Subsea 7 has won a significant contract from Petrobras via a competitive tender, for the development of the Buzios 11 field offshore Brazil

Subsea 7 has won a significant contract from Petrobras via a competitive tender, for the development of the Buzios 11 field offshore Brazil

The company will be providing engineering, procurement, fabrication, installation, and pre-commissioning of 112 km rigid risers and flowlines system for the field development.

While the company will be initiating project management and engineering work from its offices in Rio de Janeiro, Suresnes and Sutton, it will handle pipelines fabrication from its spoolbase in Brazil.

Located approximately 180 kms off the coast of Rio de Janeiro, Brazil, at 2,000 metres water depth in the pre-salt Santos basin, activities on the site will take place in 2027 and 2028.

Yann Cottart, Senior Vice-President Brazil and Global Projects Centre West said, "This award again underscores Subsea7’s proven expertise in delivering complex, world-scale size projects, reinforcing our strong execution capabilities and commitment to operational excellence and safety.

"With a solid backlog and a diverse portfolio, we continue to drive value for our shareholders while further contributing to Brazil’s development. We thank Petrobras for their trust and look forward to once again playing a significant role in the success of the Buzios field."

Seamless tubular solutions provider, Vallourec is also contributing in the Petrobras-operated Buzios project.

One of the Gulf of Mexico’s leading late-life decommissioning specialist, Promethean Energy, has completed the decommissioning of offshore orphaned wells in the Matagorda Island lease area.

One of the Gulf of Mexico’s leading late-life decommissioning specialist, Promethean Energy, has completed the decommissioning of offshore orphaned wells in the Matagorda Island lease area.

Steve Louis, SVP of Decommissioning at Promethean, said, “Our team is incredibly proud to have completed this critical work efficiently, safely and ahead of budget. By integrating our expertise, technologies and strategic partnerships, we have demonstrated that decommissioning can be both cost-effective and environmentally responsible.”

The project began with drone inspections, safety preparations and detailed well diagnostics, leading to the lower and upper P&A of the wells. Promethean’s approach aligns with its commitment to leveraging cutting-edge technology to ensure safe and responsible end-of-life asset management.

Clint Boman, Senior Vice President of Operations, commented, “We are advancing standards at Matagorda Island and providing a replicable model for similar projects worldwide. Our focus is – and always will be – raising standards for safety, efficiency and innovation in decommissioning across our industry. For example, we implemented visual intelligence tools to manage safety risks associated with ageing offshore infrastructure addressing a long-standing industry challenge.”

Ernest Hui, Chief Strategy Officer of Promethean Energy, concluded, “Building on our strong execution performance, our strategy is to continue identifying synergies with other asset owners, fostering collaboration, and developing sustainable decommissioning campaigns that drive efficiency across the industry."

Expro Group Holdings N.V., in its financial and operational results for the first quarter of 2025, reported notable progress in offshore well intervention operations across the Middle East and North Africa (MENA) region.

Expro Group Holdings N.V., in its financial and operational results for the first quarter of 2025, reported notable progress in offshore well intervention operations across the Middle East and North Africa (MENA) region.

The company posted US$94mn in MENA revenue for Q1 2025—a 1% increase compared to the previous quarter—supported by growth in well intervention and integrity activities in Qatar, enhanced production solutions in Algeria, and expanded Coretrax well construction work.

Significantly, Expro successfully concluded deepwater Tubular Running Services (TRS) for two exploration wells in the East Mediterranean. These operations demonstrated the company's ability to deliver reliable and efficient offshore services under complex conditions, reinforcing Expro’s reputation for safety and technical excellence in deepwater environments.

A major technology milestone in the region was the successful pilot of Expro’s QPulse multiphase flow meter in Saudi Arabia’s Jaffurah field. The system showed strong correlation with traditional test separators, validating it as a standalone, non-intrusive solution for production testing. Portable and environmentally conscious, QPulse enables real-time performance monitoring without production deferrals or safety risks, positioning it as a forward-looking tool in the company’s offshore intervention arsenal.

Segment EBITDA for MENA rose to US$34mn with a margin of 37%, up from 35% in Q4 2024, driven by improved activity mix.

This article is based on Expro’s Q1 2025 report, which outlines operational and technological advancements across multiple global regions.

The decommissioning challenge facing Australia is coming into sharp focus, presenting critical legal and contractual issues for all involved, according to law firm Wotton Kearney (WK).

The decommissioning challenge facing Australia is coming into sharp focus, presenting critical legal and contractual issues for all involved, according to law firm Wotton Kearney (WK).

In a recent update, the firm outlined the scale of the task facing operators, contractors and engineering teams against a regulatory environment that will be watching closely.

Over the next 50 years, Australia is expected to see more than US$40bn in offshore decommissioning activity, with most of that spend focused on well plugging and abandonment, as well as pipeline removal.

Titleholders are legally responsible for the full cost and safe removal of offshore infrastructure under the Offshore Petroleum and Greenhouse Gas Storage Act 2006, and must meet strict environmental and consultation obligations.

“While this signals significant economic opportunities for the broader Australian maritime sector,” WK noted in the update, “in an era when much greater focus and emphasis is placed on the green economy, decarbonising, and prioritising environmentally sound practices over economic expediency, it also raises questions.”

These questions include not only the technical feasibility in carrying out these complex and potentially hazardous operations, but also precisely what the decommissioning and environmental obligations are for operators and infrastructure owners.

“The media has recently focused on some high profile examples, such as Esso’s decommissioning plan for 12 platforms in the Bass Strait, Victoria, with the Maritime Union of Australia raising concerns that not all of the infrastructure will be removed,” the WK update added.

It noted that the discussion around Esso’s proposal has prompted debate as to what the 2006 Act actually permits.

“While decommissioning activities under the 2006 Act cannot commence without the titleholders securing a series of environmental approvals through the National Offshore Petroleum Safety and Environmental Management Authority (NOPSEMA), Esso’s decommissioning proposal includes leaving rigs in place and converting these into artificial reefs. This was previously done in the Gulf of Mexico.”

But the practice of leaving some infrastructure in place has created debate about the environmental implications and whether that breaches any legal obligations, WK added in the update.

In this regard, decommissioning involves a range of “complex and sometimes controversial issues,” WK stated.

Australia, like other nations, also has international obligations as a signatory to the United Nations Convention on the Law of the Sea 1994 (UNCLOS), which is the primary international legal instrument governing decommissioning.

What it means is that “complying with regulatory requirements for decommissioning is far from the straightforward.”

That is purely from a legal and regulatory perspective, without the additional burden from any public scrutiny or reputational risks arising from decommissioning activities.

“It’s therefore crucial to develop an appropriate strategy with appropriate stakeholders, align this with insurance cover, and coordinate execution of this plan with logistic and supply chain suppliers,” WK added.

The law firm is exploring some of these issues in a series on decommissioning to identify key issues for stakeholders and to help navigate the uncertainties ahead.

More than 200 offshore fields comprising of over 1,500 platforms and 7,000 wells are expected to curb production by 2030, signalling an urgent need for clarity in regard to decommissioning regimes.

Despite the task size, only a handful of southeast Asian countries are involved in decommissioning activities, making their overall experience limited. Adding to this challenge, are the following three region-specific issues:

Earlier in the year the Centre of Decommissioning Australia welcomed Simon Kemp as the latest member to its Industry Advisory Committee.

Earlier in the year the Centre of Decommissioning Australia welcomed Simon Kemp as the latest member to its Industry Advisory Committee.

Simon, whose current role is Decommissioning Manager at ExxonMobil Australia, has brought two decades’ worth of industry experience to the role. After spending 23 years with ExxonMobile in diverse roles across offshore projects in the Bass Strait, he brings a wealth of knowledge to the Committee.

Now based in Melbourne, Simon leads the strategic planning for decommissioning ExxonMobil Australia’s Gippsland operations.

Commenting on the new position, Simon said, “I’m looking forward to continuing my work with CODA in this new role, helping advance Australia’s capabilities in responsible and sustainable decommissioning.”

Inching closer towards its goals to hit 300,000 net barrels per day of oil equivalent from the Gulf in 2026, Chevron Corporation has started production from the Ballymore subsea tieback in the deepwater Gulf of America.

Inching closer towards its goals to hit 300,000 net barrels per day of oil equivalent from the Gulf in 2026, Chevron Corporation has started production from the Ballymore subsea tieback in the deepwater Gulf of America.

The latest in a series of Chevron projects to start up last year, the company expects to produce up to 75,000 gross barrels of oil per day through three wells tied back three miles to the existing Chevron-operated Blind Faith facility.

“Ballymore is an example of how we are leveraging technology and driving efficiencies to help produce affordable, reliable energy from the deepwater Gulf of America, one of the lowest carbon intensity oil and gas producing basins in the world,” said Brent Gros, Vice President, Chevron Gulf of America. “Ballymore, which was completed on time and on budget, brings additional production online without building a new standalone offshore platform. This reduces our development costs and is expected to drive higher returns for shareholders.”

A prominent leaseholder in the Gulf, Chevron is keen on exploring further growth opportunities in the basin. Since last year, the company has started production from its industry-first Anchor project and non-operated Whale project and has been prioritising water injection to boost output at its operated Tahiti and Jack/St. Malo facilities.

Estimated potentially recoverable resources at Ballymore are 150 mn barrels of oil equivalent gross over the life of the project. Ballymore is located in the Mississippi Canyon area in around 6,600 feet (2,000 m) of water, about 160 miles (260 km) southeast of New Orleans. The development is Chevron’s first in the Norphlet trend of the Gulf.

The major's subsidiary Chevron USA Inc is operator of the Ballymore project with 60% working interest, along with TotalEnergies E&P USA, Inc who owns 40% working interest.

Expro Group Holdings N.V., a leading energy services provider, has announced its financial and operational results for the first quarter of 2025, revealing a revenue decline but highlighting technological advancements and new contract wins.

Expro Group Holdings N.V., a leading energy services provider, has announced its financial and operational results for the first quarter of 2025, revealing a revenue decline but highlighting technological advancements and new contract wins.

The company reported revenue of $391 million for the three months ended 31 March 2025, down 11% from US$437mn in the fourth quarter of 2024, reflecting seasonal and market challenges.

The US$46mn revenue decrease was driven by reduced activity in the North and Latin America (NLA), Europe and Sub-Saharan Africa (ESSA), and Asia Pacific (APAC) segments, though modestly offset by higher activity in the Middle East and North Africa (MENA) segment.

Consistent with historical trends, the winter season in the Northern Hemisphere and budget cycles of national oil company clients negatively impacted revenue and profitability.

“While 2025 is expected to be a transition year for the energy services industry, the outlook for oil and gas investment and Expro remains quite compelling for the rest of the decade, so we are cautious about the near-term and more bullish over the medium- to long-term,” said Michael Jardon, CEO.

“That said, we will size our support structure, capital expenditures and other investments accordingly, so cost and capital discipline will be key themes at Expro until we have better clarity around the direction of international and offshore markets, and the timing of deepwater projects that we expected to be sanctioned in the second half of 2025 and into 2026.”

Expro showcased its commitment to advanced technology with notable deployments in Q1. The company successfully introduced its CENTRI-FI™ consolidated control console in Indonesia, enabling fully integrated tubular running services (TRS) operations from a single tablet, reducing personnel presence on the rig floor.

In the APAC region, Expro secured significant contracts, including a three-year deal worth over US$15mn to provide combined e-line cased hole and slickline services across 315 wells.

Additionally, a two-year contract valued at over US$8mn was signed in Brunei to deliver well metering services, leveraging advanced solutions like QPulseTM, Sonar Meter, and Multiphase Flow Meters.

This agreement, which began in February 2025, strengthens Expro’s role in optimising client production through precise well flow measurement.

However, APAC revenue fell 19% to $51 million from US$62mn in Q4 2024, driven by reduced subsea well access, well flow management, and well construction activity in Australia, as well as lower well intervention and integrity work in Brunei and Malaysia.

Segment EBITDA for APAC was US$11mn, or 21% of revenues, down from US$15mn, or 25% of revenues, in the prior quarter, due to lower activity and an unfavourable activity mix.

Recoverable barrels of oil from a well in the Bourdon prospect in the Dussafu Licence offshore Gabon have successfully surpassed millions following drilling

Recoverable barrels of oil from a well in the Bourdon prospect in the Dussafu Licence offshore Gabon have successfully surpassed millions following drilling

The second sidetrack DBM-1 ST2 well that has been drilled by the Norve jack-up rig for BW Energy has revealed 56 million barrels oil estimates in place. Of these, approximately 25 million barrels are considered recoverable.

Confirming the substantial oil discovery with good reservoir and fluid quality, Carl K Arnet, CEO of BW Energy, said, “The appraisal well confirms the potential for establishing a new development cluster with a production facility following the MaBoMo blueprint. We expect at least four producing wells.”

“We continue to successfully expand the Dussafu reserve base which, together with multiple additional prospects yet to be drilled, will support long-term production and value-creation in Gabon.”

Initial data shows that oil from Bourdon field has the lowest viscosity of the Dussafu discoveries measuring an average of 3.5 centipoise (cp), compared to 5 cp and 7 cp for the Hibiscus / Tortue and Ruche fields, respectively.

Evaluation of logging data and formation pressure measurements confirm approximately 11.2 metres of pay in an overall hydrocarbon column of 35.2 metres in the Gamba formation, drilled to a depth of 4,731 metres.

Bourdon is located approximately 15 kilometres west of FPSO BW Adolo and 7.5 kilometres southeast of the MaBoMo facility. The discovery will enable the Company to book additional reserves not included in its 2024 Statement of Reserves.

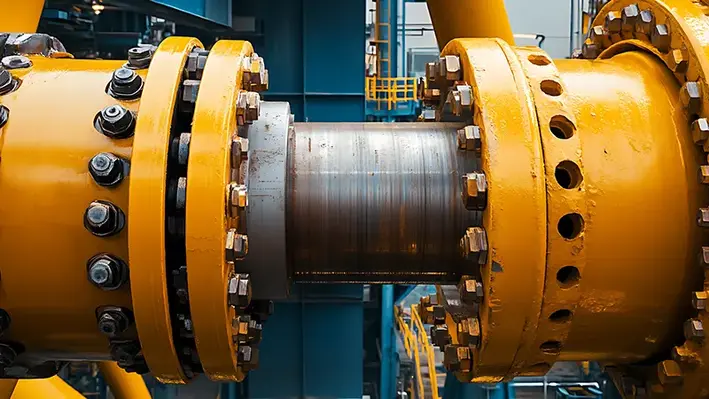

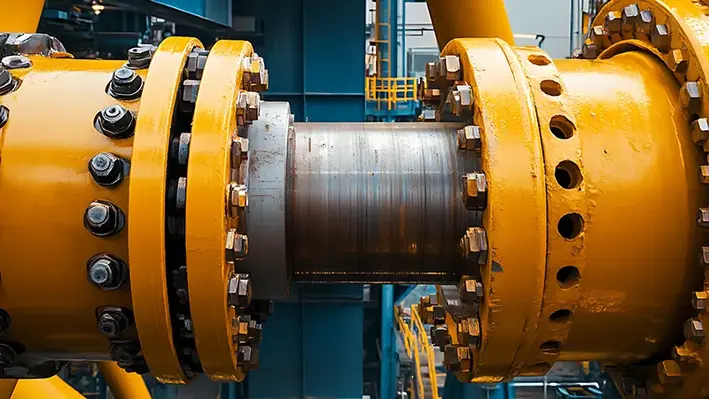

Seamless tubular solutions provider, Vallourec, has been chosen by Allseas to supply line pipes for Buzios 10 offshore project located at the Petrobras-operated Buzios field.

Seamless tubular solutions provider, Vallourec, has been chosen by Allseas to supply line pipes for Buzios 10 offshore project located at the Petrobras-operated Buzios field.

The risers and flowlines for the project will be made of Vallourec's 18,000 tons of subsea seamless premium carbon steel line pipes. The contract also extends beyond this initial offering to also leave scope for an aditional 5,000 tons approximately.

The Buzios field that is situated off the coast of Rio de Janeiro is one of the world's largest deepwater fields under Petrobras' name. Undoubtedly one of the company's most important portfolio, five additional units from the site are being worked upon so that they can start production to meet optimisation targets by 2028.

The services of a centralised digital portal by Vallourec called the Pipe Navigator solution will also be a part of the contract, offering the client a holistic idea of its line pipe projects via instant up-to-date contractual documentation, data and analysis. The entire production will be carried out at Valourec's facility in Jeceaba (Minas Gerais, Brazil) to ensure high local content and a reduced carbon footprint.

Philippe Guillemot, Group's Chairman and CEO, said, “This contract reinforces our strategic positioning in Brazil, one of our key markets for complex offshore projects. It also serves as legacy to our ability to deliver premium tubular solutions, fully manufactured in Brazil. This contract also validates the investment strategy implemented over the past three years to enhance our industrial performance and meet the most demanding requirements of our customers.”

To know more about Latin America's offshore scene, click here.

Helix Energy Solutions Group reported reduced well intervention revenues during Q1 2025 citing lower utilisation rates in the North Sea — but warned of more pressing industry-wide problems up ahead.

Helix Energy Solutions Group reported reduced well intervention revenues during Q1 2025 citing lower utilisation rates in the North Sea — but warned of more pressing industry-wide problems up ahead.

Owen Kratz, Helix President and CEO, identified a series of potential forward challenges, including an increasingly testing North Sea market environment with some operators looking to put the brakes on work as a result of recent commodity price falls.

In its latest set of results, the company said Q1 well intervention revenues decreased by US$27.8mn, or 12% compared to the prior quarter “primarily due to seasonally lower utilisation in the North Sea,” as well as mobilisation and docking issues relating to its Q7000 vessel in Brazil.

The Houston-based group’s well intervention vessels include the Q4000, the Q5000, the Q7000, the Seawell, the Well Enhancer, and two chartered monohull vessels, the Siem Helix 1 and the Siem Helix 2.

Its well intervention portfolio includes intervention riser systems, subsea intervention lubricators and the Riserless Open-water Abandonment Module.

“As expected, our first quarter was impacted by the seasonal slowdown in the North Sea and the Gulf of America shelf,” said Kratz.

However, he also warned of a series of major challenges facing the industry in the coming year.

“Our first quarter has been overshadowed by the announcement of production increases by OPEC+, the announcement of US tariffs and its impact on the global market, and the continuing challenges of the North Sea oil and gas market,” he said.

“The confluence of these events has caused a precipitous drop in commodity prices and created uncertainty for our customers and the global economy. As a result, we are seeing some operators pausing work, notably in the North Sea where the current regulatory environment was already challenging for offshore oil and gas production.”

In response to the new market environment, Helix is adjusting its own operations to align with decreased activity, including the decision to stack the Seawell due to the weak North Sea well intervention climate, “but with our strong balance sheet and backlog of contracted work, we nevertheless expect to generate meaningful free cash flow in 2025,” said Kratz.

Helix also noted that its quarterly revenue decreases were offset partially by higher rates during Q1 2025.

Utilisation on the offshore service company’s North Sea vessels declined to 17% during the quarter, from 38% during the prior quarter.

As well as well intervention services, Helix also operates in other market segments including robotics, shallow water abandonment and production facilities.

A well engineer from Slb recently demonstrated the tackling of injectivity issues on an offshore well during the Society of Petroleum Engineers’ (SPE) Nigeria Annual International Conference and Exhibition.

A well engineer from Slb recently demonstrated the tackling of injectivity issues on an offshore well during the Society of Petroleum Engineers’ (SPE) Nigeria Annual International Conference and Exhibition.

Characterised by high-permeability and unconsolidated sands in a prolific turbidite reservoir, pressure maintenance at the AX field were initially conducted by deviated frac-pack injectors which fell short in keeping issues such as fines migration and other formation damage mechanisms in check.

To address this issue, horizontal injectors were chosen, offering larger flow areas and lower velocities to mitigate sand production risks. This, however, did not turn out enough for the AX9 well, as water injectivity level still remained markedly low. It required proactive intervention to curb formation damage while ensuring long-term well integrity. Advanced surveillance techniques, including Hall plot analysis, were deployed to confirm that injectivity decline was caused by internal formation damage rather than wellbore restrictions. Mineralogical analysis revealed the presence of fines-prone clays such as Smectite, Illite, and Kaolinite, which contributed to plugging and injectivity impairment.

This gave birth to a stimulation strategy tailored to AX9’s specific reservoir characteristics. Early intervention was initiated while the well was still operating in matrix mode, ensuring maximum benefit from the stimulation process. In line with the AX9 formation, a matrix acid stimulation plan was developed utilising a nitrified mud acid system with continuous foam diversion. The metculous preparation of critical components were involved from high-pressure nitrogen units and fluid pumps to IWOCS systems, among others.

The nitrogen foaming-supported treatment sequence involved multiple stages, including ammonium chloride pre-flushes, acid pre-flushes, a main stage of 13.5:1.5 mud acid, and post-flushes. This made sure even acid distribution and effective fines removal.

Post-treatment the injection rate improved to 43 kbwpd, with a substantial pressure drop of 21% and the injectivity index rose from 20 to more than 80-100 bpd/psi. Besides the improved injection rates, the treatment helped boost production by an additional 5,000 barrels per day approximately.

Page 32 of 118