Archer, in collaboration with SLB, has been awarded an integrated plug and abandonment (P&A) contract with Equinor for the Titan platform in the Gulf of America (GoA).

Archer, in collaboration with SLB, has been awarded an integrated plug and abandonment (P&A) contract with Equinor for the Titan platform in the Gulf of America (GoA).

The service offerings under the contract includes project management, well engineering, provision of a compact workover rig, coiled tubing, wireline services, and a suite of downhole P&A technologies and the scope covers P&A of three wells. The award combines SLB’s established deepwater leadership in the region with Archer’s specialist expertise as a P&A service provider.

Dag Skindlo, CEO of Archer, commented, “This integrated deepwater P&A project builds on our momentum following several large P&A contract awards in the North Sea in 2025. The recent acquisitions of the US based fishing specialists WFR and Premium were key steps in our strategy to position Archer as a leading service provider in the growing deepwater P&A market in the GoA.”

The contract follows hot on the heels of the award of an integrated P&A contract with Equinor for 30 subsea wells. The fully integrated P&A programme incorporates the planning scope including project management, well and subsurface engineering (provided through the Archer Elemental joint venture) with the execution scope including wireline, fishing and remedial services, downhole mechanical isolation, P&A services, cementing, fluids, and mudlogging.

The awards further reinforce Archer’s leading position within the P&A market and reflect its ability to deliver integrated well abandonment solutions from concept selection through to the permanent abandonment of wells. The company has successfully completed hundreds of permanent P&A wells in the North Sea.

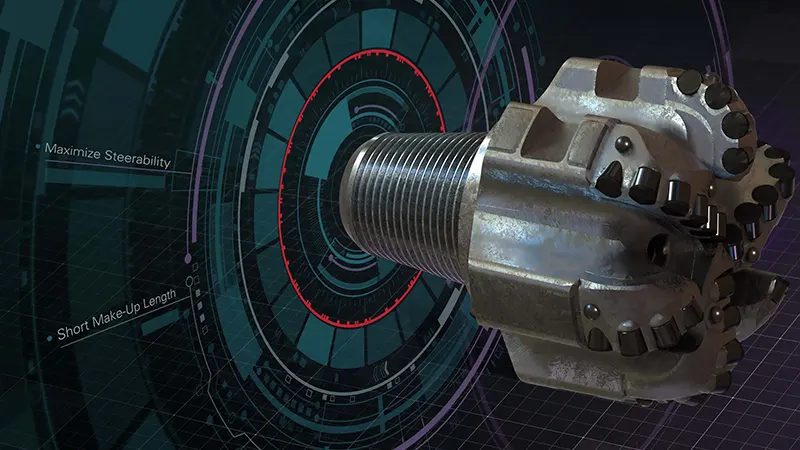

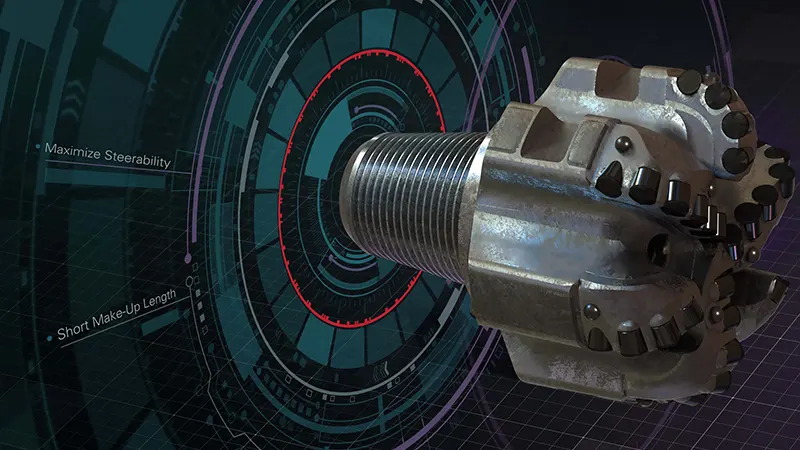

Halliburton has launched its first shankless matrix-body bit called the HyperSteer MX directional drill bit.

Halliburton has launched its first shankless matrix-body bit called the HyperSteer MX directional drill bit.

Improving durability and maximising directional control, the bit promises longer runs and fewer trips, resisting erosion and abrasion, and performing reliably in high-flow, abrasive environments.

"HyperSteer MX directional drill bits mark a major step forward in drilling. The technology combines the precise steerability of HyperSteer directional drill bits with a durable matrix body. It allows operators to drill longer in harsh environments and supports efforts to minimize well time and maximize directional performance for customers," said Amr Hassan, Vice President, Drill Bits and Services, Halliburton.

The tool utilises advanced matrix materials to resist erosion and abrasion, extend bit life in abrasive, high-flow environments, and improve efficiency and reliability during operations. It deliver precise steerability that boosts performance in vertical, curve, and lateral sections, and reduces well time as well as well construction costs. The bit reduces trips, lowers exposure to unplanned events, and maintains directional precision in the most abrasive environments.

HyperSteer MX directional drill bits adds to the HyperSteer portfolio, reflecting the oilfield services provider's engagement in innovative engineered solutions for asset value maximisation.

Gulfstream Services Inc. (GSI) and Oilfield Service Professionals (OSP) have announced a Global Strategic Technology Alliance in order to deliver next-gen automated cementing systems and integrated solutions for land and offshore operations across the world.

Gulfstream Services Inc. (GSI) and Oilfield Service Professionals (OSP) have announced a Global Strategic Technology Alliance in order to deliver next-gen automated cementing systems and integrated solutions for land and offshore operations across the world.

The alliance will combine OSP’s global service organisation, digital automation and field execution capabilities with GSI’s top-drive cement head systems to create a data-driven cementing platform.

The overall aim of the alliance is to advance safer, more efficient and more consistent cementing operations across the well lifecycle.

The core of the collaboration sits GSI’s RCH Top Drive Cement Head – a modular system with more than 3,500 runs worldwide, supporting casing sizes from 4-1/2” to 13-3/8” for demanding applications, both on land and offshore.

When this technology is paired with OSP’s automation and digital integration abilities, the system enables reduced red-zone exposure, improved operational consistency and enhanced execution visibility.

Jasen Gast, President and CEO of Oilfield Service Professionals, said, “This alliance represents a meaningful step forward in cementing operations. By combining our global service organisation and automation roadmap with GSI’s proven cementing systems, we are delivering a scalable, next-generation solution for operators worldwide.”

Chief Executive Officer of Gulfstream Services, Bobby Bond, commented, “By aligning Gulfstream’s field-proven cementing systems with OSP’s deployment and integration capabilities, we are expanding the reach and functionality of our technology to meet the evolving needs of global operations.”

According to the United States Department of the Interior's Bureau of Safety and Environmental Enforcement, well decommissioning is a critical process for environmental protection.

According to the United States Department of the Interior's Bureau of Safety and Environmental Enforcement, well decommissioning is a critical process for environmental protection.

After a well has been drilled and utilised for production, it must be safely plugged and sealed in the Outer Continental Shelf, with the production-supporting equipment removed for disposal. This is established right from the start when a company signs a lease for offshore exploration, Right-of-Way or Right-of-Use-and-Easement.

Decommissioning activity in a platform generally relates to two parts -- the topside that can be seen above the waterline, and the mudline substructure that remains between the surface and the seabed. The operational components that make up the topsides are removed to be taken to shore for repurposing. The substructure, on the other hand, is dismantled 15 ft below the mudline before they are transported to shore for commercial purposes or recycling/reinstallation.

In case a structure is kept as it is for conversion to an artificial reef in line with the National Oceanic and Atmospheric Administration's National Artificial Reef Plan, it requires approval from the Regional Supervisor.

A central part of BSEE's decommissioning rules is the 'Idle Iron' policy that is applicable for decommissioned and no longer 'economically viable' operations. This distinction bars inactive facilities from littering the Gulf of America by alarming operators on the urgency of dismantling and disposal responsibilities once non-productive wells have been plugged.

The Idle Iron policy helps safeguard environmental hazards that can result from unremoved topsides and the associated equipment, electronics, wiring, piping and tanks, among others. Also, severe weather conditions like hurricanes can cause idle facilities to leak, giving rise to unwanted risks.

The Atlantis Drill Center 1 expansion project turned out a big success for bp as it generated first oil, becoming the major's seventh upstream project startup of the year.

The Atlantis Drill Center 1 expansion project turned out a big success for bp as it generated first oil, becoming the major's seventh upstream project startup of the year.

Overall, the platform is equipped to produce up to 200,000 barrels of oil per day. Designed to boost production by an additional 15,000 barrels of oil equivalent per day, the project saw the link-up of two wells to an existing drill center, a subsea hub connecting multiple wells. New wells besides, the subsea tieback also includes existing offshore production facilities through pipelines, managing to keep the 1998-discovered field operational till date, making it bp's longest-running platforms in the Gulf of America.

bp approached the mega-scale project with a sustainable approach that saw the utilisation of existing subsea inventory while drilling and completing wells more efficiently, and streamlining offshore execution planning. This allowed project delivery two months ahead of its original schedule.

"Atlantis Drill Center 1 caps off an excellent year of seven major project start-ups for bp. This project supports our plans to safely grow our upstream business, which includes increasing US production to around 1 million barrels of oil equivalent per day by 2030.

“This latest success demonstrates the dedication of our US project team and our teams around the world, who are delivering new barrels at pace and with lower production costs, in service of growing long-term value for shareholders," said Gordon Birrell, bp’s Executive Vice President of production and operations.

Andy Krieger, bp’s Senior Vice President for the Gulf of America and Canada, said, “This expansion at Atlantis is further testament to the benefits of maximising production from our existing platforms in the Gulf of America, growing bp’s US offshore energy production safely and efficiently.

"We are committed to investing in America as we firmly believe this region will continue to play a critical role in delivering secure and reliable energy to the world today and tomorrow.”

While bp is Atlantis’ operator with 56% working interest, Woodside Energy remains co-owner with 44% working interest.

Buccaneer Energy will be advancing the next phase of development in the Fouke area of the Pine Mills field.

Buccaneer Energy will be advancing the next phase of development in the Fouke area of the Pine Mills field.

Leveraging the terms of its new offset lease, the company is preparing to implement a secondary recovery (waterflood) based on dedicated injection wells, Turner #1 and Daniel #1. This decision is the result of a technical evaluation of the recently drilled Allar #1 well.

The company is considering the waterflooding approach, as it is known to work especially in the Pine Mills field and surrounding areas. Primary recovery typically ranges between 5% and 20%, of the original oil in place, averaging around 15% in the region. Waterflood promises recovery chances of as much as 30% and 50% of the OOIP. This gives reason to anticipate that recoverable volumes in the Fouke area can go up by two to three times, with current estimates indicating 667,000 to 1,002,000 bbls could ultimately be recovered.

To commence waterflood activities, however, it is necessary to produce before the Texas Railroad Commission the formation of a "waterflood unit" comprising all leaseholders and royalty owners within the proposed area. Potentially, a six-month activity, this will allow to reinstate production from Turner #1, which is expected to deliver a modest contribution to current field output while preparatory engineering and regulatory work progresses.

Paul Welch, Buccaneer Energy's Chief Executive Officer, said, "The decision to initiate a waterflood in the Fouke area marks a key step forward in maximising long-term value from our Pine Mills assets. Waterflooding has a proven track record in these reservoirs, and we believe the Turner #1 and Daniel #1 wells provide ideal injection points to support a highly effective recovery scheme.

We are confident that this programme will materially increase recoverable reserves and enhance the field's production profile. We look forward to updating investors as we progress the regulatory and technical workstreams required for implementation."

An international oil & gas exploration and production company with development and production assets in Texas, Buccaneer owns a 32.5% Working Interest in the Fouke area of the Pine Mills field.

INEOS Energy has reported a new oil discovery in the Norphlet formation in the Gulf of America, where the company holds a 21% working interest

INEOS Energy has reported a new oil discovery in the Norphlet formation in the Gulf of America, where the company holds a 21% working interest

The Nashville exploration well, operated by Shell with a 79% interest, represents INEOS Energy’s first successful exploration outcome in the region.

Drilled to a depth of more than five miles below the seabed, the Nashville well encountered high-quality oil within one of the Gulf’s most prospective deepwater reservoirs. The discovery is located close to Shell’s Appomattox production platform, opening up the possibility of a tie-back development to existing infrastructure jointly owned by Shell and INEOS.

David Bucknall, CEO of INEOS Energy, commented, "This is a good result for INEOS Energy and an important step in building our presence in the US Gulf where world-class resources are to be found and developed responsibly. We believe Nashville will help strengthen energy security and provide reliable supplies for many years to come."

According to the company, the well was drilled using the Deepwater Proteus, regarded as one of the most advanced offshore drilling rigs currently in operation. INEOS added that further technical evaluation is under way to assess the full scale and commercial potential of the discovery.

Heather Osecki, CEO of INEOS Energy’s US Gulf business, said, "The drilling results at Nashville are very encouraging and fully in line with what we hoped to find. This discovery is an important first step in our plans to grow our existing assets while we look to further strengthen our position in the Gulf. We look forward to continuing our work to bring further value to the Appomattox host platform."

As NuGulf is looking towards major decommissioning operations, a Bureau of Safety and Environmental Enforcement-aligned Cased Hole Well Control Manual for Decommissioning Activity that is dedicated to the nearshore Gulf of America has been released.

As NuGulf is looking towards major decommissioning operations, a Bureau of Safety and Environmental Enforcement-aligned Cased Hole Well Control Manual for Decommissioning Activity that is dedicated to the nearshore Gulf of America has been released.

The document focuses on decommissioning where the well is made safer, especially during the operation. The initial process involves establishing plug and cement barriers to isolate all hydrocarbon hazards. Once this step is achieved, well changes are determined by 'class' from pressure for flow potential to no pressure and no potential to flow. Equipment rig up can change from pressure tested PCE to 'open hole' operations to cut and pull tubing and casing.

This document comes after a tried and tested onshore Cased Hole Well Control Manual that ensured consistency in operations and both well site supervisors and contractors understand what is required for any cased hole operation.

A United States-based operator, NuGulf works to eliminate the global Asset Retirement Obligation (ARO) through the careful decommissioning, plugging and abandoning, and environmental cleanup of wells and field infrastructure. Their approach involves innovative solutions to efficiently deliver some of the most challenging decommissioning, well intervention and hurricane recovery projects.

Shell Offshore has taken a final investment decision on a waterflood project at the Kaikias field in the Gulf of America to aid in boosting production.

Shell Offshore has taken a final investment decision on a waterflood project at the Kaikias field in the Gulf of America to aid in boosting production.

Water will be injected to displace additional oil in the reservoir formation which supplies production to Shell’s Ursa platform in the Mars Corridor.

The method acts as a secondary recovery where the injected water physically sweeps the displaced oil into adjacent production wells, while re-pressurising the reservoir. First injection is penned for 2028 and is anticipated to extend the production lifecycle of Ursa by several years.

Peter Costella, Shell’s Upstream President, said, “Following our decision to increase our stake in Ursa earlier this year, this additional investment continues to maximise the value of the asset. It also contributes to our aim of maximising high-margin production and longevity in a core basin to maintain liquids production.”

Pantheon Resources has been conducting well clean-up operations on the Dubhe-1 well with an aim to determine a representative oil flow rate.

Pantheon Resources has been conducting well clean-up operations on the Dubhe-1 well with an aim to determine a representative oil flow rate.

The clean up profile might need alteration to suit the well's multiple fracked stages, each differing from the previous single zone completion and requiring clean up at different points in time.

While the company's budget for well completion was set at approximately US$15mn, well planning and data gathering led to modified final costs. As clean-up continues alongside flow-back and well testing activities, these costs will be determined at the end of the programme.

Production from the Dubhe-1 well is dominated by previously injected stimulation fluids. After intermittent production, consistent small oil volumes have been visible, with boosted gas production throughout the period. Till now, approximately 40% of the injected water volume has been produced with steady gas production along with the modest production of light oil. The company's closest analog to this well is the SMD-B interval in Alkaid-2 which was flow tested in 2023 and first measured oil production when a water volume equivalent to approximately 50% of the injected water volume had been produced.

The company recorded approximately US$33mn in drilling and completion costs, a marked increase over the original budget, as it had to drill a pilot hole to allow core samples to be collected, to better refine the target landing zone and to penetrate the deeper Slope Fan System (SFS) as well as the shallower SMD-C reservoir target.

Overall, this cost outcome, inclusive of full appraisal scope, contingency measures (e.g. standby drilling rig and coil tubing unit based on the experience at Alkaid-2), and inflationary pressures, does not detract from a solid operating performance. In addition, the construction of the new Dubhe pad, which will also be available for the drilling of future wells, cost $2.5 million. Clean-up, flow-back and well testing operational costs will be determined at the end of the programme.

Max Easley, Chief Executive Officer, said, "I continue to be pleased with the ongoing safe and efficient execution of our operations to date and look forward to sharing more about Dubhe-1 results when we have them."

Enbridge Offshore Facilities in the central Gulf of America will be equipped with a major new deepwater crude oil and natural gas export systems by Allseas.

Enbridge Offshore Facilities in the central Gulf of America will be equipped with a major new deepwater crude oil and natural gas export systems by Allseas.

This export system will be backed by critical subsea infrastructure for transport expansion capacity and future energy production.

Midstream operator, Enbridge, has chosen Allseas' services for the transport and installation of four export pipelines, totalling more than 515 kms, to transport oil and gas from upcoming deepwater developments to existing offshore hubs for onward delivery to market. About 321 kms of 24-inch and 26-inch oil pipeline originating in the deepwater Keathley Canyon area of the Gulf of America will go till the Green Canyon 19 (GC19) platform. About 195 kms of 12-inch gas pipeline originating in the deepwater Keathley Canyon area of the Gulf of America connecting to Enbridge’s Magnolia Gas Gathering System (feeding its Garden Banks network).

Each pipeline will have a 3-km steel catenary riser (SCR) linking to floating production units. Installed in water depths up to 2000 m, the systems will feature multiple crossings, inline structures and termination assemblies to accommodate future tie-ins from nearby discoveries.

The oil export system will connect to the Rome Pipeline – onboard the GC19 platform – scheduled for installation by Allseas in 2028, while the gas gathering system will deliver into the Magnolia Gas Gathering System via the new Sparta Gas Pipeline owned by Enbridge’s joint venture with Shell Pipeline Company LP, which Allseas will install in 2026.

Allseas’ dynamically positioned pipelay vessel Solitaire will perform the offshore campaign between 2027 and 2028. The vessel will utilise her modified double-joint factory (DJF) – a key component of Allseas’ fast S-lay production capability – featuring fully automated welding and inspection systems to achieve precise, consistent and efficient pipelay in deepwater conditions.

Building on Allseas’ innovation in automation and digitalisation, the enhanced DJF integrates advanced pipe handling, tracking, welding and inspection processes to optimise production flow and ensure the highest weld quality standards.

By expanding Enbridge’s deepwater network, the new pipelines will provide essential export capacity to meet the Gulf’s growing production and transport demands.

Global energy and marine consultancy ABL has entered a strategic partnership with Egypt’s Petroleum Marine Services (PMS) to launch a fully integrated rig-moving service tailored for offshore operations in the Red Sea and Gulf of Suez.

Global energy and marine consultancy ABL has entered a strategic partnership with Egypt’s Petroleum Marine Services (PMS) to launch a fully integrated rig-moving service tailored for offshore operations in the Red Sea and Gulf of Suez.

Supported by the Egyptian General Petroleum Corporation (EGPC), this collaboration marks a significant step forward in enhancing Egypt’s offshore logistical capabilities and overall operational performance.

The joint initiative has been developed in line with Egypt’s broader vision to streamline offshore activities, cut downtime, and strengthen the quality and reliability of marine and drilling logistics across two of the nation’s most active offshore basins. By combining the technical strengths of both organisations, the new service aims to raise industry standards while improving the continuity of drilling campaigns.

Under the unified service model, PMS and ABL will provide a centralised operations hub for the Red Sea, delivering comprehensive site surveys, technical assessments, and in-depth risk analysis. The framework also incorporates advanced weather impact modelling to support safer scheduling, along with high-capacity towing assets and ASD vessels offering up to 126-tonne bollard pull. Additional capabilities, including seabed survey equipment and ROV support, are designed to reinforce operational precision and reduce unexpected delays. A standardised workflow has also been introduced to further cut costs and maintain drilling consistency across the Gulf of Suez.

As the technical and engineering partner, ABL contributes its extensive global experience, having executed more than 1,500 rig moves worldwide. Its methodologies, aligned with international best practice, will support the Egyptian offshore sector with marine warranty, engineering consultancy, and rig-move assurance services.

Amr Badway, PMS chairman and managing director said,“This service directly responds to the needs of production companies that seek a unified operational model that delivers efficiency, flexibility, and reliability, ultimately improving rig utilization and minimizing downtime.”

Captain Stephen Craig, ABL’s director for rig operations,added, “The dynamic marine environment in Egypt will definitely benefit from a unified operational framework. We will also ensure knowledge transfer to reinforce local capability and improve overall system reliability.”

Page 1 of 23

Copyright © 2025 Offshore Network