Helix Energy Solutions Group, Inc. has announced that it has entered into a definitive agreement to acquire 100% of the equity interests of the Alliance group of companies for US$120mn million cash at closing, plus the potential for post-closing earnout consideration.

Helix Energy Solutions Group, Inc. has announced that it has entered into a definitive agreement to acquire 100% of the equity interests of the Alliance group of companies for US$120mn million cash at closing, plus the potential for post-closing earnout consideration.

Alliance is a Louisiana-based privately held company that provides services in support of the upstream and midstream industries in the Gulf of Mexico shelf, including offshore oil field decommissioning and reclamation, project management, engineered solutions, intervention, maintenance, repair, heavy lift and commercial diving services.

Helix said that the transaction aligns with its ‘Energy Transition’ business model, by expanding its decommissioning presence in the Gulf of Mexico shelf and advancing Helix’s ESG initiatives by responsibly supporting end-of-life requirements of oil and gas projects.

The transaction also augments Helix’s decommissioning and life-of-field maintenance service capabilities through the addition of Alliance’s comprehensive shallow water assets, including a fleet of Jones Act-compliant lift boats, offshore supply vessels, a heavy lift derrick barge and diving vessels, as well as plug and abandonment systems, coiled tubing systems and snubbing units.

The deal further positions Helix to further penetrate the North American decommissioning market, with published reports forecasting nearly US$3bn of decommissioning expenditures between 2022 and 2025, and the potential to expand into the global market. Based on the assets being acquired, the parties’ assumptions and market conditions, and anticipating Alliance's potential annual EBITDA in excess of US$30-40mn, the transaction is expected to add accretive free cash flow and diversify Helix’s asset base and revenue stream, at an attractive valuation.

According to Helix, the deal will help in preserving a strong financial position and liquidity, as Helix’s pro forma cash, liquidity and net debt would approximate US$145mn, US$186mn and US$119mn, respectively. The transaction is also expected to enhance the financial performance outlook, with expected continued improvements in free cash flow resulting in expected strong liquidity and leverage position.

Owen Kratz, Helix’s President and Chief Executive Officer said, “Based on a number of markets and regulatory drivers and our current expectations, we fully believe that the offshore oil and gas decommissioning market will grow significantly in the near term. This acquisition complements Helix’s present deepwater abandonment offerings by adding shelf and facility abandonment capabilities and significantly enhances our position as a full-field abandonment services provider, both in the Gulf of Mexico and globally. We also see possibilities to expand our opportunities within our existing late-life production business.”

Steve Williams, owner of Alliance said, “Our recent successes in acquiring and developing businesses and assets to establish Alliance as an offshore shallow water energy services company has led us to Helix, who we see as the industry standard in deepwater energy services.”

The acquisition is expected to close in mid-2022 and is subject to regulatory approvals and other customary conditions.

Petrofac, one of the leading providers of services to the global energy industry, has grown its presence in Africa having been selected by Tullow Oil to provide well decommissioning services in Mauritania.

Petrofac, one of the leading providers of services to the global energy industry, has grown its presence in Africa having been selected by Tullow Oil to provide well decommissioning services in Mauritania.

The contract, with a potential total value of more than US$60mn, involves the project management, engineering, planning and plugging and abandonment (P&A) of seven subsea wells on Tullow Oil’s Banda and Tiof fields.

Petrofac will assume responsibility for the subsea well decommissioning scope from Maersk Decom, who have been preparing the work since 2020. By mutual agreement, the parties have novated the contract to Petrofac who will take immediate responsibility for the project, with the offshore scope running from the fourth quarter of 2022 throughout first quarter of 2023.

Petrofac said it will provide all personnel, assets and equipment required for the project, including management of the ‘Island Innovator’ drilling unit and offshore support vessels.

Nick Shorten, Chief Operating Officer for Petrofac’s Asset Solutions business said, “The contract award is a demonstration of the international demand that exists for the skills and quality of delivery we have established in the North Sea. Since 2016 Petrofac has delivered three successful decom campaigns for Tullow Oil. We look forward to emulating this success for them in Mauritania, and across the African continent as we continue to grow our business here.”

Karoon Energy Ltd has reported that its contract with Maersk Drilling for the Baúna intervention campaign has commenced, following the receipt of all permits and regulatory approvals required.

After loading supplies and equipment for the programme, the rig departed Rio de Janeiro on 8 May BRT and arrived at the PRA-2 well site in license BM-S-40 (Baúna), southern Santos Basin. The rig moored, using pre-installed mooring buoys, and the first Baúna intervention in the four-well campaign commenced on 15 May BRT.

The intervention campaign, which is aiming to add 5,000-10,000 bopd to Baúna production, comprises the installation of new electric submersible pumps in the PRA-2 and SPS-92 wells, installation of gas-lift equipment in SPS-56 and re-opening of the lower zone of the BAN-1 well.

The campaign is anticipated to take four to five months to complete. The Maersk Developer rig is then scheduled to drill two development wells on the Patola Field and, subject to the receipt of required regulatory licences, one or potentially two control wells on the Neon oil discovery.

Karoon Energy’s CEO and Managing Director, Dr Julian Fowles, commented, “The commencement of the Baúna intervention programme represents the culmination of more than 18 months of detailed planning and hard work from the Karoon teams and our contractor partners in Australia and Brazil.

“Our key focus is on delivering this campaign safely, efficiently and on schedule, in close cooperation with the operator of the drilling rig, Maersk Drilling. We will update the market on progress in the June 2022 quarterly report.”

At the Offshore Well Intervention Middle East 2022 conference, representatives from BP provided a detailed case study on their successful rigless abandonment of a well in Block 61, Oman.

Aala Abbas, Wells C, I & I Engineer at BP, opened the session by explaining the background of the operation. She noted that the well was drilled back in 2016, targeting the Amin formation and appraising the northern concession of Block 61. The formation is of tight gas which required hydraulic fracturing to produce, and the well was intervened post D&C immediately where the targeted zone was perforated and break down was attempted. This, however, was unsuccessful and, after attempts were made to re-stimulate in addition to extensive testing, the decision was finally made to permanently abandon the well as part of the oil and gas ministry requirement.

“Conventionally, wells P&A jobs are performed via a drilling rig which is very efficient, has a low-risk profile, is fairly straightforward but costly,” Abbas commented. “Hence, we looked into different methodologies and benchmarked them against the rig option which was projected to take 11 days and a cost of one [given as a comparative figure].”

“The second methodology was a hybrid option where the rig and rigless would be used. It would entail killing the well via coiled tubing before setting a plug and cementing the wellbore via a rig. The P&A job was expected to take approximately 12 days of operation at a cost of 1.23. This is quite high but would save rig time.”

“The other option, and the one we selected, was P&A completely through rigless. The well would be killed via coiled tubing before the setting of the plug and perforation above it would be conducted via E-line. It would then be cemented in the wellbore via the cement unit. The total duration of this methodology was approximately 22 days, and the planned cost was 0.73 with zero rig time. There were, however, disadvantages in it being non-standard, relatively higher risk profile and it was the least experienced method.”

The rigless operation, once selected, was divided into four main stages. The first was to isolate the reservoir by pumping cement via coiled tubing covering approximately 530 metres from the well TD to above the pay zone. BP then tagged the cement to confirm its placement and quality via coiled tubing and, post tag, they displaced the well back to one SG before inflow testing the plug and pressure that up to 8,000 psi.

The next stage included setting a copperhead bridge plug across the packer to isolate the shallowest reservoir section and then pressure tested to 7,000 psi. Initially they ran with tubing punch but this was unsuccessful and so they ran with 2-7/8” perforating guns, perforating just above the packer to allow reverse circulation later for the cement job. The injection test was successful with a circulation rate of six barrels per minute.

Continuing the presentation, Sultan Al Abri, Wells C, I & I Engineer at BP, commented, “For the third stage we had to confirm that we had sufficient circulation of cement through the perforation and so, to stimulate that, we pumped a high viscous pill which confirmed the circulation and capability to receive cement through the perforations. After that, we reversed circulated the cement from the A-annulus up the tubing while applying positive pressure on the tubing to avoid having cement free-falling from the annulus. The cement was then given time to cure before running slickline tag to confirm the cement placement and the quality of the cement which was successful.

In the fourth and final stage, the tree was removed, and the tubing and wellhead were cut using a thermal cutter at the surface. The remaining void, from tubing to the annulus side, was pumped with cement using a cement unit with a PVC pipe. After the abandonment the barriers in place included cement across the Amin formation, 15K copperhead bridge plug across the packer depth covering the shallowest reservoir, cement in A-annulus from packer to surface, cement in B-annulus from 13 3/8” shoe to surface, and cement in 4 ½” by 5 ½” tubing from the copperhead bridge plug to the surface.

This was a non-standard operation for the company, and they therefore had some challenges. These included:

• An inability to establish circulation through tubing post tubing punch as the punch tool was not fit for purpose. To remedy that in the future they would select a perforation gun instead.

• Longer WOC duration as the shallowest section BHST was not incorporated into the lab test. In the future the company would therefore ensure lab tests would be performed in a more representative environment and the cement recipe would be optimised.

• Incorrect pumped cement volume due to on site pre-job recalculation using incorrect capacities. This could be avoided in the future by ensuring all changes to the programme are managed by MOC process.

• Inability to cut the tubing due to an inadequate gas weld cutter. The lesson learned from this was to use the plasma cutter for tubing cut.

“Despite the challenges, we delivered the abandonment job with an extra one day than planned but with a 27% less cost than initially expected. For individual service lines we had well testing delivered at about 90% of the planned cost at eight instead of ten days duration; slickline was conducted at the right cost but took an extra half day; coiled tubing was delivered at 65% the planned cost and ran for three and half days instead of five; cementing was completed at about 60% of the projected cost at approximately the same amount of time; and tree removal took the same amount of time as expected,” Al Abri concluded.

“The only service line that we exceeded the planned cost and duration was E-Line and that is attributed to the NPTs mentioned earlier where extra runs were required.”

HydraWell has joined forces with READ (including subsidiaries READ Cased Hole and ANSA), a cased hole production logging, well integrity and reservoir evaluation solutions provider, to create a leading well integrity specialist with ambitions to play a prominent role in late-life oilfield activities.

HydraWell has joined forces with READ (including subsidiaries READ Cased Hole and ANSA), a cased hole production logging, well integrity and reservoir evaluation solutions provider, to create a leading well integrity specialist with ambitions to play a prominent role in late-life oilfield activities.

Both companies have long-established histories of delivering expert well integrity services and solutions for clients around the world. The new combined company will be strategically located with offices and bases in Stavanger, Aberdeen and Houston together with a presence in Alaska, Australia, Brazil, Malaysia and Qatar. HydraWell CEO, Mark Sørheim, will now be CEO of the combined company which will have a total of 75 employees. Total revenue for the combined company is expected to reach approximately US$20.3mn in 2022.

According to HydraWell, late-life oil and gas wells worldwide have an increased requirement for well integrity monitoring, and there is a growing demand for permanent plugging and abandonment of these ageing assets. HydraWell, READ and ANSA will operate within well integrity, with READ and ANSA measuring and analysing well integrity issues with HydraWell remediating the issues identified. The combination of the companies will allow customers to benefit from seamless well integrity planning and diagnostics to barrier installation using digital tools, repeatable and reliable service delivery and effective new technologies that reduce risk and cost to operations.

Sørheim commented, “This is an exciting juncture in our corporate journeys, and we are delighted to join forces with a like-minded specialist business whose services are complementary. This allows us to create a unique offering within the well integrity market to deliver further added value to our customers through deeper knowledge, increased operating efficiencies and improved workflows across their well operations.”

Manager Director of READ Cased Hole, Bruce Melvin added, “READ Cased Hole continues to go from strength to strength and the merger adds to this by positioning our new entity as leading integrated well integrity measurement, analysis and remediation specialists. This will not only enhance READ’s presence in the abandonments market but also expedite ANSA’s digital platform attracting new client relationships. We look forward to what the future holds and building on the success of both companies.”

Havfram, a Norwegian oil field equipment supplier recently announced that PC Mauritania 1 Pty Ltd, a wholly-owned subsidiary of PETRONAS, has awarded Havfram an offshore decommissioning contract.

The contract includes the provision of engineering, procurement, retrieval and disposal (EPRD) services for the abandonment and decommissioning of Subsea Facilities at Chinguetti and Banda Fields, offshore Mauritania, in March 2022.

“The PETRONAS Chinguetti and Banda EPRD project is another significant project award for Havfram in the Africa region. This is one of four projects Havfram has been awarded in Africa and the Mediterranean in the last 12 months, further enhancing our already strong track record in the region. We are proud to have been chosen by PETRONAS to meet their decommissioning needs in this field,” said Odd Strømsnes, CEO, Havfram.

Under the contract, Havfram will utilise its in-house expertise to project manage, engineer, retrieve and dispose of the remaining field infrastructure, having already executed the first phase of decommissioning operations in 2018.

“Our focus on risk mitigation and efficient execution solutions has seen us selected by Petronas once again as the perfect partner for decommissioning operations,” said Kevin Murphy, EVP Subsea and Deputy CEO, Havfram. “Havfram has consistently delivered a range of subsea projects across the continent for our clients, and we look forward to renewing our working partnership with Petronas’ Chinguetti and Banda team.”

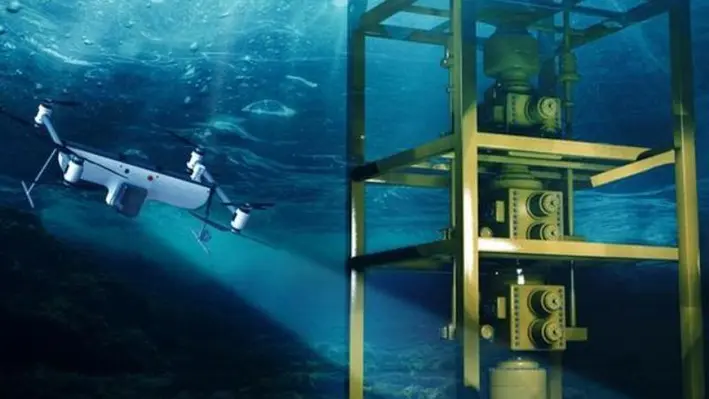

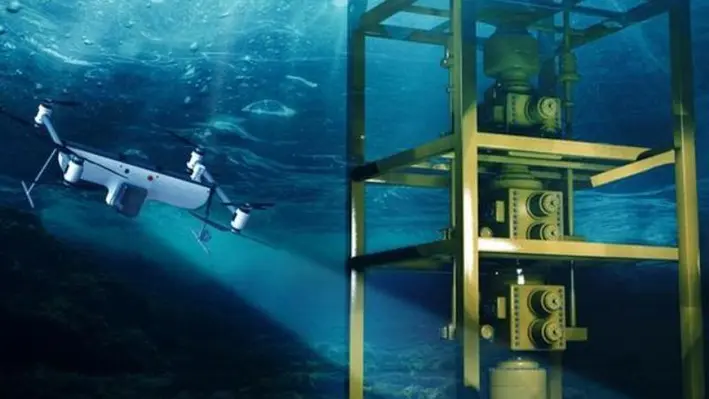

Defuzzy Labs, one of the leading robotics companies specialising in unmanned systems in the UAE, collaborated with SubUAS, the US company behind the Naviator Air/Sea Drone platform, to demonstrate its latest robotics fleet management solution and shed light on the future of offshore inspections.

The demonstration, which was held at the AWS Energy Symposium in Houston, featured the Sharjah-based operator instructing a Naviator drone fleet to perform an inspection from over 11,000 kilometres away, alongside the SubUAS team based in New Jersey, USA.

The live demonstration showcased Defuzzy's latest development of its robotics fleet management solution, which uses AWS's Roborunner service to command multiple Naviator drones over the cloud. This scalable and modular solution enables Defuzzy to easily integrate robots of various makes, models, and forms into the fleet and control them. The cloud services will further help enhance remote monitoring solutions and complete accurate robotic inspections, thus improving the safety and efficiency of inspection operations.

During the demonstration, Defuzzy engineers stationed in Sharjah, UAE, displayed their ability to monitor and command multiple Naviator drones located in New Jersey, USA. The fleet management solution automatically planned a mission and assigned it to the available drone in the background, after which the Sharjah-based operator was seen monitoring the fleet's status and the live video stream of the inspection routine.

Adnane ElSoussi, CEO and Co-Founder, Defuzzy, said, “We are pleased to announce that Defuzzy’s robotics fleet management solution will be used to command a fleet of offshore robotic platforms, which will not just be limited to drones, but a combination of USVs (Unmanned Surface Vessels) and other drones. Our robotic fleet management solution eliminates many challenges associated with inspections of offshore facilities, such as adverse weather and harsh operational conditions, limited and poor communication, availability of multi-talented inspectors, difficulty to access spaces requiring special tooling and equipment, high-risk operational environment, and lastly, high operational costs.”

Archer Oiltools has been awarded a two-year contract extension from Equinor Energy AS in the North Sea.

The contract covers plug and abandonment (P&A), fishing and downhole mechanical isolation equipment. Based on current activity levels, the additional backlog is estimated at US$60mn for the 24 months period which will commence in June this year.

“This is a strategically important extension for Oiltools in one of our core markets, which further strengthens our footprint and presence in the region. Our technology and strong record of execution in the North Sea makes us a supplier of choice for Equinor. We continue to support Equinor’s requirements for safe and efficient operations while providing proprietary low carbon solutions and operational efficiencies to further their energy transition goals,” said Hugo Idsøe, Vice President, Archer Oiltools.

At the Offshore Well Intervention Middle East 2022 conference, Mustafa Adel Amer, Senior Petroleum Production Technology Engineer and Well Integrity Management at BAPETCO, guided the audience through an expert case study focused on well production and methane abatement.

Adel Amer began by explaining the latest goals set out to reduce methane emissions whereby, at COP26, more than 100 countries signed the global methane pledge to cut methane emissions by 30% by 2030. Methane emissions are now at the centre of climate discussions and the abatement of them is, and will become, key to the competiveness of fossil fuels in the future.

The upstream sector, Adel Amer continued, is assumed to contribute around 80% of the methane emissions in the industry, with the majority of this coming from venting operations. Given the global desire to abate methane emissions, it is therefore of paramount importance for operators to reduce this without affecting production rates.

In pursuit of this, Adel Amer presented a case study from his company which focused on treating liquid loaded gas wells in a method that reduced methane emissions and saved significant money.

Adel Amer said, “Liquid loading in a gas well is the inability of produced gas to produce the entrain liquids from the wellbore. Over time, gas velocity decreases and liquids in the well will impact the lift performance that reduce or even stop gas production.”

“Turner discovered the liquid loading could be projected by a droplet model illustrating when droplets move up or down depending on the velocity relative to a critical velocity.”

Adel Amer explained that is common to use VLP to diagnose liquid loading where, in practice, critical velocity is generally defined as the minimum gas velocity in the produced tubing required to produce with low probability of liquid loading risk.

“With the Turner approach, the droplets accumulate in the large ID section but bubble flow takes place at the very low gas flow rate, you need very low gas rate usually at the far left end of the VLP curve. In many cases you don’t see the size of liquid columns that you would expect to balance the drawdown when the well is shut in for cycles.”

Mustafa, in his presentation, presented technical analysis showed that wells that operate in their unstable, hydrostatic dominated, part of their VLP suffer from increased liquid holdup along the entire well.

“We therefore need to focus on increasing velocity across the entire well,” Adel Amer remarked.

In order to do so BAPETCO showed a solution performed on an old well located in an onshore gas field with over 10 wells suffering from liquid loading and run under manual unloading cycles. The well chosen was an old one, beyond 17 years of operation, which had a five inch completion. The task was to end the cyclic behaviour of wells to increase production and eliminate methane emissions.

Considering the context of the field and the company in terms of near wellbore damage after well killing and the well integrity manual that mandate having operable sub-surface safety value in all gas wells, the best solution as Adel Amer said, “was to run a velocity string without killing the well while maintaining the sub-surface safety valve operable and without reliance on a snubbing unit.”

They began by conducting surveillance to select the best candidate wells through in-house developed python code that analyse reservoir data, production data, well history, and well integrity history to gain insightful analytics of the well integrity failure history, potential gain, clearance of the well etc. They then selected candidates and examined the potential in terms of possibility of success and expected gain.

Once done, they went to the PIPESIM to model the surface network and make sure production gains coming from fixing the intermittency of the gas wells would not be constrained by network capacity or connection with other high pressure wells in the network.

The modelling results indicated that inserting 2 7/8 inch completions reduced the risk of liquid loading over the completion string and maintained liquid loading velocity ration favorable for stable gas production.

In practice, to run the velocity string without killing the well, without snubbing units and while having operable sub-surface safety valve, the operating included:

• Rigless inspection of the existing five inch completion and settling an isolation packer with surge disk.

• Workover to run the 2 7/8 inch and set an upper packer below the sub-surface safety valve.

• Rigless coiled tubing to unload the brine and break the surge disk.

Adel Amer said, “This was completed successfully and the project converted the well from one with a fluctuation intermittent behaviour to a more stable state. The stability of production increased to 2.5MMSCF/D after applying the velocity string, up from a 1.5MMSCF/D the day before the project.”

The project helps to achieve various positive results including:

• Cost reduction: the cost of using workover rig to run the 2 7/8 inch tubing inside the existing 5 inch completion was only 10% of a snubbing unit with payback time of 5-6 weeks.

• Increased the gas production rate by 1.5 times and condensate production by 3.8 times.

• The monthly reduced GHG emissions per well is equivalent to 4.4mn miles of passenger vehicle emissions.

• Reduced workload on production operations from elimination of manual unloading.

• Maintained compliance with well integrity standards.

Abel Amer concluded, “We now have a new way of dealing with intermittent gas wells which is less expensive, does not kill the reservoir and maintains an operable sub-surface safety valve. Even though liquid loading is a dynamic process, using PIPESIM provided very useful clue to estimate the liquid loading velocity ratio which was among the main design parameters.”

Abel Amer can be contacted through his LinkedIn profile here.

Petrofac, a leading provider of services to the global energy industry, and Promethean Decommissioning Company (PDC), a pure-play decommissioning operator, will come together to decommission the South Pass 60, South Pass 6 and East Breaks 165 fields, offshore Gulf of Mexico.

The substantial scope of work includes work on nine platforms, 200 wells and 32 pipeline segments, all of which will need to be safely and assuredly decommissioned.

PDC takes on the role of decommissioning operator and is responsible for fulfilling the field decommissioning orders received from the U.S. Department of the Interior’s Bureau of Safety and Environmental Enforcement in February 2022.

Petrofac has been appointed by PDC as the decommissioning services provider in a contract valued at around US$200mn. The company will use its proven decommissioning programme management systems, tools, and processes to deliver the programme.

The PDC-Petrofac alliance has selected Danos, a leading Gulf of Mexico offshore services provider, for more than 75 years to support field operations and the decommissioning programme. With nearly 2,500 employees, Danos has a proven history of operational excellence and safe operations.

The project will be led from Houston, with the integrated alliance team using the latest digital software, including Petrofac’s proprietary project management tool Turus, to deliver the decommissioning project with comprehensive dashboards, transparency and assurance.

Nick Shorten, Chief Operating Officer for Petrofac’s Asset Solutions business, commented, “This significant contract recognises our industry-leading decommissioning programme management experience and our unique in-house capability to manage all well and asset decommissioning phases. It’s been more than four decades since Petrofac first began in Texas and in that time we have expanded our offshore capabilities across the globe. This expertise will be applied to the project, complemented by our already strong onshore presence in Texas.”

Aditya Singh, Founder and CEO, Promethean Energy Corporation added, “We are pleased to offer our new outsourced ‘decommissioning operator’ service to the industry and to commence activity on this major decommissioning project. We are fully aligned with all our stakeholders to improve environmental performance through the safe and efficient decommissioning of end-of-life assets. We accomplish this with a dedicated, fit-for-purpose entity, PDC, via an integrated operating service model and focused programme management. I am particularly pleased that the PDC and Petrofac alliance has been selected, leveraging the complementary strengths of both companies.”

Baker Hughes has launched the MS-2 Annulus Seal, designed to save substantial operational rig costs by reducing rig trips.

The new integrated sealing solution, the latest technological development to the MS-SN, has already been adopted by multiple customers in North and South America.

The MS-2 Annulus Seal integrates with Baker Hughes’ existing MS-800 wellhead system and helps to lower the cost of well construction and intervention, expands intervention options and ensures security and confidence of well integrity in challenging conditions.

“We constantly strive for technological optimisation and delivering the most advanced solutions to our subsea customers,” said Neil Saunders, Executive Vice President of Oilfield Equipment at Baker Hughes. “Through our new MS-2 Annulus Seal, we are helping to transform the subsea market and are developing quality technology that delivers long-term value, reliability and efficiencies for subsea customers.”

The MS-2 can be installed in a single trip, with an integrated lock ring that results in improved rig efficiency by providing immediate lockdown of up to 2mn pounds force without the need for a second trip, saving rig time. The MS-2 also provides easier access to wells, with no need for supplemental lockdown devices. It is tested to 20,000 psi, and to 200 load cycles ensuring life-of-field reliability and further demonstrating the seal integrity.

Andrea Sbordone, Business Development Manager at TechnipFMC, will describe four case studies of successful riserless light well intervention (RLWI) campaigns at the upcoming Offshore Well Intervention West Africa 2022 conference in Accra.

At the conference, which is running from 12-13 July, Sbordone will review the four campaigns which were performed by Island Constructor in West Africa, providing the opportunity for the audience to appreciate the efficiency of this fully integrated RLWI system.

At the session, Sbordone will assess how RLWI can effectively increase production at the lowest total cost in the upcoming 5th West Africa campaign running in Q4 2022 and Q1 2023.

To listen and participate in this exclusive session be sure to attend OWI WA 2022 which will play host to a range of key operators in the region including BP, Shell, Tullow Oil and more, as well as a range of experts from across the industry.

To learn more, be sure to download the event brochure here:

https://www.offsnet.com/owi-wa/conference-brochure

Or reach out to the details below:

Rachael Brand

Project Manager

T: +44 (0) 20 3409 3041

e:

Page 86 of 118