BiSN, a leading supplier of sealing solutions and technology to the global oil and gas industry, has reached a significant milestone after completing its 300th deployment, helping operators around the world to effectively solve common downhole flow issues.

The operations were carried out on six continents (Australia, The Americas, Europe, the Middle East, Africa and South Asia) and took place in a range of challenging conditions and location; onshore, offshore, high temperature or high pressure.

By providing critical production enhancement, intervention, completion, and plug and abandonment services, using its patented Wel-lok sealing technology, BiSN reduced costs, improved production, and dramatically extended the life of hundreds of wells.

By working with specially developed chemical reaction heaters to carefully melt unique bismuth-based eutectic alloys into plugs, BiSN developed its Wel-lok technology to create a bismuth plug that is not only safer, but much more reliable and easier to deploy. It makes it possible to form a gas tight (v0) seal and with a density that is 10 times higher than water it effectively displaces all wellbore fluids.

Paul Carragher, CEO of BiSN said, “As operators strive to address downhole flow issues safely, increasing production while reducing costs, we have made it our mission to help them achieve this. We have the extensive real world experience in applying this method. As a result of carrying out more than 300 deployments globally, we know how to successfully use our technology to complete operations aimed at enhancing production, completions, plug and abandonment, and intervention. These jobs represent operations carried out for many repeat customers, illustrating the value and confidence they continue to place in our work.”

To help operators tackle complex challenges downhole, BiSN draws upon its varied experience and services. These range from shutting off water production and isolating zones to setting a gas-tight plug, repairing damaged casing or tubing, and permanently sealing multiple annuli, among others.

While the company continues to provide downhole sealing solutions to new and existing customers in the US, Canada and Australia, BiSN is actively expanding in Europe and Africa and has recently opened an office in Aberdeen.

Well decommissioning specialist Well-Safe Solutions, has officially added WilPhoenix, a semi-submersible drilling rig to its fleet.

The company stated that the WilPhoenix will now undergo improvements as part of its repurposing as a dedicated P&A asset, and will soon be known as the Well-Safe Defender. In May, Awilco Drilling had made the deal to sell it to Well-safe Solutions.

The WilPhoenix is one of Awilco Drilling's two Enhanced Pacesetter semi-submersible drilling rigs. It was built in 1982 and upgraded in 2011. WilHunter, Awilco Drilling’s other semi-submersible, is in the process of being sold for recycling.

Phil Milton, CEO at Well-Safe Solutions, said, “The addition of our second semi-submersible rig, to be known as the Well-Safe Defender, is a landmark achievement for the business.”

Built in 1983, the WilPhoenix is an established presence in the North Sea, having been extensively refurbished and upgraded in 2016. Well-Safe Solutions expect to take delivery of the rig in June 2022 and will carry out optimisation and recertification requirements for future well plug and abandonment (P&A) activity.

The rig acquisition is expected to create around 100 jobs in a variety of onshore and offshore roles, in addition to the 231 personnel already employed by Well-Safe Solutions.

Neil Ferguson, Operations Manager at Well-Safe Solutions, added, “The WilPhoenix has a strong track record and is the right candidate to undergo conversion for well P&A.”

Well-Safe Solutions is the first UK company with its own assets to provide a Tier 1 well decommissioning service focused exclusively on P&A, with the Aberdeen-headquartered company owning and operating the Well-Safe Guardian semi-submersible and Well-Safe Protector jack-up rig.

The WilPhoenix is expected to enter service with its new owners as the Well-Safe Defender in late 2022.

Energy technology start-up Clearwell Technology has taken up a feasibility testing programme for a new tool that could cut the costs and emissions of well decommissioning projects by half, following support from Scottish Enterprise.

Bruce Cardno and Paul Ray set up Clearwell Technology to develop their thermal milling technology, Therm-X-Mill, and transform the current methods of oil and gas well decommissioning by eliminating the use of drilling rigs and their associated equipment.

SMART:Scotland grant funding of £84,000 from Scottish Enterprise helped Clearwell Technology perform a testing programme. The company is now looking ahead to the next stage of development which will involve further testing, development of a prototype tool and field trials prior to full-scale commercialisation.

Scottish Enterprise head of low carbon transition Andy McDonald said, “Industry reports highlight that the decommissioning market is growing, especially as more focus is spent on energy transition activities and less on drilling new wells.

“This creates opportunities for companies like Clearwell Technology to provide decommissioning technology that will help aid the wider global energy transition agenda and it is fantastic to see a company from Aberdeenshire take forward this innovation.

“Scottish Enterprise aims to support entrepreneurial talent to build a stronger more sustainable Scottish economy and projects like this highlight the collaborative approach to delivering net zero solutions taking place here in Scotland.”

According to a Decom Insights report from Offshore Energies UK, the decommissioning market is currently around 12% of UK offshore industry expenditure with forecasts of over £16bn due to be spent over the next decade and around 4,000 wells estimated still to be decommissioned.

In addition, the recent North Sea Transition Deal set out the sector’s decommissioning supply chain target to ensure 50% local content around projects – all creating opportunities for Scottish businesses.

Bruce Cardno, Director of Clearwell Technology, said, “As energy companies focus on transition our technology aims to make the oil and gas well decommissioning process simpler and more environmentally friendly, while also releasing resources to drive net zero projects in the industry.

“Almost half the cost of any decommissioning project is spent on the plugging and abandonment of the wells so by reducing this cost with our Therm-X-Mill tool we aim to transform the industry’s approach.

“We are ramping up our testing from our site in Aboyne as we progress towards prototype development so this is a really exciting time for us, and we are hugely thankful for the support from Scottish Enterprise to help drive our technology.”

Norwell Engineering, a global well engineering and project management firm, has secured a multi-million dollar contract to deliver an integrated offshore decommissioning project in the UAE on behalf of operator Sinochem Corporation (Sinochem).

Norwell Engineering will develop the abandonment strategy for Sinochem’s UAQ Gas Field as well as detailed well and facilities decommissioning planning, tendering and procurement services, logistics, marine support and operational execution.

Mike Adams, General Manager of Norwell Engineering, said the company partners with client decommissioning teams to address technical, safety, environmental and legislative considerations.

He commented, “While the decommissioning sector is heating up with several well engineering firms active in the space, our experience and technical focus across the entire field provides operators with a different perspective – reducing risks and identifying efficiency savings during every phase.

“The wells are the most complex and costly element of an integrated decommissioning scope and this is what Norwell has specialised in for more than 30 years. Together, with our subsurface partners, and growing topsides decommissioning team, we are in an excellent position to support clients such as Sinochem with end-to-end project management of their integrated decommissioning scopes.”

Sinochem, is a leading, state-owned, player in the global oil exploration and production sector. The UAQ Gas Field was the first offshore gas field independently developed and built overseas by Sinochem. As part of the integrated project, Norwell will be responsible for developing the abandonment strategy, as well as detailed well and facilities decommissioning planning, tendering and procurement services, logistics, marine support and operational execution.

Norwell will then deliver dismantling of the platform equipment before moving the platform onshore, where it will be handed over to the UAE government.

Legasea has announced the successful completion of a significant circular economy project, requiring the disassembly of 10 decommissioned Subsea Production Systems recovered from the Celtic Sea.

According to Legasea, the ‘Shore-to-Store’ service, supported by the Scottish Enterprise’s Green Jobs Fund, has reduced the carbon footprint of subsea decommissioning operations, by taking subsea equipment that is no longer required, and finding routes to refurbish, recertify, remanufacture and reuse, keeping as many components as possible in use, with a projected annual carbon saving of 10,000 tonnes CO2e.

The company said that the project is the culmination of several years of research and planning conducted by Legasea, involving engagement with a wide range of operators and service companies in the subsea sector, to develop a service which benefits the industry environmentally and economically.

Since its establishment in 2018, Legasea has also consulted with a range of government and industry stakeholders, to ensure that the service is closely aligned with decommissioning and environmental policy, and the company has been awarded a SEPA Waste Management Licence, which permits the company to accept a range of material, defined as waste, from subsea decommissioning operations.

Commenting on the project completion, Lewis Sim, Legasea Managing Director, said, “We are delighted with the progress made, with the introduction of the Shore-to-Store service to the subsea industry, and the support received from across the sector has been phenomenal. Every member of our team has contributed to this successful project, and they deserve a big thank you, as do all of the supply chain companies that helped to support the project.

“With more than 6,400 Trees installed globally, at least a quarter of which are in the North Sea; we look forward to assisting with many more decommissioning scopes, with the recovered parts supporting late-life operations in a sustainable manner,” Lewis added.

Speaking in an exclusive interview with Offshore Network, David Fisher, Business Development Manager at Oilenco, highlights the latest technology his company is offering to support well intervention and abandonment operations, and looks to the future in the ever-changing oil and gas market.

Since its foundation in 2008, Oilenco has established itself as a trusted designer, engineer, and manufacturer of well intervention and downhole tooling, offering solutions and support to the global oil and gas industry. Founder and Managing Director, Warren Ackroyd, established the company in Aberdeen, UK, and the company has grown and evolved internationally, with a current workforce of 38 employees and growing.

Oilenco’s core business region, as Fisher explained, is the North Sea where they serve key oil and gas operators. While the North Sea will continue to be a major focus for the company, they have recently opened an office in Stavanger, Norway, Oilenco Norge AS, to establish themselves internationally as one of the market leaders in their field. Recent projects in Australia, West Africa and the Middle East strengthens their capabilities as a global provider.

On display at OWI EU

While their scope now spans across the globe, on the immediate horizon is the Offshore Well Intervention EU 2022 (OWI EU 2022) conference arriving in Aberdeen on 14-15 June. As event sponsor, Oilenco is looking forward to showcasing a range of cutting-edge solutions available to the market.

One such technology is their Hybrid Plug range which can be used on routine well intervention or abandonment operations. Fisher commented, “The Hybrid Plug provides a secure, high-performance well isolation barrier that can be set and retrieved on slickline and uses an existing landing nipple profile within the wellbore.”

“One of the key components of the Hybrid Plug is its sealing arrangement. Conventional lock mandrels that are nipple-set tend to have a seal stack and are run and set into a specified landing nipple. However, the Hybrid Plug uses a mechanically ‘energised’ seal providing a ‘best of both worlds’ approach; the pressure integrity assurance of a bridge plug sealing element and the simple operation of a conventional blanking plug. Essentially, it is a cross between a standard lock mandrel design and a bridge plug sealing element, providing a very robust bi-directional seal.”

“As it is a ‘one-run’ solution, it brings significant time savings to the operator generating cost efficiencies, increasing safety, and reducing risk.”

In one case study demonstrating the value of this product, a North Sea operator was conducting a programme of plug and abandonment activity over several subsea wells using a mobile offshore drilling unit (MODU). Oilenco, to support the operation, provided a package of downhole equipment including the Annulus Bore Hybrid Plug package. During routine operations, the operator experienced difficulties establishing a satisfactory pressure test against a bridge plug that had been set in the annulus tubing. As the tubing hanger featured a landing nipple within the annulus bore, Oilenco’s Hybrid Plug could be set in the hanger profile.

The plug was successfully set, and pressure tested by the onboard slickline crew allowing this phase of the programme to be completed on schedule. It was noted that the hybrid plug solution was dependable, easy to operate, saved time, and broadened the capability of the regular offshore crew.

Another technology which the company is looking to showcase at OWI EU is the Pressure Wave Valve, an open-on-demand, intervention-free equalising device that can be attached to lock mandrels or bridge plugs and operates only when it senses a specified ‘wave’ of applied pressure.

Fisher remarked, “If you set a plugging device in the wellbore, you would have to intervene on the well to equalise it before you can pull it out of the well. This means you have to rig up wireline on the well which is an extra run in the hole causing extra risk and extra cost. However, if you have the pressure wave valve installed, it means when you want to equalise, you simply cycle pressure starting from a low-pressure, increasing to an upper pressure, and returning to a low pressure again repeatedly over 6 to 12 cycles. After a predetermined number of cycles, the valve will open.”

The Pressure Wave Valve is particularly useful in P&L/P&A operations and completion workover operations. In one instance, when an abandonment service provider was seeking timesaving opportunities to improve efficiencies during abandonment tubing recovery, they sought the help of Oilenco.

While similar solutions have been in use for several years, Oilenco’s Pressure Wave Valve incorporates significant improvements to increase the operational reliability of the device, including enhancing debris management. In the abandonment project, Oilenco were able to configure the Pressure Wave Valve for the client within their desired operating parameters. The Pressure Wave Valve was pressure cycled open, allowing the tubing to be pulled ‘dry’ without the need for further wireline intervention.

The operation of the valve is non-time dependent. Activation cycles can be carried out within minutes of each other or several months or even years later, with no specific setups required, and the operating parameters of the Pressure Wave Valve are not affected by changes in the wellbore pressures below.

A full range of support

The Hybrid Plug technology and Pressure Wave Valve are key products for the company, but as Fisher was keen to emphasise, they are just the tip of the iceberg.

“We have a wide range of products and solutions that can be tailored towards a customer’s requirements. At OWI EU, we will be discussing different solutions that are relatable to routine well intervention operations and abandonment, such as our scale remedial package, safety valve remedial package, sleeve solutions and much more.”

Oilenco is more than just a high-quality product supplier. They offer a range of services including product training, so customers are fully emersed in the Oilenco solution and full operability of the product.

Fisher noted, “If a client wants to run the equipment themselves rather than receiving onsite support from an Oilenco engineer, we provide training either in our workshop or through training videos (if overseas), as well as providing technical manuals and documents to support our solutions. If attending a training course in person, the delegate is issued with a certificate of competence at the end.”

Ready for the rebound

The pandemic created challenging times for all industries, with those operating within the oil and gas industries forced to contend with uncertain prices, lockdown regulations and employee safety. While we are not completely on stable ground yet, the early recovery signs look positive for the oil and gas sector.

In relation to his company, Fisher remarked, “2018 and 2019 were strong years for us with consistent growth throughout both. 2019 was our best performing year with well intervention and abandonment activity in the North Sea. Covid presented many challenges, but we were here to help our clients through these challenging times, continuing to provide essential support, collaborating with their teams to meet supply requirements. As a result, not only were we fortunate enough to retain our headcount and keep the years of knowledge and experience we have within the company, but we also invested in our facility to ensure that post Covid, we continue to design and manufacture innovative solutions, and provide the high-quality products and services our clients have come to expect from us.”

“Coming out of Covid, certainly from a market perspective, a lot of the projects which were shelved or delayed are starting to resurface. Not only with the current oil price, but partly due to the current geopolitical situation, demand is growing and globally, we are seeing operators investing in production either in existing wells to help increase production or investing in exploration and new well discovery.”

“That being said, well abandonment is still very much on the agenda for many operators, and I am sure it will be here for the next 20-30 years. As Oilenco’s solutions are transferrable between intervention and abandonment, we look forward to continuously supporting our clients globally” Fisher commented.

In concluding, Fisher stated, “Overall, from a company side, it is good to be in a post-Covid recovery space. Being back in face-to-face meetings with clients, being involved in conferences such as OWI EU, seeing and hearing what industry and operators are planning. Oilenco can do everything from initial design to manufacturing, testing, inspection, and training, as well as providing access to a large rental fleet for immediate release. Our team have a breadth of experience that runs right through from concept to completion, it is what makes us a strong company and we are looking forward to showcasing our capabilities.”

Find out more about Oilenco at their website here.

Deep geothermal delivery specialist CeraPhi Energy has been awarded the first of its kind geothermal study to undertake the repurposing of offshore oil and gas wells using its proprietary advanced closed-loop system

Deep geothermal delivery specialist CeraPhi Energy has been awarded the first of its kind geothermal study to undertake the repurposing of offshore oil and gas wells using its proprietary advanced closed-loop system

The study will cover the initial phase of a staged process to determine how retrofitted wells can reduce the carbon footprint of an operating platform.

The project is being led by the CeraPhi subsurface engineering team in collaboration with topside engineering services company Petrofac. The study will use EnQuest’s Magnus Platform as the base case.

The Magnus Platform, formally operated by BP, is one of the UK's largest operating facilities and sits north of the Shetland Islands. Magnus is a fully integrated drilling and production facility with a design capacity of 85,400 bpd of crude oil, 110 mmscfd of gas export and a maximum of 240,000 bpd of produced water.

The study will incorporate the use of CeraPhi's proprietary advanced closed-loop technology, CeraPhiWell, which is designed to fit into old wells to extract heat from deep underground by a downhole heat exchanger. Depending on the operating temperatures established in the study the heat produced could be used as direct power and/or heating or cooling for utilities and other services reducing the overall carbon emissions of the facility.

Karl Farrow, CeraPhi, Founder and CEO, said, “This award is a statement to how the oil and gas industry is transitioning in the decarbonisation of the oil and gas extraction process.”

“If we can use old non-productive wells to produce clean baseload energy, why can’t we make those same wells produce carbon-free energy when they are drilled, reducing the carbon footprint during the oil and gas extraction process and ensuring the maximum use of these assets through a complete energy transition over decades,” Karl furthered.

Craig Nicol, Project Manager, NZTC, said, “We are delighted to be supporting CeraPhi with this ground-breaking project that if proven could become a serious contributor to the renewable energy mix. The industry is facing a significant challenge to decommissioning wells that have come to the end of their production, this novel approach has the potential to extend their life whilst delivering on our net-zero targets.”

Jonathan Carpenter, Vice-President, Petrofac New Energy Services, said, “Our engineering specialists are looking forward to working with CeraPhi on this pioneering study, which has the potential to unlock a completely new way of generating renewable power using existing oil and gas infrastructure. It could be a game-changer in our efforts to decarbonise the oil and gas production process and has wider applicability for clean baseload power as well.”

CeraPhi Energy was founded by a team of oil and gas experts just over 18 months ago, and is driving deep geothermal projects using its proprietary closed-loop technology across the world, with a total of nearly 1.5GW of heat, cooling and power projects under development and more than 5 GW under appraisal.

Allseas’ Pioneering Spirit has delivered the Gyda topsides to the Aker Solutions yard in Stord, Norway, for disposal.

Gyda is a field in the southern part of the Norwegian sector in the North Sea, between the Ula and Ekofisk fields. The field was developed with a combined drilling, accommodation and processing facility supported by a steel jacket standing in 66 m water depth. The platform started producing in 1990, with a decommissioning plan submitted in 2016.

After removing the 18,400 tonne former drilling and production facility from the southern North Sea, Pioneering Spirit arrived in Norway on 24 May.

The latest delivery means that, since March 2022, Allseas has lifted more than 65,000 tonnes of North Sea facilities, an achievement made possible by their motion compensation and single-lift systems.

2022 is now on schedule to be a record year for the company with dozens of offshore lifts, ranging from light bridges to entire jackets and topsides, to be undertaken. They include the massive Gyda jacket, which Allseas is booked to remove later this summer.

Eni Australia is said to have committed to full decommissioning of the Woollybutt offshore oil field by NOPSEMA, after being issued one of the seven directions of compliance to adhere to the OPGGS Act.

Eni Australia is said to have committed to full decommissioning of the Woollybutt offshore oil field by NOPSEMA, after being issued one of the seven directions of compliance to adhere to the OPGGS Act.

The Woollybutt oil field, located near the northwest of Western Australia ceased production ten years ago. Since then, Eni is said to have failed to maintain this project's infrastructure, which has continued to deteriorate.

Lack of maintenance by Eni recently made headlines when twenty metres of wellhead framing that had been chained to the seabed floated to the ocean surface and was found outside of the project’s location.

This was followed by Eni's request to abandon the Woollybutt field’s remaining equipment including control umbilicals, flowlines, and jumpers. NOPSEMA has refused Eni’s request and has called for all the deteriorating property to be decommissioned and removed.

Work is due to commence this year and is expected to take two to three months and the union will keep a close eye on who is tendering for this contract. As the scale of decommissioning work is set to rise, the MUA will continue to monitor NOPSEMA’s response to the industry.

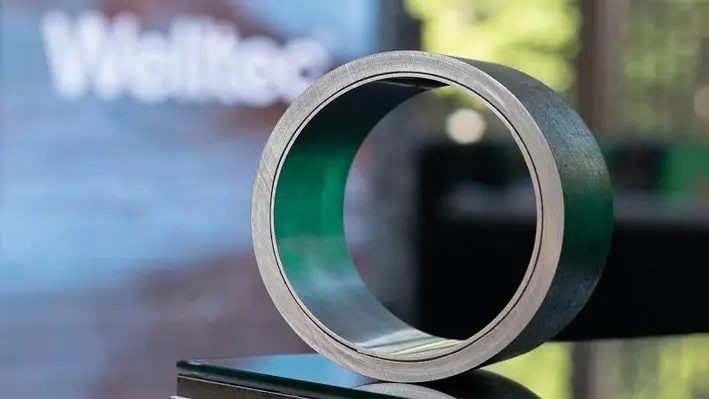

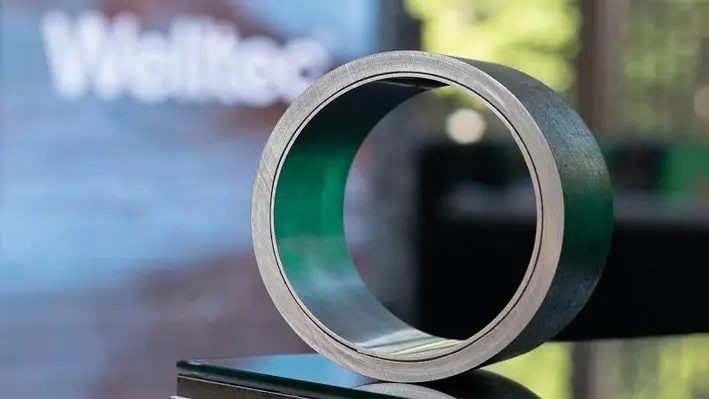

Welltec has formed an exclusive partnership with Isealate AS to become the largest shareholder in the innovative company which provides a patented patch-thru-patch technology.

Chief Commercial Officer at Welltec, Tommy Eikeland, commented, “Well leaks and damages are among the primary concerns raised by our customers during the intervention and workover phase. This acquisition perfectly complements our existing technology portfolio and adds a new dimension in terms of metal expandable capabilities. Once fully integrated, we will be able to set patches and Welltec Annular Barrier technology on either wireline or drill pipe, providing our customers with the ultimate re-lining and repair solutions for well integrity.”

Isealate’s downhole patches can currently be run on wireline and provide multiple benefits typically associated with straddles and larger steel patches without any compromise or trade-offs. The ultra-slim patches have a variety of applications from water-shut off and leak repair, to damaged casing or completion repair, whilst managing to maintain a near full bore ID with minimal restrictions allowing patch-thru-patch operations.

Isealate AS Founder and Board Member, Bengt Gunnarsson, commented, “The integration with Welltec will allow us to bring our unique technology to more operators and deliver it through a global partner with a proven track record. In the meantime, this enables our team to fully focus on further development of the unique patch technology

“Welltec has a truly international field service organisation and management support structure, along with unique engineering, mechanical and electronic capabilities, combined with inhouse manufacturing capacities, which made them the obvious partner choice,” Bengt added.

CRA Tubulars B.V., a new technology company based in the Netherlands, is now formally part of the Shell GameChanger Programme.

CRA Tubulars B.V.’s proposal was shortlisted from the submissions that were sent to the Well Technologies Call for Solutions for Storage of CO2 or H2 in Geoformations and was ultimately selected by a panel of Shell technology experts and GameChangers for funding.

As a result, CRA Tubulars B.V. has signed a collaboration agreement under which it will receive advice and funding to validate and qualify the application of its technology including Titanium lined Composite Tubulars (TCT) and Premium Hydraulic Concentric Connection (PHHC) technology for Carbon Capture and Storage (CCS) well applications. A six-month testing and certification programme has been kicked off to ensure industry standard (API) qualification as a key step towards field deployment.

CRA Tubulars uniquely uses aerospace certified materials to achieve superior high-pressure performance corrosion resistance under extreme downhole conditions. TCT is qualified for such applications as it can manage the low temperature swings.

Further benefits include light weight and optimum flow performance. An efficient use of high quality, yet widely available materials, delivers a unique and cost-effective, full well lifecycle alternative to conventional materials.

Qualification testing on the patented technology of 3.5 in TCT pipe and PHHC connection will be completed in accordance with API 5C5 Fourth Edition, Jan 2017 CAL II test requirements to 5,000 Psi, and additional Series B testing to -35 degrees C. Prototype testing has shown potential up to 18,000Psi burst and 240,000lbs tensile strength at temperatures as low as -54 degrees C.

Founder Emile Burnaby-Lautier, and Joost de Bakker, CEO of CRA Tubular, stated, “We are excited about our partnership with Shell GameChanger. We want to show that our vision to win the fight against corrosion, can actually deliver a step change in technical and economic performance in the energy sector. By repurposing superior components and materials with recorded operating performance from the different industry sectors, CRA Tubulars has delivered a corrosion resistant alternative completion tubing that is corrosion free, light weight, reusable, stronger, whilst adhering to industry dimensions.”

Veronica Simmonds, Commercial Partnerships Manager at Shell GameChanger, commented, “The Shell GameChanger programme is the ideal platform to accelerate the qualification and certification of technologies. In particular technologies that offer our organisation and the industry reliable and cost-effective innovation and contribute to the transition to an affordable and reliable low carbon energy system. And CRA tubulars B.V. with their TCT technology is part of it.”

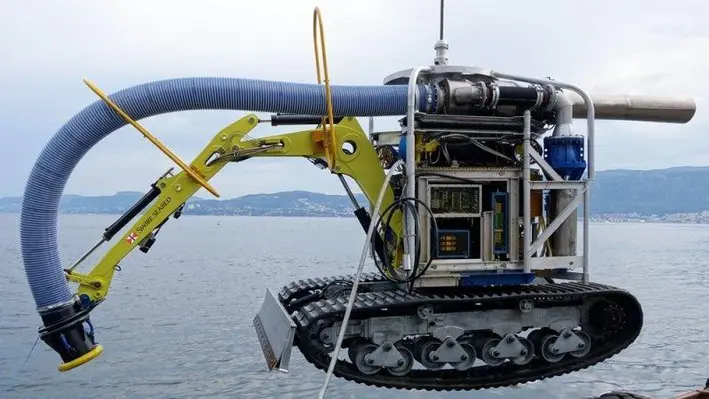

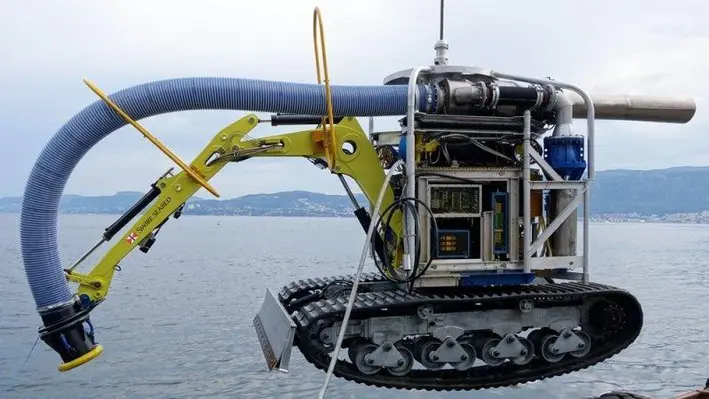

Claxton AS, a brand within the Energy Services division of Acteon, a marine energy and infrastructure services company, has signed a collaboration agreement with Norwegian-based supplier Seabed Solutions to add value to its decommissioning projects and help operators fulfil their obligation to return subsea sites to their natural state.

Claxton AS, a brand within the Energy Services division of Acteon, a marine energy and infrastructure services company, has signed a collaboration agreement with Norwegian-based supplier Seabed Solutions to add value to its decommissioning projects and help operators fulfil their obligation to return subsea sites to their natural state.

According to Claxton, the partnership simplifies procurement, increases project execution efficiency and reduces costs for infrastructure owners by offering a wider range of dredging, excavation, cutting and decommissioning equipment and services through a single contract interface and by using a combined offshore crew.

Claxton and Seabed Solutions are known for extensive subsea experience and the former is said to have had an operational presence in Norway for over nine years and expanded its base in 2019 to meet industry demand. Seabed Solutions was established in 2015 by a management team with decades of experience leading the Norwegian seabed intervention market.

“As more and more oil and gas installations are getting close to the end of their economic and productive life, the demand for decommissioning services increases. This partnership means that the owners of the outdated installations can get the entire scope of decommissioning services on the same contract,” said Christian Aas, Seabed Solutions Managing Director.

Nick Marriott, Claxton General Manager, Norway, said, “Claxton is excited about the partnership, which will allow us to explore synergies to enhance our client offerings and methodologies to drive growth.”

“Offering integrated services through one contract and a single interface, and with collegial crew use, will help to increase procurement and project execution efficiency,” Nick added.

Page 85 of 118