Two exploration wells on Block 2914 that fall under the purview of Petroleum Exploration License (PEL) 85 offshore Namibia have now been delivered by Rhino Resources and Halliburton.

Two exploration wells on Block 2914 that fall under the purview of Petroleum Exploration License (PEL) 85 offshore Namibia have now been delivered by Rhino Resources and Halliburton.

Orchestrated from Halliburton's new operational bases in Walvis Bay, Swakopmund and Luderitz, the operation was made possible with world-class technology and local collaboration.

Antoine Berel, vice president, Halliburton sub-Saharan Africa, said, "This success is an example of what’s possible when world-class technology, local collaboration, and a shared long-term vision come together. Our newly established infrastructure across Namibia enabled this discovery, which will help unlock Namibia’s energy potential and build the capacity to support the country’s future as an energy hub in Africa."

As Namibia attracts international interest in its offshore basins, the success of this campaign sets a new standard for energy development in the region.

“At the onset of the drilling campaign, we communicated to our partners that Rhino’s exploration efforts in Namibia should simultaneously prove geological potential and deliver long-term benefits for the country. The discoveries on Block 2914 are a promising start to this journey, which will contribute to the foundation we are laying for Namibia’s burgeoning oil and gas industry — one built on knowledge and skills transfer, local capacity building and the upliftment of young Namibians,” said Travis Smithard, CEO of Rhino Resources.

The Rhino-Halliburton Technology Centre at the University of Namibia (UNAM) Southern Campus came into being in October last year to advance geoscience education and research nationwide.

Driven by a framework agreement signed with Woodside Energy (Senegal) BV, ocean services provider DeepOcean will be supervising subsea inspection, maintenance, and repair (IMR) services for the Sangomar field offshore Senegal, West Africa

Driven by a framework agreement signed with Woodside Energy (Senegal) BV, ocean services provider DeepOcean will be supervising subsea inspection, maintenance, and repair (IMR) services for the Sangomar field offshore Senegal, West Africa

“We have extensive experience from similar IMR operations offshore West Africa, but this is our first project offshore Senegal and with Woodside. We look forward to being Woodside’s subsea IMR supplier here over the coming years and to demonstrate our competence and extensive pool of specialist subsea tools and underwater assets,” said Øyvind Mikaelsen, CEO of DeepOcean.

Driven by 24 subsea wells and associated subsea systems that comprises of wellheads and subsea trees, in-line tees, manifolds, flowlines and risers, flowline-end terminals, and umbilicals, the project demands long-drawn services from DeepOcean. Its scope of work will include project management, engineering, and execution of subsea services such as inspection, survey, intervention, and maintenance, as well as additional services such as underwater inspection of FPSO (UWILD) and standalone ROV operations. The Norway-based provider will be supported by a Senegalese service company called Teranga Oil and Gas Services SARL.

“Sangomar is a large and impressive field development, with extensive subsea infrastructure. Our aim is always to inspect and maintain it as effectively as possible, thereby keeping costs and operational disturbances to a minimum for Woodside,” said Mikaelsen.

A project of strategic importance, the Sangomar oil field is supported by investments from the Africa Finance Corporation.

It is not long now until the doors are set to open once again on West Africa’s leading well intervention conference, offering exclusive access to operator best practices, innovative technologies, exploration strategies and more.

It is not long now until the doors are set to open once again on West Africa’s leading well intervention conference, offering exclusive access to operator best practices, innovative technologies, exploration strategies and more.

This year’s instalment of the OWI WA 2024 conference will return on 28-29 May in the brand new location of Lagos, Nigeria, in the Sheraton Lagos Hotel. With the focus this year predominantly honing in on the combination of innovative well intervention technologies with strategic planning practices in order to optimise the performance of the ageing assets within the region, this event once again unties West Africa’s offshore community as they come together in a series of unique networking opportunities.

Featuring more than 30 expert speakers, 10 technology demos, and two technical breakout workshops, the conference promises to be an insightful and lucrative experience for all attendees. More than 200 decision makers are expected to attend, partaking in six dedicated networking events and engaging in a series of sessions covering key topics such as regional analysis, mature and ageing assets, strategic planning and management, and production optimisation.

This year, OWI WA 2024 has partnered with Women in Energy Network, an association dedicated to providing a platform for women who work across the entire energy industry chain in order to build confidence and enhance their professional progress.

For more information regarding OWI WA 2024, the full brochure can be downloaded here. For any additional enquiries please contact Jack Heffernan at

Silverwell Technology, a global developer of digitally intelligent gas lift production optimisation systems and services, has celebrated a step forward in permeating the African market after securing a contract from a major operator offshore Nigeria.

Silverwell Technology, a global developer of digitally intelligent gas lift production optimisation systems and services, has celebrated a step forward in permeating the African market after securing a contract from a major operator offshore Nigeria.

The contract will see Silverwell bring its digitally intelligent artificial lift (DIAL) gas lift production optimisation system to the country. This system integrated in-well monitoring and control of gas-lift well performance with surface analytics and automation to continually optimise production, remotely and without well intervention. This is expected to bring significant benefits to the operator with DIAL reportedly enhancing the net present value (NPV) of each well by up to US$50mn over their lifetime.

According to Silverwell, DIAL is used by operators around the world for onshore and offshore applications. Currently, it is being installed in shallow water oil wells in the Gulf of Guinea and is operated from an unmanned production platform.

“The key driver for the operator was the OPEX saving related to well intervention and the associated logistical cost. The DIAL system also enables the ability to ensure continuous and remote well monitoring and production optimization,” remarked Stephen Faux, General Manager of Operations for the Eastern Hemisphere. “Conventional gas lift systems would require identification of the optimisation issue, data analysis, vessel mobilisation, and ceasing production to perform well intervention to change the gas lift valve(s).

“This process, from start to finish, can take several months and incurs significant financial impact. With DIAL, all data is delivered in real time to the engineer’s desk allowing them to perform analysis, identify uplift opportunities, and make changes to the configuration without visiting the platform. Petroleum engineers can improve production uplift in minutes.”

Silverwell noted that with the system cutting well lifecycle costs by eliminating well intervention, avoiding deferred production and substantially reducing logistics expenditure, it could bring significant benefits to West Africa. And, in doing so, the company expects this contract to lead to further adoption of DIAL in West Africa and across the continent.

Darrell Johnson, Silverwell CEO, said, “Entering the African market and successfully delivering our first project there is a major milestone for Silverwell, as recognition of DIAL’s benefits to operators continues to gather momentum globally.

“Opening up this latest frontier for our industry-leading technology provides a platform for further expansion in West Africa and the wider continent. We see significant potential for DIAL in Africa and elsewhere. From North America to the Middle East, Asia Pacific, and now Africa, demand for a proven method to reduce operational expenditure while maximizing asset productivity is growing. We’re excited for the next steps in DIAL’s journey toward adoption by operators in every region.”

The Offshore Well Intervention West Africa Webcast from Offshore Network shines the spotlight on a market with significant potential and unpicks the challenges holding it back.

The Offshore Well Intervention West Africa Webcast from Offshore Network shines the spotlight on a market with significant potential and unpicks the challenges holding it back.

Moderator Robert Daniels, Editor at Offshore Network, was joined by an expert panel of guests who joined the discussion from a myriad of locations across the region. This list of panellists willing to share their knowledge and experience included Obasi Isdore Chigozie, Well Intervention Specialist at Sterling Oil Exploration & Energy Production Co. Ltd; Albert Amewolah, Subsea Operations Engineering at Tullow Oil; and Isioma Agbadiba, Subsea Production Supervisor at Eni Nigeria.

At a time when the global oil and gas industry is grappling with the energy transition, the need to maintain production targets has remained imperative – despite COP28 calling for an eventual transition away from fossil fuels – in line with growing power demand. In West Africa, companies are now looking to do their part for the environment while also contending with the wider issues around electrification and the role fossil fuels will continue to play in the economic development of its nations.

It is against this backdrop that the panellists spoke on the role of offshore well intervention within this evolving environment – a method often depicted as the answer to enhancing production rates without incurring the sustainability hit of drilling new wells. Additionally, the market and its servers are receiving heightened attention due to the growing need for plug and abandonment activities as the world’s (and region’s) offshore wellstock increases in average age with every passing year.

Together, the industry experts explored such topics and answered where West Africa fits into this global trend? What are the factors unique to the region and that are shaping its future? And what must be done for more well intervention campaigns to be conducted there?

Click here to discover the full, free-to-view webcast.

And for any questions surrounding the topics covered or the upcoming OWI WA conference (running from 28-29 May in Lagos, Nigeria), reach out to:

Jack Heffernan - Project Manager

e:

t: +44 (0)20 3038 6926

Helix Energy Solutions Group has been awarded a deepwater well intervention contract by Esso Exploration and Production Nigeria (Esso).

Helix Energy Solutions Group has been awarded a deepwater well intervention contract by Esso Exploration and Production Nigeria (Esso).

The contract is for work offshore Nigeria in the Erha and Usan fields wherein Helix will provide its Q4000 well intervention vessel to cover fully integrated well intervention services from production enhancement to plug and abandonment.

Scotty Sparks, Helix’s Executive Vice President and Chief Operating Officer, commented, “We are pleased to announce this contract for the Q4000. We are eager to strengthen our relationship with Esso and to further establish our presence as the leader for well intervention services in West Africa.”

The project is expected to commence in September 2024, with the vessel expected to stay in Nigeria until 2025.

40 years since the launch of its first subsea test tree system, Expro, a leading energy services provider, has remained at the forefront of subsea landing string technology.

40 years since the launch of its first subsea test tree system, Expro, a leading energy services provider, has remained at the forefront of subsea landing string technology.

The first 10ksi subsea test tree assembly (SSTTA) was created for an exploration and appraisal well project for Hamilton Brothers in the North Sea in 1983. Several of its SSTTA technologies have been on a first to market basis and have helped to progress the sector’s capabilities over the years. Expro has now undertaken more than 3,000 subsea deployments in exploration and appraisal, completion, and intervention applications, and remains a global leader in large-bore SSTTA solutions.

Other subsea well access major milestones Expro has achieved over the years have included the introduction of the first 7 3/8” 10ksi horizontal tree completion landing string system; the launch of the industry’s first 6 ¾” high debris SSTTA system; the release of the first large bore 6 ¾” 10 ksi subsea electro hydraulic control system; unveiling the first 6 ¾” 10ksi dual bore and mono-bore subsea test tree offshore; revealing the first 15ksi 6 1/8” horizontal tree SSTTA and electro-hydraulic control system; and the development of 7 3/8” 10ksi high debris SSTTA.

The evolution of subsea test tree assemblies has allowed the company to expand into the open water well intervention market through the introduction of both riser-based and riser-less well intervention solutions. Such success and dedication to subsea well access application even earned the company the accolade of Intervention Champion of the Year at the recently-held OWI Global Awards 2023.

At the company is showing no signs of building on its successful history. In a bid to continue this history, it has sought to boost its subsea capabilities by acquiring PRT Offshore, the only company to offer a complete Hook-to-Hanger solution enabling comprehensive well completions, interventions, and decommissioning services from surface to subsea. The acquisition enables Expro to expand its portfolio of cost-effective, technology-enabled services in the North and Latin America region and accelerate the growth of PRT Offshore’s surface equipment offering into the Europe and sub-Saharan Africa and Asia Pacific regions.

“At Expro, we’ve been first to the market with many of our subsea test tree assembly products and, as future technical challenges arise, we believe that with our customer-bespoke solution philosophy, we’ll continue to be at the top of the subsea test tree application,” remarked Graham Cheyne, Expro’s Vice President of Subsea Well Access.

“From starting in 1983 supporting operators in the Norwegian North Sea, we’ve become a global player in all parts of the world, supplying fully integrated technologies and services from surface to seabed – the hook to hangar concept. The subsea test tree market operates in the full well lifecycle – from exploration and appraisal through to abandonment and decommissioning while continually looking to improve our delivery and operational performance, and service quality to our global client base.

"Whilst leading in this market for over 40 years with many first to market technologies we are committed to delivering the new technology requirements of tomorrow in order to meet our customer needs whilst maintaining the high level of service quality and customer care.”

Global leader in oil and gas well integrity and production optimisation, Coretrax, has appointed Colin Graham as the company’s first Sales and Operations Manager for Africa as it plans for future expansion.

Graham joins the business with more than four decades of experience under his belt, including previous works completed in the North Sea, Middle East and Africa. In his previous role as Business Development Manager for the Middle East and Caspian at TAM international, he was responsible for driving new and existing business across the region, with a particular focus on well intervention, completions and drilling.

His new role will see him play a key role in strengthening Coretrax’ presence in Africa by building on the company’s existing relationships within the region. His appointment follows a number of substantial project wins for Coretrax in western and southern Africa.

Graham said, “I’m very proud to be joining the team at Coretrax to enhance existing operations and actively expand the business’ footprint across Africa. The region is so vast, and no two fields are the same, so the breadth of Coretrax’s technology allows us to support every stage of the well lifecycle for both onshore and offshore projects. I am eager to share the opportunities that these technologies present to the energy industry in Africa and with the companies operating in the region.”

John Fraser, CEO at Coretax, commented, “As we continue to grow our business on a global scale, Colin will be a huge asset to the Coretrax team. His operational experience and expertise in well intervention and integrity will be extremely valuable to our existing customers in Africa and optimise well performance, and actively address operator challenges.

“Africa has been a key focus area for the business, and we have significant experience supporting major projects in Ghana, the Ivory Coast, Mauritania, Tanzania and Angola with a strong aim to increase our operations. We look forward to extending the delivery of our technology and high quality customer service to enable valuable time and cost savings to our customers.”

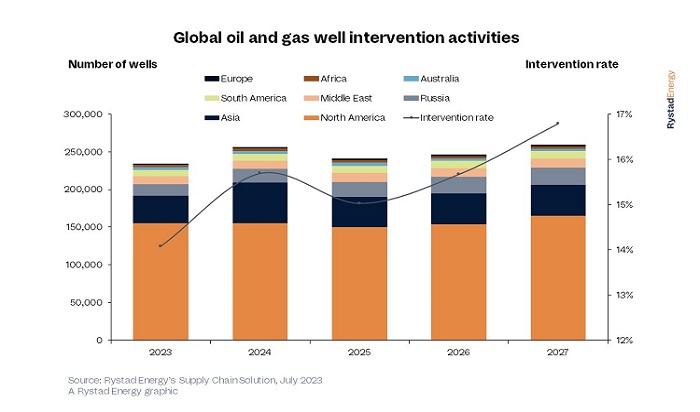

According to Rystad Energy, the well intervention market is receiving a healthy boost as oil and gas companies look to increase their output.

The research and business intelligence company claimed that spending on interventions is projected to jump by almost 20% in 2023 to total US$58bn and this is just the start of a surge in the coming years.

The intervention rate is forecast to reach 17% in 2027 which would total about 260,000 wells globally.

Breaking this down, Rystad showed that more than US$11bn of the total expenditure will be directed to the wireline & perforating segment, while together, intervention units and oilfield chemicals sectors will represent 35%. In addition, the sum of the investments in coiled tubing, water management, and intervention tools is expected to close 2023 surpassing US$20bn.

Regionally, onshore interventions in Asia, South America, and Africa will lead the 9% growth in activities related to intervention during 2024, a year expected to be significant for the well intervention market. North America is projected to account for 64% of the total oil and gas wells ready for intervention in 2027, whereas Asia and South America will reach their maximum in 2026, with respectively 41,413 and 9,703 wells.

Jenny Feng, Supply Chain Analyst at Rystad Energy, explained, “As oil demand picks up in the second half of this year, operators will look to ramp up production from existing fields, and well interventions will be a vital piece of the puzzle. As a quick, efficient, and cost-effective method of maximizing existing resources, interventions are going to be a hot topic in the years to come.”

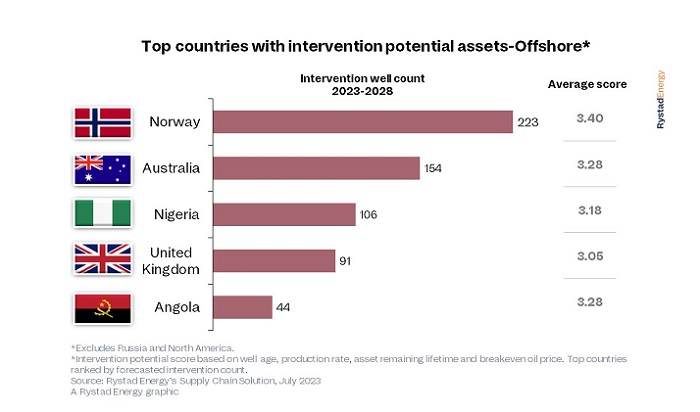

In terms of offshore markets, 618 assets are highly attractive for intervention. Norway and Australia stand out with 36% and 25%, respectively, while the UK has 91 wells likely to be involved in intervention activities.

Oilenco Ltd has announced the appointment of David Nicoll who has joined the company as Business Development Manager for sub-Saharan Africa (SSA) in order to reinforce Oilenco’s focus on overseas well intervention markets.

Oilenco Ltd has announced the appointment of David Nicoll who has joined the company as Business Development Manager for sub-Saharan Africa (SSA) in order to reinforce Oilenco’s focus on overseas well intervention markets.

David, known to his network as Davie, will bring 25 years’ worth of experience to the company, with more than 16 years working across a variety of downhole intervention roles. He commented, “I’ve spent the last nine years travelling all over SSA learning about this market. As a leader in well intervention and abandonment within the UK, Oilenco are uniquely positioned to deliver best-in-class solutions that are ideally suited to the SSA market.”

In his role, Davie will be responsible for bringing Oilenco products and solutions to this evolving market, developing the Oilenco brand in the sub-Saharan region and establishing the company as the provider of choice for downhole tool solutions.

Davis will make his debut as Business Development Manager next week at the Offshore Network Well Intervention West Africa Conference on 20 and 21 June.

“I am delighted to be joining such an innovative team, at an exciting time for the company. With a real focus on growth not only in Africa, but in other regions, I look forward to bringing Oilenco’s reputation as a first-class downhole tooling provider to the market,” Davie said.

Energy services provider, Expro, has announced a five-year well intervention and integrity contract with TotalEnergies EP Uganda for the multi-well Tilenga project.

Energy services provider, Expro, has announced a five-year well intervention and integrity contract with TotalEnergies EP Uganda for the multi-well Tilenga project.

Expro’s ability to provide an innovative environmental solution was a key component for securing the contract worth more than US$30mn for slickline services. The solution supported the client’s carbon reduction objectives, as well as coincided with Expro’s commitment to national recruitment in line with a local development plan set up in collaboration with TotalEnergies and the Petroleum Authority of Uganda (PAU).

Work will begin in Q2 2023, with Expro initially supporting drilling activity followed by production optimisation, integrity and well workover support. The company has designed four well intervention units to deliver a single operational solution for slickline and braided line in a cased hole environment across the life of the well. The solution is designed to reduce equipment footprint and equivalent CO2 emissions, while delivering improved efficiency.

Iain Farley, Expro’s Regional Vice President for Europe and sub-Saharan Africa, said, “We are delighted to further develop our relationship with TotalEnergies through work on this key project, which reinforces Expro’s ability to partner in frontier field developments in support of energy security.

“Expro’s solution was designed and engineered with the specific needs of this project in mind, taking into account the environmental sensitivities of the location and the need to support the project’s overall environmental and social objectives. It builds on our current operations in East Africa and on many years of successful delivery on key projects in locations such as Algeria, Saudi Arabia, Mozambique and Egypt.”

BiSN, a global provider of Wel-lok sealing solutions, has achieved a remarkable milestone by reaching 400 commercial deployments of its Wel-lok technology, a patented technology enabling bismuth-based seals that are more reliable, durable, and cost-effective than traditional sealing methods.

It was only 13 months ago that BiSN reached 300 commercial deployments of Wel-lok technology. According to the company, the rise in deployment since then has been part of a wider, exponential demand growth over the past three years among operators for both plug and abandonment and well intervention. As a result, 2022 represented the busiest commercial year for BiSN and Q1 of 2023 has already been record setting.

BiSN has now deployed into major areas such as North America, Europe, Africa, the Middle East, Asia, and Australia. Within these regions, the company has run commercial deployments in 17 countries, most recently in Mozambique. Building on this success, BiSN now harbours plans to continue its global reach while continuing to foster productive and collaborative relations with global operators.

Currently, Wel-lok technology has been commercially applied to 11 different applications, including water shut off, cement repair, packer repair, and plug and abandonment. The company has stated that it will continue to refine and develop Wel-lok technology for a variety of well intervention, completion, and plug and abandonment applications.

Paul Carragher, CEO and Founder of BiSN, remarked, “We are thrilled to have achieved this important milestone of 400 commercial deployments. It is a testament to the value and effectiveness of Wel-lok technology and could not be achieved without the commitment of the full BiSN team. As demand continues to rise across all active regions, BiSN is expanding to meet that demand by opening facilities now in Australia and Brazil.”

Page 1 of 4