Australian law firm Johnson Winter Slattery (JWS) has released a paper on some of the legal issues surrounding what it calls the 'rising regulatory scrutiny' on offshore petroleum assets.

Australian law firm Johnson Winter Slattery (JWS) has released a paper on some of the legal issues surrounding what it calls the 'rising regulatory scrutiny' on offshore petroleum assets.

It has been estimated that around 5.7 million tonnes of decommissioning material will need to be removed from Australian waters over the next 30-40 years at a cost of around US$60bn.

The document — entitled ‘Navigating the Waters of Decommissioning: Legal Obligations and the Rising Regulatory Scrutiny on Offshore Petroleum Assets’, by Rebecca Cifelli, a Partner at JWS — highlights key steps and processes facing operators and contractors in this fluid environment.

“Decommissioning forms part of the offshore petroleum lifecycle,” the paper notes. “Obligations to remove or appropriately deal with property arise for titleholders, not just at final cessation of operations, but throughout the operation phase as assets within an operating field reach the end of their useful life.”

As the Australian oil and gas industry matures, a number of fields are reaching end of life. Accordingly, the paper notes, decommissioning liabilities are coming into “sharper focus” for both industry and regulators.

“Regulators are increasingly concerned that titleholders meet their obligations during the operations phase by proactively decommissioning throughout the life of the project and planning for decommissioning as early as possible,” it notes.

This is reflected in The National Offshore Petroleum Safety and Environmental Management Authority’s (NOPSEMA) information paper, ‘Planning for proactive decommissioning’ and its ‘Decommissioning Compliance Strategy 2024-2029’.

NOPSEMA sets out its expectations that titleholders engage in planning for decommissioning from the inception of a project and detail this planning in environment plans (EPs) submitted under the Offshore Petroleum and Greenhouse Gas Storage Act 2006 (Cth) (OPGGSA).

The JWS paper goes on to other key areas of interest such as decommissioning obligations in Commonwealth waters and the timing for removal of physical infrastructure and assets.

NOPSEMA’s ‘base case’ for all offshore operations is the full removal of all property unless an alternative arrangement is accepted, it adds.

In terms of timelines, Section 270 (OPGGSA) requires decommissioning to be completed on a title before it is relinquished. However, the OPGGSA does not otherwise stipulate any timeframes for the completion of decommissioning obligations.

The Australian Government and NOPSEMA have interpreted section 572 as requiring timely decommissioning. In the absence of any express timeframes in the legislation, NOPSEMA’s ‘Decommissioning Compliance Strategy’ 2024-2029 sets the following targets:

Non-producing wells: to be suspended with downhole barriers within 12 months of loss of real-time monitoring and permanently abandoned within 10 years of suspension.

Floating infrastructure: to be removed within 12 months of cessation of production (COP).

All wells: to be plugged and abandoned within three years of COP.

All other property: to be decommissioned to approved end state within five years of COP.

“While these are targets only, our experience indicates that NOPSEMA will apply them to its assessment of EPs and will need to be satisfied that departures from the targets are justified,” the JWS paper adds.

The vast majority of decommissioning liabilities are located off Western Australia and will therefore fall within the jurisdiction of either NOPSEMA or the WA Department of Energy, Mines, Industry Regulation and Safety (DEMIRS).

Victoria is the only other State that has significant property to be decommissioned in its coastal waters.

In the second half of 2024, the Victorian Government launched an inquiry into offshore petroleum infrastructure requiring decommissioning over the coming decades and the regulatory powers of the Victorian Government to ensure oil and gas producers meet their obligations.

The JWS paper also explores areas such as permissioning documents and early planning, as well as remedial directions and trailing liability.

Global Underwater Hub (GUH) and Subsea Innovation Cluster Australia (SICA) have signed an MoU to collaborate over the development of the subsea sector in both hemispheres.

Global Underwater Hub (GUH) and Subsea Innovation Cluster Australia (SICA) have signed an MoU to collaborate over the development of the subsea sector in both hemispheres.

Under the agreement, the organisations will actively promote opportunities for their subsea supply chains in both countries and share market intelligence and learnings around diversification strategies for the energy transition and defence operation.

GUH Chief Executive, Neil Gordon, said, “Australia has a broad conventional energy mix with strong ambitions towards net zero […] crucially, and similar to the UK, Australia champions a just transition which builds in energy resiliency and security with opportunities in sustained oil and gas production, decommissioning and carbon capture.”

Gordon also highlighted the continued production within the oil and gas industry within Australia where there are opportunities within new developments as well as in the expansion oil current production by leading operators including Woodside and Santos.

He added, “Decommissioning is a significant opportunity in Australia where the inventory of subsea assets requiring to be decommissioned includes over 1,500 wells and structures and 4,500km of pipelines with major opportunities for specialist plugging, cutting, inspection and recovery technologies.”

SICA Cluster Manager, Colin McIvor, commented, “This MoU marks an important step in strengthening collaboration between Australia and the UK’s subsea sectors. By working with GHU, we’re opening new opportunities for innovation, knowledge sharing, and international market access for SICA members. Both organisations bring unique strengths: SICA’s agility and cross-sector innovation focus and GUH’s depth of experience and established global networks. By sharing these, we can deliver real impact for established and emerging industries and accelerate significant growth for both countries.”

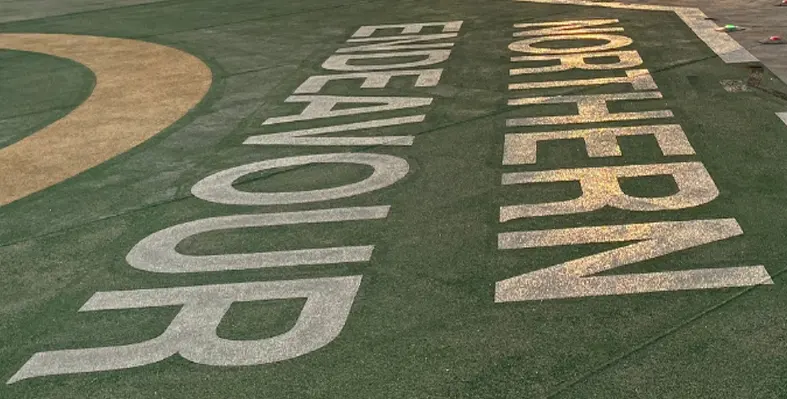

Australia’s 2025 federal budget, unveiled this week, reinforces the government’s commitment to decommissioning, including the completion of the Northern Endeavour project.

Australia’s 2025 federal budget, unveiled this week, reinforces the government’s commitment to decommissioning, including the completion of the Northern Endeavour project.

Earlier this month, the Australian Government awarded COSCO Shipping Heavy Transport (COSCO) a contract to dry tow the Northern Endeavour FPSO vessel to its recycling location.

Earlier this month, the Australian Government awarded COSCO Shipping Heavy Transport (COSCO) a contract to dry tow the Northern Endeavour FPSO vessel to its recycling location.

The Hua Rui Long semi-submersible heavy lift vessel will tow the Northern Endeavour to a facility for decontamination, dismantling and recycling. The FPSO measures 274 metres in length, meaning there are only a few vessels in the world capable of carry something of this magnitude. Securing a vessel in the right timeframes for this project marks a significant milestone for the programme.

COSCO will work with Petrofac to arrange for the FPSO to be towed to the recycling location after disconnection. The Department of Industry, Science and Resources released a request for tender to find a supplier to recycle the FPSO. Submissions closed on December 13th, 2024, and the Department is currently evaluating its options.

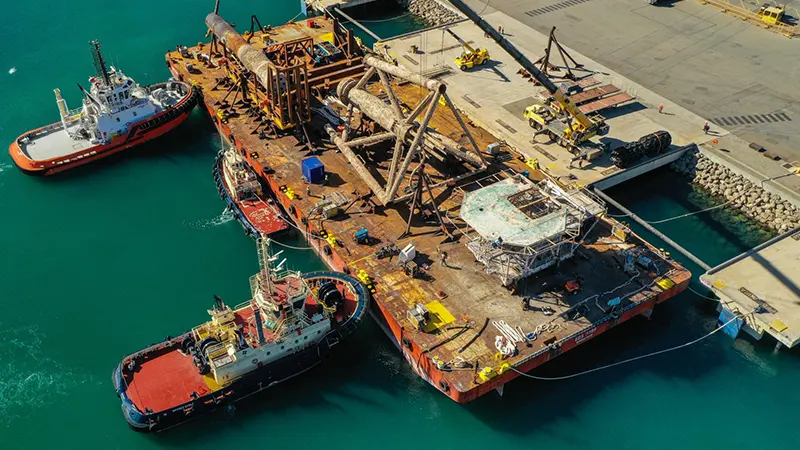

Liberty Industrial has completed the onshore deconstruction and recycling of the Santos Campbell platform on behalf of McDermott International Ltd.

Liberty Industrial has completed the onshore deconstruction and recycling of the Santos Campbell platform on behalf of McDermott International Ltd.

The project featured the Roll-On-Roll-Off procedure of the oil platform using Self-Propelled Modular Transporters (SPMTs) at the Australian Marine Complex Common User Facility (AMC CUF).

“The decommissioning of the Campbell platform exemplifies Liberty Industrial’s ability to tackle the intricate nature of onshore decommissioning, setting a benchmark for excellence in a rapidly growing industry sector,” said Jed Van Iersel, decommissioning manager at Liberty Industrial.

Van Iersel added that it highlighted the company’s ability “to meet all stakeholder requirements” and to handle complex marine operations.”

Following the offshore removal by McDermott, the Santos Campbell platform arrived at Port Henderson in three unique structures via barge.

These structures were safely transported via SPMTs to the onsite deconstruction yard for disposal and recycling.Liberty Industrial executed the Roll-On-Roll-Off procedures in just five days, following six months of meticulous planning with leading in-house and subcontractor engineers.

The deconstruction posed significant logistical challenges, the company added in a statement.

Each structure, the heaviest weighing over 600 tonnes, required a bespoke handling plan to ensure safe and efficient transfer from the barge to the decommissioning site, addressing various water displacement considerations and tight port schedules.

The remaining onshore deconstruction and recycling programme was completed on budget, on time, and with exceptional stakeholder satisfaction in 57 days, the statement noted.

Located in the Varanus Island hub, the Campbell Platform removal was contracted to McDermott in 2023, who then engaged Liberty Industrial for the task of deconstruction and waste recycling management.

All structures were deconstructed using suitable demolition excavators, with demolition of taller structures achieved by high reach excavators, oxy-cutting from EWP to pre-weaken structures before final induced collapse, the Liberty Industrial statement noted.

The materials from these structures were then downsized and moved to the processing area for segregating and processing using hot oxy-cutting and cold mechanical shearing, achieving a 99.5% recycling rate.

“We are extremely pleased with our ability to manage the complexities of the project by expanding our capabilities to include marine offloading operations and set a new benchmark for onshore decommissioning in Australia,” said Warwyck Smith, Decommissioning Project Manager, Liberty Industrial.

“We look forward to expanding on our already established and growing presence as a subject matter expert in onshore decommissioning in Australia and internationally.”

A major milestone has been reached regarding the decommissioning of the Northern Endeavour FPSO wherein an extensive well suspension and flushing campaign has been successfully completed.

A major milestone has been reached regarding the decommissioning of the Northern Endeavour FPSO wherein an extensive well suspension and flushing campaign has been successfully completed.

The campaign started in September 2024, led by Phase 1 contractor Petrofac Facilities Management Limited (Petrofac). Sapura Constructor, the light well intervention vessel, has completed the works in the Laminaria-Corallina oil fields.

The critical work included temporarily suspending seven of the nine oil wells in the Laminaria-Carollina oil fields (two of the wells were previously suspended). The process involved closing off the valves that control pressure and flow on the sea floor, and installing two sets of specialised barriers at two different sections of the well to ensure fluids cannot escape.

The other part of the campaign involved flushing of nearly 30km of pipeline, including subsea umbilicals, risers and flowlines. The process ensures the pipeline are clear of hydrocarbons and hazardous materials before disconnecting the FPSO which is penned for the second half of 2025.

The completion of this well suspension and flushing campaign is a major step towards allowing the FPSO to be safely disconnected from the subsea infrastructure without leaking fluids into the ocean. More work will take place in later phases of the project to permanently plug and abandon the wells.

The decommissioning process comprises a total of seven stages, with preparation being the third stage.

This stage involves well P&A, cleaning, purging and isolation, and a preliminary categorisation of material streams. Using renewable energy sources like wind, solar or wave power to perform offshore decommissioning activities offers a plethora of environmental and cost-saving benefits.

Some notable applications include:

Australia’s total decommissioning liability is estimated at around US$40.5bn, with the region’s disposal industries, although being well placed, possess some critical knowledge gaps that urgently need addressing.

According to a report by CODA, a scenario mapping exercise based on the Strengths, Weaknesses, Opportunities Threats (SWOT) analysis was performed. From the analysis, the following potential disposal solutions were found to be ideal:

With the presence of an efficient domestic recycling industry and concrete recycling market, the waste management and recycling phase of Australia’s offshore decommissioning seems to be on track. However, a number of negative factors have resulted in the preference of abroad disposal over domestic disposal:

By working towards enhancing domestic disposal capabilities, Australia can not only reap economic and environmental benefits, but also promote technology and infrastructure development and adhere more strongly to local laws. This in turn helps in building public trust and reputation, thereby giving Australia a chance to position itself as a leader in sustainable offshore decommissioning.

A recent report by Macquarie University’s Centre for Energy and Natural Resources Innovation highlights a pressing issue regarding how the structural integrity and failure risks that come with offshore wells that are suspended, plugged or abandoned tend to be severely underestimated.

Wells that are not appropriately abandoned can pose a serious threat to the health of neighboring countries and the environment. Inadequate plugging can also result in excessive emission of methane, contributing to climate change. Moreover, leaks and operational issues can make them a significant safety hazard.

The report highlighted six recommended best practices and regulatory reforms that would be useful for handling plugged and abandoned oil and gas wells. Upon its launch, professor of Energy and Resources Law at Macquarie and writer of the report, Tina Soliman-Hunter, in collaboration with the members of the Maritime Union of Australia (MUA) urged the need to strengthen the regulatory framework for end-of-life offshore oil and gas assets.

CODA's forecast emphasised that around 51% of Australia's on- and offshore decommissioning liability will occur before 2030, with 23% occuring between 2031 and 2040. This liability considers the removal of offshore material, most of which comprises steel and concrete. The removal of a majority of offshore infrastructure material would depend on NOPSEMA requirements.

According to an article by Petroleum Australia, deputy leader of the Victorian Greens and Member of the Victorian Legislative Council, Sarah Mansfield stated that nearly 150,000 tonnes of methane were being emmitted by just a handful of surveyed sites each year. She also initiated the inquiry into abandoned and plugged wells, given Victoria's gradual transition towards renewables.

Global law firm Clifford Chance has provided its feedback on Australia’s recently-published roadmap for decommissioning, calling the blueprint a welcome development but one that needs "tangible" support to ensure success.

Global law firm Clifford Chance has provided its feedback on Australia’s recently-published roadmap for decommissioning, calling the blueprint a welcome development but one that needs "tangible" support to ensure success.

In its report – The Road to Decommissioning: Establishing a Global Decommissioning Hub in Australia – it charts the steps Australia plans to make following the release of the government’s long-awaited Offshore Resources Decommissioning Roadmap. In its closing remarks on where to next for the industry, Clifford Chance highlights some of the many opportunities –and challenges –ahead.

"There is significant potential for growth in the Australian decommissioning industry through involvement in upskilling employees, re-purposing existing ports and building facilities that will improve the efficiency of recycling decommissioned materials," it states. "The government's commitment to ensuring Australia is equipped to grow the decommissioning industry is a welcome development, which needs to be matched with tangible actions."

Testimony to Australia's continuing commitment to energy transition, the main objective of the roadmap is to develop a world leading decommissioning hub in Australia. This proposed hub will service global demands, seizing the opportunity to capitalise on the estimated US$60bn spend on decommissioning offshore facilities over the next 30 to 50 years. Among the growth opportunities highlighted by Clifford Chance are prospects for international collaboration. It notes that Australia lacks adequate vessels for engaging in heavy offshore decommissioning and there is also an opportunity for stakeholders to collaborate with other global markets to import machinery. Port modification is also seen as another area of opportunity. No existing Australian port researched by CODA and KPMG has all the required attributes to handle offshore decommissioning, Clifford Chance noted in its report. This means existing ports will need to be modified to host decommissioning.

But ultimately, this is only the beginning of the journey, it adds. "It is clear that the Australian government, and its state counterparts (who must come along this journey), are still in the information-gathering phase of developing the industry, as there has been a recent request for tender by the Department of Industry Science and Resources for technical advice relating to decommissioning.

"It is a long road ahead, but the areas of development highlighted by the government should act as a checklist for interested parties in ensuring that Australia is at the forefront of the decommissioning industry.

"The roadmap is a welcome and significant stepping stone in Australia’s energy transition journey, and in developing and fostering stakeholder engagement on Australia's ambitions to become a global leader in the offshore decommissioning sector. Australia's next step is eagerly awaited."

The end of 2024 saw the Australian Government’s Department of Industry, Science and Resources release ‘Australia’s Offshore Resources Decommissioning Roadmap’, summarising the Government’s plan to create a sustainable domestic decommissioning industry.

The end of 2024 saw the Australian Government’s Department of Industry, Science and Resources release ‘Australia’s Offshore Resources Decommissioning Roadmap’, summarising the Government’s plan to create a sustainable domestic decommissioning industry.

In the Minister’s Foreword, Madeleine King, Minister for Resources and Minister for Northern Australia, stated, “An Australian decommissioning industry can be part of our economic transformation as we move to net zero. It can support new jobs for our skilled offshore workforce and attract new investment for Australian businesses. It can also grow domestic industrial capabilities while supporting the circular economy. This industry will play a key role in the continued protection of our marine environment by ensuring Australia continues to meet the robust environmental standards under Australian and international law.

“The foundations of an Australian decommissioning industry have been laid. We have the skills and expertise to underpin a world-class decommissioning industry, backed by strong regulatory settings.”

The roadmap outlines the steps the Australian Government will need to take to coordinate and guide policies while setting clear regulatory expectations in order to seize the estimated AUD$60bn in economic opportunity lying in wait.

To implement the roadmap, a dedicate Offshore Decommissioning Directorate will be established within the Department and will work with industry, unions, state and territory governments, First Nations groups, international organisations and local communities to help build an Australian decommissioning industry. The Directorate will focus on the most pressing issues identified by stakeholders and also work across governmental bodies to necessary policies in place to maximise the contribution of decommissioning to the Australia economy.

In line with the roadmap, the Australian Government will implement the following actions to support the development of the regions’ decommissioning industry:

More information, as well as the full roadmap, can be found on the Government’s website.

Australia’s leading decommissioning and abandonment conference (D&A AUS 2025) will be opening its doors once again this June for a jam-packed schedule full of more industry updates, case study analyses, networking opportunities and VIP events than ever before.

Australia’s leading decommissioning and abandonment conference (D&A AUS 2025) will be opening its doors once again this June for a jam-packed schedule full of more industry updates, case study analyses, networking opportunities and VIP events than ever before.

Taking place at The Crown Perth on 10-11 June, 2025, this year’s edition, once again in partnership with CODA, will shine the spotlight on the region’s regulators, including an in-depth session with NOPSEMA discussing the roadmap for new technology implementation within the Australian decommissioning market.

Attendees will also have the chance to hear the latest updates regarding the notorious Northern Endeavour project in a talk led by the Department of Industry Sciences and Resources, as well as develop a deeper understanding of the on-going environmental research conducted by NDRI, AIMS and ANSTO in a panel session dedicated to identifying current gaps in the research.

Australia’s largest operators will also play an integral role in the conference, including Chevron, ExxonMobil and Woodside who will take centre stage to delve into regional case studies from their current decommissioning portfolio.

This year will feature the debut of the newly revamped expo hall, boasting double the number of booth as previous years and a fresh new look promising to be the one-stop-shop for all decommissioning needs.

As the content value of the conference has continuously elevated, so too have the networking opportunities, allowing delegates to indulge in the VIP treatment. This year, attendees can kick-start proceedings with the Pre-Conference Icebreaker Drinks, garnering new relationships and reconnecting with old faces over cocktails and canapés before toasting to the exciting days to come. D&A AUS 2025 will also once again host its invaluable Networking Drinks after the Day One sessions have ended, allowing delegates to relax, unwind and debrief.

Adding a touch of luxe to the events calendar, this year’s Deluxe Pass Holders will once again be treated to a Deluxe Dinner. The exclusive gathering offers a unique opportunity to connect with fellow delegates in a more intimate setting over a five-course menu. To round out the conference on a high note, VIP Pass Holders will enjoy a night of entertainment complete with a premium drinks package, a three-course meal and plenty of surprises in store.

Featuring 500 delegates, 50 new technology demos, 50 expert speakers, five interactive exhibition and networking spaces and five bespoke networking sessions, D&A AUS 2025 promises to be an unmissable event in the region’s oil and gas calendar.

Page 5 of 13

Copyright © 2025 Offshore Network