The Offshore Decommissioning Directorate is leading the implementation of Australia’s Offshore Resources Decommissioning Roadmap, a strategic initiative focused on growing the country’s offshore decommissioning industry. To better support the sector’s growth, the Directorate is seeking input from stakeholders to determine which decommissioning activities are most valuable to different industry players. This feedback will guide efforts to overcome barriers and make the decommissioning process more efficient.

The Offshore Decommissioning Directorate is leading the implementation of Australia’s Offshore Resources Decommissioning Roadmap, a strategic initiative focused on growing the country’s offshore decommissioning industry. To better support the sector’s growth, the Directorate is seeking input from stakeholders to determine which decommissioning activities are most valuable to different industry players. This feedback will guide efforts to overcome barriers and make the decommissioning process more efficient.

The Roadmap’s key objectives include promoting Australia as a global leader in safe, efficient, and environmentally responsible decommissioning practices, expanding the domestic decommissioning industry, and improving interactions with regulatory systems. While the National Offshore Petroleum Safety and Environmental Management Authority (NOPSEMA) remains the regulator for safety and environmental approvals in Commonwealth waters, the Directorate is working to enhance collaboration across the sector.

To achieve these goals, the Directorate is partnering with a wide range of stakeholders, including industry leaders, unions, state and territory governments, First Nations groups, local communities, and international organisations. By encouraging collaboration, improving transparency across the decommissioning pipeline, and offering expert guidance on policy matters, the Directorate aims to ensure that the decommissioning industry operates in line with the Australian Government’s Future Made in Australia agenda.

The Directorate is also focused on strengthening community confidence in regulatory frameworks, ensuring that decommissioning remains an offshore industry responsibility. By collaborating with other governments to share knowledge and best practices, the Directorate is helping to grow the industry’s knowledge base and position Australia as a leader in decommissioning globally.

Australia's decommisioning industry regulator, the National Offshore Petroleum Safety and Environmental Management Authority (NOPSEMA) in its Decommissioning Compliance Strategy 2024-2029 outlines the key steps taken to achieve its objective for decommissioning all petroleum wells, structures, equipment and property in Commonwealth waters.

NOPSEMA's vision is to ensure that all decommissioning activities are completed in a timely, safe and environmentally responsible manner. To achieve this, the authority has laid out a list of targets that aim to reduce uncertainity and support the transparency of NOPSEMA's regulatory actions. These targets provide simple, time-based expectations for decommissioning. The approach is shaped by criteria that focus on the time to end of production, uncertainity surrounding that timing, financial capacity and the titleholder's planning performance.

Potential regulatory actions for the four risk tiers in relation to decommissioning include:

Bhagwan Marine has partnered with Linch-pin to deliver the Thevenard Island Offshore Decommissioning Project contract for Chevron Australia.

Bhagwan Marine has partnered with Linch-pin to deliver the Thevenard Island Offshore Decommissioning Project contract for Chevron Australia.

With special focus on environmental sustainability, the retirement project involves safe removal and the repurposing of nine offshore platforms as reefs.

While Bhagwan Marine will be supplying the marine and diving spreads, Linchpin will cover engineering aspects and deploy skilled construction personnel.

A major win for Bhagwan Marine, the offshore services provider is aiming a seamless and successful execution of the project for Chevron. The company is confident of its expertise and ability to deliver complex projects of this nature.

Woodside Energy has prepared and submitted an experts-consulted, final environment plan (EP) to the National Offshore Petroleum Safety and Environmental Management Authority (NOPSEMA), in accordance with the requirements of the Offshore Petroleum and Greenhouse Gas Storage Act 2006 and Environment Regulations.

Woodside Energy has prepared and submitted an experts-consulted, final environment plan (EP) to the National Offshore Petroleum Safety and Environmental Management Authority (NOPSEMA), in accordance with the requirements of the Offshore Petroleum and Greenhouse Gas Storage Act 2006 and Environment Regulations.

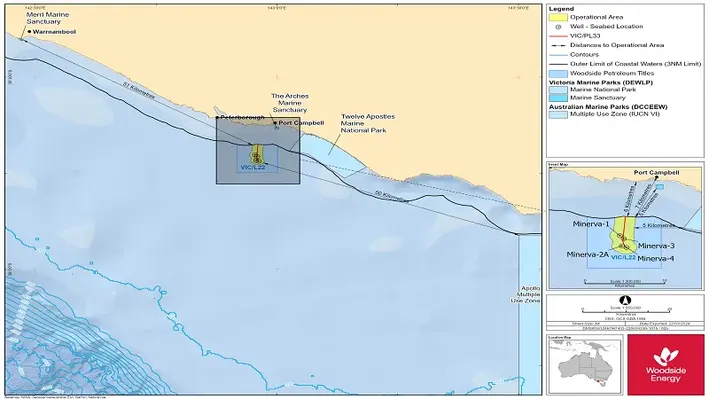

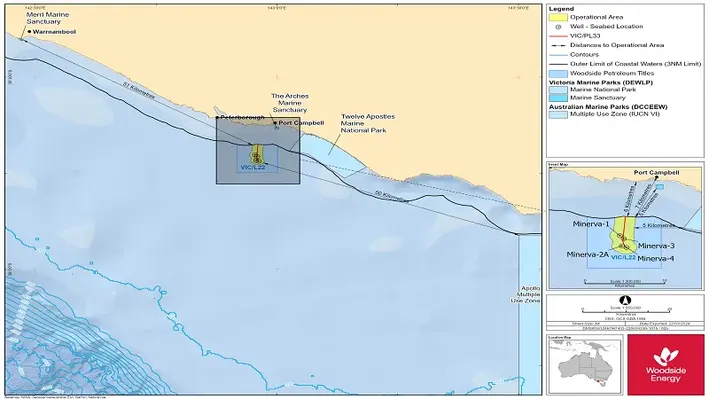

In the capacity of a titleholder under the Offshore Petroleum and Greenhouse Gas Storage (Environment) Regulations 2023 (Commonwealth), Woodside has proposed to undertake decommissioning activities within offshore petroleum production licence VIC/L22 and pipeline licence VIC/PL33.

It will include the removal of approximately 5 km of pipeline bundle and associated equipment, well tie-in infrastructure, and Minerva-2A wellhead and guide base that make up the Minerva subsea infrastructure.

As planning activities are well in progress, a rig has been secured for plug and abandonment in the Minerva field through a rig consortium with other titleholders in the region.

Keeping with the Environment Regulations, Woodside's EP has attempted to identify and describe the probable environmental impacts and risks that may arise during the end-of-life operations. It has worked out a process of appropriate management controls to reduce impacts and risks to a level that is ‘as low as reasonably practicable’ and acceptable. It defines Environmental Performance Outcomes (EPOs), Performance Standards (PSs) and Measurement Criteria (MCs) to ensure minimum adverse impact.

Woodside is planning the plug and abandonment of the Minerva-1, Minerva-2A, Minerva-3 and Minerva-4 wells (in accordance with a separate Minerva Plug and Abandonment EP), and removal of property in VIC/L22 and VIC/PL33 (under this EP).

Woodside's scope of decommissioning activity as mentioned in the EP is focussed in Commonwealth waters in the Otway Basin approximately 7 km south-southwest of Port Campbell, Victoria, where the Minerva subsea infrastructure is in approximately 55–59 m water depth at lowest astronomical tide (LAT). The operational area is thus defined as a 1,000 m radius around the subsea infrastructure, wellheads, and the gas production pipeline (the pipeline) within Commonwealth waters.

Spread over 24-hours per day, and seven days per week, Woodside believes the decommissioning activities might take up to 90-120 days, and completion is not anticipated before 30 June 2025.

Decom Engineering (Decom), a provider of green decommissioning solutions, has executed three market-entry Australian contracts to strengthen its position within the Asia Pacific region.

The company was commissioned to supply and operate its chopsaw cutting technologies on behalf of a major operator in the Bass Strait alongside two other clients in Australian waters. Together, the contracts amounted to more than UK£500,000.

The decommissioning specialist performed three cuts on a 20’’ concrete weight coated carbon steel rigid pipeline as well as 25 cuts on a 13’’ in-filled flexible flow line jumper, with a 4.5’’ piggy back. This was achieved through the deployment and use of its C1-24 chopsaw at water depths of around 400 m. Meanwhile, another C1-24 chopsaw was utilised on assets in the country’s North West Shelf at water depths of around 500 m.

Decom Engineering Managing Director, Sean Conway, remarked, “The award of these three contracts by major operators is a clear signal that our commitment to the Australian decommissioning sector is being rewarded. With the extensive track-record Decom has established on projects in the UK North Sea, Africa and Asia, we judged that now was the right time for us to enter the Australian market and we are keen to be part of the sector’s journey to sustainability.”

The commitment to the country took the form of a significant investment in the region of UK£500,000 in order to establish infrastructure and relocate equipment and personnel to be reactive to local market demands. This decision was taken after the company recognised the remarkable opportunity that Australia presents, leading Decom to recognise it as strategic market for its future growth. This is also in line with a wider growth directive for the Asia Pacific market, with Decom investing upwards of UK£2mn to design and manufacture a nine-strong portfolio of chopsaws and supporting equipment (including control panels, spares and consumables) which have been used of projects throughout the region.

“We are excited to be kicking off three Australian projects in tandem and look forward to building a strong relationship with our customers,” Conway added. “As our reputation grows, we will replicate our AsiaPac model by investing in facilities, equipment and personnel in Australia, to provide cutting edge technologies which will assist contractors and operators looking for cost effective and environmentally sound decommissioning solutions.”

Following initial success, the company is aiming to introduce its Pipe Coating Removal (PCR) system to Australia in order to offer a full-service decommissioning option for redundant oil and gas steel pipes. The PCR strips steel tubulars of coating and transforms the pipe into a reusable product suitable for other uses.

Conway concluded, “To date our PCR system has processed more than 30,000 tonnes of steel tubulars from surplus prime and decommissioned oil and gas fields and we think that this is an offering which could introduce significant environmental and financial benefits to the massive Australian decommissioning sector.”

Cooper Energy Limited, an exploration and production company, has announced that the Helix Q7000 vessel has commenced work on the first well of the Basker Manta Gummy (BMG) decommissioning programme.

Although the company admitted that progress has been slower than anticipated, it is now making headway on the project with the Helix Q7000 – a purpose-built DP3 semisubmersible vessel from Helix Energy Solutions – now commencing work on the Basker-3 well after initially arriving late to the BMG field. The late arrival of the vessel resulted in Cooper Energy incurring more than three months of holding costs for the remaining contractor spread on the BMG programme and, in addition, more time was required during start-up activities due to factors such as loading of equipment and integration of the Integrated Riser System (IRS).

While Cooper Energy does not anticipate the start-up delays to impact the remainder of the project, the slow progress means re-forecasting of the programme for the remaining six BMG wells is required. As a result of this, the company has revised its mid-case cost estimate for the BMG decommissioning from AUS$193-198mn to approximately AUS$240-280mn. In order to keep this as low as possible, the company has indicated it will be applying learnings from the Basker-3 decommissioning work to the remaining wells. In addition, where possible, Cooper Energy and its contractors will aim to simplify the scope of decommissioning.

While the focus remains on executing the decommissioning programme safely and within the minimum time possible, the company has indicated there are certain risks retaining, including variables outside of the company’s control that could increase the total cost of the decommissioning programme.

Previously, the Helix Q7000 was at work offshore in New Zealand, conducting a decommissioning campaign on the Tui oil field. Click here to learn more.

McDermott, a fully-integrated provider of engineering and construction solutions to the energy industry, has been awarded an engineering, procurement, removal and disposal contract by Santos for the full removal and disposal of the Campbell platform structure.

The platform is part of the Varanus Island Hub offshore Western Australia. McDermott has agreed to provide project management and engineering services for the removal and transportation of the platform topsides, structure and associated items to an onshore facility. There to be dismantled and disposed.

Mahesh Swaminathan, McDermott's Senior Vice President, Subsea and Floating Facilities, remarked, “Our successful, proven track record of project delivery spans the entire energy value chain. This decommissioning award reflects the commitment we share with Santos to timely, safe, and environmentally responsible removal of infrastructure at the end of its operational life cycle. We look forward to continuing to be part of delivering their sustainability commitments while also contributing to the circular economy for a lower carbon future.”

The contract is regarded as ‘sizeable’ by McDermott, being between US$1mn and US$50mn. The project management and engineering will be conducted by the company’s team in Perth with support from Indonesia and Malaysia. It represents the fourth decommissioning contract executed by McDermott in the country in the last two years.

Woodside Energy, an Australian petroleum exploration and production company, has safely and successfully lifted the 83 m-long Nganhurra Riser Turret Mooring (RTM) onto a barge off the North West Cape in Western Australia.

Following the successful lift, the RTM is now transitioning to the Australian Marine Complex (AMC) near Perth. Upon arrival, it will be cleaned and deconstructed for recycling and reuse – more than 95% of the RTM is expected to be eligible for this.

In a world-first, the heavy lift vessel Heerema Aegir, with three supporting tugs, lifted the 2,500 tonne RTM onto a 120 m barge where it was secured ahead of its journey to the AMC. Woodside has presented the removal as a demonstration of its abilities to manage activities in the sensitive marine environments where it operates.

The Nganhurra RTM brought subsea production lines from the Enfield oil field to a floating production storage and offloading facility. Enfield ceased production in November 2018 and the RTM is being removed as part of decommissioning activities at the field, which also includes the permanent plugging and abandonment of 18 former production wells.

The decommissioning concept for the Nganhurra RTM was matured over more than two years of careful planning and detailed engineering, undertaken in conjunction with a range of specialist contractors.

In-field preparatory activities included remote operated vehicle inspections, removal of redundant equipment and installation of a purpose-built lifting point.

Following an assessment of the forecast weather and sea-state, the remaining mooring lines were cut, and the RTM was towed to a sheltered location to ensure the lifting operation could be executed safely. After the RTM is unloaded at AMC, it will be cleaned of marine growth and deconstructed for recycling and reuse opportunities, supporting local employment and contracting opportunities.

The Maritime Union of Australia (MUA) has launched a report produced alongside the Macquarie University’s Centre for Energy and Natural Resources Innovation and Transformation calling for a major shakeup in government policy and regulation for the dismantling, processing, recycling and disposal of offshore oil and gas infrastructure.

The Maritime Union of Australia (MUA) has launched a report produced alongside the Macquarie University’s Centre for Energy and Natural Resources Innovation and Transformation calling for a major shakeup in government policy and regulation for the dismantling, processing, recycling and disposal of offshore oil and gas infrastructure.

The report focuses on the decommissioning processes of offshore infrastructure and the necessary next steps once the structure are removed.

MUA’s Assistant National Secretary, Adrian Evans, said, “Australian maritime workers built and maintained our offshore oil and gas industry throughout the latter decades of the 20th Century, and with our eyes set firmly on the need to decarbonise our economy and diversify our renewable energy supplies the MUA is advocating for a sustainable and clean withdrawal from offshore oil and gas that includes the comprehensive removal and recycling of the massive volume of disused offshore equipment.”

The MUA and the Centre for Energy and Natural Resources Innovation and Transformation have examined Australia’s international and legal obligations and domestic laws relating to the decommissioning and disposal of the offshore infrastructures and have identified gaps in the legal framework, analysed best practice in mature jurisdictions and provided a series of recommendations for the development of the Australian government’s policy.

Mich-Elle Myers, MUA Assistant National Secretary, commented, “Offshore energy projects have provided generations of members with rewarding and fulfilling work building and maintaining the infrastructure that powers our economy. That’s not going to change with the shift to offshore renewable projects, and as older oil and gas projects wind down and come offline we have a collective obligation to remove and dispose of these installations thoroughly and sustainably.”

The recent 'Decommissioning and Abandonment Australia 2023' conference held in Perth saw many insightful presentations from a distinguished list of speakers. On the legal and regulatory side, Ben Adamson, a lawyer from HFW, an international law firm specialising in offshore energy and maritime law, provided a diverse audience with an in-depth dive into Australia’s offshore decommissioning regime.

The recent 'Decommissioning and Abandonment Australia 2023' conference held in Perth saw many insightful presentations from a distinguished list of speakers. On the legal and regulatory side, Ben Adamson, a lawyer from HFW, an international law firm specialising in offshore energy and maritime law, provided a diverse audience with an in-depth dive into Australia’s offshore decommissioning regime.

Ben kicked off his presentation with a briefing on the international framework relevant to decommissioning, which is driven primarily by United Nations Convention of Law of the Sea (UNCLOS) and the International Maritime Organisation (IMO). He then transitioned his presentation to discuss Australian legislation designed to enforce local decommissioning obligations. Of particular interest were his comments comparing and contrasting various national regulatory regimes, which appear to vary significantly between countries and offshore regions.

Ben pointed out that nothing in the Australian offshore oil and gas industry happens in a vacuum. An overlay of international laws and conventions exists that will continue to have a real effect on how Australia regulates the large pipeline of decommissioning work set to take place over the next two decades.

Revamped regime

The most important parts of the Australian offshore decommissioning regime are set out in the Offshore Petroleum and Greenhouse Gas Storage Act 2006 and its various regulations. Parts of the Act relevant to decommissioning underwent a major overhaul in 2021 to make the legislation fit for purpose and to respond, in part, to an unfortunate series of events where the decommissioning of an Australian FPSO and associated offshore field fell at great cost to the Australian taxpayer following the insolvency of the titleholder.

As Ben set out, the Australian government appears anxious to avoid a repeat of such events. The central pillar of the revamped Australian decommissioning regime is that titleholders must maintain and repair all structures, equipment and property brought into a field. Once the structure, equipment or property is no longer in use, titleholders must remove it. If the current titleholder is not available, or is unable or unwilling to undertake decommissioning, the Australian government has the power to bring former titleholders (as well as a range of other parties) back to decommission the offshore asset.

Trailing liability

The most important and topical of the changes to Australia's offshore decommissioning regime is what Ben described as trailing liability. Common in some other offshore jurisdictions around the world, trailing liability means that the government has the power, as a last resort, to 'call back' a past titleholder to remediate the environment or remove property. In that context, Ben raised some pertinent questions such as what would or could occur if at some distant point in the future a plugged well began leaking oil. Who will (or should) be brought back under a trailing liability regime to remediate it? Is it fair to force a former titleholder to decommission a well where that titleholder was at some point operating the field, but was otherwise not responsible for drilling or plugging the well?

In addition, Ben canvassed a number of other as-yet unresolved aspects of Australia's new decommissioning laws that arise from trailing liability. For example, what is the fair approach regarding small-percentage titleholders that form part of a joint venture comprising the titleholder? In the event that a former titleholder must decommission an asset, should they be entitled to tax breaks? Further, as Ben put it, can titleholders ever get a 'clean break' from a field after legitimately divesting their interest, if the spectre of trailing liability exists in perpetuity? As Ben concluded, current Australian decommissioning laws do not fully address these tricky issues, as well as a host of other issues raised by the new regime.

The second important point under the new Australian framework is that surrender of titles can only occur with the consent of the regulator. If a titleholder has not done the necessary decommissioning and the field is nearing the end of its life, Ben pointed out that with the passage of the amendments to the legislation, it will be difficult for the titleholder to transfer title, especially to a more speculative entity attempting to extract profit from an aging field.

In light of the major overhaul to Australia's decommissioning laws, Ben's opinion was that the most interesting aspect of Australia's updated decommissioning regime is how the regulator will manage its growing regulatory burden while upholding Australia's decommissioning obligations under international law. This is a complex and involved area that will evolve over time.

Increased accountability from titleholders

In terms of the role the Australian oil and gas regulator plays, the revamped decommissioning regime hands the regulator a new arsenal of powers to enforce titleholders' decommissioning obligations. Broad powers now exist to monitor and if necessary, intervene to stop, changes to the control of a titleholder, and passage of title from one titleholder to another.

Now, a change of ownership at the level of the titleholder is firmly within the regulator's grasp. Ben stated that players in the market can expect the regulator to act should it conclude, for example, that the entities taking control of a titleholder are not suitably resourced or experienced, or do not have the appropriate financial backing to carry out decommissioning. Before concluding his remarks about the new Australian regime, Ben reiterated that the trailing liability laws and powers to intervene in changes to control of the titleholder do not directly apply to contractors, employees, banks or customers.

The second part of Ben's presentation was a practical discussion on what a typical decommissioning contract may look like from a risk management perspective. He prefaced the discussion by setting out the typical options presented to those engaged in work offshore: either transfer risk, or accept it, insure against it, and price it in. Although decommissioning is a highly specialised undertaking, in Ben's view, the major themes and principles underlying contracts typically found in the offshore oil and gas sector would be relevant for offshore decommissioning contracts.

The offshore industry is a unique environment and there have been, over a long period of time, contractual terms developed that deal with the unique risk and liability issues faced in the offshore setting. Ben was clear that the typical knock-for-knock indemnity arrangements so common in the wider offshore and maritime world would likely be retained in decommissioning contracts, because these terms allowed contracting parties to either transfer risk, or assume it and insure against it.

Dealing with waste

Perhaps the biggest difference between typical offshore contracts and decommissioning contracts is how waste is dealt with. This aspect of Ben's presentation was directed to those in the audience who are preparing to deal with the vast volume of waste equipment, assets and material that is expected to be generated over the coming decades as Australia tackles its offshore decommissioning task. The big questions in this space are: what is to be done with the waste (some of it clearly hazardous) and crucially, how risk and title in the waste may be transferred between contracting parties. Ben recounted the difficulty his clients experienced exporting Australian offshore oil and gas waste overseas. As a final parting word, he challenged those present to develop local, home-grown waste disposal alternatives to avoid the issues arising in sending Australia's hazardous waste overseas.

Reflex Marine's STORM-WORK suspended work basket was successfully employed in its 100th offshore project in October 2020.

Reflex Marine's STORM-WORK suspended work basket was successfully employed in its 100th offshore project in October 2020.

The STORM-WORK was designed specifically for offshore industrial work activities and was very well received by offshore operators across industries – heavylift, decommissioning, oil & gas, and offshore wind. ConocoPhillips in Australia is using the customised enlarged version of STORMWORK while the standard units have been employed in multiple projects throughout Europe, among others, with Seaway7.

The design, safeguarding both the workers inside the basket and the assets worked on thanks to the soft-touch features and contoured shape, is praised by users worldwide. The small footprint and light weight allow for improved manoeuvring, while the highly durable, low-maintenance materials used ensure long unit lifespan.

“The unit is excellent for accessing areas with obstacles and tight landing spaces," comments a STORM-WORK user from Boskalis. Reflex Marine’s innovative work basket design has been recognised by industrial engineering body LEEA with an award in the Safety category confirming the outstanding crew protection features and safety benefits.

STORM-WORK is available for purchase and hire and can be customised to meet the required size and capacity.

C-Kore Systems has announced the successful completion of a decommissioning campaign offshore Western Australia.

C-Kore Systems has announced the successful completion of a decommissioning campaign offshore Western Australia.

The campaign was completed using C-Kore Sensor Monitor units to interrogate the wellhead pressure and temperature sensors on the oilfield. With their automated test routine, the Sensor Monitor units repeatedly tested and data-logged the information, allowing the operator to complete the campaign swiftly and safely.

Cynthia Pikaar, Sales & Marketing Manager for C-Kore, said, “It is fantastic to be working on this project in Australia. With an increasing number of orders for our Sensor Monitor tools, operators understand the value of our testing tools offer, automating and data-logging results. We look forward to working in Australia again on the next campaign.”

C-Kore Systems has a range of subsea testing tools used globally for decommissioning, fault-finding and new installation campaigns. The tools can be operated without the need for C-Kore personnel to be present, providing rapid feedback. The systems offer significant operational savings to testing campaign with the simple, accurate and reliable deployment.

Page 1 of 4