Expro has secured a contract with a major operator for the first deployment of its unique single shear and seal high-debris 15K ball valve assembly.

The multi-functional single shear and seal mechanism will form part of a full subsea deepwater completion/intervention system being designed by Expro for a long-standing and valued customer for a deepwater subsea field at about 6,600 ft in the Gulf of Mexico.

The mechanism is designed to answer the customer’s requirement for a versatile, single-valve subsea solution rather than the conventional double-valve system while offering the reassurance of risk reduction through an additional safety barrier.

Graham Cheyne, Expro’s Vice President of Subsea Well Access, commented, “We are proud to offer our innovative shear and seal solution to meet the needs of this important customer in the Gulf of Mexico. Our cutting-edge technology propels the industry’s momentum towards increased automation, improving safety on the rig floor by minimising personnel and mitigating human error, while providing an additional safety barrier. It offers operators with flexibility for their operations in both in-riser and open water subsea applications.”

Expro’s high-debris single ball system, which delivers shear and post shear seal on a multitude of sizes of coiled tubing, slickline, and electrical cable, is a solution for both gas and liquid. Its versatility makes it suitable for deployment in both in-riser or open water environments.

It is NACE MR0175 compliant and qualified for sour hydrogen sulfide environments. Bi-directional sealing is available even after a pump-through. The mechanism has been qualified to API 17G standard for the performance and design of subsea well intervention equipment. Its ability to handle up to 15% debris is a significant improvement over alternative mechanisms used in this environment today.

Expro’s shear and seal valve is available in the ELSA-HP 15ksi enhanced landing string assembly. It can be configured as a single valve, a single valve with a latch mechanism, or as a conventional subsea test tree arrangement, enabling flexibility. Expro is currently integrating the shear and seal ball system into its ELSA-HD 10ksi equipment and open water offerings.

While the oil and gas industry in Southeast Asia is looking ahead to an impressive array of merger and acquisition deals, the region cannot forget its ever-growing decommissioning and abandonment (D&A) liabilities. Approximately 200 offshore fields in Southeast Asia, comprising more than 1,500 platforms and 7,000 plus wells, are likely to stop producing by 2030.

While the oil and gas industry in Southeast Asia is looking ahead to an impressive array of merger and acquisition deals, the region cannot forget its ever-growing decommissioning and abandonment (D&A) liabilities. Approximately 200 offshore fields in Southeast Asia, comprising more than 1,500 platforms and 7,000 plus wells, are likely to stop producing by 2030.

Sustainable D&A practices now stand more relevant than ever as a recently released IEA report predicts that high prices and security of supply concerns highlighted by the global energy crisis is hastening the shift towards cleaner energy technologies. Circumstances have led analysts from Goldman Sachs to revise its bullish prediction of the Brent crude price hitting US$100 by mid-2023 to finish as low as US$86 this year. Such waning confidence in the future oil price and demand in the face of the growing energy transition especially calls for serious consideration of end-of-life responsibilities by operators.

To navigate the elaborate and often complicated process of D&A, operators must follow clear regulatory regime, which is the only way to understand their liabilities. To establish an effective regulatory framework, it may help Southeast Asia to play catch-up with foolproof guidelines and processes already in place elsewhere, such as the UK or the Gulf of Mexico. Chevron and Shell are currently collaborating with Thai and Bruneian regulators respectively through knowledge transfer and pilot project initiatives.

While Southeast Asia is following international conventions such as the International Maritime Organisation Guidelines (IMO) and the United Nations Convention on the Law of the Sea (UNCLOS), it has also adopted new clauses along with these to make them region-specific. For example, the area of ‘pipelines’ is an addition by the ASEAN Council of Petroleum – otherwise absent in the global frameworks – to allow export pipelines to be left in situ, provided that there is no history of pipeline spanning, or movement of the seabed.

A cheap alternative to the costly affair of decommissioning, the Rigs to Reefs programme has the potential to benefit marine life as well. The rig-to-reef way of D&A can spare companies a significant capital. In the Asia-Pacific region, an average 6,000-ton oil platform will cost approximately US$35mn to completely remove, notes an Asia-focused research website. However, D&A via the rigs-to-reefs approach would cut that amount in half, with an average saving of up to nearly US$22mn per platform decommissioned, according to decommissioning expert Brian G Twomey.

The Bureau of Ocean Energy Management (BOEM) has proposed changes to modernise financial assurance requirements for the offshore oil and gas industry, in order to better protect American taxpayers from incurring the costs associated with the oil and gas industry’s responsibility to decommission offshore wells and infrastructure.

BOEM Director, Liz Klein, commented, “These proposed updates to our financial assurance regulations will help ensure that energy companies that are operating in publicly-owned federal waters are able to fulfill their clean-up and decommissioning responsibilities, without taxpayers having to step in to foot the bill. The commonsense updates that we are proposing would modernise evaluation and financial criteria so that we are better protecting taxpayers from the decommissioning costs associated with aging oil and gas infrastructure on the Outer Continental Shelf.”

Together with reforms to royalty rates, rental rates, onshore bonding requirements, and leasing practices, the changes being announced today continue to advance the Biden-Harris Administration’s federal oil and gas reform agenda, which was outlined in a report that the Department of the Interior developed in response to Executive Order 14008.

The proposed rule would establish two metrics by which BOEM would assess the risk any company poses for the American taxpayer.

To accurately and consistently predict financial distress, BOEM would use credit ratings from a nationally recognized statistical rating organisation, or a proxy credit rating generated through a statistical model. BOEM would require companies without an investment-grade credit rating to provide additional financial assurance. BOEM is seeking public feedback on whether it should rely on credit ratings to make these determinations and what credit rating threshold would best protect taxpayer interests without imposing undue burdens on industry.

Second, BOEM would consider the current value of the proved oil and gas resources on the lease itself when determining the overall financial risk of decommissioning, given that any lease with significant reserves still available would likely be acquired by another operator that would then assume the liabilities in the event of bankruptcy.

The proposed regulatory changes would provide additional clarity and reinforce that current grant holders and lessees bear the cost of ensuring compliance with lease obligations, rather than relying on prior owners to cover those costs.

BOEM would use decommissioning estimates based on industry reported data collected by the Bureau of Safety and Environmental Enforcement (BSEE) at a level that would adequately cover estimated decommissioning costs without being overly burdensome. This proposed rule would allow current lessees and grant holders to request phased-in payments over three years for new financial assurance amounts.

The proposed changes were published in the Federal Register on 29 June, which will open a 60-day public comment period.

Aquaterra Energy, a leader in global offshore engineering solutions, has announced a multi-million-pound contract with a major Abu Dhabi based operator, working in partnership with TPMC, to provide offshore riser equipment and services for a decommissioning campaign offshore Abu Dhabi.

Aquaterra Energy will provide a completion and workover riser system complete with AQC-CW connectors, as well as an additional subsea riser system, tieback engineering and rig modifications. It will do this to decommission eight wells, in 80 m water depths by 2029. Throughout the contract Aquaterra will deliver a complete end-to-end managed service, providing engineering services, expertise and personnel.

The completion and workover riser system, complete with AQC-CW connectors, is certified to BS EN ISO 13628-7 2006 and can operate in water depths of up to 1,500 m. The system has been designed to withstand repeat make and breaks, whilst offering a gas tight metal-to-metal seal.

Aquaterra Energy will work closely alongside in-country partners to manufacture and transport the project equipment. Local in-country inspectors will be deployed to ensure the high quality of work throughout the project.

James Larnder, Managing Director, Aquaterra Energy, remarked, “We are delighted to have secured this work in the Middle East and to expand on our decommissioning and riser expertise. This is an important region for us as a business and we’ve seen significant growth here over the last few years. We plan to continue this momentum and are on course to increase both our presence and revenue in the region by the end of the year. This project represents a step forward in this journey as we spearhead our global expansion.”

Andrew McDowell, Operations Director at Aquaterra Energy, added, “Winning this tender further demonstrates our team’s global riser system expertise, understanding of operational requirements in the Middle East, and the significant advantages of our independent connector OEM status. We’re looking forward to utilising our experience and working closely alongside engineers in the UAE, sharing our knowledge, and building on existing local capabilities to deliver a top-class end-to-end service.”

After identifying the Middle East as a key geography to support its global growth plan, the contract marks another significant step forward in the region for Aquaterra Energy. It has now delivered intelligent engineering solutions to more than 35 projects in the Middle East to date.

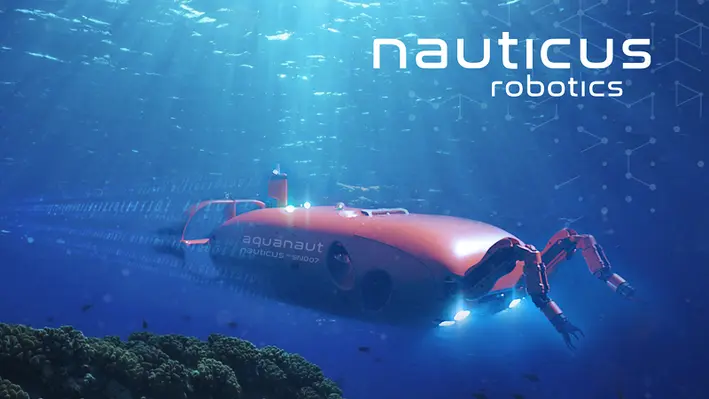

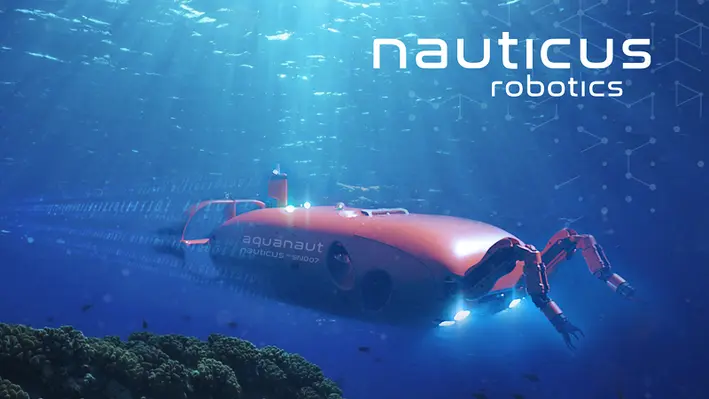

Nauticus Robotics, a developer of autonomous robots using artificial intelligence for data collection and intervention services, has been awarded a contract by Petrobras to deploy its autonomous subsea robot, Aquanaut, to support the company’s offshore activities.

Aquanaut will be used in Petrobras’ deepwater production field using supervised autonomy for infield inspection services. The contract, one of the largest of its kind to date, consists of approximately two months of subsea inspection and expands Nauticus’ growing international presence to South America.

The fully-electric Aquanaut carries an array of multi-spectral perception sensors that allow the robot to detect, classify, inspect, and act upon subsea infrastructure using its pair of manipulators without direct operator control. This method provides significant cost and greenhouse gas emissions reductions over conventional methods.

Nicolaus Radford, CEO of Nauticus, commented, “A contract with another worldwide leading operator for Nauticus speaks to the state-of-the-art technologies of our autonomous robots as we further penetrate the global markets. The market opportunity for Nauticus in offshore Brazil is significant, as it is one of the world's most active offshore energy basins; we are pleased to enter this market through a world class operator.

“We competed through a rigorous tender process with many well-respected industry competitors to earn this business with Petrobras and eagerly await the deployment of our assets to validate our capabilities. We continue to build our robust pipeline of opportunities, giving us confidence to execute on our mission and deliver long-term value to shareholders.”

IOG plc, a UK developer and producer of indigenous offshore gas, has announced that the wireline intervention at Blythe H2 well, located in the southern North Sea, has been completed.

“We have successfully completed the wireline intervention at Blythe H2 well, which has now flowed at a maximum stabilised rate around 42 mmscf/d, slightly above our original 30-40 mmscf/d guidance,” commented Rupert Newall, CEO of IOG. “Production will now be managed up from 20 mmscf/d towards the maximum rate to further dewater the pipeline. The team has worked very well to identify the issue and remediate it safely and efficiently. The significant improvement in our operating team performance is also demonstrated by Blythe operating efficiency increasing from 59% in 2022 to 93% over 1H23 to date.”

The company provided details on the H2 intervention operation which included:

• During well testing prior to H2 First Gas on 12 June, gas flow appeared to be choked back below expected levels by a restriction above the reservoir. Equipment was mobilised to the rig to test whether this was caused by a partially activated downhole valve,

• Over the weekend, the downhole blockage was duly verified at the expected depth. The valve was then fully opened with suitable equipment and the anticipated change in downhole pressure was observed,

• The well was handed back to the operations team in the early hours of Sunday 25 June and subsequently flowed at a maximum stabilised rate of 41.9 mmscf/d,

• Production is now initially set at 20 mmscf/d and will be steadily built up to full rate over the coming week as the Saturn Banks Pipeline System is further dewatered,

• The absence of formation water production from H2 is expected to significantly reduce aqueous liquid arrivals at Bacton, which should in turn reduce unit operating expenditure,

• The plan remains to produce from H2 only over the next few months; once water levels have re-equilibrated at the H1 location, periodic production is planned from H1 at lower rates to minimise water production.

Following the intervention, Newall remarked, “In parallel with the remediation work on H2, we have been assessing next steps for the business very carefully. Mindful of current gas market and balance sheet risks, we have decided to pause drilling activity for now in order to maximise near-term cash flow."

Baseload Capital, an investment entity dedicated to advancing geothermal energy deployment globally, has announced its second strategic investment from energy technology company Baker Hughes.

Together, the partners will look to expand global geothermal project development and position the resource as a high-impact, clean energy source for global markets; catalyse market growth by facilitating the implementation of new commercial and development models; and advance next-generation technologies from the pilot stage through to commercial scale.

Alexander Helling, Baseload Capital CEO, remarked, “Developing long-lasting, strategic and co-beneficial partnerships is vital to driving innovation and scaling up geothermal power. Baker Hughes' second round of investments exemplifies the importance of leveraging assets and expertise across the energy sector for a swift transition to a global renewable energy mix.”

Ajit Menon, Vice President of Geothermal Energy, Oilfield Services and Equipment at Baker Hughes, added, “Baker Hughes is dedicated to driving lower carbon solutions through strategic investments in key growth areas. Our collaboration with Baseload Capital represents a truly innovative alliance in the geothermal market, leveraging the unique strengths of both companies to rapidly expand installed geothermal capacity.”

TGT Diagnostics, a through-barrier diagnostics company for energy production and storage, has launched its latest acoustic platform, ChorusX, a new diagnostic resource specifically designed to locate and characterise flow in oil and gas wells.

This all-new acoustic array platform enables energy companies to find and map fluid flow throughout the well-reservoir system with greater ease and precision, helping them to keep wells safe, clean, and productive.

Ken Feather, TGT’s Chief Marketing Officer, commented, “Understanding flow dynamics in the well system is the key to unlocking better well and reservoir performance, and acoustic techniques have become an indispensable means of achieving that goal. ChorusX is the result of two decades of intensive research, innovation, and extensive field experience in applying the power of sound to flow diagnostics in thousands of wells. Eight high-definition array sensors, extreme dynamic range recording and a unique phase analysis engine work in concert to deliver uncompromising levels of clarity, precision, and certainty to analysts and well operators.”

At the heart of ChorusX is a compact array of eight nano-synchronised sensors that record high-resolution flow sounds across an extreme dynamic range of intensities and frequencies. A unique phase analysis workflow combines specialised acoustic field modelling with a sophisticated waveform-matching algorithm. This combination delivers an important new dimension to acoustics and flow diagnosis – radial distance. In combination, these advances underpin four new complementary answer products that enable TGT analysts to easily and accurately locate and map flow throughout the well system.

Ken added, “ChorusX has been redesigned from the ground up to excel in three important areas: extending spatial and audible reach to record the lightest, quietest, and furthest flows; recognising different types of flows; and pinpointing flow sources with unmatched accuracy in depth, and radially. Flow events are displayed more clearly in high definition, enabling operators to plan actions with greater confidence and implement them efficiently with precision.”

ChorusX is available to all TGT Diagnostics customers through a range of True Flow and True Integrity/Seal Integrity products.

THREE60 Energy, a leading independent energy service company offering complete asset life cycle expertise, has been awarded a multi-million dollar well decommissioning contract in Europe.

As announced on social media, the new contract will see THREE60 Energy plug and abandon 13 injection, production and observation wells in the UK and Europe.

The company will utilise its well decommissioning team to deliver the plug and abandonment designs, prepare operational planning and supervise the offshore execution, which includes the management of the jack-up rig and well abandonment subcontractors.

Nick Ford, Wells UK Managing Director at THREE60 Energy, commented, “With our strong track record of offshore delivery and well abandonment we bring almost 20 years of the technical skills, capabilities and experience needed to successfully deliver this significant well decommissioning project offshore Europe.

Walter Thain, CEO at THREE60 Energy, added, “This contract clearly demonstrates the opportunities available for supply chain companies globally, especially within decommissioning, and is a great example of transferring our competency and capability across multiple geographies.”

The Bureau of Safety and Environmental Enforcement (BSEE) Director, Kevin Sligh, has announced a US$3mn investment from the Bipartisan Infrastructure Law to help reduce the risk of pollution from orphaned infrastructure on the federal Outer Continental Shelf.

The funding will specifically support BSEE decommissioning service contracts in the Matagorda Island lease area in the Gulf of Mexico. The funds are part of a nearly US$64mn commitment from President Biden’s Investing in America agenda to address orphaned oil and gas wells on public lands.

“The funding announced today under the President’s Bipartisan Infrastructure Law is critical for helping BSEE leverage available funds to tackle the backlog of decommissioning orphaned infrastructure offshore in the Gulf of Mexico,” commented Sligh. “If not properly decommissioned, offshore oil and gas infrastructure can become safety hazards, cause environmental harm, or interfere with navigation, fishing, or other uses of the Outer Continental Shelf.”

BSEE plans to award contracts to address nine orphan wells and associated pipelines and platforms in the Matagorda Island lease area, approximately 12 miles off the Texas coast. The initial contract will address the most immediate and urgent needs to reduce the risk of safety incidents and pollution in preparation for well-plugging operations.

An important part of BSEE’s responsibilities is to ensure that infrastructure used in exploration, development, and production activities undertaken according to the Outer Continental Shelf Lands Act is properly decommissioned to provide the long-term protection of the resource and the surrounding environment.

Oilenco Ltd has announced the appointment of David Nicoll who has joined the company as Business Development Manager for sub-Saharan Africa (SSA) in order to reinforce Oilenco’s focus on overseas well intervention markets.

Oilenco Ltd has announced the appointment of David Nicoll who has joined the company as Business Development Manager for sub-Saharan Africa (SSA) in order to reinforce Oilenco’s focus on overseas well intervention markets.

David, known to his network as Davie, will bring 25 years’ worth of experience to the company, with more than 16 years working across a variety of downhole intervention roles. He commented, “I’ve spent the last nine years travelling all over SSA learning about this market. As a leader in well intervention and abandonment within the UK, Oilenco are uniquely positioned to deliver best-in-class solutions that are ideally suited to the SSA market.”

In his role, Davie will be responsible for bringing Oilenco products and solutions to this evolving market, developing the Oilenco brand in the sub-Saharan region and establishing the company as the provider of choice for downhole tool solutions.

Davis will make his debut as Business Development Manager next week at the Offshore Network Well Intervention West Africa Conference on 20 and 21 June.

“I am delighted to be joining such an innovative team, at an exciting time for the company. With a real focus on growth not only in Africa, but in other regions, I look forward to bringing Oilenco’s reputation as a first-class downhole tooling provider to the market,” Davie said.

Petrofac, a leading provider of services to the global energy industry, has added a third Gulf of Mexico field, and extended the scope of its existing contract to decommission two fields, in the Gulf of Mexico.

Following this contract expansion, the legacy offshore fields and assets now include 12 platforms, 211 wells and 32 pipeline segments, as well as operations and logistics services. The scope includes the safe, efficient, and assured decommissioning of the fields and operation of the fields during the execution of the decommissioning work.

Petrofac will use its proven decommissioning programme management systems, tools, and processes to deliver the project. Its integrated local team, wider global decommissioning organisation and supply chain partners, have collectively plugged and abandoned more than 2,300 wells and decommissioned over 250 facilities.

Nick Shorten, Chief Operating Officer for Petrofac’s Asset Solutions business, remarked, “This sizable contract expansion recognises our industry-leading decommissioning programme management experience and our differentiated in-house capability to manage all well and asset decommissioning phases.

“Through this and other decommissioning projects, Petrofac is actively and sustainably contributing to the energy transition globally.”

Page 68 of 118