Amidst the tightening up of decommissioning regulations, and the substantial amount of infrastructure coming to the end of its operational life, the Rigs-to-Reef programme has emerged as an attractive option in the Gulf of Mexico in the face of spiralling decommissioning costs.

Amidst the tightening up of decommissioning regulations, and the substantial amount of infrastructure coming to the end of its operational life, the Rigs-to-Reef programme has emerged as an attractive option in the Gulf of Mexico in the face of spiralling decommissioning costs.

Over the course of their lives, oil and gas structures in the marine environment become a haven for marine life. The Rigs-to-Reef programme, operated by the Bureau of Safety and Environmental Enforcement (BSEE) provides an alternative to the obligation to onshore disposal by converting retired platforms into permanently submerged ‘artificial reefs’. Such a method (achieved through tow-and-place, topple-in-place, or partial removal) allows operators to save an estimated quarter of the cost of a full service removal and is something of a trademark of the region, with around 600 platforms turned into reefs since conception in 1984. According to an article in the Scientific American, of the 15 structures decommissioned in the Gulf of Mexico in depths greater than 400 feet, 14 have been “reefed.”

According to the BSEE, the benefits of such an approach include saving fuel emissions that otherwise would be expended transporting and disposing of obsolete structures; enriching the marine life in the area, given the natural bottom of the Gulf of Mexico offers very little natural hard bottom and reef habitat; attracting recreational and commercial fishing and diving; and promoting biodiversity. A typical eight-leg structure provides a home for 12,000 to14,000 fish, according to a study by the Coastal Marine Institute, while a typical four-leg structure provides two to three acres of habitat for hundreds of marine species. For the oil and gas companies themselves, repurposing obsolete structures saves them the costs of removing, transporting, and disposing of them onshore. BSEE regulations require that, within one year of a lease's expiration, the obsolete structure must be removed.

All five Gulf of Mexico coastal states have approved artificial reef plans and have incorporated decommissioned platforms into their artificial reef programmes. Converting into reefs entails meeting strict criteria and requirements, such as the structure being sound, stable, clean, and overall beneficial to the environment, while protecting the Gulf of Mexico's natural resources. The operator is required to make a donation to the state, which goes towards the management of the state’s artificial reef programme. Once the operator has received approval, converts the structure to a permanent artificial reef and has complied with all permits and donation agreements, the title and liability for the structure is transferred from the operator to the state.

While there are examples of rig-to-reef approaches in other regions of the world and interest is growing, there are as yet no international standards governing the reefing of rigs, and the Gulf of Mexico has the most developed and regulated system. While some stress the benefits of the initiative, and the environmental damage that could be caused by complete removal of a rig with the potential destruction of a rich aquatic ecosystem, many are less convinced, and public perception is often not in favour. Many oppose any oil infrastructure being permitted to stay in the ocean given it could be seen to let oil and gas companies off the hook financially, arguing that operators should be required to return the area to its original state.

There has been a number of efforts to expand production in Malaysia’s offshore oil and gas fields, with a number of key industry players increasing their stake in the region.

TotalEnergies, for instance, has finalised the acquisition of interests of OMV and Sapura Upstream Assets in SapuraMOV Upstream, an independent gas producer in Malaysia. SapuraOMV’s main assets are its 40% operated interest in block SK408 and 30% operated interest in block SK310, located offshore Sarawak. In 2024, SapuraOMV’s operated production (100%), supported by the start-up of the Jerun gas field, is expected to reach approximately 590 Mcf/d of natural gas, feeding the Bintulu LNG plant operated by Petronas, as well as 10 kb/d of condensates.

Elsewhere, EnQuest Petroleum Production Malaysia announced in December an agreement to develop approximately 155 Bscf (c.27mn barrels of oil equivalent) of additional Seligi field gas resources along with a 50% equity share.

In partnership with PETRONAS Carilgali Sdn Bhd and E&P Malaysia Venture Sdn Bhd, the agreement enables the parties to develop and commercialise the non-associated gas resources in the PM8E PSC contract area and, in line with expected demand, supply around 70mmscf per day of sales of gas. EnQuest will produce additional Seligi Field non-associated gas by modifying its existing infrastructure, providing a cost-efficient way to deliver new volumes into the Peninsula Malaysia gas system.

“Malaysia is a key area for EnQuest’s growth strategy, and this agreement complements the signing of the DEWA Complex Cluster SFA PSC in October this year,” remarked EnQuest CEO, Amjad Bseisu.

December was also marked by PETRONAS awarding production sharing contracts for three discovered resource opportunities clusters and one exploration block offered under the Malaysia Bid Round (MBR) 2024 which was launched earlier this year. The resources are located next to existing infrastructure, enabling synergistic development and swift monetisation that, PETRONAS said, will allow for efficient and cost-effective resource extraction.

“We are pleased to see our petroleum arrangement contractors growing their portfolios in Malaysia,” said Senior Vice President of MPM, Datuk Ir. Bacho Pilong. “With their strong track records and proven capabilities, they continue to contribute significantly to the growth of Malaysia's petroleum sector… The year 2024 marks another successful year with the award of 18 PSCs across exploration, DRO and Late Life Asset. This is a testament of investors' confidence in PETRONAS' innovative asset offerings with high monetisation potential, solidifying Malaysia’s position as a preferred destination for upstream investments.”

While Malaysia is already a strong point in the APAC region for well intervention services beyond drilling, the expansion of production in the country suggests that even more opportunities will be forthcoming for such service providers.

In a bid to boost production from the Perdido platform that is operational for the Phase 3 Silvertip Development in the US Gulf of Mexico, Shell has onboarded Subsea7 for extensive engineering, procurement, construction, and installation (EPCI) work that will run 3,000 metres deep into the Alaminos Canyon.

In a bid to boost production from the Perdido platform that is operational for the Phase 3 Silvertip Development in the US Gulf of Mexico, Shell has onboarded Subsea7 for extensive engineering, procurement, construction, and installation (EPCI) work that will run 3,000 metres deep into the Alaminos Canyon.

Subsea7's services will also include the installation of a production flowline and related subsea infrastructure. The company is currently tackling the project management and engineering of this contract at their office in Houston, Texas.

"This new award strengthens our diverse portfolio of deepwater projects in the Gulf of Mexico. We look forward to continuing our collaboration with Shell," said Craig Broussard, Senior Vice President for Subsea7 Gulf of Mexico.

Owned by Shell (40%) – who is also the operator – and Chevron (60%), the wells within the Silvertip Frio reservoir can achieve a combined yield of nearly 6,000 barrels of oil equivalent per day. A final investment decision has hence been reached to advance production optimisation across two wells that comprise the Phase 3 Silvertip project. The companies are aiming first production in 2026.

"This investment at Perdido is another example of our focus on high margin, lower carbon intensity barrels," said Rich Howe, Shell's Executive Vice President for Deep Water. "As the largest operator in the US Gulf of Mexico, we prioritize opportunities nearby our existing assets in these advantaged corridors, where we are well-positioned to develop shorter-cycle, high value tieback opportunities."

With nearly US$60bn expected to be invested into decommissioning offshore infrastructure over the next three to five decades, the Australian government has formed an Offshore Decommissioning Roadmap aimed at boosting the growth of the country's decommissioning industry.

With nearly US$60bn expected to be invested into decommissioning offshore infrastructure over the next three to five decades, the Australian government has formed an Offshore Decommissioning Roadmap aimed at boosting the growth of the country's decommissioning industry.

Growing Australia's domestic decommissioning industry not only benefits the country's economy and environment, it also plays a key role in Australia's transition to net zero.

The roadmap maximises the amount of decommissioning activity that happens domestically and ensures that planned activities are taking place with improved efficiency and transparency. It also sets out a path to grow Australia's industrial capability in the management of decommissioning and materials, create safe, top-tier jobs to service a thriving decommissioning industry, all while ensuring that the industry undertakes its decommissioning obligations in a safe, timely and environmentally responsible way.

The roadmap focuses on five main areas of opportunity including the establishment of a regulatory framework that safeguards the environment while attracting investment, fostering meaningful partnerships with First Nations people and local communities, and maximising infrastructure opportunities and availability. Moreover, it encourages job creation and investment in the recycling and waste management sectors while also developing an offshore decommissioning workforce that is safe, skilled and diverse.

To support the roadmap, the Offshore Decommissioning Directorate was formed this month to encourage collaboration among all parties involved, improve transparency across the pipeline, be a trusted partner and advisor on policy matters, strengthen regulatory frameworks and ensure that industry activities complement the Future Made in Australia agenda.

Over the past few years Latin America has positioned itself on the global stage as an emerging and critical industry across the well lifecycle that addresses the growing need to effectively and efficiently retire infrastructure once the well has reached end of life.

Over the past few years Latin America has positioned itself on the global stage as an emerging and critical industry across the well lifecycle that addresses the growing need to effectively and efficiently retire infrastructure once the well has reached end of life.

It has not been smooth sailing for the industry as the region has faced a series of complex challenges in light of the energy transition, however with environmental licenses by the Brazilian Institute of Environment and Renewable Natural Resources (IBAMA) becoming an integral factor in the materialisation of production interests and an overall increase in environmental awareness from across the industry, stakeholders and key industry players are embracing innovative well intervention methods and ensuring thorough end-of-life measures are in place.

Looking primarily at decommissioning and abandonment (D&A) the main drivers of the market within Latin America are the expiration of production licenses, the need to comply with evolving environmental regulations, and the region’s increasing push toward sustainability. As many oil and gas reserves in the region begin to mature, particularly in major oil-producing countries such as Brazil, Argentina, and Mexico, companies are facing the reality of retiring older, less profitable fields.

The decommissioning process involves safely dismantling infrastructure and restoring sites to environmentally sound conditions. This is becoming increasingly important as Latin American countries adopt stricter environmental laws and regulations.

Beyond regulatory requirements, the economic necessity of decommissioning older fields and facilities also plays a pivotal role. As operational costs rise for aging infrastructure, many companies are opting to decommission older assets to refocus their capital on newer, more productive fields. Furthermore, as the region transitions toward cleaner energy sources, companies and governments must address the legacy of fossil fuel infrastructure, making decommissioning an essential part of the energy transition.

Despite the growth of the D&A market, there are several challenges that the region faces. One of the most significant obstacles is the lack of sufficient funding for decommissioning projects. Decommissioning offshore platforms or dismantling pipelines requires substantial financial investment, and in many cases, the financial burden can often be too much for operators to bare. In countries where oil and gas revenues are a major part of the economy, this financial challenge can become even more complex, as the state often has to step in to fund decommissioning in cases where operators are unable to pay for the safe removal of infrastructure.

Another challenge is the scarcity of local expertise and technology required to carry out these tasks. While the oil and gas industry in Latin America has a skilled workforce, decommissioning often requires new, specific training that many countries have yet to provide in sufficient numbers.

Additionally, the market’s development is hindered by regulatory uncertainty. Some countries in Latin America have evolving or unclear regulations around decommissioning, which can complicate long-term planning and investment decisions.

Despite these challenges, the Latin American D&A market offers considerable opportunities. The region’s large and aging oil and gas infrastructure is a significant driver for decommissioning services. Countries like Brazil, Mexico, and Argentina offer substantial opportunities for international investment into D&A activities.

As the energy landscape shifts towards renewable energy, Latin American countries are emphasising sustainable decommissioning practices, focusing on environmental restoration, and waste management. This presents a chance for innovative solutions and technologies to be implemented on a wider scale.

International collaboration and partnerships are also becoming more common. Several multinational oilfield services companies, along with local firms, are forming joint ventures to navigate the region’s waters and overcome the financial challenges.

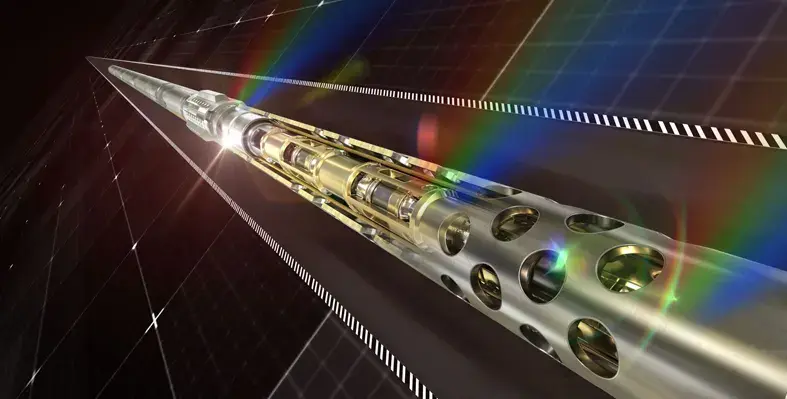

Expro, an energy services provider with capabilities spanning well construction, well flow management, subsea well access, and well intervention and integrity solutions, has won a significant contract for the provision of a well decommissioning solution.

The company has agreed to provide a surface fluid management package and its market-leading 7-3/8” large-bore subsea test tree assembly (SSTTA) with surface tree and controls, providing dual barrier and disconnect capability to facilitate re-entry into the subsea wells.

The contract is reportedly valued at more than US$10mn and will see Expro plug and abandon 52 wells – many of which the company had previously been in the construction of.

“Having been involved in the development phase for many of these fields, we have gained a life of well experience that will be invaluable for this P&A campaign,” said Iain Farley, Expro’s Regional Vice President for Europe and Sub-Saharan Africa. “Our expertise and know how will help deliver key technical and commercial benefits for the client across the project.”

In receiving the contract, Expro drew attention to its unrivalled portfolio of standard and bespoke subsea solutions. The company offers subsea well access systems that interface with any Christmas tree type and can operate in open water or within a drilling riser with blow-out preventer. Expro’s surface well test systems equally provide industry-leading solutions that can be configured to specific well conditions and customer requirements.

“The contract reinforces our reputation as the leading provider of subsea safety systems and surface well test equipment, including within the P&A sector,” Farley added. “It demonstrates our commitment to delivering best-in-class equipment, allied with the highest standards of safety and service quality that Expro is renowned for.”

The United Kingdom and Australia have formed a partnership agreement to strengthen cooperation on offshore oil and gas decommissioning.

Announced in a joint statement, the governments of the UK and Australia have sought to establish the partnership that builds on the recently-signed Australia-UK Climate and Energy Partnership. It will combine the 40 years of UK expertise in the North Sea with the blossoming decommissioning services market in Australia.

The agreement was signed by Australian Minister for Resources and Minister for Northern Australia, Madeleine King, and the UK Minister for Services, Small Businesses and Exports, Gareth Thomas. Together, they agreed to encourage cooperation in areas including supply chains, knowledge and skills, regulations, and financing while supporting engagement between UK and Australian businesses engaged in decommissioning.

Furthermore, it will establish a working group comprising industry representatives, academic partners, and regulatory bodies to develop a collaborative framework and partnership programme. This will identify viable decommissioning projects that would benefit from cooperation, delivering these in accordance with international quality and sustainability standards.

Through the identification of capability, equipment gaps and strengths, the group will also facilitate the sharing of decommissioning expertise between the two countries with knowledge transfer opportunities.

In a move expected to create the UK North Sea’s biggest independent producer, Equinor UK and Shell UK have agreed to combine their UK offshore oil and gas assets and expertise into one company.

With a 50/50 split stake between Equinor and Shell, the new joint venture will reportedly be more agile, focused, cost-competitive and strategically well positioned to maximise the value of the combined portfolio. According to Shell, the decision was made in light of the maturing nature of the basin, with production rates naturally declining. As a result, the new company will target the continued economic recovery of the resource and will invest to provide long-term sustainable future for individual oil and gas fields and platforms.

“Domestically produced oil and gas is expected to have a significant role to play in the future of the UK’s energy system,” remarked Shell plc’s Integrated Gas and Upstream Director, Zoë Yujnovich. “To achieve this in an already mature basin, we are combining forces with Equinor, a partner of many years. The new venture will help play a critical role in a balanced energy transition providing the heat for millions of UK homes, the power for industry and the secure supply of fuels people rely on.”

Equinor’s Executive Vice President for Exploration and Production International, Philippe Mathieu, added, “Equinor has been a reliable energy partner to the UK for over 40 years, providing oil and gas, developing the offshore wind industry, and advancing decarbonisation. This transaction strengthens Equinor’s near-term cash flow, and by combining Equinor’s and Shell’s long-standing expertise and competitive assets, this new entity will play a crucial role in securing the UK’s energy supply.”

In the UK, Shell currently produces around 100,000 barrels of oil equivalent per day with Equinor contributing an additional 38,000. With the new joint venture already expressing its desire to maintain rates, this could be a potentially game-changing development for the various well intervention service and equipment suppliers to the region.

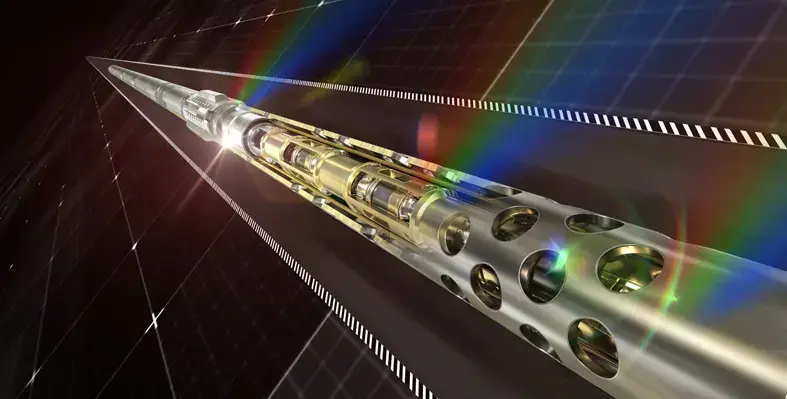

Halliburton has introduced the Intelli suite of diagnostic well intervention wireline logging services.

Halliburton has introduced the Intelli suite of diagnostic well intervention wireline logging services.

Whether integrated or used individually, this suite of services help in production optimisation by ensuring customised and improved well insights, supporting asset life expansion, and operational costs reduction.

"As customers look to maximise production and improve the efficiency of their wells, our Intelli suite helps improve downhole insights in a highly customisable way. Because each job is unique, we wanted to develop a suite of products that could be used individually, or as an integrated solution, ultimately, delivering a better experience and result for our customers," said Chris Tevis, Vice President of Wireline and Perforating.

A complete diagnostic well intervention package, the suite consists of IntelliSat, IntelliFlow, IntelliGuard and IntelliScope.

The IntelliSat pulsed-neutron logging service provides reservoir insights either in open hole or after a well is completed. This service helps improve recovery with the detection of bypassed pay, and provides spectroscopy and KUTh measurements.

The IntelliFlow array production logging service is co-located with fluid ID and flow rate sensors to ensure high accuracy of production profiles, precision phase analysis, and dynamic flow information.

The IntelliGuard corrosion evaluation service is the next generation high-definition casing inspection technology, quantifing metal loss in up to seven concentric casings, and pinpointing damage without the need for costly well intervention.

The IntelliScope leak and flow diagnostic service identifies precise leak sources and flow paths vertically and radially behind pipe in a single, continuous pass.

The Enersea group has announced the launch of its third sister company called Frequensea

The Enersea group has announced the launch of its third sister company called Frequensea

This new wing has developed an innovative decommisioning tool designed to extract power cables, that are no longer in use, from the ocean. These subsea cables are often buried as deep as three meters below the seabed, presenting significant technical difficulties.

The latest addition to the corporate family was announced at the Offshore Energy Exhibition & Conference, where Dieter Korndorffer, Managing Consulatnt at Enersea demonstrated the patented technology of Frequensea, which utilises a vibration-based mechanism that liquefies surrounding soil, enabling the efficient removal subsea power cables. This process not only facilitates the recovery of valuable metals from the cables but also supports the transition to a circular economy by recycling materials that would otherwise remain unused.

Akastor ASA, which owns a 50% share of AKOFS Offshore, has announced that Equinor Energy AS has extended its existing contract for the vessel AKOFS Seafarer.

The three-year option period has been activated by Equinor and is expected to commence in late Q4 2025. This is after the vessel has completed its customary special periodic survey and is in direction continuation of the current contract period.

According to Akastor, the option has a total value of US$300mn and will mean that the vessel will continue to perform light well intervention services for Equinor well into 2028.

Akastor’s move to acquire a 50% interest in AKOFS Offshore was undertaken in light of the “compelling” subsea well intervention and installation sector. Learn more about this development by clicking here.

In a press conference last week, the Government of Alberta has committed CAD$50mn to establish the Alberta Drilling Accelerator (ADA), Canada’s first test site dedicated to advancing drilling technologies for geothermal, lithium and carbon capture industries.

In a press conference last week, the Government of Alberta has committed CAD$50mn to establish the Alberta Drilling Accelerator (ADA), Canada’s first test site dedicated to advancing drilling technologies for geothermal, lithium and carbon capture industries.

ADA will offer an open-access site for testing innovative technologies in high-temperature subsurface conditions across an array of rock formations. Eavor Technologies, Halliburton and Tourmaline Oil Corp are among the top companies expressing an interest in becoming anchor tenants for the project.

Minister of Environment and Protected Areas, Rebecca Schulz, said, “We are increasing production, reducing emissions, all while meeting those rising demands for energy for years to come. This is thanks to our geology, expertise and highly skilled workforce of Albertans.”

Eavor CEO, John Redfern, affirmed Alberta’s drilling legacy, stating, “By establishing this technology incubator, we’re ensuring Alberta remains an international leader in geothermal innovation.”

Page 46 of 118