E2E Energy Solutions has signed of a Letter of Intent with Novus Earth to jointly develop the Latitude 53 Hinton Inc project over two phases

E2E Energy Solutions has signed of a Letter of Intent with Novus Earth to jointly develop the Latitude 53 Hinton Inc project over two phases

Situated just outside of Hinton, Alberta, the groundbreaking initiative represents a major step forward in geothermal energy development. With construction set to begin in early 2025, the project will drive both sustainable energy solutions and agricultural growth.

The first phase of the project will focus on utilising geothermal energy to support year-round strawberry cultivation across a 20-acre greenhouse. This facility will receive up to 50 gigajoules of sustainable, consistent heat per hour, provided by E2E's geothermal technology. The second phase will incorporate E2E’s patented Enhanced Geothermal Reservoir Recovery System (EGRRS) to generate 10 MW of zero-emission power, proving the feasibility of geothermal technology as a reliable energy source.

"We are looking forward to introducing this innovative approach to thermal and electrical generation to Alberta," said Jeff Mesner, President of Novus Earth. "Our partnership with E2E Energy Solutions perfectly aligns with our mission to leverage advanced geothermal technology for sustainable, community-centered projects."

“We’re very pleased to see our EGRRS technology integrated into a project that will bring stable, affordable energy to Alberta,” said Nick Daprocida, CEO of E2E Energy Solutions. “This project demonstrates how geothermal energy can contribute to creating sustainable jobs and delivering reliable baseload power to the agricultural sector.”

Tenaris, a global manufacturer and supplier of steel pipes and relates services for the energy industry, has used its presence at ADIPEC 2024 to introduce WISer, a suite of digital solutions designed to enhance well integrity, safety, efficiency and reliability.

As one of the world’s leading energy events, there could hardly be a better stage to reveal new solutions that can help the sector deal with its most pressing challenges. As such, WISer becomes the latest addition to the Rig Direct service package and builds on the company’s renowned on-site field assistance.

The pipe-by-pipe traceability enabled by PipeTracer technology and the 24/7 support provided from its remote monitoring centre, WISer includes two digital solutions that maximise the lifecycle of pipe strings.

This includes the iRun Casing cloud-based tool that provides real-time monitoring of casing installation to minimise the risk of lost lateral length and production. It also helps to prevent costly accessibility issues caused by fatigues damage, buckling, over-torque or stuck pipes.

There is also the Torque turn monitoring system. Tenaris field service experts collect and analyse real-time torque data at the well using advanced equipment to improve connection make-up reliability, reduce errors, and enhance the overall integrity of the assembly.

“With WISer, we support our customers' drilling projects during pipe running operations, improving decision-making and enhancing the consistency and reliability of well construction by combining our extensive field service experience with real-time data analytics and remote monitoring,” commented Lucas Pigliacampo, Tenaris Vice President Oil & Gas Technologies. “A key addition to our Rig Direct mill-to-well service model, WISer reflects our ability to continually adapt and innovate.”

Aside from providing a platform for the industry to discover the latest solutions entering the market, ADIPEC was also a forum for debate and progressing ideas that will change the face of the sector for years to come.

Unsurprisingly, decarbonisation was a key topic of discussion of the conference in Abu Dhabi as oil and gas leaders strive to strike the balance between meeting barrel demands and lower emissions output.

Tenaris strode into the discourse, with Gabriel Podskubka, the company’s Chief Operating Officer, participating in the ‘Optimising Operations to Advance Decarbonisation: A Digital and Cultural Shift’ panel session. Here, the panellists agreed that while advanced technologies, data-driven insights and process improvements can contribute to reducing emissions across the value chain, to achieve meaningful decarbonisation, deeper cultural shifts and cross-industry collaboration is required.

“At Tenaris, we are true believers that sustainability and decarbonization support our business strategy” Podskubka contributed. “These are key priorities for our leadership, our employees, our communities, and our customers. Today, our carbon emissions intensity is the lowest in our sector, and we are investing to ensure it remains so in the future. At Tenaris, we see decarbonisation not only as the right thing to do, but as a sound business decision. It’s an opportunity for us to continue leading in another dimension of our business.

“You need a vision, measurable targets and a strong leadership that is willing to convert this vision into reality. After communicating our decarbonisation commitment, we focused on defining KPIs for measuring emissions of our processes at every site. We now communicate both internally and externally on our progress and initiatives to reduce our CO2 emissions intensity per ton of steel by 30% by 2030.”

Akastor ASA has signed an agreement to acquire all of the interests Mitsui & Co. Ltd holds in AKOFS Offshore, a provider of vessel-based subsea well installation and intervention services to the oil and gas industry.

“We sincerely thank Mitsui for their valuable and good collaboration since 2018,” remarked Karl Erik Kjelstad, CEO of Akastor. “We believe the timing for increasing our investment in AKOFS Offshore is right, as market dynamics within the subsea well intervention and installation sector are increasingly compelling.”

A purchase price of US$22.5mn will see Akastor now hold 75% of the shares in AKOFS Offshore with Mitsui O.S.K. Lines holding the remaining 25%. As part of this development, the two shareholders will negotiate and enter into a new shareholders agreement on similar terms but reflecting the changed ownership.

“We are excited to deepen our commitment as well as to continue the journey together with MOL as partner,” continued Kjelstad. “Together, we remain confident that AKOFS Offshore is well-positioned for continued growth in the years to come and are well-aligned regarding our ownership strategy.”

International, a protective coating brand of AkzoNobel, has introduced the next evolution in epoxy passive fire protection (PFP)

Chartek ONE has been introduced as a single-coat, mesh-free solution that simplifies PFP application for assets in the energy sector by maximising efficiency, streamlining installation processes and enhancing health and safety.

As a 100% solids, boron-free two-pack material, Chartek ONE provides enhanced durability and combined corrosion, cryogenic and hydrocarbon protection. It provides three hours of jet and pool fire protection across a wide operating temperature range, effectively shielding assets from all fire types.

Chartek ONE can accelerate installation of PFP systems both in the workshop and onsite, lowering installed weight, reducing labour and material costs whilst achieving the same fire protection, which is particularly important for industries with strict weight requirements, such as offshore oil and gas. In doing so, Chartek ONE can reduce workshop hours by up to 59%, saving users both time and money throughout projects and over the lifetime of the asset.

Introduced for customers in the Middle East, Chartek ONE availability in other regions is planned for 2025.

“Chartek stands at the forefront of the industry, offering a comprehensive range of solutions that reflect our heritage and track record of success,” remarked Robin Wade, Global Fire Protection Manager at AkzoNobel. “Our investment in research, development and PFP capabilities enable us to provide our customers with the best possible outcomes.

“Chartek ONE was developed in our Felling facility which is one of the world’s largest UKAS-accredited PFP testing centers for intumescent PFP. Patented polysiloxane modified thio-ether and epoxy technology resolves many of the pain points found in the provision and longevity of epoxy PFP in one simple solution. International is a dedicated partner and through the celebrated history of Chartek, we are committed to excellence in technical support, product specific engineering solutions, and delivering class-leading products.”

Chartek benefits from a presence in the industry spanning more than half a century. As passive fire protection, it excels in the most demanding conditions and the range is one of the world's most complete portfolio of epoxy intumescent PFP coatings available, according to the company.

Formulated and tested against critical industry standards for energy assets including NORSOK M-501:2022 Edition 7 and ISO 22899 (standard and high heat flux jet fires), Chartek ONE is free from boron and has a 100% solids formula to reduce occupational risks and improve HSE performance and footprint.

“We are thrilled to be introducing Chartek ONE for our Middle East customers at ADIPEC 2024,” added Andy Holt, Business Development Manager - Middle East at International. “Crafted to offer our customers superior safety, reliability, and peace of mind, Chartek ONE showcases our continued dedication to sustainability and innovation.

“This single-coat, mesh-free solution will drastically simplify PFP projects for our customers, minimizing downtime and reducing overall project costs. Our commitment to considering the environmental impact of our work is an integral part of the development process. Chartek ONE’s 100% solids, boron-free formula, stands as a testament to this commitment.”

According to Mammoet, which helps clients with smarter, safer and stronger solutions for heavy lifting and transport challenges, Brent Charlie has been successfully skidded onto the quayside for decommissioning.

Brent Charlie is the last and heaviest topside from the Brent oil and gas field, located 186 km northeast of the Shetland Islands. It is now to follow its siblings – jacket-based Alpha, and gravity-based Bravo, Charlie and Delta – into a decommissioned retirement having been the last one in operation since 2014.

Mammoet has now provided an update on the project, reporting that it has successfully performed the skidding of the 31,000t topside onto the quayside, overcoming complex engineering and safety challenges in the process.

Brent Charlie was required to be removed and transported from the Brent field to the Able Seaton Port near Hartlepool, UK. In order to do so, the company followed a similar process from the previous three Brent topsides.

Allseas used its motion-compensated heavy lift vessel Pioneering Spirit to remove the structure at sea in a single lift and transport it to shallow waters, where the topside was transferred onto Iron Lady, Allseas’ purpose-built cargo barge.

Mammoet had already fitted Iron Lady with skidding equipment (some 45 truckloads of materials), which would be needed to offload Brent Charlie at the port. Mammoet also provided mooring winches for Iron Lady within specific guidelines provided by Allseas on lengths and drum load capacities.

Once the barge had moored at Able Seaton Port and settled into the seabed, the team could determine the starting height of the skid tracks on the quayside and begin laying them down. The topside was skidded over twelve skid tracks, which needed to be perfectly aligned with the skid tracks installed on the barge.

The skidding operation was performed in two stages. First, the topside was skidded five meters to the aft of the barge. Then, after 12 hours to allow for further settling, it was skidded the remaining 130 meters onto the quay, to its final position.

A configuration of 76 skid shoes - divided between the four legs of the platform - and 40 push-pull units were used to skid the topside 15 meters per hour. The combined pushing capacity was 3,320t; the total lift capacity was 51,000t.

Suspended netting was used to collect any falling debris and marine growth that might come away from the structure. All movements were remotely controlled from a control room to minimise the presence of people underneath the platform, and therefore maximise safety.

One of the primary challenges was managing the structures four legs, which cause it to be less stable during skidding. As Richard Verhoeff, Mammoet Sales Director, explained, “When you look at stability, three legs are always stable; four legs are not. You try to keep a three-point suspension when performing a load-in, and still need to achieve that even with four legs. That’s where hydraulic grouping comes in very handy.”

But there can also be some level of deflection between the legs, so the force needs to be able to communicate between the different hydraulic groups.

This is why there were hydraulic cylinders under each leg, and why the cylinders between both pairs of two legs had to be connected – to ensure the pressure on each remained the same.

Despite the various challenges, Mammoet drew from its extensive experience of performing similar operations to successfully complete the task. “We have a pragmatic approach, which is required on jobs like this,” remarked Leo de Vette, Project Manager at Mammoet. “It’s really a team operation, you must do it together. Time is of the essence, so equipment can be moved to the next job. Once the topside is on the barge, there is only one priority – get it off as safely and efficiently as possible.”

SLB, a global technology company, has announced that its SLB OneSubsea joint venture has been awarded a contract by bp to implement a boosting system in the greenfield development of the Kaskida project in the Gulf of Mexico.

“We’re delighted to expand our relationship with bp into the subsea processing domain, especially with such a critical delivery to bp’s first Paleogene field development” remarked Mads Hjelmeland, CEO of SLB OneSubsea. “Our subsea boosting system will accelerate and maximise the immense potential for this development.”

The contract represents the first engineering, procurement and construction contract for a subsea boosting system between bp and SLB OneSubsea. It includes a supplier-led, high-pressure subsea pump solution complete with an integrated power and controls umbilical, in addition to topside equipment.

The boosting system has been regarded as a key technology within bp’s first Paleogene field development. It will supply the required artificial lift needed to maximise production through the accelerated recovery of reserves with minimal energy consumption. The new award has also been celebrated as a continuation of the long-standing relationship between bp and SLB OneSubsea.

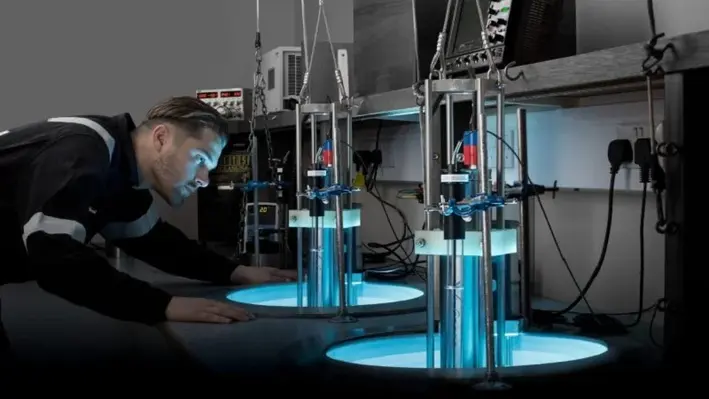

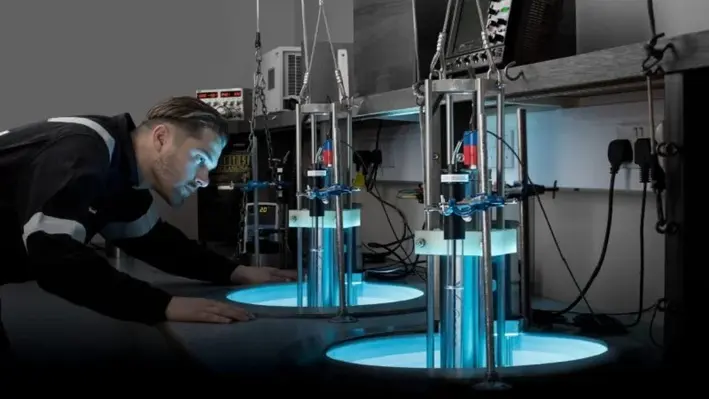

CBRE Investment Management, on behalf of a fund managed by its Private Infrastructure division, has acquired a majority stake in Finnish geothermal company, Geonova Oy

CBRE Investment Management, on behalf of a fund managed by its Private Infrastructure division, has acquired a majority stake in Finnish geothermal company, Geonova Oy

Specialising in decentralised heating and cooling services using ground source heat pump (GSHP) technology, Geonova has around 20 years experience in providing full turn-key heating solutions, covering system design, installation and management. The demand for these systems is set for continued growth as it aligns with Finland's 2035 net zero goals. Also, Finland has the highest per capita consumption of heat in the EU.

CBRE IM has acquired an 80% stake in the company from current shareholders, including Helsinki-based Helen Oy and LampoYkkonen Oy. LampoYkkonen will retain a 20% stake in Geonova. CBRE IM has also made a further capital commitment to fund the future expansion of the business. The investment will form a core part of the strategy of CBRE IM’s Private Infrastructure division to invest in infrastructure assets and technologies that support the decarbonisation of the built environment.

Andreas Köttering, Head of Private Infrastructure Europe at CBRE IM said, “Investing in businesses like Geonova demonstrates our strategy of decarbonising the built environment. We can support that strategy by bringing to bear the capabilities of our entire CBRE platform.”

“Geonova has already established itself as a leading player in the GSHP sector in Finland,” said Kerron Lezama, Senior Director, Infrastructure Investments of CBRE IM. “We are excited to be able to work with Geonova’s excellent management team and Vesa to support its future growth as low carbon heating systems play a greater role in making buildings more energy efficient.”

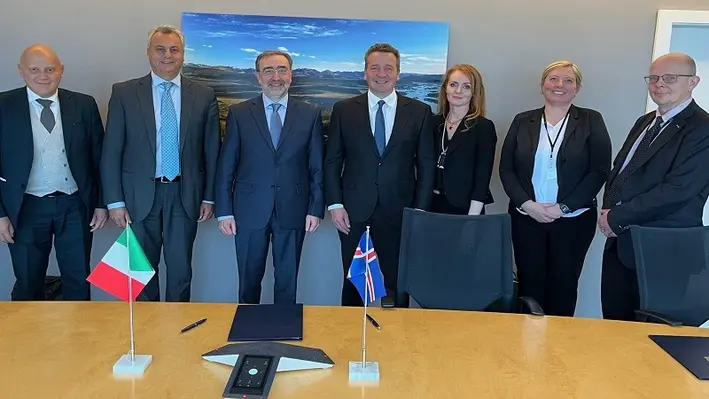

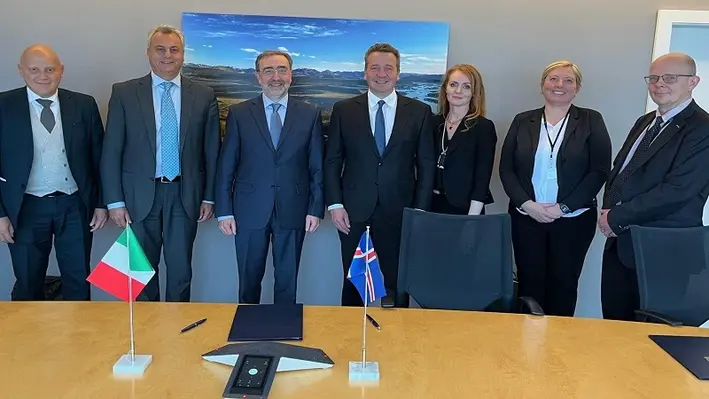

A cooperation agreement has been signed between Iceland and Italy regarding increased collaboration in the field of geothermal issues, both bilaterally and within the network of international organisations.

A cooperation agreement has been signed between Iceland and Italy regarding increased collaboration in the field of geothermal issues, both bilaterally and within the network of international organisations.

The agreement was signed by Guðlaug Þór Þórðarson, Minister of the Environment, Energy and Climate, and Stefano Nicoletti, Italy’s Ambassador to Iceland on behalf of Italy’s Minister of Energy.

Guðlaug Þór said at the signing that it was appropriate and timely for the two countries with the longest history and vast knowledge in the field of using geothermal energy within Europe to sign the agreement of cooperation.

Nicoletti said there are many similarities in the use of geothermal between the two countries: Italy’s first geothermal plant was built in 1905, garnering a breadth of experience and knowledge that the Italians bestowed onto other countries, including Iceland.

The agreement marks a new beginning of closer cooperation between the two countries, highlighting the importance of bringing experts and private sectors to the table.

At the October plenary session of the European Economic and Social Committee (EESC), the significant untapped potential of geothermal energy in Europe was explored with members emphasising the resource as an essential part in the forthcoming energy transition.

Members Zsolt Kükedi, and Thomas Kattnig led these discussions, underlining how the low-emissions resource could help the EU reduce its dependence on fossil fuels and support decarbonisation.

“Geothermal energy can make a useful contribution to achieving the EU’s 2050 climate neutrality goals,” said remarked Kükedi.

“Its potential is unexploited and the European Commission should move immediately to put together a comprehensive strategy to make use of the resources it provides,” added Kattnig.

While the potential is near limitless, the committee was quick to point out that investment in geothermal power plants will not work without financial help at national level. Specifically, government funding and incentives will be required in order to attract and de-risk initial investments. Moreover, changes in energy policy or financing can affect the attractiveness of geothermal projects.

To bring geothermal projects online, therefore, the committee stated that the risks need to be accurately identified and that this process should be carried out with local communities with a view to increasing public acceptance.

The statement from the committee concluded by noting that currently geothermal energy is still not very developed across Europe, and its real potential remains unassessed due to insufficient geothermal resource mapping. However, as explored by the International Renewable Energy Agency, geothermal energy, as a long-lasting and cost-effective source of renewable energy, has the potential to stabilise electricity grids and partly offset risks connected to the fast deployment of variable renewables.

Ahead of the publication of its 2024 Decommissioning Insight, Offshore Energies UK (OEUK) has stated that operators need to plug 200 abandoned North Sea oil and gas wells a year in order to stay on top of targets.

This will be among the findings of the new report which seeks to detail the challenge facing the region’s energy industry. Multiple changes to the tax regime are causing continuing economic and fiscal uncertainly which has damaged activity levels. These goalposts are set to remain on the move following the Chancellors Autumn statement later this month.

Despite these setbacks, OEUK has said that the report will also showcase the expertise and capabilities of the UK decommissioning industry which is helping to turn this challenge into a more manageable task.

It will reportedly outline that stable government policy can help support the decommissioning industry in the UK and prevent multi-million pound contracts go elsewhere. A successful approach here could secure the future of thousands of skilled UK jobs for decades to come.

OEUK decommissioning manager Ricky Thomson said: “Operators must continue to sanction projects and the supply chain must remain resilient and competitive. The energy transition has decommissioning at its heart and sharing cross-sector information and expertise is crucial. I have no doubt we can make this happen.”

The report will be released at OEUK’s 2024 Decommissioning Conference in St Andrews, Scotland from 18-20 November.

Ashtead Technology, a provider of subsea technology and services, has signed an agreement to acquire Seascan Limited and its subsidiaries (known as Seatronics), as well as its sister company J2 Subsea Limited, international subsea electronics and ROV tooling rental and services businesses, from Acteon Group.

The UK£63mn acquisition – which remains subject to closing conditions – represents the company’s ninth in seven years. By bringing Seatronics and J2 onboard, Ashtead Technology is aiming to expand its capabilities within the global survey & robotics rental market. Together, the two entities have operations in Singapore, UK, US and UAE, from which they provide subsea electronics and tooling products and services to the offshore energy market. This includes supporting the installation, inspection, maintenance & repair, and decommissioning of subsea oil & gas infrastructure, as well as renewable counterparts.

Brice Bouffard, Chief Executive Officer of Acteon, commented, “Upon closing, this transaction will be the next important step in focusing our service portfolio to achieve Acteon’s long-term strategic goals. Seatronics and J2 have been an integral part of our business for many years and I’m very pleased to see both teams moving together to such a dynamic new home at Ashtead Technology.

“Acteon is committed to optimising our portfolio to better serve our customers and stakeholders as we support the evolving offshore energy market.”

In acquiring the two companies Ashtead has gained access to a highly-skilled employee base of 110 and has added more than 7,000 proprietary assets, thus increasing its rental portfolio by 30%.

“Seatronics and J2 are businesses we have known for a long time,” remarked Allan Pirie, Chief Executive Officer of Ashtead Technology. “With our most recent acquisitions focussing on expanding our mechanical services capability, this latest acquisition strengthens our international footprint and capability within our survey & robotics market. We look forward to welcoming new colleagues to Ashtead Technology and increasing the wealth of in-house expertise as a larger Group, creating a world leading subsea survey and robotics team.”

BiSN, a global provider of wel-lok sealing solutions, has achieved a remarkable milestone having reached 500 commercials deployments of its bismuth-based sealing technology.

The technology has now been deployed in more than 20 countries across the world, including in each of the major energy-producing regions having ticked off sites in North America, South America, UK & Europe, Africa, the Middle East, Asia, and Australia.

This new achievement comes off the back of another record setting period for the company, taking less than a year to achieve the last 100 deployments.

“With another year-on-year record of deployments, major operators around the globe are realising how effective wel-lok technology is for applications throughout the life cycle of a well, in addition to new industries,” remarked Paul Carragher, Founder and CEO of BiSN. “This year we have seen the first deployments in gas storage and carbon capture projects signalling new areas of growth and interest in our technology.”

According to the company, its commercial success has been significantly aided by its efforts to expand across the globe. Such an initiative has seen it open new facilities in Australia and Brazil in the last 12 months, which now work in tandem with the existing sites in Norway and Scotland.

Arild Stein, Senior Vice President of Research and Development, explained, “It is critical for BiSN to be where our clients are. The expansion strategy allows for the development of successful and lasting partnerships with operators, and to expand into new industries where our engineered sealing technology can be transformative.”

Despite the success, BiSN has made it clear that it has no intention to rest on its laurels but continues to refine and develop its wel-lok technology. Well suied for well intervention completion and P&A applications, the company is also targeting more use in additional activities such as around gas storage, hydrogen and carbon capture.

“Bismuth as a sealing material is particularly suited for the highly corrosive environment in CCS and gas storage projects,” surmised Stein “Bismuth alloy is impermeable and non-corrosive. We are very excited for this new growth area for BiSN and how it will enable the success of large-scale storage projects.”

Page 48 of 118