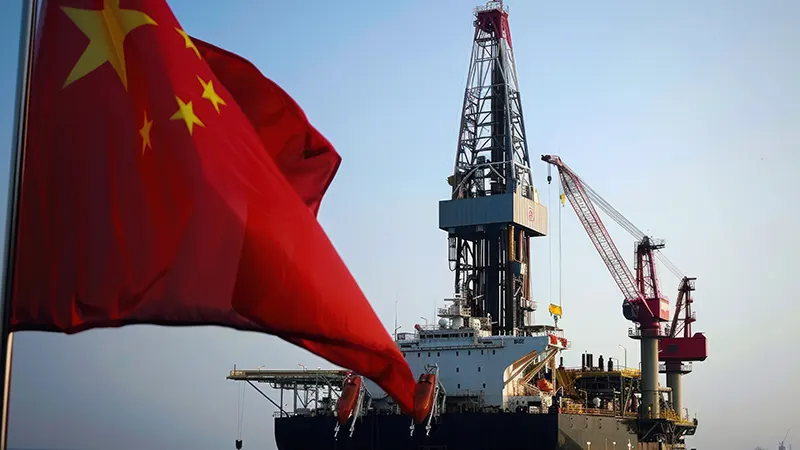

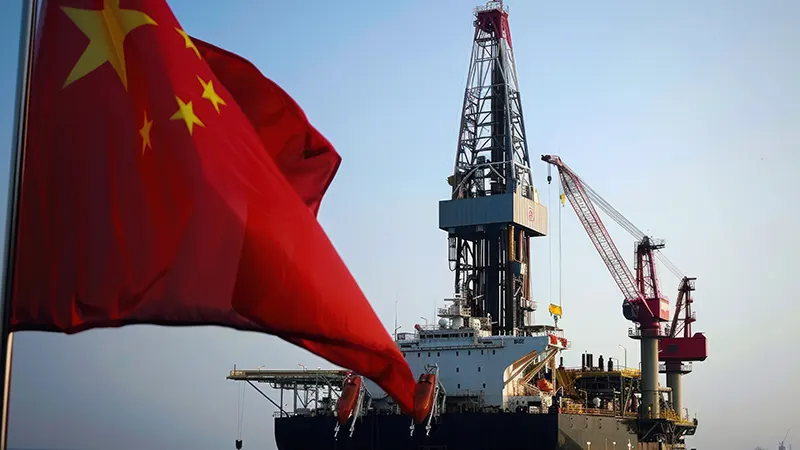

The Intervention and Coiled Tubing Association (ICoTA) has re-established its China Chapter, a recognition of the country’s growing importance to global energy markets and in the evolution of advanced well technologies.

The Intervention and Coiled Tubing Association (ICoTA) has re-established its China Chapter, a recognition of the country’s growing importance to global energy markets and in the evolution of advanced well technologies.

ICoTA called it a “significant milestone” in the association’s global expansion and a commitment to technological innovation in well intervention.

In a statement, it said the revitalised China Chapter would serve as a critical hub for networking, knowledge exchange and technological advancement in the well intervention and coiled tubing sector across the whole of the Asia-Pacific region.

“This strategic relaunch reflects ICoTA's dedication to supporting emerging markets and fostering global industry collaboration,” the association noted.

Steve Moir, Global Chair of ICoTA, called it a landmark moment with implications for the whole region.

“Re-establishing the China chapter of ICoTA marks a pivotal moment as we unite to harness the immense potential of well intervention services in one of the world’s largest markets,” he said.

“Together, we will drive innovation and collaboration, ensuring a prosperous future for coiled tubing technology in China and beyond."

Frank Kong, from CNPC USA, described the market for well intervention services in China alone as huge.

“In 2024, the number of coiled tubing operations is about 12,000 jobs,” he said.

“The CNPC Engineering Technology R&D Company and Jianghan Machinery Institute have taken the lead in establishing the Coiled Tubing Technical Committee of the China Petroleum Society, which plays a leading role in China. The combination of China and ICoTA will for sure greatly promote the development of the industry and expand ICoTA's influence.”

Key objectives of ICoTA’s renewed China Chapter include:

Providing a robust platform for Chinese and international professionals in well intervention technologies.

Facilitating knowledge sharing and technical expertise across regional and international boundaries.

Supporting local industry professionals through networking, training and professional development opportunities.

Promoting cutting-edge technological innovations in well intervention and coiled tubing operations.

The Asia Pacific region is set to continue to provide a steady stream of work for the interventions market for some years to come, as high levels of upstream activity drive demand for drilling contractors and specialist expertise across a broad range of areas.

The well interventions segment is likely to prosper injecting new life into some of the region’s ageing oil and gas fields, all set against a backdrop of a general rise in energy demand globally.

This is likewise driving current upstream activity in the area.

According to industry consultancy, Westwood Energy, there are more than a dozen high-impact wells expected across the Asia Pacific region during the course of this year.

This includes the Hai Su Vang-1X well, which was completed as a discovery in early 2025.

As the region’s oil and gas sector expands and matures, the demand for well intervention services from local and international contractors is expected to follow suit.

Energy services provider, Expro Group, for example, reported significant contracts from the Asia-Pacific region in its Q1 results, including work to provide combined e-line cased hole and slickline services across 315 wells.

UK-listed EnQuest is among the upstream operators with an eye on the region’s hydrocarbon potential, with operations now spread across Malaysia, Vietnam and Indonesia.

Organic and transactional growth in the region already provides a pathway for the company to grow its South East Asian production to more than 35,000 Boepd by the end of the decade, EnQuest Chief Executive, Amjad Bseisu, said at the end of May.

He also noted that the group is in “advanced discussions” around a further new country entry in the region, highlighting keen investor appetite.

It underscores the potential for contracting teams, including across the well services and internentions market, to secure more business as the industry flourishes.

Westwood Energy identified various other key frontier wells for 2025 across the region, offshore South Korea at Daewanggorae, as well as at Mailu offshore Papua New Guinea.

Drilling will also continue in the Kutei Basin, offshore Indonesia, it noted, whilst a 2025 exploration programme offshore Malaysia is still to be firmed up, with only the Megah high-impact well currently drilling confirmed.

In addition, India should see at least five or six high impact wells from Oil India and ONGC across the east coast and Andaman Islands basins, the consultancy group noted earlier this year.

Veolia Water Technologies has been awarded a multi-million dollar contract from Seatrium to provide advanced seawater desalination solutions for two Petrobras FPSOs in the Santos Basin.

Veolia Water Technologies has been awarded a multi-million dollar contract from Seatrium to provide advanced seawater desalination solutions for two Petrobras FPSOs in the Santos Basin.

The contract includes project engineering, procurement, equipment supply and installation.

The project will serve Petrobras’ P84 and P85 FPSOs, with each platform having the capacity to process 225,000 barrels of oil and 10mn cubic metres of gas a day. These require sophisticated water management solutions to minimise environmental impact while maximising production efficiency, according to Veolia.

Oil and gas production relies on treated, desalinated seawater to be injected into reservoirs through sulphate removal units (SRU). The project will include a state-of-the-art SRU system for water injection production, featuring Veolia’s ZeeWeedTM Ultrafiltration and SWSR Series Nanofiltration membranes. These advanced systems will reliably process 1,960 cubic metres per hour of water per platform. By removing harmful sulphates and other ions, this technological solution protects reservoirs and flowlines while reducing the environmental footprint of injection operations and ensuring optimal performance.

As well as enhancing oil recovery, Veolia’s technology also helps to prevent well souring and scale formation, thereby extending the life of the infrastructure and aligning with the industry's push toward more responsible practices in offshore operations.

Anne Le Guennec, CEO of Water Technologies at Veolia, commented, “This strategic partnership with Seatrium exemplifies how our advanced desalination technologies can drive both operational excellence and environmental responsibility in offshore energy production. Through our innovative solutions, we're helping secure vital energy needs while minimising environmental impact. We are particularly proud to support Seatrium and Petrobras in the energy sector's journey toward more efficient and environmentally conscious operations.”

An oil producer from the United States employed Emerson and the company's local partner, Puffer-Sweiven, to replace existing traditional actuator systems on shutdown valves at production wellheads with two Bettis RTS electric valve actuators

An oil producer from the United States employed Emerson and the company's local partner, Puffer-Sweiven, to replace existing traditional actuator systems on shutdown valves at production wellheads with two Bettis RTS electric valve actuators

Successfully pilot-tested, the solutions reduced power consumption and surge events, improved time to market (TTM) with quick implementation, and ensured data-based maintenance decisions. The FQ Series fail-safe quarter-turn actuator mounted on a ball valve, and the FL Series fail-safe linear actuator mounted on a reverse-acting gate valve. As electric actuators, these did not require air compressors, filtration and tubing.

The existing model cost the producer high maintenance charges and operational disruptions as it required addressing failures in cases of power outages or air leaks. Diaphragm wear and corrosion in the air lines raised safety issues as they needed manual intervention. Emerson's systems eliminated this step with its onboard diagnostic features to enable remote monitoring and troubleshooting, including partial valve stroke test (PVST). Equipped to achieve Safety Integrity Level 3 (SIL3), they are mechanical fail-safe to support emergency shutdown applications with the necessary response time. To deal with outage issues, the systems come with a fail-safe 24 V DC circuit, independent of the main power grid.

Capable of operating within a temperature range from -40 °F to +140 °F (-40 °C to +60 °C), it solved the problem of frozen instrument air supply lines of the traditional actuators during colder seasons.

The new systems eliminated methane emissions which were common with each stroke from the tradional actuators.

Click here to register for Offshore Network's global well intervention and decommissioning conferences.

China’s DS Global Offshore has reported that its Huan Qiu 1200 vessel has now completed decommissioning contract work in Thailand, on behalf of operator, Chevron.

China’s DS Global Offshore has reported that its Huan Qiu 1200 vessel has now completed decommissioning contract work in Thailand, on behalf of operator, Chevron.

The vessel has now returned to Chinese waters for domestic-based work.

“From early spring 2024 to late spring 2025, after more than a year of hard work, the Thailand Chevron oil and gas field subsea pipeline recovery project led by the ship, Huan Qiu 1200, of DS Global Offshore Engineering (Tianjin) Co.,Ltd. has successfully concluded,” it noted in a statement.

“After more than 400 days, with the excellent performance of the DP2 power positioning system, the team successfully recovered more than 60 21-inch cement-coated sea pipes in the deep sea, breaking the industry record and setting a new benchmark for global deep-sea energy development.”

It described the submarine pipeline labyrinth as an “underwater steel forest” spanning multiple kilometres in length.

DS Global Offshore said in its statement that precision technology and solutions had won praise from Chevron for overcoming challenges such as the increased weight of cement coatings and disturbance from underwater currents in the deep-sea environment.

It said the project team adopted the “segmented disassembly and precise lifting scheme, optimising the cutting path through dynamic simulation and using high-precision sensors to adjust the lifting angle in real time, successfully avoiding the risk of pipeline entanglement.”

At the core of the project, it noted, was the vessel’s DP2 power positioning system.

“The system analyses wind speed, ocean currents and ship displacement data in real-time through onboard computers, automatically adjusts the propulsion power, and controls the positioning error of the engineering ship within three metres, even in deep sea and level four sea conditions,” the DS Global Offshore statement noted.

The company added: “The Chevron owner stated: This cooperation fully demonstrates the excellent technical strength and professional competence of the engineering ship team, setting a benchmark for future offshore energy projects.”

Chevron is looking to decommission dozens of offshore platforms and subsea pipelines in Thailand over the coming years.

A recent report by Allied Market Research titled “Well Intervention Market by Service, Intervention Type, Well Type and Application: Global Opportunity Analysis and Industry Forecast, 2021–2030” forecasts strong growth in the global well intervention market.

Valued at US$8.7bn in 2020, the market is expected to reach US$15.3bn by 2030, growing at a CAGR of 5.8%

Well intervention involves various operations designed to increase the productivity of oil and gas wells. These services include slickline and wireline interventions, subsea intervention, coiled tubing, hydraulic workover, remedial services, stimulation, and others.

Globally, mature oilfields contribute up to 75% of total oil production, which significantly drives the demand for well intervention services. This demand is expected to rise as operators seek to enhance well productivity and efficiency.

In Europe, countries such as Germany, France, Spain, and Italy have been impacted by the COVID-19 pandemic, which introduced challenges to well intervention activities. Strict safety measures like social distancing and movement restrictions reduced manpower availability and disrupted supply chains, leading to slower operational activity.

Despite these challenges, Europe continues to be an important market due to its mature oilfields and ongoing need for well maintenance and production enhancement.

Key drivers influencing the growth of the well intervention market include:

The report highlights several market segments:

Regionally, North America remains the dominant market due to extensive shale oil developments and the presence of key players. However, Europe’s mature fields and regulatory environment make it a critical region for well intervention services.

For a comprehensive insight into the global well intervention market, you can access the full report by Allied Market Research here.

The offshore decommissioning market is forecast to grow from US$9.56bn in 2024 to US$15.4bn by 2032, at a CAGR of around 6.1% during this period, according to a new report from Wise Guy Reports

The offshore decommissioning market is forecast to grow from US$9.56bn in 2024 to US$15.4bn by 2032, at a CAGR of around 6.1% during this period, according to a new report from Wise Guy Reports

The offshore decommissioning market is seeing strong activity as ageing offshore oil and gas infrastructure reaches the end of its operational lifecycle. Increasingly stringent regulatory requirements, safety concerns, economic considerations and ESG commitments are among the other factors driving the market.

Key players are increasingly collaborating with environmental and engineering firms to streamline operations and minimise environmental impact. The market is also moving from traditional heavy-lift methods to more efficient, automated, and cost-effective solutions.

Technological advancements are having a strong impact on the decommissioning sector, the report notes. Remotely Operated Vehicles (ROVs) are widely used to inspect and dismantle subsea structures, reducing the need for human involvement and enhancing safety. Advanced vessels equipped with heavy-lift cranes and modular lifting systems allow for safer and more efficient removal of topsides and jackets. Companies are leveraging digital twin technology to simulate the decommissioning process, allowing better planning and execution while minimising operational risks. There is a growing emphasis on recycling and reusing decommissioned materials. Technologies are being developed to treat and dispose of hazardous waste in environmentally friendly ways. New methods for sealing wells are emerging, including resin-based and thermite plug technologies, which enhance sealing reliability and reduce long-term environmental risks.

“The global offshore decommissioning market, once seen as a financial liability, is now evolving into a specialised and profitable sector, offering lucrative opportunities for engineering firms, service providers, and environmental consultancies,” the report comments.

The risks and challenges are also highlighted. These include the high costs of the decommissioning process, often deterring operators from initiating timely projects unless strictly mandated. Navigating different regulatory environments across countries and regions adds complexity and uncertainty to project planning and execution. There is a shortage of specialised vessels, equipment, and skilled professionals capable of executing complex offshore decommissioning tasks. If not executed properly, decommissioning activities can cause environmental damage, including oil spills, disturbance to marine ecosystems, and improper disposal of waste.

“One of the key trends anticipated is the emergence of decommissioning hubs—strategic locations equipped with recycling and waste management facilities that serve as central points for multiple projects,” the report says. “Another trend is the rise of collaborative decommissioning models, where operators with adjacent platforms work together to share infrastructure, vessels, and project timelines to reduce costs.”

In March 2008, Libya produced 1.75 million barrels of oil per day (bpd). Since then, thanks to political instability, it has never reached that figure again. Will 2025 be the year Libya goes back to its peak crude oil production?

The country is the richest in terms of oil reserves in Africa, and its offshore oil and gas sector is a cornerstone of its energy industry.

In the last few years, some significant developments have begun to shape the Libyan oil market, which could signal positive news for the industry.

Recent developments in offshore fields like Bouri, Bahr Essalam, Sabratha, and Al Jurf, alongside new exploration initiatives, highlight Libya’s efforts to bolster offshore production through well intervention and infrastructure upgrades.

In fact, in December last year, Libya produced 1.4 million bpd, which is its best performing figure since 2013. The country has ambitions to reach 1.6 million bpd by year end.

A key development is the February resumption of gas production at Well CC18 in the Bahr Essalam offshore field, operated by Mellitah Oil and Gas (a joint venture between Libya’s National Oil Corporation (NOC) and Eni).

This restart likely involved well interventions such as coiled tubing or acid stimulation to address reservoir issues like scale buildup, ensuring consistent gas flow to the Mellitah treatment plant for domestic and European markets.

Similarly, the Sabratha Compression Project, in its execution phase with startup planned for late 2025, aims to enhance gas production.

Compression projects often require interventions like gas-lift optimisation to maintain well productivity, underscoring the role of advanced techniques in Libya’s offshore strategy.

The Bouri Gas Utilisation Project, another significant initiative, focuses on increasing gas output from the Bouri field, one of Libya’s largest offshore assets.

Operated by Eni and NOC, this project involves installing equipment to optimise production, likely supported by interventions such as perforating or chemical treatments to counter declining reservoir pressure.

Eni’s Structures A&E Project, with drilling set for mid-2025, channels gas from two offshore fields to Mellitah.

This project, involving new platforms and subsea infrastructure, will likely require well interventions like hydraulic fracturing to optimise new wells and ensure long-term productivity.

The adoption of AI-driven technologies by Eni suggests potential advancements in intervention efficiency, such as real-time monitoring to guide coiled tubing or wireline operations.

In January 2025, NOC launched its first exploration bid round in 17 years, offering 22 onshore and offshore blocks, including areas in the offshore Sirte Basin.

This initiative, attracting interest from companies like Repsol and BP, signals future offshore development.

New wells will eventually require interventions like well testing or stimulation to bring them online efficiently, building on Libya’s estimated 48 billion barrels of oil reserves, much of which lies offshore.

However, political instability poses significant risks. Only last month, Libya’s eastern-based government threatened a force majeure on oil fields and ports, following attacks on NOC facilities.

This echoed a 2024 shutdown that halted 700,000 bpd, impacting offshore fields like Al Jurf.

Such disruptions necessitate well interventions to restore production post-shutdown, as seen in Al Jurf’s history of workovers after prolonged closures.

Despite these challenges, Libya’s US$3–4bn investment plan for 2025 prioritises offshore infrastructure and interventions to achieve its production targets, reinforcing the sector’s critical role in the nation’s energy landscape.

Subsea 7 has received a subsea contract in West Africa

Subsea 7 has received a subsea contract in West Africa

This contract will see the company transporting and installing flexible pipelines, umbilicals, and associated subsea components for the connection of a floating production, storage and offloading (FPSO) vessel. It will also cover the pre-laying activities for an upcoming drilling campaign.

Project management and engineering work will begin immediately at Subsea7’s offices in Sutton, UK and Suresnes, France, and offshore activity is expected to start in 2026.

Jerome Perrin, Vice President Africa, Middle East, and Turkiye for Subsea7, said, “Our close and agile collaboration with our clients allows us to make possible cost-effective and reliable offshore solutions for their needs. We are pleased to be able to support this client in executing such a strategically important project in West Africa. ”

Aker Solutions has successfully deployed an autonomous drone system on Aker BP’s Edvard Grieg platform in the North Sea, enabling frequent, remote inspections controlled from an onshore centre in Stavanger.

The company recently achieved a milestone by completing its first offshore beyond-visual-line-of-sight (BVLOS) drone operation.

The inspection flight, conducted by a drone stationed on the platform, utilised autonomous navigation and advanced sensors to capture high-resolution imagery and data, marking a significant step toward fully autonomous offshore inspections.

The drone system includes an offshore docking station, supporting infrastructure, and custom software developed by Aker Solutions, complemented by an onshore control room.

It integrates airspace and AIS monitoring, along with two-way communication with the Helicopter Landing Officer (HLO) and platform leadership, ensuring seamless coordination.

By combining autonomous drones with AI-powered analytics, the system enables frequent, highly accurate inspections.

The drone captures consistent, precisely positioned images and videos, facilitating continuous equipment monitoring.

This allows for early detection of wear, corrosion, or other issues, enabling proactive maintenance to prevent escalation.

Autonomous drones, machine learning, and robotics are central to Aker Solutions’ digital strategy, which focuses on enhancing project execution, developing innovative services, and building a digitally ready organisation grounded in advanced data and software technology.

“We believe autonomous drones will revolutionise how inspection and maintenance are performed in the energy industry. Permanently deploying a drone on an oil platform — combined with robotics, AI, and digital technologies takes offshore maintenance to a new level, improving safety, reducing costs, and increasing efficiency across offshore asset management,” said Anja Dyb, SVP Life Cycle Services, Aker Solutions.

“Aker BP's operational strategy is based on the assumption that robotics and drones will be an integral part of observation, inspection and task executions offshore. These technologies will operate autonomously or remotely, either on-site or from land. The successful remote-controlled offshore drone operation at the Edvard Grieg platform, executed by Aker Solutions, is an important milestone for Aker BP as well," said Thomas Øvretveit, director of operations at Aker BP.

“We estimate that autonomous drones can reduce inspection costs by up to 70% and deliver detailed insights within hours — a process that traditionally takes days with manual drone operations,” said Joachim Hovland, head of drones and robotics.

MODEC has been awarded a contract by ExxonMobil Guyana to develop a floating production, storage and offloading (FPSO) vessel for the Hammerhead project.

MODEC has been awarded a contract by ExxonMobil Guyana to develop a floating production, storage and offloading (FPSO) vessel for the Hammerhead project.

MODEC will be delivering the contract in two phases, starting with front-end engineering and design (FEED) for phase one, followed by engineering, procurement, construction and installation (EPCI) for phase two.

Awaiting relevant government and regulatory approvals, the contract currently stands as a limited notice to proceed (LNTP) by ExxonMobil Guyana. This allows MODEC to begin the designing-related activities to meet the project startup deadline in 2029 following approvals. The second phase is subjected to further approvals as well as project sanction by ExxonMobil Guyana Limited and its Stabroek Block co-venturers.

Simultaneously, the Operations and Maintenance Enabling Agreement (OMEA) for MODEC’s Guyana fleet has been established to enable the operations and maintenance of multiple FPSOs under a long-term contractual arrangement.

The Hammerhead FPSO will have the capacity to produce 150,000 barrels of oil per day (bopd), along with associated gas and water. It will be moored at a water depth of approximately 1,025 meters using a SOFEC Spread Mooring System.

MODEC Group President and CEO, Hirohiko Miyata, said, "We are incredibly honored and excited to have been awarded this contract. It is a testament to our team's dedication, expertise, and commitment to delivering innovative and reliable offshore floating solutions. We look forward to collaborating closely with ExxonMobil Guyana to ensure the successful delivery of this second FPSO, contributing to the advancement of the offshore energy sector in Guyana."

Click here to register for Offshore Network's global well intervention and decommissioning conferences.

South East Asia’s decommissioning challenge is at a pivotal point. With an estimated 1,500 platforms and 7,000 wells nearing decommissioning by 2030, it is a challenge that is coming into sharp focus. But which country faces the greatest test?

South East Asia’s decommissioning challenge is at a pivotal point. With an estimated 1,500 platforms and 7,000 wells nearing decommissioning by 2030, it is a challenge that is coming into sharp focus. But which country faces the greatest test?

While Southeast Asia is a region with profound market differences, each of the main oil and gas-producing states faces a stern test ahead. According to recent insight article by Bureau Veritas South East Asia, the decommissioning journey ahead will not be simple, but with billions of dollars at stake, sustainable, economic and effective solutions must be found.

With over 630 offshore platforms, many of which are over 40 years old, Indonesia faces a great challenge ahead. Despite its comparatively limited decommissioning experience, Indonesia’s regulatory body, SKK Migas, is focused on enhanced oil recovery initiatives and maximising output from existing assets before decommissioning, notes Bureau Veritas, a world leader in testing, inspection and certification services. However, initial projects such as the Anoa field’s decommissioning and the removal of the Belanak floating storage and offloading unit have provided important learnings for future activity, it adds.

Brunei is home to some of the oldest oil and gas infrastructure anywhere in the wider Asia Pacific region. It is prioritising the phased abandonment of its shallow-water fields, including the Champion and Ampa fields, according to the Bureau Veritas article. With 214 offshore platforms and over 1,400 wells, the nation’s petroleum infrastructure is extensive, though, it notes. Decommissioning activities are supported by updated guidelines developed in collaboration with Brunei Shell Petroleum.

It is estimated that around 40% of Malaysia’s 300-plus offshore platforms are now over 30 years old — moreover, a significant number are operating beyond their design life. To address this problem, state oil company, Petronas, plans to invest around US$2bn in decommissioning activities over the coming decade. Future plans include plugging and abandoning approximately 153 wells and the abandonment of about 37 offshore facilities, as well as one onshore facility connecting the Sabah-Sarawak Gas Pipeline.

With 450 offshore platforms, Thailand is channelling its decommissioning efforts through initiatives such as Decomm 2.0, the Bureau Veritas article notes, which streamlines regulatory approvals under the Thailand Department of Mineral Fuels. According to Bureau Veritas, the nation’s legal framework, rooted in its Petroleum Act, provides “a strong foundation” for efficient and sustainable decommissioning activities.

Page 1 of 90