Earlier this month, the Australian Government awarded COSCO Shipping Heavy Transport (COSCO) a contract to dry tow the Northern Endeavour FPSO vessel to its recycling location.

Earlier this month, the Australian Government awarded COSCO Shipping Heavy Transport (COSCO) a contract to dry tow the Northern Endeavour FPSO vessel to its recycling location.

The Hua Rui Long semi-submersible heavy lift vessel will tow the Northern Endeavour to a facility for decontamination, dismantling and recycling. The FPSO measures 274 metres in length, meaning there are only a few vessels in the world capable of carry something of this magnitude. Securing a vessel in the right timeframes for this project marks a significant milestone for the programme.

COSCO will work with Petrofac to arrange for the FPSO to be towed to the recycling location after disconnection. The Department of Industry, Science and Resources released a request for tender to find a supplier to recycle the FPSO. Submissions closed on December 13th, 2024, and the Department is currently evaluating its options.

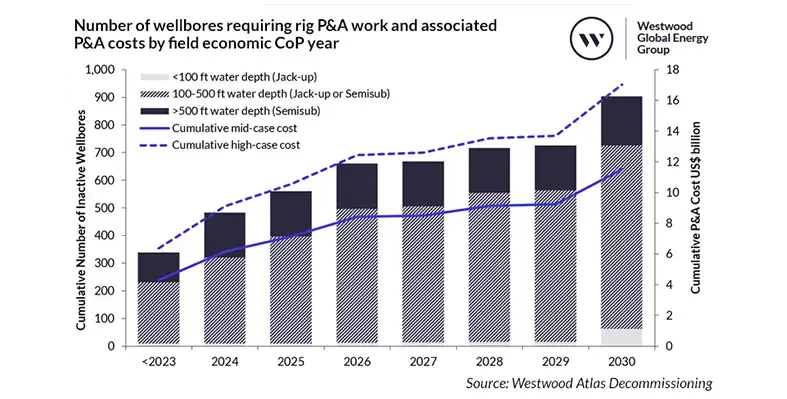

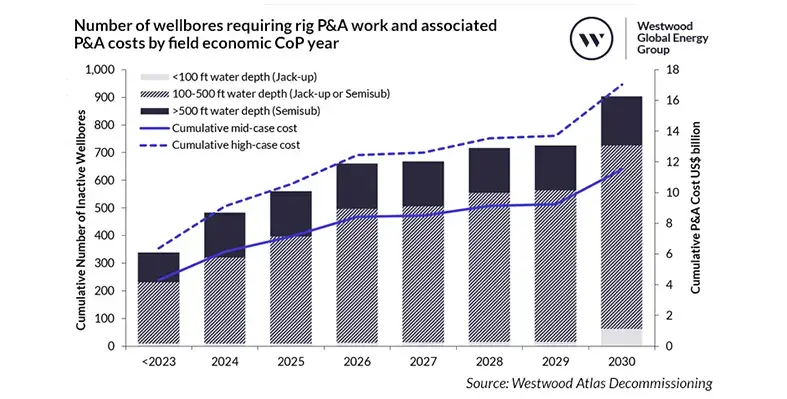

Energy market research and consultancy firm, Westwood Global Energy Group, has found that decommissioning in the North Sea involves considerable financial and logistical challenges.

Energy market research and consultancy firm, Westwood Global Energy Group, has found that decommissioning in the North Sea involves considerable financial and logistical challenges.

Domestic production is declining owing to shaken investor confidence in the UK as a result of political and fiscal uncertainty. This suggests around US$26bn might be spent on decommissioning in the next decade, with well plug and abandonment (P&A) alone accounting for ~50% of the cost.

While decommissioning tasks keep piling up, contract awards, especially for rigs, have remained low due to the uncertainties driving financial and operational risks for operators. Execution of delayed decommissioning work will pose pressure on the already-strained supply chain. This can P&A costs could climb by up to US$5.5 billion, due to higher offshore rig dayrates, increasing financial liabilities for both operators and the UK Government, which provides tax relief on decommissioning costs.

“As the UK North Sea enters a new phase where decommissioning becomes the dominant industry driver, the supply chain faces significant demand and major financial risk,” said Yvonne Telford, Research Director at Westwood. “Based on current investment plans, up to 40% of UK fields could cease production before 2030. With the impact of decommissioning tax liabilities on abandonment expenditure, cost-effective P&A must be paramount."

Dominic Ferry, CEO at Westwood, said, “Westwood’s new Atlas Decommissioning module provides the clarity the market needs by linking infrastructure data with economic forecasts, offering stakeholders a clear view of the timing, cost, and risks associated. By delivering granular insights into decommissioning activity, the module helps operators, service providers, and investors make informed decisions, mitigate financial exposure, and seize emerging opportunities in this evolving landscape.”

Westwood has launched the new Atlas Decommissioning module which gives detailed insights into decommissioning timelines, infrastructure removal and market dynamics in real-time. It leverages key economic drivers, such as commodity prices and operating costs to dynamically model decommissioning schedules, allowing them to predict shifts in activity and optimise planning.

Chevron has recently completed a rigs-to-reef campaign across the former Genesis Platform which was submerged off the cost of Louisiana last year.

Chevron has recently completed a rigs-to-reef campaign across the former Genesis Platform which was submerged off the cost of Louisiana last year.

In its previous life above the waves, Genesis was referred to as an ‘offshore gamechanger’ with its 705-foot, 28,700-ton steel floating spar which was the first to house both drilling and production facilities.

Now, the platform houses an abundance of marine life after the operator chose to undergo a rigs-to-reef programme. This is not the first time Chevron has repurposed offshore components, in 2022 the Pascagoula Refinery donated equipment to be repurposed into artificial reefs.

Given the sheer scope of end-of-life activities needed across the Gulf for aged assets, the Bureau of Safety and Environmental Enforcement has adopted the rigs-to-reef programme, and it is has presented itself as an attractive option for operators to lessen the financial burden of their decommissioning liabilities.

More information regarding rigs-to-reef programmes across the Gulf of Mexico can be found here and here.

US-based oil and gas services specialist, Expro Group, is upbeat about prospects in the Middle East and North Africa (MENA) after a first deployment to the region of a well technology acquired only recently.

US-based oil and gas services specialist, Expro Group, is upbeat about prospects in the Middle East and North Africa (MENA) after a first deployment to the region of a well technology acquired only recently.

Despite a challenging environment in Saudi Arabia, the region’s main oil and gas producer, it believes its so-called Blackhawk technology holds great potential and said “additional opportunities” have presented themselves following the maiden deployment.

In the company's full year 2024 results, Expro Group said that it had, for the first time, utilised the Blackhawk Wireless Plug Dropping Cement Head with SKYHOOK in the Gulf.

“In MENA, despite recently announced curtailment of offshore activities in the Kingdom of Saudi Arabia, Expro successfully displaced conventional plug manifolds through its first deployment of Blackhawk Wireless Plug Dropping Cement Head with SKYHOOK in the Arabian Gulf.”

The technology has previously won awards for improving safety during well intervention work.In conjunction with the automated wireless cement-head, the SKYHOOK device serves to eliminate the final trip in the derrick; meaning a cement job can be performed in its entirety without ever sending a person to work at heights.

Blackhawk Specialty Tools, which developed the technology originally, was later acquired by Frank’s International, which then merged with Expro in 2021, adding specialty cementing and well intervention services and products to the group’s portfolio.In its results 2024 statement, Expro also referenced another technology, iTONG, an advanced single push button tubular make-up solution, which has likewise brought worker safety benefits.

“Like iTONG, the system creates operational efficiencies while improving safety by removing personnel from the red zone — in particular, by eliminating the need to send personnel up the derrick. The technology enables cementing with full tensile, torque and pressure capacity, alongside increased pumping and displacement rates.”

It added, “This successful deployment has resulted in additional opportunities, including planned 2025 projects aimed at addressing well integrity and zonal isolation challenges across critical offshore wells.”

FourPhase, a specialist in solids and production performance within the oil and gas sector, has introduced The Observer, an advanced tool for real-time data capture and optimisation.

FourPhase, a specialist in solids and production performance within the oil and gas sector, has introduced The Observer, an advanced tool for real-time data capture and optimisation.

Already deployed in five operations across the Gulf of Mexico and the Norwegian Continental Shelf, the solution will soon be integrated across all FourPhase operations, enabling full-scale remote monitoring. As operators increasingly shift towards data-driven smart operations, the real-time insights provided by The Observer are proving invaluable.

Addressing key industry challenges

The Observer is designed to tackle three critical industry challenges: minimising downtime through data-driven decision-making, enhancing equipment maintenance efficiency, and accelerating the shift to remote operations. The system continuously captures real-time data to generate a live operational feed within FourPhase’s control centre while simultaneously populating online dashboards accessible to customers globally.

A key strength of The Observer is its robust security architecture. Adhering to a zero-trust security model, it complies with ISO 27001, 27017, and 27701 standards. The system establishes a secure connection to onshore operations via Starlink or similar technologies, providing a protected data transmission channel between offshore sites and onshore centres.

"Coupled with onsite remote operations, these capabilities are enabling a step-change improvement in offshore sand management. This opens up new opportunities for production optimisation and autonomy that were previously not possible," remarked FourPhase CEO Øyvind Heradstveit.

Leveraging a decade of data

Since 2013, FourPhase has been gathering solids management data, using it to simulate operational scenarios. By applying insights from real-world experiences rather than relying purely on theoretical calculations, the company has achieved an uptime exceeding 99.5% over the past decade. This extensive database allows for more accurate operational planning and improved performance predictions.

"As the energy industry operates with multiple, often competing, data-sharing standards, we’ve developed The Observer as a universal solution, integrating over 300 languages and protocols rather than locking into a single standard. This allows for real-time monitoring across diverse equipment—including Multiphase Flow Meter, the DualFlow Desander, Acoustic Sand Detectors, and client plant data—all simultaneously. The goal is to capture and process data instantly, empowering operators with real-time insights to make informed decisions," explained Jørgen Bruntveit, COO/CTO.

"Many competitors claim real-time monitoring, yet their systems often suffer from minute-long delays and cumbersome designs—some as large as a server rack. The Observer delivers true real-time monitoring in a form factor small enough to hold in one hand," added Bruntveit.

Although real-time condition monitoring and data-driven optimisation are now standard in many production-related workflows, sand management has largely remained dependent on labour-intensive legacy methods. This reliance has slowed the adoption of autonomous and low-manning platforms. By investing significantly in remote monitoring technology, FourPhase has closed this gap, ensuring The Observer enables full oversight across its entire fleet, including desanders.

Energy technology company Baker Hughes has announced a joint technology development programme with Petrobras to provide a solution for stress corrosion cracking in flexible pipelines.

Energy technology company Baker Hughes has announced a joint technology development programme with Petrobras to provide a solution for stress corrosion cracking in flexible pipelines.

The agreement encompasses development and testing, as well as a purchase option for the next-gen flexible pipes, which will have an extended service life of 30 years in high CO2 environments. The collaborative effort between both companies will be primarily executed in Baker Hughes’ Rio de Janeiro Energy Technology Innovation Center and nearby pipe systems manufacturing plant.

Stress corrosion cracking due to CO2 (SCC-CO2) was identified in 2016 and has an effect on flexible pipes in pre-salt fields, which have a high concentration of naturally occurring CO2. If water penetrates a pipe’s annulus area, the corrosion to steel reinforcement layers can weaken structural integrity. This issue is particularly apparent in Brazil’s pre-salt fields, where Petrobras is reinjecting CO2 from its production operations into wells to enhance oil recovery.

Amerino Gatti, Executive Vice President, Oilfield Services & Equipment at Baker Hughes, said, “Baker Hughes has led the way in addressing SCC-CO2, and we will bring that expertise and experience to bear in developing the definitive solution to this critical industry challenge. By deploying flexible pipe systems that last for decades, Petrobras can more efficiently unlock the vital natural resources that power the region, while also safely returning CO2 deep underground.”

Until now, operators in high-CO2 environments have relied on solutions that mitigate the impact of SCC-CO2 while limiting the service life of risers and flowlines. Baker Hughes’ flexible pipe systems and advanced monitoring technologies have proven effective at minimising this impact and the company is a major supplier of flexible pipelines to Petrobras.

In a major realisation of its production and cost optimisation objectives, the Nigerian National Petroleum Company (NNPC), along with joint venture partner First Exploration & Petroleum Development Company (First E&P), has announced a significant hydrocarbon discovery in the Songhai field, located in OML 85 in the shallow offshore region of Bayelsa.

In a major realisation of its production and cost optimisation objectives, the Nigerian National Petroleum Company (NNPC), along with joint venture partner First Exploration & Petroleum Development Company (First E&P), has announced a significant hydrocarbon discovery in the Songhai field, located in OML 85 in the shallow offshore region of Bayelsa.

Spudded as part of efforts to increase and sustain the joint venture's oil production over the next five years, the well was drilled to a total depth of 8,883 feet measured depth (MD) in 30 metres of water. It encountered hydrocarbons across eight reservoirs, logging over 1,000 feet of hydrocarbon-bearing sands, most of which reveals promising reservoir properties. There has been an indication of substantial oil and gas volumes for commercial exploration. The derived well data will now be integrated for thorough research and analysis to calculate resource estimates and optimise field development plans.

"This discovery marks a major milestone in our efforts to unlock the full potential of our assets. The success at Songhai Field underscores the effectiveness of our exploration strategy and our commitment to delivering sustainable value to all stakeholders," said Segun Owolabi, General Manager, Exploration and Development at FIRST E&P.

"This aligns with NNPC Limited’s mandate to drive production growth and cost optimization. The success at Songhai Field reflects our commitment to strategic partnerships, advanced technology, and efficient operations to maximize Nigeria’s hydrocarbon potential sustainably," said Seyi Omotowa, Chief Upstream Investment Officer of NUIMS. "The discovery also highlights the role of strategic collaboration in expanding Nigeria’s hydrocarbon reserves," he added.

"This discovery reaffirms the potential of Nigeria’s offshore assets and the importance of collaboration in boosting reserves and production. NNPC Limited remains committed to driving efficiency and long-term value creation for the nation," said NNPC’s Group Chief Executive Officer, Mallam Mele Kyari.

First oil from the Mero Field in the Santos Basin is expected in the second half of the year with the arrival of SBM Offshore's Alexandre de Gusmao floating production storage and offloading (FPSO) vessel.

First oil from the Mero Field in the Santos Basin is expected in the second half of the year with the arrival of SBM Offshore's Alexandre de Gusmao floating production storage and offloading (FPSO) vessel.

This follows the recent arrival of FPSO Almirante Tamandare, which began production on 15 February, as a part of Petrobras fleet.

Alexandre de Gusmao is SBM Offshore's ninth FPSO vessel in Brazilian waters. It boasts a production capacity of 180,000 barrels of oil per day and 12 million cubic meters of gas per day.

SBM Offshore deals with FPSO vessels with production capacities ranging from 150,000 bpod to 250,000 bpod. It can convert oil tankers or very large crude carriers (VLCCs) into FPSOs. It has overall 15 units, deployed mainly in the Latin America region other than in West Africa. Its Fast4Ward offering focuses on risk mitigation and quality enhancement with the help of digital solutions.

"This achievement is a testament to the hard work and dedication of our teams, who have worked tirelessly to bring this project to fruition. The addition of this vessel to our fleet marks a significant milestone in our operations and reinforces our commitment to excellence and innovation in the sector. Welcome to the fleet, FPSO Alexandre de Gusmao," said Bruno Giusti, Brazil Operations Director at SBM Offshore.

Through inspection maintenance and repair, the company has covered services such as the designing, supply, installation, operation and life extension of the FPSO vessels.

To know more about Latin America's offshore well intervention scene, click here.

Liberty Industrial has completed the onshore deconstruction and recycling of the Santos Campbell platform on behalf of McDermott International Ltd.

Liberty Industrial has completed the onshore deconstruction and recycling of the Santos Campbell platform on behalf of McDermott International Ltd.

The project featured the Roll-On-Roll-Off procedure of the oil platform using Self-Propelled Modular Transporters (SPMTs) at the Australian Marine Complex Common User Facility (AMC CUF).

“The decommissioning of the Campbell platform exemplifies Liberty Industrial’s ability to tackle the intricate nature of onshore decommissioning, setting a benchmark for excellence in a rapidly growing industry sector,” said Jed Van Iersel, decommissioning manager at Liberty Industrial.

Van Iersel added that it highlighted the company’s ability “to meet all stakeholder requirements” and to handle complex marine operations.”

Following the offshore removal by McDermott, the Santos Campbell platform arrived at Port Henderson in three unique structures via barge.

These structures were safely transported via SPMTs to the onsite deconstruction yard for disposal and recycling.Liberty Industrial executed the Roll-On-Roll-Off procedures in just five days, following six months of meticulous planning with leading in-house and subcontractor engineers.

The deconstruction posed significant logistical challenges, the company added in a statement.

Each structure, the heaviest weighing over 600 tonnes, required a bespoke handling plan to ensure safe and efficient transfer from the barge to the decommissioning site, addressing various water displacement considerations and tight port schedules.

The remaining onshore deconstruction and recycling programme was completed on budget, on time, and with exceptional stakeholder satisfaction in 57 days, the statement noted.

Located in the Varanus Island hub, the Campbell Platform removal was contracted to McDermott in 2023, who then engaged Liberty Industrial for the task of deconstruction and waste recycling management.

All structures were deconstructed using suitable demolition excavators, with demolition of taller structures achieved by high reach excavators, oxy-cutting from EWP to pre-weaken structures before final induced collapse, the Liberty Industrial statement noted.

The materials from these structures were then downsized and moved to the processing area for segregating and processing using hot oxy-cutting and cold mechanical shearing, achieving a 99.5% recycling rate.

“We are extremely pleased with our ability to manage the complexities of the project by expanding our capabilities to include marine offloading operations and set a new benchmark for onshore decommissioning in Australia,” said Warwyck Smith, Decommissioning Project Manager, Liberty Industrial.

“We look forward to expanding on our already established and growing presence as a subject matter expert in onshore decommissioning in Australia and internationally.”

A federal judge in Louisiana has rejected a bid by three US states to block a rule adopted in 2024 that strengthens the financial assurance requirementsfor offshore oil and gas companies to ensure they meet their decommissioning obligations.

A federal judge in Louisiana has rejected a bid by three US states to block a rule adopted in 2024 that strengthens the financial assurance requirementsfor offshore oil and gas companies to ensure they meet their decommissioning obligations.

The judge declined to issue a preliminary injunction sought by the Republican-led states of Louisiana, Mississippi and Texas along with the Gulf Energy Alliance, Independent Petroleum Association of America, Louisiana Oil & Gas Association, and U.S. Oil & Gas Association.

The 2024 rule was issued by the U.S. Bureau of Ocean Energy Management (BOEM), which noted that since 2009, more than 30 corporate bankruptcies had occurred involving offshore oil and gas companies that did not have sufficient financial assurance to cover their decommissioning obligations, which had highlighted a weakness in BOEM’s current supplemental financial assurance programme. BOEM noted that the new rule finalises amendments to existing provisions and increases regulatory clarity about financial obligations “to better protect the taxpayer from potentially bearing the cost of facility decommissioning and other financial risks associated with OCS development, such as environmental remediation.” The new rule includes the requirement that companies which cannot provide adequate financial assurance have to put up a surety bond.

The three states and industry groups argued that the rule if enforced would result in "potentially existential consequences" for small and medium-sized companies as they would be unable to obtain such bonds.

The judge said that issuing a preliminary injunction was not warranted on the grounds that the threatened harm is not imminent, given that the new requirements are being phased in over three years, and demands for supplemental financial assurance would not be issued until mid-2025 at the earliest.

"While these harms may be likely, a preliminary injunction can only be issued if the threatened harm is also imminent," the judge said.

However he said he would expedite the case so the court can reach a final decision on the merits before the demand letters are issued and plaintiffs incur any resulting costs.

Watch this space!

A major milestone has been reached regarding the decommissioning of the Northern Endeavour FPSO wherein an extensive well suspension and flushing campaign has been successfully completed.

A major milestone has been reached regarding the decommissioning of the Northern Endeavour FPSO wherein an extensive well suspension and flushing campaign has been successfully completed.

The campaign started in September 2024, led by Phase 1 contractor Petrofac Facilities Management Limited (Petrofac). Sapura Constructor, the light well intervention vessel, has completed the works in the Laminaria-Corallina oil fields.

The critical work included temporarily suspending seven of the nine oil wells in the Laminaria-Carollina oil fields (two of the wells were previously suspended). The process involved closing off the valves that control pressure and flow on the sea floor, and installing two sets of specialised barriers at two different sections of the well to ensure fluids cannot escape.

The other part of the campaign involved flushing of nearly 30km of pipeline, including subsea umbilicals, risers and flowlines. The process ensures the pipeline are clear of hydrocarbons and hazardous materials before disconnecting the FPSO which is penned for the second half of 2025.

The completion of this well suspension and flushing campaign is a major step towards allowing the FPSO to be safely disconnected from the subsea infrastructure without leaking fluids into the ocean. More work will take place in later phases of the project to permanently plug and abandon the wells.

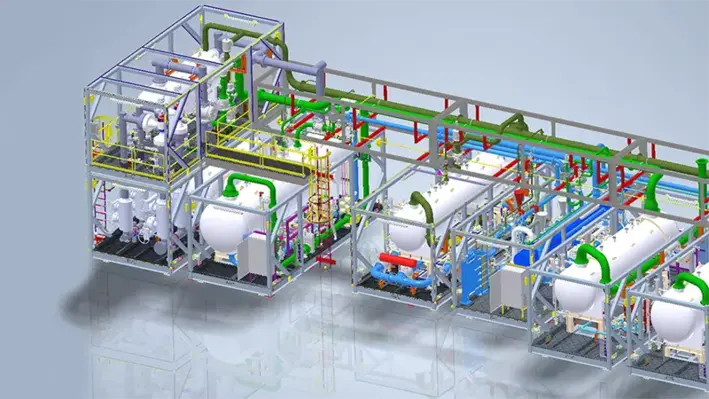

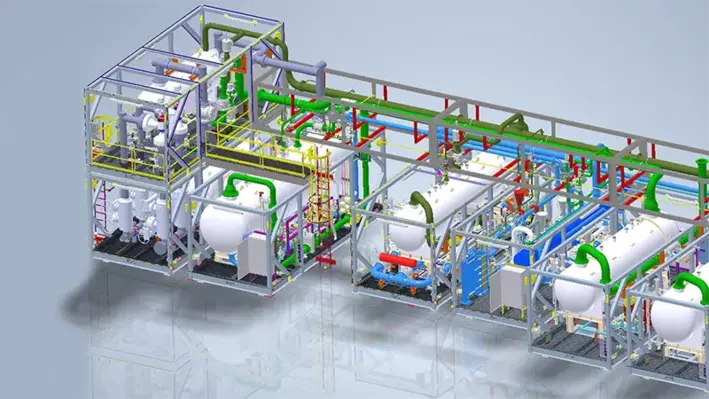

Deep water well control service provider, Marine Well Containment Company (MWCC), has onboarded W-Industries with a multimillion contract to conduct the engineering, fabrication, and delivery of its new drill-ship deployed containment system.

Deep water well control service provider, Marine Well Containment Company (MWCC), has onboarded W-Industries with a multimillion contract to conduct the engineering, fabrication, and delivery of its new drill-ship deployed containment system.

This will enhance the coverage for potential deep water well control situations that majorly impact the offshore oil & gas industry. MWCC’s new MODU Deployed Containment System (MDCS) will be put into place by W-Industries, involving designing, manufacturing, and integration of its seven key flowback modules. This new equipment will further enhance MWCC’s already extensive capabilities to capture and keep hydrocarbons out of the environment in the event an incident well cannot be immediately shut-in. Designed to operate reliably in challenging offshore environments, the flowback solution will provide dependable performance for up to six months, allowing sufficient time for relief wells to be drilled to permanently plug the well.

“W-Industries is proud to partner with MWCC on this critical project,” said Michael Bain, SVP Integrated Systems at W-Industries. “With our extensive technical experience in offshore automation and modular fabrication, we are dedicated to delivering an efficient and robust solution that will significantly enhance MWCC’s containment response capabilities.”

“MWCC is excited to work with W-Industries on this important enhancement to our current flowback capabilities, a great example of our never-ending focus on continuous improvement,” said David Nickerson, CEO of MWCC. “W-Industries’ expertise in delivering highly automated modular processing systems is exactly what MWCC was looking for.”

This partnership reinforces W-Industries’ leadership in offshore energy innovation, particularly in supporting industry safety initiatives and regulatory requirements. By contributing to MWCC’s continued advancements in well control capabilities, W-Industries is demonstrating its commitment to operational safety, regulatory compliance, and offshore risk mitigation. This positions the company as a trusted partner for offshore and subsea energy solutions, ensuring that well containment technology continues to keep pace with developments in offshore drilling practices.

Page 36 of 118