North America

- Region: Gulf of Mexico

- Topics: Decommissioning

- Date: June, 2021

At the Deepwater Decommissioning Gulf of Mexico 2021 Virtual Workshop, Thore Andre Stokkeland, Head of Global Sales Archer Oiltools, Archer, chaired a panel to explore the latest innovations permeating the plug and abandonment (P&A) and decommissioning markets, and what the best practices are for getting new technology recognised by the industry.

Stokkeland began by noting that new technology is inherently designed to reduce risk and improve efficiency and asked the panel to outline some of the benefits which can be achieved for P&A and decommissioning operations through the implementation of these innovations.

Bart Joppe, Well Abandonment Leader at Baker Hughes, focused on the significant cost and time saving that can be unlocked through the utilisation of new technology. Providing an example of this, Joppe described an innovation Baker Hughes brought to the North Sea after they identified an opportunity in the market to remove subsea wellheads more cost-effectively. Traditionally, these have been removed by using a drill pipe-deployed cutting and pulling system from a rig, semisubmersible or a drillship which can be costly while other methods often have similar limitations.

Baker Hughes designed a solution to use a chemical cutter on a wellhead clamp and then power all of it with a ROV. The ROV and the crane wire are the only two things on the water and on deck the only equipment is the bottom-hole assembly. Once this is overboard there is no equipment on the surface. Using this technology, the subsea wellhead can be cut and pulled by two people from any vessel as long as it can deploy the tool overboard. This is a much more cost-effective solution especially for remote wells where getting a rig on location would cost a lot of time, effort and money as well as generate a lot of emissions.

Reducing emissions

Picking up on emissions reduction, the panellists noted that this had fast-become a serious concern of the industry and, therefore, technology that could help operators limit their climate impact was becoming of paramount importance.

Gabriel Barragan, Well Abandonment Advisor, Chevron, said, “We all know that operators are on a strong push to look at carbon emission reduction, with significant pressure from governments, shareholders and customers to do so. It is something pretty fresh and it is still developing now. At Chevron we are brainstorming ideas on how to achieve this such as reducing the risk of fugitive emissions and reducing idle time for rigs. While diesel engines are idly running, emissions are being produced, so reducing this time is a great opportunity. At some point we will come to service providers and see where there technology can help us in this aspect.”

Kevin Squyres, Sales and Service Deliver Manager, Archer, added to this by noting how there are a lot of indirect emissions which are only just being seriously identified as a low hanging fruit to reduce carbon footprint. Saving just a day or two of rig time, for example, is great for the environment. In regards to P&A, when dealing with wells drilled in the 1960s to 1980s the cement technology and care was not there. It is difficult to deal with these nowadays, but new technology can help clients fix these wells.

Stokkeland said, “The industry was very much focused on time saving and cost saving in environments when the rig cost was high. Now we look to reduce rig times not just for the cost saving but also for the emissions savings. Solutions are getting smarter and we can now perform more operations in one run than we could just a few years ago. That will be the way forward, to reduce footprint, reduce rig time and reduce the amount of people on the drilling rig.

Delivering new technology to the market

While at all times there is plethora of new technology being developed, often many fail at the first hurdles or are unable to make an impression on operators and so do not live up to their potential. The panellists therefore explored how providers can ensure that these innovations can make an impact on the market and help operators achieve the value they are designed for.

“Technology development starts by identifying the challenge you want to resolve and how you can address it most effectively. It is really important to understand how the perspective of the operator, customer and regulator as well as ensuring that you are selecting the technology for the right application. There have been lots of innovations where the trial did not work because the right application was not selected,” Joppe commented.

“Also, don’t develop technology and then try and solve the most complex scenario you can think of. Instead build a staircase, select multiple wells of different levels of complexity in a step-by-step testing process and learn as you go.”

Barragan noted, “Take advantage of industry events such as these. Present a technology, do some networking and get contact information from the appropriate people. It is important to understand their well management portfolio which will build your case and value proposition to that operator. Explain at what stage you are in the development phase, is it an early concept? Has a prototype been tested? Or perhaps it has been trialled multiple times. It is important to be transparent about the technology, and this includes being up front about its limitations.”

Squyres echoed these thoughts by noting that in regards to Archer’s Stronghold systems his company tried to be as open and transparent as possible. He said, “If a client comes and says we have this dual casing which is larger than we have done before we won’t just sit there and say we can do anything. Of course we want to say that but it is important to take time, and ensure you have your calculations, case histories and risk assessment as well as ensuring regulators and stakeholders are on board.”

Stokkeland added, “It is about patience and learning. As they say, Rome was not built in a day and it is the same with new technology. You have to learn, you have to go through hurdles sometimes before you end up with a field proven product.”

- Region: Gulf of Mexico

- Date: June, 2021

At the Deepwater Decommissioning Gulf of Mexico 2021 Virtual Workshop, a panel of industry experts discussed the essential considerations when conducting plug and abandonment (P&A) operations in order to mitigate risk and enhance efficiency.

At the Deepwater Decommissioning Gulf of Mexico 2021 Virtual Workshop, a panel of industry experts discussed the essential considerations when conducting plug and abandonment (P&A) operations in order to mitigate risk and enhance efficiency.

Opening the session, Kenneth Bhalla, Chief Technology Officer at Stress Engineering Services Inc., explained that even in the last couple of decades the design of subsea wells have dramatically changed, which can raise multiple complications to operators looking to conduct P&A operations if this is not properly taken into consideration. He commented, “If you look at wells which came into operation 20-30 years ago, typically they were drilled with a fourth generation blowout preventer (BOP). Relative to fifth and sixth wells, the stack has gotten taller and heavier going from 600 Kips to more than a 1000 Kips. The wellhead and casing system are going to be see much larger loads, whether that is static loads or dynamic loads and the loads of the BOP stack need to be accounted for during P&A operations.”

“Also to note is the conductor casing, which typically today are 36” x 2” X80. Going back 20-30 years ago these wells were designed with X56, 36” x 1” for example. Your conductor casing is lower yield as well as lower stiffness. In addition, if you look at conductor casing design today we push the first connector as low as possible to reduce the fatigue loads. When dealing with the P&A of wells drilled 20-30 years ago we have a different type of well design where the connectors are not as deep as they are today and are thus susceptible to potential fatigue damage and overload as well. You need to understand the fatigue damage caused by prior operations as well.”

Following this, Alex Lawler, Drilling/ Completions Engineer at LLOG Exploration, added that there truly are generational differences between the designs of wells and what was fit for purpose even a decade ago is completely different environment to today. For example, he outlined the production packer generations which can affect everything. If the packer needs to be removed, the operator needs to understand if it is a shift to release or cut to release as well as other considerations such as what the cut zone is, for example.

Therefore, in order to carry out a P&A operation safely and effectively, it is paramount when planning to understand these differences, understand them early, and understand them thoroughly. It is also important to remember that you may require some specific tools designed for the well, and often these have been discontinued since drilling. Sometimes these could be in another part of the world, and if this is not planned for it could cause real problems down the line.

Getting the right information

With older wells that have often changed owners several times, the information and documentation is frequently unavailable. It can therefore be incredibly difficult to find out everything you need to know before planning a P&A operation.

One way to mitigate this is to speak to engineers who have worked on the well previously (preferably those who were involved in drilling and production) and have them on board for the operation. Bhalla said, “I have been involved in a couple of different instances where two particular operators had a number of fields that they stopped development on but they knew they would come back in a year or two for P&A. They knew the people and the rig would change, so what they did was create a file around the wells based on the experience of their engineers there and people involved in earlier campaigns in order to identify future risks.”

Sometimes, especially with much older wells, it is not possible to contact past engineers. If this is the case, the panellists commented that you just have to go back to basics by going to the public records or seeing if you can get information from past operators. By identifying which rig performed the initial drilling, if there were any recompletions, and as much about its life as possible you can patch together some information on the well. The more that can be gathered, the safer and more efficient the P&A will be.

Planning contingencies

The participants continued by emphasising that it was absolutely fundamental contingency plans were put in place, as you are planning to fail without them.

Lawler said, “You are gutting an old house – there are going to be a few surprises. Do as much planning ahead of time and plan those contingencies, because they are going to happen. They are essential if the operation is going to be a success. What we have discovered to be very beneficial is approaching BSEE (or whichever local regulatory body you are dealing with) early. They want to make you attempt to isolate the zone, but if you say you have concerns and point out your contingencies to them you may not get immediate approval but it will not surprise them when the contingency comes up. When the contingency is needed, you will usually need approval very quickly, it could even be a matter of hours, and you will be more likely to get quick approval as they are aware of it.”

Dave Mantei, Subsea Manager at Murphy Oil, echoed these sentiments by adding, “I cannot emphasise how useful early engagement with regulatory bodies is for getting early direction so that when, at 2am the calls comes in and the contingency is needed, that are already on the same page. That is absolutely key in conducting a P&A operation.”

George Coltrin, D&C/ Wells Advisor at Endeavor Management, commented, “A couple of things which can help with these operations is foresight when drilling. When you plan new wells, especially development projects, it is worthwhile putting in the effort to think about the impact on the P&A. Obviously this is not a big driver in the choices you are making at that moment as you are thinking more about well integrity and production, but it is still a driver which should be considered and will help later on.”

“Also, often it seems when we are dealing with P&A is that it is planned more piecemeal. When an operator is drilling a series of exploration wells and need a gap filler P&A is often used to fill this. But we can get into a lot more when considering all the P&A obligations as a portfolio. In an ideal world, operators would get a rig and conduct a whole P&A programme. As an industry we are more efficient with things we do on a regular basis; operations not done for a while tend to be not as efficient as workers have not used the tools for a while or perhaps not ever. So doing a whole P&A campaign would avoid problems and make operations much more efficient,” Coltrin added.

All about the people

Finally, the participants emphasised the importance of people, noting that having competent and experienced employees will ensure P&A operations are conducted much more effectively and safely as, at the end of the day, they are the ones on the front line who will be conducting the operations.

Coltrin said, “With new rigs and equipment what we can do today is incredible. But I would prefer to have mediocre tools with great people rather than mediocre people and great tools. Therefore focusing on people is really one of the best things you can do. If you are trying to reduce the risk of operations, good communication between the office team and rig team is essential, and the best way to do this is get people in the office who have experience on the rig, who know it and have relationships with the engineers out there. You need to put time into the people who are on your team, otherwise you might get teams with mismatches, and risks can be the result.”

- Region: Gulf of Mexico

- Date: June, 2021

At the Deepwater Decommissioning Gulf of Mexico 2021 Virtual Workshop, Kevin Squyres, Sales and Service Delivery Manager, Archer, presented the Stronghold systems: the latest set of innovations from Archer Oiltools which offer an economical effective alternative to traditional methods of plug and abandonment (P&A).

At the Deepwater Decommissioning Gulf of Mexico 2021 Virtual Workshop, Kevin Squyres, Sales and Service Delivery Manager, Archer, presented the Stronghold systems: the latest set of innovations from Archer Oiltools which offer an economical effective alternative to traditional methods of plug and abandonment (P&A).

Squyres explained how, by eliminating the need for milling, Archer’s Stronghold systems have the capacity to deliver more efficient P&A operations. When used in conjunction with Tubing Conveyed Perforating (TCP) products and new charge developments, the systems give economical and safe execution of operations providing time and cost savings for customers. The systems have been tried and tested in multiple environments across the globe including, the Gulf of Mexico, Alaska, the North Sea, the Middle East, Asia, and Australia.

Going into more detail, Squyres outlined the three tools for barrier verification and setting which make up Stronghold systems.

Barrier Verification

Archer Oiltools’s verification solutions consist of the Stronghold Defender and Stronghold Fortify systems:

-The Stronghold Defender test system enables operators to efficiently perforate and test an annular barrier. It functions in three steps by first perforating the casing or liner, then verifying the integrity of the annulus, before finally placing barrier material inside the casing.

-The Stronghold Fortify system provides a reliable verification of annular integrity in just one trip which consists of perforation of the casing, testing the integrity of the annulus, verifying the annulus integrity with a unique pressure verification system and cementing across the perforated areas.

Barrier Setting

The Stronghold Barricade system, the main focus of Squyres presentation, perforates, washes, and cements the annulus in order to create a rock-to-rock barrier to achieve permanent caprock integrity.

Usually, this can be achieved in just one trip, which consists of perforating the section, at which point the guns drop automatically; thoroughly washing the perforated annular section, moving down and up if required; placing spacer fluid in the annulus using the calculated pump and pull method; and placing the barrier material using the same technique, once the blank casing is reached the ball will automatically shear out. At this point the pumps are stopped and the operator will pull above expected top of cement to circulate/reverse out any residual cement in the drill pipe.

Squyres explained that in the Gulf of Mexico frequently rat holes are not available and so two trips may be required, but even if this is the case a lot of time and cost can still be saved against a lengthy cut and pull or section milling operation for example.

To demonstrate the benefits of using the Stronghold Barricade system, Squyres outlined a case study from the Gulf of Mexico where an operator needed to set a 330 ft cross sectional cement barrier in 13 3/8” x 20” casing which had no cement in place. The well was located in more than 6,000 ft of water depth and required a barrier placed just above the 20” casing shoe. The operator wanted a barrier to be deployed in order to prevent a cut and pull.

To meet this challenge, Archer deployed the Stronghold Barricade system after working with a local provider to ensure they had the right TCP charge performance. The tool successfully washed and cemented the 330 ft long interval with even rates at 1200 lpm. A successful test thereafter showed the operation was a success and the operator was able to move on with the completion of the P&A.

By using this method, the operator was able to capture value and time by avoiding a cut and pull. Off of the successful completion of this operation, Archer has now been commissioned for several more projects in the region with this client and indeed several others.

Globally, more than 200 P&A plugs have now been installed using Stronghold systems which have delivered 99% operation efficiency, achieved US$250mn in customer savings, and saved 190 tons of CO2 emissions per barrier.

- Region: Gulf of Mexico

- Topics: Decommissioning

- Date: June, 2021

Heerema has announced that last month its deepwater construction vessel, Balder, completed the offshore removal of the Morpeth Tension-leg Platform (TLP) on behalf of client Eni US Operating Company.

The Balder vessel, constructed in Japan in 1978, is 154 metres long and 86 metres wide with a draft of 36 feet (which can be increased to 82 feet when ballast water is taken in). It is capable of a tandem lift of 4,000t and working within water depths from 70 feet and beyond.

Balder mobilised to the Morpeth Field in mid-April to begin executing the removal of the TLP. The campaign involved the engineering, preparation, removal, and disposal of the offshore infrastructure. The removal consisted of the 2,650 short-ton topside, 2,500 short-ton hull, and 1,300 short-tons of tendons and piles.

Following the successful removal of the components, the topside was transported by barge, the tendons and piles on supply vessels, and the hull wet towed for recycling at MARS (Modern American Recycling Services) facilities at various US locations.

This project was the first TLP removal campaign for Heerema and adds another successful decommissioning project to Heerema’s portfolio, following a record-breaking 2020 that saw the company remove 85,277 metric tons of decommissioned structures in one year.

- Region: Gulf of Mexico

- Topics: Integrity

- Date: May, 2021

Magma Global has delivered the world’s first high-pressure composite riser pipe to HWCG’s storage location on the U.S. Gulf Coast, completing its rapidly deployable Offset Flexible Riser (OFR) system.

Magma Global has delivered the world’s first high-pressure composite riser pipe to HWCG’s storage location on the U.S. Gulf Coast, completing its rapidly deployable Offset Flexible Riser (OFR) system.

HWCG, to enhance its rapid deployment emergency well containment system, commissioned Magma Global to qualify and manufacture a high pressure, high temperature m-pipe to be used as a flexible riser connection. The lightweight, flexible m-pipe section will provide additional flow and capture emergency response options for HWCG’s members in the U.S. Gulf of Mexico.

The m-pipe is designed for rapid installation and is suitable for responses where vertical access is restricted and an offset is required such as water depths where the presence of combustible and volatile compounds affect personnel safety or where access under a floating production facility is needed. The system may also be used in deeper waters where more flexibility is desired in managing the marine systems during a response.

The 800 ft long section of m-pipe will provide a flexible riser connection between the capping stack placed on the incident well and a rigid riser suspended from a MODU. The m-pipe will form a horizontally oriented “S” shape between the capping stack and the rigid pipe riser, thus decoupling motion and decreasing surface station-keeping requirements for the temporary production facility. Once in operation, hydrocarbons released from the well flow through the complete riser flow path and are processed on board the temporary production facility to be collected in shuttle tankers for transportation.

Martin Jones, CEO at Magma Global, said, “This is a bittersweet success for Magma. We are proud to supply the first composite flexible riser for high pressure, high temperature hydrocarbons, for use in the Gulf of Mexico, yet we hope it will never have to be used. Nevertheless, m-pipe doesn’t corrode or degrade over time and hence will always be ready to enable HWCG to install at speed and with confidence.”

Bolstering HWCG’s well containment capabilities

HWCG’s response provides for the installation of a capping stack within 7-14 days and the ability to commence contingent flow and capture operations within 18 days, assuming no weather or other uncontrollable delays. Once installed the m-pipe is qualified to operate for at least six months, which is enough time to drill a relief well to provide final well kill and containment.

Mitch Guinn, Technical Director for HWCG, commented, “HWCG was one of the first organisations to accept the responsibility for providing equipment and personnel to respond rapidly and safely to a deepwater well incident. The addition of a flexible riser component to our suite of response equipment further enhances our ability to respond even more efficiently by allowing more flexibility in selecting a temporary production facility and enabling the selected facility to increase its operating window regarding weather conditions. The addition of Magma’s composite m-pipes is a huge benefit for our Members and is seen as one of their critical response components. We hope this work will open the doors to future applications of this breakthrough technology.”

Andy Jefferies, Deep Sea Development Services, and OFR Project Manager for HWCG, added, “The initial concept, and subsequent evolution, of the Offset Flexible Riser builds on the industry’s use of riser technology to manage unique operating conditions and environments requiring incident well flowback as part of a well containment strategy. The engineering and design aspects of this breakthrough technology have been led by DSDS for HWCG. The application of the Magma m-pipe design represents a step change in that technology and brings a time effective solution to well containment for flow and capture operations for all scenarios, but is particularly well suited to shallow water, high-rate gas wells, and wells requiring an offset flow and capture operation.”

- Region: All

- Date: Apr, 2021

Ardyne, an Aberdeen and Norway-based fishing, milling and casing recovery provider, has announced a strategic alliance with Dynasty Energy Services (Dynasty), a leader in specialised fishing services and plug and abandonment (P&A), to deliver enhanced P&A services around the world.

The exclusive partnership will enable easier access to leading world-class downhole technologies from both companies to deliver major cost and time efficiencies for P&A operations. As part of the agreement, Ardyne’s US team of five people will transfer to Dynasty, ensuring continuity from employees experienced in running Ardyne equipment over the last three years in US onshore and offshore applications.

Worldwide service

The alliance broadens Dynasty’s market offering in the western Hemisphere, while also enhancing Ardyne’s technology offering in the North Sea and wider eastern Hemisphere. It also allows for increased efficiencies for clients in both western and eastern Hemisphere markets.

Alan Fairweather, CEO of Ardyne, commented, “The future of many oil and gas supply chain companies will depend on their ability to adapt to market conditions and to continue identifying opportunities to improve their offering by creating greater operational efficiencies.

“Our strategic alliance with Dynasty is not only exciting for Ardyne, it also presents a model for other companies of a similar size to strengthen their existing technology portfolio and deliver a more robust global offering to clients.”

The alliance’s offerings

Ardyne will bring to the table its systems for casing recovery which save rig time and can provide solutions to challenging operations. The company’s Casing Recovery Toolbox offers flexibility and functionality to optimise operations and quickly adapt to unexpected circumstances.

Ardyne’s TRIDENT system, an integrated, single-trip casing cutting and pulling system has been developed to save rig time while offering precision and additional functionality is also on offer. Additionally, the TITAN system provides power downhole, enabling repeatable, on demand casing cutting and jacking capability in a single trip – it has been run successfully more than 1,200 times around the world.

From Dynasty, the unique Predator thru-casing section milling technology mitigates sustained pressure, providing a secure environment for barrier placement, saving costs through less rig time and multiple trips in the well. The Predator enables stabilised multiple string section milling without damaging outer casing strings. It allows real time decision-making, greater flexibility and contingency planning – especially valuable for P&A campaigns where the original well records are questionable or absent.

Combining Predator with the TRIDENT and TITAN systems enables multiple time saving solutions for P&A operations, with the benefit of being available from one service provider.

Alan Fairweather continued, “Forecasts for the decommissioning market are healthy but to maximise these opportunities will require greater innovation in technology and service provision. The exclusive partnership between Ardyne and Dynasty answers the need for a truly world-class full service fishing, milling and casing recovery offering for the global P&A sector.

“It reaffirms our ongoing commitment to the North Sea well-decom efficiency tool kit and opens our business up to greater opportunities in the locations where Dynasty is already established, including the Gulf of Mexico and US land.”

Keith Alexander, executive VP and chief operations officer of Dynasty Energy Services, added, “Under the partnership agreement, we will supply Ardyne’s technologies to support our services in the Western Hemisphere while Ardyne will supply our products along with their own in the Eastern Hemisphere.

“Combining our technologies to establish a stronger, holistic offering represents a win-win for both companies. However the ultimate winners are the clients who will benefit from easier access to our products to help them achieve greater P&A efficiencies.”

- Region: Gulf of Mexico

- Date: Apr, 2021

Chevron U.S.A. (Chevron) has awarded Worley, a global provider of professional project and asset services in the energy, chemicals and resources sectors, an engineering and procurement services contract to provide brownfield modification services for one of its deepwater production facilities located in the Ballymore oil and gas field, Gulf of Mexico.

Chevron U.S.A. (Chevron) has awarded Worley, a global provider of professional project and asset services in the energy, chemicals and resources sectors, an engineering and procurement services contract to provide brownfield modification services for one of its deepwater production facilities located in the Ballymore oil and gas field, Gulf of Mexico.

Ballymore is a large oil and gas field drilled by Chevron in 2018. It is located in the Mississippi Canyon area of the Gulf of Mexico, in water depth of 6,536 feet. Chevron is the operator and holds a 60% working interest in the prospect, with Total owning the remaining 40%.

Worley will provide engineering and design services for the integration and subsea tieback of the Ballymore oil and gas field, support both the subsea and topsides designs and will also provide procurement services for topsides.

The topsides services and project management will be executed by Worley’s US Gulf Coast team, with Intecsea executing the subsea portion of the project. Intecsea is part of Worley’s Advisian consulting business and is a world leader in subsea systems, offshore pipelines, floating systems and overall field development. Support will also be provided by Worley’s Global Integrated Delivery office in India.

Chris Ashton, Chief Executive Officer of Worley, commented, “As a global professional services company headquartered in Australia, we look forward to helping Chevron meet the world’s changing energy needs and continuing Worley’s longstanding global relationship with Chevron.”

- Region: All

- Date: Apr, 2021

Halliburton Company (Halliburton) will offer Optime Subsea’s (Optime) innovative technologies as a service across its global portfolio as part of a new strategic alliance.

As part of the agreement, Optime’s innovative Remotely Operated Controls System (ROCS) will be applied to Halliburton’s completion landing string services. The companies will also collaborate to offer intervention and workover control system services leveraging Optime’s Subsea Controls and Intervention Light System (SCILS) technology, a remote digital enabled system that compliments Halliburton’s subsea intervention expertise.

The alliance will facilitate umbilical-less operations and subsea controls for deepwater completions and interventions delivering increased operational efficiencies while minimising safety risk through a smaller offshore footprint.

Daniel Casale, Vice-President of Testing and Subsea at Halliburton, commented, “We are excited to work with Optime and leverage their technologies within our existing subsea completions and intervention solutions. Our alliance advances remote capabilities and provides a capital efficient solution, allowing customers to reduce safety risk, operational footprint, setup and run-time.”

Jan-Fredrik Carlsen, CEO of Optime Subsea, added, “We believe that strong mutual alliances across the vertical supply chain drives continuous improvements needed in our industry. By solidifying this relationship with Halliburton and combining their well-established, reputable service and technology capabilities with Optime’s innovative controls and intervention technology, more customers will have access to these cost-efficient subsea solutions.”

Another step forward for Subsea Optime

The collaboration with Halliburton marks another step in Optime’s short but impressive history, since its foundation in 2015, as an integrated system and service provider with the capability to optimise well interventions and completion operations. Recently the ROCS, perhaps their most successful offering, proved its worth when it was deployed during a completions operation for a production well for Aker BP on the Ærfugl-field on the Norwegian Contintental Shelf in late February. The operation was a success and optimised operations with noticeable reductions in HSE risks and overall cost. Now the ROCS (and the rest of Optime’s offerings) has the opportunity to perform on the global stage, and this partnership with Halliburton will help the company expose its services to a wider customer base.

- Region: All

- Date: Mar, 2021

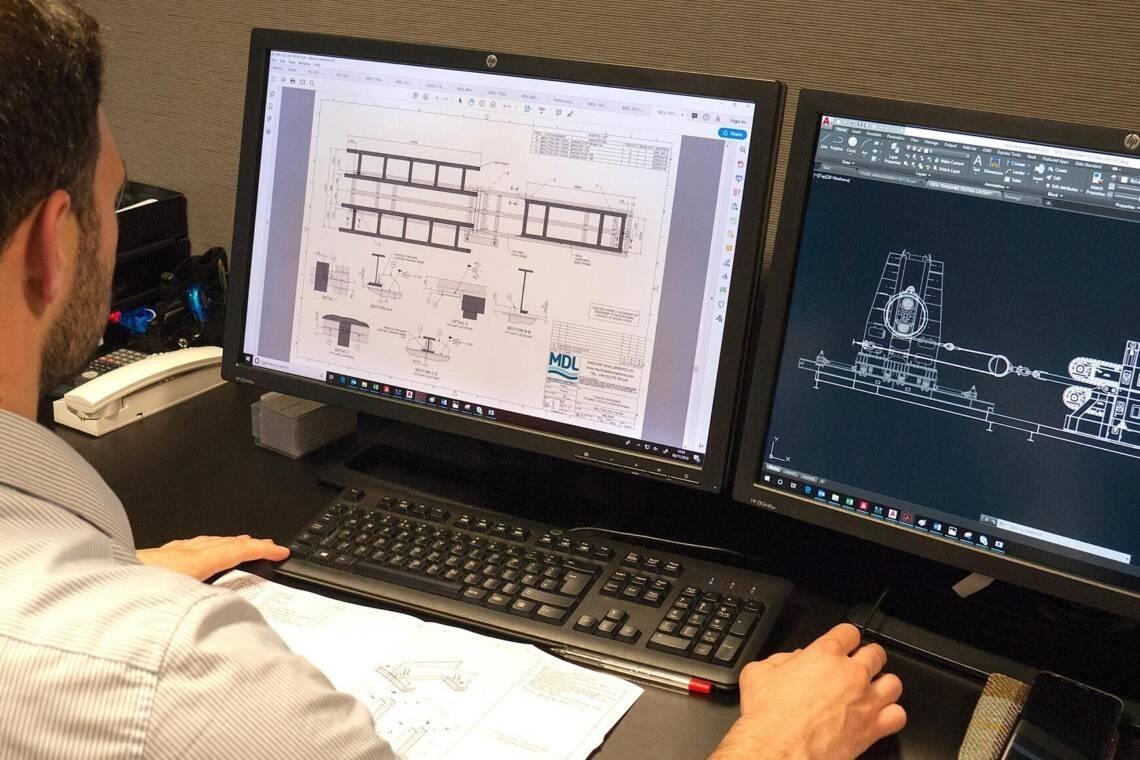

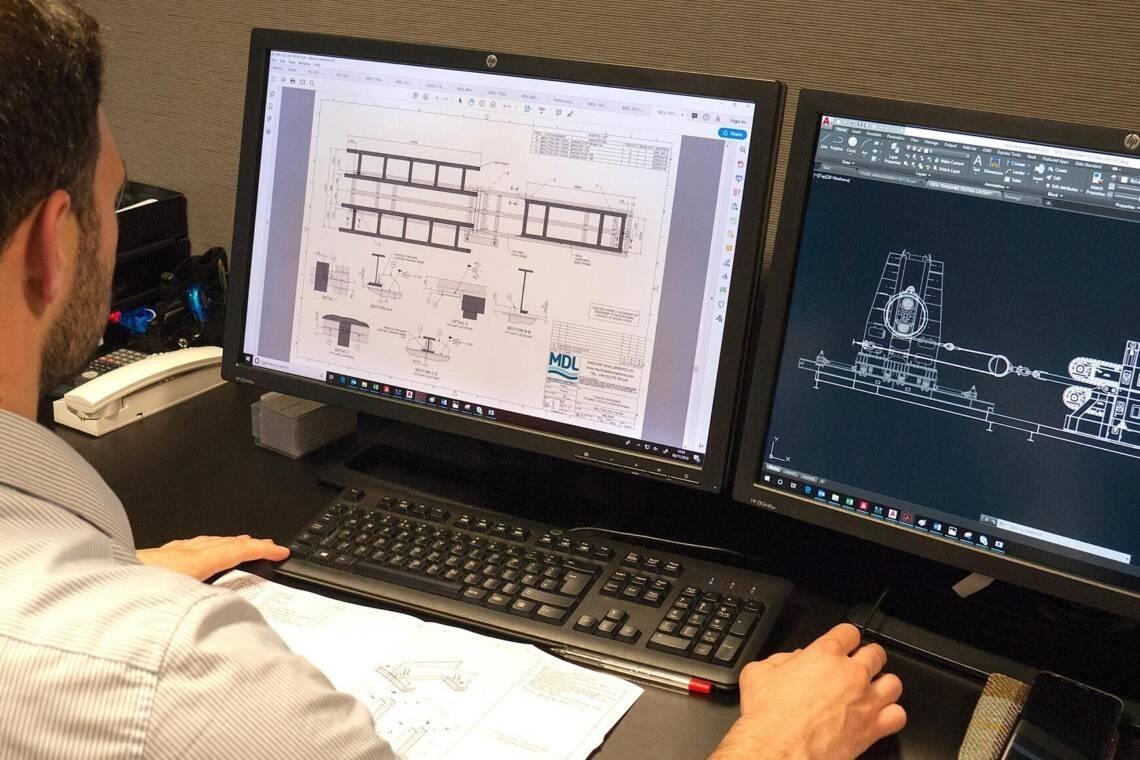

Helix Energy Solutions Group (Helix) has announced that it has entered into a new agreement for response resources with HWCG LLC which was closely followed by Helix Robotics Solutions (HRS), a division of Helix, awarding Maritime Developments Ltd (MDL) a two-year frame agreement for project engineering services and equipment supply.

HWCG LLC

HWCG’s members, under the new agreement with Helix, will be given the opportunity to identify the Helix Fast Response System as a response resource in permit applications to U.S. federal and state agencies, and to deploy the Helix Fast Response System to respond to a well control incident in the U.S. Gulf of Mexico.

The Helix Fast Response System consists of the Helix Producer I floating production unit, Q4000 or Q5000 vessels, subsea intervention systems, crude transfer systems and other well control equipment.

Under the terms of the agreement, HWCG will pay Helix an annual retention fee and HWCG’s members will receive a credit against this fee for every day that a member utilises the Q4000 or Q5000.

Owen Kratz, CEO of Helix, commented, “We are pleased to continue our long-standing relationship with HWCG, and are proud to stand on call as a first responder in the Gulf of Mexico. Helix’s industry expertise in offshore well intervention and well control is second to none, and we feel this agreement demonstrates the parties’ commitment to the continued safe planning, operation and execution of offshore oil and gas production. We embrace our role as a provider of sustainable solutions, are proud to offer the Helix Fast Response System to help mitigate and remediate the environmental risks associated with offshore drilling and production operations.”

Adding to this, HWCG’s Managing Director, Craig T. Castille said, “HWCG and its membership are pleased to have Helix continue as a business partner and core contractor for its source control and containment response in the U.S. Gulf of Mexico.”

The agreement replaces the parties’ prior agreement and is effective April 1, 2021 for an initial two-year term.

Maritime Developments Limited

Closely following this, Helix Robotics Solutions, announced that it has awarded MDL a two-year frame agreement covering the provision of MDL Project Management and Engineering services, as well as personnel and equipment, to optimise HRS’ offshore campaigns.

HRS will now be able to draw on MDL’s in-house expertise for storyboard development, visualisations and procedures/task plans for offshore execution, deck layout optimisation, sea-fastening design and verification, drawings and calculation packages and crane lift requirement assessments.

For the project execution phase, HRS will also have access to MDL’s expert personnel and market-leading rental fleet and look to optimise the costs and timescales in mob/demob stages with MDL’s portable technology.

MDL will also provide field engineering support to act as the interface between vessel management team, end client and pipelay equipment spread during mobilisation, offshore execution and demobilisation.

For bespoke projects, MDL has offered its 21-year track record in mechanical handling design and manufacture, to deliver newbuild solutions, as well as equipment maintenance, repairs and upgrades.

More Articles …

- Oceaneering to conduct additional operations in the Khaleesi/Mormont and Samurai fields

- 3D at Depth launch offshore Geophysical Survey Services division

- Logan Industries introduces new set of coiled tubing reelers for open water interventions

- The importance of connectivity in the path to Industry 4.0

Page 14 of 17

Copyright © 2024 Offshore Network