Pentarch Offshore Solutions, which provides marine logistics for offshore energy, heavy industry and decommissioning, is bolstering its bunkering capabilities.

Pentarch Offshore Solutions, which provides marine logistics for offshore energy, heavy industry and decommissioning, is bolstering its bunkering capabilities.

The company, a partner of the Centre of Decommissioning Australia (Coda), has signed a Memorandum of Understanding (MoU) with Integr8 Fuels to help meet growing Australian maritime refuelling needs at the Port of Edrom, Eden, New South Wales (NSW).

The agreement marks a key step in enhancing bunker fuel provision and operational support for expanding offshore energy, maritime, and defence activities in the region, according to William Kanavan, Managing Director of Pentarch Offshore Solutions.

“The signing of this MOU marks a significant milestone for Pentarch Offshore Solutions, firmly positioning our region on the global map as a growing hub for marine and offshore energy operations,” said Kanavan.

“Our developing partnership with a world-leading fuel provider like Integr8 Fuels demonstrates the scale of opportunity this regional port can deliver – for industry, and for Australia.”

The collaboration means the two partners, alongside regional stakeholders, will be contributing to the ongoing transformation of the Port of Edrom into a multi-functional marine and energy terminal.

The MOU builds on existing fuel supply commitments to a range of Australian and international marine contractors, including allied defence and naval refuelling operations.

“This partnership strengthens Integr8 Fuels’ presence in the Australian market, demonstrating our commitment to supporting critical marine and offshore operations,” said Christopher Seidel, Integr8 Fuels’ Business Manager.

“We look forward to collaborating with Pentarch Offshore Solutions and contributing to the growth and capability of the Port of Edrom and the Far South Coast community of New South Wales.”

The Australian Government Department of Industry, Science and Resources has published a consultation paper seeking feedback on reforms to decommissioning and financial assurance arrangements for the offshore oil and gas industry

The Australian Government Department of Industry, Science and Resources has published a consultation paper seeking feedback on reforms to decommissioning and financial assurance arrangements for the offshore oil and gas industry

Australia has up to US$60bn of offshore oil and gas decommissioning activities expected to occur over the next 30 to 50 years. Previous reforms have strengthened the offshore petroleum decommissioning regulatory framework. However, there are aspects that may require further reform to ensure industry is undertaking timely, safe and environmentally responsible decommissioning.

While the paper focuses mainly on oil and gas projects, it is also seeking input on the regulatory regime for decommissioning carbon capture and storage projects.

The proposed reforms aim to strengthen the decommissioning framework so industry:

• decommissions in a timely, safe and environmentally responsible way

• remains responsible for the risks and liabilities of offshore activities.

The consultation paper invites feedback on:

• the existing decommissioning framework in Australia

• lessons from international and onshore frameworks

• proposed areas for reform, including:

• decommissioning planning

• financial planning and assurance

• decommissioning and financial capacity risk assessments

• compliance and enforcement tools

• title surrender.

Feedback to the consultation paper is now open and will close on 13 January 2026. Feedback to this consultation will help the government develop these reforms and may also inform related activities.

There will be future public consultation informed by the responses to this paper, and the government will also consult on any legislative changes.

To read the consultation paper and provide feedback please visit www.consult.industry.gov.au.

Kimberley Marine Support Base (KMSB), a new purpose-built floating wharf in Broome, is looking to aid Western Australia’s (WA) oil and gas decommissioning efforts.

Kimberley Marine Support Base (KMSB), a new purpose-built floating wharf in Broome, is looking to aid Western Australia’s (WA) oil and gas decommissioning efforts.

The facility enables 24/7 operations independent of tides, a significant advantage in northern Australia, where tidal windows can create unpredictable delays and added costs.

KMSB marks another significant private investment in the state’s critical port infrastructure steered by Founder and Managing Director Andrew Natta — building on the successful model he established at the existing Onslow Marine Support Base (OMSB) in the Pilbara region of WA.

OMSB is an industry partner of the Centre of Decommissioning Australia (CODA), which highlighted the new project in its recent newsletter.

The new facility boasts a 300-metre berth and heavy-lift capability, and is designed to accommodate breakbulk and project cargo up to 600 tonnes, as well as roll-on roll-off (RoRo) equipment for the resource and defence sectors, and containerised freight, critical minerals, renewable energy infrastructure and decommissioning equipment.

The KMSB facility is designed to operate as a complementary terminal to the Port of Broome, which has served as the region’s main maritime logistics hub for more than 80 years.

Australia’s northwest has long grappled with infrastructure bottlenecks, such as vessels waiting on tides, delayed project cargo, and escalating costs from demurrage and congestion —operational constraints that all carry economic implications.

Broome, in particular, has been a critical hub supporting offshore oil and gas, community resupply, defence readiness and emerging renewable energy projects.

Yet, despite this strategic importance, limitations in port infrastructure have repeatedly challenged shipping schedules and project timelines.

“Our floating wharf at KMSB is designed for ‘non-tide dependant’ operations – removing the bottlenecks that have long-plagued supply chains within the region,” said Natta.

He said KMSB will boost productivity, safety and reduce costs for established Kimberley businesses in the agricultural and resources sectors, while also allowing cruise ships to come alongside for passengers to visit Broome without the need to wait for appropriate tides.

Crucially, the facility will also enable the growth of new sectors – such as proposed critical minerals and renewable energy developments – by providing the necessary infrastructure for handling specialised cargo like wind turbines, solar systems and commercial battery imports.

“Our 24/7 operational capability, combined with our flexible, client-focused approach, means businesses can now plan with confidence, operate cost effectively and significantly improve their supply chain efficiency.”

Improved efficiencies and experience may help to ease the cost of decommissioning Australia’s ageing offshore oil and gas infrastructure, a new report suggests.

The Department of Industry, Science, and Resources recently commissioned consultancy, Xodus Group, to explore the nation's overall decommissioning liabilities.

The report — Australian Offshore Oil & Gas Decommissioning Liability Estimate 2025 — estimates the industry will spend A$43.6bn through to 2070, rising to A$66.8bn when factoring in inflation.

This includes all fixed and floating facilities, rigid and flexible lines, subsea infrastructure and wells.

It added that around 55% of the decommissioning spend will occur before 2040, with 61% of the liability focused on Western Australia, 23% in Victoria and 16% off the Northern Territory.

The decommissioning of wells represents the single largest portion of the decommissioning liability, with an estimated cost of A$17.9bn, the report added, followed closely by pipeline decommissioning, with an estimated liability of A$17.85bn.

The report noted that decommissioning practice and technology have already improved since 2020, a trend that could continue, yielding benefits along the way.

There is an opportunity for further improvements in efficiency, it added, through operator cooperation when decommissioning, in addition to further technological advances and industry investment in onshore disposal and recycling.

“Possible cost reductions primarily relate to the opportunity for efficiencies, technological development and future infrastructure investments,” it stated.

These include:

Single and multiple operator campaigns to distribute the costs of equipment and vessels across multiple assets.

A dedicated disposal yard for deconstruction and cleaning.

Domestic steel recycling to reduce the amount of steel which is exported for recycling.

Aligning decommissioning campaigns with offshore wind construction to reduce vessel mobilisation rates.

Implementing new technologies and/or engineering practices to ensure that the most appropriate and efficient methodology, vessels, and equipment are used to perform decommissioning activities. Here, it cites the example of changes in the commonly accepted removal methodologies for certain infrastructure types.For example, reverse s-lay was previously considered the only methodology for recovery of pipelines — however, cut and lift now remains the most accepted method for pipeline removal.

Other findings in the report highlight the sheer magnitude of the task now facing contractors and operators across the board, with at least 2.7 million tonnes of infrastructure set to be removed, including a large portion of steel, with huge potential for local recycling.

The Institute for Energy Economics and Financial Analysis (IEEFA) has published its responses to the Victorian Legislative Council Environment and Planning Committee and its inquiry into the decommissioning of oil and gas infrastructure.

The Institute for Energy Economics and Financial Analysis (IEEFA) has published its responses to the Victorian Legislative Council Environment and Planning Committee and its inquiry into the decommissioning of oil and gas infrastructure.

IEEFA is an independent energy finance think tank that examines issues related to energy markets, trends and policies.

The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.

In a statement published on its website, IEEFA noted that Victoria is in a “unique position” to establish a decommissioning industry, given the state has some of the oldest oil and gas extraction infrastructure in Australia “and therefore has a greater proportion of its property and equipment ready for decommissioning.”

It also called on the Victorian government to ensure decommissioning work is undertaken in an orderly and transparent manner.

“This will help to keep cost downs and provide opportunities for the state’s oil and gas workforce and contractors to move into the next phase of oil and gas lifecycle, decommissioning.

Victoria’s decommissioning asset profile includes 22 platforms, over 2,000 km of pipelines and umbilicals, as well as around 460 wells to be plugged and abandoned, according to the National Offshore Petroleum Safety and Environmental Management Authority (Nopsema).

The infrastructure earmarked for decommissioning offshore Victoria is owned and operated by a handful of companies.

Historically, the largest oil and gas producing complex is the Gippsland Basin Joint Venture (GBJV), also known as the Bass Strait project. This year, Woodside took over as operator of the venture from ExxonMobil, which had operated the project since 1969.

Other companies with decommissioning liabilities offshore Victoria include Beach Energy and Amplitude Energy.

In an article on the ASCO website, John Davidson, Operations Manager – Environmental Services, ASCO discusses how the UK’s experience of building a system to deal with Naturally Occurring Radioactive Material (NORM) can benefit Australia.

In an article on the ASCO website, John Davidson, Operations Manager – Environmental Services, ASCO discusses how the UK’s experience of building a system to deal with Naturally Occurring Radioactive Material (NORM) can benefit Australia.

Davidson points out that as Australia faces a massive decommissioning wave, dealing with NORM will be one of the challenges it will need to address. This residue, which builds up in pipework, tanks and separators over years of oil and gas production, carries radiological risks and requires expert handling, treatment and disposal.

In the UK, the oil and gas sector has been dealing with NORM for decades, although the early years were challenging, he notes. “But through trial and error, the UK built a system that now works,” he says.

“NORM processing was centralised. Long-distance, highly regulated transport systems were developed. Experienced specialists were embedded into local teams. Most importantly, collaboration gradually replaced competition. Today, the UK has one of the most mature decommissioning supply chains in the world.”

Australia has a chance to avoiding years of inefficiency and unnecessary cost by learning lessons from the UK experience, he suggests. ASCO, which has built and operated one of the world’s most advanced NORM facilities in the North Sea, can now transfer that knowledge directly into Australia.

He goes on to suggest that a logistics strategy to deal with the long distances of offshore assets from disposal sites needs to be put in place; the expertise of experienced specialists should be leveraged at an early stage; and collaboration between companies should be encouraged, with shared infrastructure, expertise and logistics creating efficiencies and helping to address gaps in local capabilities.

On the questions of regulation, he notes that UK authorities engaged closely with industry to co-develop standards and best practice. “The UK’s lesson is clear: proactive engagement builds trust, accelerates approvals and avoids gridlock.”

“If Australia can absorb the lessons above now, rather than repeat the UK’s early missteps, it has the opportunity to build one of the world’s most resilient and effective decommissioning supply chains,” he concludes.

The closing date is fast approaching for the submission of bids to deliver Phase 2 of Australia's Northern Endeavour decommissioning programme.

The closing date is fast approaching for the submission of bids to deliver Phase 2 of Australia's Northern Endeavour decommissioning programme.

Lead contractor bids must be submitted by 1 December 2025 on the AusTender platform. The Phase 2 RFT document provides essential guidance for preparing a compliant and completed tender response.

The Northern Endeavour is a 274 m long floating production, storage and offloading (FPSO) facility. It was permanently moored between the Laminaria and Corallina oil fields, about 550 km northwest of Darwin in the Timor Sea. Following liquidation of the former private owner, the Commonwealth now owns the Northern Endeavour FPSO. The Australian government is now decommissioning, disconnecting and disposing of the FPSO and remediating the Laminaria-Corallina oilfields.

The decommissioning programme is being managed in three phases.

Phase 2 of the Northern Endeavour programme includes permanently plugging and abandoning nine wells in the Laminaria and Corallina oil fields in a planned two-stage process. Stage 1 will involve project management, engineering, logistics, regulatory approval, subcontracting and procurement activities to: design and plan to permanently plug and abandon the wells; develop a Stage Gate Review Pack outlining a pricing model with detailed budget, risk profile and Performance Management Framework; and achieve Registered Operator status and monitor and maintain the Laminaria Corallina oil fields.

Stage 2 will include: permanently plugging and abandoning the wells; project management, engineering, procurement and field monitoring; meeting all regulatory requirements, including a National Offshore Petroleum Safety and Environmental Management Authority (NOPSEMA) approved Safety Case.

Phase 1 of the Northern Endeavour decommissioning project is progressing well. With the help of Petrofac, the lead contractor for Phase 1, the FPSO has been disconnected and towed to Singapore. While in Singapore, the vessel will undergo further work to remove protrusions and strengthen and repaint the hull for its journey to Denmark for recycling.

Phase 3 will involve removing subsea infrastructure and remediating the Laminaria and Corallina fields.

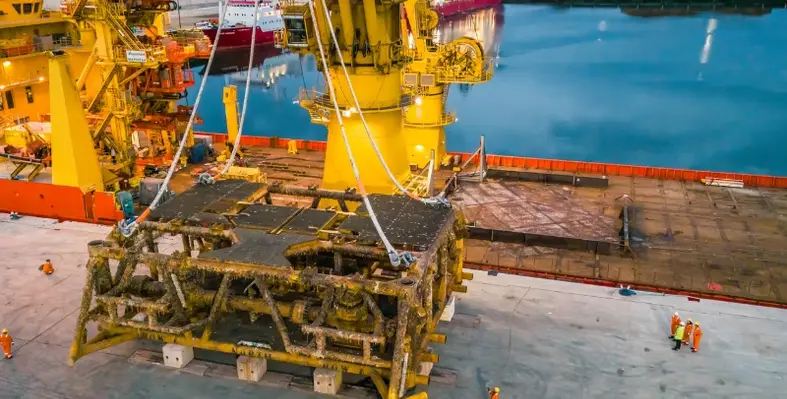

Australia’s Strake Engineering has expanded its offshore equipment offering with the addition of four DNV-certified subsea baskets, purpose-built to support installation and recovery tasks across decommissioning and broader offshore operations.

Australia’s Strake Engineering has expanded its offshore equipment offering with the addition of four DNV-certified subsea baskets, purpose-built to support installation and recovery tasks across decommissioning and broader offshore operations.

Each basket offers a 53-tonne payload and 47-tonne tare weight, complete with rigging, load test certification, and manufacturer data records.

The units have already demonstrated “proven offshore performance” on a recent decommissioning project, it was reported by the Centre of Decommissioning Australia (CODA), which announced the new equipment launch on its website.

The Perth-based company is a CODA partner as Australia gets to grips with its immense offshore decommissioning challenges.

The new subsea baskets are designed to enhance safety, boost operational efficiency and reduce project costs through a flexible rental model.

“Strake is proud to introduce its fleet of subsea baskets for rent, delivering a safer, smarter, and highly efficient solution for offshore installation and recovery tasks,” the company noted in its marketing of the new equipment, also available on the CODA website.

According to Strake, the purpose-built equipment enhances safety by mitigating the risk of unknown structural integrity in offshore recovery; boosts efficiency by streamlining workflows and reducing project timelines with optimised handling and transport; and reduces costs, via a rental model that offers access to top-tier equipment without the capital expenditure of ownership.

Service provider DeepOcean will support the decommissioning of subsea infrastructure at Western Australian oil and gas fields.

Service provider DeepOcean will support the decommissioning of subsea infrastructure at Western Australian oil and gas fields.

The scope of work includes suspension of subsea trees, removal of flowlines, riser and dynamic umbilical, and removal of a disconnectable turret mooring buoy (DTM). The work is scheduled to begin next year and will be performed form one of the company’s regional vessels.

The fields are located off the coast of Western Australia in depths of 300-400 metres.

Colin McGinnis, Managing Director of DeepOcean’s Asia Pacific operations, said, “We are honoured that DeepOcean has been entrusted with the delivery of this significant project. It builds on our extensive regional and international experience in decommissioning and reinforces our long-term commitment to supporting the energy sector in Australia.

“DeepOcean is already one of the market leaders within subsea decommissioning in the mature North Sea region. This project demonstrates that we are already managing to combine local Shelf Subsea expertise with our North Sea decommissioning competence. The end-beneficiary is our clients in the region.”

As ExxonMobil Australia steps up decommissioning of ageing offshore oil and gas assets in the Gippsland Basin, the company is also repurposing onshore infrastructure as part of its ongoing energy transition and forward investment plans.

As ExxonMobil Australia steps up decommissioning of ageing offshore oil and gas assets in the Gippsland Basin, the company is also repurposing onshore infrastructure as part of its ongoing energy transition and forward investment plans.

That includes the demolition of the former Altona refinery facilities, which Mobil commenced in September.

Rhys Kelly, Terminal Manager, Melbourne Terminal, said in an update that this decommissioning work would continue for two more years.

“Demolition of former refinery infrastructure is a complex task,” he noted. “Work commenced in September 2025 and is expected to continue through to the end of 2027.”

It follows a review of future opportunities for parts of the Altona Terminal site which are not required for fuel terminal operations.

Following the review, the company is planning to demolish a number of tanks, former refinery process units and associated infrastructure that are not required to support its vision for a reliable supply of fuel to Victoria.

Since works to transition the Altona site to a world-class terminal began in 2021, it has refurbished a number of tanks, increasing fuel storage capacity by almost 250 million litres to ensure it can meet the federal government’s minimum fuel storage requirements, as well as maintain a vital role in supplying around 40% of Victoria’s fuel needs.

“This year, we continue to focus on delivering additional fuel storage across the Mobil Melbourne terminal, including at Gellibrand Wharf and the Altona site, so that we can maintain our supply of around 40% of Victoria’s fuel from Melbourne’s largest fuel storage and distribution terminal,” added Kelly.

“It has been a productive year, and we have completed many projects that will provide the additional storage required to support our ongoing, reliable supply of fuel to Victoria into the future.”

In a community bulletin, Mobil added that it had carefully planned the demolition work to ensure it is managed safely.

Given the nature of the work, it said there may be “noticeable changes” in the site profile, with the flare being one of the first assets to be removed.

Mobil added that it will also implement strict environmental controls to minimise impact on the neighbourhood, including completing most work during the day, industrial hygiene monitoring and using dust suppression.

“We have worked closely with regulators to obtain the necessary approvals and carefully planned the demolition works to minimise impacts on our neighbours,” said Kelly.

“We will also closely monitor the works so that we can quickly respond to any unexpected impacts if they occur.”

ExxonMobil has released a new information document on its Gippsland Basin decommissioning activities, inviting feedback and consultation from stakeholders.

ExxonMobil has released a new information document on its Gippsland Basin decommissioning activities, inviting feedback and consultation from stakeholders.

The latest bulletin focuses on Stage 2 of the Gippsland Basin Decommissioning Campaign #1 programme, covering transport, offloading and set-down.

Esso’s planning and preparation to remove non-producing platforms during Decommissioning Campaign #1 is well underway, the document notes.

This includes activities such as the removal of the topsides and supporting steel jacket structures of up to 13 facilities by a heavy-lift vessel (HLV) or construction support vessel (CSV).

The HLV or CSVs will then transport the topsides and steel jackets to a sheltered location closer to shore, within Commonwealth waters (referred to as the transfer area), where they will be transferred onto a heavy transport vessel (HTV) or barge with tugs.

They will then be transported from the transfer area, through existing Corner Inlet shipping channels, before mooring at the Barry Beach Marine Terminal (BBMT) and subsequent offloading and set-down at an Onshore Reception Centre (ORC) within BBMT. Removal, transit and offloading is expected to take around four months.

After set-down at the ORC laydown areas, a dismantling and recycling contractor will dismantle the structures, during which materials will be segregated and sent offsite for recycling or disposal. Dismantling onsite is expected to take between two to three years to complete with a target of recycling over 95% of the material.

The new information bulletin expands on the detailed planning activities and environmental studies currently underway in support of Stage 2, which includes transportation of structures through Victorian State waters and subsequent offload and set-down at the ORC. This is expected to be BBMT, an existing port facility owned by Esso that has been part of South Gippsland’s industrial history for over 50 years and well placed to support decommissioning efforts.

Stage 3 of the decommissioning programme entails the onshore dismantling operations at the ORC.

Stage 1: ORC Early Works (site readiness)

Stage 2: Transportation and offloading operations at the ORC

Stage 3: Onshore dismantling operations at the ORC.

Esso noted that it has received regulatory permissions for Stage 1 from relevant authorities and is now undertaking planning and technical studies for future stages.

Pending regulatory decisions and further public consultation, Stage 2 operations at the ORC are anticipated to commence from September 2027, it added.

This Stage 2 work, including the transportation of structures from the Victorian State waters limit through existing Corner Inlet shipping channels to BBMT via the HTV or barge, will involve approximately 26 marine vessel transits to BBMT, planned between September 2027 and January 2028 (one every five days on average). The HTV or barge will be accompanied by tugs to ensure safe navigation.

Work will also include the offload of structures from the HTV or barge with tugs and set-down within the ORC using self-propelled modular transporters; the refit of structural supports on the HTV or barge with tugs after offloading to prepare for subsequent loads; and short-term storage of structures at the ORC prior to commencement of Stage 3.

Esso also highlighted numerous ways of minimising environmental impacts during the process, notably given the ORC’s proximity to Corner Inlet, an internationally recognised wetland that supports a range of sensitive marine habitats and ecosystems.

Lachlan Harris will replace Sherry Duhe as Santos’ Acting Chief Financial Officer on an interim basis.

Lachlan Harris will replace Sherry Duhe as Santos’ Acting Chief Financial Officer on an interim basis.

Harris has served as Santos’ Treasurer and Deputy Chief Financial Officer for more than two years and has previously acted in the Chief Financial Officer role. Harris joined the company 15 years ago from KPMG and has had extensive experience in a range of risk and finance roles across Santos since.

Managing Director and Chief Executive Officer, Kevin Gallagher, thanked Duhe for her service to the role, “Sherry has made a significant contribution in her time at Santos, leading the structural cost reduction initiative over the past year and implementing a number of other business improvements, particularly in the long-term planning and budget processes.

“Sherry has been a valued member of the Santos executive leadership team and is leaving the company to pursue other interests. I wish her all the very best for the future.”

Page 1 of 13

Copyright © 2026 Offshore Network