With some of Vietnam’s older fields entering the decommissioning stage, reflecting the maturity of south-east Asia’s offshore oil and gas sector, the industry is still capable of throwing up a surprise or two.

With some of Vietnam’s older fields entering the decommissioning stage, reflecting the maturity of south-east Asia’s offshore oil and gas sector, the industry is still capable of throwing up a surprise or two.

In a move that should stir longer-term demand for oil well services of all kinds, Vietnam has just unearthed its largest discovery in a generation.

For US independent Murphy Oil Corporation, 2026 truly began with a bang with the drilling of the Hai Su Vang-2X (HSV-2X) appraisal well in Block 15-2/17 in the Cuu Long Basin, yielding what is thought to be the biggest find across the region in 20 years.

Located approximately 40 miles off the coast of Vietnam, the well spud in early October 2025 and marks a major milestone in Murphy’s strategic appraisal campaign for the Hai Su Vang (Golden Sea Lion) field.

The HSV-2X well was drilled to appraise the 2025 Hai Su Vang discovery, where an initial discovery well encountered approximately 370 feet of net oil pay across two reservoirs.

The HSV-2X well encountered 429 feet of net oil pay across the same two reservoirs, including 332 feet of net oil pay in the deeper primary reservoir and 97 feet of net oil pay in the shallow reservoir.

While further testing is ongoing, the primary reservoir achieved a production rate of 6,000 barrels of oil per day (bopd) of high-quality, 37-degree API oil.

These results confirm Hai Su Vang as a “significant discovery,” a Murphy Oil statement noted, pushing up resource estimates at the site beyond the initial 430 MMBOE high-end range.

“This is a pivotal moment for our Vietnam business,” said Eric Hambly, Murphy Oil’s President and CEO.

“The success of HSV-2X not only reinforces the commerciality of the Hai Su Vang field but also sets the stage for a robust development programme.”

Additional appraisal wells are needed to further refine the range of recoverable resources for both reservoirs — the HSV-3X appraisal in Block 15-1/05, and the HSV-4X well in Block 15-2/17 are both included in the group’s 2026 capital programme.

It also bodes well for the Cuu Long Basin going forward and the scope for oil well services in the region.

Now considered a mature basin, work on decommissioning, dismantling and relocation of Vietnam’s Song Doc Platform is already underway.

It means news from the Murphy Oil camp at the start of 2026 will be welcomed by the whole services industry.

Norwegian offshore vessel owner and subsea services specialist DOF Group has strengthened its position in the Asia-Pacific (APAC) market after securing two significant offshore contracts for vessels and integrated subsea services.

Norwegian offshore vessel owner and subsea services specialist DOF Group has strengthened its position in the Asia-Pacific (APAC) market after securing two significant offshore contracts for vessels and integrated subsea services.

The first agreement is a three-year frame contract covering subsea inspection, maintenance and repair (IMR) services across the APAC region. As part of this deal, DOF has already confirmed a call-off that will deploy the dive support vessel (DSV) Skandi Singapore. The campaign will focus on diver-less subsea operations for a brownfield tieback project, scheduled to take place in the first half of 2026.

In addition, DOF has been awarded a second contract linked to a hook-up campaign. This scope of work will be carried out by the multipurpose support vessel (MPSV) Skandi Hercules, with offshore activities also planned for the first half of 2026.

Together, the two contracts are valued at between US$25MN and US$50MN and will see DOF deliver its full range of in-house capabilities. These include project management, engineering, procurement and logistics support, reinforcing the company’s end-to-end offshore services offering.

The combined duration of the offshore campaigns is expected to span between 90 and 120 days, highlighting sustained demand for subsea expertise and offshore construction services in the APAC energy market.

Mons S. Aase, CEO of DOF, said,“We look forward to delivering safe, efficient, world class subsea and marine services, further enhancing our reputation as a trusted partner in the APAC region.” said .

The latest contract wins underline DOF’s growing momentum in offshore energy services and its strategic focus on long-term opportunities in the Asia-Pacific region.

As the year draws to a close, Esso Australia will remember 2025 as a year of several milestones achieved in terms of decommissioning.

As the year draws to a close, Esso Australia will remember 2025 as a year of several milestones achieved in terms of decommissioning.

Tackling Australia’s largest decommissioning project, the company has completed nearly US$3bn of initial works across offshore operations. This included the permanent sealing of more than 200 wells in Bass Strait, and processing over 10,000 tonnes of steel and concrete for recycling or disposal at Barry Beach Marine Terminal.

The company started out with abandonment activities in the Bream B platform, which was an unstaffed facility. As part of the first phase of a series of high-level decommissioning campaigns, the platform's topsides that formed concrete gravity structures, were removed. The Valaris 107 jack-up rig was deployed to commence plug and abandonment activities across 21 platform-based wells at Bream B. While these activities begun as early as 2024, this year saw the second stage of the plug and abandonment scope.

Other areas of work included end-of-life activities on open water exploration wells and comparatively older wells before moving on to Halibut, which is nearly 60-year old. This work followed extensive inspections on underwater platforms as well as on structural platform above water, including flare booms. Extra-solid steel piled jackets supporting the Halibut platform that needs removal will be around 70-m long, roughly implying the height of a 20-storey building on land.

Work on the Haliburt platform will be followed by decommissioning activities on Esso's first platform, Marlin One.

Other activities completed this year includes abandoning as many as 222 platforms while restoring the original caprocks.

Once Barry Beach work was opened to shareholders for feedback, the company had to rethink its approach and avoid expansion of the port at Barry Beach so as to ensure minimal impact on the Ramsar wetland and onshore environment. Barry Beach is now being equipped with hardstand to accomodate the structures when they arrive.

These activities form a part of solid groundwork by Esso Australia, which will prepare the company before the world’s largest construction vessel, the Allseas Pioneering Spirit, arrives, and will travel from the Netherlands to start removal of 12 retired offshore facilities in 2027.

The Asia-Pacific offshore oil and gas sector advanced significantly in well decommissioning and abandonment during Q4 2025, with key developments in regulatory frameworks, cost assessments, and workforce development amid a projected regional spend of US$30-100bn by 2030 for over 7,000 wells and 1,500 platforms.

Australia took centre stage with the release of its Offshore Resources Decommissioning Roadmap on 9 December.

This government initiative outlines strategies to foster a domestic decommissioning industry, emphasising timely and environmentally responsible removal of infrastructure, workforce training, and international partnerships.

It projects approximately A$60bn in spending over the next 30-50 years, supporting economic opportunities while aligning with net-zero transitions.

Complementing this, a November report by Xodus Group revised Australia's offshore decommissioning liability downward to A$43.6bn (A$66.8bn inflation-adjusted) through 2070, covering over 700 wells, 7,600 km of pipelines, and 520 subsea structures.

The reduction stems from refined forecasting, advancements in well plugging and abandonment (P&A) techniques, and potential efficiencies from coordinated campaigns and emerging technologies.

In Malaysia, Petronas launched the Hydraulic Workover Unit (HWU) Academy on 23 October to address skills shortages in well abandonment.

The academy, a collaboration with industry partners, universities, and government ministries, offers hands-on training using retired assets to build national expertise for safe, cost-effective P&A operations.

This supports Petronas' ongoing plans to plug and abandon around 153 wells and decommission 37 offshore facilities through 2027-2028.

These initiatives underscore the region's focus on cost management, regulatory compliance, and local capacity as Southeast Asia prepares for its decommissioning peak.

Innovations like rigless P&A and rigs-to-reefs are gaining traction to balance economics and environmental stewardship.

As 2025 closes, stakeholders anticipate accelerated activities in 2026, driven by maturing fields and energy transition pressures.

Petronas' natural gas development project offshore Brunei Darussalam will see engineering, procurement, construction, installation and commissioning (EPCIC) work by McDermott.

Petronas' natural gas development project offshore Brunei Darussalam will see engineering, procurement, construction, installation and commissioning (EPCIC) work by McDermott.

A subsea contract between Petronas and McDermott, this follows front-end engineering design, engineering optimisation and readiness planning delivery for the project, also by McDermott.

A significant conventional gas project from Brunei, the latest contract will require McDermott to support the development of a subsea production system and associated infrastructure. The company will be delivering umbilicals, risers and flowlines, which will connect six wells to a floating production unit for natural gas recovery. It will also cover EPCIC services for a gas export pipeline that will supply feedstock to Brunei's liquefied natural gas (LNG) sector.

"Transitioning from FEED to a full EPCIC award underscores McDermott's engineering excellence and proven ability to deliver complex subsea projects across the region," said Mahesh Swaminathan, McDermott's Senior Vice President, Subsea and Floating Facilities. "It also reinforces McDermott's collaborative approach in working with customers to drive engineering value. We look forward to continuing our collaboration with PETRONAS Carigali Brunei and its partners to advance this project safely and efficiently."

Project management will be led from McDermott's engineering center of excellence in Kuala Lumpur, Malaysia, supported by teams across other McDermott offices and project sites.

The Brunei gas development project aims to deliver a long-term solution for natural gas supply, covering the region's domestic energy needs and LNG export commitments.

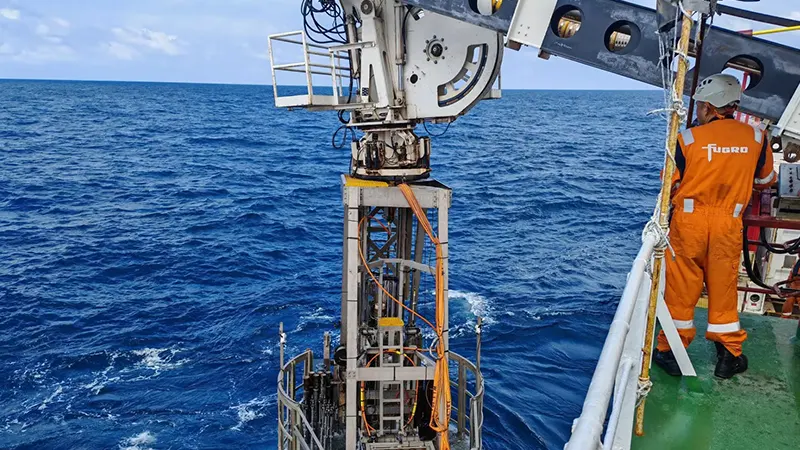

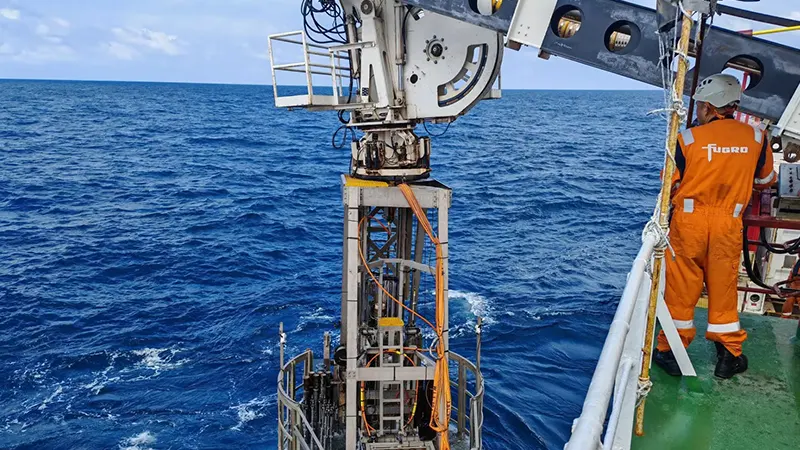

Fugro has secured a significant contract with Mubadala Energy (South Andaman) RSC Limited to deliver cutting-edge soil investigation services for the South Andaman Deepwater Development offshore Indonesia.

Fugro has secured a significant contract with Mubadala Energy (South Andaman) RSC Limited to deliver cutting-edge soil investigation services for the South Andaman Deepwater Development offshore Indonesia.

ADES Holding has secured a new contract for its Compact Driller standard jack-up through its Shelf Drilling subsidiary for work offshore Brunei.

ADES Holding has secured a new contract for its Compact Driller standard jack-up through its Shelf Drilling subsidiary for work offshore Brunei.

The contract, awarded with Brunei Shell Petroleum, covers plug and abandonment operations offshore, and is expected to commence in Q4 2026. The contract has a two-year term and is worth approximately US$63mn.

Mohamed Farouk, CEO of ADES Holding, said, “We are delighted to announce our first contract award following the successful acquisition of Shelf Drilling, a milestone that reinforces our strategic vision and solidifies our presence in Southeast Asia, a region of immense opportunity and growth. This award reflects Shelf Drilling’s proven track record of safety and operational excellence, particularly its unique experience delivering P&A services in the region.

“This track record underscores the rationale behind our acquisition. We are pleased to begin our partnership with BSP and remain committed to delivering safe and efficient operations in support of their activities in Brunei. It is a testament to the dedication of the combined teams and the strength of our integrated platform. We look forward to building on this momentum and continuing to deliver exceptional results for our clients and partners.”

Malaysian well interventions specialist, United Asiapac Energy Bhd, has launched an initial public offering (IPO) on the ACE Market of the local stock exchange.

Malaysian well interventions specialist, United Asiapac Energy Bhd, has launched an initial public offering (IPO) on the ACE Market of the local stock exchange.

According to filings lodged with Bursa Malaysia, the company aims to use the IPO to bolster its services and operational capabilities to take advantage of emerging opportunities in Malaysia’s upstream sector.

Specifically, that includes plans to strengthen its technical capabilities by acquiring new well intervention tools and equipment.

“To support future business growth, it is essential that our group has available well intervention tools, equipment and DNV-certified cargo baskets that we can mobilise

simultaneously in order to meet our project deadlines,” its stock market prospectus notes.

In line with this goal, the company plans to acquire a break-out unit for installation at its Kemaman base, to be used for the assembly and testing of well intervention tools.

Presently, the group’s tools and equipment are transported to a third-party facility within the Kemaman base for assembly, testing and inspection, which requires careful planning to ensure project timelines are met and incurs additional logistical costs.

“We also intend to purchase DNV-certified cargo baskets, which are used to transport tools during every mobilisation,” the company added.

The group boasts strategic locations in Kemaman and Labuan, which it claims give it a competitive edge over other industry players, which are predominantly international firms.

United Asiapac Energy added that it also intends to introduce new well intervention solutions to broaden its service offering.

“We plan to introduce e-line, slickline and wireline recovery services, particularly for small hole fishing,” its prospectus notes.

“In addition, we plan to offer hydrocarbon well cleanout services to remove obstructions and debris through the procurement of specialised tools. This expansion is a direct response to increasing market demand and enquiries from existing and prospective clients seeking for well intervention solutions under a single service provider.”

The company also said that it intends to expand its services in Sabah, as well as acquire a new corporate office in the Kuala Lumpur area.

Sarawak expansion is also in its sights.

“We aim to expand our market presence in well intervention solutions within Sarawak,” it notes in the Bursa Malaysia filings.

“The state presents significant opportunities for growth, driven by the anticipated increase in greenfield exploration activities and the maturing of existing hydrocarbon fields. With new fields being explored and developed, and mature fields nearing the end of their productive life, the resulting demand for well intervention, particularly P&A services, appears promising.”

HEA Energy, a fast-growing offshore services provider based in the UAE, has officially expanded its fleet with the addition of HEA Survey, a highly versatile subsea support and survey vessel designed to meet the evolving demands of modern offshore operations.

HEA Energy, a fast-growing offshore services provider based in the UAE, has officially expanded its fleet with the addition of HEA Survey, a highly versatile subsea support and survey vessel designed to meet the evolving demands of modern offshore operations.

The ABS-classed, Panamanian-flagged vessel represents a major step forward for the company as it continues to strengthen its capabilities across the Middle East’s offshore oil, gas, and renewable energy markets.

Built by Jiangsu Islands Shipbuilding in China, HEA Survey was conceived as a multi-role offshore workhorse capable of undertaking a wide spectrum of subsea activities. These include high-precision survey work, ROV support, subsea inspection campaigns, light well intervention, dive support, heavy lifting, firefighting duties, and anchor-handling operations. Although the vessel’s construction began in 2013 and was significantly delayed, with completion only achieved in late 2024, she emerges with a thoroughly modern design tailored to today’s offshore requirements.

Measuring 59.25 metres in length with a beam of 15 metres, the vessel features a robust diesel-electric propulsion system engineered for operational flexibility. Two 2,100hp engines, paired with multiple generators and controllable-pitch propellers, deliver up to 12 knots while enabling dynamic load management. This configuration allows the vessel to operate efficiently during low-speed survey work or station-keeping a critical capability for precision subsea tasks. An electrically driven bow thruster further enhances lateral manoeuvrability, making the vessel suitable for operations in both shallow and deepwater environments.

A considerable 350-square-metre aft working deck, reinforced to handle seven tonnes per square metre, gives HEA Survey the capacity to support modular mission packages such as ROV hangars, geotechnical equipment, and ISO container-based systems. With a maximum payload of up to 500 tonnes and a 25-tonne SWL crane, the vessel is well-equipped for heavy offshore logistics and deployment work.

Despite not being DP-classed, the combination of controllable-pitch propellers, bow thrusters, and a diesel-electric system ensures reliable station-keeping for a broad range of survey and subsea activities. The vessel also features a complete suite of modern navigation and communication electronics, including S- and X-band radars, AIS, echosounder, GPS, Doppler log, and MF/HF radio equipment.

Accommodation onboard is fully air-conditioned and compliant with ILO standards, providing comfortable living quarters for up to 48 crew members across a mix of single, double, and quad cabins. Safety provisions are SOLAS-compliant, with liferafts, immersion suits, fire monitors, and a dedicated MOB boat with davit launch capability.

Entering service in the UAE, HEA Survey positions HEA Energy to meet growing regional demand for multi-role offshore support vessels particularly within subsea construction, well intervention, offshore survey campaigns, and the expanding clean-energy marine sector.

MISC has secured a major contract from Petronas Carigali for the provision of a Floating Production Storage and Offloading (FPSO) unit in support of a key natural gas development project in Brunei.

MISC has secured a major contract from Petronas Carigali for the provision of a Floating Production Storage and Offloading (FPSO) unit in support of a key natural gas development project in Brunei.

This significant award follows an international competitive bidding process, with MISC emerging as the chosen partner for the project.

The contract stipulates a 12-year charter for the FPSO, with an option for Petronas Carigali to extend the agreement for up to three additional one-year terms. MISC will also take responsibility for the operation and maintenance of the floater throughout the charter period. The FPSO is expected to begin operations in the first half of 2029, playing a pivotal role in the Kelidang offshore gas development.

While MISC has not disclosed the specific name of the project, it is confirmed that the floater will be deployed in the Kelidang field, located approximately 125 kilometres off Brunei’s coast. The gas development encompasses three key discoveries: Kelidang North East, Keratau, and Keratau South West.

The project is a collaboration led by Petronas Carigali, in partnership with Shell and Brunei National Petroleum Company. Central to the project’s development is the installation of the FPSO vessel, designed to handle up to 450 million standard cubic feet per day (mmscf/d) of gas. The FPSO will be stationed at a depth of around 150 metres, supported by an advanced network of subsea flowlines connecting up to six subsea wells, each located at depths reaching up to 2,000 metres.

The pre-bid process began in January 2024, with leading contenders such as Yinson, Bumi Armada, and others competing for the deal. The project's total capital expenditure is estimated at around US$750mn, positioning it as a high-profile energy investment in the region.

Increased drilling know-how and technology adoption is helping to build momentum at CNOOC Limited, including advanced tools for oil well intervention.

Increased drilling know-how and technology adoption is helping to build momentum at CNOOC Limited, including advanced tools for oil well intervention.

Most recently, the company announced the start of production from its Weizhou 11-4 Oilfield Adjustment and Satellite Fields Development Project in the Beibu Gulf Basin of the South China Sea, its latest completion.

Presenting its 2025 interim results, back in August, CNOOC flagged how it remained committed to innovation-driven growth, utilising digital and intelligent tools in its upstream work.

Net production increased by 6.1% year-on-year, while natural gas was up 12% in the same period, a reflection of its prowess in the field.

Key technologies for reserves and production growth were developed and applied, the company noted in a statement, while reserve utilisation and oil recovery rates continued to improve, and natural decline rates of oilfields offshore China remained at a low level.

“Intelligent injection-production technologies were deployed on a large scale to help control the natural decline rate,” the company added.

Advanced geophysical technologies were also applied to improve the quality of seismic data from deep plays.

CNOOC added that it promoted intelligent drilling and completion, with the construction speed of demonstration projects accelerating by 26%.

It also integrated satellite remote sensing, unmanned equipment, and AI algorithms, to enhance its emergency response capability against typhoon-related risks, laying solid foundation for safe production.

Its latest Weizhou 11-4 development, located in water depths of 43 metres, leverages various adjacent existing facilities.

The main production facilities include a newly-built unmanned wellhead platform and a central processing platform, connected to an existing platform through a trestle bridge.

Under the development plan, 35 development wells are set to be commissioned, including 28 production wells and seven water injection wells.

The project is expected to achieve a plateau production of approximately 16,900 barrels of oil equivalent per day in 2026.

The offshore decommissioning market is entering a phase of significant change, particularly across the Asia–Pacific region, where ageing infrastructure, evolving regulations, and rising environmental expectations are reshaping industry priorities.

Governments throughout APAC are tightening their regulatory frameworks, introducing more comprehensive guidelines to ensure that the dismantling of offshore assets is carried out responsibly and with minimal environmental impact. These regulatory pressures are pushing operators to embrace innovative, sustainable technologies as they update their decommissioning strategies.

A major influence on this shift is the accelerating move towards renewable energy. As countries in the region prioritise cleaner energy sources, many oil and gas platforms are being retired to make room for offshore wind developments and other low-carbon alternatives. This transition is generating sustained demand for specialist decommissioning services, creating opportunities for companies able to support safe and efficient asset removal.

Collaboration is also becoming a defining feature of the offshore decommissioning market. Operators, contractors, and regulators are increasingly pooling expertise to streamline projects, share resources, and establish consistent industry standards. This cooperative approach supports smoother project delivery while encouraging the development of best-practice frameworks across the sector. Governments are also placing greater emphasis on local content, encouraging the involvement of domestic firms and promoting workforce development around decommissioning activities.

Several key drivers are shaping the market’s expansion. Ageing offshore infrastructure remains one of the most pressing, with more than 200 platforms in APAC expected to require full decommissioning by 2030. Analysts anticipate an annual market growth rate of around 10% as companies tackle end-of-life assets and associated safety and environmental risks.

At the same time, investment in renewable energy across APAC is forecast to exceed US$50bn by 2027, accelerating the removal of outdated platforms to support offshore wind and related developments. Evolving regulatory structures, particularly in markets such as Australia and Japan, are expected to increase compliance costs by as much as 15% over the next five years, compelling firms to enhance their decommissioning frameworks.

Technological advances especially in robotics, automated systems, and remotely operated vehicles—are helping to reduce project costs by as much as 20% while improving safety and precision. These innovations are strengthening the competitiveness of companies adopting them.

Market segmentation highlights several trends: Well Plugging and Abandonment remains the dominant service type due to strict environmental requirements, while Pipeline and Power Cable Decommissioning is emerging rapidly in response to renewable energy expansion. Shallow-water decommissioning still holds the largest market share, though deepwater activity is growing quickly as operators venture into more challenging environments. In terms of structure, Topside remains the largest segment, with Substructure decommissioning expanding at the fastest pace due to improved removal techniques.

Page 1 of 14

Copyright © 2025 Offshore Network