Ready to be extracted via a single subsea well, Shell's Victory gas field in the UK North Sea will help maintain domestically produced gas for Britain’s homes, businesses and power generation.

Ready to be extracted via a single subsea well, Shell's Victory gas field in the UK North Sea will help maintain domestically produced gas for Britain’s homes, businesses and power generation.

Approximately 47 km north-west of the Shetland Islands, the Victory field has started production for Shell UK Limited to reach the Shetland Gas Plant via an existing pipeline network connencted to the subsea well. Utilising the existing infrastructure will reduce operational emissions. The gas will be piped to further travel the Scottish mainland at St Fergus near Peterhead, where it will be fed into the national gas network.

Peak production is estimated at around 150 million standard cubic feet per day of gas (approximately 25,000 barrels of oil equivalent per day) at full capacity, which is equivalent to heat nearly 900,000 homes per year. Most of the field’s recoverable gas is expected to be extracted by the end of the decade.

As older gas fields reach the end of production, Victory can help bridge the gap while also reducing the UK's reliance on imports.

"Gas fields like Victory play a crucial role in the UK’s energy security, and the country will rely on them for decades to come. They provide an essential fuel we need now, and act as a partner to intermittent renewables as we move through the energy transition,” Shell UK Upstream Senior Vice President, Simon Roddy said. “By developing fields like Victory next to existing infrastructure, we are making sure our production in the UK North Sea remains cost competitive and reduces operational emissions.”

Serica Energy plc has announced the signing of an agreement to acquire BP’s entire stake in the P111 and P2544 licences in the UK Central North Sea, pending the waiver of applicable pre-emption rights.

The Proposed Acquisition includes a 32% non-operated interest in the P111 licence, home to the Culzean gas condensate field, and the adjacent P2544 exploration licence.

Culzean, operated by TotalEnergies, is currently the largest single producing gas field in the UK North Sea.

Under the joint operating agreement, the Proposed Acquisition is subject to a 30-day pre-emption period, during which partners TotalEnergies (49.99%) and NEO NEXT (18.01%) may acquire BP’s stake on the same terms. Updates will follow as appropriate.

Chris Cox, Serica's CEO, stated, “Should this transaction complete, it would deliver a step-change for Serica, adding material production and cash flows from the largest producing gas field in the UK. Culzean is a world-class asset, delivering gas from a modern platform with exceptionally high uptime and low emissions.”

The Proposed Acquisition carries an economic date of 1 September 2025, with an upfront cash consideration of US$232mn, subject to customary working capital adjustments and partially offset by interim post-tax cashflows expected by completion at the end of 2025.

Two additional contingent cash payments are included: one linked to successful results from P2544 exploration, and another tied to changes in the UK ring-fence fiscal regime. Funding will come from interim Culzean cashflows and existing financial resources, including the $525 million Reserve Based Lending facility, with the potential for a new acquisition facility to support the Company’s larger asset base.

Culzean is a mid-life gas condensate field discovered in 2008 and onstream since 2019, producing c.25,500 boepd net to BP in H1 2025 at 98% efficiency.

Remaining net 2P reserves are estimated at c.33 mmboe. Production costs are US$10.7/boe, with one of the lowest carbon footprints in the UK North Sea, well below the sector average of 20 kg CO2/boe. Future infill drilling and licensed exploration offer upside potential.

Greece is in the final stages of negotiating a major offshore energy exploration contract with US oil major Chevron and local partner Helleniq Energy, aiming to conclude the deal by the end of 2025. The agreement would mark a milestone in Greece’s efforts to boost domestic energy production and strengthen its position as a regional gas transit hub.

Chevron and Helleniq Energy have jointly bid to explore four deep-sea blocks off the Peloponnese peninsula and the island of Crete. “We are working intensively with the US company and Helleniq Energy to meet the timetables and conclude the contract within 2025,” said Energy Minister Stavros Papastavrou on Action24 television.

The initiative aligns with the European Union’s strategy to reduce dependence on Russian gas and enhance energy security following the invasion of Ukraine. Greece, which currently imports most of its gas for power generation and domestic use, hopes the exploration will unlock new reserves and attract long-term investment in its energy sector.

Once signed, the contract will require approval from Greece’s court of auditors and parliament before Chevron begins seismic surveys in 2026. The exploration phase is expected to last up to five years, with any potential test drilling anticipated between 2030 and 2032.

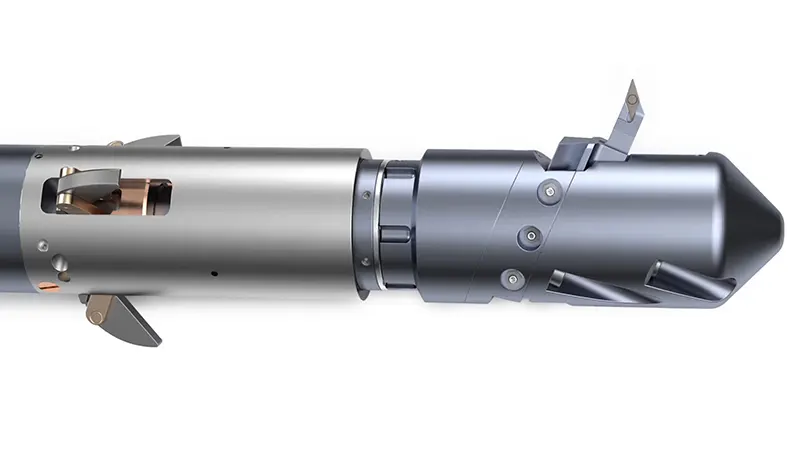

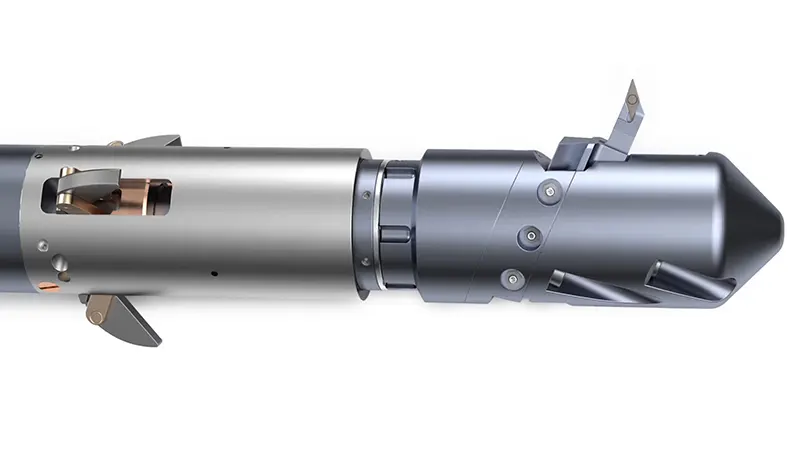

Hunting PLC has introduced Opti-TEK, a new suite of Optimised Intervention Technologies aimed at helping operators extend well life, minimise downtime, enhance decision-making, and lower both operational costs and environmental impact.

Hunting PLC has introduced Opti-TEK, a new suite of Optimised Intervention Technologies aimed at helping operators extend well life, minimise downtime, enhance decision-making, and lower both operational costs and environmental impact.

Developed through Hunting’s TEK-HUB innovation platform, Opti-TEK combines the company’s internal expertise with strategic technology partnerships to accelerate the delivery of next-generation tools to the market.

The initial range of products includes:

Allan Gill, Product Line Director for Well Intervention, commented: “Opti-TEK represents Hunting’s commitment to delivering smarter, safer and more cost-effective interventions. By aligning cutting-edge innovation with real-world operational demands, we are enabling our customers to optimise every intervention and maximise the value of their asset.”

The launch of Opti-TEK underscores Hunting’s ongoing drive to innovate within the well intervention sector, equipping operators with advanced tools designed for greater precision, safety, and sustainability in increasingly complex field environments.

The riserless light well intervention (RLWI) market, valued at US$270.52 mn in 2024, is projected to reach US$405.81 mn by 2032, growing at a CAGR of 5.2%, according to Credence Research.

The riserless light well intervention (RLWI) market, valued at US$270.52 mn in 2024, is projected to reach US$405.81 mn by 2032, growing at a CAGR of 5.2%, according to Credence Research.

Key players shaping the market include Expro, ExxonMobil, Halliburton, Aramco, NOV, Emdad, Baker Hughes, Oceaneering, Hunting Energy, and Nortech. These companies focus on technological innovation, vessel upgrades, and digital integration to improve efficiency and safety in offshore interventions.

Logging and bottom hole surveys dominate the service segment, accounting for over 25% of demand. These services are vital for evaluating reservoirs, identifying production zones, and providing accurate well diagnostics without costly drilling. Operators increasingly adopt advanced downhole logging tools to gain real-time insights, reduce non-productive time, and optimize subsea operations.

The global increase in aging oil and gas wells serves as a significant driver for RLWI adoption. Many wells, particularly in the North Sea and mature offshore fields, require intervention to sustain production levels and extend well life. RLWI provides a practical solution by enabling remedial activities such as zonal isolation, sand control, and artificial lift installation without extensive downtime. The ability to enhance recovery rates from declining wells ensures continuous demand. This trend aligns with industry goals to maximize asset utilisation and improve return on investment.

Europe: Mature fields drive RLWI adoption

Europe holds approximately 28% of the global RLWI market, with the North Sea serving as a major hub. The region’s mature offshore infrastructure and large number of aging wells create significant demand for intervention solutions aimed at maximizing recovery rates. Operators and governments prioritise safe, cost-efficient methods, making RLWI a preferred choice over traditional rig-based systems. Continuous investment in digital integration and sustainability-driven practices strengthens Europe’s market position, ensuring RLWI remains critical for managing production from mature subsea assets.

To learn more about the RLWI market in other regions, visit Credence Research’s full report here

AF Gruppen, through its AF Offshore Decom subsidiary, has entered into a Joint Venture (JV) with THREE60 Energy after being awarded a contract with bp to provide integrated decommissioning services for the Andrew field in the North Sea.

AF Gruppen, through its AF Offshore Decom subsidiary, has entered into a Joint Venture (JV) with THREE60 Energy after being awarded a contract with bp to provide integrated decommissioning services for the Andrew field in the North Sea.

For the first time in the UK Continental Shelf, this contract with see the JV assume the role of decommissioning partners where the two companies will deliver post-cessation of production operations, well decommissioning, facilities/pipelines/topsides preparation, substructure and topsides disposal and subsea infrastructure removal.

The JV will also work alongside the topsides removal contractor to ensure successful unified delivery of the full decommissioning scope.

The project will be carried out under a long-term framework agreement, with the contract value worth up to NOK4,000mn.

Lars Myhre Hjelmeset, EVP Offshore at AF Gruppen, said, “AF Offshore Decom has for many years been an advocate for integrated decommissioning solutions and we are very proud to make the move from concept to execution together with our client bp and partner THREE60 Energy. This initative responds to the call for new business delivery models aimed at reducing cost and complexity and supporting ‘next generation’ decommissioning.”

The Andrew field is located 225km northeast of Aberdeen and serves as a central hub for four subsea fields and includes 17 platform wells, eight subsea wells, 41km of subsea bundles, 42km of umbilicals, and 2,500 tonnes of subsea equipment.

Expro, a leading energy services provider, has successfully completed the first full deployment of its Remote Clamp Installation System (RCIS), marking a major advancement in offshore safety and operational efficiency

Expro, a leading energy services provider, has successfully completed the first full deployment of its Remote Clamp Installation System (RCIS), marking a major advancement in offshore safety and operational efficiency

Developed by Expro’s Frank’s Tubular Running Services (TRS), the RCIS provides a unique industry solution for smart well completions, enabling real-time monitoring and control of downhole tools from the surface via control lines. This technology allows operators to optimise production, manage downhole safety devices essential for well integrity, and extend well life, reducing the need for costly interventions. By fully automating clamp installation on tubing, the RCIS eliminates much of the manual work traditionally required, enhancing efficiency and reducing personnel exposure on the rig floor.

The RCIS was first deployed in the UK’s North Sea during Q4 2024 as part of a test trial, delivered in collaboration with BP, which partially sponsored the technology’s development.

Following this success, the RCIS was deployed again in Q2 2025 by another North Sea operator, where Expro ran a complete hands-free Upper Completion at up to 15 joints per hour with zero non-productive time or control line damage, increasing running efficiency by 25%. Control line clamps were installed remotely, cutting installation time by around two minutes, or 50% per clamp.

Jeremy Angelle, vice-president of Well Construction, said: “This is a breakthrough in clamp installation. By automating a previously manual and high-risk process, we’ve not only increased efficiency but also advanced safety in a meaningful way.”

“The RCIS is designed to offer a practical solution for reducing exposure in hazardous zones, improving crew safety, and streamlining completion activities. As the industry continues to seek ways to minimize manual intervention and improve efficiency, the RCIS represents a scalable, forward-looking solution for offshore operations worldwide.

Angelle added: “This is a new era of safer, smarter completions.”

Russian energy major Gazprom has confirmed a lengthy delay to its Sakhalin 3 offshore project, with first gas now unlikely before 2028, three years later than previously anticipated and one year after it is supposed to start supplying China through a new cross-border pipeline.

The revised schedule was disclosed by Sakhalin Governor Valery Limarenko during an industry gathering in Yuzhno-Sakhalinsk, where he noted that production at the complex would not begin until at least 2028.

Sakhalin 3 covers four separate deposits. The smallest, Kirinskoye, holds around 162bn cubic metres of reserves and began output in 2013 using subsea equipment supplied by FMC Technologies, now part of TechnipFMC.

Gazprom had initially intended to apply the same approach at South Kirinskoye, the largest field in the block with an estimated 815bn cubic metres of reserves.

That strategy collapsed in 2015 after the United States introduced sanctions following Russia’s annexation of Crimea. Since then, Gazprom has been forced to turn to domestic suppliers.

In 2019, it awarded a contract to defence manufacturer Almaz-Antey to design and build subsea production systems. While the company delivered two specialised subsea wellheads in 2023, progress on the remaining infrastructure has stalled, with no clear delivery schedule announced.

The continued delays underscore the difficulties Gazprom faces in developing technically complex offshore projects without Western technology, particularly as pressure mounts to secure new export flows to China.

Weatherford International plc has announced that it has been awarded an eight-year contract by SNGN Romgaz S.A., Romania’s largest natural gas producer and main supplier, and the third-largest gas producer in Europe.

The contract involves providing services for real-time monitoring and transmission of dynamic parameters from gas well wellheads, enhancing production optimization through digital and AI-enabled insights.

This represents Romgaz’s first engagement of such services, demonstrating the company’s commitment to digital transformation and production automation. Under the agreement, Weatherford will implement a wellsite monitoring campaign across thousands of existing wells. Using cloud infrastructure, Weatherford technology will gather critical field data, providing Romgaz with essential information for production decisions. This data will guide in-field automated infrastructure supplied by Weatherford to achieve Romgaz’s production optimisation goals.

Girish K Saligram, president and chief executive officer of Weatherford, commented, “We are proud to support Romgaz in their first deployment of real-time monitoring services. With our technology, expertise, and recent investments in Romania, Weatherford is well positioned to help Romgaz optimise production and build fields of the future with solutions that enable smarter and more reliable operations.”

Razvan Popescu, chief executive officer of Romgaz, added, “Partnering with Weatherford marks a significant step forward in Romgaz’s digital transformation journey. For the first time, we are implementing real-time wellsite monitoring technologies that will provide actionable insights and enhance the efficiency of our operations. This initiative aligns with our strategic objectives of innovation and operational excellence. We are confident that this collaboration with Weatherford represents a strategic first step in integrating AI-driven technologies into our operations and laying the foundation for a new era of intelligent transformation.”

Weatherford’s well monitoring solutions deliver continuous, high-fidelity well data, enabling smarter decision-making and proactive intervention strategies. Implementing these systems will allow Romgaz to gain enhanced visibility of well conditions and optimise production throughout the duration of the contract.

Petrofac has secured an extension to its contract with ONEgas West, reinforcing its presence in the Southern North Sea market.

The deal, issued on 15 September 2025, continues Petrofac’s long-running service role across ONEgas West’s portfolio, including support for the Clipper South complex, Leman Alpha assets, Bacton Terminal, and OneGas barge operations.

John Pearson, chief operating officer of Petrofac’s Asset Solutions and Energy Transition Projects, noted that the company has supported these assets since 2020, positioning it as an embedded member of the delivery team with the ability to assist in production enhancement and field life extension.

This extension builds on a similar EPC contract awarded in March 2024, when Petrofac won a two-year brownfield EPC extension with ONEgas West, which is operated by NAM and owned by Shell UK. The renewed scope underscores ONEgas West’s confidence in Petrofac’s teams in Great Yarmouth and Aberdeen, valued for their operational knowledge and delivery.

As the industry faces pressures including energy transition goals and tighter regulation, contracts like this become strategic. Supporting key infrastructure such as terminals, complex offshore installations, and barge operations helps ensure continuity of supply and contributes to operational resilience.

For Petrofac, this deal strengthens its standing in one of its primary markets and demonstrates its capability to deliver both maintenance and enhancement in challenging offshore settings.

“Having supported these assets since 2020, Petrofac is embedded within the delivery team and is uniquely placed to support production enhancement and field life extension,” said Pearson.

“The North Sea remains one of Asset Solutions’ core markets and this award demonstrates confidence held in our team and the value they drive. We look forward to continuing this relationship, delivering safe and reliable operations.”

UK's Serica Energy has revised its 2025 production guidance following maintenance challenges and scheduled subsea work on fields tied to the Triton FPSO.

The Triton Floating Production Storage and Offloading (FPSO) vessel is operated by South Korea's Dana Petroleum.

Serica Energy said production guidance has been reduced to between 29,000 and 32,000 barrels of oil equivalent per day (boepd), down from a previous range of 33,000–35,000 boepd.

Operator Dana Petroleum notified Serica of a temporary reduction in output from the Triton FPSO due to a vibration issue within the compression trains.

Production is currently running at a significantly reduced rate but is expected to return to normal levels by the end of September once repairs are completed.

Production net to Serica from the Triton FPSO exceeded 25,000 boepd in August. Once both compressors are operational, output will be boosted further, supported by additional production from the EV02 well on the Evelyn field.

Dana has also scheduled subsea intervention work on the Bittern field for November 2025 to address an emerging infrastructure vulnerability.

Originally expected in 2026, the three-week scope will now halt production not only from Bittern but also from the Evelyn and Gannet fields, temporarily reducing Serica’s output by more than 20,000 boepd.

Despite the setbacks, Serica highlighted that production ramp-ups earlier this year had lifted wider portfolio output to more than 55,000 boepd in mid-August, before the maintenance-related constraints began.

HELLENiQ Energy has confirmed its participation, in partnership with Chevron, in the Call for Tenders issued by the Ministry of Environment & Energy (FEK 2104/30.04.2025) for hydrocarbon exploration and production rights in four offshore blocks located south of the Peloponnese and south of Crete.

The joint offer was formally submitted on 10 September, in line with tender regulations.

This step marks a significant milestone for HELLENiQ Energy as it builds on its existing exploration and production portfolio in Greece, reinforcing the company’s commitment to supporting the country’s energy ambitions and strengthening its upstream activities.

For Chevron, the participation represents a strategic new entry into the Greek energy market, underscoring the international appeal of Greece’s offshore potential.

The partnership between HELLENiQ Energy and Chevron combines deep technical expertise, operational experience, and financial strength, positioning the consortium as a competitive player in unlocking the hydrocarbon resources of the region.

If awarded, the project is expected to contribute to enhancing domestic energy security, diversifying supply sources, and supporting the wider energy transition goals of Greece and the European Union.

Stavros Papastavrou , Greek Minister of Environment and Energy, said on Wednesday, "Today, the Chevron and HELLENiQ Energy consortium announced its participation in the international competition for the 4 offshore blocks south of Crete and the Peloponnese. Thus, a new chapter opens for the exploitation of the underwater energy wealth of our homeland."

"This is a development of Hope and Perspective for our country. Greece, with national self-confidence, is laying solid foundations for its energy self-sufficiency and capitalising on its geopolitical position in the Eastern Mediterranean. The Government of Kyriakos Mitsotakis is fulfilling its duty to our children and future generations, implementing its commitments for a Greece that is energy secure, investment attractive and geopolitically strong. Starting tomorrow, we are moving forward even more decisively, faster, unlocking our country's potential for progress and prosperity for all Greek women and men."

Page 3 of 36

Copyright © 2025 Offshore Network