in hazardous offshore environments. Autonomous coiled tubing units and electric wireline tools enable precise, minimally disruptive interventions.

The market covers service types, well types, and applications across countries like Norway, the UK, Turkey, Italy, Denmark, and Germany. Comprehensive competitive analyses highlight major players and emerging opportunities tailored to corporate strategies.

This analysis is based on the report “Europe Well Intervention Market, By Country, Competition, Forecast and Opportunities, 2020-2030F” conducted by Research and Markets. For more information, visit here

In a significant stride for India’s energy infrastructure, the Panna-Mukta and Tapti (PMT) joint venture – comprising Shell (via BGEPIL), Reliance Industries Limited (RIL), and ONGC – has wrapped up country’s first offshore decommissioning project successfully.

In a significant stride for India’s energy infrastructure, the Panna-Mukta and Tapti (PMT) joint venture – comprising Shell (via BGEPIL), Reliance Industries Limited (RIL), and ONGC – has wrapped up country’s first offshore decommissioning project successfully.

The milestone marks the safe removal of offshore facilities in the mid and south Tapti fields, located off India’s west coast.

The PMT JV, which operated the Tapti fields under a production sharing contract with the Government of India, includes ONGC with a 40% stake, and BGEPIL (Shell) and Reliance holding 30% each.

Production from the fields ceased in March 2016, marking a major shift in India’s oil and gas sector – from extracting resources to safely shutting down operations.

The multi-phase project involved the removal of five wellhead platforms, the safe plugging and abandonment of 38 wells, and the removal of infield pipelines. The entire process closely adhered to safety and environmental standards, at every stage – from offshore execution to onshore dismantling, planned with utmost precision.

The project, aligned with India’s ‘Make in India’ mission, awarded major contracts to Indian firms – Larsen & Toubro, who led the offshore removal, while Chowgule Shipyard in Ratnagiri handled the onshore dismantling. This not only strengthened domestic capability in energy infrastructure but also created a blueprint for future decommissioning operations in Indian waters.

What sets this project apart is not just its scale but its role in shaping a strong regulatory and operational framework for offshore decommissioning in India. Built in close collaboration with stakeholders – the Ministry of Petroleum and Natural Gas, the Directorate General of Hydrocarbons, and the Oil Industry Safety Directorate, the Tapti decommissioning project sets a benchmark of how legacy fields can be responsibly retired.

“The safe and successful completion of the Tapti offshore project is a landmark moment for India’s offshore energy sector,” said Nipun Pradhan, managing director of BGEPIL and GM, Shell Upstream India, adding, that this project sets a new benchmark for responsible decommissioning, which has been made possible by global expertise, strong collaboration, and an unwavering commitment to safety and sustainability.

Sanjay Barman Roy, president of E&P, Reliance Industries, shared, “The safe and responsible offshore decommissioning by the PMT JV marks a significant step forward for India’s energy sector. From the outset, the JV partners worked tirelessly to strengthen local supply chains and enhance the technical and safety capabilities of Indian contractors, especially for offshore dismantling activities,” stating that this has been successful in fulfilling the government’s ‘Make and Break in India’ vision.

For ONGC, the project’s complexity, given its proximity to active assets, underscored the importance of meticulous planning. “This first-of-its-kind large-scale offshore decommissioning underscores ONGC’s commitment to responsible energy practices, said Pankaj Kumar, director of production, ONGC, expressing that the project’s complexity, especially its proximity to ONGC’s live assets demanded strategic planning, precise execution, and utmost focus on safety and that it sets the foundation for India’s next chapter in offshore transformation.

As India strives to balance energy growth with environmental responsibility, the Tapti project sets a timely benchmark for offshore decommissioning in the country’s evolving energy transition.

Offshore contractor Allseas — which has been tasked with decommissioning work in the Bass Strait for ExxonMobil Australia — is expanding its fleet.

Offshore contractor Allseas — which has been tasked with decommissioning work in the Bass Strait for ExxonMobil Australia — is expanding its fleet.

Its new cargo barge, Braveheart, which is being added to the fleet to boost flexibility for heavy lift campaigns, is now taking shape at the CIMC Changhong Shipyard near Shanghai in China.

Following official keel laying in April, the first of 145 huge steel blocks – together weighing a massive 26,000 tonnes – has been lifted into the dry dock for assembly, outfitting and painting.

At 200 metres long and 57 metres wide, it’s a close match to another Allseas barge, Iron Lady, but with key enhancements: a deeper operational draught, a full electric ballast system for faster load transfer operations and a significantly higher deck load capacity.

Together, Allseas’ trio of purpose-built cargo barges — Iron Lady, Braveheart and Bumblebee — will support the company’s platform removal and installation operations, delivering efficient topsides and jackets loading and transfer solutions to and from disposal yards.

The company has already started planning and preparation for what will be the largest offshore decommissioning assignment in Australian yet on behalf of Exxon subsidiary, Esso Australia Pty Ltd.

Allseas last year secured the contract to remove up to 12 retired platforms from the Gippsland Basin in the Bass Strait, with a combined weight of approximately 60,000 tonnes.

It plans to remove all the structures with another vessel, Pioneering Spirit — currently active in the North Sea — during an intense campaign beginning in late 2027.

Once safely removed, the facilities will be transferred to barges or vessels for load-in to the Barry Beach Marine Terminal in Victoria for dismantling and recycling by a separate onshore contractor.

In the meantime, Allseas is expanding its fleet with the Braveheart barge, which is expected to launch this September, with delivery scheduled at the end of 2025.

At the Chinese shipyard, the first construction phase in the dock focuses on the bottom section of the ballast pump room housing critical equipment.

Installing these blocks first allows the yard to immediately begin fitting the 1.5-metre diameter ballast pipes and four powerful ballast pumps, capable of moving nearly 10 Olympic-sized swimming pools' worth of water every hour.

Once this phase is complete, construction will move on to phase two: assembling the engine room.

Allseas also announced this month two further newbuild offshore construction vessels to enhance its fleet, to be built by Wuchang Shipbuilding Industry Group in China.

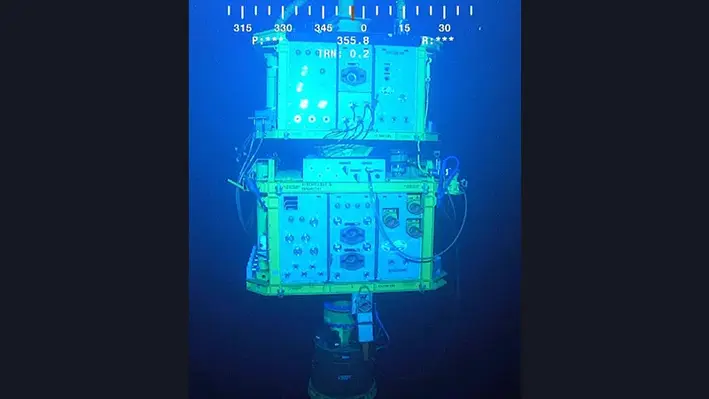

Houston-based subsea hardware and offshore service solutions, Trendsetter Engineering, has deployed for the first time its flagship Trident 20K Intervention System for Beacon Offshore Energy’s Shenandoah project in the Gulf of America

Houston-based subsea hardware and offshore service solutions, Trendsetter Engineering, has deployed for the first time its flagship Trident 20K Intervention System for Beacon Offshore Energy’s Shenandoah project in the Gulf of America

The deployment was initiated from the Deepwater Atlas for a two-well flowback operation at the Shenandoah site. The system was wet-hopped between wells, which not only helped to cut down operational costs but also several days of critical path rig time. The system is currently undergoing post-campaign maintenance by Trendsetter so that it is ready for further deployments.

The launch of the 20K Open Water Intervention Riser System (OWIRS) with its first deployment marks a milestone for Trendsetter.

The 20K intervention system enhances the company's fleet of rental intervention kits. It is the realisation of a groundbreaking innovation as it has been on the cards since the company's 2020 launch -- Trident 15K Intervention System. It was the result of dedicated research, development, engineering, design, assembly, and testing.

From exploration drilling through abandonment, Trendsetter Engineering offers solutions globally.

Register here for Offshore Network's global well intervention and decommissioning conferences.

Well intervention in the Asia Pacific (APAC) region is expected to witness significant growth in the coming years.

According to a report by Allied Market Research, an increase in energy demand and revitalisation of aging brown field wells are factors propelling the growth of the market. However, environmental risks coupled with strict government regulations are key factors that slow down market growth.

The well intervention services market is categorised based on service type, applications, and countries. China, Australia, India, Indonesia, and Malaysia are among the handful of APAC countries that are set to experience remarkable market growth. Companies such as FMC Technologies, Nabors Industries Limited, Archer Limited, and Expro International Group Holdings Ltd., have adopted various innovative strategies, that have enabled them to gain a strong foothold in the market.

Driven by increasing energy demand, exploration activities and technological advancements in well intervention, the market is projected to expand to around US$2.7bn by 2032.

UK-based Odfjell Technology has reported that a workover contract it had in place for south-east Asia has been scrapped by its client, Brunei Shell Petroleum Company Sendirian Berhad.

UK-based Odfjell Technology has reported that a workover contract it had in place for south-east Asia has been scrapped by its client, Brunei Shell Petroleum Company Sendirian Berhad.

In a statement, the company said that its client was “terminating this contract for convenience”.

It added: “The client reiterates that the termination is not related to the performance of Odfjell Technology and the two parties remain open to working together on future potential projects.”

Odfjell Technology said that it will close out the contract in accordance with any terms and conditions, with any expenses to be reimbursed by the client.

It also added that there will be “limited” financial effect in 2025 following the cancellation.

Asia Pacific is a region where the company is keen to grow its footprint, however, after entering the Indonesian market, and also landing the services of Australian energy industry equipment provider, R&D Solutions, earlier in the year.

It means Odfjell Technology’s industry-leading well intervention services, wellbore clean up and whipstock tools are now also available to service the Australian well services and deepwater markets, with plans for future growth in the regional plug and abandonment sector.

In its 2024 annual report, released recently, the company also reiterated its global growth ambitions.

“We are well positioned for growth in a competitive market in 2025,” it noted. “Our ambition is to increase our global footprint with well services, entering new geographies as we have in

2024, and focusing on high margin product lines.”

It added that technology development and strategic growth represent a large part of its ambitions for its well services division in 2025.

As well as its European activities, the company is also active in North America, Africa and the Middle East.

But while the cancellation of the project in Brunei may have little immediate impact on finances, it is a blow to the group’s forward aspirations.

In its 2024 annual report, the company noted that the Brunei workover job “opens both an exciting geographical market and type of service, with huge potential.”

Commencement for workover operations in south-east Asia was scheduled for the middle of this year, while mobilisation efforts began last November.

In November, Simen Lieungh, CEO of Odfjell Technology, highlighted the contract’s importance “for significantly increasing our footprint in south-east Asia.”

But in his introductory notes in the 2024 annual report he remained bullish about the group's overall global growth prospects in 2025.

“We will actively explore opportunities for acquisitions and international expansion in line with our strategy,” he noted.

Sentinel Subsea, a specialist in subsea well integrity monitoring, has successfully delivered a six-figure project involving the deployment of two WellSentinel Coral systems for a major operator in the North Sea.

Sentinel Subsea, a specialist in subsea well integrity monitoring, has successfully delivered a six-figure project involving the deployment of two WellSentinel Coral systems for a major operator in the North Sea.

Supporting a large-scale drilling campaign, the project represents a key step in enhancing offshore safety and operational effectiveness.

The Coral systems provided continuous integrity monitoring throughout the well suspension period, helping to ensure safe operations during this critical phase. The deployment took place entirely in February 2025.

Notably, this is the first time the WellSentinel technology has been deployed at the start of a well’s lifecycle, underscoring the value of passive monitoring early in offshore developments. The operator’s adoption of this strategy aligns with the ALARP (As Low As Reasonably Practicable) principle, reducing risk exposure during planning delays before christmas tree installation.

“We are thrilled to have successfully completed this project, which highlights Sentinel Subsea’s commitment to safety, innovation, and growth. This is a key moment for us, as it is the first time our WellSentinel technology has been deployed at the beginning of a well’s lifecycle. Partnering with a major operator in the North Sea strengthens our presence in the region and contributes to our continued global expansion,” said Neil Gordon, CEO of Sentinel Subsea.

The Coral systems were installed onto 18 ¾” wellheads from a jack-up rig via the texas deck using crane wire. As the units were preconfigured for detection before installation, no in-well intervention was required, streamlining operations.

Headquartered in Aberdeen since its founding in 2018, Sentinel Subsea continues to deliver passive monitoring solutions globally for both major and independent operators. This project further establishes its leadership in subsea well integrity monitoring.

The global slickline services market size is expected to reach US$ 8.23bn in 2025, rising to around USD 12.56bn by 2034 at a CAGR of around 2.79%, according to a new report from Custom Market Insights.

The global slickline services market size is expected to reach US$ 8.23bn in 2025, rising to around USD 12.56bn by 2034 at a CAGR of around 2.79%, according to a new report from Custom Market Insights.

According to the report, the offshore segment is dominating the slickline services market as the demand for well intervention in deepwater and ultra-deepwater oilfields, such as Brazil's pre-salt reserves, is increasing.

The report highlights that as oil and gas reservoirs become deeper and more complex, operators are turning to digital slickline solutions for improved efficiency, data acquisition, and automation due to the constraints of traditional mechanical slickline techniques.

Operators are incorporating fibre-optic slicklines, memory tools, and automated control systems that allow for real-time data collection and predictive maintenance. The evolution is transforming the marketplace, enabling oil and gas organisations to remotely monitor well conditions and minimise operational risks.

Digital slickline solutions offer operators immediate access to well data, enhancing well diagnostics as operators can track downhole conditions more rapidly and with improved accuracy, and enabling better and faster decision-making.

The integration of automation and AI is another notable trend driving the slickline services market, the report notes. Automation improves accuracy, reduces human errors, and improves operational efficiency by minimising the need for human involvement.

Predictive analytics use AI to allow operators to predict which equipment will fail and when, allowing them to optimise timing of an intervention, and thereby saving costs. For example, Total Energies and Shell are deploying AI-enabled monitoring systems during offshore operations to ensure the reliability and efficiency of well intervention activities.

As a result, there has been a trend toward robotic slickline units, especially in more remote and dangerous environments where worker safety is a particular concern.

However, such innovations are expensive, proving a constraint to widespread adoption, especially by smaller service providers. This needs to be balanced against the long-term return on investment through improved efficiency, reduced downtime and more accurate well diagnostics.

In the race for innovation in slickline services, industry giants are now investing heavily in next-generation solutions that promise to reshape the slickline landscape, thus strengthening well intervention around the world.

A report by the Australian Academy of Technological Sciences & Engineering on Offshore oil and Gas Decommissioning Technologies has highlighted Australian research and technology capabilities and gaps.

A report by the Australian Academy of Technological Sciences & Engineering on Offshore oil and Gas Decommissioning Technologies has highlighted Australian research and technology capabilities and gaps.

The report argues that there are a number of areas where further R&D would benefit the decommissioning industry, particularly towards the end of the decommissioning value chain around waste management, recycling opportunities and the environmental impact of decommissioning. Australia’s focus on environmental protection will provide opportunities for further research both at home and abroad, the ATSE comments.

With world-leading marine research, strong transferable geotechnical skills from the mineral resources sector, and the government’s Net Zero by 2050 commitment, Australia has an opportunity to leverage this expertise and momentum to drive technology innovations in decommissioning which are suited to Australia’s unique marine ecosystems.

The report highlights Australian strengths in marine science and contamination research, making it well placed to lead research on the impact of contaminants on the environment and ecosystems. The nation is home to three major national marine science organisations – CSIRO, the Australian Institute of Marine Science (AIMS) and the Fisheries Research and Development Corporation, which produce world-leading marine research – as well as a number of other national centres of research excellence in this domain. The report identifies research gaps in contaminant profiling of infrastructure; contaminant exposure limits; mapping of contaminants through ecosystems; long-term impacts of contaminant exposure; real-time, in-field contaminant monitoring technologies; domestic facility re-use profiling; and integrity and environmental management for in situ decommissioning.

Another research strength is recycling; Australia has set ambitious targets for waste recovery and recycling, supported by funding into initiatives such as the AUD $250 million Recycling Modernisation Fund, and the establishment in 2024 of the Solving Plastic Waste Cooperative Research Centre, focused on designing out plastic waste and supporting the transitions of companies in Australia's plastics value chain. The report identifies research gaps in cleaning process optimisation; plastic waste recycling pathways; and new and improved waste recycling pathways.

With well-established oil and gas and mineral extraction industries, and the presence of large industry players driving technological and process innovations, Australia has the opportunity to leverage its expertise to facilitate research into oil and gas decommissioning technologies, the report suggests. Research gaps exist in waste transport approaches; waste management infrastructure and circular economy planning; long-term impacts of contaminant exposure; and domestic facility re-use profiling.

The report notes that Australia and its universities have limited expertise in developing technologies specifically for oil and gas decommissioning, suggesting that Australian universities should be encouraged to develop links with private industry and government research funding to develop the necessary expertise and address capability gaps in conjunction with universities with strengths in these areas, including those in Norway, the UK and the US Gulf of America.

Page 30 of 118