The Australian government is seeking expert guidance to dismantle over 200 aging oil and gas structures set for decommissioning this year. The Department of Industry, Science, and Resources (DISR) has issued a call for technical specialists to oversee the process, ensuring compliance with environmental and regulatory standards.

The Australian government is seeking expert guidance to dismantle over 200 aging oil and gas structures set for decommissioning this year. The Department of Industry, Science, and Resources (DISR) has issued a call for technical specialists to oversee the process, ensuring compliance with environmental and regulatory standards.

With a wave of decommissioning ahead, Australia is preparing for large-scale offshore infrastructure removal. The Centre of Decommissioning Australia (CODA) projects significant activity between February and July 2025. The scope includes 41 platform wells, 34 subsea wells, 15 exploration wells, multiple production units, pipelines, and various subsea structures.

Strengthening regulations and industry oversight

The growing number of obsolete offshore installations has prompted a tightening of Australia’s regulatory framework. Amendments to the Offshore Petroleum and Greenhouse Gas Storage Act 2006 (OPGGS Act) have introduced stricter financial requirements, increased oversight on asset transfers, and implemented trailing liability measures—holding companies accountable long after operations cease.

CODA estimates decommissioning liabilities at approximately USD $40.5 billion, with well plug and abandonment (P&A) and pipeline removals making up the bulk of costs. In response, DISR has created a dedicated Decommissioning Branch, recruiting specialists to refine policies, assess risks, and align strategies with international best practices.

Positioning Australia as a decommissioning leader

Beyond environmental and financial safeguards, Australia sees an opportunity to build a competitive decommissioning industry. With an estimated $60 billion in offshore retirement costs over the next 30–50 years, the government is laying the groundwork for a domestic sector that could drive job creation, innovation, and expertise.

The National Offshore Petroleum Safety and Environmental Management Authority (NOPSEMA) is leading efforts to uphold safety and environmental protocols throughout the process. By establishing best-in-class decommissioning capabilities, Australia aims to not only manage its offshore legacy but also export its expertise to global markets, transforming a costly challenge into an economic opportunity.

A recent report on Offshore Oil and Gas Decommissioning by the Australian Academy of Technology Sciences and Engineering highlights the surge in the development and deployment of advanced technologies tailored to the decommissioning process.

A recent report on Offshore Oil and Gas Decommissioning by the Australian Academy of Technology Sciences and Engineering highlights the surge in the development and deployment of advanced technologies tailored to the decommissioning process.

The oil and gas industry has embraced a sector-wide digital transformation, with the benefits of enhancing worker safety, reducing environmental impacts, driving efficiencies and cutting costs. This transformation has enabled a reduction in the number of workers on offshore facilities, for example, thanks to increasing remote operations and increased automation. There is likewise scope for the decommissioning sector to undergo a similar transformation.

However the report notes that, while digital technologies are a key enabler for more efficient decommissioning practices, they need to be accompanied by the further development of physical technologies to advance decommissioning processes.

One key area of technological advancement highlighted is the use of robotics and autonomous systems for subsea infrastructure removal and dismantling. These technologies enable precise and controlled operations in challenging offshore environments, such as the Gulf of Mexico, reducing the need for human intervention and minimising safety risks. Automated cutting systems use robotics and advanced machinery to perform precise cutting tasks during the removal phase of decommissioning, for example ROVs equipped with cutting devices can be used to cut pipes into sections, facilitating pipeline removal, and swarm robotics for collaborative subsea monitoring, involving the use of multiple small, autonomous robots for collaborative monitoring tasks, can enhance efficiency and coverage in subsea environments. The integration of AI and ML algorithms is enhancing the predictive maintenance of decommissioning equipment, facilitating process optimisation, and improving cost-effectiveness.

Rigless P&A processes are being explored globally due to potential cost efficiency gains, improved environmental compliance and enhanced safety outcomes, the report notes. This approach enables safe pressure testing, providing a comprehensive understanding of individual well conditions, leading to safer and more cost-effective P&A interventions. In addition, alternative barrier technologies such as thermite plug technology, resin plugs and bismuth alloy play an important role in ensuring the integrity of decommissioned wells as attentions shifts towards more cost-effective, efficient and environmentally compliant decommissioning solutions.

Another technological development highlighted is the application of advanced sensing and monitoring systems, which can assess environmental impacts and support risk assessment during decommissioning activities. This includes autonomous and remote systems equipped with state-of-the-art sensors, as well as satellite imagery. These technologies are also being used to provide real-time data on areas such as water quality, marine life and ecosystem health, helping operators to make informed decisions about decommissioning strategies and mitigating potential environmental risks.

Circular economy principles are increasingly driving innovation, the report notes, particularly in recycling and reusing decommissioned materials. Advanced material separation technologies and processing methods can be used to recover valuable resources from decommissioned equipment and structures, contributing to resource conservation, and reducing waste.

As part of its promise to boost the competitiveness of its upstream sector while pursuing a sustainable future, PETRONAS will continue to prioritise its decommissioning responsibilities, directing its focus to accessing unused assets for potential repurposing.

As part of its promise to boost the competitiveness of its upstream sector while pursuing a sustainable future, PETRONAS will continue to prioritise its decommissioning responsibilities, directing its focus to accessing unused assets for potential repurposing.

The Malaysia-based operator has released its 2025-2027 Activity Outlook report, where it highlights the call to decommission the Sabah-Sarawak Gas Pipeline alongside 37 offshore facilities. PETRONAS’ three-year plan also includes the plugging and abandonment of 153 wells within the region.

The report states, “PETRONAS continues to explore innovative decommissioning solutions focusing on technologies, reuse/repurpose options, integrated multi-year execution approach for economies of scale, as well as identifying potential alternatives that can introduce cost compression. Thus, participation and collaboration are encouraging from all parties.”

PETRONAS’ report noted the importance of decommissioning matured assets in Malaysia’s upstream oil and gas industry as it is “essential to restore the area to a safe and environmentally stable condition.”

With that initiative at the forefront, in December 2024 the operator collaborated with the Department of Fisheries to launch the 10-year Malaysia Master Reefing Plan which outlines the potential for reefing in the region by spotlighting suitable candidates and locations to undergo the ‘rigs-to-reef’ operation: an initiative which stands as a popular decommissioning alternative in the Gulf of Mexico.

Alongside decommissioning, PETRONAS shares its outlook regarding upstream operations. In the short-term, the operator will focus on intensifying exploration activities and expediting appraisal programmes to sustain production and contribute towards Malaysia’s energy security. In the medium- to long-term, PETRONAS will continue to meet production targets and maximise shareholder value while decarbonising the value chain through innovation, technical deployment, and close collaboration with industry partners.

To read the full 2025-2027 Activity Outlook, click here.

Woodside Energy has released an update of the company's decommissioning activities for the fourth quarter of 2024.

Woodside Energy has released an update of the company's decommissioning activities for the fourth quarter of 2024.

The removal of the Griffin Riser Turret Mooring (RTM) has been a highlight for the company as it marked the removal of nearly 25000 tonnes of infrastructure that included over 200 kms of pipe and 100 subsea structures that covered the Enfield, Echo Yodel, Stybarrow and Griffin fields. RTM removal besides, 20 wells have also been permanently plugged.

The RTM was recovered without significant obstacles to be transported to the Australian Marine Complex at Henderson, Western Australia, where its components will be cleaned and disassembled for recycling or reuse.

The Griffin field that is situated off 65 km north west of Onslow and 94 km north east of Exmouth had served in its lifetime Western Australia’s power needs with not only 62 billion cubic feet of gas, but also 167 million barrels of oil.

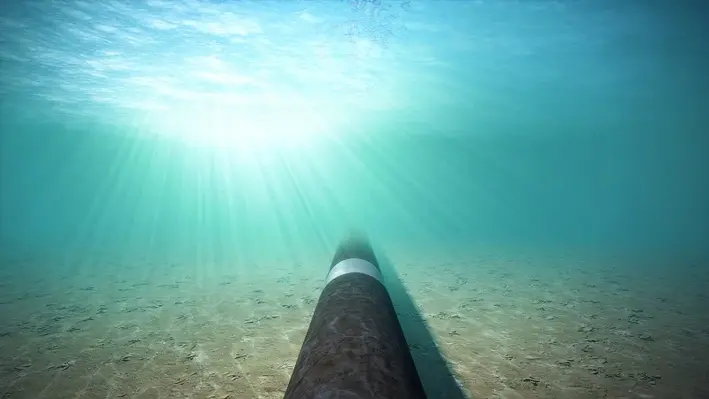

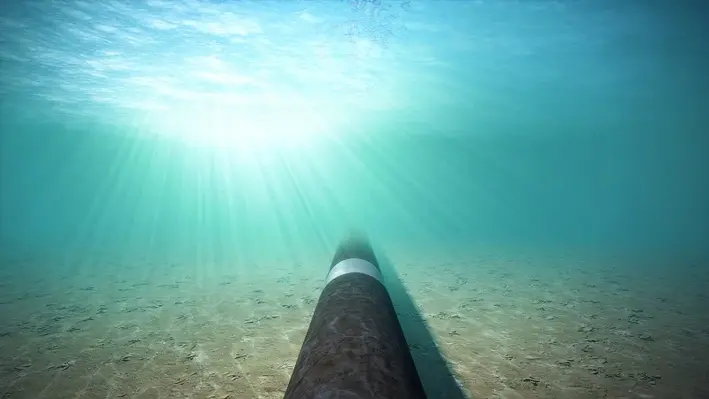

Above: Australia is preparing for a wave of decommissioning activity this year. (Image source: Adobe Stock)

Woodside's decommissioning campaigns at Stybarrow included the plugging and abandoning of three wells, removal of several moorings, structures, and wellheads that covered multiple fields offshore Western Australia. Last year, the company plugged and abandoned seven of 10 Stybarrow wells, recovered more than 90 subsea structures including wellheads, Xmas trees

and manifolds, and recovered 149 km of pipe.

Woodside's decommissioning work in Stybarrow was supported by McDermott under an engineering, procurement and removal contract.

“This award not only demonstrates McDermott’s proven track record in undertaking deepwater projects of diverse scopes, but it also highlights the critical importance of decommissioning in the offshore industry.

“With our seamless integration of engineering, fabrication, and offshore mobilisation expertise, we believe we are well-equipped to execute this project efficiently and responsibly, ensuring the safe recovery and removal of the Stybarrow DTM buoy,” said Mahesh Swaminathan, Senior Vice President, Subsea and Floating Facilities, McDermott.

The contract enables McDermott to fully remove the Stybarrow disconnectable turret mooring (DTM) buoy, and provide project management and engineering services for the recovery, transportation and offloading of the DTM buoy to an onshore yard for dismantling and disposal.

The Bass Strait decommissioning work continues as well, with plug and abandonment completed on the Perch and Dolphin facilities. Steel gravity based monotowers, the Perch and Dolphin facilities saw the deployment of DOF multi-purpose support vessel (MPSV) Skandi Darwin.

The MPSV's floating support asset can accomodate the whole workforce, eliminating crew transportaion costs. It also allows to complete abandonment operations on non-producing facilities which do not have accommodation based on them.

Speaking of the MSVP, Marine Field Superintendent, Matt Barney said, “We’re excited to start utilising the MPSV to expand our capabilities and adopt new technology to identify efficiencies, while ensuring the work can be completed safely.”

Allseas is also part of the Bass Strait decommissioning campaign, whereby the company will be dismantling up to 12 retired platforms from the region. “This landmark decommissioning project represents a significant milestone for Allseas in Australia,” said Evert van Herel, General Manager of Allseas Australia.

To know more about Australia's decommissioning scene, click here.

The Maritime Union of Australia (MUA) is looking forward to working with the new Offshore Decommissioning Directorate that has been established by the Australian Federal Government

This is a welcome development that signals to all stakeholders that offshore oil and gas decommissioning opportunities will be in the forefront of government thinking over the coming years and decades. The Union will continue to raise concerns and fight for a roadmap that delivers everything we should expect: full decommissioning, done properly, and all the high quality, safe and skilled Australian jobs and environmental care that is an essential component of the just transition from hydrocarbon industries to renewable energy projects offshore.

The Union is actively engaged with the Decommissioning Directorate to shape its implementation strategy and ensure it prioritises outcomes that reflect the interests of its members. The MUA reiterates the need for:

“Decommissioning is well underway, yet offshore workers continue to face unacceptable hazards, including poorly maintained rigs, fatigue, and hydrocarbon spills. The MUA is steadfast in our commitment to holding government and industry accountable for improving safety, environmental protections, and conditions on the job,” said Thomas Mayo, the Assistant National Secretary of the MUA.

“The release of the Roadmap underscores the critical role the MUA has played in shaping this initiative, and now is a critical time to address several significant shortcomings. While we welcome the establishment of a Decommissioning Directorate, the roadmap falls short of the robust framework our members deserve. The lack of concrete commitments, such as industry-funded infrastructure, checks and balances such as independent verification of completed work, and strengthened worker safety protections, is concerning,” Mayo explained.

“This moment cannot be overstated. Our public response is a clear signal to all stakeholders – government, industry, and our members – that the MUA is increasingly dedicating attention and resources commensurate with the significance of this opportunity. We call on the Federal Government to heed the expertise of the decommissioning workforce and adopt the Union’s upcoming further recommendations to the Directorate. Complacency is not an option,” Mayo added.

Aker Solutions has entered into a strategic partnership agreement to deliver maintenance and modification services on the assets and projects operated by Vår Energi on the Norwegian Continental Shelf (NCS).

Aker Solutions has entered into a strategic partnership agreement to deliver maintenance and modification services on the assets and projects operated by Vår Energi on the Norwegian Continental Shelf (NCS).

The partnership also includes Honeywell and StS-ISONOR, building on an already established collaboration model. The contract has been penned for a duration of five years with the option to be extended up to 11 years.

Paal Eikeseth, Executive Vice President and Head of Aker Solutions’ Life Cycle segment, said, “We are proud to be a trusted and strategic partner for Vår Energi. At Aker Solutions, we believe that strong partnerships drive efficiency, foster continuous improvement, and enable a leaner project organisation.”

The partnership aims to create value through joint project planning, safe and efficient execution, collaboration and shared objectives.

Torger Rød, Vår Energi’s Chief Operating Officer, commented, “Aker Solutions, Honeywell and StS-ISONOR represent world-leading technical expertise and extensive experience in areas of strategic importance to our activities. With Vår Energi’s clear growth ambitions, a strong and long-term partnership is crucial.

“We are working purposefully to achieve results through close collaboration, actively utilising our partners’ core competencies. By year-end, we will increase production to around 400 thousand barrels per day, which makes us one of the world’s fastest-growing oil and gas companies.”

Vår Energi’s operations span the entire NCS with a portfolio of 200 licenses and 42 producing fields.

Talos Energy has reported a total US$37.7mn in capital expenditures for plugging and abandonment (P&A) and settled decommissioning obligations for the third quarter 2024.

Talos Energy has reported a total US$37.7mn in capital expenditures for plugging and abandonment (P&A) and settled decommissioning obligations for the third quarter 2024.

Besides comittment to end-of-life activities, the company's total capital expenditures for the period stands at US$118.9mn. Its quarterly report also revealed an increase of spending on P&A and decommissioning to US$100-110,000.

Talos' decommissioning services up untill 2028 has been covered by Helix Energy Solutions Group under an agreement signed early last year. This agreement empowers Helix with the first right of refusal involving significant segments of Talos’ decommissioning schedule in the US Gulf of Mexico. Helix will be in charge of leading Talos' abandonment goals, including offshore wells, pipelines and platforms. For the campaign, Helix Alliance, the company's shallow water abandonment wing from Louisiana, will be deployed for structure removals by using its derrick barges, liftboats for plug and abandonment activities, and dive support vessels (DSVs) for pipeline abandonments. The initiative will see multiple offshore supply vessels (OSVs) among a divwerse range of other assets as well.

Speaking of the agreement, Helix’s President and Chief Executive Officer, Owen Kratz, had said, “We are excited to have been awarded this significant framework agreement for well and structure removal and decommissioning. Helix and Talos have worked together on field production, well intervention and decommissioning in the deepwater arena for many years, and this framework expands the relationship onto the shelf, further demonstrating Helix’s position as the preeminent company for full-field decommissioning in the Gulf of Mexico.”

The second and third quarters of 2024 saw significant decommissioning obligations for Talos, during which time the plugging and abandoning of the Sebastian prospect also took place. While operated by Murphy Oil Corporation at a 26.8% interest, Talos holds a 25.0% interest in the prospect. Other partners include Westlawn Americas Offshore at 18.2%, Alta Mar Energy at 20.0%, and Houston Energy at 10.0%.

Drilled in the third quarter 2024, Murphy had to finally plug and abandon the Sebastian number 1 exploration well after only non-commercial hydrocarbons were encountered. This involved the removal of various tubulars and equipment, which can only be initiated once all safety and sustainability measures are put into place.

Talos had eneterd into an agreement regarding the Sebastian prospect in the Mississippi Canyon Block 387 of the US Gulf of Mexico, where drilling began in the later half of August 2024. The drilling aimed to reach a true vertical depth of approximately 12000 ft of the rich Upper Miocene K-1 reservoir situated in the region. There were plans to tie back the Sebastian prospect to the Delta House facility, where Talos holds interests as well.

While initial tests suggested an estimated gross resource potential of 9-16 mn boe with an aticipated early production rate of 6-10 mn boe per day, from this amplitude-supported prospect, post drilling results hardly matched expectations. The well had to be plugged and abandoned even though stakeholders initially considered it as one of the 'tactical, lower-risk opportunities' that can be 'brought online relatively quickly' to aid bigger upstream projects.

To know more about Gulf of Mexico's decommissioning and abandonment scene, click here.

TechnipFMC was awarded a substantial contract by Shell Nigeria Exploration and Production Company Limited to supply Subsea 2.0 production systems for the Bonga North development in Nigeria.

TechnipFMC was awarded a substantial contract by Shell Nigeria Exploration and Production Company Limited to supply Subsea 2.0 production systems for the Bonga North development in Nigeria.

The contract covered the design and manufacture of subsea tree systems, manifolds, jumpers, controls, and services, marking a significant step in advancing deepwater technology in the region.

Jonathan Landes, President, Subsea at TechnipFMC, commented, “Shell was the first to adopt our Subsea 2.0® configure-to-order solution, and continues to deploy it across multiple basins—underscoring its commitment to the technology globally. This award further positions us for future deepwater opportunities in the region.”

For TechnipFMC, a “substantial” contract is between US$250 million and US$500 million. This award was included in inbound orders in the fourth quarter of 2024. The contract highlights TechnipFMC's growing footprint in the subsea market and its strategic partnership with Shell.

Failure to decommission offshore oil and gas infrastructure on time and in compliance with requirements poses safety, environmental, and financial risks.

Failure to decommission offshore oil and gas infrastructure on time and in compliance with requirements poses safety, environmental, and financial risks.

Failure to maintain offshore oil structures, while leaving them idle and unused can degrade these structures and pose safety risks to employees and regulators visiting the site. Moreover, a lack of maintenance can restrict access to the platform, requiring them to undergo expensive repairs and further contributing to delays in decommissioning operations. Moreover, poorly maintained structures lack appropriate lighting which can behave as a navigational hazard by disrupting ships that are operating in the area.

Delays and noncompliance with decommissioning requirements can give birth to financial risks, particularly to the US government and taxpayers. In most cases, post-bankruptcy decommissioning liabilities in federal waters have been met by co-owners, previous owners, or new owners. However, some instances have had the government having to use taxpayer dollars to pay the costs of cleaning up after delinquent oil companies. When a current leaseholder is unwilling or unable to pay decommissioning costs, federal regulators can, under a system known as 'joint and several liability,' require any or all co-owners or previous lease-holders to pay the decommissioning costs for that infrastructure. For big oil companies with operations in the Gulf of Mexico, these 'contingent liabilities' could amount to two to six times the amount of their direct decommissioning liabilities. Oil companies often do not report these contingent liabilities on their balance sheets.

Some observers have voiced concern and doubt about the strength of federal joint and several liability regulations and the government’s ability to force previous lease-holders to pay decommissioning costs as more offshore oil and gas facilities reach the end of their productive lives.

Stagnant oil and gas infrastructures in the Gulf of Mexico can be vulnerable to deterioration and decay, thereby becoming a source of pollution. This is because detereoration and decay of these structures can lead to oil spills due to a failure of tanks and pipelines. The resulting release of corroded metal into the water can cause chronic pollution. Generally, offshore wells that are either improperly plugged or unplugged are found to become a source of pollution along with leaky or shallow-water wells or abandoned platforms that could be significant sources of greenhouse gas emissions.

While oil spills from idle or unused oil and gas infrastructure are unlikely to discharge high volumes of material, even small amounts of oil are toxic to marine organisms—from plankton to marine mammals—and can cause adverse impacts to their health or their ability to reproduce.

Moreover, deteriorated infrastructures can be prone to hurricanes and other major weather events, which have been increasing in frequency and intensity due to climate change. The Gulf of Mexico is subject to powerful hurricanes that can destroy equipment such as oil storage tanks, move subsea pipelines, or even topple entire platforms.52 Any of these events can trigger oil spills, either directly from the damaged equipment or through impacts to connecting or adjacent facilities.

Following Australia's first operator-supported offshore decommissioning liability assessment, several measures have been identified to reduce cost based on the insights generated from the asset databases.

Following Australia's first operator-supported offshore decommissioning liability assessment, several measures have been identified to reduce cost based on the insights generated from the asset databases.

By adjusting the work breakdown structure of the costed decommissioning database, a quantum of reduction that can be targeted for key measures has been estimated:

In order to maintain continuity of savings on the liability, effective industry-wide knowledge sharing should be ensured, failure of which will risk sub-optimal cost reduction outcomes.

Amidst the stringent regulations in place regarding liability in the face of end-of-life assets, and the substantial cost associated with decommissioning activities, the ‘Rigs-to-Reef’ policy the Bureau of Safety and Environmental Enforcement (BSEE) has adopted has presented itself as an attractive option in light of the sheer scope of end-of-life work ahead.

Amidst the stringent regulations in place regarding liability in the face of end-of-life assets, and the substantial cost associated with decommissioning activities, the ‘Rigs-to-Reef’ policy the Bureau of Safety and Environmental Enforcement (BSEE) has adopted has presented itself as an attractive option in light of the sheer scope of end-of-life work ahead.

BSEE have previously stated that the policy can help operator’s cut their decommissioning costs by up at least a quarter, while remaining sustainably conscious in a process where concerns have been raised about environmental ramifications associated with decommissioning.

Looking deeper into the reefing process, as outlined in Offshore Network’s Gulf of Mexico Decommissioning and Abandonment 2024 conference (D&A GOM 2024), there are various types of reef constructions. Those consist of:

The process of rigs-to-reef operations include vehement survey and evaluation tests to ensure the rig structure is compatible with reef development (all of which is outlined on the BSEE website). The size of the platforms, structural integrity and locations of the structure of key factors to consider when determining the validity of the project. Thus far within the region, the Department of the Interior has approved approximately 600 rigs-to-reef proposals, with only a handful denied since the policy’s introduction in 1986.

Countless studies have been conducted by the US Government to examine the impact the reefs have both on the structures themselves and the surrounding marine ecosystem. One benefit is that of marine restoration and biodiversity enhancement – the deployment of artificial reefs in areas that have been affected by situations such as coral bleaching and destructive fishing practices allows new habitats to house a variety of marine life and play a significant contribution to ecosystem restoration.

Other benefits can include the enhancement of fisheries around the localised area; a rise in ecotourism, in particular destination diving; added coastal protection from erosion as the rigs act as submerged breakwaters; advancement in marine research; increased maintenance of nutrient cycling and water quality; contribution to environmentally responsible practices; and coral restoration and conservation.

On the other side of the coin, however, there has been some pushback within the industry regarding rigs-to-reef operations due to a number of posed risks associated with the process.

Some of the concerns include habitat displacement as some reefs can alter local marine habitats; the risk of pollution from improperly prepared materials; physical damage to the seafloor if the design or placement of the rig is not appropriate; damage to the surrounding ecosystem if the construction has not been actioned properly; the negative impacts associated with long-term maintenance of the rigs; the economic costs of reef management; and design flaws which may create conflict with the local environmental conditions.

While these concerns remain a continuous reminder about the fragility of rigs-to-reef operations, operator’s must decide whether shouldering the financial burden of fully decommissioning their assets outweighs the benefits presented by the reef policies. Even with these risks in min, the Gulf is currently one of the world’s leading nations for rigs-to-reefs projects, and the future continues to look bright for the environmentally-friendly alternative to decommissioning.

Playing a key role D&A GOM 2024, reefing discussions will once again shine in the spotlight for the 2025 edition of the world’s biggest decommissioning event. All of the details regarding the upcoming conference in April can be found here.

Australia’s offshore oil and gas industry is undergoing a seismic shift, with an estimated 5,695 kilotons of infrastructure set to be decommissioned from its coastal waters by 2060 and beyond.

Australia’s offshore oil and gas industry is undergoing a seismic shift, with an estimated 5,695 kilotons of infrastructure set to be decommissioned from its coastal waters by 2060 and beyond.

This monumental effort, spanning both onshore and offshore activities, involves a broad range of businesses, from initial planning and permitting to dismantling offshore platforms and recycling materials. It’s a complex process that includes plugging oil and gas wells, removing pipelines, dismantling steel structures, and safely disposing of waste materials. As the industry adapts to the future, the scale of decommissioning is expected to evolve, and the potential impact on Australia’s economy, environment, and job markets is immense.

The expanding offshore decommissioning value chain

Australia’s offshore decommissioning value chain is vast, with many key players involved in various stages of the process. Key activities include:

* Planning and securing necessary approvals: Obtaining government permits and satisfying environmental regulations are crucial first steps.

* Removal of subsea infrastructure: This includes plugging and abandoning over 1,000 wells, removing more than 4,960 km of pipelines and 1,700 km of flowlines from the seabed, and dismantling a host of offshore facilities such as fixed production platforms and floating production storage facilities

* Waste management and recycling: Steel, plastics, and other materials are salvaged and recycled, while hazardous materials are safely disposed of.

The Gippsland Basin, located off the coast of Victoria, holds a significant portion of the offshore infrastructure, accounting for about 9% of the total materials slated for decommissioning. However, the bulk of the work lies in Western Australia, where 89% of the material to be removed is concentrated. The sheer scale of this operation requires a coordinated effort among various stakeholders, including government agencies, private companies, and environmental organizations, to ensure that decommissioning is done responsibly and efficiently.

The costs and economic implications

The cost of decommissioning in Gippsland Basin and North Carnarvon Basin alone is projected at US$11bn by 2032. This is just the beginning, as decommissioning peaks are expected in 2033-2037 and 2043-2047, corresponding with the end of life for large infrastructure projects.

With the ongoing evolution of offshore wind, decommissioning activities will only become more extensive and expensive. The pipeline of decommissioning projects is projected to continue expanding well into the second half of this century, shaping Australia’s energy landscape for decades to come.

The information in this article is sourced from the Department of Industry, Science and Resources. You can read more here

Page 42 of 118