Offshore Network has released a free-to-download report outlining the developing prospects for the Asia Pacific’s offshore well intervention industry.

The wider energy sector is facing daunting challenges in the shape of increasing electricity consumption and the ever-increasing demand to limit environmental impact. While the rise of cleaner energy sources such as renewables appear unstoppable, there does, however, remain a place at the table for oil and gas, with fossil fuels set to continue to be an important component of the energy mix for the decades ahead. This trend is particularly pronounced in Asia, which is set to dominate global oil demand growth in 2024 and beyond.

While drilling has traditionally provided the answer to meeting growing demand, rising costs, uncertainty of success and environmental concerns are turning heads away from this activity and towards the potential of well intervention. The emergence of this is also being encouraged by the need for plugging and abandonment, a concern ever-growing in urgency as the region’s well stock continues to age. With market conditions opportune for well intervention to take centre stage, there remain some key challenges that must be overcome before it can fully step into the spotlight and fulfil its potential.

Offshore Network’s latest outlook assesses these key challenges such as collaboration and operator-service provider disharmony while examining the vast opportunities the region is offering.

Coretrax is set for further growth as the company has secured five multi-year contract wins for 2024 and plans to expand its footprint in the Asia Pacific region by a further 30%.

Coretrax is set for further growth as the company has secured five multi-year contract wins for 2024 and plans to expand its footprint in the Asia Pacific region by a further 30%.

The latest deals encompass key milestones including the business’ first project win in Latin America and its first expandable casing patch deployment in the UAE.

Following a string of successful geothermal and carbon capture and storage (CCS) projects, Coretrax has secured its largest geothermal contract to date – a multi-year project in Denmark where it will deliver its Origin wellbore clean up technology across 17 geothermal wells.

John Fraser, CEO of Coretrax, stated, “We have experienced a period of sustained growth and are excited to be entering 2024 with a strong pipeline of work and plans for further expansion in the coming months. Our technology spans the entire well lifecycle which means we can support operators from drilling right through to the plugging and abandonment phase.”

The company is also expected to increase its 320-strong workforce by an additional 100 personnel across its bases in Europe, the Middle East, Asia Pacific and the Americas.

“The coming 12 months will see us increase our headcount and footprint globally,” Fraser continued, “with Asia Pacific a particular focus for the business as we respond to increasing demand for our technology across countries including Australia, Brunei and Malaysia. We are also eager to extend our operations in the geothermal and CCS sectors with our circulation tools gaining a strong track record in these emerging markets.”

The contract wins come off the back of the company expanding its well intervention offering by acquiring a suite of new technology from Wireline Drilling Technologies.

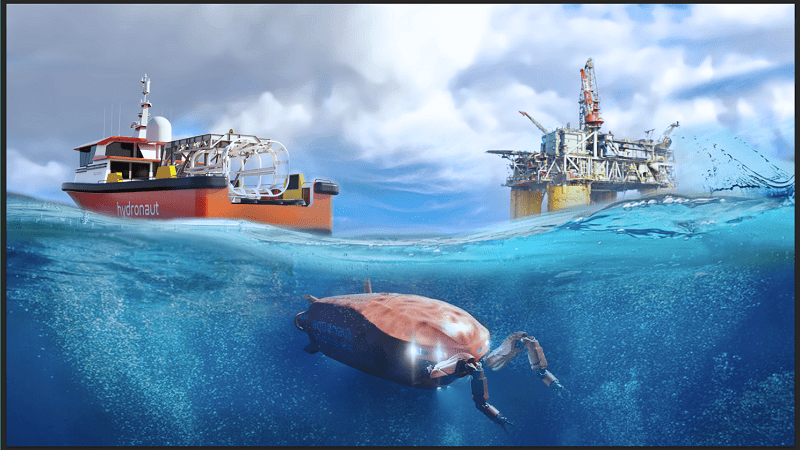

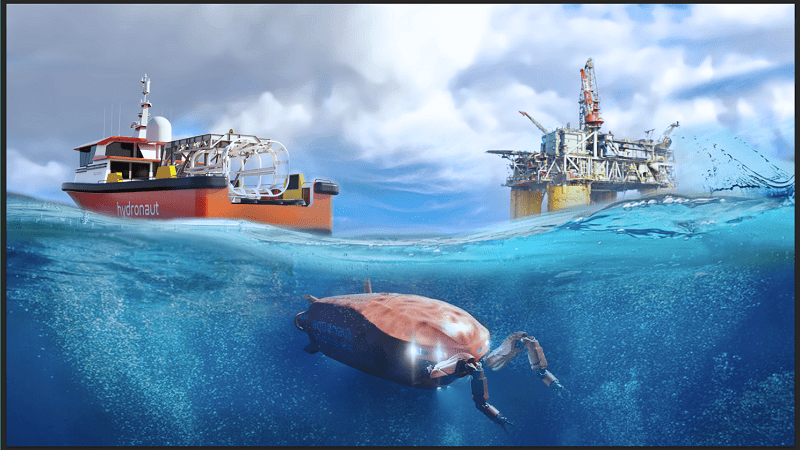

Nauticus Robotics Inc., a developer of autonomous robots for intervention services, has announced it has signed a memorandum of understanding (MoU) with MMA Offshore Limited, a global provider of high-specification vessels and subsea services, for the development of an integrated service offering to provide more cost-effective and environmentally-friendly maintenance to subsea infrastructures in the Asia-Pacific region.

Nauticus Robotics Inc., a developer of autonomous robots for intervention services, has announced it has signed a memorandum of understanding (MoU) with MMA Offshore Limited, a global provider of high-specification vessels and subsea services, for the development of an integrated service offering to provide more cost-effective and environmentally-friendly maintenance to subsea infrastructures in the Asia-Pacific region.

Nauticus’ autonomous subsea robots, Aquanauts, enable the use of smaller service vessels not previously utilised for inspection, maintenance and repair (IMR) work, which MMA owns and operates. By combining their capabilities, the two companies hope to offer a more economical solution to subsea intervention.

Nicolaus Radford, Founder and CEO of Nauticus, said, “This MoU is just one in a series of strategic moves we are making to disrupt autonomous subsea robotics and solidify our place as the industry leader in the field. Aligning with an established industry player, such as MMA Offshore, in multiple offshore markets provides a significant opportunity for Nauticus to continue expanding its reach and international customer base.”

Tom Radic, Executive General Manager Subsea at MMA Offshore, commented, “MMA is excited to have entered into this exclusive partnership with Nauticus Robotics and looks forward to being able to integrate its leading autonomous robotic and AI software technology into its subsea services. This partnership will ensure our clients have access to the latest autonomous and machine learning technology to help meet their subsea requirements.”

Odfjell Technology, an integrated supplier of offshore drilling and well operations, has added wellbore cleaning chemicals to its in-house well services offering in order to streamline supply chain processes.

Previously, wellbore cleaning chemicals were offered to the company’s global customer base via third-party suppliers but the company has sought to streamline this and become more competitive in pricing.

As such, it has launched Ultra-Max Chemical Cleaner and UltraWash Heavy-duty Degreaser as part of its chemical product offering. These are high-performance chemicals designed to quickly and efficiently remove hydrocarbon residues from downhole tubulars, equipment and casing. The non-flammable, non-abrasive and non-caustic formulas eliminate built-up residue on drilling rigs, pumps and equipment.

Cleaner wellbores are crucial to facilitate efficient fluid displacements during hydrocarbon recovery, so they can flow freely.

The Ultra product range is globally compliant with industry standards, receiving the GOLD classifications by the Centre for Environment, Fisheries and Aquaculture Science (CEFAS), meaning the chemicals are safe to use in line with global standards and will not harm the environment

Ian Low, Global Product Line Manager, Well Intervention at Odfjell Technology, remarked, “By bringing these high-grade cleaning chemicals into our in-house wellbore clean-up offering, we will unlock opportunities for new business and projects.

“Launching the Ultra product range enables us to be more competitive in pricing, providing our customers with gold-standard wellbore cleaning at an affordable cost. And as we all strive towards more energy efficiency improvements, our world-class tooling and chemicals will assist in enhancing the efficiency of operations, reducing energy waste and optimising processes to decrease emissions.”

The company stated that by taking control of its costs, broadening its service offerings, and unlocking new avenues, it is cementing its position as a leading provider of offshore services that contribute to safe, decarbonised operations.

Silverwell Technology, a global provider of digitally intelligent gas lift production optimisation systems, has secured a contract with a major national oil company (NOC) in Southeast Asia.

The company will install its digital intelligent artificial lift (DIAL) production optimisation system across multiple oil wells across a three-year contract. The technology will be deployed in challenging operating environments in both brown and green field assets.

DIAL integrates in-well monitoring and control of gas lift well performance with surface analytics and automation in order to continually optimise gas-lifted fields, remotely and without intervention. Already utilised by operators around the world (both on and offshore), it is hoped that the successful completion of this contract will encourage more wide-spread adoption of DIAL by other operations in the region. In pursuit of this, Silverwell has expanded its local footprint by recruiting additional operations staff in Malaysia and Indonesia.

Badroel Rizwan Bahar, Regional General Manager Asia Pacific, surmised, “Our latest multi-well contract provides further evidence of the growing confidence among operators in DIAL’s ability to save them millions of dollars.”

Darrell Johnson, Silverwell CEO, added, “This milestone contract for the large-scale adoption of DIAL enhances Silverwell’s presence in an important geographic market. Around the world, sales of DIAL are increasing as operators seek proven methods to reduce operational expenditure while maximizing asset productivity.”

Thunder Cranes, an offshore crane rental and lifting solution provider, has provided a case study where it delivered lifting support for a standalone E-line well intervention offshore Malaysia.

The unnamed client requested Thunder Cranes assistance on an offshore platform as the existing crane had insufficient lifting capacity for loading and positioning the heaviest component of the E-line equipment from the supply boat to the platform main deck.

After accepting the challenge, Thunder Cranes provided a cost-effective lifting support solution in the form of a TC15 Stiff Leg crane which was deployed on the platform. In addition to lifting the components on deck, the Thunder Cranes crew also helped the well intervention team in skidding and repositioning the E-line equipment to multiple wellhead locations throughout the project.

Thunder Cranes reported that the operation was completed in a timely, safe and successful manner adding that, by deploying the TC15 Stiff Leg crane, the client benefitted from a cost-effective lifting solution that was well-suited to the platform size and need of the E-line contractor. It also avoided costly alternatives such as a lift vessel.

The Asia Pacific oil and gas industry, making use of a period of relative oil price stability and seemingly maintained future demand, is increasingly looking to ramp up production rates which, in light of a rapidly approaching decommissioning wave, is leading to a thriving oilfield services market.

A period of stability is something the oil and gas industry has been yearning for ever since the outbreak of Covid-19 which, in the first quarter of 2020, burst onto the global arena in a devastating manner. But after a period of volatility driven by the pandemic and geopolitical developments in eastern Europe, the oil price has finally stabilised, settling at around US$80 per barrel across most benchmarks. From here, commentators such as Goldman Sachs and Fitch Ratings have predicted prices to maintain stable across 2023 and even hit US$100 by the end of the year.

One of the reasons for this security is a growth in oil demand, driven primarily by the re-opening of China at the start of the year. While the incessant rise of renewables has caused many to doubt the future prospects of fossil fuels as the world strives to its collective net zero ambition, according to OPEC’s 2022 World Oil Outlook 2045 energy demand will increase from 285.7 million barrels of oil equivalent per day (mboe/d) in 2021 to 351 mboe/d in 2045 at an increase of 23%. To meet this, the report suggests renewables will not be sufficient by themselves and oil and gas must continue to be exploited to meet the world’s needs. In view of this, it forecasts that by 2045, oil could retain a 29% share in the energy mix and gas would meet 24% of it. This translates to oil demand rising to 109.8mb/d in 2045 – in this scenario it must also be remembered that the expansion of production rates must also come alongside an extra 5 mb/d being added every year just to maintain current production rates, given an average industry decline rate of around 5%.

This is translating to a solid future for the global oil and gas industry and, in light of this, the Asia Pacific community is looking to increase its production rates – especially as the region consumes 35% of the world’s oil while supplying just 8% of its production. To do so, it is turning to its reliable tool of drilling but also on less-utilised methods such as well intervention. The latter is also being spurred by the region’s offshore oil well stock moving ever-closer to end-of-life with, according to a Wood Mackenzie 2018 report, more than 380 fields expected to cease production in the next decade.

T7 Global Berhad, a leading solutions provider primarily in the energy industry with a strong presence in Asia, has announced that Hibiscus Oil & Gas Malaysia Limited, has awarded a work order to Tanjung Offshore Services, a wholly-owned subsidiary of T7, for integrated well services.

The work order, awarded under the Pan Malaysia Umbrella Contract, is effective from 3 August 2022 until 2 August 2024 on a call-out basis and includes integrated well services for intervention, workover and abandonment for PACs. Under the Pan Malaysia Umbrella Contract, Tanjung Offshore will be participating in upcoming jobs for integrated well services for well workover and well abandonment from petroleum arrangement contractors (PACs) in Malaysia.

T7 Global Group Chief Executive Officer, Tan Kay Zhuin, commented, “We are honoured and thankful for this award from Hibiscus. This award marks a milestone for Tanjung Offshore as this award include well workover and plug and abandonment services under the Pan Malaysia Umbrella Contract.

“Integrated well services, which covers both production wells and abandonment of old wells, will form part of our long-term energy solutions for offshore operators. Over the next few years, we aim to secure more similar jobs by providing innovative well solutions to other offshore operators in the region.”

Pharos Energy plc, an independent oil and gas exploration and production company, has announced that the Hoang Long Joint Operating Company has successfully completed its 2021 TGT well intervention and development drilling campaign.

Ed Story, President and CEO of Pharos Energy, commented, "I am delighted to announce that the first phase of the infill development drilling programme in TGT has finished, with all four wells testing at rates in line with or ahead of pre-drill expectations. The campaign was completed ahead of schedule and under budget.

“The well intervention programme conducted earlier in the year also delivered rates above expectations. Together, these two operational campaigns have increased production capacity and will ultimately improve recovery from the field. They also support the further activity set out in the Full Field Development Plan designed to optimise field oil & gas recovery and a submission request for a five-year contract term extension.

The initial flow of the four development wells of 8,800 bopd exceeded the predicted combined initial oil rate of 5,650 bopd by 3,150 bopd.

Well interventions and a gas lift optimisation programme earlier in the year resulted in an initial TGT production gain of 3,200 bopd. The six wells with additional perforations showed a gain of 1,800 bopd, the four wells with water shut off gained 900 bopd and eight wells where demulsifier injection was applied gained 500 bopd.

The TGT field gross production rate on 17 November 2021 was 14,800 boepd, but would have been approximately 19,800 boepd without the impact of the compressor fault mentioned below.

The results of the drilling and intervention activity support additional opportunities as set out in the Full Field Development Plan (e.g. nine contingent wells and an extensive well intervention programme), which could support a TGT license extension request to December 2031.

The Hoang Long Operating Company Management Committee has also approved two additional TGT wells and 13 well interventions (ten firm additional perforations and three water shut-offs) in the budget for 2022 on 17 November 2021.

Brunei Shell Petroleum Company Sdn Bhd and AccessESP have successfully completed a trial project using GoRigless ESP System technology, a proprietary through-tubing deployment and slickline-retrieval technology for AccessESP high-performance permanent magnet motors and industry-standard ESP pumps.

David Malone, CEO, AccessESP, commented, “We appreciate the opportunity to demonstrate the reliability and effectiveness of our technology in offshore Brunei. Our system allows the operator to perform well cleanouts and boost production with less cost and reduced environmental impact.”

AccessESP delivers advanced technologies that help oil and gas operators reduce intervention costs, maximise well productivity, and enhance reservoir recovery rates by achieving the technical limit in ESP performance.

By avoiding the cost and complexity of a heavy workover rig required for traditional tubing-deployed ESP system interventions, millions of dollars of workover costs are avoided, greenhouse gas emissions are reduced, and recovery boosted.

TechnipFMC has announced its intention to acquire the remaining 49% of shares in TIOS AS, a joint venture between TechnipFMC and Island Offshore Management AS (Island Offshore) formed in 2018.

TIOS provides fully integrated Riserless Light Well Intervention (RLWI) services, including project management and engineering for plug and abandonment, riserless coiled tubing and well completion and intervention operations, and has serviced more than 740 wells globally since 2005.

The acquisition will accelerate the development of TechnipFMC’s integrated service model focused on maximising value to its clients.

The company will continue to utilise Island Offshore as the vessel provider for RLWI services.

Jonathan Landes, President, Subsea at TechnipFMC, said, “We are pleased to welcome TIOS wholly into TechnipFMC. This transaction brings into the company additional expertise that will maximise our capability to provide a complete range of well services globally to our clients in a rapid and economical manner.”

This announcement comes soon after the company released its Q2 2021 results, in which its subsea performance was particularly strong.

Doug Pferdehirt, Chairman and CEO of TechnipFMC, commented, “Subsea inbound orders of US$2.8bn in the first half of the year were strong. We continue to see a healthy list of prospects and remain very confident in our full-year guidance for Subsea orders of more than US$4bn. Furthermore, growth in 2022 is supported by an increasing set of opportunities.

“We believe that offshore will continue to play a meaningful role in the total energy mix. We are building partnerships in support of new energy, leveraging our differentiated technologies, and capitalising on our integrated project execution and expertise as the subsea architect.”

At the virtual Offshore Well Intervention Asia Pacific Conference, an expert panel discussed how a growing emphasis on collaboration is complementing the shift to integrated services which is unlocking value for both operators and service providers.

At the virtual Offshore Well Intervention Asia Pacific Conference, an expert panel discussed how a growing emphasis on collaboration is complementing the shift to integrated services which is unlocking value for both operators and service providers.

Commenting on the rise in integrated services, Scott Deacon, Subsea Intervention Lead, Baker Hughes, opened the session by stating, “This is a growing area in the light well intervention space and it is also growing in the plug and abandonment (P&A) space as well. To have integrated solutions allows us to collaborate and support each other and brings cost effective and efficient solutions for operators.”

Chin Siang Tan, Senior Services Manager at Baker Hughes, added, “When we go into discussions with operators, they are much more open to the idea of us putting things together in a customised package and it is a very wide range of offers we are talking about now. Not just hardware but things like digital, software, remote surveillance etc are really striking interest in the conversation with operators now.”

“The scope of these integrated services is not just defined by operators but as a service contractor we have a responsibility to integrate and support not just within ourselves but outside our capabilities. Working with key subcontractors well help provide a bigger range of coverage and exercise the flexibility to customise solutions and provide the best project value for operators.”

Ankesh Nagar, lead engineer Petroleum Engineering & Surface facility North East India, Cair Oil & Gas, said, “Looking at a decade of our discrete services we realised there were some slippages on key contracts and projects which was ultimately due to some discrete contracts unable to deliver in the right spirit of the project. We as a group thought that when we moved into integrated solutions for both OPEX and CAPEX we would be able to take care of that aspect and improve on delivery. This is exactly what we saw when we took this step from 2015 onwards. Now we have multiple, regional, integrated service contracts for drilling as well as drilling and testing integrated services. We have found that even if you have projects over large areas you can still manage the delivery of them with leaner teams and achieve objectives of your business plans.”

Muhamad Zaki Amir Hussein, Well Intervention Specialist, Petronas MPM, noted that while it can be more messy for smaller providers to merge with others in order to offer these integrated services, generally the advantages far outweigh the associated challenges. He said, “For services providers this can align and focus your resources rather than having separate businesses developed for different service lines and having to manage separate contracts and performance levels. Having a single contract is more efficient and gives them more room to work in terms of economic of scale.”

Collaboration

The growing popularity of integrated services, combined with the Covid-19 restricted climate, has put a much greater emphasis on collaboration, with most service providers and operators now considering this a far greater part of their business model.

Deacon said, “Collaboration has been highlighted as the way forward and I think it is key for industry especially through the times we have just had. Service providers need to work together, operators need to work together. By looking outside of the business you can utilise other solutions which may be the best solution for the operator.”

Commenting on how his company has expanded this aspect, Nagar said, “We do an annual workshop with not only the service companies who have done work with us but also discrete and more niche services present as well. Then, when we project a need for a solution, there is already a good networking platform for these niche companies to showcase their potential so they can ultimately become part of the integrated service solution. Since our objective is to get a good quality output it is important to ensure there is good collaboration not just between us but also on their end as well. At the end of the day good communication and good collaboration equals good delivery of projects.”

Zaki added, “I agree there are great opportunities for smaller service providers with standalone solutions to learn through collaboration. There is great potential for syndication, experience and resource sharing across these service providers via collaboration for integrated solutions. As for collaboration among operators, there are more opportunities for this especially for bigger packages like workover and subsea work where mobilisation costs are high.”

“Bigger mobilisation and higher spread rates with subsea and workover packages require more economic of scale. Hence we try to find synergies and encourage collaboration across operators for this in the form of joint tenders or farming into an existing, awarded contract.”

To view the full session, follow the link below:

https://www.youtube.com/watch?v=1mPcYhTsBfE

Page 1 of 2