Driven by a commitment to work in partnership with indigenous communities to advance the clean energy transition, the Government of Canada has announced it will supply over CAD$2mn in geothermal funding.

Driven by a commitment to work in partnership with indigenous communities to advance the clean energy transition, the Government of Canada has announced it will supply over CAD$2mn in geothermal funding.

Michael McLeod, Member of Parliament for Northwest Territories, announced the increased funding through the Clean Energy for Rural and Remote Communities (CERRC) programme to support ADK Holdings Ltd.’s geothermal energy development project.

Held by Acho Dene Koe First Nation’s economic development corporation, the project will engage the community of Echaot’l Koe (Fort Liard) and support Acho Dene Koe First Nation in determining the best strategies for developing the geothermal resources found in the First Nation’s traditional territory.

The initiative aims to identify specific opportunities for geothermal resource development. Supporting the potential transition of Indigenous communities to renewable energy will reduce diesel use for heating, create jobs and enable economic development in the Fort Liard region.

“In northern Canada and across the country, clean energy presents an enormous economic opportunity that will also help people save money on their energy bills while keeping the air clean. The ADK Geothermal Development project will make a real difference in the lives of people living in the Northwest Territories while also driving down climate-changing emissions. Indigenous communities deserve to have access to the resources they need to advance clean energy solutions in their home territories – and that is exactly what the Government of Canada is supporting through this project.” said Jonathan Wilkinson, Minister of Energy and Natural Resources.

Michael McLeod, Member of Parliament, Northwest Territories, said, “It’s great to see innovative projects come to life that will contribute to reducing diesel use and bringing health and economic benefits to communities. It’s another step in the Government of Canada’s commitment to supporting reconciliation, further recognising Indigenous communities’ expertise in addressing climate change and protecting the environment.”

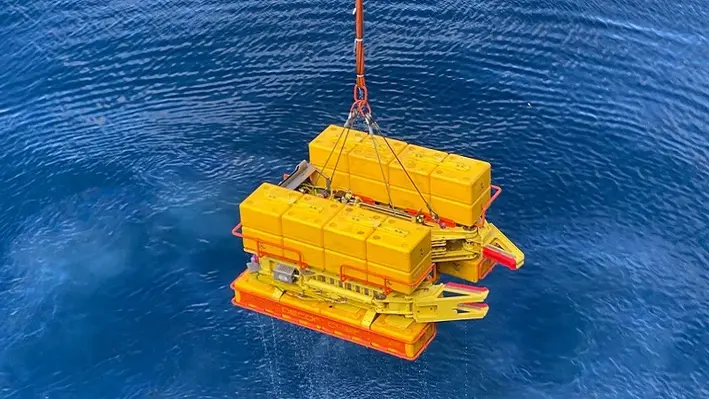

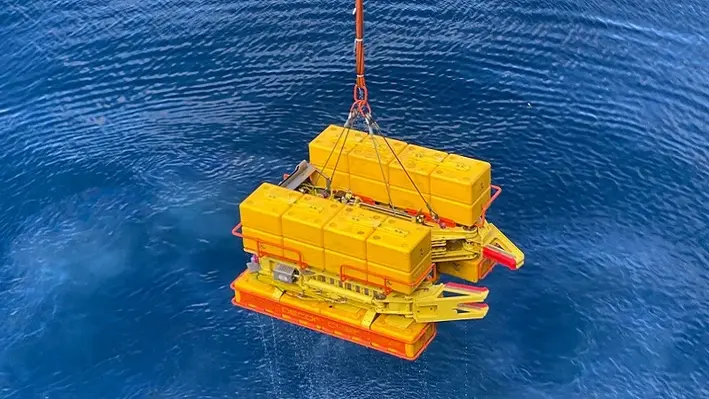

McDermott has been awarded a large engineering, procurement, removal and disposal (EPRD) contract by Santos for the decommissioning of the Harriet Alpha platform and associated infrastructure, located offshore Western Australia.

McDermott has been awarded a large engineering, procurement, removal and disposal (EPRD) contract by Santos for the decommissioning of the Harriet Alpha platform and associated infrastructure, located offshore Western Australia.

The contract follows the successful execution of the Campbell decommissioning project for Santos in Australia. Part of the Harriet Joint Venture (HJV) assets, the Harriet Alpha platform is one of the largest facilities slated for decommissioning.

McDermott will provide EPRD services, including engineering, procurement and fabrication of specialised equipment, as well as the removal and transportation of the platform structure to an onshore facility for dismantling and disposal. The contract scope also includes the removal, transportation and disposal of a flare tower, exploration well and subsea development system comprising of two subsea template wells.

"This is our largest decommissioning project to date, reflecting our continued commitment to delivering bespoke solutions for the timely, safe, and environmentally responsible removal of infrastructure at the end of its operational life cycle," said Mahesh Swaminathan, McDermott's Senior Vice President, Subsea and Floating Facilities. "McDermott's growing decommissioning portfolio in Australia also underscores the commitment we share to continue supporting circularity efforts in a lower carbon economy."

Project management and engineering will be executed by McDermott's team in Perth, Australia, with support from Batam, Indonesia and Kuala Lumpur, Malaysia.

Seequent, the Bentley subsurface company, has announced it has entered it a strategic partnership with the International Geothermal Association (IGA) to boost the role of geothermal power as a reliable renewable energy source.

Seequent, the Bentley subsurface company, has announced it has entered it a strategic partnership with the International Geothermal Association (IGA) to boost the role of geothermal power as a reliable renewable energy source.

Currently, Seequent software supports more than half of the world’s geothermal electricity production. The company has been one of the forefront leaders in bringing technical advancements to the industry, for example it has helped bring geothermal energy directly into homes in both Paris and Munich for heating.

The company’s latest innovations include adding new capabilities to its software to trace fluids more accurately, leading to more efficient resource management and more sustainable geothermal operations.

Graham Grant, Chief Executive Officer at Seequent, said, “Seequent is honoured to partner with the International Geothermal Association for the next two years. We will work with global partners to build clear and consistent messaging for the industry, positioning geothermal as a vital contributor to the energy transition.

“An emerging use case for geothermal is the rise of hyperscale AI-enabled data centres which represent a rapidly emerging new form of power demand requiring reliable baseload, or consistent, power supply. Geothermal is the cleanest form of renewable energy able to provide this baseload power and should play a key role in future data centre strategy globally.”

Seequent customer Fervo Energy is applying its technology to find new ways to produce geothermal energy for Google’s data centres in Nevada.

Marit Brommer, Chief Executive Officer of the IGA, commented, “We are excited to partner with Seequent, whose technological innovations in subsurface modelling bring clarity to geothermal development, empowering countries to leverage this clean energy resource and drive meaningful progress toward global net zero goals.

“We encourage other industry leaders and companies to join and amplify promotion of geothermal, as collaborative efforts are key to unlocking geothermal's full potential for a sustainable future."

Decom Engineering, a provider of green decommissioning solutions, has proved the capabilities of its ‘neutrally-buoyant’ Chopsaw on a North Sea decommissioning project.

Offshore contractor Allseas tasked Decom Engineering with designing a chopsaw specifically for the unique challenges posed by the conductor removal scope for the Brent Charlie platform decommissioning campaign. This required 40 well conductors to be cut at various water depths and needed the Chopsaw to be positioned and powered from a ROW subsea (with several cuts below the conductor guide-frame).

The tool, therefore, had to be neutrally buoyant in seawater, as well as being easily manoeuvrable with a single ROV. The Chopsaw width was also restricted to three metres due to the complexity of the conductor layout at the seabed.

"We successfully designed, manufactured, assembled, and tested the new Chopsaw within just six months, ready for offshore deployment from Allseas' heavy lift vessel Pioneering Spirit,” remarked Decom Engineering Managing Director, Sean Conway.

"The C1-32 Chopsaw has demonstrated its effectiveness in the field, completing numerous conductor cuts with an average cut time of approximately one hour. The tool's capability to perform multiple subsea cuts before needing to return to deck has saved both operational and vessel time.

"With the buoyancy functioning as designed and tested, the ROV was able to easily navigate the Chopsaw to and from each conductor, even at depths as shallow as 20 meters below sea level."

The C1-32 Chopsaw was engineered to cut conductors up to 32" outer diameter (OD), with a blade diameter of 2,100mm. Each of the 40 Brent Charlie conductors had an OD of 30 inches, consisting of both welded and Talon conductors, as well as some flexible risers.

With its neutrally buoyant design, the Chopsaw weighed approximately 6,700 kg in air but only about 50 kg in seawater, making it easily manoeuvrable by a ROV and allowing the tool to be flown into position and manoeuvred between conductors with precision.

To facilitate safe deployment and recovery, the Chopsaw was used in conjunction with a ‘deployment frame’ which allowed the tool to be quickly deployed to the correct subsea depth and safely through the splash zone. Once at the desired depth, the ROV connected the hot stabs, opened the clamps, and removed the tool from the frame.

“We have a strong relationship with Allseas, having worked for them on a previous North Sea platform removal project,” Conway concluded. “Completion of the Brent Charlie workscope further cements our credentials as a major provider of complex subsea conductor cutting services.

"Ongoing investment in R&D has been a critical factor in securing these projects and we will continue to invest and innovate so that our technologies remain as the market leader in cutting solutions."

THREE60 Energy, a leading independent energy service company, has received a multi-million-pound contract to deliver and support end-to-end decommissioning for multiple assets in the North Sea.

The contract was awarded by a major North Sea operator and covers both installation and pipeline operator scopes and initially includes three offshore assets with the option to include a further three over the six year period.

With its fully integrated services, THREE60 will deliver and support from the initial planning and regulatory compliance to project management, post cessation of production (CoP) operations, engineering preparation and infrastructure removal.

“We are proud to take on this significant multi-platform decommissioning scope, which reflects the growing demand for our fully integrated services,” remarked Walter Thain, CEO of THREE60. “We have co-created a specific service offering in conjunction with our customer which combines our unique capabilities to responsibly manage these projects, ensuring that we meet the highest environmental standards while delivering safe, efficient and cost-effective decommissioning.

Decommissioning is a key enabler of the energy transition within the UK and a huge export opportunity as other basins globally reach late life.”

Well-Safe Solutions, an international energy transition specialist, has secured two new decommissioning contracts in the UK Continental Shelf for Spirit Energy and an additional global operator.

The workscope comprises approximately 170 days with the Well-Safe Protector jack-up and Well-Safe Defender semi-submersible vessels being used. The two contracts are worth about US$25mn but both include options for a further combined duration of up to 140 days in 2025 and 2026 which could see the total rise by an additional US$50mn.

“Securing these contracts with an array of blue-chip operators – each with their own distinct requirements – demonstrates the flexibility of the Well-Safe Solutions offering in safely and efficiently liquidating ageing well stock,” remarked Chris Hay, Chief Commercial Officer at Well-Safe Solutions.

“Welcoming back Spirit Energy for another mutually-beneficial project is testament to the close cooperation and high performance we achieved together in our last campaign. As the North Sea continues to face political and economic headwinds, it is heartening to see operators securing valuable North Sea assets amidst a backdrop of availability concerns and units departing the region."

Hay continued, “Approximately 60% of the UKCS’ topside and subsea decommissioning is set to occur between 2026 and 2032, making this a key growth industry for the UK and Scotland alike. We are proud to be collaborating with our clients as the industry moves towards a low-carbon future for the North Sea.”

Spirit Energy have selected the Well-Safe Protector having successfully utilised the vessel to decommission 15 subsea wells in the Trees, Chestnut and Appleton fields last year. The new contract will result in the decommissioning of five wells on the York platform, located in Block 47/03a of the southern North Sea, over 97 days. It is planned to commence in Q2 2025, with two optional subsea wells (projected to take approximately 50 days) to be decommissioned in direct continuation or deferred until a later date.

“With York having reached the end of its economic life in the summer this year, Spirit Energy has partnered effectively with Well-Safe Solutions to ensure swift and responsible decommissioning of the asset,” commented Spirit Energy’s Head of Wells, Nicky Riley. “This builds on the success of our previous collaborations on the Chestnut, Trees and Appleton fields. Together, we look forward to continue setting the standard for efficient, responsible decommissioning of assets at the end of their productive lives.”

Elsewhere, the Well-Safe Defender will carry out its decommissioning campaign for an unnamed client. Beginning in March 2025, at least two subsea wells will be worked on across 75 days. This contract also contains two optional subsea well which may be added in direct continuation with the firm scope, plus another three to be executed in 2026.

Well engineering, subsurface and project management specialist, Elemental Energies, has announced a joint venture (JV) agreement with drilling and well services company, Archer, delivering integrated plugging and abandonment (P&A) services to global decommissioning projects.

Well engineering, subsurface and project management specialist, Elemental Energies, has announced a joint venture (JV) agreement with drilling and well services company, Archer, delivering integrated plugging and abandonment (P&A) services to global decommissioning projects.

The long-term partnership will give way to a focused P&A well engineering team that will focus on learning and best practices for P&A design and operations across all well types.

Archer's advanced well services technology and delivery capabilities, along with Elemental Energies' technical subsurface, well engineering and project management expertise, will empower the JV to offer end-to-end well abandonment solutions for platform as well as subsea decommissioning projects. This will deliver integrated planning and execution for large-scale campaigns, supporting operators to maximise efficiency, maintain oversight, and reduce cost. The JV will have the ability to support operators from the earliest project stages, leveraging the strengths of both companies to deliver the most suitable methods and technologies for each project.

Dag Skindlo, CEO of Archer, said, “We’re delighted to deepen our collaboration with Elemental Energies. We acknowledge that some customers are looking to approach P&A differently, and the critical importance of offering a flexible approach to P&A services. This joint venture will help deliver highly efficient well planning and design, with the ability to integrate best in class barrier philosophy and design with deep knowledge of most effective methods to plug and abandon various well types. Ultimately this will help drive down cost of permanent P&A for our clients around the world.”

Mike Adams, CEO of Elemental Energies, added, "There is a close strategic and cultural alignment between our companies, built around a successful track record of working together on joint projects. For P&A to work, it needs long term and highly efficient solutions. This JV will bring that longevity to clients, through a mutual commitment between two long term partners, and a joint venture team that is entirely dedicated to driving efficiency in P&A. This JV partnership is a natural evolution of our relationship with Archer, and we are already actively supporting operators on P&A projects in the North Sea."

As global offshore decommissioning spend is set to rise, the JV aims to offer cost reduction with innovation - essential for advancing decarbonisation. While recognising that P&A needs and preferences vary by region and client, Archer and Elemental Energies are dedicated to supporting these unique requirements, whether through integrated solutions or traditional contracting approaches. This JV represents a commitment to fostering a more efficient and integrated approach to decommissioning across the industry.

Ocean services provider DeepOcean has collaborated with well management and reservoir specialist EXCEED to supply vessel-based well plug and abandonment (P&A) services to the global decommissioning market.

Ocean services provider DeepOcean has collaborated with well management and reservoir specialist EXCEED to supply vessel-based well plug and abandonment (P&A) services to the global decommissioning market.

The partnership will offer operators turnkey P&A service for decommissioning projects under a single contract, with services including equipment, planning, execution and close-out, leaving a full audit trail to ensure optimum repurpose and re-use of retrieved assets.

“Compared to rig-based P&A, we believe this partnership can deliver significant time and cost benefits to operators’ decommissioning projects. Our complementary service offering has already proven that it can provide a comprehensive, best in class solution to well decommissioning. We are excited about further developing our relationship with EXCEED,” said Olaf A Hansen, Managing Director, DeepOcean Europe.

The partnership has recently-completed a multi-well, vessel-based P&A campaign on behalf of Serica Energy, saving significant time and costs as well as reduced CO2 emissions compared with rig-based P&A activity.

“By pairing DeepOcean’s subsea engineering competence and diverse global fleet of vessel with EXCEED’S specialist range of well decommissioning expertise, we can offer the international decommissioning sector a world-class vessel-based well P&A service. Forged in the North Sea, we look forward to continuing this relationship by commencing another multi-client, multi-well campaign later this year,” commented John Anderson, Commercial Director at EXCEED.

EXCEED’s dedicated vessel-based decommissioning team provides a fully compliant subsea wellhead removal service. Removing post-decommissioning liability, clients also benefit from cost efficiencies via a campaign approach.

“Our joint competence, technology and assets allow this partnership to deliver safe and efficient offshore operations to clients both here in the North Sea and further afield. We look forward to cooperating with our clients to develop multi-well campaigns that will deliver significant cost and time savings,” remarked Robin Mawhinney, Managing Director of DeepOcean’s UK operation.

Interoil Exploration and Production ASA, a Norwegian-based exploration and production company with a focus on Latin America, has announced that its Colombian subsidiary has carried out a downhole intervention to the Vikingo well.

Interoil Colombia Exploration and Production (ICEP) successfully completed the project which included the installation of a jet pump with a modified operational configuration. In doing so, it raised production levels from 105 barrels of oil per day (bopd) up to an impressive 400 (bopd). Production is expected to stabilise at around 200 bopd and the intervention has also improved operational efficiency by reducing lifting costs with the new jet pump configuration.

“This intervention reaffirms Interoil’s confidence in the potential of our assets,” remarked Leandro Carbone, CEO of Interoil. “We are committed to maximising the value of our fields while creating lasting benefits for the local communities, our employees, and shareholders.”

The success of the project has been described by the company as a commitment to optimising production efficiency, extending the economic life of its assets, achieving social and environmental objectives, and exploring opportunities to expand its asset portfolio.

Halliburton, a leading provider of products and services to the energy industry, has announced that it will open new facilities in Namibia to support the country’s in-country operations.

The facilities are located across the country, representing a combined footprint of approximately 20,000 sq m. The Windhoek office will handle support services; a Walvis Bay site will focus on cementing and drilling fluids services and warehousing; Swakopmund will house sperry drilling, well completions, testing & subsea, and wirelines & perforating services; while Lüderitz will support cementing and wirelines operations.

Up to 200 Namibians are expected to be employed at the facilities, helping to foster local expertise in relevant technologies and contribute to the country’s economy.

“These new facilities allow us to operate close to our customers, collaborate in real time, and deliver the advanced technologies and services that maximise asset value,” remarked Antoine Berel, Vice President, Halliburton Sub-Saharan Africa (South). “We are proud to support Namibia’s oil and gas industry, contribute to the economic success of the country, and create opportunities for local people.”

Halliburton has indicated that the announcement is a demonstration of the importance of the country’s growing oil and gas sector, with the new facilities dedicated to supporting this growth while strengthening the company’s regional presence.

Mermaid Subsea Services, a leading international subsea services company, has concluded a 21 well plug and abandonment campaign on behalf of a North Sea operator.

The multi-well campaign was executed using the Island Valiant vessel and was carried out on wells across the Northern and Central North Sea. As the largest contract Mermaid has completed to date, the project spanned two years and created six new jobs in the process.

“This has been a landmark project, not just for Mermaid but also for the wider North Sea decommissioning sector,” remarked Scott Cormack, Regional Director for Mermaid Subsea Services (UK).

“For a company that only entered the UK in 2020 to have carried out, what we understand to be, the largest vessel-based decommissioning campaign in the region ever is a huge achievement, testament to the Mermaid team and further proof that there is space in the market for a new player delivering innovative solutions.

“I would like to thank the whole Mermaid team for playing their part in the successful delivery of this project and to the client for putting their faith in our safe, efficient and cost-effective vessel-based well P&A offering.”

Mermaid is building its reputation in the decommissioning market at an incredibly opportune time given the wave of activity that will be required in the North Sea in the near future. According to the latest OEUK report, operators need to plug 200 abandoned North Sea wells a year in order to stay on top of targets.

Clean energy technology provider Exergy International has signed an agreement with Maren Maras Elektrik Uretim AS for the supply of two new geothermal power plants in Turkey.

Clean energy technology provider Exergy International has signed an agreement with Maren Maras Elektrik Uretim AS for the supply of two new geothermal power plants in Turkey.

Located in the Aydın region, the 33 MWe Emir GPP and the 13 MWe Nezihe Beren 2 GPP are expected to be commissioned by November 2025.

These two binary geothermal power plants will utilise Exergy's advanced ORC technology based on the Radial Outflow Turbine. The Emir GPP will feature a configuration with three turbines and two generators, while the Nezihe Beren 2 GPP will have one turbine and one generator. Both power plants will use air cooled condensers. The turbines, generators and other related equipment will be manufactured locally at Exergy’s subsidiary in İzmir. Exergy’s technology will harness Maren’s geothermal resources at maximum efficiency and deliver clean baseload power to the local grid.

Once in operation, the two power plants will enable saving approximately 134,000 tons of CO2 emission per year, avoiding an equivalent fossil fuel power generation.

Luca Pozzoni, General Manager of Exergy International, said, “This agreement marks another significant achievement for Exergy in Turkey, a region where we have 23 geothermal power plants operational in our portfolio, with several more nearing completion. We are thrilled to expand our collaboration with Maren and further contribute to Turkey's sustainable energy goals.”

Erdogan Arpaci, General Manager of Exergy Turkey, who played a major role in securing a contract, said, “I am highly satisfied with the signing of this new contract with one of our long-standing clients, which demonstrates the trust and reliability Exergy has established in Turkey. We have worked closely with Maren to achieve this outcome, and at Exergy we are very eager to begin the execution phase for these significant projects, which will bring an additional 46 MWe of capacity to the Turkish geothermal market.”

Page 47 of 118