UK-based Hunting plc, which operates in the well interventions market and other areas, has outlined plans to grows its business in the Middle East.

UK-based Hunting plc, which operates in the well interventions market and other areas, has outlined plans to grows its business in the Middle East.

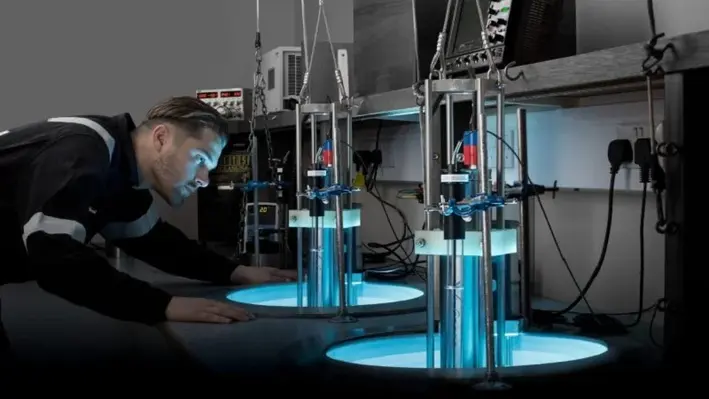

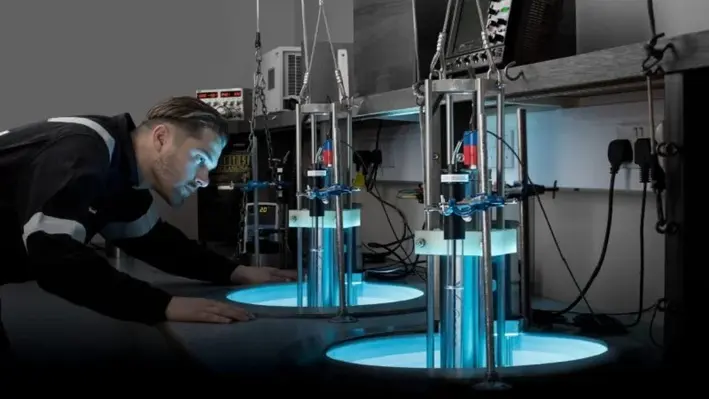

“Hunting is looking to build its presence in the Middle East with the construction of a small laboratory in the UAE to service clients in the Eastern Hemisphere,” it said in a statement on 7th March, 2025.

“With the establishment of this laboratory, the sample lead time and overall analysis time will decrease as a result of closer proximity to the customer.

Hunting is a leading manufacturer of precision engineered products and integrated systems for the global energy market as well as other industries.

Its product suite includes well intervention equipment, well test and process systems, connection technology, logging systems and other areas.

The statement coincided with the acquisition of Organic Oil Recovery (OOR) technology, in a deal worth US$17.5mn. Field trials of the OOR technology — designed to prolong the life of a field and lower water cut during end-of-life production — are currently underway in the Middle East and other parts of the world, the company said in the statement.

“Following the acquisition of this exciting business, Hunting now has the ability to deploy this remarkable technology globally,” said the company’s CEO, Jim Johnson.

The company also reported its full-year 2024 results on 6th March with both revenue and earnings growth “despite the volatile energy markets” of last year, Johnson added.

The Middle East remains a key area of growth, it added, given the level of tender activity across the region.

The UAE is one of a number operating sites in the group’s Europe, Middle East, Africa (EMEA) business, alongside Saudi Arabia, the UK, the Netherlands and Norway.

Its well intervention portfolio includes pressure control and slickline equipment, tubing technology, e-line tools and control and injection units.

The Middle East’s intervention scene appears to have a promising future as operators seek to minimise emissions while maintaining production. An indication of such a future can be found in companies such as well integrity and production optimisation leader, Coretrax, showing increased business interest in the region.

The Middle East’s intervention scene appears to have a promising future as operators seek to minimise emissions while maintaining production. An indication of such a future can be found in companies such as well integrity and production optimisation leader, Coretrax, showing increased business interest in the region.

“The Middle East is a key growth area for Coretrax ... As operators remain focused on maximising recovery efficiently and sustainably, our expandable technology is ideally placed to support this demand," said John Fraser, Coretrax CEO, while marking the Company’s first deployment of ReLineWL straddles in 2022 for a major Saudi operator.

With the help of Coretrax’s ReLineWL that provided maximum production conduit to surface over conventional options, the well was brought back online. Not only did it bring down water production by 31%, but also enhanced oil output by 1,400 bpd. This also resulted in a significant drop in carbon footprint.

ReLineWL straddles allow maximum protection against the pollutants, elevated salt levels or impurities that are generated from produced water by isolating perforation intervals to shut off water production zones. It simplifies the huge challenge of time-consuming water treatment, which is especially worse in brownfield establishments, costing operators a fortune. ReLineWL also eliminates the storage and transportation difficulties that come with water production.

A one-trip, wireline deployed straddle system to address common well integrity issues, Coretrax’s ReLineWL also offers solutions regarding corroded or compromised tubing, such as the loss of well integrity. Enabling intelligent, non-intrusive interventions, the tool’s emission reduction capacity makes a huge difference. It omits the need for extensive workovers, and even well plugging and abandonment in extreme cases.

Speaking of a latest addition to the Company’s product line called Restore Patch, Fraser said, “Through the advancement of expandable straddles like our Restore Patch, operators can effectively reline mature or non-producing wells to deliver efficient and economical recovery. Our leading expandable technology is already delivering substantial efficiencies and we are actively seeking partnerships with conveyance providers which will allow us to make this solution even more accessible to the global energy industry.”

Restore Patch can be run across coiled tubing and drill pipe to restore well integrity and tackle common issues of water production, completion leaks and sand ingress. The system’s shoeless design makes drill out redundant, saving valuable rig time with a one-trip solution. Its slim outer diameter also allows it to bypass inner diameter restrictions such as sub-surface safety valves. At a 75% expansion ratio, it delivers maximum oil and gas production conduit to surface. With more than 700% greater flow area, the tool provides unmatchable results when compared to traditional straddles. Deploying the Restore Patch that gives all-time reservoir accessibility without major intrusions will allow operators to seamlessly plan future well operations and end-of-life activities.

This is an extract from a report by Offshore Network, which explores how the Middle East’s adoption of digital solutions is reshaping the well intervention market, highlighting a forward-thinking approach that bridges the gap between traditional energy practices and the drive for a more sustainable future. Read more on this and other reports.

The Middle East, home to vast oil and gas reserves, continues to play a central role in meeting global energy demands. Nations like Saudi Arabia, the UAE, and others remain key players in shaping the global energy landscape. The region’s reliance on fossil fuels, however, faces increasing scrutiny amid the global push for sustainability and net-zero goals.

This dynamic was evident at COP28, where debates centred on reconciling fossil fuel use with climate action. Saudi Arabia, a leading voice in the Organisation of the Petroleum Exporting Countries (OPEC), supported a compromise in the summit's final agreement, advocating for an equitable transition that respects each nation's unique circumstances. This approach aligns with Saudi Arabia's efforts to lead the region in adopting technologies like carbon capture and storage (CCUS) to reduce emissions without abandoning its economic backbone.

Key developments at COP28 included the signing of the Oil and Gas Decarbonisation Charter (OGDC) by 50 companies, including Aramco and ADNOC. The charter commits signatories to lower greenhouse gas emissions, enhance transparency, and phase out routine flaring by 2030. It also promotes investments in low-carbon fuels and negative emissions technologies to address methane emissions effectively.

“At ADNOC our aim is to reduce the methane intensity from our operated oil and gas assets, at the same time as we meet the forecast growth in energy demand for decades to come. We will do this by making significant investments in new technologies to improve our environmental performance, strengthening our commitment to responsible production and demonstrating our support for the UAE’s Global Methane Pledge,” said Abdulmunim Saif Al Kindy, Executive Director, People, Technology & Corporate Support Directorate at ADNOC.

Methane reduction remains a focal point, with proven measures capable of cutting emissions by over 75%. Saudi Arabia’s Middle East Green Initiative (MGI) aims for a regional emissions reduction of 670 million tonnes of CO2, contributing to national and collective goals. ADNOC, targeting net-zero emissions by 2045, has set a methane intensity reduction target of 0.15% by 2025—the region's lowest. It employs advanced methods such as flare gas recovery, infrared leak detection, and drone-mounted sensors to curb methane emissions.

Emerging technologies also play a crucial role. Well integrity issues, a significant source of methane leaks, are addressed with solutions like metal expandable packers (MEP) by Welltec. Successful trials in ADNOC’s Bab field have demonstrated MEP’s efficacy in preventing methane leakage, underscoring the industry's shift toward sustainable practices.

When a leading oil-producing nation like the UAE hosts a global climate summit such as COP28, the message to the world is clear: balancing climate commitments with energy realities is a complex but necessary endeavour.

The recent conference in Dubai reaffirmed the goal of limiting global warming to 1.5°C. However, with fossil fuels still providing about 80% of the world’s energy, their role in meeting global demand cannot be overlooked in the near term.

This reality, coupled with ongoing geopolitical and economic challenges, has driven energy companies to prioritise efficient methods of boosting production. Enter well intervention – a critical tool for optimising output from existing oil fields.

Jenny Feng, Supply Chain Analyst at Rystad Energy, emphasised the importance of this strategy: “…operators will look to ramp up production from existing fields, and well interventions will be a vital piece of the puzzle. As a quick, efficient, and cost-effective method of maximising existing resources, interventions are going to be a hot topic in the years to come."

According to Rystad’s research, spending on well interventions reached nearly US$58bn last year. With sustainability now a central focus, this figure is expected to rise, as the proportion of wells eligible for intervention is predicted to grow to 17% by 2027, representing approximately 260,000 wells globally.

As the world grapples with the challenge of balancing urgent climate action with a continued reliance on oil and gas, the Middle East finds itself at the forefront of this critical transition. One of the region’s key strategies is leveraging digital technologies to optimise its oil and gas operations, ensuring efficiency and sustainability.

With advancements like artificial intelligence (AI) and machine learning (ML) becoming integral to enhancing well production, the industry is undergoing a significant transformation. These cutting-edge technologies are redefining workflows, using advanced algorithms and automation to maximise output while minimising environmental impact.

This is an extract from a report by Offshore Network, which explores how the Middle East’s adoption of digital solutions is reshaping the well intervention market, highlighting a forward-thinking approach that bridges the gap between traditional energy practices and the drive for a more sustainable future. Read more on this and other reports.

Clean energy technology provider Exergy International has signed an agreement with Maren Maras Elektrik Uretim AS for the supply of two new geothermal power plants in Turkey.

Clean energy technology provider Exergy International has signed an agreement with Maren Maras Elektrik Uretim AS for the supply of two new geothermal power plants in Turkey.

Located in the Aydın region, the 33 MWe Emir GPP and the 13 MWe Nezihe Beren 2 GPP are expected to be commissioned by November 2025.

These two binary geothermal power plants will utilise Exergy's advanced ORC technology based on the Radial Outflow Turbine. The Emir GPP will feature a configuration with three turbines and two generators, while the Nezihe Beren 2 GPP will have one turbine and one generator. Both power plants will use air cooled condensers. The turbines, generators and other related equipment will be manufactured locally at Exergy’s subsidiary in İzmir. Exergy’s technology will harness Maren’s geothermal resources at maximum efficiency and deliver clean baseload power to the local grid.

Once in operation, the two power plants will enable saving approximately 134,000 tons of CO2 emission per year, avoiding an equivalent fossil fuel power generation.

Luca Pozzoni, General Manager of Exergy International, said, “This agreement marks another significant achievement for Exergy in Turkey, a region where we have 23 geothermal power plants operational in our portfolio, with several more nearing completion. We are thrilled to expand our collaboration with Maren and further contribute to Turkey's sustainable energy goals.”

Erdogan Arpaci, General Manager of Exergy Turkey, who played a major role in securing a contract, said, “I am highly satisfied with the signing of this new contract with one of our long-standing clients, which demonstrates the trust and reliability Exergy has established in Turkey. We have worked closely with Maren to achieve this outcome, and at Exergy we are very eager to begin the execution phase for these significant projects, which will bring an additional 46 MWe of capacity to the Turkish geothermal market.”

Tenaris, a global manufacturer and supplier of steel pipes and relates services for the energy industry, has used its presence at ADIPEC 2024 to introduce WISer, a suite of digital solutions designed to enhance well integrity, safety, efficiency and reliability.

As one of the world’s leading energy events, there could hardly be a better stage to reveal new solutions that can help the sector deal with its most pressing challenges. As such, WISer becomes the latest addition to the Rig Direct service package and builds on the company’s renowned on-site field assistance.

The pipe-by-pipe traceability enabled by PipeTracer technology and the 24/7 support provided from its remote monitoring centre, WISer includes two digital solutions that maximise the lifecycle of pipe strings.

This includes the iRun Casing cloud-based tool that provides real-time monitoring of casing installation to minimise the risk of lost lateral length and production. It also helps to prevent costly accessibility issues caused by fatigues damage, buckling, over-torque or stuck pipes.

There is also the Torque turn monitoring system. Tenaris field service experts collect and analyse real-time torque data at the well using advanced equipment to improve connection make-up reliability, reduce errors, and enhance the overall integrity of the assembly.

“With WISer, we support our customers' drilling projects during pipe running operations, improving decision-making and enhancing the consistency and reliability of well construction by combining our extensive field service experience with real-time data analytics and remote monitoring,” commented Lucas Pigliacampo, Tenaris Vice President Oil & Gas Technologies. “A key addition to our Rig Direct mill-to-well service model, WISer reflects our ability to continually adapt and innovate.”

Aside from providing a platform for the industry to discover the latest solutions entering the market, ADIPEC was also a forum for debate and progressing ideas that will change the face of the sector for years to come.

Unsurprisingly, decarbonisation was a key topic of discussion of the conference in Abu Dhabi as oil and gas leaders strive to strike the balance between meeting barrel demands and lower emissions output.

Tenaris strode into the discourse, with Gabriel Podskubka, the company’s Chief Operating Officer, participating in the ‘Optimising Operations to Advance Decarbonisation: A Digital and Cultural Shift’ panel session. Here, the panellists agreed that while advanced technologies, data-driven insights and process improvements can contribute to reducing emissions across the value chain, to achieve meaningful decarbonisation, deeper cultural shifts and cross-industry collaboration is required.

“At Tenaris, we are true believers that sustainability and decarbonization support our business strategy” Podskubka contributed. “These are key priorities for our leadership, our employees, our communities, and our customers. Today, our carbon emissions intensity is the lowest in our sector, and we are investing to ensure it remains so in the future. At Tenaris, we see decarbonisation not only as the right thing to do, but as a sound business decision. It’s an opportunity for us to continue leading in another dimension of our business.

“You need a vision, measurable targets and a strong leadership that is willing to convert this vision into reality. After communicating our decarbonisation commitment, we focused on defining KPIs for measuring emissions of our processes at every site. We now communicate both internally and externally on our progress and initiatives to reduce our CO2 emissions intensity per ton of steel by 30% by 2030.”

International, a protective coating brand of AkzoNobel, has introduced the next evolution in epoxy passive fire protection (PFP)

Chartek ONE has been introduced as a single-coat, mesh-free solution that simplifies PFP application for assets in the energy sector by maximising efficiency, streamlining installation processes and enhancing health and safety.

As a 100% solids, boron-free two-pack material, Chartek ONE provides enhanced durability and combined corrosion, cryogenic and hydrocarbon protection. It provides three hours of jet and pool fire protection across a wide operating temperature range, effectively shielding assets from all fire types.

Chartek ONE can accelerate installation of PFP systems both in the workshop and onsite, lowering installed weight, reducing labour and material costs whilst achieving the same fire protection, which is particularly important for industries with strict weight requirements, such as offshore oil and gas. In doing so, Chartek ONE can reduce workshop hours by up to 59%, saving users both time and money throughout projects and over the lifetime of the asset.

Introduced for customers in the Middle East, Chartek ONE availability in other regions is planned for 2025.

“Chartek stands at the forefront of the industry, offering a comprehensive range of solutions that reflect our heritage and track record of success,” remarked Robin Wade, Global Fire Protection Manager at AkzoNobel. “Our investment in research, development and PFP capabilities enable us to provide our customers with the best possible outcomes.

“Chartek ONE was developed in our Felling facility which is one of the world’s largest UKAS-accredited PFP testing centers for intumescent PFP. Patented polysiloxane modified thio-ether and epoxy technology resolves many of the pain points found in the provision and longevity of epoxy PFP in one simple solution. International is a dedicated partner and through the celebrated history of Chartek, we are committed to excellence in technical support, product specific engineering solutions, and delivering class-leading products.”

Chartek benefits from a presence in the industry spanning more than half a century. As passive fire protection, it excels in the most demanding conditions and the range is one of the world's most complete portfolio of epoxy intumescent PFP coatings available, according to the company.

Formulated and tested against critical industry standards for energy assets including NORSOK M-501:2022 Edition 7 and ISO 22899 (standard and high heat flux jet fires), Chartek ONE is free from boron and has a 100% solids formula to reduce occupational risks and improve HSE performance and footprint.

“We are thrilled to be introducing Chartek ONE for our Middle East customers at ADIPEC 2024,” added Andy Holt, Business Development Manager - Middle East at International. “Crafted to offer our customers superior safety, reliability, and peace of mind, Chartek ONE showcases our continued dedication to sustainability and innovation.

“This single-coat, mesh-free solution will drastically simplify PFP projects for our customers, minimizing downtime and reducing overall project costs. Our commitment to considering the environmental impact of our work is an integral part of the development process. Chartek ONE’s 100% solids, boron-free formula, stands as a testament to this commitment.”

Ashtead Technology, a provider of subsea technology and services, has signed an agreement to acquire Seascan Limited and its subsidiaries (known as Seatronics), as well as its sister company J2 Subsea Limited, international subsea electronics and ROV tooling rental and services businesses, from Acteon Group.

The UK£63mn acquisition – which remains subject to closing conditions – represents the company’s ninth in seven years. By bringing Seatronics and J2 onboard, Ashtead Technology is aiming to expand its capabilities within the global survey & robotics rental market. Together, the two entities have operations in Singapore, UK, US and UAE, from which they provide subsea electronics and tooling products and services to the offshore energy market. This includes supporting the installation, inspection, maintenance & repair, and decommissioning of subsea oil & gas infrastructure, as well as renewable counterparts.

Brice Bouffard, Chief Executive Officer of Acteon, commented, “Upon closing, this transaction will be the next important step in focusing our service portfolio to achieve Acteon’s long-term strategic goals. Seatronics and J2 have been an integral part of our business for many years and I’m very pleased to see both teams moving together to such a dynamic new home at Ashtead Technology.

“Acteon is committed to optimising our portfolio to better serve our customers and stakeholders as we support the evolving offshore energy market.”

In acquiring the two companies Ashtead has gained access to a highly-skilled employee base of 110 and has added more than 7,000 proprietary assets, thus increasing its rental portfolio by 30%.

“Seatronics and J2 are businesses we have known for a long time,” remarked Allan Pirie, Chief Executive Officer of Ashtead Technology. “With our most recent acquisitions focussing on expanding our mechanical services capability, this latest acquisition strengthens our international footprint and capability within our survey & robotics market. We look forward to welcoming new colleagues to Ashtead Technology and increasing the wealth of in-house expertise as a larger Group, creating a world leading subsea survey and robotics team.”

TAQA, an international company offering leading well solutions for the energy industry, has revealed the next-generation inflow control system.

The M4 Inflow Control System dictates the flow of undesired fluid (such as water and gas) and avoids any binary (open/close) effect that can result in instability or even stop production. Enabling operators to optimise their reservoir performance while sustainability managing fluid production, the new system excels in controlling water in ultra-light and light applications and enhances gas production control, providing stability and flexibility in diverse reservoir conditions.

“With the largest portfolio of inflow control systems more than 20 years of inflow control devices expertise, the M4 Inflow Control System represents the pinnacle of our innovation so far,” remarked Mojtaba Moradi, subsurface engineering manager of TAQA. “This new generation offers water control by gradually reducing inflow as water production increases, avoiding premature well shut in.

“Its main benefit is precision control based on reservoir production. The device allows operators to maximise output without risking shutting wells in, so they can manage production continuously and efficiently, which translates into obvious financial benefits.”

According to TAQA, the M4 Inflow Control System technology incorporates an advanced pilot control system that is super sensitive to density, making it suitable for a wide range of oil types, including ultra-light, light, medium, and heavy oils. It also features advanced multi-phase control, allowing the device to perform independently of its orientation in the wellbore.

TAQA also offers a ‘plug and play’ integration with its full portfolio of inflow systems and has been built to optimise performance in all types of wells in all reservoir types. Additional operational features such as last-minute capacity change, and the ability to circulate to the bottom have also been incorporated into the design.

Although not limited to any oil viscosity, so far, the system has demonstrated excellent performance with oil viscosities as low as 0.5cP tested together with water to define the operating and control points at various water cuts. A full qualification matrix of debris, erosion and cycle testing has also been completed.

Oil Spill Response Ltd (OSRL), the largest international industry-funded cooperative dedicated to supporting its members in preparing for and responding to oil spills, has marked another step in its rebranding efforts through the reveal of its newly designed logo.

Encapsulating OSRL’s core values of safety, collaboration and innovation while reflecting its commitment to future aspirations, the new logo is part of the company’s wider rebrand which also includes a refreshed mission and vision.

“We wanted a brand that not only reflects our 40 years of leadership but also positions OSRL for the future,” remarked Darren Waterman, Engagement Director. “The new identity stands as a symbol of our unwavering commitment to safety, innovation, and collaboration.”

The new logo, which was conceived through an extensive brand review, will be gradually rolled out across all company touchpoints, including its website, social media channels, training materials, and operational equipment.

“We are proud to introduce a brand that honours our rich legacy while looking toward the future,” commented Vania De Stefani, CEO. “This new logo is not just a visual change; it’s a reflection of OSRL’s evolution and our ongoing dedication to our members and the industry.”

The brand rollout will continue throughout 2025 to ensure a sustainable approach minimising waste.

In an operational update from the SASB gas field well intervention programme, Trillion Energy International has noted the improved flow rates from the South Akcakoca-2 well.

In an operational update from the SASB gas field well intervention programme, Trillion Energy International has noted the improved flow rates from the South Akcakoca-2 well.

“The fantastic response of South Akcakoca-2 once the water was lift off the perforations indicates that the reservoirs will produce the gas they contain once the water loading is removed. The wells are going to be perforated and monitored during clean up to evaluate the reservoirs response. The next phase of this project is to install the smaller production tubing (2 3/8”) to allow the wells to produce for a few years before water loading occurs again," Arthur Halleran, CEO of Trillion, said.

The South Akcakoca-2 well was perforated over the intervals 2319.5-2323.5 (4.0 m), 2339.6-2341.3 (1.7m) and 2411.1-2412.8 (1.7m) for a total of 6.4 m (all measured depth MD). Well hole pressure (WHP) was 86 psi before perforation, the WHP increased to 1046 psi.

The well flowed continuously from early 9 July, and by 10 July afternoon the flow rate was 0.70 MMcf/d with a WHP of 140 psi. By 15 July, the flow rate was 2.88 MMcf/d with a WHP of 318 psi.

Monitoring of the South Akcakoca-2 well will be continued until it hits a stable point.

The production characteristics indicated that perforating the new zones blew the water out of the well, while also implying that the reservoirs that were water-blocked are cleaning up and producing gas.

Guluc-2 well was perforated over the intervals 3512-3514.5 (2.5 m), 3749.5-3751.3 (1.8 m), 3770.7-3772.4 (1.7m) and 3781.6-3783.3 (1.7m) for a total of 7.7 m (all MD). WHP was 650 psi and increased to 1243 psi before settling to 1098 psi.

Guluc-2 will be flowed to clean the water and perforation debris out and be capable of gas production, however, it will then be shut in while South Akcakoca-2 well gas production stabilises.

The increase in the WHP during perforation indicates gas flowed into the borehole from the new perforated zones.

Updated flow rates have yet to be established for this well due to the ongoing testing of SA-2.

The perforation operation is currently continuing ongoing on West Akcakoca-1 well after which it will perforate the remaining pay in Akcakoca-3.

SLB and TotalEnergies have announced a 10-year partnership to co-develop scalable digital solutions to enable access to energy resources with improved performance and efficiency while establishing a flexible framework to address key challenges including carbon capture, utilisation, and sequestration (CCUS).

SLB and TotalEnergies have announced a 10-year partnership to co-develop scalable digital solutions to enable access to energy resources with improved performance and efficiency while establishing a flexible framework to address key challenges including carbon capture, utilisation, and sequestration (CCUS).

The companies will integrate advanced digital capabilities, including the use of AI with new and existing applications on SLB’s extensible Delfi digital platform. SLB and TotalEnergies will combine digital and domain expertise to accelerate the development and deployment of these solutions at scale, benefiting TotalEnergies’ global operations and SLB’s worldwide customer base.

The partnership will initially focus on subsurface digital solutions for reservoir engineering and geoscience modelling and interpretation, leveraging Delfi on-demand reservoir simulation (ODRS).

Rakesh Jaggi, President of SLB’s Digital & Integration business, said, “Collaboration and knowledge sharing are key for our industry to continuously develop more effective ways of unlocking energy access. With this visionary partnership, we are combining the know-how and expertise of both companies to accelerate the delivery of new digital capabilities that will benefit the whole industry.”

Namita Shah, President, OneTech at TotalEnergies, commented, “Through this digital partnership we will develop cutting-edge next-generation software, digital applications and new algorithms applied to geoscience.

“Thanks to these innovative modelling technologies, we will not only be better able to utilise the analyses of geological reservoirs and basins in the oil and gas sector, to reduce emissions, but also make further progress in geological carbon storage.”

Page 6 of 13

Copyright © 2026 Offshore Network