Speaking in an exclusive interview with Offshore Network, David Fisher, Business Development Manager at Oilenco, highlights the latest technology his company is offering to support well intervention and abandonment operations, and looks to the future in the ever-changing oil and gas market.

Since its foundation in 2008, Oilenco has established itself as a trusted designer, engineer, and manufacturer of well intervention and downhole tooling, offering solutions and support to the global oil and gas industry. Founder and Managing Director, Warren Ackroyd, established the company in Aberdeen, UK, and the company has grown and evolved internationally, with a current workforce of 38 employees and growing.

Oilenco’s core business region, as Fisher explained, is the North Sea where they serve key oil and gas operators. While the North Sea will continue to be a major focus for the company, they have recently opened an office in Stavanger, Norway, Oilenco Norge AS, to establish themselves internationally as one of the market leaders in their field. Recent projects in Australia, West Africa and the Middle East strengthens their capabilities as a global provider.

On display at OWI EU

While their scope now spans across the globe, on the immediate horizon is the Offshore Well Intervention EU 2022 (OWI EU 2022) conference arriving in Aberdeen on 14-15 June. As event sponsor, Oilenco is looking forward to showcasing a range of cutting-edge solutions available to the market.

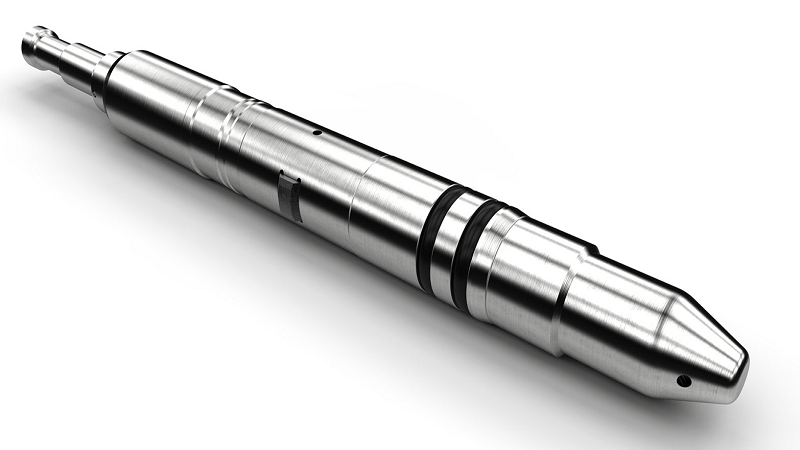

One such technology is their Hybrid Plug range which can be used on routine well intervention or abandonment operations. Fisher commented, “The Hybrid Plug provides a secure, high-performance well isolation barrier that can be set and retrieved on slickline and uses an existing landing nipple profile within the wellbore.”

“One of the key components of the Hybrid Plug is its sealing arrangement. Conventional lock mandrels that are nipple-set tend to have a seal stack and are run and set into a specified landing nipple. However, the Hybrid Plug uses a mechanically ‘energised’ seal providing a ‘best of both worlds’ approach; the pressure integrity assurance of a bridge plug sealing element and the simple operation of a conventional blanking plug. Essentially, it is a cross between a standard lock mandrel design and a bridge plug sealing element, providing a very robust bi-directional seal.”

“As it is a ‘one-run’ solution, it brings significant time savings to the operator generating cost efficiencies, increasing safety, and reducing risk.”

In one case study demonstrating the value of this product, a North Sea operator was conducting a programme of plug and abandonment activity over several subsea wells using a mobile offshore drilling unit (MODU). Oilenco, to support the operation, provided a package of downhole equipment including the Annulus Bore Hybrid Plug package. During routine operations, the operator experienced difficulties establishing a satisfactory pressure test against a bridge plug that had been set in the annulus tubing. As the tubing hanger featured a landing nipple within the annulus bore, Oilenco’s Hybrid Plug could be set in the hanger profile.

The plug was successfully set, and pressure tested by the onboard slickline crew allowing this phase of the programme to be completed on schedule. It was noted that the hybrid plug solution was dependable, easy to operate, saved time, and broadened the capability of the regular offshore crew.

Another technology which the company is looking to showcase at OWI EU is the Pressure Wave Valve, an open-on-demand, intervention-free equalising device that can be attached to lock mandrels or bridge plugs and operates only when it senses a specified ‘wave’ of applied pressure.

Fisher remarked, “If you set a plugging device in the wellbore, you would have to intervene on the well to equalise it before you can pull it out of the well. This means you have to rig up wireline on the well which is an extra run in the hole causing extra risk and extra cost. However, if you have the pressure wave valve installed, it means when you want to equalise, you simply cycle pressure starting from a low-pressure, increasing to an upper pressure, and returning to a low pressure again repeatedly over 6 to 12 cycles. After a predetermined number of cycles, the valve will open.”

The Pressure Wave Valve is particularly useful in P&L/P&A operations and completion workover operations. In one instance, when an abandonment service provider was seeking timesaving opportunities to improve efficiencies during abandonment tubing recovery, they sought the help of Oilenco.

While similar solutions have been in use for several years, Oilenco’s Pressure Wave Valve incorporates significant improvements to increase the operational reliability of the device, including enhancing debris management. In the abandonment project, Oilenco were able to configure the Pressure Wave Valve for the client within their desired operating parameters. The Pressure Wave Valve was pressure cycled open, allowing the tubing to be pulled ‘dry’ without the need for further wireline intervention.

The operation of the valve is non-time dependent. Activation cycles can be carried out within minutes of each other or several months or even years later, with no specific setups required, and the operating parameters of the Pressure Wave Valve are not affected by changes in the wellbore pressures below.

A full range of support

The Hybrid Plug technology and Pressure Wave Valve are key products for the company, but as Fisher was keen to emphasise, they are just the tip of the iceberg.

“We have a wide range of products and solutions that can be tailored towards a customer’s requirements. At OWI EU, we will be discussing different solutions that are relatable to routine well intervention operations and abandonment, such as our scale remedial package, safety valve remedial package, sleeve solutions and much more.”

Oilenco is more than just a high-quality product supplier. They offer a range of services including product training, so customers are fully emersed in the Oilenco solution and full operability of the product.

Fisher noted, “If a client wants to run the equipment themselves rather than receiving onsite support from an Oilenco engineer, we provide training either in our workshop or through training videos (if overseas), as well as providing technical manuals and documents to support our solutions. If attending a training course in person, the delegate is issued with a certificate of competence at the end.”

Ready for the rebound

The pandemic created challenging times for all industries, with those operating within the oil and gas industries forced to contend with uncertain prices, lockdown regulations and employee safety. While we are not completely on stable ground yet, the early recovery signs look positive for the oil and gas sector.

In relation to his company, Fisher remarked, “2018 and 2019 were strong years for us with consistent growth throughout both. 2019 was our best performing year with well intervention and abandonment activity in the North Sea. Covid presented many challenges, but we were here to help our clients through these challenging times, continuing to provide essential support, collaborating with their teams to meet supply requirements. As a result, not only were we fortunate enough to retain our headcount and keep the years of knowledge and experience we have within the company, but we also invested in our facility to ensure that post Covid, we continue to design and manufacture innovative solutions, and provide the high-quality products and services our clients have come to expect from us.”

“Coming out of Covid, certainly from a market perspective, a lot of the projects which were shelved or delayed are starting to resurface. Not only with the current oil price, but partly due to the current geopolitical situation, demand is growing and globally, we are seeing operators investing in production either in existing wells to help increase production or investing in exploration and new well discovery.”

“That being said, well abandonment is still very much on the agenda for many operators, and I am sure it will be here for the next 20-30 years. As Oilenco’s solutions are transferrable between intervention and abandonment, we look forward to continuously supporting our clients globally” Fisher commented.

In concluding, Fisher stated, “Overall, from a company side, it is good to be in a post-Covid recovery space. Being back in face-to-face meetings with clients, being involved in conferences such as OWI EU, seeing and hearing what industry and operators are planning. Oilenco can do everything from initial design to manufacturing, testing, inspection, and training, as well as providing access to a large rental fleet for immediate release. Our team have a breadth of experience that runs right through from concept to completion, it is what makes us a strong company and we are looking forward to showcasing our capabilities.”

Find out more about Oilenco at their website here.

Deep geothermal delivery specialist CeraPhi Energy has been awarded the first of its kind geothermal study to undertake the repurposing of offshore oil and gas wells using its proprietary advanced closed-loop system

Deep geothermal delivery specialist CeraPhi Energy has been awarded the first of its kind geothermal study to undertake the repurposing of offshore oil and gas wells using its proprietary advanced closed-loop system

The study will cover the initial phase of a staged process to determine how retrofitted wells can reduce the carbon footprint of an operating platform.

The project is being led by the CeraPhi subsurface engineering team in collaboration with topside engineering services company Petrofac. The study will use EnQuest’s Magnus Platform as the base case.

The Magnus Platform, formally operated by BP, is one of the UK's largest operating facilities and sits north of the Shetland Islands. Magnus is a fully integrated drilling and production facility with a design capacity of 85,400 bpd of crude oil, 110 mmscfd of gas export and a maximum of 240,000 bpd of produced water.

The study will incorporate the use of CeraPhi's proprietary advanced closed-loop technology, CeraPhiWell, which is designed to fit into old wells to extract heat from deep underground by a downhole heat exchanger. Depending on the operating temperatures established in the study the heat produced could be used as direct power and/or heating or cooling for utilities and other services reducing the overall carbon emissions of the facility.

Karl Farrow, CeraPhi, Founder and CEO, said, “This award is a statement to how the oil and gas industry is transitioning in the decarbonisation of the oil and gas extraction process.”

“If we can use old non-productive wells to produce clean baseload energy, why can’t we make those same wells produce carbon-free energy when they are drilled, reducing the carbon footprint during the oil and gas extraction process and ensuring the maximum use of these assets through a complete energy transition over decades,” Karl furthered.

Craig Nicol, Project Manager, NZTC, said, “We are delighted to be supporting CeraPhi with this ground-breaking project that if proven could become a serious contributor to the renewable energy mix. The industry is facing a significant challenge to decommissioning wells that have come to the end of their production, this novel approach has the potential to extend their life whilst delivering on our net-zero targets.”

Jonathan Carpenter, Vice-President, Petrofac New Energy Services, said, “Our engineering specialists are looking forward to working with CeraPhi on this pioneering study, which has the potential to unlock a completely new way of generating renewable power using existing oil and gas infrastructure. It could be a game-changer in our efforts to decarbonise the oil and gas production process and has wider applicability for clean baseload power as well.”

CeraPhi Energy was founded by a team of oil and gas experts just over 18 months ago, and is driving deep geothermal projects using its proprietary closed-loop technology across the world, with a total of nearly 1.5GW of heat, cooling and power projects under development and more than 5 GW under appraisal.

Allseas’ Pioneering Spirit has delivered the Gyda topsides to the Aker Solutions yard in Stord, Norway, for disposal.

Gyda is a field in the southern part of the Norwegian sector in the North Sea, between the Ula and Ekofisk fields. The field was developed with a combined drilling, accommodation and processing facility supported by a steel jacket standing in 66 m water depth. The platform started producing in 1990, with a decommissioning plan submitted in 2016.

After removing the 18,400 tonne former drilling and production facility from the southern North Sea, Pioneering Spirit arrived in Norway on 24 May.

The latest delivery means that, since March 2022, Allseas has lifted more than 65,000 tonnes of North Sea facilities, an achievement made possible by their motion compensation and single-lift systems.

2022 is now on schedule to be a record year for the company with dozens of offshore lifts, ranging from light bridges to entire jackets and topsides, to be undertaken. They include the massive Gyda jacket, which Allseas is booked to remove later this summer.

CRA Tubulars B.V., a new technology company based in the Netherlands, is now formally part of the Shell GameChanger Programme.

CRA Tubulars B.V.’s proposal was shortlisted from the submissions that were sent to the Well Technologies Call for Solutions for Storage of CO2 or H2 in Geoformations and was ultimately selected by a panel of Shell technology experts and GameChangers for funding.

As a result, CRA Tubulars B.V. has signed a collaboration agreement under which it will receive advice and funding to validate and qualify the application of its technology including Titanium lined Composite Tubulars (TCT) and Premium Hydraulic Concentric Connection (PHHC) technology for Carbon Capture and Storage (CCS) well applications. A six-month testing and certification programme has been kicked off to ensure industry standard (API) qualification as a key step towards field deployment.

CRA Tubulars uniquely uses aerospace certified materials to achieve superior high-pressure performance corrosion resistance under extreme downhole conditions. TCT is qualified for such applications as it can manage the low temperature swings.

Further benefits include light weight and optimum flow performance. An efficient use of high quality, yet widely available materials, delivers a unique and cost-effective, full well lifecycle alternative to conventional materials.

Qualification testing on the patented technology of 3.5 in TCT pipe and PHHC connection will be completed in accordance with API 5C5 Fourth Edition, Jan 2017 CAL II test requirements to 5,000 Psi, and additional Series B testing to -35 degrees C. Prototype testing has shown potential up to 18,000Psi burst and 240,000lbs tensile strength at temperatures as low as -54 degrees C.

Founder Emile Burnaby-Lautier, and Joost de Bakker, CEO of CRA Tubular, stated, “We are excited about our partnership with Shell GameChanger. We want to show that our vision to win the fight against corrosion, can actually deliver a step change in technical and economic performance in the energy sector. By repurposing superior components and materials with recorded operating performance from the different industry sectors, CRA Tubulars has delivered a corrosion resistant alternative completion tubing that is corrosion free, light weight, reusable, stronger, whilst adhering to industry dimensions.”

Veronica Simmonds, Commercial Partnerships Manager at Shell GameChanger, commented, “The Shell GameChanger programme is the ideal platform to accelerate the qualification and certification of technologies. In particular technologies that offer our organisation and the industry reliable and cost-effective innovation and contribute to the transition to an affordable and reliable low carbon energy system. And CRA tubulars B.V. with their TCT technology is part of it.”

Claxton AS, a brand within the Energy Services division of Acteon, a marine energy and infrastructure services company, has signed a collaboration agreement with Norwegian-based supplier Seabed Solutions to add value to its decommissioning projects and help operators fulfil their obligation to return subsea sites to their natural state.

Claxton AS, a brand within the Energy Services division of Acteon, a marine energy and infrastructure services company, has signed a collaboration agreement with Norwegian-based supplier Seabed Solutions to add value to its decommissioning projects and help operators fulfil their obligation to return subsea sites to their natural state.

According to Claxton, the partnership simplifies procurement, increases project execution efficiency and reduces costs for infrastructure owners by offering a wider range of dredging, excavation, cutting and decommissioning equipment and services through a single contract interface and by using a combined offshore crew.

Claxton and Seabed Solutions are known for extensive subsea experience and the former is said to have had an operational presence in Norway for over nine years and expanded its base in 2019 to meet industry demand. Seabed Solutions was established in 2015 by a management team with decades of experience leading the Norwegian seabed intervention market.

“As more and more oil and gas installations are getting close to the end of their economic and productive life, the demand for decommissioning services increases. This partnership means that the owners of the outdated installations can get the entire scope of decommissioning services on the same contract,” said Christian Aas, Seabed Solutions Managing Director.

Nick Marriott, Claxton General Manager, Norway, said, “Claxton is excited about the partnership, which will allow us to explore synergies to enhance our client offerings and methodologies to drive growth.”

“Offering integrated services through one contract and a single interface, and with collegial crew use, will help to increase procurement and project execution efficiency,” Nick added.

HydraWell has joined forces with READ (including subsidiaries READ Cased Hole and ANSA), a cased hole production logging, well integrity and reservoir evaluation solutions provider, to create a leading well integrity specialist with ambitions to play a prominent role in late-life oilfield activities.

HydraWell has joined forces with READ (including subsidiaries READ Cased Hole and ANSA), a cased hole production logging, well integrity and reservoir evaluation solutions provider, to create a leading well integrity specialist with ambitions to play a prominent role in late-life oilfield activities.

Both companies have long-established histories of delivering expert well integrity services and solutions for clients around the world. The new combined company will be strategically located with offices and bases in Stavanger, Aberdeen and Houston together with a presence in Alaska, Australia, Brazil, Malaysia and Qatar. HydraWell CEO, Mark Sørheim, will now be CEO of the combined company which will have a total of 75 employees. Total revenue for the combined company is expected to reach approximately US$20.3mn in 2022.

According to HydraWell, late-life oil and gas wells worldwide have an increased requirement for well integrity monitoring, and there is a growing demand for permanent plugging and abandonment of these ageing assets. HydraWell, READ and ANSA will operate within well integrity, with READ and ANSA measuring and analysing well integrity issues with HydraWell remediating the issues identified. The combination of the companies will allow customers to benefit from seamless well integrity planning and diagnostics to barrier installation using digital tools, repeatable and reliable service delivery and effective new technologies that reduce risk and cost to operations.

Sørheim commented, “This is an exciting juncture in our corporate journeys, and we are delighted to join forces with a like-minded specialist business whose services are complementary. This allows us to create a unique offering within the well integrity market to deliver further added value to our customers through deeper knowledge, increased operating efficiencies and improved workflows across their well operations.”

Manager Director of READ Cased Hole, Bruce Melvin added, “READ Cased Hole continues to go from strength to strength and the merger adds to this by positioning our new entity as leading integrated well integrity measurement, analysis and remediation specialists. This will not only enhance READ’s presence in the abandonments market but also expedite ANSA’s digital platform attracting new client relationships. We look forward to what the future holds and building on the success of both companies.”

Archer Oiltools has been awarded a two-year contract extension from Equinor Energy AS in the North Sea.

The contract covers plug and abandonment (P&A), fishing and downhole mechanical isolation equipment. Based on current activity levels, the additional backlog is estimated at US$60mn for the 24 months period which will commence in June this year.

“This is a strategically important extension for Oiltools in one of our core markets, which further strengthens our footprint and presence in the region. Our technology and strong record of execution in the North Sea makes us a supplier of choice for Equinor. We continue to support Equinor’s requirements for safe and efficient operations while providing proprietary low carbon solutions and operational efficiencies to further their energy transition goals,” said Hugo Idsøe, Vice President, Archer Oiltools.

Liebherr has announced that its Heavy Lift Crane (HLC) 295000 is on board the Orion and is ready to work on decommissioning projects.

The Orion is a next generation offshore installation vessel by DEME which is capable of installing windfarms and decommissioning ‘old’ energy platforms. On the vessel, Liebherr has delivered the HLC which is the largest crane the company has ever built, boasting a lifting capacity of 5,000 tonnes.

After its name-giving ceremony in Vlissingen, Netherlands, the vessel is now heading to help develop the offshore wind farm ‘Arcadis Ost I’ in the Baltic Sea.

“What we are witnessing here, is indeed a very memorable event. Fundamentally, it demonstrates what is achieved, when people are closely working together, especially alongside with a competent and reliable partner. Today, we are proud. In an extraordinary effort, our team at Liebherr brought this heavy lift crane up on this ship so now everyone can see what has been accomplished,” said Robert Pitschmann, Global Application Manager, Heavy Lift Offshore at Liebherr.

By the help of the compact design, the crane is destined to serve in the offshore market. For example the base column, being only 16.8 metres diameter, is unique in the market. The HLC 295000 requires little space on deck and offers more storage space for transportation. It is ready to take up its work in the ample field of the offshore industry. With its maximum capacity of 5,000 tons and an outreach of up to 151 metres, the HLC can manage large components, for example, during the decommissioning of offshore platforms.

A maximum lifting height of 175 metres enables the HLC 295000 to operate in the required height right away without special efforts. All this demonstrates that the heavy lift crane in general can be regarded as the ideal instrument for the challenges ahead within the changing field of energy production as well as in all related working areas closely related to it. The extraordinary efficiency, swift- and readiness when it comes to transporting, accuracy but also power give this Liebherr heavy lift crane and the HLC-Series an advancement due to its smart versatility.

Northumberland-based offshore technology company Osbit has announced that it is set to receive a Queen’s Award for Enterprise.

Osbit has been rewarded for its excellence in innovation – a nod to outstanding achievement and commercial success.

The prize has been given to the company for its development of offshore technology to deliver a step-change in offshore operations. Osbit’s Intervention tension Frame system were designed for industry-leading services company Helix Energy Solutions and use innovation to support energy transition activities, facilitating safer and more efficient closure of expired oil wells.

A representative from Osbit will collect the award at a reception hosted by HRH The Prince of Wales at Buckingham Palace, in July.

Director Steve Binney, commented, “This win is fantastic recognition of what Osbit is capable of, in terms of developing large and complex systems, successfully delivering them, and making a real difference to our customers’ project outcomes.

“Innovation has always been at the heart of everything we do – we’re constantly trying to use our engineering skills to improve on what’s gone before, to do things better, more safely, more effectively.

“We are very proud of this win, which is testament to the genuine skill and ingenuity of our team.”

Maersk Drilling has been awarded contracts which will see the harsh environment jack-up rig Maersk Resolute, employed to plug and abandon (P&A) a total of 31 wells in the Dutch sector of the North Sea.

Maersk Resolute is a 350ft Gusto-engineered MSC CJ50 and a high-efficiency jack-up rig that was delivered in 2008, currently operating offshore the Netherlands.

The newly-awarded contracts, which are expected to commence in Q2 or Q3 of 2022, are in support of a rig sharing agreement between TotalEnergies EP Nederland BV and Petrogas E&P Netherlands BV. They are in direct continuation of the rig’s current contract, and will include the plugging and abandonment of 11 wells with TotalEnergies and 20 wells with Petrogas.

The estimated duration for the substantial campaign is 575 days, and the total firm contract value is approximately US$43mn, excluding potential performance bonuses. The contracts include options to add additional work scopes with a total estimated duration of 228 days.

COO Morten Kelstrup of Maersk Drilling, commented, “We’re pleased to secure this long-term commitment for Maersk Resolute to continue operating in the Netherlands. By deploying the rig for a combined 31-well campaign we will be able to ensure a consistent focus on efficiency improvements from well to well, while simultaneously operating with the respect for the continued sustainability of the marine environment that is a key component in successful plugging and abandonment operations.”

DOF Subsea has attained a 99% rate for the combined recycling and repurposing of recovered materials on its decommissioning project for Repsol Sinopec Resources UK.

The company provides engineering, preparation, removal and disposal (EPRD) services at the Buchan and Hannay fields in the Central North Sea.

The offshore works were carried out for over 74 days, using Skandi Acergy and Skandi Skansen, and saw the recovery of 135 concrete mattresses weighing approximately 800 tonnes, more than 12km of rigid pipelines, SSIV/PLEM Structures, 15.5km of flexibles and umbilicals, spoolpieces, and around 1,500 grout bags and general debris.

The material was shipped to Aberdeen Harbour’s Clipper Quay for dispersal, with the recovered material dispatched for a wide variety of uses. A total of 15 concrete mattresses were repurposed into aggregate for use in the roads at the £350mn Aberdeen Harbour extension project. The plastic sheaths from the flexible risers and umbilicals were recycled by an approved supplier and all metal was smelted.

This was the second decommissioning project carried out by DOF Subsea on behalf of Repsol Sinopec in the Buchan and Hannay fields. In 2019, they carried out EPRD services, including the 124 tonne Mid-Water Arch (MWA) – one of the largest structures ever decommissioned through Aberdeen Harbour.

DOF Subsea has built a decommissioning portfolio over the last decade, delivering more than 30 projects around the world for major operators.

IKM Testing UK, an independent integrated solutions provider, has been awarded a multi-year contract to deliver well integrity services across bp’s portfolio of North Sea assets.

The agreement – the first well services contract between the companies – comprises well integrity remediation services, which includes sustained casing pressure mitigation (SCP).

SCP is excessive pressure in any well annulus that requires regular bleed down and often can be managed during normal offshore operations, depending on the severity. It also requires remediation during P&A operations if not addressed during the normal well lifecycle.

This new contract looks to address the issue of SCP in a more permanent manner, reducing the requirement for continual management. Under the contract IKM will provide engineering, determination of applicable chemistry/methodology, and deployment of equipment and personnel offshore.

Work to remediate sustained casing pressure using a bespoke resin capable of being placed via gravity feed is expected to commence in 2022.

Mark Rasmusen, Director of International Division at IKM Testing commented, “This is an exciting award and provides the springboard for us to further grow and develop our well services offering.

“Sustained casing pressure can generally be managed offshore, however bp is looking for a solution that doesn’t require continual management by offshore personnel which not only reduces risk but also saves significant time and costs. We were selected as we provide an independent perspective and have the capabilities to carry out the full suite of engineering services from cradle to grave.

“We look forward to helping bp achieve its well integrity goals by determining and executing innovative and cutting-edge solutions.”

The contract also has future provision for supporting bp’s international assets with similar workscopes.

Page 21 of 31

Copyright © 2025 Offshore Network