Helix Energy Solutions Group, Inc. has entered into a two-year extension of its well intervention charter and services contracts with Petróleo Brasileiro S.A. (Petrobras) for the Siem Helix 2 well intervention vessel offshore Brazil.

The negotiated extension is scheduled to conclude in December 2024.

Scotty Sparks, Helix’s Executive Vice President and Chief Operating Officer, commented, “We are glad to negotiate this contract extension and look forward to continuing our long and productive working relationship with Petrobras. Market conditions globally and in Brazil have been improving, and demand for our world-class assets and experienced crews has been steadily increasing.”

The Siem Helix 2 is a purpose-built, advanced well intervention vessel capable of performing a wide range of subsea services including production enhancement, well decommissioning, subsea installation, offshore crane and Remotely Operated Vehicle operations, offshore construction and emergency response. The vessel is currently performing riser-based well intervention activities in the Santos and Campos Basins and to date has completed more than 60 well interventions for Petrobras.

Sparks added, “The Siem Helix 2 has consistently provided industry – and global-leading well intervention services to Petrobras. This two-year extension demonstrates the capacity for Helix to continually provide innovative solutions to fit client needs, backed by our experience and proven track record, and supports our Energy Transition business model of offering clients the ability to maximize production from their existing wells.”

During the forthcoming Offshore Well Intervention Latin American 2022 (OWI LATAM) conference, held in Rio, Brazil, Joao Batista, Wells Technology R&D Manager at Repsol Sinopec Brasil, will hold a session discussing the new Economical Technologies in the region.

Attendees will discover the innovative new technologies within the decommissioning and intervention space that they are encouraged to implement within their own well work.

As well as this, the detailed sessions will dig into recognising the challenges of deepwater technology development in Brazil and work to build a plan to bridge the gaps between knowledge and technology.

Batista will then review the Brazilian O&G ecosystem compared to the ANP levy funds in order to best navigate the activity in the region.

OWI LATAM returns for its third year on 18-19 October and will feature presentations from a number of world-leading experts within the oil and gas community as well as the opportunity to come together and collaborate with renowned global well intervention companies.

To view the full programme click here:

https://www.offsnet.com/latam/conference-brochure

Or reach out to the details below:

Rachael Brand

Project Manager

T: +44 (0) 20 3409 3041

e:

Marcelo Victor Tomaz De Matos, Plug and Abandonment (P&A) Advisor at Petrobras, will deliver a session on the company’s P&A updates and future plans at the Offshore Well Intervention Latin America 2022 (OWI LATAM), which will be held in Rio, Brazil from 18-19 October 2022.

Marcelo Victor Tomaz De Matos, Plug and Abandonment (P&A) Advisor at Petrobras, will deliver a session on the company’s P&A updates and future plans at the Offshore Well Intervention Latin America 2022 (OWI LATAM), which will be held in Rio, Brazil from 18-19 October 2022.

The speaker will outline Petrobras’ decommissioning forecasts to prepare for the upcoming wave of P&A activity. During the session, attendees can also expect to have access to the company’s P&A activities and performance results in subsea wells to take away best practices in mitigating future liability.

The presentation by Marcelo will also let attendees discover Petrobras’ P&A R&D roadmap, current challenges, and new techniques and technologies that can be applied to upcoming campaigns.

The presentation by Marcelo will also let attendees discover Petrobras’ P&A R&D roadmap, current challenges, and new techniques and technologies that can be applied to upcoming campaigns.

OWI LATAM is South America’s one-stop shop to gain first-hand knowledge from the world’s leading decommissioning and P&A experts as well as a hub for insightful sessions on new technologies.

To view the full programme click here:

https://www.offsnet.com/latam/conference-brochure

Or reach out to the details below:

Rachael Brand

Project Manager

T: +44 (0) 20 3409 3041

e:

To help TotalEnergies – an oil and gas company – with a deepwater plug and abandonment (P&A) challenge offshore in the Brazilian pre-salt, Welltec, an international provider of robotic well solutions for the oil and gas industry, designed and manufactured a unique solution utilising a 414 Well Cutter equipped with a new Tiger Claw cutting element.

The well had been designed without a completion disconnect device, adding difficulty to the overall series and increasing the timeframe, if additional intervention and fishing was required.

To maintain optimal efficiency, a tool capable of cutting beyond the outer diameter of the 6 5/8 inches super 13Cr tubing and through the control line flatpack (with two Incoloy tubes) would be required. Furthermore, it was crucial that this be achieved in a single run.

P&A is a necessary operation at the end of a well’s productive years. Efficiency is vital during preparation and execution phases in order for operators to minimise costs, especially given the asset will be decommissioned and no longer producing.

Prior to the operation, multiple tests were carried out at the headquarters and subsequently at a local base in Brazil. These were done to ensure that a clean cut could be achieved all the way through to the flatpack in scenarios involving different cutting locations, in consideration of margins of error, as well as levels of slack or tension on the flatpack which would affect the cut.

Test cut locations included just below the clamp (15 cm), within the tubing connection (to see if the additional material could be cut), and in the middle of two clamps where it was anticipated the control line may be too slack.

Despite successful test cuts just below the clamp, and within the tubing connection, the client opted for a middle of the tubing cut. A 414 Well Cutter was run in hole with specially designed Tiger Claw cutting element and activated six meters below the clamp.

As an additional precaution, a physical limitation was implemented to restrict the cutting range of the Tiger Claw to 8.2 inches, therefore de-risking the operation in terms of the 8.5 inches outer casing being compromised. The angled cutting arms were able to cut through the tubing and control line flatpack as predicted.

After pulling out of hole, the operator was able to pull the completion, seeing the control line flatpack shear six meters below the clamp. As a result of this operation, TotalEnergies was able to save time with tubing retrieval, avoiding the delays that would have followed a cut to only the tubing.

The newly designed Tiger Claw cutting element provided an increased cutting range in comparison to its predecessors, guaranteeing a continuation of cutting beyond the outer diameter of the tubing, and through the control line flatpack.

Helix Energy Solutions Group, Inc. has been awarded a field decommissioning contract by Trident Energy do Brasil (Trident Energy).

The project, located offshore Brazil in the Pampo and Enchova Clusters in the Campos Basin, is expected to commence in late 2022 for a firm period of 12 months with options to extend.

Helix will provide a riser-based well intervention vessel (either the Siem Helix 1 or Siem Helix 2); a 10k Intervention Riser System; project management and engineering services; and, in conjunction with Helix’s Subsea Services Alliance partner Schlumberger, fully integrated plug and abandonment well services.

Trident Energy owns and operates four platforms in the Campos Basin, and its Brazil operations are part of a global organisation backed by Warburg Pincus with a stated focus on operating and redeveloping mid-life oil and gas assets.

Scotty Sparks, Helix’s Executive Vice President and Chief Operating Officer, commented, “We are pleased that Helix has been awarded this major decommissioning contract. This is another step forward in the execution of our strategic objectives which include diversifying our client base in the region while continuing to provide best-in-class and global leading decommissioning services. We look forward to developing our relationship with Trident Energy.”

Daniel Stuart, Helix do Brasil’s Director of Operations, added, “Our rigless well intervention services offer a lower cost and lower greenhouse gas intensive solution for decommissioning offshore wells compared to rig alternatives. We believe that delivering this milestone field decommissioning project will support future growth in the region, and lead to additional opportunities.”

Brazilian state-run oil company Petrobras has opened a public consultation to obtain information from suppliers on alternative technology for retrieving flexible pipelines in the Marlim field, off Brazil’s southeast coast.

According to the state-run oil firm, the service to be hired is particularly challenging because some of the pipes that lie 1,250m under water do not have the necessary structural strength to guarantee their retrieval.

That is, under the premise that the pipelines would not support their own weight under a catenary (curves forming a U shape) equivalent to or close to the water depth in which they are installed, they must be retrieved using a resource or tool that is submerged to the proper water depth.

The tool must avoid dredging the seabed and not come in contact with any equipment that may be installed there, remaining at a minimum distance of 30m from the seabed.

The recovery must be done by a reel system within the standard used by Petrobras in its operational bases. In addition, there is a need to use smaller vessels, such as ROVs (remotely operated support vessels), for example, as there are currently a reduced number of operational bases that support vessels of the size of PLSVs (pipelay support vessels).

A possible solution proposed by Petrobras comprises a recovery method consisting of descending a reel drive system to a fixed distance from the seabed, close to 50m (enough to avoid colliding with obstacles and subsea systems), therefore minimising the catenary generated during the recovery.

The completion and submission of the public consultation, with the title ‘Subsea Reel Drive’, must be done by 4 March, 2022.

Located in the Campos basin, the Marlim field is going through a revitalisation process, which encompasses the installation of two new FPSOs (Anita Garibaldi and Anna Nery) and the decommissioning of several production units (P-18, P-19, P-20, P-26, P-27, P-32, P-33, P-35, P-37 and P-47) and associated subsea equipment.

James Fisher, a leading provider of innovative marine solutions and specialised engineering services, has launched a new business line named James Fisher Decommissioning (JF Decom), which will support the decommissioning needs of customers in the renewables and oil and gas markets by delivering considerable cost and time saving solutions.

JF Decom will provide customers with access to a dedicated, multi-disciplined team that reduces the number of contractual interfaces, to provide an end-to-end service delivery capability in complex decommissioning scopes including: subsea infrastructure removal; structural removal, well severance, and well abandonment.

With one of the world’s largest fleets of decommissioning tooling and in-house design and engineering capability, JF Decom will be able to support the rise in decommissioning projects worldwide to deliver considerable cost and time saving solutions.

Jack Davidson, Managing Director at JF Decom commented, “Increasing demand for experienced decommissioning experts within the energy industry presents an opportunity for the group to focus on what it does best - providing tailored and pioneering solutions to address customer challenges.

“In addition to the challenges faced by customers to conduct decommissioning activities as timely and cost effectively as possible, JF Decom is also dedicated to ensuring that decommissioning is conducted as sustainably as possible by restoring the seabed to its natural state.”

In building its highly skilled team, JF Decom has utilised the extensive expertise of James Fisher Offshore, which has assisted operators in the installation and maintenance of oil and gas platforms - many of which will be decommissioned as the industry adapts to the energy transition. The in-depth knowledge of the differences between these platforms, allows JF Decom to deploy the most appropriate methodology and technology to optimise the delivery of a decommissioning project.

JF Decom’s services also include the innovative well abandonment tool SEABASS, a strategic investment made in 2021, that provides a more cost effective and quicker alternative to rig-based solutions when abandoning category 2 wells, due to its ability to deploy from a vessel of opportunity and work in any water depth.

Davidson added, “With our noise attenuation tools such as Bubble Curtains we can also minimise environmental impact to marine life during decommissioning works and ensuring we provide environmentally responsible services is something that is at the forefront for JF Decom.”

Helix Energy Solutions Group, Inc. (Helix) has extended its well intervention charter and services contracts for the Siem Helix 2 offshore Brazil with Petróleo Brasileiro S.A. (Petrobras).

This will extend the original four-year contract by one year at a reduced rate reflective of the current market. The Siem Helix 2 is now set to remain under contract with Petrobras until mid-December 2022 performing riser-based well intervention activities.

The Siem Helix 2 is a purpose-built, advanced well intervention vessel capable of performing a wide range of subsea services including production enhancement, well decommissioning, subsea installation work, offshore crane and ROV operations, offshore construction work and emergency response capabilities.

Scotty Sparks, Helix’s Executive Vice President and Chief Operating Officer, remarked, “On the back of our recent accommodation and support contract for sister ship the Siem Helix 1 in Ghana for another customer, we are glad to finalise this process and look forward to continuing a long and productive working relationship with Petrobras.

“The Siem Helix 2 has consistently provided industry-leading well intervention services to Petrobras. This extension demonstrates the capacity for Helix to continuously provide innovative solutions to fit our clients’ needs backed by our experience and proven track record.”

Helix continues to make a global impact on the global stage with this announcement coming hot on the heels of its contract for the plugging and abandonment of wells in the Tui Oil Field, New Zealand. Click here for more details on this announcement.

Across three packed, entertaining days, attendees of the Offshore Well Intervention Latin America 2021 conference were treated to a host of presentations and panel sessions featuring industry experts exploring the latest trends, technologies and opportunities shaping the region’s offshore oil and gas industry.

The shift to reducing carbon emissions and increasing longevity of wells is being embraced by operators across the world and it is no different in Latin America. Speakers at the conference discussed how this was a region well positioned to take advantage of the blossoming well intervention and P&A markets and acknowledged the cascade of associated new technologies which have found a home in the region’s waters.

Offshore Network has selected and reported on key sessions from across the conference, which you can find below:

-Secure and efficient P&A of Wells: Artur Barbosa, Business Development Manager at Archer, gave a presentation on secure and efficient P&A of wells, which focused on the company’s Stronghold Barrier setting and Barrier Verification systems, part of its suite of recovery and P&A solutions.

-Sand control simplified: Bhargava Ram Gundemoni, 3M Global Solutions Specialist, showcased how operators can enhance their oil and gas production and how better sand control can lead to better productivity and profitability.

-Accurate tube integrity diagnostics using ‘pulse’ electromagnetic technology: Maxim Volkov, the Principal Domain Champion at TGT Diagnostics, spotlighted how ‘tube integrity diagnostics’ are pivotal to successful well operation, and how ‘Pulse’ electromagnetic (EM) technology can deliver the most accurate metal wall thickness measurements in all completion types, including specialised alloys with high chrome and/or nickel content.

-Bringing RLWI to Brazil: Martin Tardio Velasco, Regional Subsea Services and Wellheads Director at Baker Hughes, led a panel of experts to explore how the uptake of riserless light well intervention (RLWI) in Brazil could be developed, what benefits it could bring to the industry there, and what are the obstacles standing in the way.

-Challenges to integrity and future transformative technologies: Representatives from MADCON Corporation, EV, Quartic Advisory, Petrobras and PetroRio made up a panel to discuss the past, present and future of well integrity and transformative technologies in the pipeline.

-Brazil ripe for well intervention wave: A panel of industry professionals discussed how the Brazilian market is responding to an international drive to well interventions and decommissioning activity.

-Driving forward P&A in Latin American waters: Industry experts explored how new technologies and techniques for cost-effective and efficient decommissioning processes could be deployed, while ensuring compliance with P&A regulations.

A panel session on P&A and Regulation at the OWI LATAM virtual conference explored how new technologies and techniques for cost-effective and efficient decommissioning processes could be deployed, while ensuring compliance with P&A regulations.

A panel session on P&A and Regulation at the OWI LATAM virtual conference explored how new technologies and techniques for cost-effective and efficient decommissioning processes could be deployed, while ensuring compliance with P&A regulations.

The session was moderated by Carl Roemmele, Subsea Intervention Director, Baker Hughes. Speakers were Carlos Eduardo, Manager – Technology and Reliability Subsea Wells, Petrobras; Marcelo Matos, Wells P&A Technical Advisor, Petrobras; Joao Guandalini Batista, Wells Technology R&D Manager, Repsol Sinopec; and Katherine Beltrán Jiménez, Research Scientist, NORCE.

Eduardo started by outlining the “strong, robust” processes whereby Petrobras evaluates new technologies to address problems and challenges, with KPIs to determine which to develop and proceed with. The company works with research departments such as NORCE, other service companies and operators to develop these technologies and test them in the field. He added that there is considerable scope for developing new technologies to enhance P&A activities and speed up processes, given the challenges of P&Aing Brazil’s subsea wells, many of which are old.

Being in close contact with the market as well as operators is key to keeping on top of new developments, he said. “We need market knowledge; research departments such as NORCE are key to improving our activities.”

He added that the focus of the company’s development portfolio has been on technologies for well construction rather than P&A. “We need to think more about P&A; we as operators have to establish what our challenges are and where we want to go.”

Marcelo added that there are synergies to be explored with other operators given that they face common challenges in P&A. However he felt “industry can’t wait for the operators to take the lead in development; services suppliers need to play a key role and take the lead, discussing with operators their needs.” He commented that P&A activity in Brazil has been increasing in the recent past due to Petrobras activities and the entry of other operators into the market and the country has a good record in terms of successful P&As.

Batista stressed that P&A is a “multibillion liability for operators; we are hungry for solutions. We are working together to establish partnerships; we need to be more collaborative.” Repsol Sinopic is involved in P&A activities in Brazil in partnership with one of the operators, he said. He agreed that service companies need to be more proactive in bringing new technologies to operators and sponsoring feasibility studies and research to assist with the international approval and regulator approval process.

Roemmele raised the question of how receptive operators are to new technologies versus tried and tested technologies. Eduardo agreed that introducing new technologies is a step-by step process, given the risks compared with established technologies. Jiménez commented that the two main challenges with testing new technologies are ensuring that new technologies comply with market regulations, and finding operators to test them. NORCE tries to ensure that when testing new technologies the risk is reduced to the operator, she added.

Gamechanging technologies

Asked which technologies would be gamechangers for P&A, Jiménez highlighted three specific topics that are leading development. “The first is logging; there is a big trend for logging tools and processing of logging and data interpretation and diagnosis; the second is rigless P&As; and the third is new materials, for example new cement recipes, polymers, nano materials.”

Marcelo highlighted the benefits of a risk-based approach to P&A. “We have a very developed engineering process, and today we can have a better understanding of the risks,” he said. This could enable operators to challenge the validity of prescriptive regulations and requirements, a “hot topic for operators”, he added.

Discussing new and alternative materials, Eduardo said Petrobras is actively exploring and testing new methods and materials, but underlined the need for research to ensure that their longevity could be relied upon.

Marcelo added, “Alternative materials are already a reality; they are not widespread in the industry but some operators are using new elements when they need to or at the end of a qualification process.” He highlighted a case in the Gulf of Mexico where an operator had to execute a P&A using resin. “We are seeing increasing utilisation of bismuth alloys as a barrier.” He suggested that the usage of alternative materials could be accelerated. However, Jiménez pointed out that new materials could be more expensive.

Turning the discussion to total cost of field ownership, a current focus for the industry, Roemmele asked whether there is a vision for the future of P&A at the well drilling stage.

Jiménez underlined the “change in mentality” needed in drilling for abandonment. “We need to think about the abandonment phase at the well drilling stage, not just about getting the well to produce quickly,” she said, suggesting that the design of wells could be changed so that it is easier to abandon at a later stage. She expressed the hope for “more disruptive change in the way we abandon wells” and more new technologies implemented in the field.

Marcelo said that Petrobras’s vision of the future is of a “self abandonable well, where the completion would carry the materials and technologies required for you to just push a button, and achieve a permanent barrier.” This would mean the P&A cost for the well would be zero, but “there is a long road before we achieve that.” Marcelo foresaw a step change in P&A cost reduction thanks to new technologies and techniques.

Critical role of data

Eduardo raised the challenge posed by the possibility of changing regulations in the future, and it was felt that data and digitalisation has a critical role to play in this context. “If regulations change, we can use data to design a new reality,” said Batista. He explained how Repsol is embedding sensors in the well to monitor conditions and provide data, leading to a predictive approach for well integrity and enabling a true risk-based P&A design.

“More sensors equals more data equals easier decisions,” said Roemmele, pointing however that access to data is often a challenge, and data is not always transferred when ownership changes.

Roemmele raised the issue of carbon capture and storage (CCS). “Could this be a future opportunity and do we have enough knowledge to use some of these wells to reverse the flow?”

Batista underlined the link between P&A and CCS issues and challenges, and felt geothermal offers particularly strong potential. However he urged a cautious approach; while the idea of re-using the well is attractive, and would effectively reduce P&A costs, it could pose engineering challenges; efforts would be needed to ensure the integrity of the well, after years of use, possibly in difficult conditions, would be up to supporting a new application. “More data and more interventions are needed to better understand the real condition of the well,” he suggested.

Echoing this caution, Marcelo questioned whether a well built for a different purpose with different technologies 25 to 30 years ago would be usable for the next 30 years or more, and whether CCS made sense in the Brazilian scenario, given the location of fields in deep water far from shore. Jiménez agreed a regional approach is needed, commenting that while Norway, with its focus on reducing emissions, is leading CCS research, the infrastructure needed to compress and transport CCS may not make sense in Latin America. She further pointed out that further research is also needed on the behaviour of CCS and its reaction with cement.

Summing up, Roemmele concluded that Brazil and Latin America already have a good record in terms of successful P&As, and that openness to new technologies and techniques, supporting new research, risk-based modelling, sharing data and collaboration between regulators, operators and service companies are key to successfully driving forward P&A in the future.

At the Offshore Well Intervention Latin America conference, a panel of industry professionals discussed how the Brazilian market is responding to an international drive to well interventions and decommissioning activity.

David Carr, Senior Vice-President at Helix Well Ops (UK) Ltd, opened the session with a video discussing the recent developments in the international offshore community. He noted that despite the last 12-18 months being one of the most challenging in living memory, well intervention activity has suffered less than most and, according to RigLogix, in a period where drilling activity reduced by almost 35%, well intervention activity only declined by around 21%.

On top of this, Carr continued, there have been positive signs from within the industry with companies such as Harbour Energy, Equinor, C-Innovation and Petronas planning or conducting significant intervention work. Carr added, “In Latin America operators have returned to profitability but drilling activity has not really increased ‒ partly due to the need to pay off debt and the turn to renewable energy. However, depleting reserves need to be replaced and intervention is the lowest cost and risk way of doing this. More and more companies are entering the riserless light well intervention (RLWI) space, resulting in more innovations arising in the market. Additionally, oil and gas regulators are gaining greater powers to enforce policies to maximise economic recovery and ensuring operators fulfil their decommissioning obligations.”

Lucas Mota, Manager of Financial and Physical Planning at Petrobras, noted that his company has made a strong statement in maximising their portfolio value with a focus on deep and ultra deep waters and already there have been key intervention targets identified in order to keep up with production targets. He added, “Petrobras has a strong workover portfolio so we are looking closely to new technology and opportunities to get the most out of our producing fields. The pandemic has affected the scenario for workover activities and we have seen reductions but we have gained back momentum and expect to be back to pre-pandemic levels starting in 2022. Being resilient, being cost effective, and introducing new technology will be paramount for making sure we meet production targets and keep extraction costs low.”

David Dempsie, P&A Task Force Leader of Global Drilling & Completions at Repsol, noted that in general terms operators are constantly looking for the “the best bang for their buck” and the benefits of intervention is we typically understand better objectives and targets and are therefore more sure of outcomes.

“To further increase production, the ability globally to drill becomes hard at times. Licences to drill take more time whereas interventions are faster to react and they align well with many regulatory requirements. Such a period of uncertainty with oil prices means relying on high cost drilling activities is not always appropriate anymore whereas intervention is much more cost effective.”

Providing a detailed update on the state of the offshore oil and gas market in Brazil, Mariana Franca Operational Safety & Environmental Superintendent at ANP, noted that even in the most challenging times, oil production has increased ‒ as was the case in 2020 which has been maintained across 2021. She noted that as a regulator, her company is working to incentivise operators to increase the recovery factor and that they have witnessed a decrease in drilling in this time. There are also hopes that plug & abandonment (P&A) activities will increase as operators take their liabilities more seriously.

A decommissioning wave on the horizon?

On the subject of P&A and decommissioning, Dempsie said that generally as the industry and fields of a region mature, the companies active in there mature. While there is a tendency to delay such operations companies can no longer afford to do so due to environmental concerns.

“As confidence grows and the number of P&A operations increase, it has an effect on operators and service providers to do more. When this happens, abilities increase and costs decrease. The appetite is starting to be there. Overall, this has somewhat been kicked down the road but it can go no further. People need to understand they have reliability to do better.”

“In Brazil the deepwater elements pose unique challenges but subsea contractors confidence builds the more work that is performed and this will allow greater progression and natural growth will come as one operator to another does more. P&A, when I arrived in the market, was something for my grandchildren but it has crept up. It is a market which will grow as Brazil invests and will strengthen operators to create a more sustainable business plan.”

To encourage more activity of this type, Franca stated that new well integrity management system regulation was published in 2016 which addresses P&A obligations as before it was old fashioned. With the new system, they are aligning Brazilian regulation with best practices. Now, for example, liabilities are harder to be extended and there is a maximum period of three years for well to be idle without monitoring well integrity.

Building on these comments, Mota said that for his company decommissioning and enhancing production is of paramount importance. They have a five year plan amounting to US$4.6bn and more than half of that is being spent on well intervention costs with around 500 well interventions planned in the next ten years. They are also targeting efficiency in these activities. The company currently has achieved 40 days per abandonment well and is aiming to reduce this to 30 days per well.

Reducing costs

One of the main issues relating to P&A, decommissioning and well intervention is they can carry weighty costs for operators. The panellists addressed this concern, noting some trends which could reduce costs and encourage more of these activities in Brazil.

For instance, Mota noted that RLWI is being taken up more around the world and is a method which can bring reductions ranging from 40-50% in time and costs. There is a lot of interest in this in Brazil and from his company.

Dempsie added that collaboration is key to this and many operators are looking to work together on P&A and intervention campaigns to capture value on these necessary operations. He said, “This has worked well globally under various guises and it suited the economic needs of many organisations.” Rig clubs, for example, have been looked at elsewhere and could really help companies share risks and shoulder costs in Brazilian waters.

Additionally, as the panellists touched upon, the continued development of new technology is enabling operators to better understand when wells require P&A and intervention work and is allowing them to carry it our more safely and for less money. This will only encourage those active in Brazil to pursue such activities more aggressively.

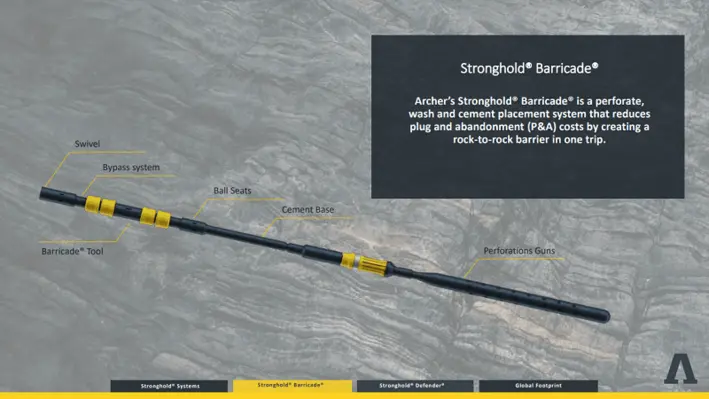

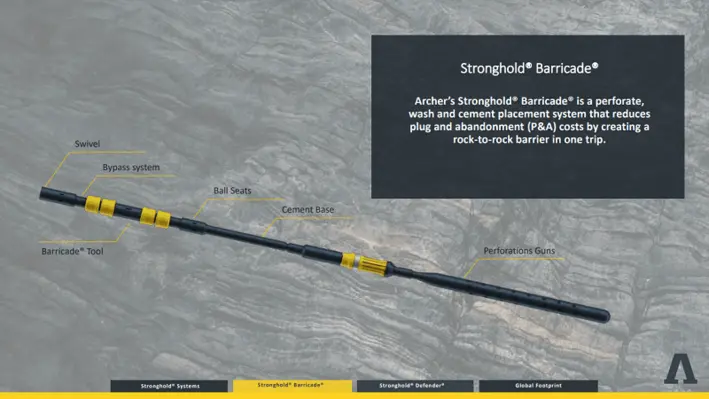

At the OWI LATAM 2021 conference, Artur Barbosa, Business Development Manager at Archer, gave a presentation on secure and efficient P&A of wells, which focused on the company’s Stronghold Barrier setting and Barrier Verification systems, part of its suite of recovery and P&A solutions. The presentation demonstrated how the Stronghold systems provide an economical and effective alternative to traditional plug and abandonment (P&A).

Barbosa started by giving an overview of Archer, a global oil services company with a 45-year history and strong focus on safety. Its solutions support drilling services, well integrity, intervention, P&A and decommissioning. The company operates in 40 locations in 19 countries across the globe, with more than 5,000 employees.

“In our current portfolio we have 33 platforms, three subs, and two modular rigs, where we are responsible for operations, maintenance and certification of drilling equipment on these assets; rental division providing specialised equipment for offshore operations; engineering solutions for enhancing customers’ assets performance; cased hole wireline services; and oiltools, which provide solutions for well cleaning and cementing, slot recovery and P&A,” he explained.

“Archer can provide all these services in an integrated services contract model, reducing the interfaces with subcontractors and making Archer the focal point of drilling and well services activities,” he stressed.

Barbosa gave an outline of Archer’s wide-ranging capabilities and solutions across the well lifecycle from exploration and development through workover intervention, to abandonment and slot recovery. He emphasised that Archer can provide the customer full life cycle in P&A and slot recovery solutions for cut and pull, casing exit and barrier setting and verification.

“The advantage of the Stronghold barrier system is it eliminates the need for milling during P&A operations,” he explained.

“For barrier setting, the Stronghold Barricade system is designed to perforate a selected casing section, wash and clean and set a permanent barrier,” he said. It reduces P&A costs by creating a rock-to-rock barrier in one trip.

“The Barricade Plus is an improvement on the system; it deals with higher circulation and pressure and bypass capabilities, and is designed to deal with larger casing sizes,” he continued.

“For barrier verification we have the Defender, which is designed to verify the integrity of the barrier, and it’s the most efficient way for us to P&A a well.” It enables operators to perforate and test an annular barrier in a single trip.

“The Fortify is an improvement on this system, with a unique pressure verification system,” he went on.

Barbosa added that the company has conducted more than 200 successful jobs all over the globe, resulting in US$250mn in savings for customers.

Barbosa explained in detail the schematics and operation sequence of the systems, and shared some technical paper references where these technologies and their benefits are explored in depth. These include SPE-191528-MS (TotalEnergies), SPE-193945-MS (Aker BP), SPE-193989-MS (Shell) and SPE-197149-MS.

He also referred to a case study illustrating the successful deployment of the Stonghold Barricade in the Gulf of Mexico. In this case, a major deepwater operator needed to set a 330ft cross sectional cement barrier in 13 3/8” x20 casing. This well, in over 6,000 ft MD water depth required a cement barrier to be placed just above the 20” casing shoe in order to meet the qualifications to plug and abandon the well.

The Archer 13 3/8” Stonghold Barricade was successfully deployed for washing and cementing of the 330ft long interval with even rates at 1200 lpm. The tests run after performing the operation firmly tagged top of cement 6ft above the planned height, and a successful positive/negative test allowed the operator to move on with the completion of the plug and abandonment.

Barbosa gave another example of the application of the Barricade washing tool , where it was used with the Thor casing cleaning and recovery system, which is designed to perforate, clean and recover the casing in a single trip, the method being to move the friction in the casing, and recover the casing.

“The challenge is where we have significant barite, where it would be very time consuming to recover the casing, with multiple cutting required. With this solution we could make two cuts in the casing, perforate, wash out the barite, activate our plug and recover the casing. That was the business case for one of the jobs with our Thor system. In this case the customer was finding it difficult to pull the casings out, so we used our Samurai cutting tool to cut the casing with two cuts, then ran in hole with the Thor, washed the section and recovered the casing.”

The presentation stimulated a number of questions, which were addressed in a lively q&a session to conclude the session.

Page 2 of 2