While the oil and gas industry in Southeast Asia is looking ahead to an impressive array of merger and acquisition deals, the region cannot forget its ever-growing decommissioning and abandonment (D&A) liabilities. Approximately 200 offshore fields in Southeast Asia, comprising more than 1,500 platforms and 7,000 plus wells, are likely to stop producing by 2030.

While the oil and gas industry in Southeast Asia is looking ahead to an impressive array of merger and acquisition deals, the region cannot forget its ever-growing decommissioning and abandonment (D&A) liabilities. Approximately 200 offshore fields in Southeast Asia, comprising more than 1,500 platforms and 7,000 plus wells, are likely to stop producing by 2030.

Sustainable D&A practices now stand more relevant than ever as a recently released IEA report predicts that high prices and security of supply concerns highlighted by the global energy crisis is hastening the shift towards cleaner energy technologies. Circumstances have led analysts from Goldman Sachs to revise its bullish prediction of the Brent crude price hitting US$100 by mid-2023 to finish as low as US$86 this year. Such waning confidence in the future oil price and demand in the face of the growing energy transition especially calls for serious consideration of end-of-life responsibilities by operators.

To navigate the elaborate and often complicated process of D&A, operators must follow clear regulatory regime, which is the only way to understand their liabilities. To establish an effective regulatory framework, it may help Southeast Asia to play catch-up with foolproof guidelines and processes already in place elsewhere, such as the UK or the Gulf of Mexico. Chevron and Shell are currently collaborating with Thai and Bruneian regulators respectively through knowledge transfer and pilot project initiatives.

While Southeast Asia is following international conventions such as the International Maritime Organisation Guidelines (IMO) and the United Nations Convention on the Law of the Sea (UNCLOS), it has also adopted new clauses along with these to make them region-specific. For example, the area of ‘pipelines’ is an addition by the ASEAN Council of Petroleum – otherwise absent in the global frameworks – to allow export pipelines to be left in situ, provided that there is no history of pipeline spanning, or movement of the seabed.

A cheap alternative to the costly affair of decommissioning, the Rigs to Reefs programme has the potential to benefit marine life as well. The rig-to-reef way of D&A can spare companies a significant capital. In the Asia-Pacific region, an average 6,000-ton oil platform will cost approximately US$35mn to completely remove, notes an Asia-focused research website. However, D&A via the rigs-to-reefs approach would cut that amount in half, with an average saving of up to nearly US$22mn per platform decommissioned, according to decommissioning expert Brian G Twomey.

InterMoor, a brand in Acteon’s engineering, moorings and foundations division, has been awarded a decommissioning contract by Chevron Thailand Exploration and Production (CTEP).

Following InterMoor’s completion of Phase 1 decommissioning work in 2021 in the Gulf of Thailand, CTEP has extended InterMoor’s field decommissioning contract by adding more packages for the disconnection and removal of pipelines.

InterMoor’s scope of work after the extension includes project management engineering, procurement and offshore execution; disconnection and removal of pipelines; disconnection and removal of single point mooring (SPM) and associated subsea infrastructure; and topside modifications work.

InterMoor will use cutting tools provided by its sister company, Claxton. Aquatic will provide subsea umbilicals, risers and flowlines (SURF) recovery equipment and UTEC plans to provide the survey spread.

The Asia Pacific oil and gas industry, making use of a period of relative oil price stability and seemingly maintained future demand, is increasingly looking to ramp up production rates which, in light of a rapidly approaching decommissioning wave, is leading to a thriving oilfield services market.

A period of stability is something the oil and gas industry has been yearning for ever since the outbreak of Covid-19 which, in the first quarter of 2020, burst onto the global arena in a devastating manner. But after a period of volatility driven by the pandemic and geopolitical developments in eastern Europe, the oil price has finally stabilised, settling at around US$80 per barrel across most benchmarks. From here, commentators such as Goldman Sachs and Fitch Ratings have predicted prices to maintain stable across 2023 and even hit US$100 by the end of the year.

One of the reasons for this security is a growth in oil demand, driven primarily by the re-opening of China at the start of the year. While the incessant rise of renewables has caused many to doubt the future prospects of fossil fuels as the world strives to its collective net zero ambition, according to OPEC’s 2022 World Oil Outlook 2045 energy demand will increase from 285.7 million barrels of oil equivalent per day (mboe/d) in 2021 to 351 mboe/d in 2045 at an increase of 23%. To meet this, the report suggests renewables will not be sufficient by themselves and oil and gas must continue to be exploited to meet the world’s needs. In view of this, it forecasts that by 2045, oil could retain a 29% share in the energy mix and gas would meet 24% of it. This translates to oil demand rising to 109.8mb/d in 2045 – in this scenario it must also be remembered that the expansion of production rates must also come alongside an extra 5 mb/d being added every year just to maintain current production rates, given an average industry decline rate of around 5%.

This is translating to a solid future for the global oil and gas industry and, in light of this, the Asia Pacific community is looking to increase its production rates – especially as the region consumes 35% of the world’s oil while supplying just 8% of its production. To do so, it is turning to its reliable tool of drilling but also on less-utilised methods such as well intervention. The latter is also being spurred by the region’s offshore oil well stock moving ever-closer to end-of-life with, according to a Wood Mackenzie 2018 report, more than 380 fields expected to cease production in the next decade.

Decom Engineering (Decom) has kicked of the new year with numerous project wins and work scopes valued in excess of seven figures.

Decom Engineering (Decom) has kicked of the new year with numerous project wins and work scopes valued in excess of seven figures.

The decommissioning specialist has secured new projects in Africa, Norway, Thailand and Singapore, while strengthening existing ties in Malaysia.

The UK-based company will mobilise chop saws and supporting crews in Q1 2023 to support campaigns in the Gulf of Thailand, and over in the Democratic Republic of the Congo, Decom will provide a C1-24 chop saw with hot slab functionality to assist in the recovery of a production jumper in depths of up to 1,000 m. The acquisition of this work scope came about after Decom was able to successfully prove its technology could success where others had failed.

In Norway, the company will provide support through a tier 1 contractor to a major operator during the summer campaign to cut concrete coated pipelines with its new C1-46 chop saw.

Decom Engineering Managing Director, Sean Conway, commented, “It is an encouraging start to the year to have an array of international work on the books, and it confirms that out chop saws and operational cutting expertise is seen as an integral component of complex subsea asset recovery and decommissioning projects.

“Our strategy is to continue investing in expanding the capabilities of our chop saws to meet the technical challenges faced by clients, and we are in the process of developing a larger chop saw, capable of cutting piping infrastructure up to 46” in diameter.”

T7 Global Berhad, an energy solutions provider, has secured two contracts worth approximately RM100mn (around US$23mn) from PTTEP Group of Companies and Hibiscus Oil & Gas Malaysia Limited.

The work with PTTEP includes the provision of headhunting and recruitment services while the second letter of award, from Hibiscus, is for the provision of facilities decommissioning services for South Angsi Alpha.

T7 Global Group Chief Executive Officer, Tan Kay Zhuin, commented, “The Hibiscus award marks an important milestone for the Company to execute offshore facility decommissioning projects of such scale. There is initiative for rig-to-reef by converting the structures into artificial reef to enhance the marine habitat at the intended location. We see this as a sustainable approach for oil & gas operators moving forward which can contribute to their Environmental, Social and Governance (ESG) agenda. Over the next few years, we will be on the lookout for more ESG related projects in the region.”

T7 Global Berhad, a leading solutions provider primarily in the energy industry with a strong presence in Asia, has announced that Hibiscus Oil & Gas Malaysia Limited, has awarded a work order to Tanjung Offshore Services, a wholly-owned subsidiary of T7, for integrated well services.

The work order, awarded under the Pan Malaysia Umbrella Contract, is effective from 3 August 2022 until 2 August 2024 on a call-out basis and includes integrated well services for intervention, workover and abandonment for PACs. Under the Pan Malaysia Umbrella Contract, Tanjung Offshore will be participating in upcoming jobs for integrated well services for well workover and well abandonment from petroleum arrangement contractors (PACs) in Malaysia.

T7 Global Group Chief Executive Officer, Tan Kay Zhuin, commented, “We are honoured and thankful for this award from Hibiscus. This award marks a milestone for Tanjung Offshore as this award include well workover and plug and abandonment services under the Pan Malaysia Umbrella Contract.

“Integrated well services, which covers both production wells and abandonment of old wells, will form part of our long-term energy solutions for offshore operators. Over the next few years, we aim to secure more similar jobs by providing innovative well solutions to other offshore operators in the region.”

James Christie, who is Regional Director for Ashtead Technology’s Asia Pacific region, and has been with the company for over three years, also assumes the role of Head of Mechanical Solutions as the company looks to cement its market position as a leader in IMR and decommissioning services for the global offshore energy sector.

James Christie, who is Regional Director for Ashtead Technology’s Asia Pacific region, and has been with the company for over three years, also assumes the role of Head of Mechanical Solutions as the company looks to cement its market position as a leader in IMR and decommissioning services for the global offshore energy sector.

Christie has over 22 years’ subsea industry experience following a career that has seen him accumulate extensive experience of both offshore and shore-based ROV and life of field operations. In his expanded role, Christie will continue to be based in Singapore and will work with Ashtead Technology’s regional teams to grow the company’s capabilities and drive forward the international expansion of its mechanical solutions service line which specialises in subsea cutting, dredging, coating removal technologies and ROV tooling and associated services, all built through the acquisitions of Forum Subsea Rentals, Underwater Cutting Solutions, Aqua-Tech, and most recently, WeSubsea.

Allan Pirie, Ashtead Technology’s CEO, said, “James has been instrumental in supporting the international growth of the business during his time with us so far and based on his background and expertise in the subsea IMR and decommissioning sectors he was a natural choice to take on this growth-focused role.

“This appointment comes at a time where there is tremendous scope to grow our mechanical solutions business internationally and through ongoing investment in our equipment, people and infrastructure, we look forward to capitalising on these opportunities globally.”

Christie said, “I am thrilled to take on this leadership role at such an exciting and pivotal stage in Ashtead Technology’s growth journey and work with my mechanical solutions colleagues across our international locations to continue to deliver best-in-class technologies and services to support our customers’ offshore energy projects.”

Maersk Drilling has secured a contract extension with Sarawak Shell Berhad and Sabah Shell Petroleum Co Ltd (SSB/SSPC) for the seventh generation drillship Maersk Viking.

SSB/SSPC have executed the remaining three one-well options of the current drillship contract and awarded an additional eight-well contract to Maersk Drilling.

A five-well work scope will be novated to PTTEP for drilling and plugging and abandonment activities at the Kikeh field offshore Sabah, Malaysia, with a total estimated duration of 116 days and an expected commencement of the first well in November 2022.

Following completion of its work scope with PTTEP, Maersk Viking will undergo a scheduled periodic survey, after which the rig will commence a six-well drilling campaign with SSB/SSPC. This work scope is expected to commence in Q4 2023, with an estimated duration of 281 days.

The total firm contract value of the extension and additional contract is approximately US$153mn, including demobilisation and mobilisation fees, as well as fees for the use of managed pressure drilling on certain wells.

“PTTEP welcomes Maersk Drilling into our exciting 2022-23 deep-water drilling campaign, and we look forward to forging a strong partnership in Malaysia,” said Nitipong Kongpat, Head of Malaysia Wells Operations for PTTEP.

“We are thrilled to announce that Maersk Viking will continue to support Malaysian oil and gas developments for the next two years. This agreement is a testament to our great collaboration with Shell, and by coordinating the rig’s schedule across several different deep-water operators, we are driving efficiency and leveraging synergies for everyone involved,” said COO Morten Kelstrup of Maersk Drilling.

When the Decommissioning & Abandonment Asia pacific Workshop 2022 (D&A APAC) arrives in Kuala Lumpur, Malaysia, in October, Nora Farahzilla bt Abdullah, Wells WI and P&A DD Engineer at Shell Sarawak will contribute to the impressive agenda of discussions and presentations to enlighten the Asia Pacific oil and gas community on the regions decommissioning landscape.

The representative from Shell Sawawak will focus her presentation on the scope of the plug and abandonment performed on one of her company’s platforms, providing a valuable case comparison for the upcoming abandonment campaigns of other companies.

While Covid-19 restrictions continue to relent across the globe, many will remain for some time yet and the threat of variants means there is always a chance of more being reinstated. With this in mind, the Wells Engineer will reveal how the operation was managed during Covid-19 to allow for the maximum utilisation of available resources within pandemic restrictions.

Attendees will have unrivalled access to the lessons learned from the project and how this method will be improved and used for replica operations.

To find out more, click here: https://events.offsnet.com/DAAPAC2024#/

Or reach out to the details below:

Erin Smith

Global Accounts & Australasia Regional Manager

T: +64 (0) 289 900 118

E:

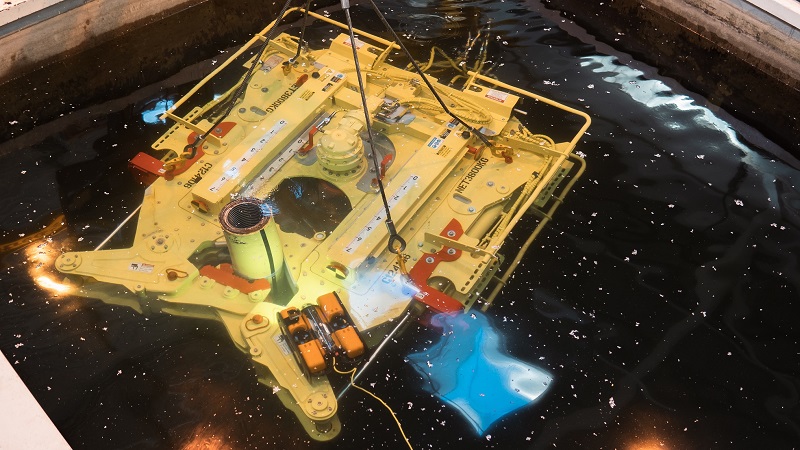

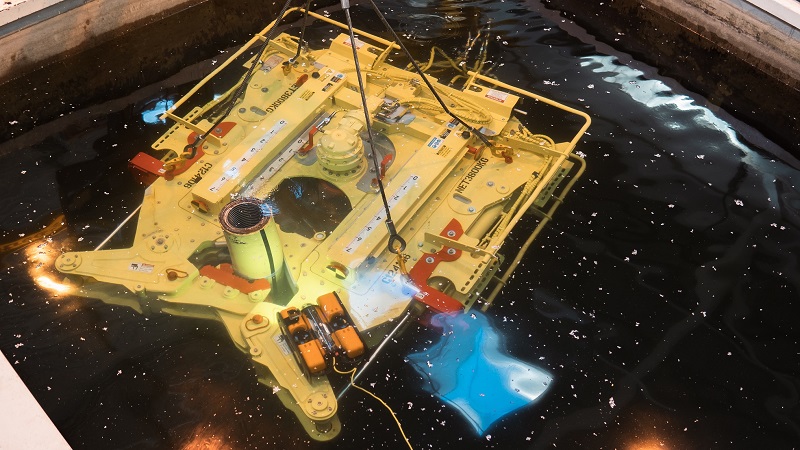

The Robotics division of Helix Energy Solutions Group, Helix Robotics Solutions, has been awarded a 180 day firm-plus-options contract by a local Thailand contractor to perform decommissioning services using the subsea construction vessel Grand Canyon II.

The contract scope of work, to be performed across multiple Thailand offshore fields, includes DP3 vessel services, crane support and ROV services in connection with subsea well abandonment and decommissioning operations. It is scheduled to begin in the late fourth quarter 2022.

Jeremiah Hebert, Helix’s Vice President – Americas/APAC Region, commented, “This decommissioning award offshore Thailand is another significant project for Helix as it represents the flexibility of our vessel and ROV assets to seamlessly transition from renewable services we are currently supporting to oil and gas operations, and expands our already strong track record in the Asia Pacific region.”

The Grand Canyon II is a DP3 multi-role construction support vessel equipped with a 250 MT AHC subsea crane, moonpool, two 3,000m rated 250hp UHD ROVs, integrated ROV deck space and removable bulwarks. With clear deck areas up to 1,650 sq m, it is well suited for subsea construction, inspection, repair & maintenance and offshore renewables activities.

The Grand Canyon II has been under long-term charter with Helix since 2015, and recently signed a five-year charter extension that runs from January 2023 through the end of 2027. Most recently, it was working offshore Taiwan on Renewable energy and wind farm construction work.

In October, Kuala Lumpur, Malaysia, will be host to the Asia Pacific offshore community, the upcoming Decommissioning & Abandonment Asia Pacific Workshop 2022 (D&A APAC), where the offshore community will gather to review the region’s decommissioning landscape and develop cost effective decommissioning strategies for future campaigns.

Among the wide range of presentations and panel discussions currently being prepared for the conference, Abdul Halim Ab Hamid, Decommissioning & Abandonment (D&A) Executive, Group Project Delivery, Project Delivery & Technology, at Petronas Carigali will explore one of the most tantalising prospects within the abandonment space – sustainable artificial reefing.

Rig to Reef, as it is often known, is a practice well established in jurisdictions such as the Gulf of Mexico but is often disregarded or simply underutilised in other regions around the globe.

The representative from Petronas Carigali at D&A APAC will discuss Rig to Reef as a sustainable repurpose concept and showcase it as a potential strategy for decommissioning planning.

He will seek to explain the effectiveness and sustainability of Rig to Reef as a programme by establishing reefing guidelines via reef design and reefing engineering parameters, marine environmental considerations and pollution prevention plans.

Finally, he will help attendees to maximise the recovery value from materials to be refurbished and prevent value leakage from waste via material inventories classification for reefing.

To learn more about the workshop: https://events.offsnet.com/DAAPAC2024#/

Or reach out to the details below for more information:

Erin Smith

Global Accounts & Australasia Regional Manager

T: +64 (0) 289 900 118

E:

As part of the decommissioning facilities section of the upcoming Decommissioning & Abandonment Asia Pacific Workshop 2022 (D&A APAC), a contingent from Petronas Carigali will present on the potential for integration within the end of life space.

The formidable party from Petronas Carigali will feature Ahmad Zawawi Abdul Raja, Well P&A and Decommissioning; M Zhafran B Sulaiman, Head Decommissioning & Abandonment Facilities; and M Redzuan B a Rahman, Head of Technical Solutions.

The three members will help attendees to understand the opportunity for integrated resources for upcoming decommissioning projects and how well and facility teams can benefit from this.

They will also present case studies from Malaysia where collaboration for decommissioning has been a success, including the challenges and lessons learned from such projects.

Attendees will get the opportunity to hear all this from these industry experts, giving them a chance to ensure future projects are as efficient as possible.

With decommissioning emerging as a significant focus for the oil and gas community in Asia Pacific, D&A APAC is not one to be missed!

To learn more about the workshop: https://events.offsnet.com/DAAPAC2024#/

Or reach out to the details below for more information:

Erin Smith

Global Accounts & Australasia Regional Manager

T: +64 (0) 289 900 118

E:

Page 7 of 11

Copyright © 2025 Offshore Network